Are Reits Risky Investments

In general, REITs are not considered especially risky, especially when they have diversified holdings and are held as part of a diversified portfolio. REITs are, however, sensitive to interest rates and may not be as tax-friendly as other investments. If a REIT is concentrated in a particular sector and that sector is negatively impacted , you can see amplified losses.

How To Buy Reits

Below, I am going to outline the different ways you can invest in REITs, starting with opening a good online brokerage.

Whats even better is that all of my preferred brokers offer $0 commission trades, no account minimums, and a convenient mobile trading platform, so you can track your stocks and execute trades on the go.

Know Why Reits Can Be Good Investments

Equity REITs were created to make investing in commercial real estate accessible to everyday investors. For example, before REITs existed, you had to be pretty wealthy to invest in a shopping mall, but now you can take advantage of this type of investment by purchasing a single share of a REIT that specializes in mall properties.

The primary reason for investing in REITs is for a combination of income and growth. REITs generally offer above-average dividends and have the ability to grow significantly over time as their properties appreciate in value. This combination can produce some impressive total returns.

In fact, leading healthcare REITWelltower has averaged a 15.6% total return since its IPO 46 years ago, and leading net-lease retail REIT Realty Income has averaged 16.9% total returns since its 1994 New York Stock Exchange listing. Compare this to the overall stock market, which has historically returned about 9%-10% per year.

Don’t Miss: How To Invest In Ecommerce Business

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Choosing The Types Of Reits To Invest In

If one or more of the real estate markets where your equity REIT holds assets experiences a sharp market downturn, your quarterly dividends will be much lower than expected. Imagine owning shares in a retail REIT that is centered on shopping malls. That would have been humming along fairly well until the pandemic put the squeeze on people going out to do their shopping in public places.

Mortgage REITs are secured by the properties attached to the loans, but they also have risk. Mortgage REITs profit on the margins between money borrowed at the prime rate by the REIT before they lend it out to builders and developers. If interest rates rise, then the profit margin for the equity REIT can shrink along with your dividend.

Read Also: Stock Investing As A Business

You Can Use Some Retirement Accounts To Invest In Reits

According to Jhangiani, alternative investment options have been becoming more accessible through retirement accounts, including when it comes to REITs. You can invest in publicly-traded REITs through retirement accounts, including traditional and Roth IRA’s.

When it comes to 401 plans, though, it’ll depend on what is available through your employer’s plan. Many employers only allow you to invest in a target date fund through your 401. But you can always contact your company’s benefits team to get some clarification on whether or not you have the option to invest in REITs through your 401 plan.

How Much Money Do You Need To Invest In Reits

For publicly-traded REITs, the minimum amount to be invested is the price of a share of the trust. That said, some brokers nowadays offer the possibility of buying fractional shares and this would allow investors to buy a fraction of a REITs stock instead of an entire unit.

Meanwhile, for non-traded REITs, the minimum investment required typically starts at $1,000 and can go much higher depending on the scope and size of the project. Finally, for private REITs, the minimum investment can start at $10,000 or higher due to the sophisticated nature of these vehicles.

Read Also: National Association Of Real Estate Investment Managers

How To Evaluate A Reit

Just like youd evaluate a companys performance before buying a stock, you should also take a look at a variety of metrics before investing in a particular REIT.

Though there are some similarities in how you compare performance, this unique asset class requires a slightly different lens. Heres what to evaluate and how to interpret your findings:

Know The Right Metrics To Use When Evaluating Reits

REITs are unique types of companies, and because of this, it’s important to use the right metrics when evaluating them. Specifically, traditional accounting methods don’t accurately reflect income and valuation for real estate businesses.

The first metric you need to learn is funds from operations, or FFO, which is the REIT version of “earnings.” This metric adds back in property depreciation and makes a few other adjustments to accurately show a REIT’s income and, therefore, its ability to pay dividends. From this you can use a Price/FFO multiple when valuing REITs, just like you might use a P/E multiple to value a blue chip stock.

