Why Choose A Roth Ira

Roth IRAs have a superpower thats unique among tax-advantaged retirement accounts: Contributions to a Roth IRA are made using money thats already been taxed, and as a result, all withdrawals in retirement are totally free of income taxes. Thats right, you wont pay a dime of taxes on qualified withdrawals from a Roth IRA.

Thats not the only benefit of a Roth IRA. Tax-advantaged retirement accounts lock down your money before you reach age 59 ½. Withdraw money earlier, and in all but a few special circumstances youll owe the IRS a 10% penalty, plus income taxes. But with a Roth IRA, you can withdraw contributions, but not any earnings, tax and penalty free at any time.

Similar to other tax-advantaged retirement accounts, a Roth IRA shelters your retirement investments from capital gains taxes. Compare that to a taxable brokerage account, where you pay taxes on any profits you realize when you sell investments or earn dividends.

Find Out If You Are Eligible

First, find out if youre eligible. You must have earned income for the year, or else you wont be able to contribute to your account. Roth IRAs are associated with income limits and contribution maximums, so be sure to know these as well.

-

Tax Year 2022: For the 2022 tax year, the phase-out range for an individual is $129,000 to $144,000. For couples, it is $204,000 to $214,000.

-

Tax Year 2021: For the 2021 tax year, the phase-out range for an individual is $125,000 to $140,000. For couples, it is $198,000 to $208,000.

The next condition to keep in mind is the contribution maximum. This is how much you are allowed to deposit into your Roth IRA in a given year. Currently, the maximum is $6,000. If you are over 50 years old, the maximum is increased to $7,000. If you fall somewhere in between the ranges listed above, you can still contribute, but your contribution limit is reduced. If your income is above the range, then you are not eligible to contribute at all.

Below youll find the contribution limits defined based on tax filing status and modified adjusted gross income for the filing years 2020 and 2021.

2022 Roth IRA Income Limits

Contribution Limit: Up to the Limit

Modified AGI : > $204,000 but < $214,000

Contribution Limit: Reduced Amount

Modified AGI: < $10,000

Modified AGI: $10,000

Contribution Limit: Zero

Single, head of household, or married filing separately and you do not live with your spouse

Modified AGI: < $125,000

Contribution Limit: Up to the Limit

Index Funds For Roth Ira

Disclaimer: This post may contain affiliate links. If you make a purchase or signup through our partner links, we will get compensated at no cost to you. Please read our disclosure for more information.

Are you looking for resources on how you can start investing in index funds for Roth IRA?

Welcome, youve come to the right place.

Today, let us walk you through the process of index investing. Plus, let us share with you the top index funds for Roth IRA.

Ready to paint a picture of your golden years?

Lets get it on!

Recommended Reading: How To Invest In Polka Dot

Can You Lose Money In A Roth Ira

Yes, you can lose money in a Roth IRA. However, these losses can be mitigated with patience and control. Your investments will fluctuate along with the market, so if the market nosedives, then so can your investments. However, market fluctuations balance out over time. Patience is the key. The surest way to take a direct hit on your Roth IRA is by making an early withdrawal. If you take money out of your Roth IRA too early, you will get taxed on that income, plus another tax penalty of 10 percent. The longer you can leave your investment untouched, the less likely you are to lose money.

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

Also Check: How To Open Investment Account For Child

Whats The Difference Between Traditional Ira And Roth Ira

The key difference is in the way they are taxed. Traditional IRAs are funded with pre-tax dollars. This means your contributions are tax-deductible and bring down your tax bill, but youâll have to pay taxes once you retire and start making withdrawals. With Roth IRA, you pay your usual tax and then fund your account. So youâll pay slightly more tax throughout your life, but after you retire all the gains are yours! The allowances and limits for both these types are the same, and you can even have both if you decide to do so.

Allowable Investments In A Roth Ira

Once the funds are contributed, a variety of investment options exist within a Roth IRA, including mutual funds, stocks, bonds, exchange-traded funds , certificates of deposit , money market funds, and even cryptocurrency.

Note that IRS rules mean that you cannot contribute cryptocurrency directly into your Roth IRA. However, the recent emergence of Bitcoin IRAs has created retirement accounts designed to let you invest in cryptocurrencies. The IRS also lists other assets that are not permitted within an IRA, such as life insurance contracts and derivative trades.

If you want the broadest range of investment options, you need to open a Roth self-directed IRA , a special category of Roth IRA in which the investor, not the financial institution, manages their investments. These unlock a universe of possible investments. In addition to the standard investments , you can hold assets that arent typically part of a retirement portfolio. Some of these include gold, investment real estate, partnerships, and tax lienseven a franchise business.

