What Is Private Equity And How Can I Invest With My Ira

Private equity is part of the alternative asset class available to self-directed IRAs. Not long ago, private equity was reserved specifically for high-net-worth individualsaccredited investors like Peter Theil and Warren Buffet. However, those rules have been relaxed for certain opportunities, allowing average individuals who meet specific requirements to invest and potentially achieve big benefits in their investment portfolios and retirement accounts. This article explains what private equity is and how you can invest with your IRA.

What Is Private Equity?

In general terms, private equity consists of funding from investors that is pooled together to acquire large and often lucrative assets.

Specifically, private equity and stock are available to those who eagerly invest in established private companies, distressed companies, buyouts, and other existing entities that need funding for expansion, revitalization, and growth. Venture capital is a form of private equitywhich provides funds for startups and other entrepreneurial endeavors that are not yet producing much, if any, revenue.

Private investors recognize the risks but are savvy enough to understand the benefits fruitful private equity investments produce. An added bonus for investors is knowing they have a direct and positive impact that helps revitalize communities and encourages creativity and innovation.

Private equity options include:

- Small businesses looking to expand

What Can You Invest In An Ira

David J. Rubin is a fact checker for The Balance with more than 30 years in editing and publishing. The majority of his experience lies within the legal and financial spaces. At legal publisher Matthew Bender & Co./LexisNexis, he was a manager of R& D, programmer analyst, and senior copy editor.

PeopleImages / Getty Images

Any investor who is saving for retirement should consider having an individual retirement account as part of their saving strategy.

