Canadian Listed Etfs Vs Us Listed Etfs

An alternative to this to avoid the 15% withholding tax is to buy the Canadian listed ETF version of VTI, which is VUN.

The VTI Canadian equivalent is VUN. VUN has been available since 2013.

VUN stands for Vanguard US Total Market Index ETF and it is traded on the Canadian stock exchange, or TSX.

It is the Canadian dollar equivalent of VTI and you dont have to worry about currency conversion.

The MER for VUN is higher than VTI . The MER of VUN is 0.16%.

So if you had $10,000 to invest with VUN, it would cost $16 annually.

How To Buy Stocks Nationwideetf On Stash

Stash allows you to purchase smaller, more affordable pieces of investments rather than the whole share, which can be significantly more expensive.

Stocks Nationwideâs share price is determined by its bid-ask spread, which is the difference between the price that buyers are willing to pay and the price that sellers are willing to accept. Stocks Nationwideâs price can fluctuate throughout the course of each trading dayâwhen you buy Stocks Nationwide through Stash, we execute the market order during our next available trading window . At Stash, we donât recommend trying to predict the market when buying investments. We believe it can be a better strategy to buy quality investments you believe in, then hang onto them.

Use our historic performance chart to see real-time Stocks Nationwidestock price and the Stocks Nationwide news feed to help further your research before investing in fractional shares with any dollar amount you choose.

Stash offers two subscription plans: Stash Growth and Stash+.

Each plan can help you reach different goals and offers a unique combination of financial accounts and features. All plans include access to a personal brokerage accountâalso known as your personal investment account. You can use your Stash personal portfolio to purchase any of the available investments on our platform, as well as access our suite of automatic saving and investing tools.Learn more about Stash pricing.

Is Vti Actively Managed

VTI is not an actively managed fund. Instead, VTI follows a passively managed, index sampling strategy. Therefore, no fund manager makes decisions on which stocks should be held. Instead, this fund seeks to track the overall stock market performance.

Therefore, investing in VTI allows you to track your results with the performance of the stock market. You should expect your portfolio to rise when the stock market rises. Alternatively, you should also expect your investments to decline with poor stock market performance.

All VTI is doing is tracking overall performance of the stock market. VTI attempts to maintain a close correlation between the fund and overall stock market.

An actively managed fund is different. Actively managed funds have a fund manager looking at company performance. These managers will make purchasing and selling decisions based on the research.

Read Also: Commercial Real Estate Investment Strategies

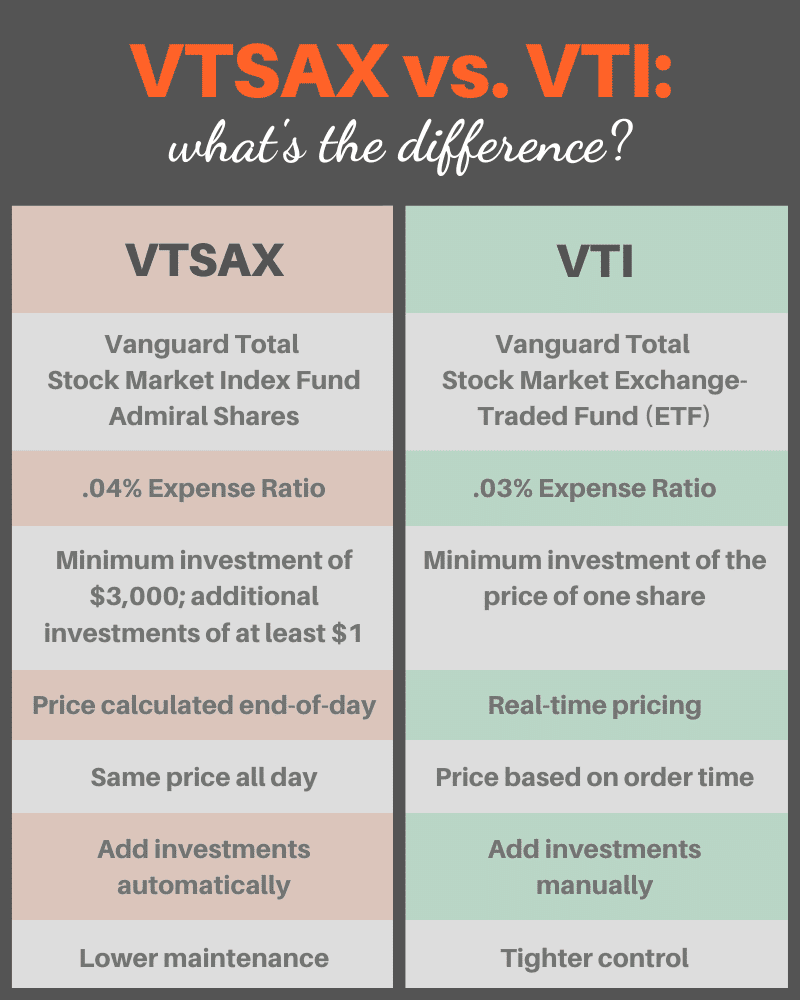

What Are The Similarities Between Vti And Vtsax

When you look at the commonalities between VTI and VTSAX, it becomes clear why people often mistake one for the other. In 1975, investor John Jack Bogle founded Vanguard, which ultimately created both VTI and VTSAX.

