But How Much Is Enough

Our guideline: Aim to save at least 15% of your pre-tax income1 each year, which includes any employer match. That’s assuming you save for retirement from age 25 to age 67. Together with other steps, that should help ensure you have enough income to maintain your current lifestyle in retirement.

How did we come up with 15%? First, we had to understand how much people generally spend in retirement. After analyzing enormous amounts of national spending data, we concluded that most people will need somewhere between 55% and 80% of their preretirement income to maintain their lifestyle in retirement.1

Not all of that money will need to come from your savings, however. Some will likely come from Social Security. So, we did the math and found that most people will need to generate about 45% of their retirement income from savings. Based on our estimates, saving 15% each year from age 25 to 67 should get you there. If you are lucky enough to have a pension, your target savings rate may be lower.

Here’s a hypothetical example. Consider Joanna, age 25, who earns $54,000 a year. We assume her income grows 1.5% a year to about $100,000 by the time she is 67 and ready to retire. To maintain her preretirement lifestyle throughout retirement, we estimate that about $45,000 each year , or 45% of her $100,000 preretirement income, needs to come from her savings.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Saving For Retirement In Your 60s

Retirement is around the corner in your 60s, and the times almost come to enjoy the money youve worked so hard to save. Consider shifting to capital preservation and income-generating investment strategies. These fixed income investments tend to be stable bonds or fixed annuities aimed to keep the money youve saved over the years safe.

As youll most likely be entering the last of your full-time working years, youll want to keep saving as aggressively as you can.

Emergency fund: Consider upping your cash savings to one years worth of living expenses, so you have more cash on hand for things like medical expenses.

Additional savings: Review your risk tolerance and investment strategy with an eye toward capital preservation. Financial advisors may be particularly helpful now in helping you figure out how to handle the asset allocation of your retirement funds.

Educational savings: If you have children still in college or grandchildren whose college youd like to help out with, you can continue contributions to 529 accounts.

Retirement savings: Make sure youre contributing as much as you can before you retire. By the time you turn 67, you should have 10 times your annual salary in retirement savings.

Catch-up tips: Even after retirement, there are always part-time jobs that can supplement your income as you adjust to living on your savings and Social Security income.

Recommended Reading: First Republic Investment Management Inc

How To Stay On Track

The point of benchmarks isnt to make you feel superior or inadequate. Its to prompt action, coupled with a guidepost to inform those actions, even if that means staying the course. If youre not on track, dont despair. Focus less on the shortfall and more on the incremental steps you can take to rectify the situation:

-

Make sure you are taking advantage of the full company match in your workplace retirement plan.

-

If you can increase your savings rate right away, thats ideal. If not, gradually save more over time.

-

If you have a company retirement plan that enables automatic increases, sign up.

-

If you are struggling to save, many employers offer financial wellness programs or other tools that can help with budgeting and basic finances.

Use these savings benchmarks to get more comfortable with planning for retirement. Then go beyond the rule of thumb to fully understand your potential retirement expenses and income sources. Beyond your savings, think about what you are saving for and how you envision spending your time after years of hard work. After all, thats the reason why you are saving in the first place.

Past performance cannot guarantee future results. All investments are subject to market risk, including the possible loss of principal. All charts and tables are shown for illustrative purposes only.

View investment professional background on FINRA’s BrokerCheck.

