The Ethical Factor In The Economic Science And Finance

For a long time, the economic science has not been comfortable with ethical issues. The rich debate of nineteenth century within the economic science led to the formulation of new methodological and epistemological foundations, according to which economics is a real science that enjoys the same status of the experimental sciences.

Hence, the utilitarian methodology of economics could work without any reference to external moral values, as it shares with the classical Smithian vision the substantial coincidence between individual interest and collective interest .Footnote 11 Personal interest and pleasure are the result of the will and of personal freedom, but they are not mediated in any way by reference to other principles that inform human beings and their living together. Decisions and actions are also independent of any historical and institutional context.

The debate on the necessity to distinguish between pure and applied economics has continued in subsequent years, especially in the form of a debate between the proponents of laissez faire and those of state intervention however, the principle of neutrality of economic science has not been basically questioned for quite a long time.

Also for all these reasons, the term ethical investment has increasingly been replaced, over the last ten years, by the term socially responsible investment or sustainable investment.Footnote 17

History and evolution of SRI practices

The History Of Socially Responsible Investing

The SRI movement first emerged in the 1970s when some investors began embracing the call to avoid buying the stocks of companies in the alcohol, firearms, gambling, and tobacco industries.

Today, this values-based approach has spread to environmental and societal causes like combatting climate change and reforming law enforcement and the justice system.

Types Of Socially Responsible Investments

Taking the different investing methods into account, there are different types of socially responsible investments. They include:

1. Mutual Funds and Exchange-Traded Funds

Several mutual funds and ETFs adhere to the ESG criteria. If an investor is looking to invest in either of the two funds, visit the SIF website, which outlines over 100 socially responsible mutual funds. Also, they can also look at different socially responsible ETFs here.

2. Community Investments

An investor can also put their money directly into projects that benefit communities. An easy way to make such an investment is to contribute to community development financial institutions .

3. Microfinance

Another way individuals can make socially-sound investments is by offering microloans or small loans to startups. They can look for businesses in developing countries that offer financial assistance.

Also Check: Investing In Stocks For Children

Modern Era: The Rising Popularity Of Sri

The modern version of SRI in America really took hold in the mid 1900s, when investors began to avoid sin stocks companies that dealt in alcohol, tobacco or gambling. In 1950, the Boston-based Pioneer Fund, established in 1928, doubled down on this movement, becoming one of the first funds to adopt SRI principles.

The avoidance of sin stocks in the 1950s marked the beginning of the rise of modern socially responsible investing, each decade bringing forth an influx socially concerned investors:

Religious Roots And Origins Of Socially Responsible Investing

Despite a consensus that ethics were an essential consideration for investment decisions, the application of the principle varied some groups used it as a guideline, others required it by law. The basis for SRI varies between religious groups, leading to many different interpretations of the subject.

Read Also: What To Invest Money In As A Teenager

Comparing Stock Market Index Performance

Considering that difference in performance of funds may be due to portfolio selection/construction process and/or the ability of fund managers and not necessarily on the nature of investments themselves, some studies have compared the performance of stock market indices instead. Two of the pioneer studies compared the performance of the Domini 400 Social Index with the S& P 500. The Sharpe ratio and the capital asset pricing model were used to estimate Jensen’s alpha for the comparison and no significant difference was found in the performance of the two indices. A follow-up study compared the performance of four SRI indices with the S& P 500 index between 1990 and 2004 and found that returns on the SRI indices exceeded returns on S& P 500 even though they were not statistically significant. Others focused only on the US and on outside the US by studying the performance of 29 SRI indices globally. Using the capital asset pricing model to estimate Jensen’s alpha as the performance indicator, no significant evidence of under/over performance was found. A comparison of the performance of SR indices with conventional indices on a global scale using found there is “strong evidence that there is a financial price to be paid for socially responsible investing.”

A more recent study showed that “improvements in CSR reputation enhance profits”.

Learn More About Our Services

The financial plans we develop are comprehensive and designed to help you achieve and maintain financial independence. The plan is driven by your needs and goals.

Request a discovery call today. Share your priorities and concerns with us. We welcome the opportunity to explain our approach. You will clearly see how our fee-only financial planning process can help you achieve your short- and long-term goals.

Read Also: How To Create A Real Estate Investment Trust

Investing In Capital Markets

Social investors use several strategies to maximize financial return and attempt to maximize social good. These strategies seek to create change by shifting the cost of capital down for sustainable firms and up for the non-sustainable ones. The proponents argue that access to capital is what drives the future direction of development. A growing number of rating agencies collects both raw data the ESG behaviour of firms as well as aggregates this data in indices. After several years of growth the rating agency industry has recently been subject to a consolidation phase that has reduced the number of genesis through mergers and acquisitions.