Also Check: Best Online Investment Platform For Beginners

Finding The Best Roth Ira Robo

For people who want to invest for retirement but dont want to worry about managing their portfolio over time, a robo-advisor is an easy choice. Generally, robo-advisors hire investment pros to develop a handful of portfolios aimed at different types of investors. Some robos offer portfolios that vary based on amount of risk, with aggressive ones for people who want a high percentage of their portfolio in stocks and conservative for people who seek a less volatile investment account.

As an investor, all you have to do is open your Roth IRA, link your bank account and follow the steps the provider uses to build your portfolio. The robo-advisor then purchases the investments for you and manages the account over time. Many robos also offer services that can help maximize your savings, such as goal-setting tools to get your finances on track, and strategies to reduce your tax bill.

» Check out all of our top picks for best Roth IRA accounts

What Is A Roth Ira For Dummies

Roth IRA is a type of retirement investment account that lets you into a variety of assets for your retirement. You need to be making at least some money or be married to someone who is and there is a limit on how much you can contribute annually, usually up to $6000. Also, if you make over a certain maximum income then you canât make contributions to an IRA.

Recommended Reading: What Is A Passive Investment Strategy

How Does A Roth Ira Work

You contribute money to your Roth IRA from your earned compensation whether you are employed or self-employed after you pay income taxes. Then your future, qualified withdrawals are tax-free. Roth IRAs allow you to contribute up to $6,000 a year, plus an additional $1,000 catch-up contribution each year if youre 50 or older.

Roth IRA contributions are required to be made either in cash or by check. Once youve made your contribution, you can choose from a variety of investment options within a Roth IRA, including stocks, bonds, certificates of deposit , mutual funds, Exchange Traded Funds and money market funds. Having these choices gives you the opportunity to diversify your savings with an appropriate mix to help meet your retirement objectives.