There are other important metrics you can learn, such as intrinsic value, cap rate, net asset value, and debt coverage, just to name a few, and you can read how these work here.

Don’t Miss: First Republic Investment Management Inc

What Is The Best Way To Invest In Reits

For most, the best way to invest in REITs is to invest in a publicly-traded REIT or REIT fund after doing research on the fund and confirming it meets your investment objectives. Non-traded REITs come with more risks, such as a lack of liquidity, so be sure you understand what type of REIT youre investing in.

The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk including the possible loss of principal.

How Do Reits Work

Congress created real estate investment trusts in 1960 as a way for individual investors to own equity stakes in large-scale real estate companies, just as they could own stakes in other businesses. This move made it easy for investors to buy and trade a diversified real-estate portfolio.

REITs are required to meet certain standards set by the IRS, including that they:

-

Return a minimum of 90% of taxable income in the form of shareholder dividends each year. This is a big draw for investor interest in REITs.

-

Invest at least 75% of total assets in real estate or cash.

-

Receive at least 75% of gross income from real estate, such as real property rents, interest on mortgages financing the real property or from sales of real estate.

-

Have a minimum of 100 shareholders after the first year of existence.

-

Have no more than 50% of shares held by five or fewer individuals during the last half of the taxable year.

|

Get up to $600 or more when you open and fund an E*TRADE account |

PromotionExclusive! US resident opens a new IBKR Pro individual or joint account receives 0.25% rate reduction on margin loans. Tiers apply. |

You May Like: How Much Do I Need To Invest In Gold

Lets First Understand What Reits Are:

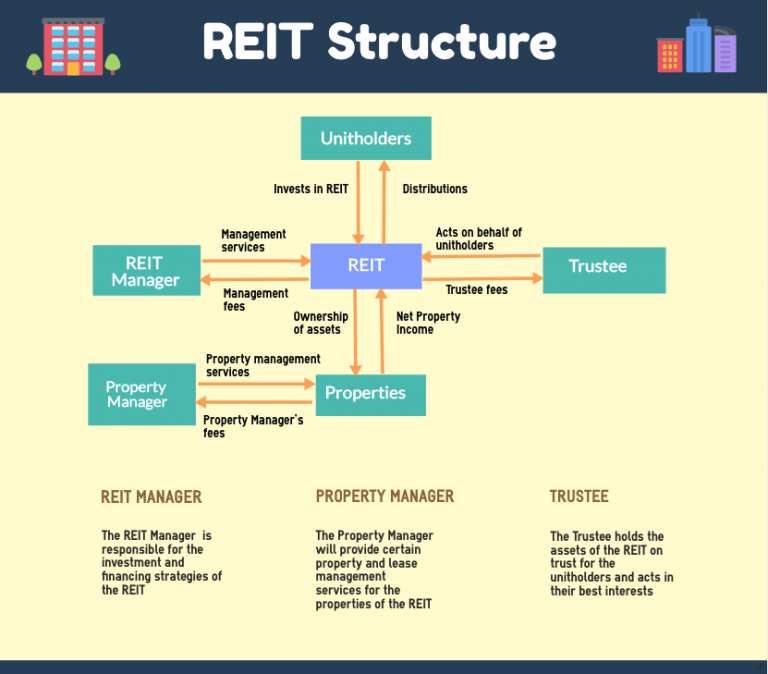

REITs are modelled like mutual funds, a publicly-traded company that owns, manages and finances income-generating properties. REIT companies pool the capital of various investors, giving them an opportunity to earn dividends from real estate investments without having to own, manage or finance a property on their own!

Pros & Cons Of Investing In Reits

Investing in REITs and direct investment in real estate both come with advantages and disadvantages. In the end, you have to weigh the options and decide which better fits your style. Some investors prefer a mix of REITs and directly owned real estate. Others prefer one type over the other, for whatever reasons. Before you invest, though, make sure you know what you are doing, and understand the risks.