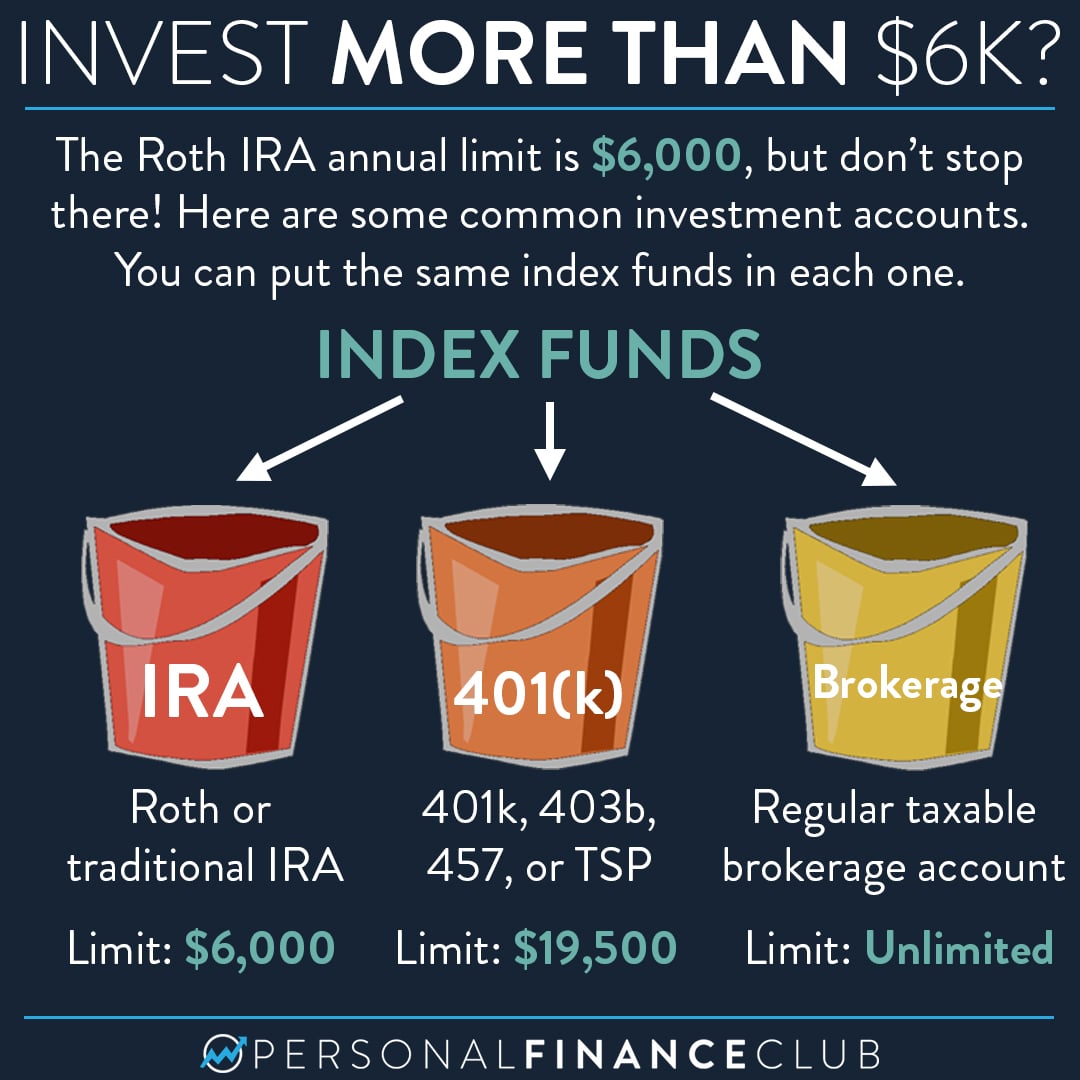

IRAs are designed to allow investors to save money in a way that reduces tax liabilities, thus boosting their ability to save. For 2021 and 2022, the federal government allows investors age 49 and younger to contribute up to $6,000 per year in an IRA.

IRAs can work in tandem with employer-sponsored 401 plans and can even serve as a good replacement for such plans when necessary. They have the distinct advantage of allowing for a wide range of investments.

Before we run down the possible IRA investment options, its first important to understand how IRA accounts can differ. A traditional IRA allows investors to deduct contributions from their taxable income, but any gains are taxed upon withdrawal. A Roth IRA, however, taxes contributions up front but allows all money to be taken out tax-free at age 59 1/2.

How Much Should I Contribute To My Ira

There are strict contribution limits, so you can only deposit a certain amount of money into your IRA each year.

Both traditional and Roth IRAs have the same contribution limits: For 2021, those under age 50 can make a total contribution into their traditional and Roth IRAs of up to $6,000. Those 50 or older have a limit of $7,000.

With traditional IRAs, you can contribute regardless of how much money you earn, but with Roth IRAs there are income limits. High-earners may not be eligible to open or contribute to a Roth IRA. Here are the 2021 income thresholds for contributing to a Roth IRA:

- Not eligible if your modified adjusted gross income is $208,000 or more

- Single, head of household or married filing separately : Not eligible if your modified adjusted gross income is $140,000 or more

- Not eligible if your modified adjusted gross income is $10,000 or more

Read Also: Best Countries To Invest In Real Estate In Africa

Investing Your Roth Ira Savings

When you contribute to a Roth IRA, these contributions are placed in various investments to grow and earn income. These investments will grow over the years through compounding, and the retirement savings could grow into thousands of dollars by the time you retire. Generally, a Roth IRA can hold any type of financial asset, from stocks, bonds, REITs, ETFs, etc.

The common types of assets that you can invest in with a Roth IRA include:

Consider Target Date Funds For Your Retirement Portfolio

TDFs are specially designed to rebalance the closer you get to your retirement date. For example, if you’re planning on retiring around 2060, you can get a TDF with that date.

The closer you get to the specified year, the less risky the fund behaves . A longer time horizon helps you maximize capital gains within these funds.

Recommended Reading: Real Estate Investment Software Reviews

Potential Benefits Of Investing In Commercial Finance

If youre already planning to start a business, using funds from your SDIRA to support its growth while also serving as an alternative long-term retirement plan can benefit your business now and your retirement plan down the line. Even if you arent one to start a business, you can invest a portion of your Self-Directed IRA funds into an existing business.

Cryptocurrency: Best For Alternate Investment/long

- Minimum Investment: Varies by platform

- Risk Level: High

- Fees: Varies by exchange or broker

Cryptocurrency isnt quite Roth IRA account ready yet. But its getting harder to ignore, especially when planning for retirement.

Crypto investing is relatively new, having begun only in 2009. The returns crypto can be spectacularly high-yield, but it does require a high level of risk tolerance. Its amazing how quickly this asset class has grown and matured in just a few years.

That said, crypto must be regarded as one of the highest-risk investment options. It is a relatively new asset class, and notorious for wild swings in price both higher and lower.

There are currently thousands of different cryptos available, which makes the field even riskier. But without a doubt, the star performer in the space is Bitcoin. If you want to begin investing in crypto, start by learning how to invest in Bitcoin. Its by far the most common type of crypto available.