Bogle believed its better to follow the stock market than to fight it, hoping to capture some alpha from choosing individual securities.

Therefore, VTI and VTSAX are both based on the CRSP U.S. Total Market Index and cover nearly the entire U.S. stock market. As of 6/30/2022, VTSAX has $269 billion in assets, while VTI has $245 billion.

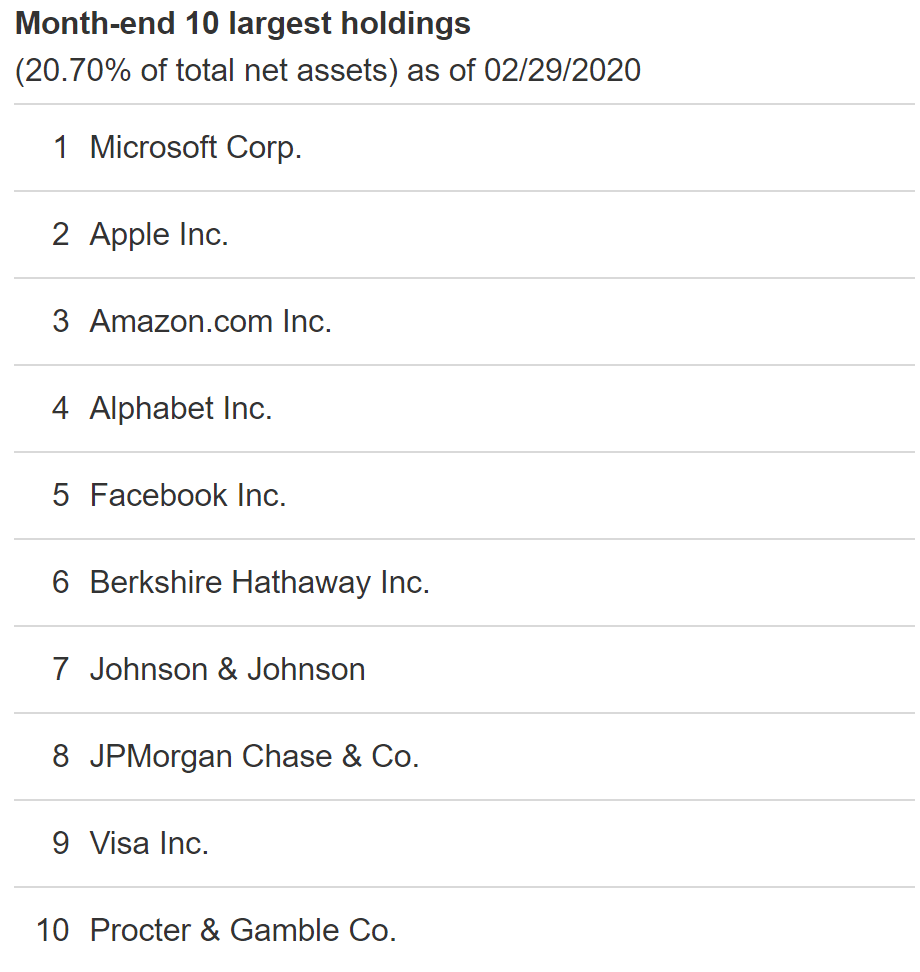

They both have about 4,100 stocks and the technology sector is most prominent at 25.8%, followed by healthcare at 14.30% and consumer discretionary at 15.80%. Mostly, the same stocks make up the highest percentage of their assets.

To get a sense for how their holdings vary by sector, have a look at the following chart for both VTSAX and VTI :

Meanwhile, here are As for how the top 10 holdings compare for both investments, they have the following five holdings represent the largest shares as a percentage of assets:

As for the specific similarities between VTI vs. VTSAX, consider the following items:

So Why Invest In Vtsax And Vti

VTSAX requires a minimum investment of $3,000 to initiate the fund. Once you invest that initial lump sum, you can buy at any amount you want. Meaning yes, you can buy fractional shares once you put that first $3,000 in.

VTI has no minimum purchase, as long as you can afford one share you can buy it. But it does not offer fractional shares, so youd need to contribute to your settlement fund and then when you have enough, purchase a full share.

