Brokerage And Investment Advisory Program Pricingjp Morgan Private Client Advisor Pricing

When you open a full-service Investment Advisory Program or Brokerage Account with us, you get the benefit of personalized advice and guidance from your dedicated Private Client Advisor.

Review the types of investment accounts offered and learn about the charges associated with brokerage and advisory accounts.

Overview Of Jp Morgan Wealth Management

J.P. Morgan Securities is the brand name for a wealth management business of J.P. Morgan Chase, a publicly traded financial services holding company with offices across more than 60 countries. With roots dating back to 1799 with the founding of the Manhattan Company by major historical figures including Alexander Hamilton, J.P. Morgan Chase operates businesses across many parts of the financial industry, including banking, asset management, securities brokerage and investment advisory services. It is a compilation of more than 1,200 predecessor institutions, including big names like The Chase Manhattan Bank, Bank One, Bear Stearns and Washington Mutual.

The division of J.P. Morgan Securities employs more than 6,000 investment advisors and researchers to manage close to $190 billion. Most of the firms financial advisors are employees of J.P. Morgan, as well as broker-dealer representatives and insurance agents. They offer their advisory services through J.P. Morgan as well as Chase Wealth Management.

Services Offered By Jp Morgan Securities

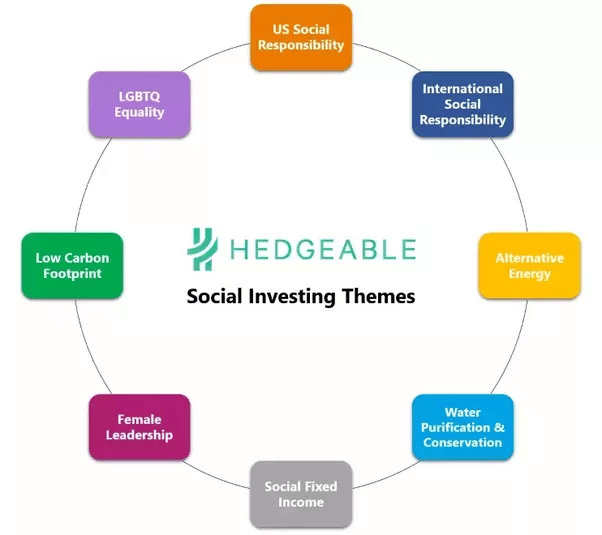

As you can see above, there are many different programs and services available through J.P. Morgan. Among these are various high-net-worth- and non-high-net-worth-focused offerings, with specific strategies built out for each. Some of these focus on equities, while others are centered around fixed-income securities and various types of funds. Which program is best for you will depend on what your goals for the future are, as well as how much you have available to invest.

Financial planning is also part of what J.P. Morgan’s financial advisors can offer. These can cover a wide variety of topics, like retirement planning, healthcare planning, estate planning, Social Security planning, education fund planning, wealth planning, philanthropic gift planning and more.

Also Check: Best Stock Brokers To Invest With

Who Is A Jp Morgan Wealth Management Account For

J.P. Morgan offers many wealth management paths, from self-directed investing for those who want a hand on their money at all times, to robo-investing for those who want to plug in their goals and let the bank do the rest.

J.P. Morgan Wealth Management is good for:

- Investors who like one-on-one investing advice

- People who like investing on their own

- Investors who use technology to manage investments

- People looking for full-service investment services

- Beginner through expert investors

How Do I Become A Jp Morgan Private Client

Please note that the minimum requirement of becoming a private client by each financial institution is different. You may discover that large wealth management firms usually have tiered services, where more money provides you access to more greater perks.

For instance, J.P. Morgan has a couple of private service tiers, with the Chase Private Client being the most basic. Its reserved for clients who hold at minimum $150,000 or above as investable assets or in their account balance. In addition, people with $10 million in assets can become JP Morgan private clients.

High net worth and ultra-high net worth clients can enjoy goals-based investing and advice, tailored financial planning, cross-border wealth advisory, and more.

But theres one thing the that investors of all sizes should know: a wealth management company with the most assets under management isnt necessarily the right one for you.

Every wealth management firms website including JP Morgan looks sharp, clear cut, might even display some testimonials showcasing how brilliant its financial advisors are. But ultimately, it comes down to one thing: PERFORMANCE.

Before you decide to sign the deal with JP Morgan or any other wealth management firm, we suggest you to first stop and ask:

- How effectively has the company been in facilitating clients reach their financial goals?

