Cons To Buying Aapl Stock

Even the most enthusiastic Apple investor cant deny that the iPhone isnt the driving growth force that it once was. iPhone sales have been trending downward, and the once dominant smartphone now makes up less than 50% of new phone sales.

While there is currently no imminent threat to Apples market share in the same way that Apple essentially took over BlackBerry, more and more consumers are switching to Android models or new models introduced by Chinese tech companies like Huawei.

Apple Stock Has Moved 193% From Yesterday’s Closing Price Learn How To Easily Invest In Apple Stock

Apple Inc is a leading consumer electronics business based in the US. It opened the day at $145.86 after a previous close of $146.87. During the day the price has varied from a low of $144.38 to a high of $150.01. The latest price was $149.70 . Apple is listed on the NASDAQ and employs 164,000 staff. All prices are listed in US Dollars.

Find The Right Brokerage

Selecting the right brokerage for you is important. You want to find one that meets your budget while offering all the tools, such as charts and data, that you need to stay on top of your investment portfolio. Many investors doing their own research choose a discount brokerage that charges one low fee per trade. Other investors go with full-service brokerages that offer investment advice but charge more in commissions.

Opening a brokerage account usually requires your personal information such as name, address, social security number, and date of birth. Investors will also choose the type of brokerage account that they want: a regular taxable account or a qualified retirement account like an IRA.

Tip: Investing in stocks in an IRA will help reduce your tax consequences as there will be no capital gains tax on stocks sold within the retirement account.

You May Like: Unique College Investing Plan National Fidelity Managed 529 Plan

Apple Stock Enjoys Best Day In More Than Two Years

Apple Inc. shares rose 8.9% in Thursday trading to record their best single-day performance in more than two years amid a strong broad-market rally. The one-day percentage gain was Apple’s largest since July 31, 2020, when it rallied 10.5%, according to Dow Jones Market Data. Apple’s rally came as the Dow Jones Industrial Average rose 1,201.43 points, or 3.7%, on the day, as the S& P 500 gained 207.80 points, or 5.5%, and as the Nasdaq Composite Index advanced 760.97 points, or 7.4%. Apple’s stoc

China’s Singles’ Day Shopping Festival Fuels Smartphone Price War As Major Vendors Seek To Stimulate Demand In Weak Market

Some of the world’s biggest smartphone vendors, including Apple and Xiaomi Corp, are waging a price war in China on the back of the annual Singles’ Day shopping extravaganza, hoping to revive a market that has posted double-digit declines in shipments during the past three quarters. This year’s promotions are offering steeper price cuts than before, according to Will Wong, a Singapore-based analyst at tech research firm IDC. He said campaigns during Singles’ Day and the midyear 618 shopping bona

You May Like: Benefits Of Investing Through An Llc

Step : Find A Good Online Broker

An online broker is a website or stock trading app which allows you to buy stocks. Some important factors to consider are:

- Which exchanges the online broker offers to buy and sell individual stocks and other securities

- Commissions and fees charged by the company for trading

- What types of stocks, funds or investments are available to trade online

- Whether you can open a brokerage account with this company because of your citizenship status

- Youll also want to consider how much time youre willing to spend learning a new platform

- Which margin rates the broker offers

The best stock trading apps for beginners focus on simplicity, functionality, educational and customer support and cost.

Some even work as micro investing apps which allow you to invest small amounts of money through making small deposits or even rounding up purchases from a link debit card.

I can help you find one at the bottom of this section which makes the best fit for your investing needs.

Some even offer sign up bonuses to give your investing journey a boost. Learn about getting free stocks from online brokers for signing up and funding your account.

Consider the following brokerage choices for starting to invest money:

Who Invented The Apple Iphone

The late Steve Jobs, co-founder and former chair and CEO of Apple Inc., invented the iPhone with his team of engineers and designers in the early 2000s. Jobs announced the first iPhone in January 2007 at the Macworld conference during an hour-long presentation. After the announcement, Apple scrambled in the following months to turn Jobs’ demo phone into a mass-market product. The first iPhone was released to the public in June 2007.

Also Check: Can I Invest Under 18

China Deploys Village Cadres To Help Foxconn Hire Workers In Bid To Secure Nation’s Role In Apple’s Iphone Supply Chain

Central China’s Henan province is mobilising its grass-roots governance system to help recruit workers for the world’s largest iPhone factory, run by Foxconn Technology Group in the provincial capital Zhengzhou, in an uncharacteristic move by the local government to safeguard the country’s position in Apple’s supply chain. The help came after draconian Covid-19 lockdowns have disrupted production at the plant, which usually employs more than 200,000 workers, prompting Apple to issue a rare state

Why Is Apple Company So Popular

Apple is one of the most popular and well-known companies in the world. Their products are known for their design, quality, and innovative features. Many people believe that Apples popularity is due to its consistent innovation, which has helped them stay at the top of the market for years.

Another reason why Apple is so popular is because of the way they market their products. They focus on creating a unique experience for their customers, and this makes it very difficult for other companies to compete with them. They also have a very loyal customer base that remains loyal even during tough times. Overall, Apple companys popularity is due to its consistency in delivering high-quality products and engaging customer service.

