Roles Within Investment Banking

If you want to become an investment banker, there are 2 pathways you can go down.

Lifepath 1: Sales, Trading and Research

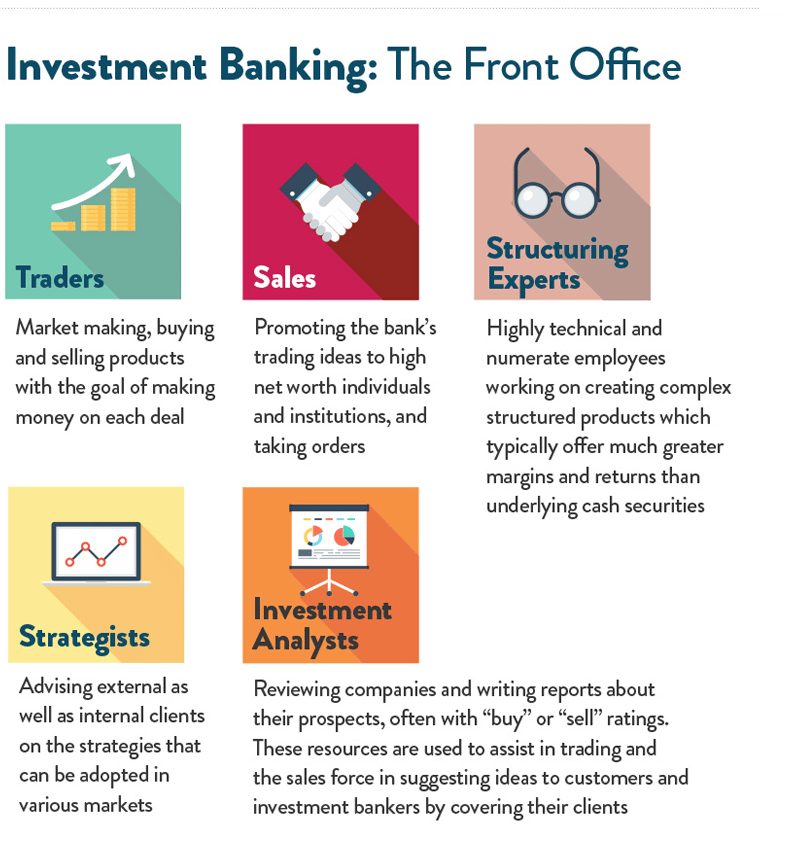

The sales, trading and equity research pathway encompasses all roles on the trading floor.

Think The Big Short or Wall Street: Money Never Sleeps.

Salespeople call potential investors to suggest companies that they might want to invest in.

A financial trader buys and sells , bonds and assets on behalf of their clients, setting prices and making trades to try and maximise profit.

Those who work in equity research analyse trends, produce reports and, on the basis of this research, recommend companies for clients to invest in.

Whichever role you choose, you will specialise in a particular market area. For example:

- Consumer and retail

Within these teams you will specialise in a certain business area, as above. A few more examples include:

