How Does Additional Property Save On Taxes

Just as you can deduct mortgage interest on your primary dwelling from your total income tax obligation, you can do likewise regarding an investment property and second home. Rules state that second home mortgages can not be higher than $1,000,000 and that the residence must not be rented out during the year unless the owner occupies the premises for 14 days longer or 10 percent more, whichever is longer, than the rental period.

Houses for exclusively income purposes offer the mortgage interest deduction as well as taxable income reductions for property taxes, maintenance expenses, and structural improvements. Your lender or IRS.gov can provide further tax-related information.

Second Home Mortgage Rules And Rates

Doing a side-by-side analysis of interest rates for a primary residence and a second home is instructive. In many situations the rates on second homes are identical to rates for primary residences however, in some situations, the second home rates are slightly higher, quite understandably, because additional property represents higher risk.

Why? Owning a second home is much less urgent than owning an only home. Therefore, if a payment must be missed, the second home mortgage is more likely to take the hit. Other restrictions often apply. The owner must physically occupy the property for at least a portion of every year.

Furthermore, a second home can not be a multi-unit house or building. Meanwhile, the borrower must exercise sole authority over the property, even if a manager is retained. Down payments are larger, as well, 10 percent or more as a minimum. Finally, the collateral can be neither a timeshare nor a predominantly investment property.

Dont Miss: Cash Out Refinance Investment Property Ltv

What Are The Mortgage Rates For A Second Home Vs Investment Property

Mortgage rates for second homes and investment properties may be slightly higher than those for primary residences, as lending on these properties is deemed a little riskier. However, mortgage rates are still at all-time lows. But, rates fluctuate daily, so contact us to learn more about todays rates.

Which Property Type is Right for You?

The best way to classify whether a second home or investment property is right for you is to determine how you intend to occupy the property. Are you looking for a vacation home, or are you looking to earn passive rental income? It is best for both second homes and investment properties to create a wants and needs list and familiarize yourself with our house hunting tips to help you narrow down your search.

From there, you can get in touch with one of our mortgage specialists to determine which financing solution is right for you.

Recommended Reading: Investment Account Sign Up Bonus

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Compare Investment Property Mortgage Ratesforcreditin

Investment properties appeal to those who seek to build wealth by, perhaps, flipping fixer-uppers or buying rentals. Find and compare current investment property mortgage rates from lenders in your area.

Edit my search

About These Rates: The lenders whose rates appear on this table are NerdWallets advertising partners. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a lenders site. The terms advertised here are not offers and do not bind any lender. The rates shown here are retrieved via the Mortech rate engine and are subject to change. These rates do not include taxes, fees, and insurance. Your actual rate and loan terms will be determined by the partners assessment of your creditworthiness and other factors. Any potential savings figures are estimates based on the information provided by you and our advertising partners.

Read Also: Best Investment Loan Interest Rates

Recommended Reading: How To Invest In Salt

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Mortgage Qualifications For An Investment Property

Its much easier to qualify for a second home than it is for an investment property. There will be higher down payment requirements and cash reserves for an investment property. This is because they tend to carry a higher degree of risk for lenders. Most investment properties have the following qualification requirements:

- At least 15% down

- Credit score above 720

- 2 years of bank statements and tax returns

The interest rate you receive on your investment property depends on your credit score and down payment amount. Since it carries significant risk for the lender, the interest rate can be 1- 1.5% higher than a standard mortgage. This can be a significant cost for borrowers looking to get an investment property.

Recommended Reading: Is It A Good Idea To Invest In Gold

Second Homes Get The Mortgage Interest Deduction

Its well-known that mortgage interest is deductible on primary residences if you itemize deductions. However, many people dont realize that the mortgage interest deduction can apply to second homes, as well.

The IRS currently lets you deduct the interest paid on as much as $750,000 in qualified personal residence debt. This can mean a primary residence or a secondary residence. It could also apply to home equity debt if the money you borrowed was used to substantially improve a primary or secondary home.

This deduction isnt available for investment property mortgage interest. It can be deducted as a business expense to lower your rental income, however.

One caveat is that the mortgage interest deduction is an itemized tax deduction. You cant use it if you claim the standard deduction.

For the 2019 tax year, the standard deduction is $12,200 for single taxpayers and $24,400 for married taxpayers filing joint returns. Unless your itemizable deductions, including mortgage interest, are greater than your corresponding standard deduction, you wont benefit from deducting mortgage interest on a second home.

Tax Benefits Of A Second Home

The IRS has a lot to say about the tax benefits of a second home. You can enjoy a few tax advantages to help lower your tax bill:

-

Mortgage Interest: You can deduct mortgage interest on up to $750,000 of mortgage debt on any personal residence, whether itâs your first or second home.

-

Rental Income: If you rent your home occasionally, you donât have to report the rental income if you rent it out for fewer than 15 days per year.