ESG integration

ESG integration is one of the most common responsible investment strategies and entails the incorporation of environmental, social and governance criteria into the fundamental analysis of equity investments. According to the non-profit Investor Responsibility Research Center institute , approaches to ESG integration vary greatly among asset managers depending on:

- Management: Who is responsible for ESG integration within the organization?

- Research: What ESG criteria and factors are being considered in the analysis?

- Application: How are the ESG criteria being applied in practice?

Negative screening

Negative screening excludes certain securities from investment consideration based on social or environmental criteria. For example, many socially responsible investors screen out tobacco company investments.

Divestment

Example Of Socially Responsible Investing

One example of socially responsible investing is community investing, which goes directly toward organizations that both have a track record of social responsibility through helping the community, and have been unable to garner funds from other sources such as banks and financial institutions. The funds allow these organizations to provide services to their communities, such as affordable housing and loans. The goal is to improve the quality of the community by reducing its dependency on government assistance such as welfare, which in turn has a positive impact on the community’s economy.

You May Like: Merrill Edge Guided Investing Fees

From Ethical Investment To Socially Responsible Investment

Several authors emphasize the ethical foundations of SRI relative to conventional investing activity. For example, according to Richardson and Cragg , SRI investors reflect the view that they have ethical responsibilities, so that they temper investment return by corporate responsibility, and to that end, they try to exert ethical influence over the firms they invest in. However, while ethical investment could in fact well describe the decision process of such value-based organizations in applying internal ethical principles to an investment strategy, some authors doubt that the same term could be applied to the profit maximizing behaviour of fund management companies supplying ethical unit trusts . As Cowton posed it: at one level, ethical investment can be seen as just another product innovation that helps widen choice . The irony is that its occurrence can be explained in pure, profit-seeking capitalistic terms, as financial institutions seek to influence and exploit their environment in the interests of profitability. Thus individual investors, potentially at least, have their values met or satisfied by institutions/people who do not share these values at all, whose sole motive might be to make more money .

The Current Debate On The Eu Regulatory Initiatives

While public consultations on the proposed packages are still underway, concerns have been raised by category organizations such as the European Fund and Asset Manager Association . The latter, while supporting the goal of enhancing ESG factors disclosure and the proposal of a EU taxonomy, recommends flexibility to allow for innovation and client-driven developments. EFAMA considers SRI as a young, innovative and still developing field, which cannot be captured by a single regime. Hence, it argues that a prescriptive legislative approach, unlike a market-led or self-regulatory approach, will create unintended barriers to market development. Moreover, it claims that the ESG reporting should be an activity of the asset-owner, rather than of the fiduciary investor. The same advice to avoid inflexible or overly prescriptive regulations has been raised by the Securities and Markets Stakeholder Group .

As for the proposed amendment of ESAs mandates, some NGO organizations, such as Finance Watch and , expressed a negative judgment, arguing that the final legislation should detail a clear mandatetasks and powersfor the ESAs to conduct analysis on a European-wide basis of ESG factors and ESG considerations into their roles. Also, the European Parliament has criticized the Commissions proposal, since allegedly the proposals chosen approach to ESAs reform is not in line with the impact assessment that the Commission conducted on the topic earlier.

Don’t Miss: How To Invest In Short Term Government Bonds

Screen Companies With Negative Practices

This tip involves the process of screening practices, services, products, and values of a company before making an investment. Suppose you discover that the company is creating potentially harmful items. If the company has unethical values and practices in place, then the investor shouldnt put the money here.

