Roth Ira Withdrawals Vs Traditional Ira Withdrawals

With a Roth IRA, you have much more flexibility when it comes to withdrawing money from your account before you reach retirement.

Withdrawing from your traditional IRA before age 59 and a half comes at a cost. You’ll be taxed, in addition to incurring a 10% early withdrawal penalty fee.

But you can withdraw after-tax contributions from your Roth IRA at any age tax- and penalty-free. With earnings, it’s a little different.

If you withdraw any earnings you’ve made on your investments in a Roth IRA before age 59 and a half, you will incur a 10% early withdrawal penalty . There are some unique exceptions to this early withdrawal penalty on Roth IRAs that include first-time home purchases, college expenses and birth or adoption expenses.

How To Invest: Make A Plan

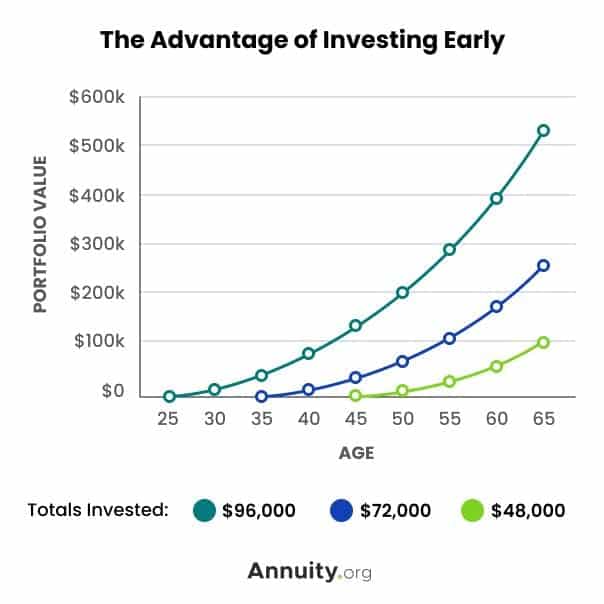

If you could have the chance to triple your net worth, would you take it?

Research has shown that, on average, people who create a financial plan end up with three times the wealth of those who don’t.*

So consider taking the time to do some financial planning.

Here are 5 simple steps to get started:

1. Identify your important goals and give them each a deadline. Be honest with yourself. It’s better to set a modest goal that you can accomplish than set a goal that’s so unrealistic you give up along the way.

2. Come up with some ballpark figures for how much money you’ll need for each goal.

3. Review your finances. How much money have you saved, and how is it invested?

4. Think carefully about the level of risk you can bear. If you want to take a big risk and it doesn’t work out, will you still be able to pay your bills?

And 5. Look at what kind of returns your investments have generated over the long term and ask yourself: if they continue to perform in line with long-term averages, will you be on track to meet your goals?

And that’s it.

If this still seems overwhelming, it’s OK to ask for help. A Certified Financial Planner can walk you through the process, and they can check in with you periodically to help you stay on track to reach your goals.

*Source: Lusardi, A. & Mitchell, O.S. Financial Literacy and Planning: Implications for Retirement Wellbeing

Schwab Health Care Fund

Slightly older than the rest of these funds, SWHFX mirrors the strength of some of its siblings. This fund is designed to search for long-term growth and is designed differently than other funds listedhealthcare and pharmaceutical companies are the entire focus of this fund.

Healthcare and pharmaceuticals make up 100% of the holdingsthe largest proportion of holdings are in Johnson & Johnson, United Health, Pfizer, Merck & Company, Abbott Laboratories and Thermo Fisher Scientific Inc.

Over a 10-year period, SWHFX returned 15.47%. The five-year return is 12.25%, while it has generated 9.89% over its lifetime. It has a price-to-earnings ratio of 26.43 and a return on equity ratio of 18.3%.

This fund is slightly more expensive to administer than other funds in this list because it is not tracking an index. This requires it to be actively managed, which explains its expense ratio of 0.8%.

Also Check: How To Invest In Ripple Cryptocurrency

Robinhood Trading App For The Young Pushes Into Retirement Accounts With This Incentive

- APARNA NARAYANAN

- 05:03 PM ET 12/06/2022

Robinhood , a free-trading app for millennials, will offer retirement accounts to its users for the first time. That could help rekindle growth. But HOOD stock fell Tuesday.

Via a blog post Tuesday, Robinhood introduced individual retirement accounts, or IRAs. Customers can sign up for a waitlist starting Tuesday and get early access in coming weeks. The IRA program will be broadly rolled out in January 2023.

Once contributions are made, users can instantly access up to $1,000 in funds to invest in stocks and ETFs, Robinhood said.

In addition, Robinhood announced Tuesday that it will offer a 1% match on the dollars contributed to retirement accounts. Traditional and Roth IRAs, which are increasingly popular investment vehicles, offer tax benefits while allowing people to save for their future.