-

Home Equity Loan Interest: If you have a mortgage on your second home and didnât borrow against the equity of the first home, you can write off the interest of a home equity loan in order âto buy, build, or substantially improvethe taxpayerâs home that secures the loan.â

-

Property Taxes: You can deduct $10,000 of your total property taxes from all your owned properties per tax return, or $5,000 if youâre married and filing separately.

Also Check: How To Manage Investment Portfolio

What It Means For Your Home Loan

Why does it matter? When you’re applying for home loans to help you buy a house or to refinance an investment property, you’ll need to specify whether you’re applying for an owner-occupier loan or an investor loan. The distinction will most likely change the rate at which you’ll be charged interest, whether you go with an offset mortgage, variable rates, fixed home loan or construction financing.Investment loans are typically the more expensive of the two, both in terms of interest rates and additional closing costs, such as the appraisal fee. For example, a variable interest home loan for an owner-occupier might be available at 3.39 per cent interest. For investment mortgages, the interest rate for a comparable loan might be 3.79 per cent. If youre looking for the cheapest investment home loan, look for lenders that dont charge high closing fees and ongoing fees, such as loans.com.au. Make sure to check the specificationsFurthermore, you might need to put forward a larger down payment for an investment home loan, meaning your maximum loan-to-value ratio will be higher. In Australia, many major banks and other lenders have recently lowered the maximum LVR and raised interest rates for investor home loans in response to concerns that the lending rate for this type of mortgage is growing too quickly.

Buying Second Homes Vs Investment Properties: Whats The Difference

Often, the intentions of buyers in the Ocean City, MD real estate market are to own a getaway place at the beach or to generate rental income. Many buyers are unfamiliar with the difference between buying a property as a second home or as an investment property. In fact, depending on your purchasing strategy, it could affect you financially.

In this article, Ill breakdown the differences between buying a second home verse an investment property in Ocean City, MD. Even if youre considering options in other markets, this could help you too!

Whether you’re looking to buy an oceanfront property or relax by the bay, second homes and investment properties in Ocean City, MD are a great investment to enjoy the coastal lifestyle.

Recommended Reading: Alternative Investments For Individual Investors

Investment Loan Vs Home Loan

As the names imply, the difference between owner-occupied residences and investment properties comes down to what you intend to do with them. When you’re buying a home or apartment you intend to live in, it’s called an owner-occupied property. If you plan to rent it to tenants or flip it, it’s considered an investment.Some people may choose to live in a home for a while and then rent it out after moving somewhere else, such as when their finances permit a transition or their careers compel them to relocate. Others may purchase a building and lease it to tenants initially, planning to move in themselves at a later date. However, if you follow this path and want to refinance your mortgage as an owner-occupier home loan, you may need to live there a set period of time before you can make the transition.What if you purchase a property with more than one flat or apartment? If it has four or fewer units, it’s typically considered owner-occupier as long as you live in one of them.

Ok How About Tax Treatment Of Second Homes

When it comes to tax purposes, Second Mortgages generally get treated the same way as your first home. You can write off property taxes from your first home, and the same goes for your second home. The same guideline and rule applies to the interest on your mortgage and to the limits that the IRS imposes. IRS allows you to write off the interest of up to $1M in mortgage debt that was incurred on buying your property or on improvements. You can also write off the interest on your mortgage up to $100K of home equity debt, which is the debt put against your first or second homes for anything other than buying them or monies spent on improving them. These limitations are not imposed on a per-house basis, but on an overall basis. For example, if you owe $1.5M between 2 homes, you can only write off the interest on your first $1M in mortgage debt and $100K in home equity debt.

Recommended Reading: First Real Estate Investment Trust

Tax Benefits Of Second Homes Vs Investment Properties

The tax benefits of a second home are very different from those associated with an investment property. The table below shows important differences:

Attn formatting: Please create an HTML table with the information below:

| Tax benefit | |

|---|---|

| Not usually taxable if property is rented less than 14 days per year | Must be reported if property is rented more than 14 days per year |

One important reminder about the 2018 tax rule changes: You can only deduct mortgage interest for up to $750,000 worth of total mortgage debt, including loans on primary residences, second homes and investment properties. However, that limit increased to $1 million if the property was purchased prior to Dec. 15, 2017.

Its always best to consult with a tax professional to get tax advice to maximize the tax benefits of your second home or investment property.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Challenges Of An Investment Property

If you buy a home to use as an investment property, youll need to take responsibility for managing the property, and youll need to be responsive to your renters.

If you arent good at fixing things or dont want to worry about collecting rent, you may want to hire a property management company to do the work for you. While every company is different, property managers will usually collect a fee thats around 10% of your rental income.

Don’t Miss: When Is The Best Time To Invest In Stock Market

Is Buying An Investment Property A Good Investment

An investment property may be a good match if your priority is to generate money by collecting rent from tenants. Youll also benefit from home equity, as the propertys value increases over time or due to upgrades.