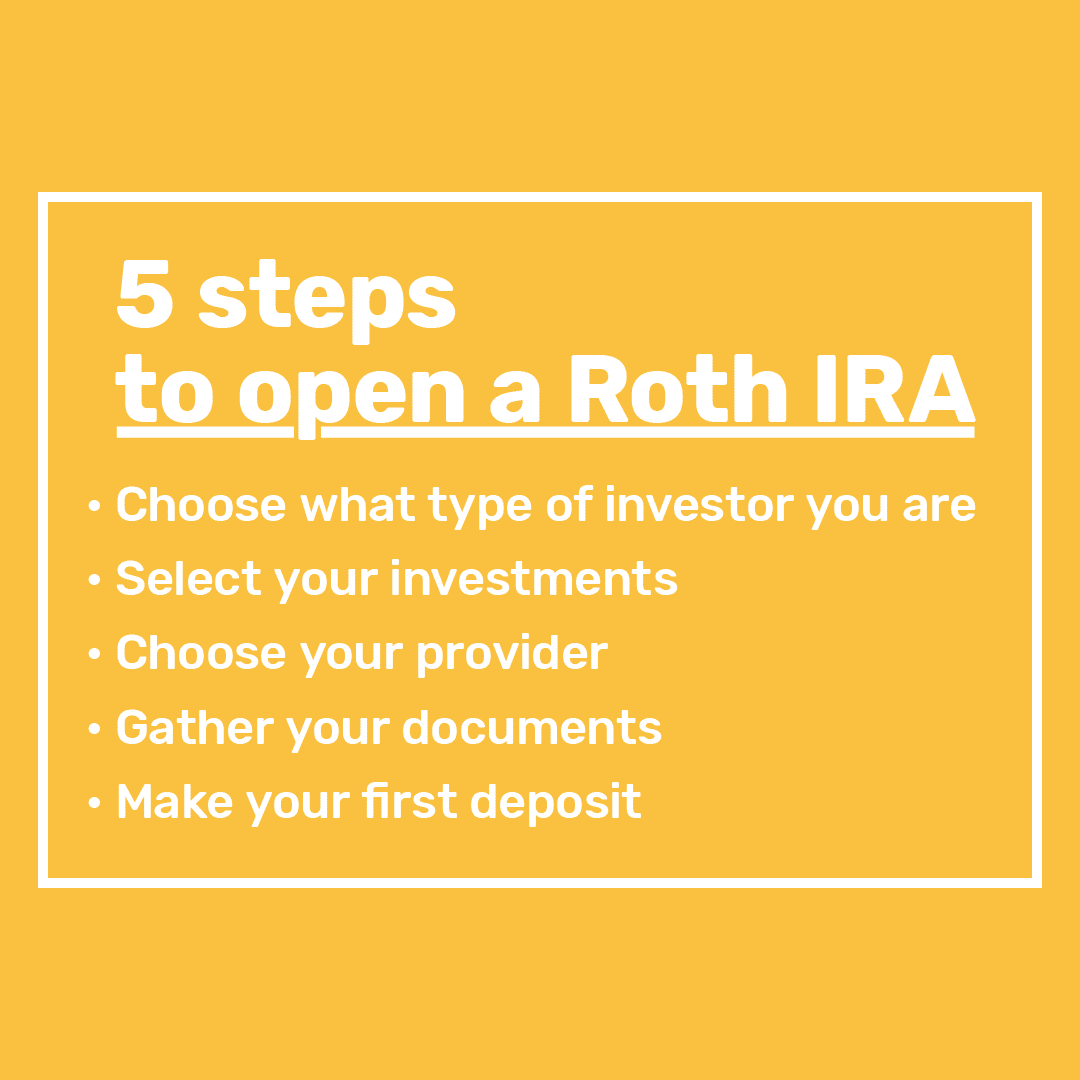

How To Open A Roth Ira

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

A Roth IRA is a true gift for retirement savers: You pay taxes on your contributions up front, you let that investment compound, and then your withdrawals in retirement are tax-free.

Here’s a step-by-step guide on how to open a Roth IRA:

Recommended Reading: Investing One Dollar In Stocks

Where Is The Best Place To Open A Roth Ira

The best place to open a Roth IRA depends on a variety of factors. NerdWallet rounded up a list of the best accounts, which youll find below. This list was selected based on factors such as investment selection, customer support, account fees, and account minimums, to name a few.

Best For Investors Who Prefer To Be Hands-Off

How To Open An Ira

You can open an IRA with any bank or broker. You may already have a brokerage account with Fidelity, Schwabb, or Merryl Lynch, for instance. If so, simply open an IRA via your current account. If you dont have a brokerage account yet, choose a reputable company that resonates with you and open one today.

Don’t Miss: Best Investments For Accredited Investors

How To Start A Roth Ira: X Common Steps For Beginners

Now letâs look at a practical Roth IRA guide. How to start investing in a Roth IRA?

Step 0 is knowing whether youâre eligible for a Roth IRA. If you are a U.S. taxpayer and you or your spouse has an annual income under $144,000 for individuals , you can make contributions to a Roth IRA. Letâs talk about how to open up an account and start investing for your retirement.

Choose Mutual Funds With Strong Returns

When youre choosing your mutual funds, look for funds with a long track record10 years or moreof strong returns that consistently outperform the S& P 500. Theyre out there! Youll also want to spread your investments evenly across these four types of funds:

- Growth and Income: These funds create a stable foundation for your portfolio by investing in big American companies that have been around for decades. They also pay dividends. You might find these funds listed under large-cap or blue chip funds.

- Growth: These funds are made up of medium or large U.S. companies that are up and coming. Sometimes called mid-cap or equity funds, theyre more likely to ebb and flow with the economy.

- Aggressive Growth: Meet the wild child of your portfolio. When these funds are up, theyre really up, and when theyre down, theyre really down. Aggressive growth funds normally invest in smaller companies that have tons of potential.

- International: Investing in international funds gives you a chance to invest in big non-U.S. companies you already know and lovelike Nestlé, which is based in Switzerland. International funds spread your risk beyond U.S. soil. Just dont confuse them with global funds, which bundle U.S. and foreign stocks together.

Read Also: How Can I Invest In Stocks With Little Money

How Much Money Do You Need To Start A Roth Ira

While brokers wont charge you a fee to open a Roth IRA, almost all of them require a minimum investment. The minimum contribution amount will depend on what type of investments will be associated with your account. Some mutual funds will have a minimum investment of around $1,000, while other investment types can get started with just a few dollars. Although you wont need to pay this upfront, you should also be prepared to pay commission on any trades that are made.

Investing In A Roth Ira

A Roth IRA is a type of individual retirement account that comes with unique tax benefits because you contribute after-tax dollars and wont pay any taxes on your earnings if you withdraw them under the right circumstances.

Learn how to invest in your Roth IRA so you can enjoy those tax-free earnings.

