What Are The Most Common Investment Property Loans

Investors try to use a conventional mortgage to buy a property with one to four units if they can meet the banks criteria because this is where theyll find the lowest rates and fees.

To buy a home to renovate and resell or lease, investors often turn to private lenders that specialize in this process. Many banks either wont provide these loans or take too long to close for an investors preference, so private money lenders are successful here.

Private and hard money lenders are also helpful when investors want to buy commercial properties like apartment complexes, medical office buildings, or office towers for example. Their terms are more flexible than conventional mortgages and they will work with borrowers who have lower credit scores where banks and credit unions may not.

Investment Property Rates Are Above Standard Rates

If you buy an investment property at the right price and finance it correctly, it can create cash flow for you almost immediately. But getting a low mortgage rate on a rental or investment property is tougher than for a primary residence. Thats because lenders charge more for non-owner-occupied transactions meaning a property you dont plan to live in.

Despite higher rates, investing in real estate is often a good idea long-term. Heres how much you can expect to pay now to finance that future cash flow.

In this article

What Are Investment Property Mortgage Rates

Investment property mortgage rates are the interest rates lenders charge for an investment property loan. The rate youll get is determined by your credit and financial profile, including the size of your down payment. In general, the higher your credit score and the more down payment you can make, the better your rate.

Don’t Miss: You Invested 2300 In A Stock

Why Are Interest Rates Higher On Investment Properties

Mortgage rates are higher for investment properties because of the increased risk on the lender’s behalf. Borrowers are more viable to default on a property other than their main dwelling, so lenders are more stringent. More often than not, riskier investments result in loftier interest rates and harsher loan terms.

Not only are there increased interest rates, but lenders also ask for more substantial down payments. For a one-unit property, a conventional mortgage requires at least 15% down, and a two- to four-unit property requires a minimum of 25% down. Loan terms are also often shorter than the standard 30-year residential mortgage.

Rather than a real estate purchase, this process is likened to a business transaction.

Other Details To Consider When Comparing Investment Property Mortgage Rates

Interest rates and fees are important when evaluating how to finance a rental property, but there are other important issues to consider.

5 Things to Know about Agency Loans

1. Self-employed beware. To qualify, youll likely need strong, consistent personal income from a third-party employer. These loans are difficult to obtain if you own your own business.

2. Liquid cash reserves. You will need substantial liquid reserves and the required reserves will go up as you grow your rental portfolio.

3. Liability risk. You will have to hold title to your rental property in your personal name. This means you could be sued personally if someone is injured while at your rental property.

4. Documents galore. Your lender is going to go through your income, asset, and tax return documents with a fine-toothed comb. Be prepared for a laborious process.

5. Credit score impact. Agency Loans are reported on your credit report. This can limit your ability to access other types of credit.

5 Things to Know about Bank Loans

1. Low priority. Most community banks focus on making commercial real estate loans and small business loans. While some will make residential investment property loans, it is not their bread and butter. So dont expect a smooth process.

3. Deposits. A lot of banks wont make you a loan unless you have a deposit relationship with them. Be prepared for a bank to want you to keep some cash with them if you want a rental loan.

6 Things to Know about Non-QM Loans

You May Like: Is Buying Gold A Good Investment

What Can I Do With An Investment Property

There are several uses for a residential investment property, including:

- House flipping, which can be done after making home improvements that increase the propertys value

- House hacking a multiunit home, which allows you to live in one unit and rent out the other unit to cover your mortgage payments and create a passive income stream

- Providing short-term rentals through a platform like Airbnb

- Providing long-term rentals in six- to 12-month increments

Fund Almost Anything Else

Unlike some other types of loans, there are no limitations on what you can do with the money you take away from a refinance. You can:

- Grow a childs college tuition fund.

- Boost your retirement savings.

- Pay for a wedding.

- Buy a new car or boat.

Refinancing can give you access to an easy source of cash and you can use it for almost anything you need. If you can dream it, you can use the money from your home equity to make it a reality.

Think a refinance might be for you? Use our refinance calculator to see if refinancing your rental property can help you achieve your goals.

Get approved to refinance.

