Is The Program Worth It

There are very few research services with such a long track record. Personal finance has been kicking butt and taking names for more than four decades and is still going strong.

The basic package is a good value at $49, but the Premium package gives you the most bang for your buck.

This Premium package includes a robust collection of additional reports and resources and print AND digital copies of each issue of Personal Finance.

The best part is that upgrading only costs $30.

The cost of Personal Finance is comparable to that of its competitors. Personal Finance, on the other hand, gives you a lot more bang for your buck.

The research reports are excellent, but almost every service provides additional research to new subscribers. What truly distinguishes Investing Daily is its solid satisfaction guarantee.

InvestingDailys full refund policy is valid for 90 days from the date of purchase. That is three times longer than is typical in the industry. But thats only the beginning.

After 90 days, you can cancel at any time and receive a prorated refund for the remainder of your subscription.

That is, quite frankly, unheard of, demonstrating Investing Dailys dedication to its product.

Overall, this is an excellent service that provides excellent value for money. This service, in my opinion, is well worth the admission fee.

Focus On Investment Quality Not Quantity

Your investing success depends on the correct selection of companies and buying them at the correct price. To be a successful investor, you do not need a large number of stocks. You need only a few outstanding companies. Keep your list of stocks short packed with the best companies. Focus on investment quality, not quantity.

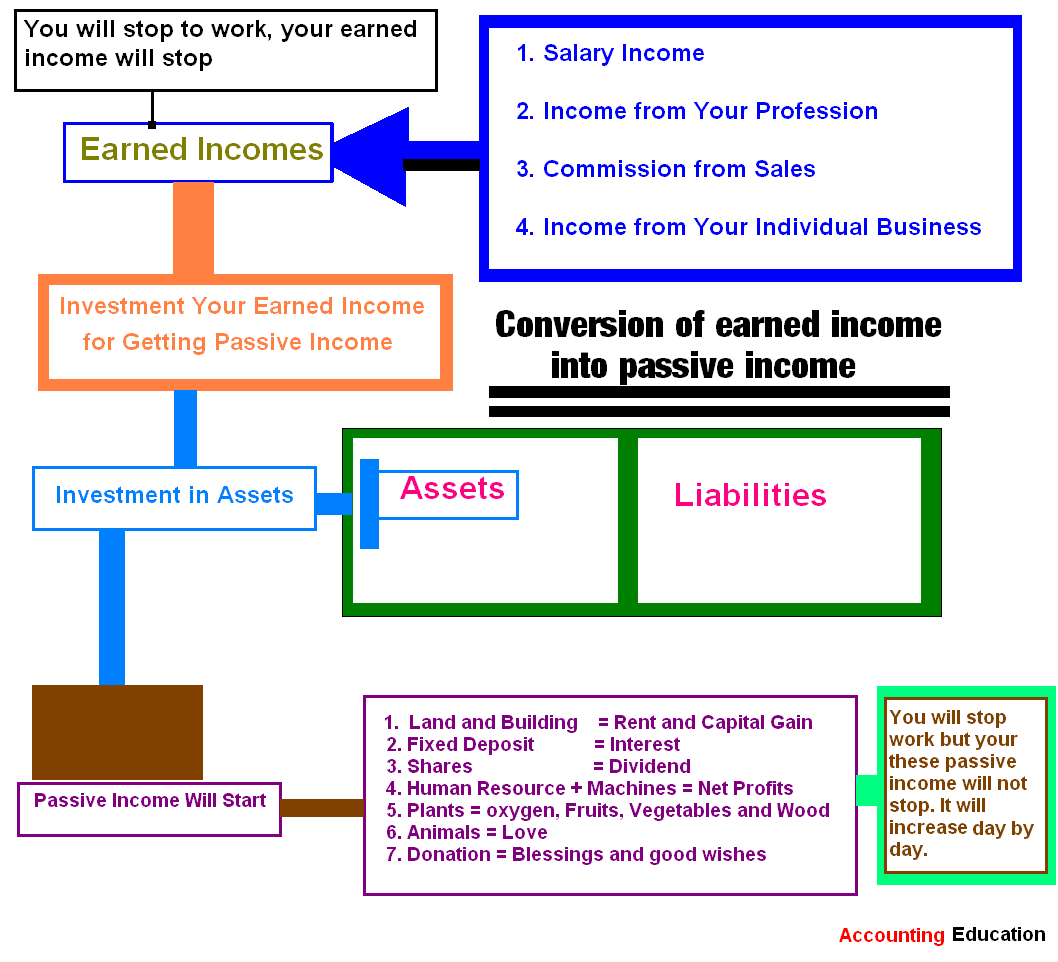

What Can I Invest In To Make Money Fast

Investing in tools that let you start a side hustle is one way to invest and make money fast. For example, you can start a blog or online business without spending much money and then turn it into an income stream.

There are even more beginner-friendly ideas as well if you get creative.

I mean, you could buy an old Android phone and then try several passive income apps to earn free PayPal money and gift cards.

