Eligibility Requirements For Navy Federal Mortgages

In addition to membership with Navy Federal Credit Union, two of the mortgage lenders loan types require specific military or Department of Defense history or relationship to either.

VA Home Loan

- 90 consecutive days of active service during wartime

- 181 days of active service during peacetime

- More than six years with the National Guard or Reserves

- Current spouse of a service member who died on duty or as a result of a service-related disability

Military Choice

Navy Federals Realtyplus Program

Through RealtyPlus, mortgage loan buyers may get between $400 and $9,000 cash back, depending on the home’s purchase price.

Enroll online and a RealtyPlus coordinator will connect you with a real estate agent at one of its partner agencies Better Homes and Gardens Real Estate, Coldwell Banker, Century 21, ERA Real Estate or Corcoran.

While RealtyPlus limits home buyers to purchases through agents at only these companies, the program is free save for applicable real estate fees or commissions and includes helpful information, such as home sale market trends and school rankings.

Note that homes for sale by owner may not qualify. Be sure to ask your assigned agent for further details.

Does Navy Federal Credit Union Offer Home Equity Loans Or Helocs

Yes! Both.

Members can get either a Navy Federal Credit Union Home Equity Loan or a Navy Federal Credit Union HELOC.

For clarity, your home equity is the amount by which the appraised value of your home exceeds your current mortgage balance.

Both these forms of borrowing have outstanding rates compared to most other types of loans. But that’s partly because your home secures the loans. If you fall too far behind with payments, this means you could face foreclosure.

Navy Federal Credit Union was founded in 1933 by seven Navy Department employees. Today, it has 11.2 million members and an excellent reputation. Its broad product range includes Navy Federal Credit Union home equity loans, home equity lines of credit , mortgages, several types of other loans, credit cards, various savings accounts, and general banking services.

Navy Federal has 350 branches, a few of which are overseas. They tend to serve areas with a significant military presence, as you’d expect. However, many of its members rarely visit branches. Instead, they rely on the credit union’s website and highly rated mobile app to do their banking. The credit union operates in all 50 states.

Eligibility

Because Navy Federal is a credit union, you have to be a member to access its products and services. And that’s restricted to “officers and enlisted men and women of all branches of the military, veterans, DoD employees, and their family members.”

Also Check: Non Discretionary Investment Advisory Services

Can I Use A Heloc For Down Payment On An Investment Property

You can use a HELOC for the down payment on an investment property, and its often worth the investment. Home equity is a valuable financial asset that exists for your benefit. Using this asset to finance an investment property can help you increase your passive income which will increase your wealth and your overall equity over time.

How Do I Determine My Homes Market Value

If you dont have a recent appraisal, you can estimate your homes market value by researching recent sale prices of similar homes in your neighborhood. A local real estate agent can assist you with this process. You can also get a general idea of your homes value by reviewing your tax statements for the assessed value of your home. A current home valuation, including clear pictures of the outside of your home, is required to determine how much equity you can borrow. When you apply for an equity loan/line of credit, your Processor will determine the type of home valuation or appraisal needed based on the details of your loan and can schedule it for you.

Read Also: 30 Year Mortgage Investment Property

Top Navy Federal Credit Union Mortgage Reviews

- 4,006,543 reviews on ConsumerAffairs are verified.

- We require contact information to ensure our reviewers are real.

- We use intelligent software that helps us maintain the integrity of reviews.

- Our moderators read all reviews to verify quality and helpfulness.

For more information about reviews on ConsumerAffairs.com please visit ourFAQ.

Sarah of Round Rock, TX Verified

Navy Federal gave us an excellent rate, they worked with us to get everything done quickly, as the seller was in a hurry due to having already purchased another home. Closing went…

Verified

I sold my house and purchased a new home in April during this pandemic. My previous mortgage company was SunTrust and I decided to go with Navy Federal. I was a little put off by …

/10 Lendingtrees Mortgage Lender Rating

LendingTrees mortgage lender rating is based on a 10-point scoring system that factors in several features, including digital application and closing processes, available loan products and online and in-person accessibility. LendingTrees editorial team calculates each rating based on a review of information available on the lenders website. Lenders receive a half-point on the standard product offerings criterion if they offer at least two of the four standard loan programs . In some cases, additional information was provided by a lender representative.

