Startup Financing: Venture Capital And Private Equity

Private equity is a relatively new term. It can cause confusion as some in the investment industry use it to only refer to investing. Others use the term to describe the entire asset class of venture capital, buyout and mezzanine investing.

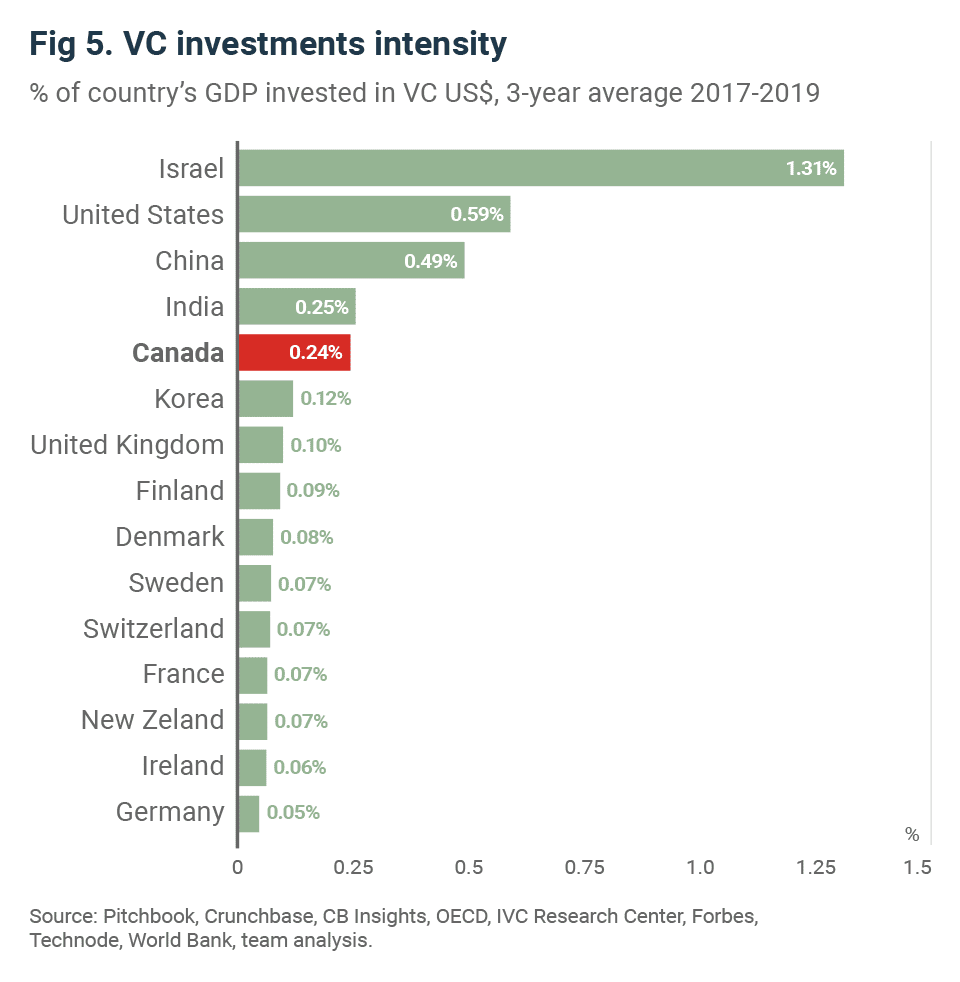

The CVCA, Canadas Venture Capital and Private Equity Association, lists over 1,500 members who operate in these three different market segments. The CVCA defines venture capital as investments in early-stage companies, mostly in the technology sector.

Understanding Fund Performance Using Irr

IRR is a valuableâalbeit trickyâmetric to analyze the return prospects of an investment. But it shouldn’t be a GPâs only valuation method. Many GPs report both IRR and TVPI to give a more holistic understanding of their investment performance.

At AngelList, we developed a calculator that factors in both IRR and TVPI so investors can assess fund performance. Our calculator offers an apples-to-apples way of comparing venture funds across vintage years. Just input your fund’s and IRR and TVPI to see how you stack up against your peers.â

Investors Appetite And Bargaining Power

Above all else, investors value startups so they can make a profit in the future. If a startup is deemed too expensive, no investors will invest. Same goes with bargaining power: the more term sheets a founder receives from investors, the higher the valuation

As well see now, the VC valuation method takes into consideration these 4 factors, improving its accuracy vs. other startup valuation methods.

Don’t Miss: Should You Invest In Gold Or Silver

What Are Your Vcs Return Expectations Depending On The Stage Of Investment

Chief Operating Officer

It is incredibly important that startup founders know what their VCs are going for so that they can be aligned and make smart decisions.