- Natural Resources

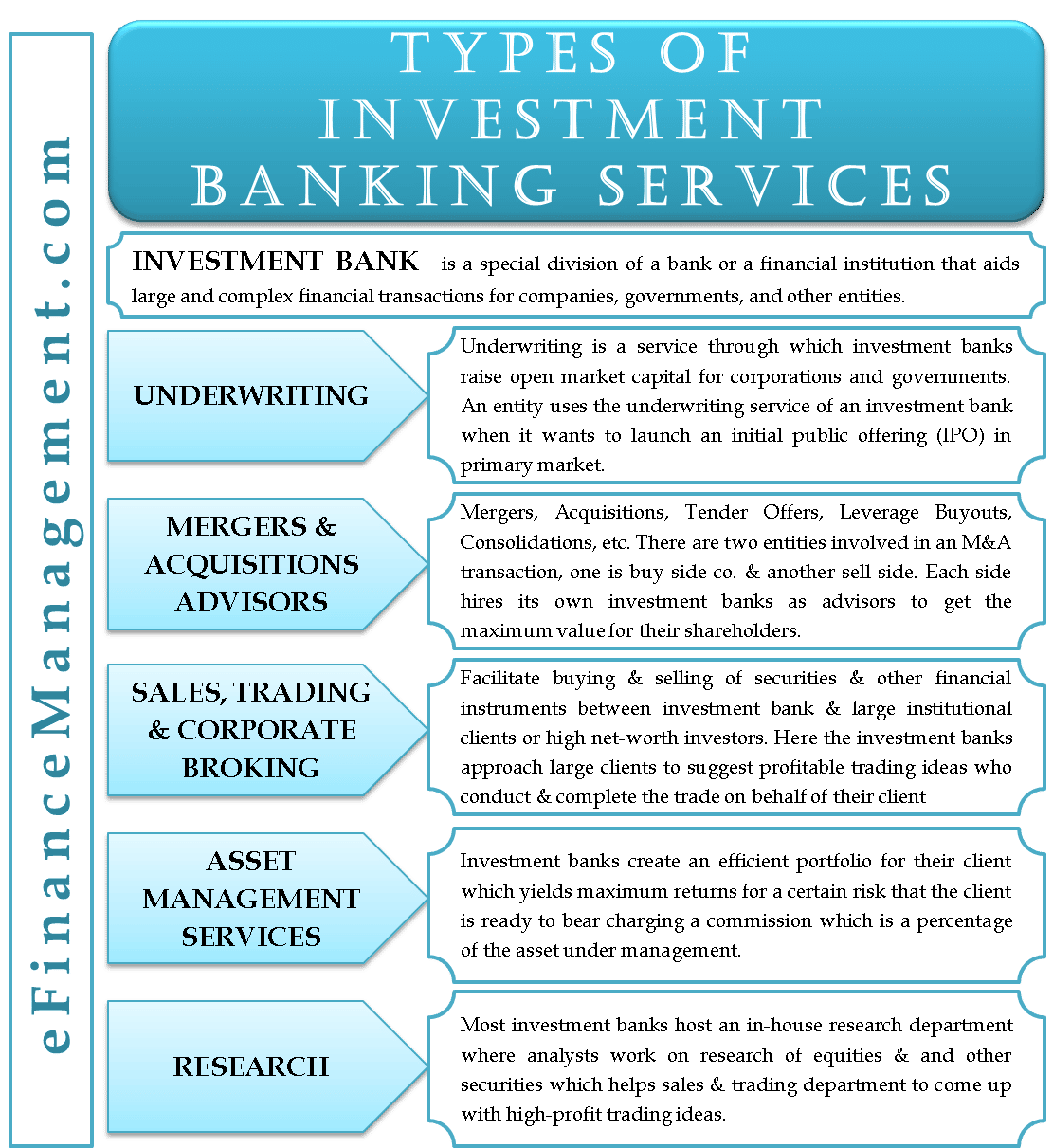

Investment bankers working in corporate finance provide a range of financial services to their clients to help them raise capital .

Examples of these services include:

- Executing a merger or an acquisition

Some of these things can be difficult to understand before you enter the field, but you dont have to worry about them too much now.

Whats more important is that you have a general idea of the different directions you can go in, as well as the skills and qualifications required for each role.

Youre Deal Is Only As Strong And As Good As The Deal Team

A chain is no stronger than its weakest link, and life is after all a chain William James

When you choose an investment banker, know that your deal is only as strong and as good as the deal team.

You can have an investment banker extraordinaire but fall short because of a weak team.

When you choose an investment banker, watch out for the bait-and-switch.

Avoid an all-star investment banker who has a deal team of juniors.

It happens more than you think and more than it should.

When interviewing investment bankers, find out who the deal team is and what each person does.

Know that the investment banker plays a large role at the start and end of the process.

And this is exactly how it should be.

Your investment banker brings interested buyers to the table at the start. The investment banker disappears and reappears at the end to get your deal done.

Its the deal team who does everything else. Ensure you meet the deal team, ask questions, and look at the quality of their work.

