What Are My 401 Options After Retirement

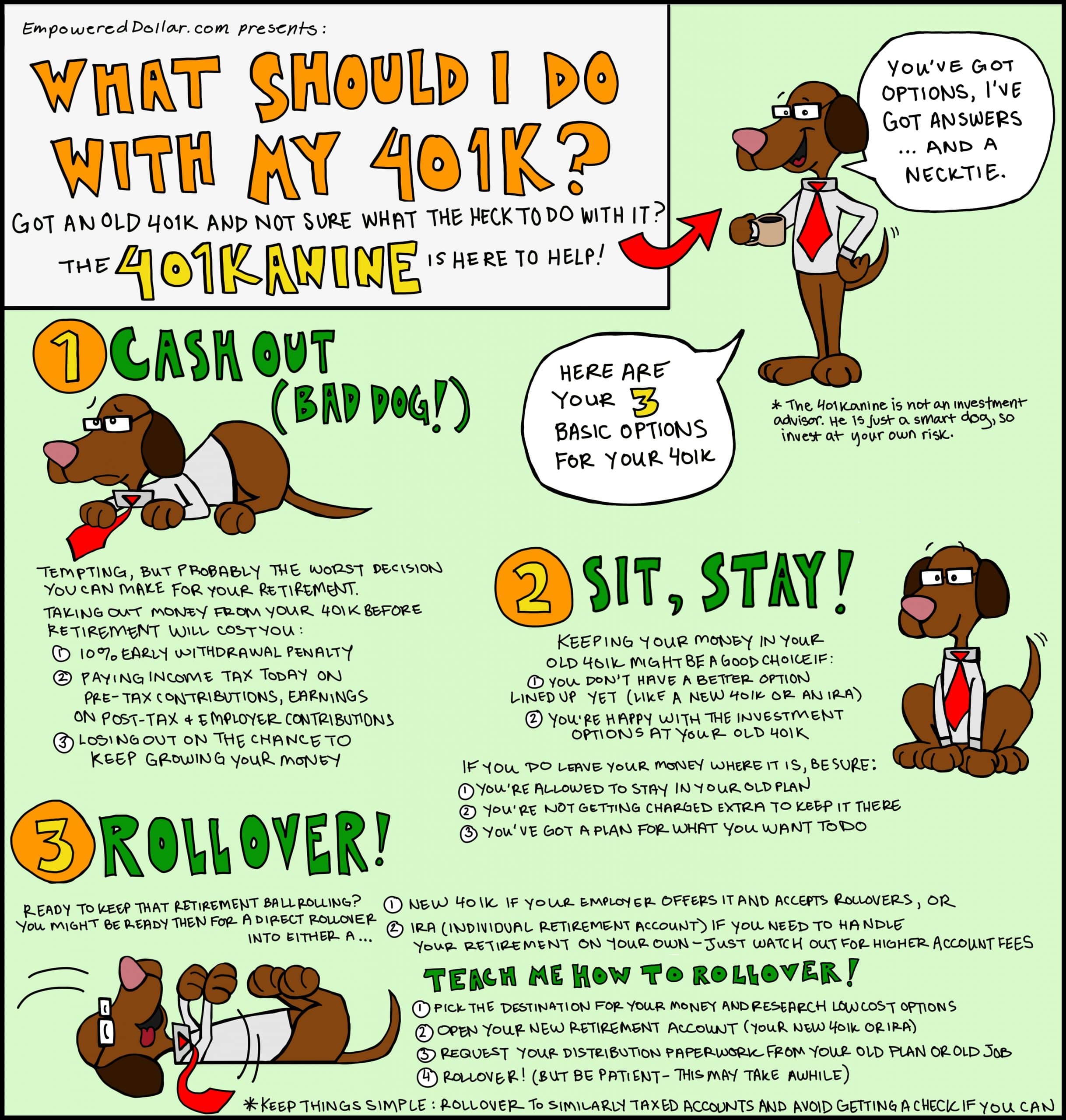

Generally speaking, retirees with a 401 are left with the following choicesleave your money in the plan until you reach the age of required minimum distributions , convert the account into an individual retirement account , or start cashing out via a lump-sum distribution, installment payments, or purchasing an annuity through a recommended insurer.

