What To Consider Before Becoming A Host

Certainly, if you own a property in a high-demand area , owning a property dedicated to Airbnb or another short-term rental system could make good sense. However, the price you charge per night must be commensurate with the money, time and labor you put into the rental.

Unfortunately, if you want to buy a property in a tourist hotspot, be prepared to spend a hefty sum. It’s possible that what you make on Airbnb might not even cover your monthly mortgage payment. In addition, unless you hire a management company to help, you’ll need to spend time and money maintaining the property and cleaning up after your Airbnb guests. That’s not to mention the possibility that the furnishings and decor you put into the property to make it attractive and desirable could be broken or trashed by your guests. Although you can charge a cleaning fee and Airbnb will insure you against property damage, those are hassles you might not want to deal with.

In addition, before becoming an Airbnb host, it’s crucial that you find out which local rules might apply to you. Because affordable housing is hard to find, many local governments have established regulations in an effort to encourage more long-term affordable rentals rather than short-term pricey ones.

These regulations might include required licenses as well as extra fees and taxes. And in Charleston, South Carolina, for example, renting out a vacation home is illegal unless the owner-operator lives on the property full time.

Airbnb Pros & Cons: Decide Whether Airbnb Is Right For You

Is buying an Airbnb a good investment for you? There are a few ways to break into the real estate market. Many real estate investors choose to go the traditional route of renting to conventional tenants who sign contracts for one year or more.

However, short-term rentals , such as an Airbnb rental, have the potential to earn you more money with less hassle and greater flexibility if you do things right. Lets quickly review some of the pros and cons of investing in Airbnb.

Make An Offer Based On A Cma

Once youâve carried out a complete Airbnb investment analysis, youâll want to figure out how much you should offer. While a real estate agent can help you with this, you can get a head start by looking at Airbnb comps and doing your own comparative market analysis . Mashvisorâs Airbnb profit calculator will provide the right comps and you can use this guide to learn how to do a CMA: Comparative Market Analysis: A How-To Guide for Real Estate Investors.

At this point, you can start working with a real estate agent who will help you get in touch with the seller and make an offer. Find a top-performing real estate agent in the city of your choice here.

Don’t Miss: What Is Investment And Portfolio Management

Higher Earnings With Higher Costs And Higher Risk

According to The Telegraph, short-term rentals can provide rental income thats up to 30% higher than long-term rentals. Thats one of the reasons the vacation rental real estate market has been growing so fast.

But how does operating a short-term rental compare to running a traditional long-term rental?

Advantages of Short-Term Rentals

Aside from the potential to make more money by running your property as a short-term rental, there are a few other advantages compared to a long-term rental:

- Flexibility – If you want to stay in your property yourself, all you have to do is keep that period of your booking calendar clear.

- Lower tenant risk – Tenant risk is the risk that a long-term tenant reneges on the contract and doesnt pay rent, which often leads to time-consuming legal and eviction procedures. Short-term rental guests tend to pay when they make the booking, thus removing this risk. In some states and cities it can be hard to evict a tenant. That’s not an issue with a short-term rental.

Disadvantages of Short-Term Rentals

Making more money and having more flexibility sounds good, but there are some drawbacks:

A Word Of Advice For Hosts

Neal encourages Airbnb hosts to put in travelers shoes if they want their property to stand out. If youre noticing a dip in bookings, look at your competition and make consistent updates to your property, he says.

Another Airbnb host, Jim Ewing, shares, It seems like a lot of people are kind of fed up with Airbnb and theyre angry about how some hosts treat them now. Im curious to see if my timing for leaving the short-term market is the right move, and if in six months or 12 months, Airbnb becomes a bad investment for people.

Don’t Miss: Real Estate Finance & Investments Risks And Opportunities

Pro: Higher Revenue During Peak Season

Renting to short-term tenants through Airbnb gives you a lot of flexibility on how much you can charge in rent. You dont have to lock yourself into one rate for a long contract like with long-term tenants. Instead, you can capitalize on the high seasons of the area and adjust your pricing to reflect trends in tourism.

If your property is located in a great area with high demand, there is no reason to not benefit from that! The only risk here is that your income is not guaranteed in the same way it t would be with a long-term tenant. There is no assurance that your property will be booked so though you have a higher earning potential, you have to accept the risk of instability.

The Top Locations For Investing In Short Term Rental Properties In 2020

To help out beginner real estate investors who would like to make money as Airbnb hosts in 2020 but have no idea where to start, weve put together a list of the best places to invest in Airbnb for sale for a high return on investment. This list is based on Mashvisors nationwide real estate market analysis.

1. Springfield, MO

Recommended Reading: Denver Real Estate Investment Firms

Should You Buy Investment Property For Airbnb

The Sharing Economy is Amazing.