Also Check: The Millionaire Real Estate Investing Series Ebook Bundle

What The Analysts Say

You can also get an idea of a stocks likely performance by looking at what the analysts have to say. These professionals make their living by following the performance of several companies in an industry and making recommendations as to whether investors should buy, hold or sell the stock.

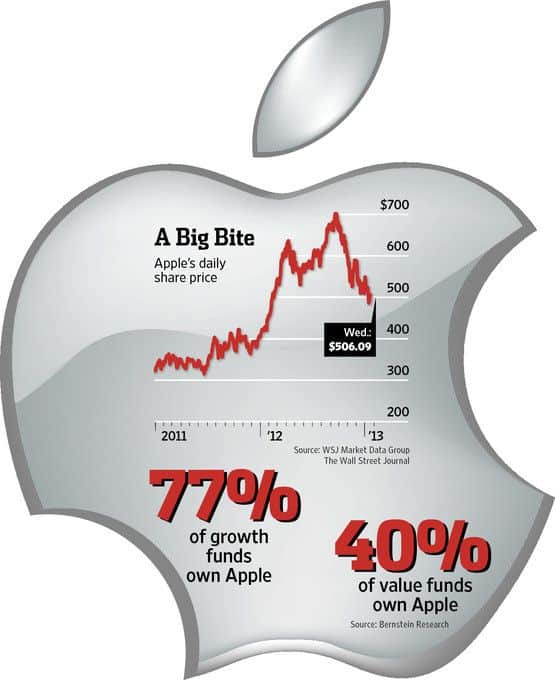

According to Yahoo Finance, of 38 analysts who follow Apple stock, 11 rated the stock a strong buy, 21 rated it a buy and six rated it a hold. None of the analysts considered Apple to be an underperformer or recommended that investors sell it.

At the market close on Jan. 28, Apple stock was trading at $170.33. The analysts who follow the stock provide a target price, which they think the stock will reach in the short term. For Apple, those estimates range from $128.012 to $210 and average $180.94, all of which are slightly higher than the estimates for last quarter.

Is Apple Stock Undervalued Or Overvalued

Valuing Apple stock is incredibly difficult, and any metric has to be viewed as part of a bigger picture of Apple’s overall performance. However, analysts commonly use some key metrics to help gauge the value of a stock.

Apple’s P/E ratio

Apple’s current share price divided by its per-share earnings over a 12-month period gives a “trailing price/earnings ratio” of roughly 23x. In other words, Apple shares trade at around 23x recent earnings.

That’s relatively low compared to, say, the trailing 12-month P/E ratio for the NASDAQ 100 at the end of 2019 . The low P/E ratio could mean that investors are pessimistic about the outlook for the shares or simply that they’re under-valued.

Apple’s PEG ratio

Apple’s “price/earnings-to-growth ratio” can be calculated by dividing its P/E ratio by its growth to give 2.6771. A low ratio can be interpreted as meaning the shares offer better value, while a higher ratio can be interpreted as meaning the shares offer worse value.

The PEG ratio provides a broader view than just the P/E ratio, as it gives more insight into Apple’s future profitability. By accounting for growth, it could also help you if you’re comparing the share prices of multiple high-growth companies.

Apple’s EBITDA

Apple’s EBITDA is $130.5 billion.

The EBITDA is a measure of a Apple’s overall financial performance and is widely used to measure a its profitability.

Recommended Reading: Real Estate Investment Banking Firms

How To Analyze Apple’s Financials

Before investing in a company, it’s smart to do some research. This helps you form a more informed decision on whether the stock is a good buy or not.

It’s also smart to take a look at the company’s competitors. Apple’s competitors include Microsoft, Samsung, Dell, and HP. It’s important to compare Apple’s financials and growth against the competition.

Here are some things you can look at to evaluate a stock. Most brokerages will provide a summary of the main numbers for each company, as well as a chart of its historical performance.

- Annual report: Details the company’s financial performance, including income and cash flow statements, revenue, and expenses. Most companies will have this for free on their website.

- Quarterly financial statements

- Profit margin : How much profit the company gains for every dollar in sales. The higher number, the better.

- Return on equity : How much profit the company generates with each $1 of the shareholders’ money. The higher number, the better.

- Price-earnings ratio : The company’s current stock share price to the company’s average earnings per share. Usually, a higher P/E ratio means investors are expecting higher growth.

- Debt-equity ratio : How much debt the company has compared to its shareholder equity. Usually, a higher ratio means more risk to investors. But you have to consider the industry.

Who Are Apples Partners

Apple is also gaining popularity and profitability by signing various partnerships with other companies around the world. Here are some of its major current partners:

- Target: The U.S. supermarket chain has signed a partnership to offer benefits related to Apple’s services in its loyalty program.

- Cisco: The two companies have partnered to develop security, networking and collaboration solutions to provide Apple users with a secure experience and business performance over Cisco networks.

