When Can I Sell My House After I Take Out A Home Equity Loan

Theres no set time limit for how soon you can sell your house after taking out a home equity loan. However, in any mortgage transaction, paying off liens is necessary to sell the property. This is due to the fact that your home is held as collateral on the loan, but it doesnt mean you have to wait to sell.

If you choose to sell your house while still making payments toward your primary mortgage and home equity loan, you will be able to pay off these liens from the home sales proceeds. For example, if you sell your home for $350,000 while owing $150,000 on your mortgage and $50,000 on your home equity loan, that money due will be deducted from your homes sale, leaving you with $150,000 in profits.

Why Is Home Equity Important

Your property equity can be a valuable resource as it can potentially allow you to fund investment home purchases. This means that the $180,000 in the example above can be taken out from your current home and used to contribute towards a second purchase. This is often how many people build strong property portfolios with multiple homes. However, its important to seek financial advice first to discuss your specific circumstances, as you want to plan ahead to get the best use of your home equity.

Nevertheless, if you want to utilise your equity, you want to grow its amount as much as possible to give you more leverage when buying another home. Here are some of my tips.

How To Use Home Equity To Buy Rental Property

Related Articles

You can unlock the equity in your home to help finance the purchase of rental property. To do so, youll need to take out a home equity line of credit or home equity loan on your home and use the money toward the down payment on the rental property. Under favorable circumstances, the rental property will generate sufficient income to pay all expenses plus provide you enough earnings to make the transaction worthwhile.

Read Also: Investing 401k In Your Own Business

What Are The Risks Of Using Equity To Buy An Investment Property

As with most things, there are also some risks that you need to be mindful of.

The goal is to add to your portfolio and not to risk both your current home or your new investment property.

To maximise and use your equity safely we suggest :

- Having a buffer for uncertain times. This could either be not using 100% of the useable equity or by having additional savings tucked away.

- Research, research, research. Look to buy the investment property in a high growth area and in an area that easily rented.

- Dont guess speak to a professional mortgage broker to get the best advice and outcome for your individual circumstances.

Cons Of Using A Home Equity Loan To Buy An Investment Property

There arent any additional requirements for using a home equity loan toward an investment, although there are some unique considerations you should take into accountespecially if you plan to use the propertys income to cover your payments.

Youll need to make sure that the property youre interested in purchasing will actually generate income, says Alex Shekhtman, CEO and founder of LBC Mortgage.

To do this, consider working with a real estate agent. They can help you understand local market conditions and ensure youre investing in an in-demand area.

You should also take into account the extra costs that come with an investment property, including maintenance, cleaning, restocking supplies, and, if youre hiring a property management company, the cost of those services.

Youll want to weigh the short-term aspects of the current buying environment with the long-term potential prospects of the property, Black says. Youll also want to figure out a budget to make sure you have cash on hand for repairs or unanticipated vacancies or slow seasons.

Some other drawbacks of this financing strategy include:

Recommended Reading: How To Invest In Dji

Want To Leverage Your Home Equity Now

Your equity is your untapped wealth. By unlocking it, youre able to use it for the following:

- As a deposit: You can use equity in your property as a deposit against an investment loan. If you have enough equity, you can borrow 80% of the property value without using your own cash.

- To take out a : You can structure your using a line of credit. Based on your equity, you will be approved with a certain amount of credit. You will only have to pay interest on the portion youve spent. You can also combine this with an to reduce the interest on your loan.

- Deposit bonds: Instead of using equity as a cash deposit, you can use it as a deposit bond or guarantee. This is generally the case if youre buying with a 12 to 24 month settlement. It also generates interest as it sits in a bank account while awaiting settlement.

- Renovations: If you dont have enough equity to buy an investment property, you can instead use it to renovate your existing property. You can then and begin your investment journey.

We can help! Call us on 1300 889 743 or complete our to discuss your investment plans with one of your expert mortgage brokers.

To Fund A Property Purchase Should I Get A Lump Sum Home Equity Loan Heloc Or A Cash

As opposed to the one-time, lump sum payment received through a home equity loan, HELOCs, or home equity lines of credit, function similarly to a credit card, as they allow you to access and utilize the equity as you choose up to a certain limit and within a certain time frame. Although HELOCs can offer more flexibility than home equity loans, they also come with higher closing costs and variable interest rates, which may mean paying more over time. Rocket Mortgage does not offer HELOCs.