Make The Middleman Work For You

Eric Volkman: I would suggest opening a traditional brokerage account. In my opinion, its the best choice for retirement investing because it offers so much flexibility.

These days, even the most bare-bones trading account offers a raft of securities to invest in ETFs, stocks, bonds, mutual funds, derivatives, etc. A brokerage is happy to allow a client to basically invest in anything theyre interested in plowing money into.

Its nice to have such a wide variety of choices available, not least because it makes it easy to tailor a portfolio to an eventual retirees investing style and goals. Are you a frequent risk taker who likes to buy derivatives? A blue chip stock buy-and-holder? A set-it-and-forget-it type? A mix of all of the above? A good broker can provide the opportunities and the resources that best fit your profile.

For retirement savers, another positive with traditional brokerage accounts is the many tools available with most of them. These include, but are by no means limited to, access to analyst research, advisory services, and educational resources that allow you to acquire or brush up on your knowledge of financial securities and trading.

Another plus with brokerages is that, thanks to a fee war that broke out a few years ago, trading commissions today are basically non-existent. So buying even a large block of your favorite company will generate exactly $0 in such fees at many brokerages.

What Kind Of Investments Are In A 401

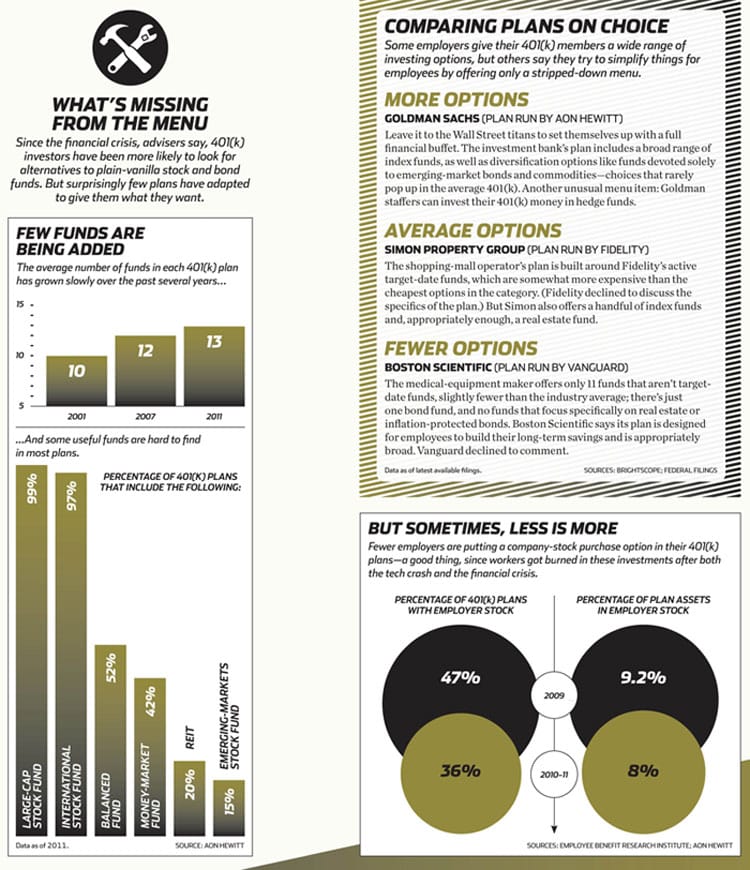

A 401 plan will typically offer a range of investments, but any single plan may not offer all possible types of investments. The most common investment options include:

- Stock mutual funds: These funds invest in stocks and may have specific themes, such as value stocks or dividend stocks. One popular option here is an S& P 500 index fund, which includes the largest American companies and forms the backbone of many 401 portfolios.