- **Simplon: Apple and Simplon have created a program that allows Simplon interns on the path to rehabilitation to learn the basics of coding to develop mobile applications using Apple’s programming language, Swift.

- Hyundai Motor Group: a partnership is being signed with Apple concerning the development of the Apple Car in 5 to 7 years, an electric and autonomous vehicle.

- Tencent: the partnership was signed with Tencent Music Entertainment and concerns the labels and artists of the Music Cloud program of the music subsidiary of the Chinese giant Tencent.

Be the first to hear about the best offers, promo codes and latest news.

Please consult service providers Terms & Conditions for more information. This site and the « helloSafe.ca » trademark are operated under license by Hello Safe. All rights reserved.

Also Check: Invest In Your Woman Quotes

Can I Buy One Dollar Of Apple Stock

Online brokers that offer fractional investing services will allow you to purchase fractions of Apple stock rather than having to buy a full one. While most brokers wont allow a $1 investment, some let people invest from as little as $10.

Disclaimer

It is vital to always invest responsibly in awareness of all risks involved. Markets can be extremely volatile, so you should conduct extensive research before investing. Our site provides regular updates and diligently verifies all platforms it recommends, but you should form your own opinion and invest only what you can afford to lose. There is never any guarantee of a return on investment.

This article was written for Business 2 Community by Connor Brooke.

Is Apple Stock A Buy Right Now

Apple stock is not a buy right now. With the current market uptrend under pressure, investors should be cautious.

Keep an eye on the overall stock market. If the market turns south, don’t try to fight the general stock market direction. Check out IBD’s Big Picture column for the current market direction.

To find the best stocks to buy and watch, check out IBD’s Stock Lists page. More stock ideas can be found on IBD’s Leaderboard, and SwingTrader platforms.

Follow Patrick Seitz on Twitter at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

YOU MAY ALSO LIKE:

Read Also: Become An Independent Investment Advisor

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Where It Might Be Going

While its difficult to determine the future of Apple, some things are known.

As of Jan. 27, Apple had over $195 billion in cash. When a company has a lot of cash, it usually does one of three things with it. It may pay a dividend, which Apple is already doing. But it will still have quite a cash stockpile, so it may buy other companies, or it could buy back shares of its own stock. BBC News reported in February 2021 that Apple had bought about 100 companies over the previous six years about one every three to four weeks, recently focusing on the augmented and virtual reality, artificial intelligence, maps, health and semiconductor industries, according to CNBC. Apple also likes to buy back stock to the tune of almost $450 billion in recent years, CNBC reported.

Don’t Miss: Ways To Invest Money In Real Estate

Is Apple Stock Right For You

Don’t make the buy-or-not decision purely based on the stock’s current price. Instead, consider if Apple is right for your goals and risk tolerance. This comes down to what kind of investor you are.

Are you looking for passive income through dividends? Apple has always paid dividends, except for a period from 1996-2012. As of August 2020, Apple pays shareholders a dividend of 82 cents per share, per quarter .

How much risk can you afford? Remember that stocks can be volatile, some sectors more so than others. Though Apple is a blue chip stock, it still carries risk of decline. There are also arguments that the FAANG bubble could burst. It’s best if you can commit to holding your investment for the long term to ride out any downturns.

Apple’s Environmental Social And Governance Track Record

Environmental, social and governance criteria are a set of three factors used to measure the sustainability and social impact of companies like Apple.

When it comes to ESG scores, lower is better, and lower scores are generally associated with lower risk for would-be investors.

Apple’s total ESG risk score

Total ESG risk: 26.15

Socially conscious investors use ESG scores to screen how an investment aligns with their worldview, and Apple’s overall score of 26.15 is pretty good landing it in it in the 37th percentile of companies rated in the same sector.

ESG scores are increasingly used to estimate the level of risk a company like Apple is exposed to within the areas of “environmental” , “social” , and “governance” .

Apple’s environmental score

Environmental score: 0.99/100

Apple’s environmental score of 0.99 puts it squarely in the 5th percentile of companies rated in the same sector. This could suggest that Apple is a leader in its sector terms of its environmental impact, and exposed to a lower level of risk.

Apple’s social score

Social score: 13.98/100

Apple’s social score of 13.98 puts it squarely in the 5th percentile of companies rated in the same sector. This could suggest that Apple is a leader in its sector when it comes to taking good care of its workforce and the communities it impacts.

Apple’s governance score

Governance score: 11.18/100

Apple’s controversy score

Controversy score: 3/5

You May Like: How To Invest In Honey

Things You Should Know Before Investing In Apple

Before investing in Apple, you should be aware of a few things. For example, Apple makes its profits not just from the sale of its products, but also from the App Store and other services it provides. So its important to understand how well these businesses are doing.

Another thing to keep in mind is that Apple is a high-priced stock. This means that although the company may have good long-term prospects, your investment may not generate a high return on your investment for a while.

Finally, you need to be sure that youre comfortable with the risks involved in investing in Apple. The company has had several difficult times in the past like when it was hit by tough global competition and theres always the possibility that something similar will happen again in the future.