Another option to consider is a cash-out refinance, which allows you to take on a larger mortgage in exchange for accessing equity in your home. Because its a form of refinancing and not a second mortgage, a cash-out refinance doesnt add to your monthly payment and instead extends the length of the original loan.

Theres a lot to consider when choosing between a HELOC and a cash-out refinance, but if youre planning to use your money as a lump sum as you would with a down payment, a cash-out refinance or home equity loan will probably make more sense.

Read Also: Best Way To Invest In Digital Currency

Advantages Of Using Equity To Buy Another Home

Many investors use equity in their existing properties to purchase more investment properties, which enables them to build a bigger investment portfolio. By using existing equity to buy more properties, you can get into the market at todays prices and reap the rewards of price growth than if you had waited and saved the deposit, which can take years.

Read Also: How To Invest In Bosch

Can You Lose Equity

Ever heard the saying, If you dont use it, youll lose it? this could not be truer when it comes to equity. Just because you have it today, doesnt mean that it will be there tomorrow.

Property investors dont live on capital growth. The income from rent and regular increases in that rent is what allows people to work a three day week. The more properties you own, the greater the passive income.

To use equity instead of just letting it sit there and do nothing, means you can buy a second, third or fourth property that much faster, which equates to more passive income.

Also Check: Investing In Real Estate Private Equity Sean Cook

Pros To Using A Home Equity Loan To Purchase An Investment Property

- Can lower your interest rate. The lower rates offered on home equity loans can help you save money on interest charges, especially if the mortgage rate for the investment property is higher.

- Helps cover your down payment. Since lenders consider investment property loans as riskier compared to traditional mortgages, they sometimes require a higher down payment. A home equity loan can help you come up with enough cash to cover this. Additionally, putting more money down could reduce your monthly payments since youâll be borrowing less from the mortgage loan itself.

- Could help you more easily qualify for financing. A home equity loan is generally easier to qualify for compared to a mortgage for a second propertyâespecially considering that mortgages for investment properties usually require a larger down payment than a traditional loan.

What Do Current Market Valuations Imply

While the overall listed global property market suffered in 2022, there are some important distinctions within regions. Asia proved somewhat more defensive, down only 14% partly due to already distressed valuations and lagged response in some reopened economies post pandemic. To achieve its inflation target, the regions largest market, Japan, is limiting the 10-year Japanese government bond yield to a maximum of 0.25%. This is in contrast to higher bond yields elsewhere resulting from aggressive rate hiking by other major central banks. On the other hand, European property has fallen by 40% in US dollar terms as the market quickly re-priced off its low interest rate level and now trades at an unprecedented discount to net asset value , including during the Global Financial Crisis. Meanwhile, the US-listed REIT market returned -23% to 18 November.5 Here, hotels and single tenant property were among the best performers, while both growth and non-growth sectors industrial and office respectively, have been the weakest.

However, the overall story has been one of rising rates, so while share prices have fallen, resulting in higher EBITDA/EV yields , bond yields rose faster. This led to the spread narrowing to the long-term average ie. the blue line and green line in figure 1 are now at a similar level.

Read Also: Can I Invest In A Private Company

Comparing Va Refinance Loans

VA refinance loans are backed by the federal governments Department of Veterans Affairs but provided by private lenders. Here are the top five things to look for when comparing VA refinance loan providers.

The monthly payments on a mortgage comprise principal, as in the amount remaining on your loan, and interest, as in the money the lender collects for providing the loan. Your APR, or annual percentage rate, consists of the interest rate plus other lender fees. The lower the interest rate / APR, the lower your monthly payments to the lender.

Terms. Like other mortgages, the typical VA refinance loan has a 15-30-year repayment term. There is no right or wrong when it comes to repayment terms whats best for you depends largely on how much you can afford to pay each month. The shorter the term, the higher your monthly payments but the less youll pay in interest over the life of the loan. The longer the term, the lower your monthly payments but the more youll pay your lender in the long run.

Closing costs. Closing costs are the fees and charges owed to the lender when the loan begins and usually range from 3-5% of the loan value. Closing costs for a VA refinance may include origination fees, property appraisal, title fees and insurance, state and local taxes, and various other costs some of which go directly to the lender and some which the lender collects on behalf of third parties. The VA funding fee is a separate fee and isnt impacted by the lender you choose.