What is the sharing economy? Itâs when people put to work the property, items, and assets they already have into an entrepreneurial endeavor.

- Have a Car? Become a âTaxiâ as a Lyft or Uber Driver

- Want to use your local knowledge to make money as a tour guide? Check out Vayable

- Have a Home? Rent it out as a âhotelâ with AirBnb

- Want to make money with your driveway? Check out Just Park

This is a wonderful concept, because it transforms liabilities into wealth producing assets â and helps generate wealth.

People are starting to buy property so they can rent out the rooms to people like a hotel by using Airbnb. In certain areas, this can be a wonderful way to generate income from your property, even more than you would typically receive from a permanent renter.

We really like the business notion â but weâre fearful that thereâs a great deal of policy and political risk for these investors.

Policy and political risk is the risk that your investment will be impacted negatively by changes in political climates, rules, laws, and regulation. Agency risk is when certain government agencies decide to impose agency law and restrictions on certain industries or behaviors.

Right now, the hotel and lodging industry pays sales tax, often an additional lodging taxes, inspection fees, licensing fees, re-licensing fees, and a host of other bureaucratic rule following.

Check Out The Airbnb Laws And Regulations

After the tremendous growth of the short-term rental industry in the last decade, local authorities in many places across the US, as well as globally, have started imposing strict regulations and sometimes even prohibitions on the work of Airbnb rentals, especially non-owner occupied ones.

The last thing that you want as a real estate investor is to break the law and face legal and financial penalties. Consequently, before you make your final decision on a housing market for your vacation rental, you should research thelocal Airbnb rules and regulations governing short-term rentals. Check out local government websites, the Chamber of Commerce website, local newspapers, and other online sources. Make sure that you understand well under what conditions you can operate an Airbnb business in the given market and what taxes and fees you will be expected to pay.

Also Check: Best Bank For Investment Property Mortgage Rate

Is Airbnb The Right Investment For You

You can see there are more pros than cons if youre considering investing in real estate for the sole purpose of renting it as an Airbnb property. But, you should weigh both the good and the bad, before you ultimately choose to make that investment, to ensure youre ready to take on the challenges if you want to reap the financial rewards of being an Airbnb host.

Find The Best Airbnb Neighborhood In A Top City

If youâve checked off everything on the above list of criteria for Airbnb market analysis, you probably have one city in mind. Next, youâll want to conduct an Airbnb neighborhood analysis. I know that getting to the point of choosing a city may have been difficult. Thatâs why Mashvisor has removed all the challenges you may face in Step #2 by creating the Airbnb Heatmap Analysis Tool.

Mashvisors Airbnb Heatmap Analysis Tool

This tool will let you quickly find the best Airbnb neighborhood in the city of your choice. It allows you to select a few different filters:

- Airbnb Cash on Cash Return

- Airbnb Occupancy Rate

For example, if you want to find neighborhoods with a high Airbnb cap rate, select the filter for Airbnb Cash on Cash Return. These two return on investment metrics are equal until you factor in your investment property financing . Neighborhoods with a high cash on cash return will be highlighted in green. Those would be the best places to invest in Airbnb property in this city based on ROI.

It works the same for all of the other filters: neighborhoods with a high value for the metric you select will be in green. Those with a low value will be in red.

Recommended Reading: Banks That Do Heloc On Investment Property

Lodging Taxes Lodging Licenses & Short Term Rentals

Minnesotaâs Lodging industry has a document here that states the following grievances:

SUPPORTING STATEMENTS :

- The short-term online rental market continues to grow as a business, and as such, it should be looked at as a business to ensure that it is meeting the proper standards of public health and safety.

- National research indicates that many of the listings on Airbnb in some markets are commercial operations rather than owner-occupied accommodations. In some cases these are faux hotels without any regulation or oversight.

What does this mean? That the regulations and taxes on the lodging industry puts them at a disadvantage to the new short-term rental hosts at Airbnb. When a large industry is at a disadvantage â particularly because of regulation and taxes â they will have to lobby to protect their best interests.

This means we should expect a push from lodging industries in the most heavily regulated and taxed cities in Minnesota to spend money to even the playing field. Weâre not saying that bureaucracy and taxes are what should happen, weâre saying that itâs inevitable that the lodging industry will fight hard to push extra taxes and regulations on Airbnb hosts.

The Star Tribune pointed out that Minneapolis and St. Paul are mulling how to regulate and tax Airbnb transactions.

Choosing The Right Airbnb Investment Property

Seasonality and potential earnings are two critical factors to bear in mind when evaluating Airbnb investment opportunities. After all, you’re purchasing a property to make money.

You’ll want to investigate your city’s tourism statistics. Find out how many tourists visit annually and if this figure is increasing or decreasing. If there is any seasonal demand for short-term rentals, and if there is ample growth forecast in the local tourism industry. The last thing you want when Airbnb investing is to put all your money into a dead or dying market.