- How well does the firms performance metrics hold up, especially in market volatility and financial crises?

Read Also: What Investment Account Should I Open

Investing With Jp Morgan Wealth Management

As a Chase Private Client, get access to personalized investment guidance from J.P. Morgan Wealth Management and feel more confident in reaching your goals.

Already a Chase customer?

-

Monthly Service Fees

There is a $35 Monthly Service Fee for Chase Private Client Checking OR $0 when you have at least one of the following each statement period: an average beginning day balance of $150,000 or more in any combination of this account and linked qualifying deposits¹/ investments² OR, a linked Chase Platinum Business CheckingSM account.

¹ Qualifying personal deposits include up to nine Chase Private Client Checking accounts, Chase High School CheckingSM accounts, Chase First CheckingSM accounts, personal Chase savings accounts , CDs, certain Chase Retirement CDs, or certain Chase Retirement Money Market accounts.

² Qualifying personal investments include balances in investment and annuity products offered through JPMorgan Chase & Co. and its affiliates and agencies. For most products, we use daily balances to calculate the average beginning day balance for such investment and annuity products. Some third party providers report balances on a weekly, not daily, basis and we will use the most current balance reported. Balances in 529 plans, donor-advised funds, and certain retirement plan investment accounts do not qualify. Investment products and related services are only available in English.

Jp Morgan Wealth Management Cons

- Potential conflicts of interest: Most J.P. Morgan Securities advisors are dually registered as broker-dealers and also licensed insurance agents, meaning they can earn commissions when you buy certain products. Thus, they may have a financial incentive to recommend certain products, creating a potential conflict of interest. The firm also stands to gain when advisors recommend J.P. Morgan affiliated products.

- No standalone financial planning services: The firm focuses on portfolio and investment management. Its online services in particular are not meant to serve as a complete financial plan or to cover all topics.

- Long list of disciplinary disclosures: J.P. Morgan Securities, as is the case with many larger firms, has a record of disclosures. See more below.

Read Also: Who Is Ken Fisher Fisher Investments

Jp Morgan Automated Investing Fees And Costs

There are two main costs involved when using a robo-advisor: the annual advisory fee and the expense ratios of the ETFs that make up your investment portfolio. J.P. Morgan Automated Investing charges an annual advisory fee of 0.35%, but it gives you a break on the ETFs by rebating the affiliated fee amount from the advisory fee. However, you will be responsible for the ETFs if you ever cancel your robo service and move your assets into a brokerage account. Therefore you should still be sensitive to ETF fees.

Add this all up and J.P. Morgan Automated Investing is expensive compared to other leading robos and generally provides fewer features.

For instance, Betterment and Wealthfront charge annual advisory fees of 0.25%. Vanguard Digital Advisor costs just 0.15% per year while Vanguard Personal Advisor Serviceswhich grants you consultations with financial advisorscharges 0.30% per year. Personal Capital charges 0.89%, but you get unlimited access to your own dedicated financial advisor. Low-fee leader SoFi, meanwhile, charges nothing but the expense ratios of its funds.

Fees Under Jp Morgan Securities

For those using J.P. Morgan Securities for its portfolio management program, there is a wrap-fee program that covers just about everything related to the program, including management services, execution of transactions, clearing and settlement of trades, custody of clients assets and periodic written performance reviews. For the MFAP, CSP, JPMCAP, J.P. Morgan Guided Annuity Program and Advisor Program, the following fee schedule applies:

| MFAP, CSP, JPMCAP, J.P. Morgan Guided Annuity Program and Advisor Program Fee Schedule | |

| Assets Under Management | |

| More than $50,000,000 | 0.30% |

In addition to the account fees listed in the table above, most clients will also need to pay some sort of manager fee. Some of these charges are more extensive than others, as the rates you’re given depend upon the type of manager and asset class you’re subscribed to. Here’s a layout of the fees ranges to expect for each program:

- Strategic Investment Services Program : 0.12% – 0.75%

- Unified Managed Account Program: 0.15%

- Investment Counseling Service: 1.00%

- J.P. Morgan Automated Investing Program: 0.35%

The table below illustrates estimated fees for the MFAP, CSP, JPMCAP, J.P. Morgan Guided Annuity Program and Advisor Program services at J.P. Morgan Securities:

| Estimated Investment Management Fees at J.P. Morgan* | |

| Your Assets | |

| $10MM | $77,625 |

| *Estimated investment management fees do not include brokerage, custodial, third-party manager or other fees, which can vary in amount. |

Recommended Reading: Should I Buy Investment Property Now

Is Jp Morgan Wealth Management Right For You

J.P. Morgan Securities offers individuals a long list of investment choices, providing options for fledgling as well as sophisticated investors. Clients can choose among internal and external portfolio managers, single- or multi-asset class strategies, and online or face-to-face advisory services. Additionally, clients can decide if theyd like to make the final decisions on trades, or if theyd like to hand the day-to-day management of the account over to a professional.