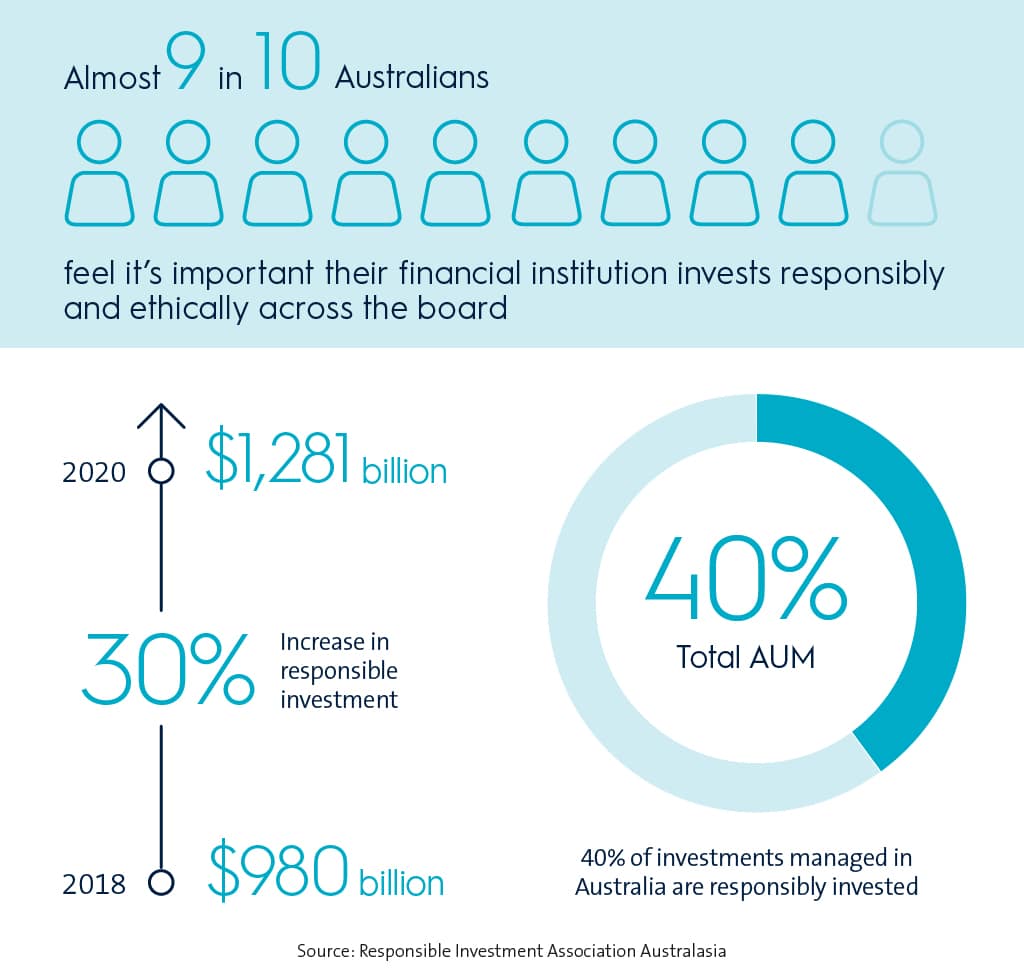

Responsible Investing In The Millennium

There has been an acceleration of positive approaches to sustainability challenges being embraced by socially responsible investors. Such modern approaches include impact investing and the mainstreaming of sustainable investing. They continues to evolve.

You can expect corporations and businesses to address their impact on social issues with social issues continuing to manifest. Some additions are income and wealth inequality, climate change, pollution, and corruption, to name only a few. They’ll strengthen their stances going forward. More investments will be designed with these concerns in mind as sustainability and corporate social responsibility keep adding perceived consumer and investor value to companies.

Recommended Reading: How To Begin In Real Estate Investing

Special Considerations Regarding Socially Responsible Investment

SRI tends to mimic the social and political climate of the time. So, thats a critical risk for investors to understand. It is because if an investment is based on social values. Then it can suffer if the values fall among investors.

Therefore, investment professionals often consider SRI through Environmental, social, and governance lens as factors for investing. This approach also focuses on the management practices of the company. Also, on whether they tend towards community improvement and sustainability.

However, there is evidence that focusing on this investment approach can offer improved returns. At the same time, there is no successful evidence for focusing on social values only.

Even more, as the awareness has increased regarding climate change and global warming in recent years. Therefore, SRI has trended towards the companies that impact the environment positively by investing in clean energy solutions or reducing their carbon emissions.

History Of Socially Responsible Investing

SRI concept was religiously motivated, where initiators urged people to avoid sinful companies. This practice dates back to 1758 when the Religious Society of Friends Philadelphia Yearly Meeting banned its members from playing a part in the slave trade purchasing and selling humans.

John Wesley, one of the founders of Methodism, adopted the concept. He spread it through sermons that illustrated how the use of money could contribute to social change.

Wesley illustrated how you could avoid harming your neighbors if you avoid industries like chemical production and tanning. Also, he urged people to avoid investing in companies associated with tobacco, guns, and liquor.

The modern era of SRI began in the 1960s political climate. During this era, socially conscious individuals began to increase their need to address civil rights, equality of women, and labor issues. Dr. Martin Luther King began economic development projects like the Montgomery bus boycott and operation Breadbasket that established socially responsible investing.