Today, well explore the question: what are your VCs return expectations depending on the stage of investment? The TLDR seed investors shoot for a 100x return Series A investors need an investment to return 10x to 15x and later stage investors aim for 3x to 5x multiple of money. This translates into portfolio returns from 20% to 35% targeted IRRs.

Before we get into how these return expectations vary by stage, and how that impacts your startups valuation, lets dig into an important part of how VCs construct their portfolios:

Venture Capital Fills A Void

Contrary to popular perception, venture capital plays only a minor role in funding basic innovation. Venture capitalists invested more than $10 billion in 1997, but only 6%, or $600 million, went to startups. Moreover, we estimate that less than $1 billion of the total venture-capital pool went to R& D. The majority of that capital went to follow-on funding for projects originally developed through the far greater expenditures of governments and corporations .

Profile of the Ideal Entrepreneur

From a venture capitalists perspective, the ideal entrepreneur:

- is qualified in a hot area of interest,

- delivers sales or technical advances such as FDA approval with reasonable probability,

- tells a compelling story and is presentable to outside investors,

- recognizes the need for speed to an IPO for liquidity,

- has a good reputation and can provide references that show competence and skill,

- understands the need for a team with a variety of skills and therefore sees why equity has to be allocated to other people,

- works diligently toward a goal but maintains flexibility,

- gets along with the investor group,

- understands the cost of capital and typical deal structures and is not offended by them,

- is sought after by many VCs, and

- has realistic expectations about process and outcome.

Read more about

Read Also: Why Are Bonds Considered Fixed Income Investments

Optimizing For The Power Law

At the beginning of the article, I mentioned how the venture capital industry, as an asset class, has posted generally unsatisfactory returns. A fascinating report by the Kauffman Foundation shed further light on the issue with some salient data points. In the report, called We Have Met the Enemy and He is Us, the Foundation uncovered that when looking at a collection of venture capital funds, only a few were responsible for most of the returns for the asset class as a whole.

In many ways, the performance of VC funds as an industry is analogous to the performance of venture deals: a few home runs and a lot of strikeouts. The shape of fund level returns follows a similar pattern to the distribution of single deal returns from the Correlation Ventures study from the beginning of the article, in which the 50x deals constitute a tiny portion of the sample, but with a significant magnitude of absolute returns.

The implication of the above is very significant. Readers will recall how returns of public stocks seemingly follow a normal distribution. What we hope to have conveyed in this article is that venture capital returns, both at a deal level as well as at a fund level, do not follow a normal distribution. Rather, they seem to follow a power law distribution, a long-tail curve where the vast bulk of the returns are concentrated within a small number of funds. The figure below illustrates the difference between a power law distribution and the more common normal distribution.

But Vcs Always Seem Successful Right

Yes and no. How are the rest of the 95 percent of VCs making ends meet? Not on their investing prowess, but rather on the fees that their investors pay. Most VCs are well compensated from the 2 percent annual fees on committed capital that they charge their investors .

Even when they dont generate great returns and most dont their personal compensation is guaranteed from the fee stream. If thats not enough, remember this: If one of their startups does see a liquidation event, they get 20 percent of the profits as a bonus. Theyre sharing the upside, without any risk if things go south. As an entrepreneur, I wish I had that downside protection!

Recommended Reading: Startup Investment Due Diligence Checklist

Venture Capital Is A Game Of Home Runs Not Averages

The first, and arguably most important, concept that we have to comprehend is that venture capital is a game of home runs, not averages. By this, we mean that when thinking about assembling a venture capital portfolio, it is absolutely critical to understand that the vast majority of a funds return will be generated by a very few number of companies in the portfolio. This has two very important implications for day-to-day activities as a venture investor:

To many, particularly those from traditional finance backgrounds, this way of thinking is puzzling and counterintuitive. Conventional financial portfolio management strategy assumes that asset returns are normally distributed following the Efficient-market Hypothesis, and that because of this, the bulk of the portfolio generates its returns evenly across the board. A 66-year sample analysis of 1-day returns from the S& P 500 in fact conforms to this bell curve effect, where the mode of the portfolio was more or less its mean.

Turning away from the more liquid public markets, investment strategies in private markets also strongly emphasize the need to balance a portfolio carefully and manage the downside risks. In an interview with Bloomberg, legendary private equity investor Henry Kravis said this:

Who Invests In Venture Capital Funds

Parties that invest in VC funds are known as limited partners . Generally, LPs are high net worth individuals, institutional investors, and family offices.

Breakdown of LP Capital Invested in VC Funds:

- Majority institutional: pension funds, endowment funds, etc. Institutional fund managers will generally invest some of the capital within VC funds, with the goal of achieving a certain overall percentage of return each year

- Small percentage from high net worth individuals: individuals with a net worth of over $1 million in liquid assets who invest their personal wealth in startups or VC. Many VC funds limit participation to individuals who clear $5 million in net worth.