But at the moment at least, there is a limitation with investing in crypto for retirement purposes. Thats because there are very few institutions that enable you to open a retirement account, including a Roth IRA, that allows you to invest in crypto.

At the moment, TradeStation is one of the very few mainstream brokerage firms offering Roth IRA accounts with crypto investing.

SDIRAs

Recommended Reading: Fannie Mae Loan For Investment Property

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

Making A Nondeductible Ira Contribution For The Long Haul

If you earn too much to contribute to a Roth IRA, you also earn too much to make a traditional IRA contribution that’s deductible on your tax return. The only option open to taxpayers at all income levels is a traditional nondeductible IRA. While investing in such an account and leaving it there might make sense in a few instances, investors subject themselves to two big drawbacks: required minimum distributions and ordinary income tax on withdrawals. The main virtue of a traditional nondeductible IRA, in my view, is as a conduit to a Roth IRA via the “backdoor Roth IRA maneuver.” The investor simply makes a contribution to a nondeductible IRA and then converts those monies to a Roth shortly thereafter.

Recommended Reading: Etf Investing What Is It

Our Picks For 6 Best Investments For Roth Ira

Normally when we provide best for guides for any financial service, we also offer a ranking of which we believe to be the best of the group. But in this case, were covering broad investment categories. Each is either necessary in building a successful Roth IRA, or at least highly desirable.

For that reason, were not going to provide a rank for our picks of the best investments for a Roth IRA. But we will provide what each investment class is best for within your portfolio.

- Stocks: Long-Term Growth

- Real Estate Crowdfunding: Investing in Real Estate Deals or Funds

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Here are some important questions and answers to help you start learning about Traditional and Roth IRAs, the most common types of IRAs. See if youre eligible to use this tax-advantaged account to save for your retirement.

Don’t Miss: Become An Independent Investment Advisor

What Is An Inherited Ira

An Inherited IRA allows beneficiaries a way to keep the funds growing tax-advantaged in an IRA while taking distributions. The account titling will always refer to the deceased IRA owner with you listed as the beneficiary. Since you arent the owner, you may not make contributions or 60-day rollover deposits to this account. The Setting Every Community Up for Retirement Enhancement Act has changed the distribution options for certain beneficiaries who inherit an IRA on or after January 1, 2020. Your beneficiary category will determine your options for distributing the money. For more information, please read IRS Publication 590-B .

You Must Take Required Minimum Distributions From Your Ira

All good things must come to an end, and such is the case with the tax deferral of a traditional IRA. Eventually, you will be required to withdraw a minimum amount from the account each year, known as a required minimum distribution or an RMD. However, the SECURE Act passed in 2019 implemented important changes to RMDs pushing back the age at which RMDs are first required from 70 ½ to 72.

If you turned 70 ½ in 2019, you should have taken your first RMD by April 1, 2020.

For those who reached the age of 70 ½ in 2020, you dont have to take your first RMD until April 1 of the year after you have turned 72. For example, if you will turn 72 in 2021, then you wont need to take your first mandatory payment until April 1, 2022.

But delaying your first payment until April 1 of the year after youve reached the mandatory age means you will have to take your second RMD that same year. All subsequent RMDs must be taken by Dec. 31.

Taking two RMDs in the same year can increase your taxable income, pushing you into a higher tax bracket. That means a larger portion of your Social Security income could be subject to taxes.

You could also end up paying more for Medicare Part B or Part D if taking two RMDs in a year increases your adjusted gross income and tax-exempt interest income over a certain threshold.

Read Also: Robs For Real Estate Investing

Certain Transactions Are Prohibitedand Breaking The Rules Could Cost You

You might have more control over what you invest in with a self-directed IRA, but you have to be careful about what you do with those investments. The IRS prohibits transactions between an IRA account and the accounts owner, its beneficiary, or other disqualified persons, such as certain family members.

The reasoning behind this: IRAs were created with the idea of ensuring future retirement stability. Any transactions conducted by an IRA must be for the exclusive benefit of the retirement plan.

For instance, if your self-directed IRA account owns a condo, you cant live in it. Nor can your child live there, even if that child is paying rent.

What happens if you dont follow the rules? Even if you make an unintentional mistake, it will cost you. Typically, if an IRA owner or another disqualified party engages in a prohibited transaction, the IRA account loses its IRA status as of the first day of the year that the transaction took place.

And you might have to pay a 10 percent penalty as well.