You May Like: Guide To Socially Responsible Investing

How Do You Make Money On A Reit

You can make money in REITs through the periodical dividends distributed by the trust to its shareholders, which are paid in cash. You can also gain from the price appreciation of the REITs shares.

On the other hand, for non-listed and private REITs, this price appreciation is typically reflected by the NAV of the REIT.

Past Performance Of Reits

Real estate has historically performed well as an investment type, and the same can be said for REITs. The success of REITs over time is typically measured by the Financial Times Stock Exchange Group NAREIT Equity REITs Index. Looking at numbers over the decade, REITs have experienced an average annual return rate of 9.5 percent. This performance is impacted by several economic and political factors, such as interest rates, job growth outlook, treasury yield, and more. Each of these components helps REITs to remain level through periods of economic downturn. Even over the course of the last year, the annual returns for REITs have increased by roughly 31 percent.

Also Check: How Can I Invest 2000

How Do I Invest In Reits

Your approach to investing in REITs depends on what type of investor you are. Some investors may want to invest in an exchange-traded fund or mutual fund that tracks a broad-based REIT index rather than investing in individual REITs. You can buy and sell REITs on your own with a Schwab One® brokerage account or call us at 877-566-0054 to talk to an experienced specialist about whether REITs are right for you.

How Do Reits Make Money

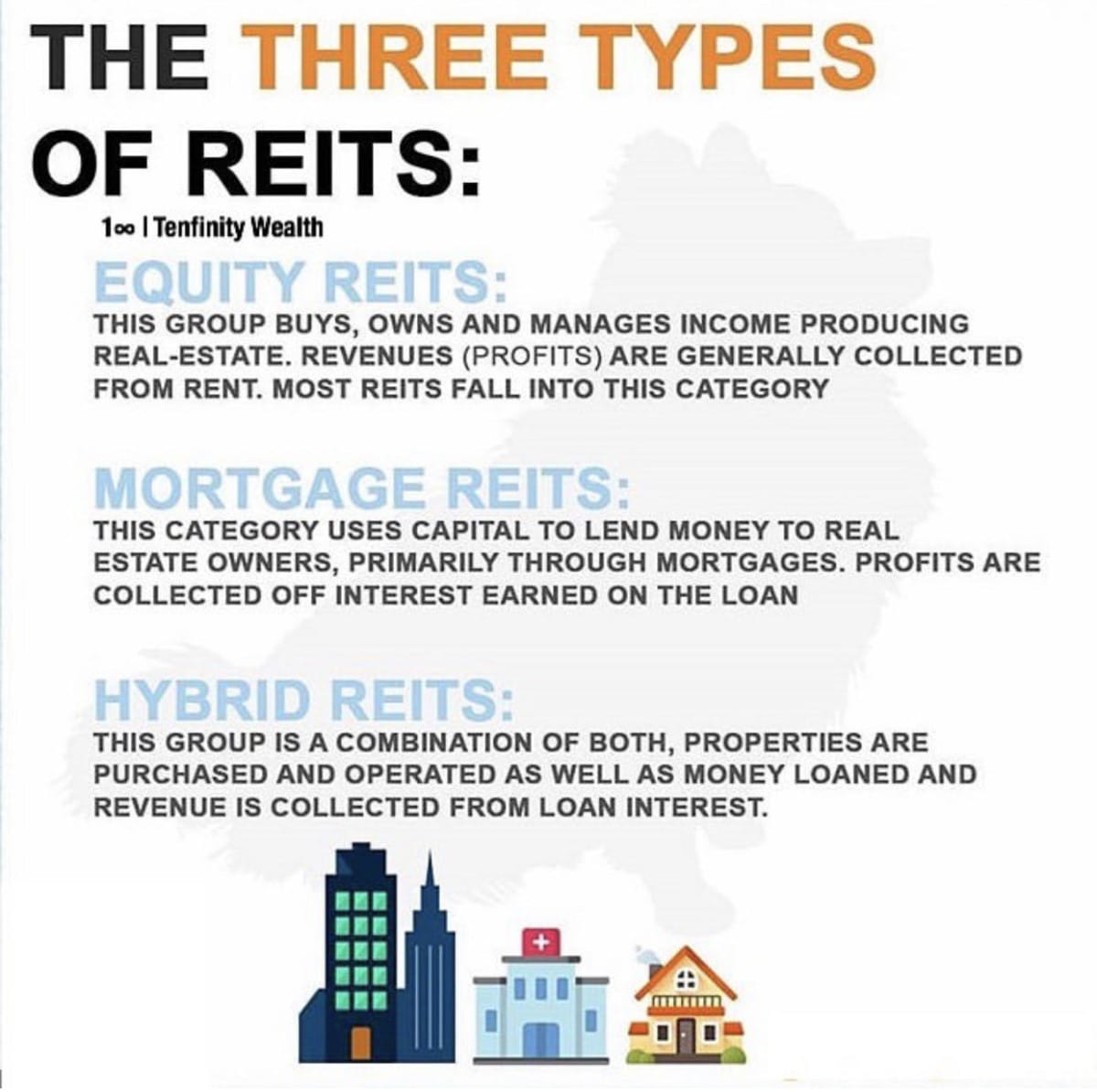

You might be thinking that a REIT is essentially a landlord that collects rent from residential tenants. While REITs do invest in apartment buildings, they also invest in offices, warehouses, malls, hospitals, hotels and many other types of properties. There are also mortgage REITs , which do not generate income from rent but rather from financing properties for borrowers. Finally, there are hybrid REITs, which do both these things. By law, REITs must pay out 90% of their income to shareholders in the form of dividends.

Read Also: The Richard Wyckoff Method Of Trading And Investing In Stocks

Are Reits A Good Hedge Against Inflation