EXAMPLE

David F. Swensen, manager of Yales $25.4 billion endowment fund, pioneered a groundbreaking investment strategy in 1976. He diversified the fund, then composed of stocks and bonds, by including multiple asset classes, and led Yale to become one of the first universities to invest in venture capital.

Venture capital went on to become Yales best performing asset class, generating a 33.8% annual return from 1976 to the present day. Yales endowment fund is packed with tech giants like Amazon, Google, Facebook, Pintrest, Snapchat, Uber, Twitter, and Airbnb.

Venture capital now makes up 16.3% of Yales overall investment portfolio, and its endowment fund generates of the universitys overall budget .

Don’t Miss: Can Non Accredited Investors Invest In Startups

Venture Capital Return Expectations By Stage Of Investment

Seed Investors

Seed investors typically have a lot of companies they invest in because it is so hard to pick the winner at the seed stage. They just have very, very low information. Oftentimes theyre investing in the people, the PowerPoint concept, and maybe an MVP, a minimum viable product or demo product, right?

So seed fund investors will do anywhere from 20 to 50 to 60 investments, depending on their fund size. They are targeting a 100X return pretty much for every company. They want every company to be 100X. However, the problem at seed is theres a high failure rate relative to the other stages of venture capital.

Oftentimes its only two or three companies that are providing all the return and all the capital back to investors in the seed stage funds. Yet, when they are signing that check and sending you that wire, they are thinking about a 100X return. Can this be a 100X company? If theyre investing at a $5 million valuation or $10 million valuations, can this be a billion or multi-billion dollar company?

They also have to factor in all the dilution they and the company will take over the years as it goes through different funding rounds. So 100X rule of thumb for seed. They know theyre not going to get it on all the deals or even most of the deals. They know theyre going to get it on hopefully one, two, or three of the deals in their portfolio.

Series A Investors

Late-Stage Investors

Negotiating Returns On Investment

Venture capital firms will frequently have a large investment portfolio. This means that your company will be one of many receiving investments from the firms. Depending on your business, this can help you more effectively negotiate your promised returns.

If your company is low-risk, for example, you may be able to promise a lower return than what a high-risk company would need to offer in order to receive an investment. Venture capital firms prefer their portfolio to contain a mixture of low-risk and high-risk investments, known as diversification.

If you are struggling to meet your payroll and don’t have the money necessary to grow your business, a venture capital firm will usually consider you a high-risk investment. When a venture capital firm determines there is higher risk involved in investing in your company, you should prepare to offer a higher return.

Also Check: Fnma Cash Out Refinance Investment Property

Choose The Investors Required Irr

Investors IRR is a required return on investment that varies between investors and the stage of investment. The higher the risk, the higher the required IRR. For example, an investor would require a higher IRR for an early stage deal such as a seed round vs. a Series A or Series B round.

Naturally, investors' IRR is investor-specific.

Naturally, the required IRR vary by investors, the stage theyre investing in and the industry.

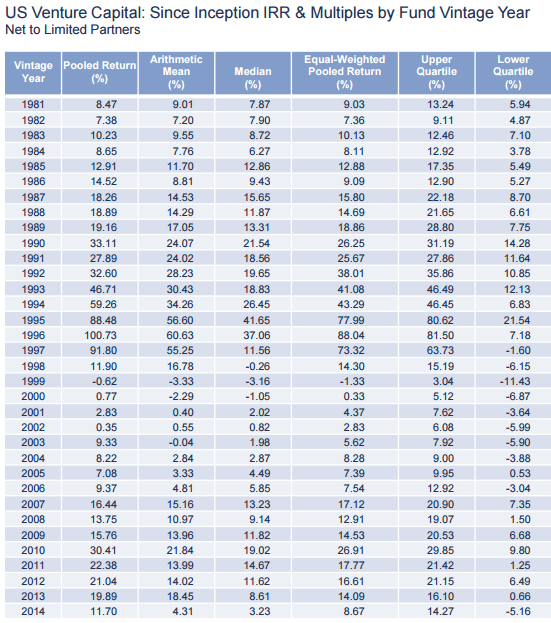

According to a recent study, the average IRR for venture capital firms was 19.8%. Yet, this percentage is an average: it also takes into account failed deals . Indeed, VCs typically hope to realise anywhere between 40-60% IRR on the deals they invest in. Again, this is a high-level average, and depends on a number of factors as explained earlier.

Now, assuming we are looking at a Series A startup, we can reasonably assume investors will require a lower IRR vs. Seed startups. As rule of thumb, a Seed investor would require 50-60% IRR, and a Series A investor 40-50% instead.

