Investing In The S& p 500 With An Etf

Like index funds, ETFs allow investors to pool their money in a fund made up of stocks, bonds, and other assets. Unlike index funds, however, which can only be traded once a day at the end of each trading day, ETFs can be traded like a stockmeaning their share prices can fluctuate throughout the trading day.

There are different types of ETFs, and not all of them track a particular index. Some ETFs correspond to a particular sector, industry, or market. To invest in the S& P 500 with an ETF, youd want to purchase an index-based ETF. The key factors to pay attention to arent much different from that of an index fund:

- Minimum investment: in many cases, ETFs will have a lower minimum investment than index fundssometimes, you might only need to pay the amount of a single share to get started.

- Expense ratio: always compare expense ratios for ETFs youre considering, and look for one with the lowest expense ratio possible.

- Dividend yield: compare the dividend yields of ETFs youre considering, and ensure its as high as possible to boost your returns.

Follow these steps to buy an ETF:

All Your Money Is Invested

Curvo works with fractional shares meaning that all your money is invested. When buying your own ETFs, you’re required to buy whole units of shares. For instance, if you buy the S& P 500 ETF, youâll notice that the price hovers around â¬400 price per share. This means that if you invest â¬150 per month, you won’t be able to buy S& P 500 for the first two months. Instead, you’ll have to wait until the third month to buy your first share. And then you’ll be left with some cash on your brokerage account.

You don’t encounter these issues with Curvo Growth. You can start investing from the first month, from â¬50, and every cent will be invested for you. You can also set up a saving plan to send contributions monthly and put your investments on autopilot.

Determine How Much You Can Afford To Invest

You dont have to be wealthy to begin investing, but you should have a plan. And that plan begins with figuring out how much youre able to invest. Youll want to add money regularly to the account and aim to hold it there for at least three to five years to allow the market enough time to rise and recover from any major downturns.

The less youre able to invest, the more important it is to find a broker that offers you low fees, because thats money that could otherwise go into your investments.

Once youve figured out how much you can invest, move that money to your brokerage account. Then set up your account to regularly transfer a desired amount each week or month from your bank. Or you can set up your 401 account to move money from each paycheck.

You May Like: Best Investment Companies For Beginners

Ask Us Your Questions

Investors should consider carefully information contained in the prospectus or, if available, the summary prospectus, including investment objectives, risks, charges, and expenses. You can request a prospectus by calling Schwab at . Please read it carefully before investing.

Past performance does not guarantee future performance.

Indexes are unmanaged and you cannot invest in them directly.

Investment returns will fluctuate and are subject to market volatility, so that an investor’s shares, when redeemed or sold, may be worth more or less than their original cost. Unlike mutual funds, shares of ETFs are not individually redeemable directly with the ETF. Shares are bought and sold at market price, which may be higher or lower than the net asset value .

Diversification strategies do not ensure a profit and do not protect against losses in declining markets.

1. According to Morningstar’s Year End Active/Passive March 2021 Barometer, over the 10 year period ending December 2020 the average dollar invested in active funds underperformed the average dollar invested in similar index funds in the following Morningstar Categories: U.S. Large Blend, U.S. Large Value, U.S. Large Growth, U.S. Mid Blend, U.S. Mid Value, U.S. Mid Growth, U.S. Small Blend, U.S. Small Value, U.S. Small Growth, Foreign Small/Mid-blend, U.S. Real Estate.

2. Asset-weighted average expense ratio as of 4/30/2019 according to Morningstar data.

How Does The S& p 500 Compare To The Dow

The Dow Jones Industrial Average is another stock market index that is closely followed by investors and analysts. Heres how it compares to the S& P 500 Index.

First, the DOW tracks a significantly smaller selection of stocks only 30 of the largest U.S. companies are included. It also excludes the utilities and transportation sectors, whereas the S& P 500 includes all sectors. This means that DJIA-tracking funds provide less diversification than S& P 500 index funds.

Second, the Dow is different from the S& P 500 Index in how it weights the companies that are included on its list. The S& P 500 is a float-market-cap-weighted index while the Dow Jones Industrial Average is price-weighted.