Empirically speaking, the price of real estate assets tends to rise when inflation goes up as investors commonly buy hard assets to hedge their net worth against inflationary pressures. Moreover, the income-producing side of real estate assets is also beneficial from an inflation standpoint as rent payments can be adjusted based on market conditions.

Therefore, dividends from REITs will usually go up during times of higher inflation although the exact extent to which their increase will outpace that of the markets overall prices will probably vary from one REIT to the other.

Get Up To $600 Or More 1 Learn How

For a limited time, receive a cash bonus when you open a new E*TRADE brokerage or retirement account with a qualifying deposit by October 31, 2022.

BONUS22

Check the background of E*TRADE Securities LLC on FINRA’s BrokerCheck seeE*TRADE Securities LLC and E*TRADE Capital Management, LLC Relationship Summary.

| Investment Products Not FDIC Insured No Bank Guarantee May Lose Value |

PLEASE READ THE IMPORTANT DISCLOSURES BELOW.

Banking products and services are provided by Morgan Stanley Private Bank, National Association, Member FDIC.

This Thematic Investing screener is an educational tool and should not be relied upon as the primary basis for investment, financial, tax-planning, or retirement decisions. This tool provides a sample of exchange-traded funds that may be of interest to investors and is provided to customers as a resource to learn more about different categories of ETFs and the use of screeners. This educational information neither is, nor should be construed as, investment advice, financial guidance, or an offer or a solicitation or recommendation to buy, sell, or hold any security, or to engage in any specific investment strategy. Additional ETFs available through E*TRADE Securities LLC may be found by using the ETF screener at .

How ETFs are selected for a theme:

Don’t Miss: Start Investing With 50 Dollars

How To Invest In Real Estate Investment Trusts

Like popular public stock, investors may decide to buy shares in a particular REIT that is enlisted on the major stock exchanges. They may do so in the following three ways.

- Exchange-traded funds: With this particular investment option, investors would avail indirect ownership of properties, and would further benefit from its diversification.