= 1 pt = 0 pts

You May Like: Investment Property Mortgage Rates Colorado

Navy Federal Credit Union Pros

Some of the characteristics many experts and customers seem to like about Navy Federal are:

- Great customer service

- A broad range of banking services and products, including home equity loans and HELOCs

- Highly rated mobile app and robust website with great functionality

As youve gathered, we admire this lender.

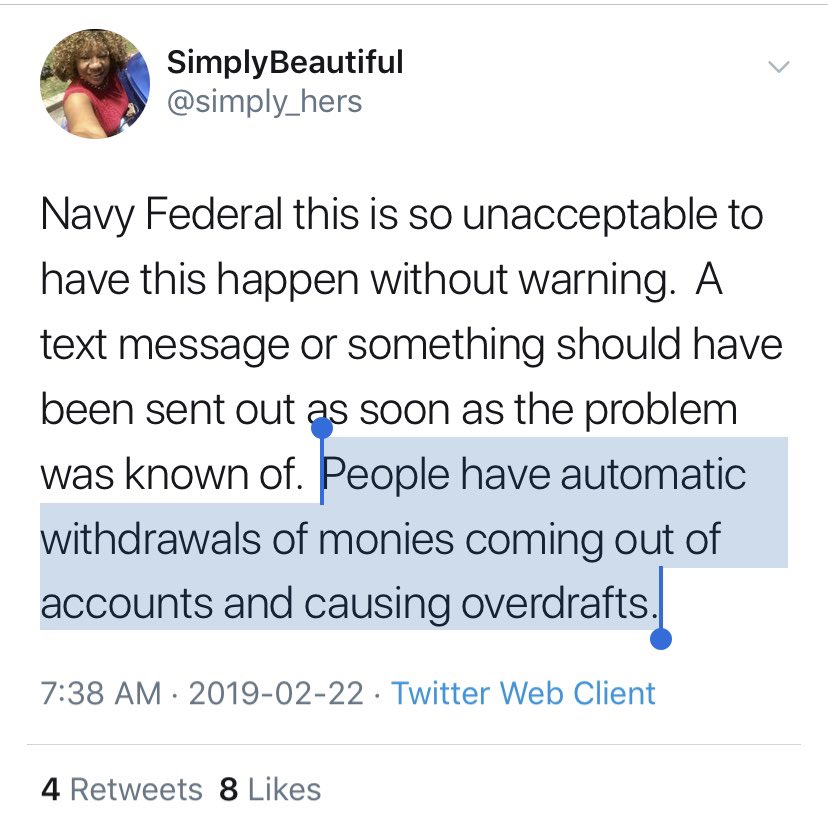

What People Are Saying About Navy Federal Home Loans

As of July 18, 2022, Navy Federal Credit Union has a 4.7 out of 5 Trustpilot score and 10,963 reviews. Many of the customer reviews praise the customer service and banking options. There are some complaints about the mortgage application process being confusing.

Navy Federal has a 1.44 out of 5 score on the Better Business Bureau . This includes 147 reviews and 441 complaints closed in the last 12 months. Many complaints were about issues with banking services and making deposits.

Finally, the Consumer Financial Protection Bureau reports 11,854 mortgage-related complaints for the year ending July 4, 2022. Most of the complaints revolve around applying for or refinancing a conventional mortgage.

Don’t Miss: Investment Firms In Los Angeles

Heloc On Investment Property

Hi, I have an investment property with about 50% equity in it. I am interested in leveraging the equity to do some more real estate investing. I have approached a few banks and a few credit unions about obtaining a HELOC on this property. I have been repeatedly told things like: 1) we don’t do HELOCs if we are in second lien position behind the primary mortgage holder 2) we only do HOLs, 3) Etc. I have checked with the primary mortgage holder and they do not offer HELOCs.

Does anyone know of any lenders that will do a HELOC in this situation?

Or does anyone have any other ideas on how to leverage this equity?