- Bond mutual funds: These funds invest exclusively in bonds and may feature specific kinds of bonds, such as short- or intermediate-term, as well as bonds from certain issuers such as the U.S. government or corporations.

- Target-date mutual funds: These funds will invest in stocks and bonds, and theyll shift their allocations to each based on a specific target date or when you want to retire.

- Stable value funds: These funds invest in low-yield but very safe assets, such as medium-term government bonds, and the returns and principal are insured against loss. These funds are more appropriate for investors near retirement than for younger investors.

Some 401 plans may also allow you to buy individual stocks, bonds, ETFs or other mutual funds. These plans give you the option of managing the portfolio yourself, an option that may be valuable to advanced investors who have a good understanding of the market.

Also Check: Legit Online Business Without Investment

Other Types Of Investment Strategies

As an investor, you may decide to add other types of investments to your portfolio. Types of securities you can add might be higher risk, but can compliment your index funds. Whatever other securities you decide to add, make sure you align them with your investment goals and do some research before to make sure you know what youre investing in.

You May Like: What Happens To Your 401k When You Die

What Is The 401 Maximum

The maximum anyone can contribute to a 401 account for 2020 is $19,500 for most savers. This limit applies to 401 plans and similar 403 and 457 plans. Those 50 and older can save an additional $6,500 per year, which is called a catch up contribution.

For investors under 30, the $19,500 maximum means you can save an average of $1,625 per month. If you are able to save and invest that much, youre well ahead of the typical American in saving for retirement.

401 accounts are great for pre-tax contributions. This means you dont pay any income taxes the year of your contribution. Instead, you pay taxes on withdrawals in the future, presumably at a lower tax rate than you pay today.

However, 401 plan accounts are notorious for high fees and few investment options. If you have old 401 accounts with past employers, its often a wise idea to roll over your balance to a Rollover IRA. But as long as you have the job, contributing to a 401 is still usually a good idea even with the typical fees.

You May Like: How Do I Invest In The Nasdaq

Read Also: List Of Pension Funds That Invest In Real Estate

Can I Roll Funds From A Traditional 401 Into A Roth Ira

Yes, you can. However, youll owe taxes on the 401 savings for the year in which you roll them into the Roth. Thats because you got the upfront tax deduction on your contributions with the proviso that youd pay taxes on withdrawals. However, youll pay no taxes on your future withdrawals from the Roth IRA. Its a good idea to inform yourself completely of the rules concerning such a rollover so you can be sure to protect your savings.

Why A Solo 401k

You might be asking why Im considering a solo 401k versus a SEP IRA or other self employed retirement savings options. Well, it all comes down to circumstance and how much you can save.

Lets look at two scenarios that are similar to mine. First, in the past, I only saved in a because my income was lower and I was still maxing out my 401k at work, so I didnt need any additional employee contributions.

With both a SEP and Solo 401k, on $30,000 of income, the employer contribution is $5,576.11. Since I was already doing the $18,000 at my primary employer, that amount didnt make a difference.

However, fast forward to today, the business makes much more income, and my wife is now working for the business. As such, it can make a huge difference in savings and lowering our taxes. Lets assume that the business is going to make $100,000 this year. That means that the business can contribute $18,587.05 to both my 401k and my wifes 401k. Plus, my wife can contribute $18,000 of her salary to the 401k as well .

As such, the solo 401k provides much more savings options, and lower taxes today as a result.

Recommended Reading: What Does It Mean To Roll Over Your 401k

Also Check: Investment Property Vs Primary Residence Interest Rate

Making A Choice For Your 401

Maybe youve switched jobs to take on new challenges. Perhaps youre thinking about changing career paths for something more rewarding. Or maybe youre finally getting ready to retire.

We understand when your life changes, other things may change toolike your goals for retirement. Well help you consider your options for your 401 accounts from past jobs, so you can feel confident youre on track for the future you want.