202204-2128727

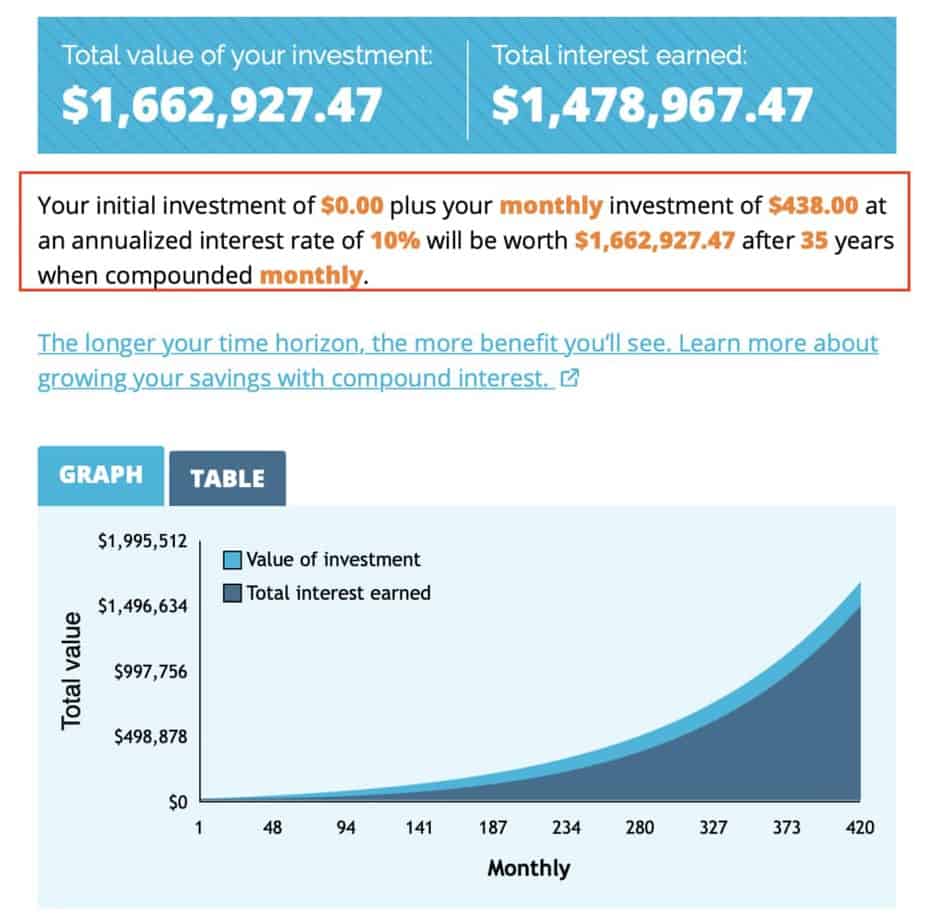

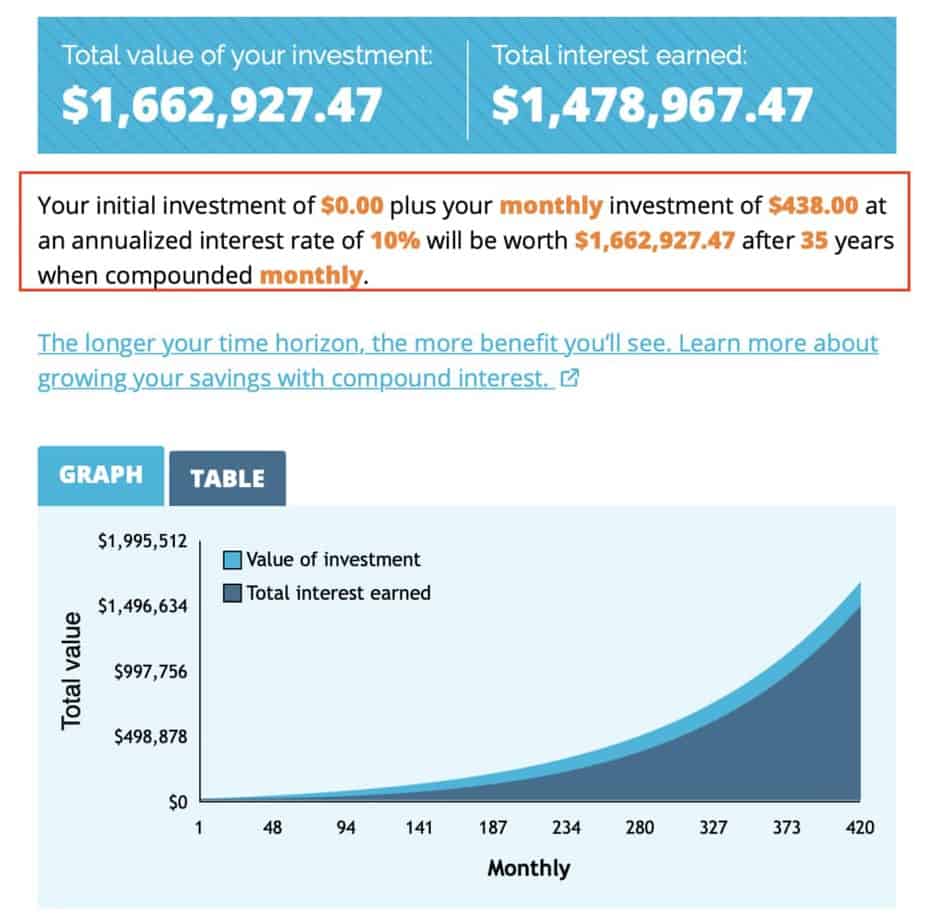

How To Use The Power Of Compounding Calculator

The power of compounding calculator is effortless to use. It has a principal amount, investment period, and rate of return fields. These fields have to be entered by the investor to check how much they will earn. The compound interest calculator gives the total investment, wealth gained, and maturity value both in number and in graphical format. In short, the power of compounding calculator shows the maturity value of a lump sum investment at the end of a specified period at a specific rate of return.

Heres an example of an investment of INR 1,00,000 for ten years with an expected return rate of 12%. The inputs to be entered are:

- Principal Amount: In the principal amount field, enter INR 100,000.