Note: I’m not much interested in the home equity loan type of offer as I’m not sure when I would pull the trigger on a another real estate transaction .

Thanks in advance.

Heloc On Your Primary Residence

You may be able to tap into the equity in your main home with a HELOC. These lines of credit typically have variable interest rates, from five to 10 years to take out any funds that you need, and a repayment period of up to 20 years.

Qualification requirements are typically looser for an owner-occupied home than an investment property, and the interest rates may be lower compared with a personal loan. But if you miss the monthly payments, you may be putting your primary home at risk.

» MORE:The best HELOC lenders

Also Check: What Is Real Property Investment

Navy Federal Credit Union Home Equity Loan

The main characteristics of Navy Federals home equity loan, which is ideal if you want a lump sum, are:

- You may be able to borrow up to 100% of your equity with a VA loan could be 100%)

- Your annual percentage rate can be as low as 4.99%* But see below

- Your loan rate will be fixed So no surprise hikes

- You can borrow over five, 10, 15, or 20 years

- Loan amounts range from $10,000 to $500,000

- There are no application or origination fees But there will likely be some closing costs

* Interest rates quoted on Navy Federals website in July 2022 ranged from 4.99% for a five-year loan with a 70% LTV to 8.5% for a 20 -year loan with a 95% LTV. Click the link for a fuller list of sample rates. The rate you’re offered will vary depending on your credit score and existing debt burden.

This deal is appreciably better than most of the ones we review. So if you are or become a member, put Navy Federal at the top of your shortlist when you begin comparison shopping.

How We Evaluated Navy Federal Mortgage Lenders

Our evaluation process began with scouring the Navy Federal Credit Union site, with particular attention to its mortgage lending pages and the annual PricewaterhouseCoopers audit.

We also looked to the credit unions social media pages for more information and feedback from members. Third-party sites played a significant role in our methodology, too.

The criteria we considered include:

- Membership eligibility

- Variety of loan types and loan terms

- Rankings and ratings from third-party sites and industry agencies

You May Like: Benefits Of Investing Through An Llc

Our Take On Navy Federal Credit Union

With its low and zero down payment home loans many of which dont require you to pay PMI Navy Federal Credit Union is worth considering. A majority of customers give glowing reviews of the credit union, and its rate match guarantee ensures youre getting the best rate available.

Navy Federal Credit Union has its share of negative reviews, mostly regarding a slow approval process. And in 2016, the Consumer Financial Protection Bureau ordered Navy Federal Credit Union to pay $28.5 million for making false threats about debt collection to its members and for unfairly restricting account access when members had a delinquent loan between 2013 and 2015.

Despite these actions, most customers have had great experiences with the credit union. All considered, we think its a strong option for most service members and their families.

How To Maximize Home Equity

Making the most of your home equity means looking at both sides: building it and using it.

To build strong equity, continue to make on-time payments and pay extra toward your mortgage whenever you can. Invest in your home with home improvement projects that raise its value. You may think of your home as simply where you live, but it is also an asset: something you can invest in.

When it comes to using home equity, be smart about how youre tapping into it. Determine if a HEL, HELOC or cash-out refinance is the best way to access that money. Also, make sure you have a plan to use your equity in a healthy way and pay back your loan in a timely manner.

Talk with Navy Federal Credit Union about how to harness the power of home equity to accomplish everything you want to do in your life. Whether its applying for a home equity loan or just learning how much equity you have, Navy Federal is here for you.

Don’t Miss: Charles Schwab Investment Management Reviews

Can I Roll My Closing Costs Into My Loan

Yes, but some closing cost fees must be paid during the application process. These include the credit report fee, appraisal , and some fees associated with condominium properties . Navy Federal will automatically roll all remaining closing costs into your new equity loan. There are no out-of-pocket expenses required on your loan closing date. For Fixed-Rate Equity Loans, closing costs will be deducted from your loan proceeds. For Home Equity Lines of Credit, a beginning balance equal to your closing costs will be added to your credit line.

First What Is A Heloc

If you need to borrow money to cover a financial emergency or finance a one-time purchase, you can go about this in two ways. One is to take out a personal loan and receive a one-time lump-sum payout.