In the early and mid-1990s, SRIs upsurge focused on different issues, including mutual fund proxy disclosure, tobacco stocks, and more. Unibanco, a Brazilian bank, became the first sell-side brokerage that offered SRI research.

See Related: Anti-Capitalist Investing: Meaning & Can It Work?

Don’t Miss: Can You Invest Without A Broker

What Does Esg Represent

ESG stands for environmental, social, and governance, which are important factors for some investors to adhere to. Those investors look for solid management of a company and seek out those that gear toward sustainability and community improvement. In 2020, the popularity of ESG investments took off.

The Remarkable Rise Of Esg

LINFEN, June 26, 2018 — Photo taken on June 26, 2018 shows the Hukou Waterfall on the Yellow River,… which is located on the border area between north China’s Shanxi and northwest China’s Shaanxi provinces.

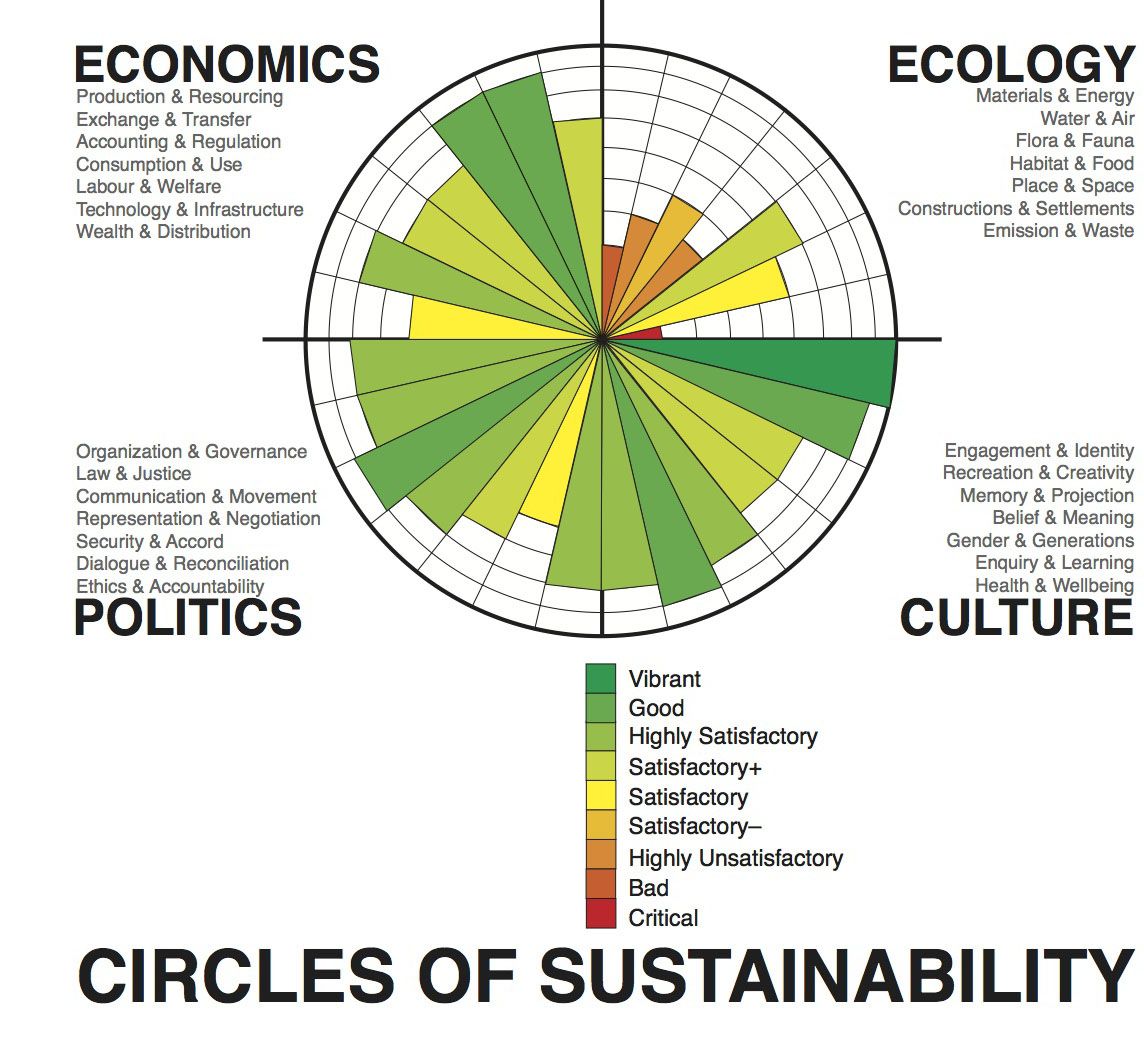

Responsible investing is widely understood as the integration of environmental, social and governance factors into investment processes and decision-making. ESG factors cover a wide spectrum of issues that traditionally are not part of financial analysis, yet may have financial relevance. This might include how corporations respond to climate change, how good they are with water management, how effective their health and safety policies are in the protection against accidents, how they manage their supply chains, how they treat their workers and whether they have a corporate culture that builds trust and fosters innovation.