The deal of the century wont be a deal if the deal team is weak and doesnt perform.

Do the smart thing and take a pass on the strong investment banker with a weak deal team.

Youll lose every time and this is not the time to lose.

You can take that to the bank.

Looking to maximize success when selling your business? Choose an investment banker.

But not just any investment banker.

The ultimate success of your exit and sale hinges on the quality of your investment banker.

Dont be.

Thanks.

Attend Events And Network

You can sign up for information sessions through your careers service, and you’ll find opportunities to speak to employers at recruitment events. Virtual talks can also provide a taster of what your day-to-day work as an investment banker may involve.

Meanwhile, there’s no excuse not to be well-connected with employers on networks such as LinkedIn – many people end up finding a job with help from social media.

When you land your first investment banking job, you should always aim to keep in touch with your peers. Not only can these industry professionals provide valuable careers guidance, they have the potential to aid your career progression further down the line.

Also Check: How To Raise Funds For Real Estate Investments

Using Your Time At University To Prepare For Success

Once youre at university, there are several things you can do to up your chances of success when it comes to applying for jobs.

Join Relevant Clubs and Societies

Finance or business-related clubs and societies are a good way to demonstrate your commitment to the profession to future employers. They also provide an excellent talking point for interviews.

Have a look on your university website or inquire at the students union to see whats on offer.

From Economics and Finance to Fintech, Women in Finance to Value Investing, youre bound to find an organisation to interest you.

Cant find exactly what youre looking for? Start your own!

Founding a club or society – or acting as president, secretary or treasurer – will show true passion and help you develop essential leadership skills.

Plus, if youre more heavily involved in the organisational side of things, it might put you in the way of new contacts, particularly if you organise events with high-profile speakers.

Apply for Spring Weeks

Spring weeks are week-long work experience placements hosted by investment banks for 1st year university students.

They take place over the Easter holidays and are designed to give aspiring bankers an overview of the banks inner workings and an insight into the industry in general.

Apply as early as you can: applications are usually considered on a first-come-first-served basis.

Get an Internship

On the Barclays Analyst Summer Intern Programme, for example:

Network, Network, Network

General Rule Of Thumb On Success Fees

Here are some rules of thumb ranges based on a company’s enterprise value:

- Less than $1 million: 8%

- Between $1 – 5 million: 6 – 8%

- Between $5 – 10 million: 4 – 6%

- Between $10 – 25 million: 4 – 5%

- Between $25 – 50 million: 2.5 – 4%

- Between $50 – 100 million: 2 – 3%

- Between $100 – 250 million: 1.5 – 2.5%

- Between $250 – 500 million: 1 – 2%

- Above $500 million: 0.50% – 1.5%

Also Check: How To Start Investing With Charles Schwab

What University Should You Go To If You Want To Be An Investment Banker

In reality, its the university that carries more weight with investment banks than the course.

Though its not officially advertised, it is generally understood that high-ranking universities like Oxford, Cambridge, LSE, UCL, Imperial College London and Warwick are favoured by the big banks. Aiming for one of these universities will stand you in good stead.

Its not just their prestigious name thats likely to work in your favour. These are the universities most targeted by top investment banks, so youre more likely to come face to face with their representatives at careers fairs, workshops and recruitment events.

Having said this, banks are said to be expanding their field of recruitment to include universities like Kings College London, Durham, Bristol, Exeter, Nottingham and Manchester.

When making your choices, aim for Russell Group universities if you can, and focus on getting the best possible grades when youre there. Whatever degree and university you choose, you will need at least a 2:1, and a really strong academic record will help set you apart from other qualified candidates.

Whats The Career Path Of An Investment Banker

Unlike in many professions, where a mid-career pivot is not unusual, the career path for an investment banker follows a more predictable trajectory. Diversions from this path make it much more difficult, if not impossible, to land an investment banking role.

The journey to investment banker begins with earning a relevant undergraduate degree or a graduate degree for career changers and at least one internship.

From there, your first role will likely be a financial analyst, followed roughly two years later by an associate position . After that, if you decide to stay in banking, the next step is vice president and then managing director.