What Are The Benefits Of A 401

There are two main benefits to a 401. First, companies usually match at least a portion of the money you put into your 401. Every company’s match is different, but your $100 contribution each week to your 401 may result in your company putting an additional $100 into your 401 as well.

Second, there are tax benefits for these accounts. If your contributions to your 401 are pre-tax, you don’t have to pay taxes on the gains you earn over time when it comes time to withdraw money for retirement. If your contributions are post-tax, you get to deduct your contributions on your federal income tax return.

Recommended Reading: How To Invest In Wyze

Set Your Contributions As A Percentage Of Your Salary

There are two general ways 401 plans allow people to manage their contributions — either as a specific dollar amount per paycheck or as a percentage of their salaries. If you have the option to enter your contribution based on a percentage of your salary, it’s a good idea to go that route.

If you choose to contribute a percentage of your salary, your contributions will increase automatically as your salary rises over time with yearly adjustments and raises. This can help to scale up your retirement savings goals over the course of your career with minimal intervention on your part.

Pick The Right Funds For Your 401

Without a thorough understanding of your mutual fund options, its easy to make bad investing choices. For instance, lets say a sample companys 401 materials have 19 investment choices that arent target date funds: six growth funds, four growth and income funds, two equity income funds, two balanced funds, four bond funds, and one cash-equivalent money market fund.

If youre trying to invest according to our advice by splitting your 401 portfolio evenly between growth, growth and income, aggressive growth, and international funds, youre already in trouble. According to the brochure, you dont have any aggressive growth or international options! You meet with an investment professional and they let you konw that of the six options the brochure has listed as growth funds, two are actually international funds and one is an aggressive growth fund. Thats exactly the kind of insight you need to help you make smart investment selections.

A lot of people dont know you can work with an outside professional to select your 401 investments, but you can!

Other investors worry that working with their own investing pro will be expensive. Your investing professional may charge a one-time fee for a 401 consultation, and thats a reasonable cost for the time they spend to help you make smart 401 selections. Just make sure you know what to expect before your appointment so there are no surprises.

Dont Miss: How Do I Know Where My 401k Is

Also Check: How To Invest In Palantir

Who Wants A Self

The self-directed IRA might appeal to an investor for any of several reasons:

- It could be a way to diversify a portfolio by splitting retirement savings between a conventional IRA account and a self-directed IRA.

- It could be an option for someone who got burned in the 2008 financial crisis and has no faith in the stock or bond markets.

- It may appeal to an investor with a strong interest and expertise in a particular type of investment, such as cryptocurrencies or precious metals.

In any case, a self-directed IRA has the same tax advantages as any other IRA. Investors who have a strong interest in precious metals can invest pre-tax money long-term in a traditional IRA and pay the taxes due only after retiring.

The self-directed aspect may appeal to the independent investor, but itâs not completely self-directed. That is, the investor personally handles the decisions on buying and selling, but a qualified custodian or trustee must be named as administrator. Otherwise, itâs not an IRA as the IRS defines it.

Also Check: How To Choose Investments For Roth Ira

How To Choose The Best 401 Provider

The right 401 provider for your business depends on a few factors.

First, you should decide whether you want one company to handle both the investments and the administrative work, or if youd like to divide it between two. Dividing between two means managing multiple accounts but gives you the flexibility to find the best fit for each part of running your 401.

In terms of reviewing companies, cost is an important factor. You should weigh both the costs for you as the employer as well as what your employees would pay for using the plan. If employee costs are too high, they might not enroll at all.

You should also ensure the 401 plan provider offers the investments your employees want, especially if you know they want specific mutual funds or a certain other type of investment.

Consider whether the provider has the 401 features you want, like whether they offer a Roth 401 vs a traditional 401 or 401 loans. Lastly, consider how they manage customer service, such as whether they offer in-person or online only.

You might also want a provider that offers robust employee education, so your workers understand how their investment decisions will affect their ability to fully fund their retirement.