Recommended Reading: Can You Invest In The Dow

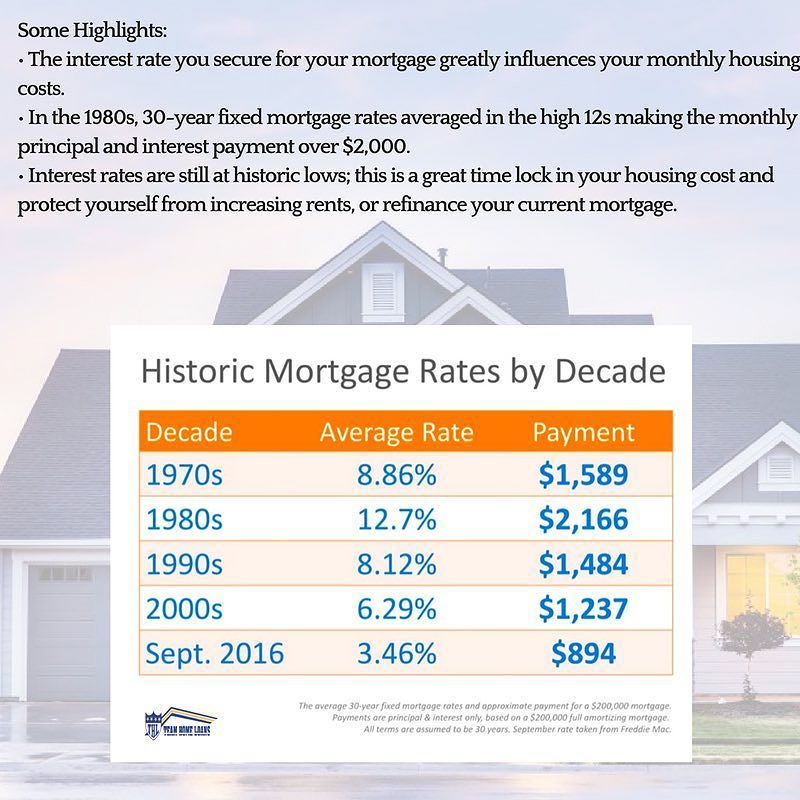

What Determines Mortgage Rates

Mortgage rates fluctuate for the same reasons home prices change supply, demand, inflation, and even the U.S. employment rate can all impact mortgage rates. The demand for homes isnt necessarily a sign of where mortgage rates are headed. The best indicator of whether rates will go up or down is the 10-year Treasury bond rate.

When a lender issues a mortgage, it takes that loan and packages it together with a bunch of other mortgages, creating a mortgage-backed security , which is a type of bond. These bonds are then sold to investors so the bank has money for new loans. Mortgage bonds and 10-year Treasury bonds are similar investments and compete for the same buyers, which is why the rates for both move up or down in tandem.

Thats why, in a slumping economy, when more investors want to purchase safer investments, like mortgage-backed securities and treasury bonds, rates tend to go down. The Federal Reserve has been purchasing MBS and treasury bonds, and this increased demand has led to the lowest mortgage rates on record.

Compare Your Refinance Options Now

Are you ready to see what rates and loan terms you qualify for on your investment property refinance? Credible can help. You can compare multiple lenders and see prequalified rates in as little as three minutes.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

Also Check: Second Home Loan Vs Investment Property

Decide Why Youre Refinancing

Refinancing is when you take out a new home loan to replace your old one. You might want to do that for a few reasons. If mortgage rates have dropped or your financial situation has improved significantly, you might be able to get a lower interest rate, meaning lower monthly mortgage payments. If your first loan was an FHA loan, you may have to refinance to a conventional mortgage to get rid of mortgage insurance. You may also want a cash-out refinance, in which you take out a loan for more money than you owe on the old loan to turn some of your equity into cash, maybe for home improvements or debt consolidation.

The Complete Guide To Investment Property Mortgages In 2022

If the road to real estate riches were an easy one, everyone would be a millionaire landlord or house-flipper.

Making big money from investment property is rarely as simple as buy low, sell high. It requires careful research, planning, hard work, and a dollop of good luck.

But as long as you make real estate investment decisions with your eyes wide open, the financial rewards could surprise and delight you.

Read Also: How To Set Up Your Investment Portfolio

What Is A Mortgage Rate

A mortgage rate is the interest lenders charge on a mortgage. Mortgage rates come in two forms: fixed or variable.

Fixed rates never change for the life of your loan and in exchange for this certainty, the rate is higher on longer loans.

Variable-rate mortgages can have lower interest rates upfront, but fluctuate over the term of your loan based on broader economic factors. How frequently a variable-rate mortgage changes is based on the loans terms. For example, a 5/1 ARM would have a fixed rate for the first five years of the loan, then change every year after that.

Can I Get An Sba Loan For Rental Property

The SBA 504 loan is the best choice for buying commercial property. Money can be used to buy a building, finance ground-up construction, or rehab an existing building. With the SBA 504 loan, you are likely to have the lowest interest rates and a 25-year repayment term.

Borrowing limits are normally $2 million for commercial property. Key requirements of this loan include the owner must occupy 51% of an existing building or 60% of a new construction building.

Also Check: Best Broker To Invest In Stocks

Current Investment Property Mortgage Rates For December 3 2022

Investment property rates are usually at least 0.5% to 0.75% higher than standard rates.

At todays average rate of % for a primary residence, buyers can expect interest rates to start around % to % for a single-unit investment property.

| Loan Type | |

| % | % to % |

Rates are provided by our partner network, and may not reflect the market. Your rate might be different. . See our rate assumptions here.

Note, todays average rates are based on a prime borrower profile, with a credit score of 740 and 30% down payment. If you have lower credit or a smaller down payment, your interest rate will likely be higher than what you see advertised.

Thats why average rates should be used as a benchmark only. Your own investment property rate will be different, so be sure to compare quotes from a few lenders and find the best deal for you.

Investment Property Tax Implications

- The mortgage interest on an investment property is fully tax-deductible. You can also deduct many expenses related to the property, including property taxes, maintenance and insurance, as well as for depreciation.