Also Check: Best Online Investing For Beginners

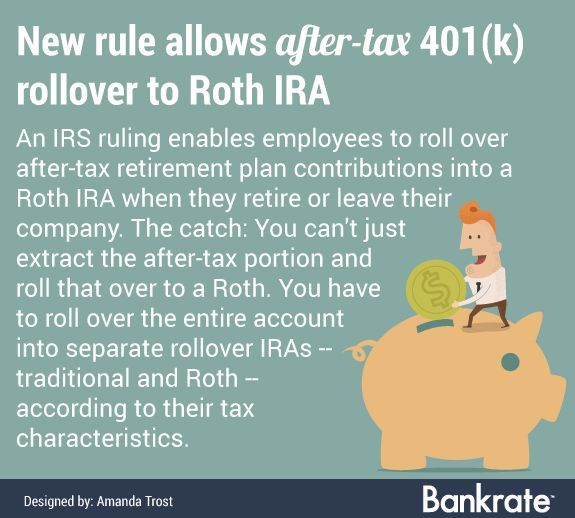

Traditional Ira/401 Conversion To Roth Ira

Another option you have for funding a Roth IRA is doing a rollover. If you have an old 401 that you want to use to fund a Roth IRA, you can do precisely that. One caveat is you need to make a pit stop in between at the Traditional IRA.

Typically, it goes something like this. You roll over your 401 to a Traditional IRA, this transfer is not a taxable event. Then you convert the Traditional IRA to a Roth IRA and pay the tax bill. Both M1 Finance and Betterment have services in place to help you with the rollover process.

One important rule to note is that most employer-sponsored 401 plans do not allow in-plan rollovers. You must retire or no longer work for the company in most cases to roll your 401 out of the plan.

Are There Rules About Making Withdrawals From A Roth Ira

In general, youre allowed to withdraw Roth IRA contributions and earnings without being taxed or penalized. If your Roth IRA account isn’t at least five years old or if you’re not yet 59½, the earnings portion of any withdrawal may be subject to taxes and a 10% penalty. The five-year count starts with your first contribution to the account.

The IRS has defined two specific rules for the five-year holding period. Here are the details of these rules.

Five-Taxable-Year Holding Period:

You May Like: Investing In A Reit Is The Same As Purchasing Property

Roth Iras: Investing And Trading Dos And Donts

Institutional Investor NewsFamily Wealth Report

A Tea Reader: Living Life One Cup at a Time

Roth individual retirement accounts are considered one of the best retirement plans and long-term investment accounts that anyone can have. Because Roth IRAs are funded with after-tax dollars, you can withdraw your funds in retirement tax free. Whats more, unlike traditional IRAs, Roths have no required minimum distributions during the owners lifetimeso you can leave the money alone to keep growing tax free for your heirs.

You can contribute up to $6,000 to an IRA for 2021 and 2022. And while you can withdraw your contributions at any time , you generally must be at least age 59½and you must have first contributed to an IRA at least five years agoto withdraw earnings without incurring taxes or penalties.

A Roth IRA can be an excellent tool for growing your nest egg, especially if you understand the dos and donts. Heres a quick look at managing your Roth IRA to make the most of it.

There Are Many Ira Account Types

There are many IRA account types to consider as you plan for retirement, and each works differently depending on your life circumstances and financial goals. Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you. With our IRA calculators, you can determine potential tax implications, calculate IRA growth, and ultimately estimate how much you can save for retirement.

Read Also: Mid Cap Companies To Invest In

Unrelated Business Taxable Income

Another thing that likely wont affect youbut is worth being aware ofis unrelated business taxable income . If a tax-exempt entity regularly engages in business unrelated to its primary purpose to make some money on the side, and if you invest in it with a self-directed Roth IRA, then you may be liable to pay tax on those particular revenues.

The IRS states that if a Roth IRA earns $1,000 or more of UBTI in a year, then the amount above $1,000 is taxable.

How Does The Roth Ira Compare To A Traditional Ira

For starters, both Roth IRAs and Traditional IRAs are tax-advantage investment tools and both allow you to save for your retirement. Where they differ is in the specific tax advantages they offer.

While a Roth IRA offers tax-free growth and tax-free withdrawals, a Traditional IRA is tax-deductible. This means that the contributions you make to your Traditional IRA will help to lower your taxable income.

With a Roth IRA, you pay your taxes now and reap the tax-free withdrawal later. With a Traditional IRA, you reap the rewards now with the tax deferral but you have to pay your taxes later when you start to withdraw the money.

Also Check: I Want To Invest 1000 In The Stock Market