Two Peas In A Pod: Leverage For Equity

To demonstrate the effects of leverage on equity, lets use the example above, but split it into outright cash vs. leverage scenario:

Cash Option: Buy a $500K property using all cash. Leverage Option: Buy a $500K property with $100K cash and a $400K loan.

If and when the property appreciates to $600K the following year, what happens?

Cash Option: Return on equity = 20% . Leverage Option: Return on equity = 100% .

By using leverage, not only do you outlay less cash but you also get a much higher return on equity.

Read Also: How To Invest In Fashion Nova

What Is A Home Equity Loan

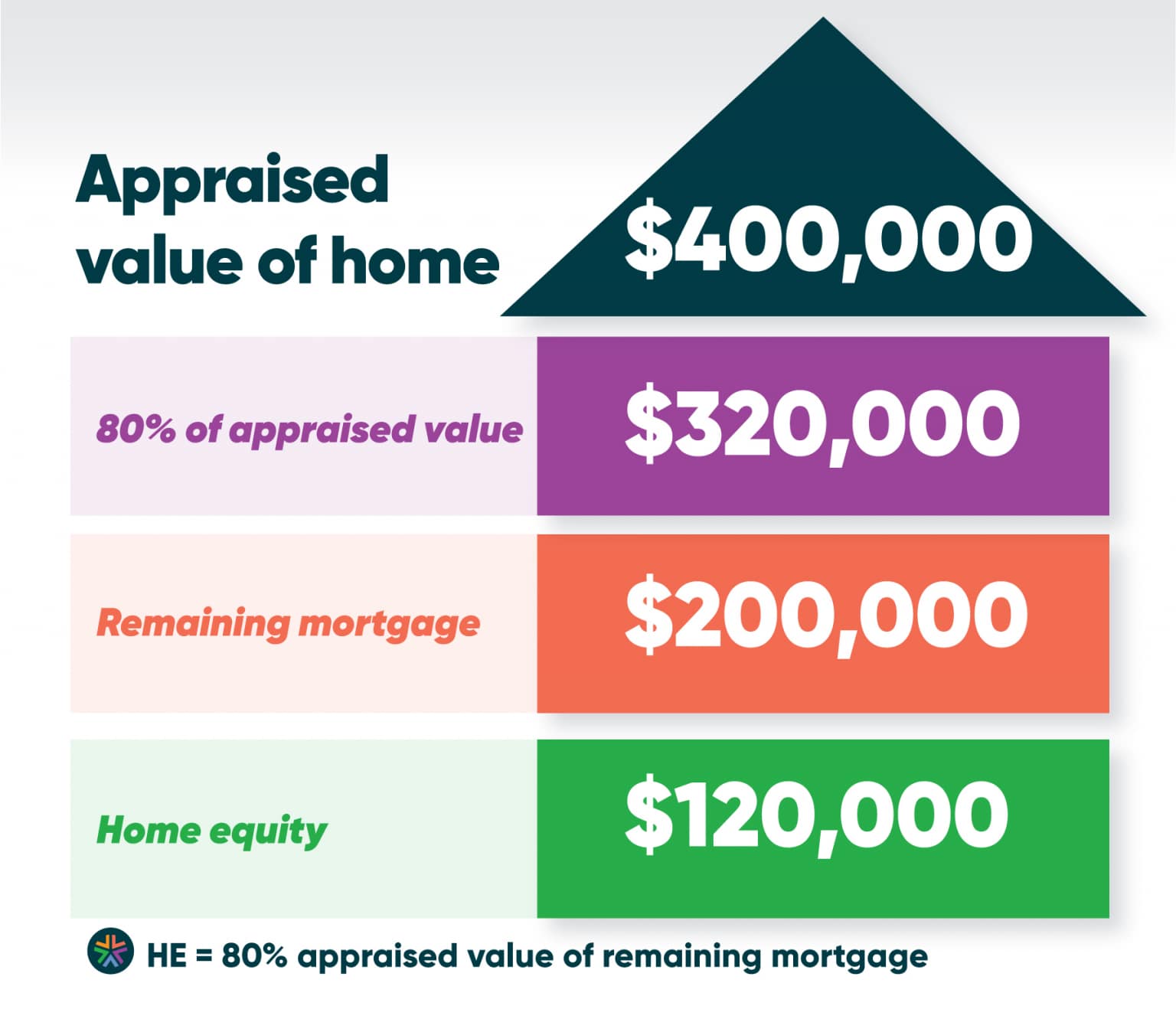

A home equity loan is a type of fixed-rate loan thatâs secured by your home. You can generally borrow up to 80% of your homeâs equity through a home equity loan, depending on the lender.