TakePalm Springs, CA: its revenue potential is $54,571, and its rental demand and rental growth score are substantial. The city sees significant year-round demand, peeking in winter and for festivals like Coachella and Stagecoach. Savannah, GA, on the other hand, is severely hampered by a lack of rental demand.

Balancing these factors is key to finding a lucrative Airbnb investment property.

Estimating your returns

There are a few key housing market indicators that can suggest Airbnb rental properties are in high demand:

High average Airbnb daily rate

High average monthly Airbnb rental income

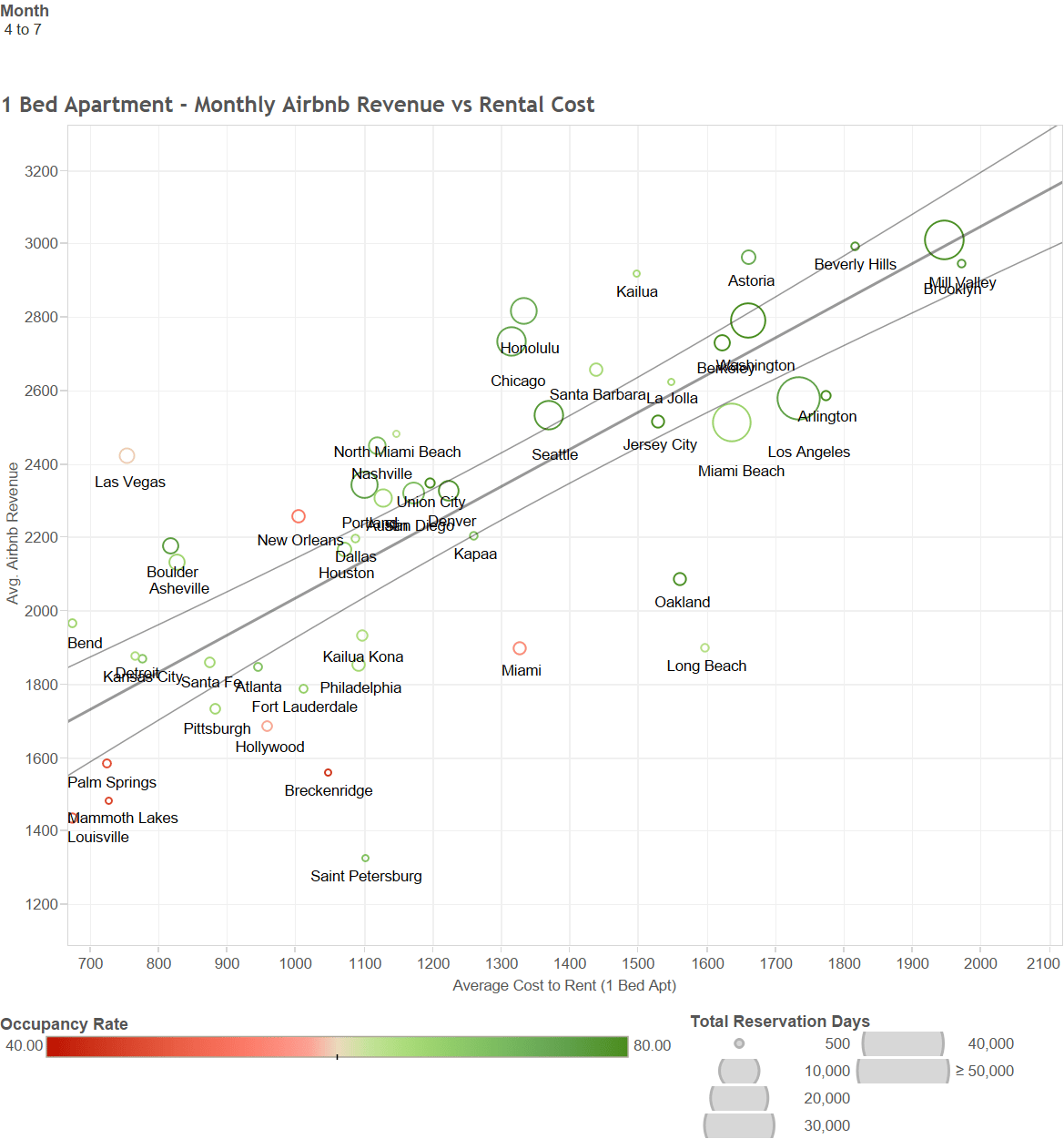

What you can charge for your Airbnb property is largely determined by local demand. Despite a low occupancy rate, you can still earn a reasonable profit from a high Airbnb daily rate. However, the best Airbnb rental markets tend to experience a combination of both factors.