Unrealized Irr Vs Realized Irr

Fund managers most commonly use unrealized IRR, which indicates that profits have not yet come in . To calculate unrealized IRR, investors use the current value of a fundâs assets, as though they were sold at the time of calculation. This allows GPs to compare performance of investments that might exit on very different time horizons.

Once the fund fully matures and investors receive their distributions, the GP can calculate the realized IRR using the actual return numbers instead of estimates.

Don’t Miss: Investing In Us Stocks From Abroad

Do Vc Investment Outperform Public Markets

The next question is whether VC has outperformed investing in publicly traded equity. This is a particularly relevant question because most investors seek in VC an alternative source of returns with respect to a large portion of their portfolio held in publicly traded securities. Ideally, VC investments should provide high returns that have little correlation with public markets. Nirvana

To measure relative performance, one typically relies on the Public Market Equivalent , which compares an investment in a VC fund to an equivalently timed investment in the relevant public market. The PME calculation discounts all cash distributions and residual value to the fund at the public market total return and divides the resulting value by the value of all cash contributions discounted at the public market total return.

The PME can be viewed as a market-adjusted multiple of invested capital . A PME of 1.20, for example, implies that, at the end of the funds life, investors ended up with 20% more than they would have if they had invested in the public markets.

The main difficulty here is choosing which discount rate one should apply to the cash flows of VC investments. Choose a low discount rate and VC will shine like gold. Choose a high discount rate and it will look dead like lead.

How Long Until A Vc Makes Returns

Venture capital investments are risky and failure is more common than success. Learn about what kind of returns VCs need, and how long it might take to achieve them.

Venture capital has been growing in prominence over the past few years. Unlike other investors in private markets, VC invest in startups, which make their investments risky and illiquid for long periods. So, along with their growing popularity, VCs have also gained a reputation in the startup world as investors with big risk appetites.

According to Crunchbase data, around US$294.8 billion of VC money was invested globally in 2019, while around $1.5 trillion of VC money was invested between 2010 and 2019.

However, VC firms or investors are not the ones that bear the risk of investment. In reality, it is the limited partners of the VC funds whose money is at risk. Generally, VC firms create a fund that seeks investment from LPs like funds of funds, university endowments, public pensions, sovereign wealth funds, corporate investors, high net worth individuals, family offices and others. After LPs buy into the fund, their money is used to invest in a portfolio of startups. They are the ones who lose their money if the investment fails to provide returns.

In fact, VC returns are heavily skewed. According to data from Correlation Ventures, 65% of VC investment rounds fail to return their capital and only 4% rounds return over 10 times the capital invested.

Read Also: Conventional Loan Investment Property Guidelines

Expected Value: A Quick Intro

In this post, we will focus on the expected value of biotech investments.

The expected value of an investment is the sum of each possible outcome of an investment times the probability of that outcome occurring.

As a simple example, say someone offers you a deal: you flip a coin, and if it lands on tails, you win $50. But you have to pay $30 to play the game.

Youd probably decline this deal: the expected value of the coin toss is less than the price of playing. Because the game costs $30 to play, youre expected to lose $5 if you play the game. If the cost to play is less than $25, however, it would make more sense to play the game.

Our analysis models biopharma venture investing as a more complex version of this coin-toss game: a company offers to pay you a large amount of money if it is successful, in exchange for you investing money upfront. Do you take the bet?

To answer that question, we need to know three basic things: how likely we are to win, how much we get if we win, and how much it costs to play the game.

How Is Expected Return Used In Finance

Expected return calculations are a key piece of both business operations and financial theory, including in the well-known models of modern portfolio theory or the Black-Scholes options pricing model. It is a tool used to determine whether an investment has a positive or negative average net outcome. The calculation is usually based on historical data and therefore cannot be guaranteed for future results, however, it can set reasonable expectations.

Read Also: How To Transfer Money From Chase Investment Account

Individuals Can Get Diversification In Private Markets

The public markets have long been the go-to destination for investors looking to achieve diversification. But in recent years, the rise of private markets has begun to change that. Today, there are a number of ways for individuals to invest in private companies.

One popular way to invest in private companies is through a fund of funds. These funds allow investors to deploy capital across a number of different VC funds, each of which makes dozens of investments. This type of investing provides instant diversification and can help mitigate risk.

For example, with Gridline, investors can deploy $100,000 across 10 different VC funds. Each of these funds makes 30 investments, meaning the investor is effectively invested in 300 different companies or just $333 per company. This allows investors to tap into far more deals than they could if they were investing directly in companies.

Similar to how Vanguard democratized access to the public markets, funds of funds are democratizing access to the private markets. For investors looking for diversification and high returns, private markets offer a compelling alternative to the public markets.