Weve also talked about how VTI has real-time pricing, but VTSAX is not an ETF, so is not traded like a stock. The price is set at the end of the trading day, and that is the price youll pay the next day, no matter what time you purchase. This is a negligible difference if youre investing over the long term, since the hour-to-hour fluctuations arent going to matter much in 30 years.

You May Like: Does Capital One Invest In Fossil Fuels

Vanguard Total Stock Market Index Fund Etf Downgraded To Sell Candidate

The Vanguard Total Stock Market Index Fund ETF price fell by -0.99% on the last day from $198.29 to $196.32. It has now fallen 3 days in a row. During the last trading day the ETF fluctuated 1.25% from a day low at $195.45 to a day high of $197.90. The price has risen in 6 of the last 10 days and is up by 5.24% over the past 2 weeks. Volume has increased on the last day by 1 million shares but on falling prices. This may be an early warning and the risk will be increased slightly over the next couple of days. In total, 3 million shares were bought and sold for approximately $667.56 million.

Here’show to buy VTI ETFif you’re new to investing.

The ETF lies the upper part of a wide and falling trend in the short term, and this may normally pose a very good selling opportunity for the short-term trader as reaction back towards the lower part of the trend can be expected. A break up at the top trend line at $200.25 will firstly indicate a slower falling rate, but may be the first sign of a trend shift. Given the current short-term trend, the ETF is expected to fall -6.63% during the next 3 months and, with a 90% probability hold a price between $162.02 and $186.97 at the end of this 3-month period. Do note, that if the stock price manages to stay at current levels or higher, our prediction target will start to change positively over the next few days as the conditions for the current predictions will be broken.

Are There Any Disadvantages To A Foreign Broker Compared To A Belgian Broker

There are, and the most important ones are:

In this article, we are going to choose Degiro as our broker because VWCE is part of their selection of free ETFs. This means that we won’t have to pay any broker fees, provided that we:

Also, Degiro is special among foreign brokers in that they withhold the Belgian transaction tax for you.

Let’s start by opening a Degiro account!

Read Also: How To Invest In Real Estate Syndication

They Track Different Indexes

The most notable difference between VTI and VOO is the different indexes they track. VTI aims to track the performance of the CRSP US Total Market Index, while VOO attempts to track the performance of the S& P 500 Index.

As of September 2022, that means investing in around 4,056 companies with VTI and around 500 with VOO.

With both funds, a large percentage of your money is invested in big names like Apple, Microsoft, and Amazon. But the fact that VTI lets you invest in around 3,500 companies more than VOO does makes VTI a winner for anyone looking for more diversification.

How To Buy Vanguard Funds In Belgium

Vanguard is one of the largest providers of index funds worldwide. They have a great reputation. Many books on investing, especially American ones, recommend Vanguard as a good place to start investing in index funds. We discuss why Vanguard is a good option, and show two ways through which Belgians can invest in Vanguard funds.

Read Also: How To Invest In Dji

Voo: Vanguard S& p 500 Etf

- Assets: $500.9 billion

- Dividend yield: 2.03%

- Expense ratio: 0.03%

The is one of the biggest index funds that track the S& P500, with $500 billion in assets under management. It also has one of the lowest expense ratios, making it very popular among passive index investors.

Like other S& P500 ETFs, it holds a market-cap weighted index of the 508 stocks in the S& P500. All of these are US-based companies that are categorized as “large-cap,” meaning they have higher than $10 billion.

Even though the S& P500 only represents 500 companies, some of them have two or more classes of stock. This explains why the index has 508 stocks, not 500.

An example of a company with two classes of stock is Alphabet, the parent company of Google that trades as both .

Is Vti A Safe Investment

VTI is a safe investment if you trust in the overall markets continued growth over a long amount of time. If you dont want to watch an index fund accrue value over a long amount of time, then theres no point to invest in one.

When the market is extremely volatile, it might mean a lower share price and a higher return down the line.

Also Check: Where To Invest Index Funds

How To Invest In Vti

1) Head to www.vanguard.com, click on the investing tab, and then account type. This is where youll choose which type of account youll use.

2) On the next screen, youll find two important parts: the settlement fund and then your investments.

The settlement fund that Vanguard uses is the Vanguard Federal Money Market Fund. Its just like a savings account, with returns of less than 2%.

There are reasons you might keep money in the settlement account that well go over below, but this is a different account than your investments. After you put money into the settlement fund you have to do the second step and move that money into investments.

3) To add your money, you need to go to the top and click on buy and sell, then towards the bottom youll click contribute to and choose whichever investment account you previously chose .

If you have chosen an account like an IRA, this will also show you your contribution limits for the year and how much youve already contributed thus far.

4) Now you can add whatever funds youd like. This is where youll choose to buy VTI.

5) Once youve added the fund you want, youll see a box beside that fund. You can put the money into your settlement fund, or VTI.

Why would you choose to put money in the settlement fund?