Clients should be aware that most advisors with the firm are also registered as broker-dealer and insurance representatives, and thus may benefit from making certain recommendations. Additionally, J.P. Morgan has a large fund family, and the firm may benefit from advisors recommending these funds, presenting an additional potential conflict of interest.

Before you make your decision, take the time to research multiple firms to ensure you find the right advisor for you.

The Find a Financial Advisor links contained in this article will direct you to webpages devoted to MagnifyMoney Advisor . After completing a brief questionnaire, you will be matched with certain financial advisers who participate in MMAs referral program, which may or may not include the investment advisers discussed.

Qualification Requirements For Chase Private Client

To qualify for Chase Private Client membership, you must maintain an average daily balance of at least $150,000 in any combination of eligible Chase deposit and investment accounts. Youll need to maintain this balance threshold every month to remain a CPC member.

Certain Chase Business Banking clients automatically qualify for Chase Private Client membership. If you have an existing Chase Business Banking relationship, talk to your business banker about how to qualify if youre not a card-carrying member already.

Chase Private Client membership is technically available by invitation only. As you approach or cross the average daily balance threshold, youll probably receive notice that youre eligible for CPC membership.

If you dont, simply ask your Chase banker or begin the process online here. You can open a CPC joint account with an adult immediate family member, such as a spouse, and share CPC privileges. Children under age 18 dont qualify as CPC joint account holders.

Read Also: Capital One Investing For Good

Jp Morgan Wealth Management Service Updates

In late 2020, JP Morgan altered the branding of its wealth management business.

It is now called JP Morgan Wealth Management. The JP Morgan Securities division, which is part of the wealth management business, is now called JP Morgan Advisors.

Kristin Lemkau became the CEO of US Wealth Management at JPMorgan Chase around that time, and Chris Harvey is the CEO of J.P. Morgan Securities.

Their goal with these changes was to more clearly communicate how their different services connect with clients who have various levels of wealth.

JP Morgan Chases Private Bank remains a separate branch from wealth management and securities.

Which Types Of Clients Does Jp Morgan Wealth Management Serve

The majority of the firms clients are non-high net worth individuals. However, the team also serves a number of individuals who are high net worth, which the U.S. Securities and Exchange Commission defines as having at least $750,000 under an advisors management or a net worth believed to be at least $1.5 million.

There is no across-the-board minimum investment required to establish a relationship with J.P. Morgan Securities. Instead, the requirement varies by account type and financial advisor. Certain managed strategies or portfolio managers require an investment of anywhere from $10,000 to $250,000, depending on the program. For example, a customized taxable or municipal bond portfolio strategy can require a minimum investment as large as $500,000 or $1 million. On the other end of the spectrum, a single asset class strategy invested largely in mutual funds and exchange-traded funds requires a minimum investment of just $10,000.

Recommended Reading: How To Invest In Paxos

Jp Morgan Securities Client Types And Minimum Account Sizes

J.P. Morgan Securities primarily serves non-high-net-worth and high-net-worth individuals. However, it also works with a wide range of institutional clients. Its current client base includes pension and profit-sharing plans, charitable organizations, insurance companies, and businesses.

There is no hard-and-fast minimum account size required at J.P. Morgan Securities. Instead, the minimum required investment depends on what program you’re enrolled in:

- Mutual Fund Advisory Portfolio : $50,000

- Chase Strategic Portfolio : $50,000

- J.P. Morgan Core Advisory Portfolio : $10,000

- Advisory Program

Services Offered By Jp Morgan Wealth Management

As a registered investment advisor, J.P. Morgan Securities primarily provides investment management and consulting services. Clients can choose from a host of accounts, giving them the flexibility to determine their breadth of investment choices, as well as how involved theyd like to be in the day-to-day management of their account. The majority of the firms assets under management are under a discretionary relationship, meaning the advisor does not need clients to approve each trade. However, the firm also oversees assets on a non-discretionary basis.