If post associate role youre ready for something new, youve got plenty of other options. As for me, I parlayed my investment banking experience into a career in financial consulting and then, after another career change, launched my own business as a career coach and talent consultant.

I have clients who have moved on to roles in the financial and/or business development departments of corporations and nonprofits, some even choosing to work for former clients. Many former bankers opt to go into private equity, hedge funds, or financial technology . Others have decided to use their hard-earned savings from their time in banking to launch their own business or pursue more creative endeavors.

Read Also: 10 Down Payment Investment Property

How You Can Start Developing These Key Skills Now

Its a good idea to start building these skills whilst youre still at school. There are several ways you can do this:

I was always very busy with a wide range of extracurriculars. I did Model United Nations, volleyball, European Society, volunteering with the Singapore Red Cross… Potential employers will look at the skills youve acquired through these kinds of activities: teamwork, analytical skills, leadership, presentation, debate, stakeholder management, accounting..

Erika Terrones-Shubiya, Associate at Goldman Sachs.

Be Sure This Is The Right Job For You

Unlike many other finance careers, investment bankers often come from a range of backgrounds, and may use their transferable skills to join other related professions further down the line, possibly moving into a research, trading or structuring post.

However, those interested in investment banking and investment as a career often fit a certain person profile – particularly graduates on the lookout for a demanding and potentially stressful job.

Although working for one of the top investment banks can be challenging, the financial rewards are worth it for many. Indeed, you can earn around £30,000 to £40,000 starting out as a corporate investment banker, and £25,000 to £55,000 as an operational investment banker, with rapid salary progression the norm in this industry.

Understanding what’s expected from the outset can help you to remain focused on taking advantage of any investment banking job or work experience opportunities that come your way.

Get personalised alerts and shortlist your favourite jobs and courses for easy decision-making

Read Also: Commercial Property Return On Investment

Choose Your Investment Banking Career

As well as different career options, there are also various roles for those working in investment banking. While there are similarities, they require different skillsets and personal attributes.

If you’re working on the operational side, your team will be responsible for the processing and settlement of transactions. You’ll need to be hard working, with excellent numerical and analytical skills.

Corporate investment bankers provide financial services to other companies and organisations. You could be working on mergers and acquisitions, lending or bonds and shares. As you’ll be providing strategic advice to your clients and working under extreme pressure, you’ll need to be good at negotiation and have strong interpersonal skills.

Working as an investment analyst is a common entry-level graduate role.

Broken Deals: Of The Engaged M& a Assignments In The Past 3 Years How Many Did Not Close And Why

This might be the most important question of all, particularly when your company is small to mid-sized. Have the advisor walk you through the recent transactions they have taken on that were not consummated. This is critical due diligence. Ask to speak with several of the business owners they have worked with. When you connect with the business owner, ask how hard the advisor worked, how long they stayed focused, and who were the individuals that really completed the work. If an advisor does not provide you several referrals, its a red flag and you should approach with caution.

You May Like: Annual Qualified Default Investment Alternative

Build An Aligned Banking

In todays world where everyone Googles you before you have a conversation, its important to make sure your online presence precedes you well. It is your responsibility to showboth through your conversations and through what people find out about you onlinethat youre the perfect fit for an investment banking role at your desired firms.

Online presence includes everything someone finds about you online, including social media and your website or blog, if you have one. For investment bankers, I recommend starting with . The key is to think of your profile page as your online billboard to land the job.

Building your online presence starts with listing your education, internship, relevant projects, and volunteer work. Beyond the basics, its important to take the time to craft your career story, or personal brandhow you connect the dots of your education, skills, unique background, etc. to demonstrate the value you add and what differentiates you from other aspiring bankers.

Taking the time to intentionally and strategically present yourself online will also help in your networking, because doing so forces you to really think aboutand clearly articulatewhy youre drawn to banking, what youve done so far to get there, and how youre addressing any perceived gaps in education and experience.