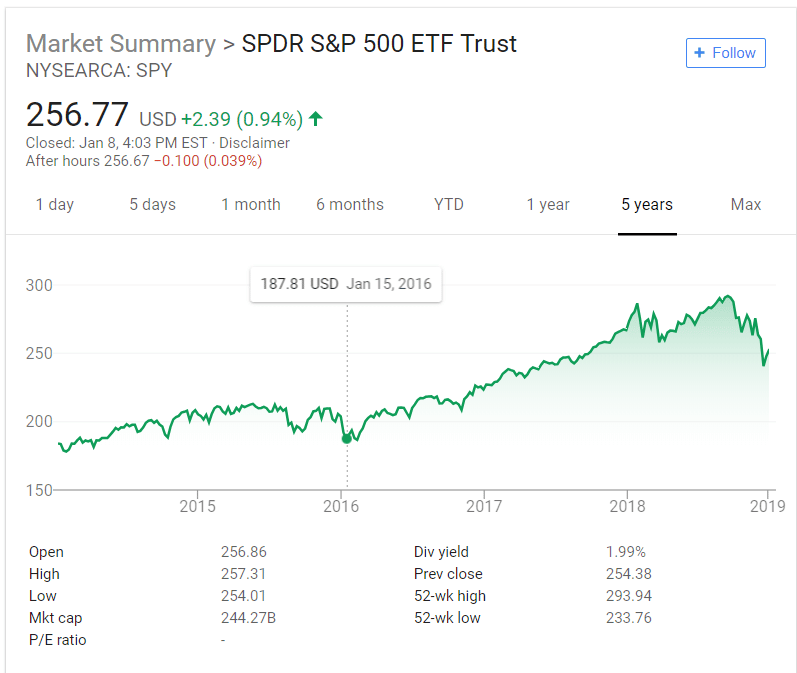

The chart below shows how SPY and DIA have performed recently.

As you can see, the Dow outperformed the S& P 500 pre-pandemic, while the S& P 500 has provided better returns since around mid-2020.

Read Also: Millennium Investment And Retirement Advisors Llc

Best Vanguard Index Funds To Buy And Hold

Vanguard index funds are some of the most famous investment vehicles available today, and for good reason.

Unlike actively-managed funds, index funds provide a low-cost way to track the performance of a given market or sector. In addition, index funds offer broad diversification, which can help mitigate risk. Still, its essential to remember that index funds are not without risk.

The following are some of the best Vanguard index funds you might want to add to your portfolio:

1. Vanguard Total Stock Market Index Fund

The Vanguard Total Stock Market Index Fund offers investors exposure to the entire US stock market. The fund is managed by Vanguard, one of the largest investment management companies in the world.

VTSAX is a passively managed index fund that aims to track the Center for Research in Security Prices US Total Market Index, the benchmark index. The fund is one of Vanguards biggest and most popular index funds, alongside VUG and VTI.

The minimum investment for VTSAX is $3,000, and the expense ratio is 0.04%. Due to more than 3,500 equities in this fund, investors can benefit from low costs, potential tax efficiency, and excellent diversification.

VTSAX is an excellent choice for investors who want broad exposure to the US stock market at a low cost.

2. Vanguard 500 Index Fund Admiral Shares

When you want to invest in the S& P 500 and diversify your portfolio outside the US, consider building a portfolio that invests in both VTSAX and VFIAX.

Is My Money Safe In A Brokerage Account

You may be familiar with the Federal Deposit Insurance Corporation, or FDIC, and that it protects deposits held in FDIC-insured banks in the event a bank fails.

A similar protection exists for brokerage accounts through the Securities Investor Protection Corporation, or SIPC, a nonprofit membership organization that was created in 1970 by federal law. The SIPC protects customers of SIPC-member brokers in the event that the firm fails. Customers are covered for up to $500,000 for all accounts at one institution, including a maximum of $250,000 for uninvested cash.

Its important to note that the SIPC does not protect you from investment losses, but rather only if your brokerage firm fails financially. So dont expect a bailout if you see the value of your stocks or bonds decline.

You May Like: Pimco Short Asset Investment Fund

Which Companies Are Included In The S& p 500

A little background on the S& P 500: It was created in 1957 by financial companies Standard and Poors, and the index is now owned by the S& P Dow Jones Indices, a joint venture between S& P Financial , global markets company CME Group and media company News Corp., which owns Dow Jones.