Tech-savvy investors or those with smaller portfolios can opt for the firms digital advisory offering, which is provided entirely on the firms websites and mobile applications. Investments are limited to J.P. Morgan ETFs.

As part of the portfolio management process, clients will discuss with their advisors their goals and objectives, such as estate planning, and receive investment guidance to reach those objectives. J.P. Morgan Securities does not, however, offer a la carte financial planning services to non-account holders, such as creating written retirement plans.

The Private Bank division of J.P. Morgan provides additional services to individual investors, such as banking, lending, assistance with trusts and estates, business ownership, cross border wealth management, executive compensation issues, philanthropy and family office services.

Here is a full list of the services offered by J.P. Morgan Securities:

You May Like: Investing 10 Dollars In Bitcoin

Requirements For Private Banking

Each institution has its own minimum requirements for private banking. Youll find that large institutions typically have tiered services, where more money gets you access to more luxurious perks.

For example, J.P. Morgan Chase & Co. has a couple of private banking tiers. Its most basic tier is Chase Private Client and is reserved for clients with at least $150,000 in account balances and investable assets at Chase.

Clients with at least $10 million in assets can become J.P. Morgan private bank customers. Its wealthy clients enjoy custom financial planning, goals-based investing and advice, cross-border wealth advisory, and more.

It Has A High Minimum Investment Requirement

While the minimum investment amount for J.P. Morgan Securities is zero, the minimum investment amount for other investment options varies. Depending on the investment strategy and the financial advisor you choose, you could spend from $10,000 to $250,000, or more. Some accounts require more than that, though, such as portfolio managers, which typically invest in mutual funds, exchange-traded funds, and ETFs.

Among banks, J.P. Morgan is the biggest player when it comes to private wealth management. The bank has announced it is expanding its private banking operations to serve high-net-worth clients and upper-income consumers. Managing the money of wealthy clients is an increasingly lucrative business for banks, as they tend to generate higher fees and carry less risk than the money of middle-class customers. However, these clients typically demand greater attention from a wealth manager.

If a high minimum investment requirement seems to be a barrier for you, consider other options. J.P. Morgan Wealth Management is easy to navigate and offers phone support during business hours. You can also email if you have questions about any of their products. Their customer service is excellent and will usually respond to your inquiry the same day. You can even download a mobile app to manage your investments on the go.

Also Check: Bloomberg Where To Invest 10000

Miscellaneous Benefits Of Chase Private Client

Chase Private Client members enjoy some additional benefits that, while not the programs main attraction, certainly sweeten the deal.

The Chase Private Client Arts & Culture program is one example. Available in select cities, it offers CPC members exclusive access to top cultural institutions, like museums and historic sites.

Some additional benefits are practical, like international rush debit and credit card replacement. No matter where you happen to be in the world, Chase is happy to rush you a replacement card.

CPC members may also enjoy informal exemption from Chases 5/24 rule, which limits Chase credit card applicants to more than five new credit cards within any 24-month period, regardless of creditworthiness or income. However, this exemption is anecdotal only Chase doesnt market or even acknowledge it and may depend on your bankers discretion.

Millionaires’ New Challenge: They’re Not Rich Enough For Private Banking

JP Morgan Chase is increasing the minimum asset level for such services as big banks focus on their richest clients and the rest of us are underserved

So youve just sold those Facebook shares that your high school buddy, Mark Zuckerberg, let you buy years before it went public, and youve made an after-tax profit of $4m. Youre feeling very, very rich.

Until, that is, you talk to a private bank that specializes in managing money for rich people. Thats when you realize that youre nothing more than a single-digit millionaire. Youre just not that special.

In fact, the rate at which the ranks of millionaires is expanding is so great, youre actually pretty boring. Last year alone, the US welcomed 300,000 new millionaires: that translates into a growth rate of 3%, outpacing the growth in the US gross domestic product.

In fact, there are now so many millionaires out there that the private banking system simply cant cope.

JP Morgans move was partly aimed at convincing clients to shift any assets they might be stubbornly holding at other banks, bringing them up above the $10m threshold. But its also a recognition that with the proliferation of millionaires, the private banks that youve heard about the ones that will walk your dog, deliver gold bars with your monogram stamped into them and provide wealth therapy so your children dont grow up entitled brats can pick and choose the clients that they deal with.

All of which brings me to an important point.

Also Check: Best Credit Union For Investment Property