You can use it as a sort of hub where you put all the money youre investing, and then from there you can distribute it to each investment portfolio you have.

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Also Check: How Do The Ultra Wealthy Invest

Option : Doing It Yourself

To make it concrete, we’re going to explain step-by-step how to buy the Vanguard FTSE All-World Accumulation ETF. Most commonly referred to on the internet by its ticker VWCE, this is one of their best and most popular ETFs. Weâre also going to use Degiro as our broker, which is one of the cheapest for Belgian investors.

Does Vti Pay A Dividend

VTI does pay a dividend and has continued to pay a dividend since inception. There have been consistent dividend increases year-over-year. Therefore, holding VTI not only pays a dividend, but has consistently seen regular dividend increases.

Generally, VTI maintains a dividend yield around 1.5 to 2% . According to Seeking Alpha, the four year hold a good ETF.

Dividend increases are an amazing thing. A dividend increase allows you to get a pay raise simply by holding shares.

For example, investing $10,000 in 2002 would have yielded $116 in dividends or 1.2% ROI. In 2019, the same 186 shares would yield $540 in dividends or 5.4% ROI.

The above example only factors in dividend increases. You could have reinvested your dividends, added capital, and capital gains are not factored in.

You May Like: Is Buying A Manufactured Home A Good Investment

Voo Vs Vti: Which Etf Is A Better Investment

Passive investing in index funds is more popular than ever.

There is a good reason for this. Research shows that passively managed index funds provide higher returns than over 90% of active professional fund managers.

However, there are thousands of funds and hundreds of companies making them. Not all of them are equal.

Of the many companies that provide index funds, Vanguard is one of the biggest and most trusted. Millions of people invest in their funds, and they collectively have over $5 trillion in assets under management.

Two of Vanguard’s exchange-traded funds are particularly popular. Both of them provide exposure to the US stock market:

- VOO: This ETF tracks the and holds 508 stocks.

- VTI: This is a more diversified ETF that holds all the S& P500 stocks, but also many mid-cap and small-cap stocks. It holds 3551 stocks in total.

This article examines the differences between VOO and VTI and which one is likely to be a better investment.

Is It A Good Time To Buy Vti

Anytime is a great time to buy a VTI share! With its long-term growth, it is another way to achieve the second part of the FIRE Movement retiring early.

Time in the market is better than timing the market, so while yesterday was the best time to invest for its long-term growth, today is the second-best day.

Research shows that those who invest consistently over time are better off, so why not but into it now?

Vanguard offers many different types of investment opportunities, so if you arent in love with its ETF options, maybe admiral shares are more your speed!

You May Like: Friends And Family Investment Round

How Similar Is Today’s Market To That Of 2000

While considering this question, I found an interesting article from the Los Angeles Times published on January 2, 2001 that reported on how much of the weight of the S& P 500 at the height of the Dot.com boom was made up of tech stocks. It tells us,

With the tech-stock mania that began around December 1998, the sectorââ¬â¢s weighting in the S& P more than doubled, to 29.9%, by the end of 1999.

The peak came in the second week of last March, when tech reached 35% of the indexââ¬â¢s capitalization.

In the aftermath of the plunge in most tech shares since March, the sectorââ¬â¢s weighting in the S& P 500 is now 21.9%, according to Bloomberg News data. But that still makes tech by far the largest industry represented in the index.

The article also points out that because of how sectors are defined, quite a few stocks that a reasonable person would think of as being Tech stocks were classified in other categories. This continues to be the case now.

The 29.9% of the S& P 500 that the overvalued tech stocks made up in 1998 is not all that different from what we saw at the peak of the COVID-19 Tech boom when Mega Cap tech performed so strongly that it counterbalanced the poor performance of so many other sectors.

With that in mind, consider what happened next to the Vanguard 500 Index Fund’s and Vanguard Total Stock Market Index Fund’s total return back after 2001.

VFIAX and VTSAXTotal Return Jan 2001 – March 2009

Seeking Alpha

Seeking Alpha

How To Buy Vti Are You Ready To Pull The Trigger

So how about you? Now that you know how to buy VTI, will you??

It certainly sounds like a solid investment with a 10-year return of 14.7%! Of course, this doesnt mean the next 10 years will produce the same results. But, it does have a great track record thus far.

Are you ready to start investing in VTI? If not, whats holding you back?

You May Like: How To Start Investing With 500 Dollars

What Is Vanguard S& p 500 Etf

The Vanguard S& P 500 ETF is an ETF that aims to track the performance of the S& P 500 Index. The S& P 500 is considered the best single gauge of large-cap companies approximately 500 companies at any given time.

Together, these 500 companies are worth around $15.6 trillion. The S& P 500 represents less than 15% of the roughly 4,000 publicly traded companies in the U.S. Nevertheless, those 500 companies account for about 80% of the value of all stocks available on the market.