What Are The Taxes For An Early Distribution From My Ira

Taxable distributions from Traditional and Roth IRAs before age 59½ may be subject to an IRS 10% additional tax for early or pre-59½ distributions . The exceptions to the 10% additional tax are for age 59½, death, disability, eligible medical expenses, certain unemployed individuals’ health insurance premiums, qualified first homebuyer , qualified higher education expenses, substantially equal periodic payments , Roth conversions, qualified reservist distribution, qualified disaster distribution, birth or adoption expenses , or IRS levy.

Also Check: Mid Cap Companies To Invest In

Ira Cds Take Up Valuable Ira Space

Annual IRA contributions are capped at just $6,000, or $7,000 if youâre 50 or older.

âUsing up that limit contributing to a low-return investment like an IRA CD detracts from the dollars that can be invested in stocks and even bonds, which over the long term have provided higher real returns,â says Eagleson.

Waiting Until The Eleventh Hour To Contribute To An Ira

Investors have until their tax-filing deadlineApril 15 for 2023to make an IRA contribution if they want it to count for the year prior. Perhaps not surprisingly, many investors take it down to the wire, according to a study from Vanguard, squeaking in their contributions right before the deadline rather than investing when they’re first eligible . Those last-minute IRA contributions have less time to compoundeven if it’s only 15 months at a timeand that can add up to some serious money over time. The year 2021 was a great example investors who waited until early 2022 to make their contributions for the 2021 tax year would have missed out on a 26% return for U.S. stocks. Investors who don’t have the full contribution amount at the start of the year are better off initiating an auto-investment plan with their IRAs, investing fixed installments per month until they hit the limit.

Read Also: How Do I Invest In Nike Stock

Running Afoul Of The Roth Ira Five

The ability to take tax-free withdrawals in retirement is the key advantage of having a Roth IRA. But even investors who are age 59 1/2 have to satisfy what’s called the five-year rule, meaning that the assets must be in the Roth for at least five years before they begin withdrawing them. That’s straightforward enough, but things get more complicated if your money is in a Roth because you converted traditional IRA assets.

Global Stock Index Funds

Investors can diversify their portfolios further by adding a global stock index fund that holds a broad selection of non-U.S. stocks. A long-term portfolio that includes a global stock index fund provides exposure to the broader world economy and lessens exposure to the U.S. economy in particular. Inexpensive funds that track an index like the MSCI ACWI Ex-U.S. or the EAFE Index provide broad geographical diversification at a relatively low cost.

Investors with a greater degree of risk tolerance may choose to invest in an international index fund with a particular focus on emerging market economies. Emerging market countries, such as China, Mexico, and Brazil, may exhibit higher but more volatile economic growth than the economies of developed countries, such as France or Germany. Though its also riskier, a portfolio with greater exposure to emerging markets has traditionally yielded higher returns than a portfolio thats more focused on developed markets. However, emerging markets have been facing especially heightened risks amid the ongoing COVID-19 pandemic.

Read Also: How Can I Get Free Bitcoins Without Investment

Can I Contribute To Both A Traditional And A Roth Ira In The Same Year

Yes, if you meet the eligibility requirements for contributing to a Traditional IRA and Roth IRA. The total contribution to all of your Traditional and Roth IRAs cannot be more than the annual maximum for your age or 100% of earned income, whichever is less. For example, in 2022, the total amount you can contribute to both a Traditional IRA and a Roth IRA combined cannot exceed $6,000 .

Ira Cds Are A Safe Low

In exchange for locking up your money for a set term, an IRA CD provides a guaranteed return on your investment. When you invest in CDs backed by a Federal Deposit Insurance Corp. member institution, like a credit union or a bank, your principal is insured up to $250,000 per depositor, for each account, in the event of a bank failure.

âWeâre holding CDs in lieu of bond funds in clientsâ IRAs, especially those who are older than 59 1/2 who want security for at least a portion of their portfolios with basically no fee,â says Dennis Nolte, a financial planner in Oviedo, FL.

Recommended Reading: Investment Advisory Firms For Sale

What Should The Average Worker Invest In

The answer to this depends upon your long range goals, how much time left until you plan to retire, and your risk appetite.

Are you age 25 or age 50? If you are younger, you can afford to take some investment risk by investing in common stocks. If you are older, you may want to be more conservative and use Bank CDs.

What is your risk appetite? If you really cant stomach the volatility of the stock market dont! Put the money in safer bank accounts and CDs. If you are willing to take on more investment risk, then diversify the money among a number of investments stocks, bonds, commodities.