However, mortgage requirements for investment homes can be more stringent and costly than other mortgage types. These home loans also usually come with the highest interest rates, credit score requirements, and liquid asset conditions of all occupancy types. This is because investment properties tend to have higher delinquency rates than other property types which means increased risk for mortgage lenders.

Youll also typically need at least 10% of the purchase price for a down payment, though you may be able to use projected rental income to help you qualify for a mortgage.

How Property Types Affect Your Mortgage

While there are no hard-and-fast lender definitions for a second home versus an investment property, some general guidelines come up a lot.

If youre applying for a second-home mortgage, many lenders will forbid you from renting out the property. Renting it for even a couple weeks a year will render it an investment property in most lenders eyes. Some lenders are relaxed on this point, however, and will let you rent your second home as long as you meet certain occupancy requirements.

Many lenders also have geographical requirements for a second home whether its a certain distance from your primary residence or a location near a popular vacation area. If youre not sure whether a potential property qualifies as a second home, you can always ask your real estate agent to steer you towards a friendly lender or at least one who can answer your questions.

That said, you can infer how a lender might define an investment property from their definition of a second home. An investment property will be rented, it may be close to your primary residence, and located in a residential, non-vacation area.

Finally, DO NOT take a shortcut and pretend your investment property is a second home. Some lenders will make unannounced visits to your property to make sure youre using it for its stated purpose. Occupancy fraud is a serious crime, and it can give your lender the right to foreclose on your loan immediately.

You May Like: Where To Start Investing My Money

What Makes A Property A Second Home

If you want to use your new home as a vacation property, then it will most likely be classified as a second home.

The classification second home has to do with how you intend to occupy it, not whether its actually the second home youve bought or whether you already own a first property.

To qualify as a second home:

- Youll have to live in the property for a part of the calendar year

- You wont be able to use the property as a rental property, Airbnb, timeshare, etc.

- No one else can have control over the property

- Your property will also have to be a single-dwellingnot a duplex or triplex.

- Finally, you must be able to live in your property year-round .

Can I Afford A Second Home

Are your finances ship-shape to the point that you can afford to buy a second home? Even if you plan to collect rental income from the property, youll want to be sure its a purchase you can afford, particularly if it will remain vacant for several months a year.

Here are some financial factors to bear in mind.

You May Like: How Does Robo Investing Work

How Do Mortgages Differ For Second Homes Vs Investment Properties

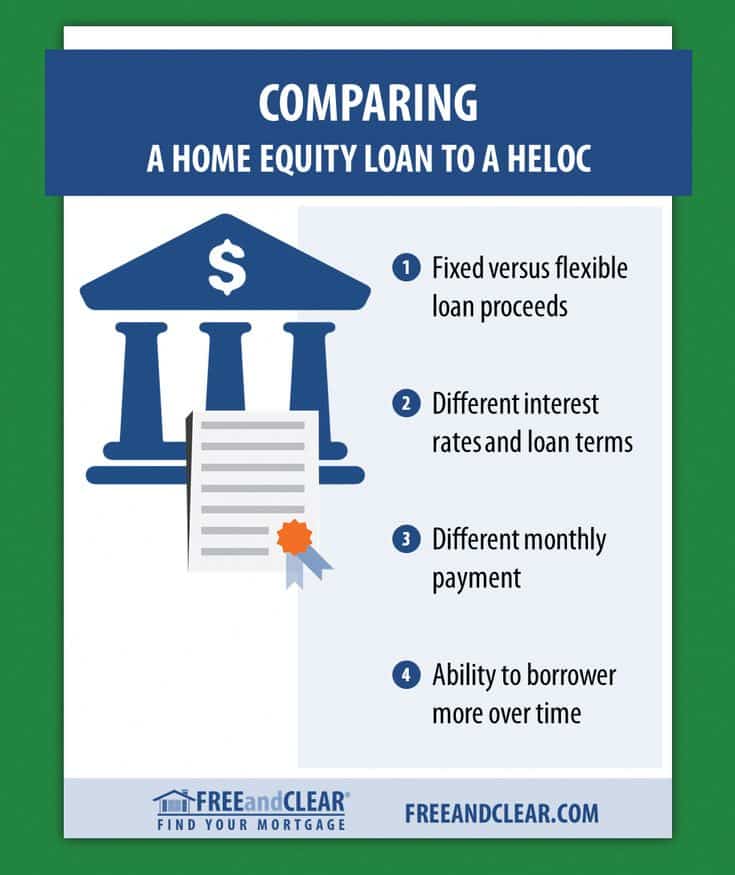

Typically, lenders offer less stringent qualifications and mortgage terms for second homes compared to investment properties. Mortgage rates for second homes vs. investment properties also tend to be different. Both loans, however, still typically have stricter requirements that relate to credit history, , income, down payment amount, and cash reserves compared to primary residences.