- If you rent out the home for more than 14 days per year, the rental income is taxable.

Homeowners enjoy the ability to deduct mortgage interest, but Pepper points out that this can get a bit tricky if you own a second home, due to the $750,000 total debt limit for interest deductions. Essentially, if you have more than $750,000 in mortgage debt between the two properties, youve maxed out the amount you can use to deduct interest.

For an investment property, however, the rules are different.

Interest on a mortgage related to an investment property is fully deductible on Schedule E for a taxpayer and can therefore be used to offset any income generated from the property, Pepper says.

In addition to deducting mortgage interest, investment property owners enjoy the ability to deduct a wide range of expenses. The IRS says the following costs are deductible:

- Advertising the property to attract renters

Recommended Reading: Can I Invest In Dow Jones

Investment Property Credit Score Requirements

When you finance an investment property, lenders generally want to see a better credit score than they do for a primary residence. For instance, Fannie Mae borrowers putting at least 25% down could get approved with a 620 FICO score for a primary home. That minimum credit score increases to 640 for a rental.

If you dont have great credit, you can try an FHA loa the underwriting is much more lenient. FHA loans are available for homes with up to four units, and credit score requirements start at 580. The catch? You must live in one of the units, so the building is still technically a primary residence.

Other Ways To Finance An Investment Property

Many investment property buyers use one of the three mainstream mortgage programs listed above. But other options include:

- Home equity: A home equity loan or home equity line of credit on your current home

- Private loans: Real estate investors will sometimes fund a purchase of rental property

- Seller financing: Occasionally, a seller who owns a home outright may trade the lump sum she would normally receive for a continuing income stream

- Hard money loans: These short-term loans can sometimes work well for house flippers

But most buying investment properties turn to mainstream mortgage lenders, including banks. You can find some through our website using the Request a Quote service. Youll soon find a question that asks whether you want the loan for investment purposes.

Don’t Miss: Selling Stock To Buy Investment Property

Investment Property Mortgage Requirements

Mortgage lenders get to set their own requirements. And the guidelines for investment property loans are usually stricter than for a primary residence.

Though rules vary by lender, here are the broad guidelines you can usually expect to see for an investment property mortgage.

- Minimum down payment: Often 15%, though some lenders still require 20%. Youll get better rates with 25% down

- Minimum credit score: 680 with a 15% down payment 620 with 25% down

- Maximum DTI: This is your debt-to-income ratio. Typically, your non-housing debts should be no greater than 28% of your gross monthly income. And your total debts plus housing costs shouldnt exceed 36%. But some lenders are less strict, often allowing 36% and 45% respectively

- Cash reserves: Many lenders want you to have cash reserves that are sufficient for you to cope for six months without rental income

- Loan limits: Government-backed mortgages and conforming mortgages have limits on the amount you can borrow. These vary according to local home prices

- Documentation: Expect lenders to request two years of tax returns, two years of W-2s, and two months of bank statements at a minimum

In addition to your finances, mortgage lenders will also evaluate the property you hope to buy.

Different Types Of Rental Property Mortgages

Not all rental property mortgages are created equal. There are different types of mortgages based on the type of property you’re borrowing against and your financing needs. These are the most common rental property mortgage types:

- Conventional loans

- Commercial loans

- Seller financing

Some investors use a home equity line of credit against their primary residence or a margin loan against their investments to purchase or finance their investment properties. These strategies minimize the average cost and time it takes to qualify for a typical mortgage to buy a property. In a competitive market, that can give you an advantage over other bidders.

Also Check: Are Gold Coins A Good Investment Uk

Why Choose Westpac For Your Investment

Discounts for diligent investors

Get additional interest rate discounts by paying 12 months interest in advance on Fixed Rate Investment Property Loans with Interest Only in Advance.***

Best Investor Lender two years running

Awarded at RFi Group Australian Lending Awards, 2020 & 2021 for Best Investor Lender

Know the property inside out

Search an address or suburb for the sale history, price guide, expected capital gain and rental income with our full online Property Report.

Finance Other Real Estate Investments

You may want to use your home equity to finance a down payment if you see a real estate investment that you want to buy quickly. As your home grows in value over time, your equity increases in value beyond what you pay on your principal.

Many investors will then parlay this built equity into more profit by using it to put money down on another investment. You might have even bigger goals, such as using the money you get from your refinance to invest in a different type of real estate venture, like a commercial property.

Also Check: How To Create An Investment Deck

What Is The Difference Between An Investment Property And A Second Home

You buy an investment property with the primary goal of making a profit, typically by renting out the space for most of the year or flipping the home. A second home is one that you intend to visit on a regular basis.

This distinction matters when you buy property because mortgage lenders treat investment properties and second homes differently. Second homes are subject to lower interest rates and easier requirements, but you must prove you plan to live there at least part of the year. By contrast, investment properties which you plan to sell or rent out full-time have slightly higher interest rates and stricter mortgage guidelines.

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you donât lock in right away, a mortgage lender might give you a period of timeâsuch as 30 daysâto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, itâs best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While itâs not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you donât lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Don’t Miss: Best Custodial Investment Accounts For Minors