- Investment Period: In the investment period field, enter 10 years.

- Rate of Return: In the rate of return field, enter 12%.

The calculator then returns the following values along with a graphical representation:

The investor can also see which funds will help him/her earn the return they are expecting in a specific period by clicking Get Started. It will show various investment portfolio suggestions based on investor requirements.

You May Like: How Do I Start Investing In Property

The Rule Of Thumb: Invest 10% To 15%

The rule of thumb is that you should invest between 10% and 15% of your income. This means that if you earn RM5,000 a month, you could aim to invest at least RM500 a month. Here are a few ways you can set aside this money:

- Pay yourself first Set up a recurring bank transfer that automatically moves a percentage of your salary into an investment account when you get paid.

- Incremental increases If 10% to 15% of your salary sounds like a lot of money, you could try working towards it incrementally. Start by setting aside just 1% of your income this month. Increase that to 2% the next month, 3% the month after that, and so on.

- Optimise your budget If youre still having trouble setting aside money to invest, review your spending habits. Consider cutting down on unnecessary spending or increasing your income.

So how much could you potentially retire with, if you invested every month at the start of your career? Well make a few assumptions:

- Youre a 22-year-old fresh graduate earning a monthly salary of RM2,500

- Your salary increases at a rate of 5% every year

- You invest 15% of your salary every month

Heres how the math works out:

| Annual return | |

|---|---|

| RM853,463 | RM1,008,976 |

It can be hard to set aside a chunk of your money every month, especially if youre only going to be using it decades later. But doing this will save you lots of financial stress down the line.

How To Save For Retirement In Your 30s

Once you enter your 30s, youre moving out of entry-level jobs and earning more. You may still be paying down student loans or other debts. But keep saving for retirement even as you remain laser-focused on paying down your debt. The longer you carry debt, the more you pay in interest and the less youll have available to save.

Emergency fund: Aim to maintain at least six months of living expenses in emergency savings, in a high-yield online savings account.

Additional savings: Once youre comfortable with the balance in your emergency fund, consider investing additional money in a brokerage account, which can earn higher potential returns than a savings account. This makes brokerage accounts useful for medium-term goals, like a home down payment, or other longer-term pre-retirement goals.

Educational savings: If youre starting a family, consider opening an educational savings account like a 529 plan to pay for educational expenses so you can avoid tapping your retirement to pay for college.

Catch-up tip: If debts weighing you down, consider an aggressive debt payoff strategy like the debt snowball or avalanche method.

Don’t Miss: Who To Talk To About Investing

Definition And Examples Of The 10% Savings Rule

The 10% savings rule is a guideline that suggests setting aside 10% of your gross income for retirement and other important savings. It’s more of a personal commitment than an actual rule. Establishing a personal budget that sets aside 10% of your gross income every paycheck is a way of prioritizing savings.

Everything You Need To Know About Fundrise

If youre still reading, Im guessing you are interested in investing through Fundrise and would like to know some of the nitty-gritty details about how it works and who can invest.

So lets get started, shall we?

First of all, the minimum investment required by Fundrise is just $10 for investors who invest in their Starter Portfolio, $1,000 in their eREIT products, and around $5,000 for those who invest in their other placements.

Here are their current plans, as of 6/8/22.

| Account Plans |

Fundrise has trademarked new terms for its investment vehicles. Heres how they work

What is an eREIT?

To understand Fundrises eREIT products, lets first define a traditional REIT, or Real Estate Investment Trust. People have been investing in REITs for about half a century. REITs own real property and you can buy and sell shares at any time through a broker, just like you would with stocks.

Fundrises eREIT, or electronic Real Estate Investment Trust, products work similarly except you dont need a broker because shares are not publicly traded. You buy shares directly from Fundrise when you open an account.

This is good because investments are not subject to the volatility of the market, but keep in mind its also harder to sell shares since theyre not publicly traded.

What is an eFund?

Like eREITs, they are not publicly traded.

As of now, any U.S. resident can invest in Fundrise provided that:

The Starter Portfolio really is one of the more intriguing offerings in the REIT space.

Read Also: Quicken Loans Investment Property Rates

Key Rules Of Investment That Enable Power Of Compounding

Start Young: Starting investments early will help in making the most of the power of compounding. Early investing will help in building wealth to achieve long term goals. It enables funds to grow over time.

Make disciplined investments: Financial discipline is essential. Define goals and work towards achieving them by investing regularly. Small investor or a big investor, it doesnt matter, investing periodically and staying invested for long will help in reaping maximum benefits. Below is an example of how disciplined investments will help in earning more money.

Be Patient: Investing for the long term is the key. Dont be in a hurry to earn a quick return. Long term investments reap higher returns due to the power of compounding. Always give a reasonable amount of time for investments to grow significantly.