The S& P 500 tracks large-cap companies across the major industry sectors, from information technology to real estate. As of Dec. 31, 2019, the index was comprised of: information technology , health care , financials , communication services , consumer discretionary , industrials , consumer staples , energy , utilities , real estate and materials .

A fun fact is that even though its called the S& P 500, there are actually 505 listed stocks because a change in methodology led to more companies having multiple listings in the index due to multiple share classes. For example, Googles parent company Alphabet has Class A and Class C shares.

The top 10 companies in the S& P 500 by index weight are:

-

InitedHealth Group Inc.

How To Invest In S& p 500 Index Funds

All the leading brokerages and financial services companies offer S& P 500 index funds, both the traditional firms like Charles Schwab, Fidelity, and Vanguard and online trading platforms and apps, like Robinhood and Stash. S& P 500 index funds are particularly popular with robo-advisors like Wealthfront and Betterment, which use computer algorithms to invest and periodically rebalance investors’ portfolios.

Some of the leading S& P 500 index funds include:

Historical note: Vanguard Group founder John C. Bogle created the concept of an index fund for individual investors in 1976, with Vanguard’s First Index Investment Trust. Composed of S& P 500 stocks, it was ridiculed as “un-American” and “a sure path to mediocrity,” according to a Vanguard history site. During its initial underwriting, the fund only collected $11 million but today, the Vanguard 500 Index Fund has grown to be one of the industry’s largest funds and one of its most successful.

Read Also: How To Invest In Online Gaming

Purchase Your Index Fund

After youve decided which fund fits in your portfolio, its time for the easy part actually buying the fund. You can either buy directly from the mutual fund company or through a broker. But its usually easier to buy a mutual fund through a broker. And if youre buying an ETF, youll need to go through your broker.

Is The S& p 500 A Good Investment Long Term

Over the last two decades, the S& P 500 has outperformed European equity indices like the FTSE 100 and the Euro Stoxx 50. Legendary investor Warren Buffet once said that all it takes to make money as an investor is to consistently buy an S& P 500 low-cost index fund.

And academic research tends to agree that the S& P 500 is a good investment in the long term, despite occasional drawdowns. According to a recently published paper in the highly rated Journal of Banking and Finance, any investor would be better off investing in stocks rather than in risky bonds, as long as the portfolio included a riskless asset a Treasury Inflation-Protected Security .

Don’t Miss: Real Estate Funds To Invest In

What Benefits Indian Investors Can Get By Investing In S& p 500 Mutual Fund

Index fund suits risk-averse investors. If you dont want the trouble to track your mutual fund investment regularly, investing in index funds is safe with a more predictable return. Another advantage is that index funds are passively managed without a fund manager selecting the stocks. The fund merely invests in stocks already present in the index.

It offers low-cost diversification in the US stocks to receive a higher return from an index that generated a steady performance. The companies listed in S& P 500 are multinational with massive global outreach, means youll be investing in leading digital, financial, and core sector industries across several sectors.

As the dollar continues to accelerate in value, the import is becoming expensive for Indians. Even the cost of education in US universities is becoming costly. It is likely to will continue in the future, so having a portion of your investment invested in S& P 500 funds where you can earn in dollar offers a hedge against appreciating dollar value.

Spy Stock Is It A Buy Now

If you’re a long-term investor, any time is a good time to buy SPY stock. Given how diversified it is, SPY is the ultimate “set it and forget it” stock. Over the long term, the S& P 500 has returned 9.9% a year on average since 1928 including dividends, says IFA.com. You would be hard pressed to find many better, low-cost plays you can hold onto forever. Keep in mind, too, if you buy and hold SPY stock you will receive the quarterly dividend payment.

Even famed investor Warren Buffett often recommends investor buy and hold the S& P 500.

Also Check: Alternative Investments Instruments Performance Benchmarks And Strategies

Find Your S& p 500 Index Fund

Its actually easy to find an S& P 500 index fund, even if youre just starting to invest.

Part of the beauty of index funds is that an index fund will have exactly the same stocks and weightings as another fund based on the same index. In that sense, it would be like choosing among five McDonalds restaurants serving exactly the same food: which one would you go with? Youd probably select the restaurant with the lowest price, and its usually the same with index funds.