Unlike with a home equity line of credit that allows you to repeatedly draw on and pay off your credit line, youâll receive your home equity loan funds as a lump sum. Youâll then pay this amount back in equal installments over your repayment termâusually five to 30 years, depending on the lender.

Because a home equity loan is secured by your house, itâs seen as less risky to the lenderâso they tend to offer a lower interest rate compared to other types of loans. Your rate will also depend on other factors, such as your credit, income and debt-to-income ratio.

Home Equity Loan Vs Home Equity Line Of Credit

The difference between a home equity loan and a home equity line of credit might sound complicated but its actually quite simple. A loan is a fixed amount of money in one lump sum paid upfront. Youll start paying interest on the loan the moment you take it out. The reason why I always suggest use a home equity line of credit instead is that you only pay interest on the funds you use as you use them. This can make a big difference when it comes to purchasing a pre-construction condo with borrowed funds. Unlike re-sale where you put down a 20% down payment upfront, pre-construction is paid in installments typically 15% in three installments over the first year with the final 5% paid approximately 4 years later upon completion.

Now that weve broken down how you can benefit when you borrow money and leverage a property instead of paying cash down, . Let us show you how coupling our leveraging strategy with our Platinum Pre-Construction Investments will maximize your return on investment.

Recommended Reading: Stock Market Investing Strategies For Beginners

What Is Equity And How Can You Build It Quickly

Simply put, is the difference between the current value of your property and the amount you owe against it. For example, if your property is currently valued at $600,000 and your mortgage is now down to $400,000, you now have $200,000 in equity that you can potentially access.

Equity takes time to build but there are a few things you can do to ramp it up quickly.

You can do cosmetic renovations to significantly boost your equity.

A new kitchen or bathroom and a lick of paint could dramatically lift the value of your property. Just make sure that you plan and budget well to avoid overspending.

You can also look at making extra repayments to reduce your mortgage quickly. The more you pay, the more equity you build in your property.

If youve just settled on a home loan you may not have enough equity yet. However, if your home loan was for 80% or less, and youve started making mortgage repayments, you will have access to some equity very soon.

Once youve accumulated sufficient equity, you may be able to use it for:

- Maintenance and renovations for your property.

- Buying an investment property or your second home.

- Other investments such as shares and managed funds.

- Improving your lifestyle such as buying a new car or going on a family vacation.

Option : A Line Of Credit

A line of credit means that youll be approved a certain credit amount based on your usable equity, but youll only start paying interest on whatever portion of that amount that you decide to spend.

But the downside is that a line of credit is effective a massive credit card secured on your property.

And just like regular credit cards, the temptation will always be there to splash out on luxuries rather than investments.

You May Like: Investing And Trading For Dummies

Home Equity Of 20% Or More

Homeowners will need more than 20% equity in their primary residence to qualify for a cash-out refinance. You typically have to leave 20% of the homes value untouched, which means that you can only cash out the amount of equity you have above that threshold.

Leaving 20% equity in the home also has an advantage: the borrower dodges Fannie Mae and Freddie Macs private mortgage insurance requirement.

However, an FHA loan will require FHA mortgage insurance premiums even with 20% equity left in the home.

Why Do You Need Leverage In Real Estate

Leveraged real estate investing can increase the profit margin on your investment properties. For example, lets say you have $50,000 cash on hand. You can use that money to do 3 things:

Which option did you choose? Assuming property values increased 7% this year, heres how much you made off your investment property.

- If you chose option 1, your investment property value is now $53,500 and your net gains is $3,500.

- If you chose option 2, your investment property value is now $107,000 and your net gain is $7,000.

- If you choose option 3, your investment property value is now $214,000 and your net gain is $14,000.

You probably see the pattern: by using more leveraged real estate investing, youre also increasing your ability to purchase higher value investment properties, which in effect increases your net gain when property values appreciate.

Read Also: Fidelity Investments Private Wealth Management