Watch your spending: Saving is easier said than done. However, watchful spending will help in saving at least a small amount. Investing doesnt necessarily have to be only in large sums. Start with small amounts, and as the income increases, make sure to increase savings proportionately. It will help in achieving financial goals comfortably.

Consider interest rates: While choosing any investment return is very important. Similarly, a higher annual compound interest rate implies higher returns.

| Time |

The total investment made by Hari is INR 25.79 lakhs

Total interest earned is INR 12.97 lakhs

Overall Earnings at the end of 10 years is INR 38.77 lakhs

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Also Check: Real Estate Investment Software Reviews

Invest Up To The Match In Your 401 403 Or Tsp

The first place to start investing is through your workplace retirement plan, especially if they offer a company match. Thats free money, folks! And when someone offers you free money, you take it.

And if your employer offers a Roth 401 or Roth 403, even better! If you like your investment options inside your workplace plan, you can invest the entire 15% of your income there and voilayoure done.

But if you only have a traditional 401, 403 or Thrift Savings Plan , its time for the next step.

Impact Of The Financial Crisis

During the financial crisis from 2007 to 2009, wages fell furthest among the top 0.1% and 1% of earners. In 2020, the top 0.1% had still not yet bounced back to what they earned in 2007.Among the top 5% of earners, wages grew 13.4% since 2007, the year before the Great Recession. Those in the top 10% saw 16.5% growth.

In the decade since the recovery from the Great Recession , the bottom 90% saw annual wage growth of just 1.7%, compared to the top 1.0% and top 0.1%, which experienced 11.2% and 5.8% growth, respectively.

You May Like: Is Fundrise A Good Investment

If You Start At Age :

- With a 4% rate of return, you need to earn $232,629 per year and save $1,938.57 per month. contributions)

- With a 6% rate of return, you need to earn $172,300 per year and save $1,435.83 per month.

- With an 8% rate of return, you need to earn $125,344 per year and save $1,044.53 per month.

To be sure, these are high salaries. In fact, the median household income in the U.S. is $61,372, according to the most recent data from the St. Louis Federal Reserve.

For further context, the average American’s 401 plan grew at a compound annual average rate of 14.2% between 2010 and 2016, according to a study of more than 6 million accounts, by the Employee Benefit Research Institute, a nonprofit based in Washington, D.C.

Of course, there’s no guarantee of similar growth in the future.

And it’s possible to retire on less than $1 million many Americans live on much less though experts suggest hitting the $1 million goal in order to have enough for expenses including health care in older age.

Although these numbers can be a helpful tool in figuring out how much you should be earning and saving to enjoy a seven-figure retirement, they don’t take into account the many ups and downs you may experience over your lifetime, including periods of unemployment or sudden financial windfalls or losses.

Even if you don’t earn much now, save what you can and work your way up to 10 or 15%. As your salary rises, increase your retirement contributions as well.

How Much Money Should You Save Each Month

Modified date: Aug. 9, 2022

More than income or investment returns, your personal saving rate is the biggest factor in building financial security.

But how much should you save? $50 per month? 50% of your paycheck? Nothing until youre out of debt or can start earning more money?

Whats Ahead:

Also Check: Investment Home Equity Line Of Credit

Invest In Different Assets

Different assets and asset classes have up and down cycles. Investing in different asset classes helps ensure your portfolio isnt hammered all at once during a down cycle.

For example, during Covid-19, the stock market was hit hard, especially for stocks like airlines. However, physical real estate had remarkable year-over-year growth.

Having a rental property could have helped your overall portfolio continue to grow, even though stocks werent doing so well.

Ill diversify my stock portfolio, splitting between dividend stocks and ETFs vs. Growth.

During some periods, growth performs while dividends are down. Other times, dividend stocks are up while growth lags.

Investment Ideas That Yield 10%+

Prepare to embrace the exotic when you chase yield this far.

To get double-digit yields today, youll have to invest in the kinds of publicly traded stocks that rarely come up in cocktail-party conversation: mortgage REITs and business development companies. Both borrow at low short-term interest rates and lend at higher long-term rates, so their success depends on the Federal Reserve keeping short-term rates low. If short-term rates start to climb, shares of both mortgage REITs and BDCs are likely to tumble.

Analyst Merrill Ross, of Wunderlich Securities, in Memphis, Tenn., recommends Invesco Mortgage Capital , $22, 12.0%). Run by an affiliate of the Invesco mutual fund group, the REIT owns residential and commercial mortgages. About 70% of its investments are agency loans, those backed by the likes of the Government National Mortgage Association. A relatively high 17% of the portfolio is in higher-yielding but riskier non-agency loans, though rising property values mitigate some of the danger.

Recommended Reading: Best Way To Get Income From Investments