How Will Having Assets With Blackrock Collegeadvantage Affect A Beneficiary’s Chances For Financial Aid

Financial aid treatment changes often and each school maintains its own policies, so it is of the utmost importance that you inquire about your unique situation when considering how 529 assets will affect any financial aid package. As a general rule, however, assets held in a 529 plan are treated as parental assets if one parent is the account owner. If the student is the account owner and beneficiary or is considered independent for financial aid purposes, any 529 assets will be attributed to the student. You should consult with your financial professional to determine how any 529 plan assets will be treated according to your specific circumstances.

You May Like: Is Socially Responsible Investing Effective

Why Consider A Roth Ira

A Roth IRA can be a good savings option for those who expect to be in a higher tax bracket in the future, making tax-free withdrawals even more advantageous. However, there are income limitations to opening a Roth IRA, so not everyone will be eligible for this type of retirement account.

Learn more about Roth vs. Traditional IRAs and which may be right for you.

Investments Available On Charles Schwab

Charles Schwab has a vast range of investments, ranging from stocks to margin loans and money market funds. According to its website, it is the third largest provider of index funds, with over 2,000 index funds and ETFs. The average annual fee for index funds is 0.15%, which is a low expense ratio.

| No annual or inactivity fee $25 per transfer $15 per transfer if submitted online | |

| Investment management fees | Schwab Intelligent Portfolios no advisory fee or commissions, $5,000 minimum to get startedSchwab Intelligent Portfolios premium $30 monthly fee, $300 one-time planning fee, $25,000 minimum to get started Schwab Private Client Starts at 0.80% of assets under management, $1 million to get startedSchwab Advisory Network no fee if referred, advisor fees vary, $500,000 to get started |

Dont Miss: How Do You Invest In Annuities

Read Also: Investing One Dollar In Stocks

Charles Schwab Research And Education

The Charles Schwab website provides a solid variety of research and educational materials put together by a group of several dozen financial planning, investment, trading and tax experts each week.

They regularly release articles, infographics, slideshows and videos covering the latest market news and trends. Theres also a knowledge center with numerous educational articles in financial areas like investing, estate planning, insurance and saving for college.

Besides these materials, Charles Schwab releases several financial podcasts, publishes a magazine and runs a live webinar where clients can ask trading questions. Their local branches also hold in-person events and seminars.The only key resource Charles Schwab lacks is paper trading, an offering other leading brokerages provide so people can try new trading techniques without risking real money.

What Happens If I Move To Another State

Unless you are moving to or away from Ohio, there will be no changes to your BlackRock CollegeAdvantage account. Since BlackRock has partnered with the Ohio Tuition Trust Authority, you would gain a state tax advantage should you move into Ohio. Conversely, you could lose that tax advantage if you leave Ohio and are no longer considered a resident of the state.

Read Also: How Do I Invest In Cryptocurrency

Choose Where You Want To Invest

While you have quite a few options for how to set up your Roth IRA, the route you choose depends on how comfortable you are doing things on your own. If DIY is in your DNA, then go online and set up a Roth IRA.

But odds are, you probably have questions an online chatbot cant answer. If you feel more comfortable working with someone face-to-face, reach out to a SmartVestor Pro. Theyre RamseyTrusted investing professionals who can guide you through all your retirement options, including setting up a Roth IRA.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Investing In Life Insurance Policies

Wide Ranges Of Investment Choices

As you can see, Charles Schwab offers a long string of choices like stock and bond trading services. You can choose more than 7000 mutual funds and ETFs available from Charles Schwab. Among those, ETFs and Schwab bond index funds are extremely low in expense. Therefore, you can put more into saving and earn more.

You should note that you can invest in 4000 more out of 7200 funds without paying commission and transaction fees. Whether the choice of offers is enough depends on personal preferences and objectives, but they are fit for most investors.

Furthermore, Charles Schwab helps savers screen funds by creating a mutual fund and ETF Select list. Investors can find their favorite funds based on criteria such as investment tools like stocks, bonds, or Morningstar category, expense ratio, and benchmark index. It is user-friendly too for beginners and advanced investors as well.

Charles Schwab also has a Personalized Portfolio Builder that helps you create a tailor-made portfolio based on your risk tolerance, financial goals, and time to retirement. You are sure not to stay away because of the diversity of investment products.

Fractional shares are now available to IRA investors. You can buy a portion of a share for a proportion of a full price. It is called Stock Slices. You can buy 10 slices at a time, but the slices are now limited to components of S& P 500 companies only.

Fees & Account Minimum Requirements

You will be happy with its zero-commission of online stock trade offer. Besides, more than 4000 mutual funds and ETFs from Charles Schwab are also free of commissions and transaction expenses. Even if you like to trade options, the cost is just 0.65 dollars per contract.

Whats more, you need not pay anything as a deposit when you open an account or if you even trade less within your Roth IRA. There is no annual fee at all.

There are no account minimum requirements for opening a Roth IRA. You have 2 ways to open an IRA account: you can open an account with the Charles Schwab website or visit any local Charles Schwab branch. All you need to get prepared are your social security numbers, beneficiary information.