Today, the UN-backed PRI is a thriving global initiative with over 1,600 members representing over $70 trillion assets under management. PRIs role is to advance the integration of ESG into analysis and decision-making through thought leadership and the creation of tools, guidance and engagement. The SSEI, supported by the Geneva-based UNCTAD, has grown over the years with many exchanges now mandating ESG disclosure for listed companies or providing guidance on how to report on ESG issues. However, despite its rapid growth into the mainstream, the rise of ESG investing has been neither smooth nor linear.

Arabesque

Recommended Reading: Best Whiskey To Invest In

History Of Socially Responsible Investing And How It Drives Change

While social responsibility has become more and more crucial to investors in recent years, shareholders have long understood the power their dollars can wield. The roots of socially responsible investing can be traced to the 18th century Quakers in America, who refused to take part in the slave trade or invest in weapons of war, and to early Methodist leader John Wesley, who declared that people shouldnât make money at the expense of othersâ welfare. Specifically, Wesley counseled against that eraâs equivalents to todayâs sin trade: gambling, usury, and industries that used toxic chemicals.

The Securities and Exchange Act of 1934 allowed an investor or group of investors who own at least 1% of a companyâs stock to influence the behavior of the companiesâone way in which socially responsible investors affect change from the inside out. The move toward investing for social justice evolved in the 1960s, when people began using their funds for investing in causes that promoted civil rights, equality for women, and labor rights. Impact investing gained traction during the 1980s, which is also when the oldest investment advisor devoted specifically to SRI, Trillium Asset Management, was founded.

One powerful example of investment money promoting global change was demonstrated by many of Americaâs powerful college endowments, which pulled out of companies that did business with South African companies in the 1980s. This divestment helped hasten the end of Apartheid.

Pressure From Investors Can Lead To Change

In the process, several success stories emerged. In 1977, Congress passed the Community Reinvestment Act, which forbade discriminatory lending practices in low-income neighborhoods. Repercussions from disasters like Chernobyl in the 1980s spawned anxiety over the environment and climate change, which led to the launch of the U.S. Sustainable Investment Forum in 1984.

Also in the 1980s, American corporate began divesting themselves from South Africa due to the apartheid. Literally meaning “apartness” in Afrikaans, apartheid was meant not only to separate the countrys non-white majority from the white minority but also to reduce black South Africans political power. The official South African legislation dates to the passage of the 1913 Natives Land Act. The Act relocated en masse black Africans to “poor homelands and to poorly planned and serviced townships.”

In 1985, students at Columbia University in New York led a three-week demonstration, demanding that the University stop investing in companies doing business with South Africa and won. Thanks to the combined efforts of the students and new “ethical criteria” for investments, by 1993, the university was able to redirect $625 billion, an increase of $40 billion from 7 years ago.

Also Check: Best Hard Assets To Invest In

How To Get Started As A Socially Responsible Investor

Creating a socially responsible portfolio doesnt have to be daunting. Provided you know the values you hold onto dearly, you can begin putting your dollars into a good cause. Here is how to get started:

1. Decide Whether to DIY or to Get Help

You can explore various avenues when creating an ethical portfolio. One is to DIY, where you pick the specific investments and monitor them over time. And the other is to get some assistance.

While most people want to figure things out on their own, it could be tedious and time-consuming. And thats where Robo-advisors come in. Robo-advisors use algorithms to create, invest and manage your portfolio based upon your level of risk tolerance and goals.

A good example of a Robo-advisor is personal capital. When investing for SRI investors, they focus on Environmental, Social, and Governance metrics. Betterment is another Robo-advisor that provides SRI alternatives for emerging market stocks and large-cap U.S. stocks.

Managed portfolios by Ally Invest also feature socially responsible investments portfolios. With them, you can invest in sustainable, energy-efficient, or other eco-friendly initiatives.

Robo-advisors are cost-effective, and most offer SRI investors an optimized portfolio, meaning all the hard work is done for you. Their main drawback is that you cannot just add a particular company that you may be interested in.

2. Open an Investing Account

3. Outline what you Value

4. Research your Investments with Caution

1. ESG Funds