Notably, REIT as an investment option tends to resemble mutual funds, the only difference being that REIT holds properties instead of bonds or stock options. Additionally, REIT investors are entitled to avail the assistance of financial advisors to make more informed decisions in terms of investing in an appropriate REIT option.

Practical Ways To Invest In Reits

If youve only got a minute:

- Reits are a cost-effective way for retail investors to diversify their portfolio by including non-residential property holdings.

- Gains from investing in Reits can be captured through dividends and capital gains.

- You can invest in Reits by buying them directly through brokerages, purchasing unit trusts, through Reit exchange-traded funds or via robo-advisors.

Real Estate Investment Trusts are seen by many as an essential component of a portfolio for income generation and dividend seeking. By investing in Reits, investors gain ownership of a wide range of properties both locally and globally at low entry costs.

Reits also make for interesting investment proposition as unlike traditional real estate investment, Reits trade like stocks. When you invest in Reits, you are basically putting your money into a collective pool of funds in a trust, which are then managed by a Reit manager, who then invests in a portfolio of income generating real estate assets, from shopping malls to offices to hotels.

Keen to invest but are unsure of how to go about purchasing Reits?

Heres a practical guide you need to get you started with investing in Reits today.

Recommended Reading: How Do I Get A Loan For An Investment Property

How To Invest In Public Non

Buying shares of unlisted public REITs is more challenging. Because they arenât traded on an exchange, it may be more difficult to find public non-traded REITs on your online brokerageâs trading platform. Instead, you may need to purchase them directly from the REIT company itself or a third-party broker-dealer firm. Although anyone may invest, public non-traded REITs typically have a minimum investment requirement of $1,000 to $2,500.

Crowdfunding real estate investing platforms like the DiversyFund, Fundrise and Realty Mogul offer another way to invest in public unlisted REITs. These platforms generally require investors to commit to real estate investments for longer periods of time, however. This can be up to five years or more in many cases.

What Types Of Reits Are There

Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs. Others may be registered with the SEC but are not publicly traded. These are known as non- traded REITs . This is one of the most important distinctions among the various kinds of REITs. Before investing in a REIT, you should understand whether or not it is publicly traded, and how this could affect the benefits and risks to you.

Read Also: Invest In Property With Little Money

Should I Invest In A Real Estate Investment Trust

As with all other types of investing, it might be best if a real estate investment trust makes up part of a diversified portfolio, as a way of protecting you from financial shock and unexpected disruptions to the market.

If youd prefer to put your money somewhere safe where it can both earn interest and benefit from FSCS protection, you might want to consider a competitive rate savings account, such as fixed rate bonds. Alternatively, another option considered as a safer way to invest is investing in bonds.

Should You Invest In International Reits

Including international investments in your portfolio can be a good way to add a layer of diversity to your strategy. REITs offer you the chance to add exposure to foreign real estate without the hassle of buying foreign property. This can be especially attractive to those who don’t want to deal with some of the red tape associated with being a foreigner and buying a property in some countries.

REITs are generally fairly easy to invest in , and you can see benefits from dividends and improvements in real estate markets. You won’t have direct control over the property, though, and you face the possibility of loss just as you would with any other investment.

Further Reading: Should You Add ADRs to Your Portfolio?

Recommended Reading: Investing In Blue Chip Art

Do Reits Pay Dividends

Yes, REITs are required by the IRS to return at least 90 percent of taxable income to shareholders every year. That means you can expect a pretty high dividend yield from REITs, making them a particularly attractive pick for investors seeking a steady stream of income, like retirees.

For example, according to the National Association of Real Estate Investment Trusts , the FTSE Nareit All Equity REITs index has a current dividend yield of 4.75 percent, as of March 31, 2020. And the FTSE Nareit Mortgage REITs index offers a whopping 22.89 percent yield. By comparison, the highest yielding stock among all the Dividend Aristocrats is ExxonMobil, with a dividend yield of 8.88 percent.