Also Check: Real Estate Investing Bigger Pockets

Millions Of People Use Charles Schwab To Save For Retirement See How Charles Schwab Compares For Ira Investors On Commissions Funds And More

When you’re ready to start saving for retirement, opening an IRA may be a very wise choice. IRAs are one of the most flexible retirement accounts, and they have some particularly attractive tax benefits, too.

But before you can rush into picking investments, you’ll need to pick a brokerage to house your IRA. While there are many services to choose from, we’ll examine just one, Charles Schwab, to see what it has to offer IRA investors.

Charles Schwab Review : Pros Cons And How It Compares

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Also Check: Does Fidelity Investments Do Mortgages

How Can I Withdraw Funds To Pay College Expenses

You can withdraw funds from our Active Investor Portal by visiting www.blackrock.com/529 . Click “Sign In” on the top right and then “Mutual Fund & 529 Accounts” in the pull-down menu. Our portal allows withdrawals payable directly to your college/university or to the Account Owner or Beneficiary with proceeds sent by check or to your bank information on file.

You can also request a withdrawal to your address or bank account on file using our voice response system. To access, please call 1-866-529-8582 and follow the prompts.

Why Consider A Roth Ira Conversion And How To Do It

Does it ever make sense to pay taxes on retirement savings sooner rather than later? When it comes to a Roth Individual Retirement Account , the answer could be yes. A Roth IRA is funded with after-tax dollars, and qualified withdrawals are entirely tax-free.1 Additionally, Roth IRAs aren’t subject to required minimum distributions , which gives you greater control over your taxable income in retirement.

Recommended Reading: How Much Do I Need To Invest In Gold

Charles Schwab Range Of Offerings

Charles Schwab has an impressive range of tradable assets, including stocks, bonds, ETFs, mutual funds, options, futures, penny stocks and fractional shares of S& P 500 stocks. The firm particularly shines in their extensive selection of thousands of zero-commission mutual funds that are part of the Schwab Mutual Fund OneSource program.

For investors looking for non-U.S. equities, Charles Schwab offers extensive international investing, such as equity trading in over 30 foreign markets and the option to trade using seven different currencies in 13 foreign markets.

Outside of investments, Charles Schwab provides cash management services so you can earn interest on your uninvested balance as well as provides access to investment advisors, including in-person support through their 300 branches around the country.

There are only a couple areas where they fell short with their range of offerings, namely because they do not offer forex trading or direct investments in cryptocurrencies. That said, clients can get some exposure through trading Bitcoin futures or by buying into investment trusts targeting cryptocurrencies, like Grayscale.

Dont Miss: Apps For Investing In Index Funds

Build A Diversified Portfolio Based On Your Risk Tolerance

Investing can generate returns over time, but it also involves risk. As an investor, you need to decide how much risk youâre willing, and able, to take on.

If your goal is many years away, there may be more time to weather the marketâs ups and downs. So, you may be comfortable with a portfolio that has a greater potential for growth and a higher level of risk. But if your time frame is shorter, and you have little ability to take a loss, you should consider taking a more conservative approach.

You May Like: New Way To Invest In Real Estate

Set Up Contributions To Your Roth Ira

Ever heard the phrase, Out of sight, out of mind? You can actually use this principle in your favor! How? By automating your investing. You can set up payroll deductions, automatic bank withdrawals or direct deposits to fund your Roth IRA.

But hold up. There are limits to how much money you can put into IRAs each year. For 2022, you can invest $6,000 in either a traditional IRA or a Roth IRA. If youre 50 or older and need to catch up, you can add an extra $1,000 for a total of $7,000.3

Setting up automatic IRA contributions will take extra paperwork, but its worth the time to make sure youre putting away money for retirement consistently. And because you never see that money, you wont even miss it! Plus, you wont be tempted to use it to pay for new tires or a new pair of jeans.

But dont go so far with this idea that you never check in on your investments. Youve got to make sure your investing plan is still on track so you can make changes if you need to.

Ira Fees: Maintenance And Inactivity Fees

We can keep it short here. Charles Schwab doesn’t have any annual account fees or inactivity fees for failing to meet certain levels of trading volume. Whether you are particularly active or passive in managing your account, you won’t have to worry about having a sneaky fee subtract from your balance each year.

Don’t Miss: How Do I Start Investing In Property

How To Start A Roth Ira

10 Min Read | Nov 1, 2022

Listen to this article

Its that nagging thought that pops into your mind whenever you think about the future: I need to save for retirement. Its easy to ignore or put off for another day . . . or another year. Maybe you havent started yet because retirement seems like such a long way off. Or maybe youve dragged your feet because you just dont know where to start.

Well, todays the day to start changing your future!

One of the best ways to save for retirement is with a Roth IRA. In fact, you should take advantage of all the Roth options you havewhether thats an IRA or a Roth 401. The biggest reason? Taxes. The money you put into your Roth IRA grows tax-free. And you wont owe taxes when you use the money from your Roth IRA once you retire. But as awesome as a Roth IRA is, it has a specific place in your wealth-building plan. Well get to that a little later.

For now, lets start by taking the mystery out of how to open a Roth IRA and why you should. Dont worryits really easy!