You May Like: How To Invest In Physical Silver

If You Want A Million

When youre saving for retirement, you want to make sure that youre making the most of your investments, so when that day finally comes, you have the most money possible. The account you invest can have huge implications for how much money youll have when you retire and how you can best minimize your tax hit.

Below, three seasoned Motley Fool contributors review the best ways to invest for retirement in order to make the most of the money you contribute.

Also Check: What Should My 401k Contribution Be

What Is A Registered Retirement Savings Account

An RRSP is a retirement savings plan that you open at a bank or other financial institution. You can do that either in person or online, depending on the services is offered by your chosen institution. RRSPs are registered by the federal government of Canada, which specifies the maximum amount each Canadian can contribute to it each year. There are two big benefits to saving or investing inside an RRSP: One, your money is allowed to grow tax-free until you need to withdraw it and two, you get an immediate break on the income tax you would otherwise pay on the amount you contribute each year, up to your annual limit.

Read Also: How To Check My 401k Balance

Read Also: Inexpensive Cryptocurrency To Invest In

So What Should You Do Right Now To Protect Your 401 From A Stock Market Crash

Protecting your 401 from a stock market crash will depend based on where you are in your career. If youâre younger, you can keep investing more in stocks because you have time to recover from any downturn. If youâre older, moving your money into government and municipal bonds will help shield most of your money from the volatility of the stock market.

Remember, time and consistency will help your 401 grow. If the stock market drops, keeping your money in your 401 is the best strategy. Youâll not only prevent you from cashing out your investments at a loss but will also see your 401 grow when the stock market recovers.

Consider talking to your planâs custodian or a financial planner as you near retirement. Youâll be able to get expert insight on how to best protect your 401 from a stock market crash.

Tags

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Don’t Miss: Merrill Lynch Wealth Management Minimum Investment

Investing In Your 401

The variety of investments available in your 401 will depend on who your plan provider is and the choices your plan sponsor makes. Getting to know the different types of investments will help you create a portfolio that best suits your long-term financial needs.

Among the most importantand perhaps intimidatingdecisions you must make when you participate in a 401 plan is how to invest the money you’re contributing to your account. The investment portfolio you choose determines the rate at which your account has the potential to grow, and the income that you’ll be able to withdraw after you retire.

What Are The Safest Investments For A 401

Contributing to a 401 is an important part of saving up for retirement for many people in the U.S. Typically, you wont withdraw funds from your 401 until you reach the age of 59½, which means these employer-sponsored retirement accounts have years, often decades, to grow in value.

You can choose from a number of different investment options, such as stocks and mutual funds. Some people have a higher risk tolerance and opt for aggressive investment options in hopes of reaping higher returns. Other people prefer a more conservative approach that minimizes risk to their 401 value. Risk is inherent to investment, but some 401 options remain relatively stable over time.

Don’t Miss: How To Invest In Netflix Stock

Understand The Companys Investment Plan

One of the first steps that can be done before choosing a 401k plan is understanding the companys plan. Read some documents which specify what kind of plan your company offers. Other than that, you should also know what the employer match and the vesting schedule. This information should help you decide how much money you are willing to contribute from your paycheck.

Best Retirement Plans For Small Businesses & The Self

Self-employment is increasingly popular in the United States. According to the Pew Research Center, in 2019 16 million Americans were self-employed, and 29.4 million people worked for self-employed individuals, accounting for 30% of the nations workforce.

Being a small business owner or a solo entrepreneur means youre on your own when it comes to saving for retirement. But that doesnt mean you cant get at least some of the benefits available to people with employer-sponsored retirement plans.

Whether you employ several workers or are a solo freelancer, here are the best retirement plans for you.

| Who Is It Best For? | Eligibility |

|---|---|

|

Self-employed business owners with no employees . |

Higher contribution limits than IRAs. Contributions are tax-deductible as a business expense. |

Recommended Reading: T Rowe Price 401k Investment Options