Here are two key criteria for selecting your fund:

- Expense ratio: To determine whether a fund is inexpensive, youll want to look at its expense ratio. Thats the cost that the fund manager will charge you over the course of the year to manage the fund.

- Sales load: If youre investing in mutual funds, youll also want to see if the fund manager charges you a sales load, which is a fancy name for a sales commission. Youll want to avoid this kind of expense entirely, particularly when buying an index fund. ETFs dont charge a sales load.

S& P 500 index funds have some of the lowest expense ratios on the market. Index investing is already less expensive than almost any other kind of investing, even if you dont select the cheapest fund. Many S& P 500 index funds charge less than 0.10 percent annually. In other words, at that rate youll pay only $10 annually for every $10,000 you have invested in the fund.

Select your fund and note its ticker symbol, an alphabetical code of three to five letters.

Go To Your Investing Account Or Open A New One

After youve selected your index fund, youll want to access your investing account, whether its a 401, an IRA or a regular taxable brokerage account. These accounts give you the ability to purchase mutual funds or ETFs, and you may even be able to buy stocks and bonds later, if you choose to do so.

If you dont have an account, youll need to open one, which you can do in 15 minutes or less. Youll want one that matches the kind of investments youre planning to make. If youre buying a mutual fund, then try to find a broker that allows you to trade your mutual fund without a transaction fee. If youre buying an ETF, look for a broker that offers ETFs without commissions, a practice that has become the norm.

The best brokers offer thousands of ETFs and mutual funds without a trading fee. Here is Bankrates list of best brokers for beginners.

Recommended Reading: Td Bank Mortgage Rates Investment Property

How Can I Invest In The S& p 500

As mentioned earlier, you cant actually invest in the S& P 500 itself. But you can invest in an S& P 500 index fund that mimics the performance of the S& P 500. Instead of purchasing 500+ separate stocks , its an opportunity to invest in a single fund.

Another way to invest in the S& P 500 is by investing in an exchange-traded fund that mirrors the index. An ETF is a low-cost, tax-efficient fund that allows an investor to stay diversified while investing in the stock market. Theyre traded on stock exchanges and can be bought and sold like stocks.

Acorns portfolios, for example, include ETFs that provide exposure to thousands of stocks and bonds, including one that mirrors the S& P 500. The Vanguard S& P 500 ETF , is included in four of five Acorns portfolios. Its one of the largest funds and provides an easy way to invest in the S& P 500 index.

Other popular and low-cost S& P 500 index funds and ETFs include SPDR S& P 500 ETF Trust, iShares Core S& P 500 ETF and Schwab S& P 500 Index Fund, according to Bankrate. You can also invest in S& P funds through your companys 401 and Individual Retirement Accounts .

Does Spy Pay Dividends

Absolutely, SPY pays dividends. SPY stock collects the dividends issued by all the dividend-paying stocks in the S& P 500 â and pays them to you. And, currently, the dividend yield on the SPY is roughly 1.5%. That means if you invest $25,000 in SPY stock, you will receive $375 a year, paid quarterly, on your investment.

You May Like: Best Way To Invest For Income

What Is S& p 500

S& P is a stock market index containing the top 500 largest publicly traded companies in the US stock exchange, based on a weighted index.

However, it is not an actual list of the largest corporations in the US in terms of market capitalisation. As a market index, S& P 500 also considers several other factors for the list. We will come to those later. For now, lets see how S& P calculates the weighted capital capitalisation of companies. The formula it uses is the following.

Weighting capitalisation in S& P = company market capital/ total of all market capital

But there is more than just calculating the weighted average. The S& P committee is responsible for selecting the stocks to feature in the top 500 list, base their analysis on a host of factors like market capital, liquidity, and sector allocation.

Many of the companies that feature in S& P 500 are tech and financial companies. It contains names like Facebook, Netflix, Disney, McDonald, Microsoft, Google, Coca-Cola, Apple, Xerox, and more. With 63 years of track record, S& P 500 is one of the oldest market indices and the most powerful. It is followed globally, and not only US investors but also investors from other countries invest in S& P 500 companies through various mutual index funds and ETFs.

If you want to invest in S& P companies but dont want to go through the process of combing through each company for investing, you can put your money through an S& P index fund.