Or you can take out a line of credit, where youre allowed to borrow up to a maximum loan amount, and you can take the money as you need it. This flexibility can help anyone who doesnt know exactly how much money theyll need to borrow.

A HELOC is a revolving line of credit, and once youre approved, youll enter into an initial draw period. During this time, you can withdraw money as needed, and youll make minimum payments to cover the cost of interest. The draw period typically lasts 5 10 years, though this will depend on your lender.

Once the draw period ends, youll enter into the repayment period during which youll pay back both the interest and the money owed.

The repayment period typically lasts up to 20 years, though the exact terms will vary depending on your lender and the amount of money borrowed.

Don’t Miss: How To Invest Money In Us Stock Market

Can You Get A Heloc On An Investment Property

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If you’ve built enough equity in your investment property, you may have considered getting a home equity line of credit, or HELOC, to make improvements, consolidate debt or even buy a new property.

You can get a HELOC on an investment property and tap into its equity, but there are strict qualification requirements, they aren’t offered by all lenders and, depending on your situation, you may have other funding options to choose from.

Heres how to find out if you can get a HELOC on an investment property.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: You Invested 2300 In A Stock

How To Get A Heloc On An Investment Property

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

A home equity line of credit on an investment property can provide an on-demand, cost-effective source of cash you can use for almost any purpose, even as the down payment on a new rental property. Still, there are strict qualification limits and potential pitfalls with this loan product.

What’s An Escrow Account

Find out how we calculate your escrow payments and get answers to your most frequently asked questions.

This article is intended to provide general information and shouldn’t be considered legal, tax or financial advice. It’s always a good idea to consult a legal, tax or financial advisor for specific information on how certain laws apply to your situation and about your individual financial situation.

A fixed-rate loan of $300,000 for 15 years at 4.875% interest and 5.104% APR will have a monthly payment of $2,352. A fixed-rate loan of $300,000 for 30 years at 5.375% interest and 5.557% APR will have a monthly payment of $1,679. Taxes and insurance not included therefore, the actual payment obligation will be greater. All loans subject to credit approval. Jumbo Loans: Loan amounts greater than $647,200. In AK and HI, the Conforming loan limit is $970,800. The Jumbo rates quoted above are for loan amounts above $647,200 up to $2,000,000.

Also Check: Series 65 Registered Investment Advisor

Regulatory Or Legal Actions

In October 2016, the Consumer Financial Protection Bureau found that Navy Federal Credit made false threats about legal actions and wage garnishment to members with delinquent accounts via letters and phone calls.

Additionally, some 700,000 members with overdue payments on credit products had access to their electronic accounts including debit cards disabled. They were also told that their commanding officers would be contacted if they did not make a payment. Navy Federal Credit Union was ordered to pay $23 million in compensation to certain members who experienced these violations.

The CFPB also ordered Navy Federal to correct its debt collection practices and ensure account access to members regardless of their account status. Navy Federal was also required to pay $5.5 million to the CFPBs Civil Penalty Fund.

According to a Reuters report issued the same year, Navy Federal Credit Union did not deny or admit to the allegations. A representative stated the credit union has cooperated with the CFPB and changed practices accordingly. Navy Federal reportedly settled for $28.5 million in total.

How To You Use A Heloc On Rental Property

In order to use a HELOC on rental property, investors must first have an asset with enough equity to tap intoonly then will a HELOC become an invaluable source of alternative financing. Using a HELOC on a rental property investment is an ideal wealth-building strategy for savvy investors.

For one, investors can borrow money against the equity in one rental property to fund the purchase of another. Additionally, investors can use a HELOC to fund home improvements for their rental properties, just as a homeowner would for their primary residence. Investors can also use HELOCs to pay off other high-interest debt if necessary. Because rental property mortgages generally carry a higher interest rate, smart investors can get a HELOC on their primary residences to pay off the mortgages on their investment properties.

It may be easier and more likely to qualify for a line of credit on a primary residence, investors can experience great benefits if they do choose to pursue the HELOC route.

Also Check: How To Raise Funds For Real Estate Investments