Read Also: Global Impact Investing Network Giin

Airbnb’s Prospects Are Improving And The Stock Is Relatively Cheap

Airbnb is one of my favorite stocks to buy right now. The worldwide travel facilitator is rebounding strongly after the devastations of the pandemic. Of course, the world is still grappling with the outbreak, but widespread vaccination in most parts of the globe has given governments the confidence to ease travel restrictions.

There are more reasons to buy Airbnb stock than the bounceback in travel demand. Its asset-light business model is generating strong cash flow, Airbnb has a massive market opportunity ahead, and it offers a better selection to travelers than traditional hotels. That said, the increasing risk of a recession is one reason to hesitate. Keep reading for more detail on each.

Airbnb Investment Strategy: Pros And Cons To Know About

All posts,Recent Posts,Vacation Rental Tips

Despite the ongoing pandemic, investing in Airbnb still looks like a lucrative strategy. According to Airbnbs data, as of October 2020, hosts have earned more than $110 billion with vacation rental investments.

Though, while investing in Airbnb rentals can offer substantial rewards, there are also some risks involved. So, to ensure that you embark on this venture with eyes wide open, check out these suggestions for buying a vacation rental property and maximizing your rental income.

Recommended Reading: Types Of Fixed Income Investments

More Lucrative Than Traditional Real Estate Investment

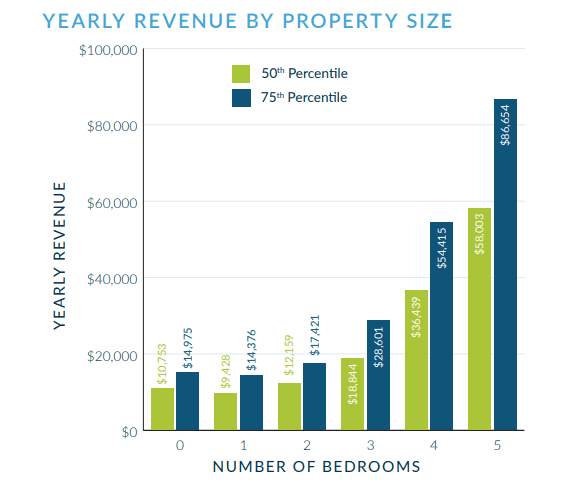

As you can typically charge more per night, you can generate more profit compared to traditional real estate investing. According to FortuneBuilders, an Airbnb property that is operated efficiently can make two to three times the revenue compared to an unfurnished, long-term rental. In fact, amidst the pandemic, the average nightly rate increased in 2020. Our data shows that the average nightly rate in the US reached over $200 in 2020.

Use Online Investment Analytics Tools

The future success of an Airbnb property can be predicted by a few different indicators. AirDNA has an incredible tool that allows you to work out the average daily rate, occupancy rate, and projected revenue of an Airbnb property in a specific zip code. It gives you a look into how active properties in that ZIP code are performing to get an idea of how your Airbnb business would stack up.

Another really great tool to take advantage of when thinking about investing in an Airbnb property is Mashvisor. They can help you calculate analytics like cash-on-cash return and capitalization rate on homes in your specified ZIP code. Resources such as these can greatly decrease the amount of time you spend researching a location and boost your confidence in your Airbnb investment.

You May Like: How To Manage Investment Portfolio

Search For Your Real Estate Investment Property Thoroughly

Once you know how much you can spend on your Airbnb rental, start searching for actual properties on sale. Exhaust all possible sources such as online listing websites, the real estate sections of local newspapers, friends, and acquaintances.

Dont go for MLS properties only but also actively look for foreclosures, bank-owned, and off markets properties as they can bring your return on investment significantly higher due to the low price youll have to pay for them.

Throughout the property search, keep your budget in mind. Dont fall for a property that you cannot afford. After all, you are buying an investment property to make money from, so your decision should be rational and based on numbers. You are not buying your dream home to live in.

The Good News For Travelers

The increase in supply means more options to choose from. While prices remain high, for now, increased supply means the ability to be more selective about the properties and hosts travelers decide to book with.

If a host is unfairly assigning menial chores to guests or making them pay unreasonable fees, its not going to benefit their business, says Neal Carpenter, the owner of short-term rental consulting service The Air Butler.

If you are asking people to do more than whats fair and reasonable and common, thats a problem, Carpenter says. If youre trying to charge exorbitant cleaning fees and profiting, thats questionable behavior.

If occupancy rates continue to drop in more destinations, price rates are likely to be pushed down as hosts bid to get more bookings, according to AirDNA.

The growth of short-term rental listings is causing nightly prices to fall and reducing the profitability of owning these vacation rentals, which should result in more long-term rental supply, helping to bring rents back down, says Taylor Marr, deputy chief economist for real estate brokerage Redfin.

You May Like: Easiest Investment Banks To Get Into