Is It Hard To Become An Investment Banker

It can be quite hard to become an investment banker because of the stressful and demanding nature of the profession. Investment bankers often have to work for over 80 hours a week, follow strict regulations and deal with high-pressure situations. They must have an excellent grasp of accounting, economics, finance, mathematics, statistics, data analytics and banking technology. Additionally, they must have strong communication skills and a confident, outgoing personality to interact and build relationships with influential and extremely wealthy people.

Don’t Miss: What Is Fundrise Real Estate Investment

Investment Banking Fees For Sell

Investment banks offer expertise and know-how that can add significant value to any transaction, but complicated fee structures can be daunting and confusing in picking an investment banker.

In negotiating fee structures, a business owner should consider the goal he or she seeks to achieve in hiring an investment banker. An owner looking to sell a business as soon as possible, and an owner willing to wait longer for the highest bidder will likely have different fee structures. In other words, a fee structure is intended to incentivize investment bankers and to align their interests with your own interests as a business owner looking to sell. In order to negotiate an appropriate fee structure that will achieve your goals, you should first understand the factors that go into a fee structure.

Below are common components of a standard fee structure.

Guide To Selecting Your Transaction Professional

If youve ever googled how to sell my business, no doubt you quickly realized that it seems far more complicated than you might have hoped. How will you transition out of your business? Who, if anyone, will help you sell it? These are important questions, and you should begin to consider the answers one to two years before you are ready to make your exit.

Many terms are used to describe the various professionals in the business of selling companies, with the most common being investment banker, M& A advisor, and business broker. Understanding the different qualifications and services provided by each type of transaction professional is an essential part of your process.

This guide will walk you through the key differentiators of each intermediary, including what to look for in a professional and what to expect during the selling process. Furthermore, you will learn why selling without a transaction professional may be temptingbut could prove to be a costly mistake.

Read Also: Best Bank Accounts For Investment Clubs

How Much Money Do Investment Bankers Make A Year

The is â¹5,97,078 per year. Your salary may vary depending on your location, experience and other factors. Generally, investment bankers who have graduated from prestigious colleges or work in large banks may have higher base salaries and receive good bonuses.

Please note that none of the companies mentioned in this article are affiliated with Indeed.

Salary figures reflect data listed on Indeed Salaries at time of writing. Salaries may vary depending on the hiring organisation and a candidate’s experience, academic background and location.

The Why Investment Banking Interview Question

Youre almost guaranteed to be asked this question in an investment banking interview. Of all the jobs you could have out of university, why investment banking?

The key is to quickly demonstrate that youre smart, that you understand what the job entails, and, having a full view of whats required, you still really want to do it!

At the end of the day, investment banks want Analysts/Associates who are

This guide will show you how to demonstrate the above three qualities in a concise way.

Recommended Reading: How Can I Invest In Foreign Stocks

What Is An Investment Bank

An investment bank provides various financial services to corporations, governments, institutions or high net-worth individuals.

There are several different kinds of banks where investment bankers might work, including international investment banks , such as J.P. Morgan or Goldman Sachs, and boutique investment banks, such as Lazard or Guggenheim Partners, which tend to work on smaller deals and specialise in particular areas within investment banking.

Careers In Investment Banking

Getting into i-banking is very challenging. There are far more applicants than there are positions, sometimes as high as 100 to 1. Weve published a guide on how to ace an investment banking interview for more information on how to break into Wall Street.

In addition, youll want to check out our example of real interview questions from an investment bank. In preparing for your interview it also helps to take courses on financial modeling and valuation.

The most common job titles in i-banking are:

View a full list of the top 100 investment banks here. It is important to note that there are many smaller firms, often called mid-market banks, and boutique investment banks that make up a very large part of the market.

Recommended Reading: How To Invest In Mutual Funds Online India

How To Become An Investment Banker: The Ultimate Guide

Olivia Ward-Smith

Thinking about a career in investment banking?

Youve come to the right place.

In this article well take a detailed look at how you can secure a successful investment banking career: what A-level subjects youll need, work experience, undergraduate degree choices, career progression and more!

Plus, tips on what you can be doing to prepare for a career in finance now.