This is just one example, so dont be afraid to get creative!

Extra Reading How To Make $1,000 A Day.

Recommended Reading: Best Cloud Computing Companies To Invest In

Use A 401k For Your Retirement Plan

If you are working for a profit organization, use a 401 plan for retirement savings. Put the maximum savings allowed into a tax-deferred investment account. Be sure to contribute enough money to get the employer match if offered by your company. Allocate the money in your retirement plan depending on the amount of risk you are comfortable with.

Make sure you stay up to date on the 401k contribution limits.

Trading In Futures Can Be Gambling

Trading in futures is like trading in stocks. If you want to invest or trade in the stock exchange or derivative market, you need to develop an understanding of the market. Trading in futures is not gambling and your outcome does not depend on your luck. Always follow basic rules and strategies, as derivatives are risky.

Read Also: Best Mba For Return On Investment

Don’t Use Derivatives For Speculation

Some professionals and traders do speculate and trade in derivatives to capture gains that come from price fluctuations in the underlying asset. With leverage the outcome, profit or loss can be significantly high. Warren Buffet, great investor, has repeatedly warned against derivatives as a financial weapon of mass destruction.

Look For High Profit Margin Stocks

Successful businesses make money. And one way to tell if a company is going to make money is by looking at their profit margin. A company that consistently delivers high profit margins is a good buy. A higher profit margin indicates the company is more efficiently run with lower operating costs and higher revenues. The companys good performance and high profitability are expected to yield higher growth. When choosing investments look for high profit margin stocks.

Also Check: Structured Asset Mortgage Investments Ii Inc

How Do Call Options Make Money

A call option writer makes money from the premium they received for writing the contract and entering into the position. This premium is the price the buyer paid to enter into the agreement.

A call option buyer makes money if the price of the security remains above the strike price of the option. This gives the call option buyer the right to buy shares at a price lower than the market price.

You Don’t Need To Be A Pro To Invest

Great Investors such as Warren Buffet and Ben Graham agree, To achieve satisfactory investment results is easier than many people think. And you dont have to be an expert to attain satisfactory investment returns. If you are a non-professional, just be aware of your boundaries. Keep your investments simple and invest for the long term in simple products like a low-cost S& P 500 index fund.

Also Check: Buy And Sell Investment Properties

How To Pick The Best Investing App

The best investing app for you will depend on your investment style. Do you want one that does the work for you, or would you rather be in control? Do you want a passive portfolio made up of lower risk funds, or would you rather build an active, riskier portfolio consisting of individual stocks?

Those wanting a more active approach to investing may opt for an app like Robinhood . Meanwhile, those looking to just put their investments on autopilot and forget about them may benefit more from a robo-advisor like Betterment.

Keep in mind that not all apps offer the same investment assets to choose from. For example, Acorns only offers ETFs, so if you want to trade individual stocks, this app wouldn’t be the best fit. Make sure you do your research and understand everything the app offers before you sign up.

Look For Bonds With High Ratings

The rating companies, such as Moodys, Standard & Poors and Fitch, provide ratings to the bond issues. The ratings that are dependent on the credibility, stability and financial health of the company, help you to determine the risk associated with the Bond. Buy only investment grade bonds having ratings from Aaa/AAA to Baa/BBB. Avoid high-yield bonds or junk bonds that promise high return as you may lose capital.

You May Like: How To Invest In Penny Stocks Online

Invest In A Certificate Of Deposit

CDs can be a safe way to grow your money without having much worry about losing your investment.

While the returns can be minimal when compared to other investments, they are a great worry-free method of investing. Similar to bonds, CDs have a maturity date in which your money can be withdrawn penalty-free. If you choose to withdraw money before the maturity date, there might be a penalty assessed. You can often find CDs with maturity dates from 5 months to over 3 years.

Keep Commission Costs Low

The overhead cost of trading eats a significant portion of your earnings. You may be shocked when you add up and see the commissions youve paid at the end of a year. Be selective in choosing a broker and advisor. Avoid frequent churning of your portfolio. A successful investor keeps his costs minimal.

Read Also: Best Investment Tools For Retirement

Save In An Educational Ira

An Education IRA is a savings plan for education. Parents and guardians are allowed to make non-deductible contributions to an education IRA for a child under the age of 18. The earnings are tax-free when used for education expenses. The funds in an education IRA can be withdrawn tax free when they are needed for educational purposes.

You can findthe best 529 plans here.

Use Graham’s Margin Of Safety

Success of value investing largely depends on the correct estimation of the intrinsic value of the stock. Grahams margin of safety, the difference between a stocks price and its intrinsic value, provides you cushion against estimation errors. The farther the purchase price is below its intrinsic value, the greater the margin of safety against future uncertainty and the greater the stocks resiliency to market downturns.

You May Like: How To Transfer Investment Accounts

Basics Of Option Profitability

A buyer stands to make a profit if the underlying asset, let’s say a stock, rises above the strike price before expiry. A put option buyer makes a profit if the price falls below the strike price before the expiration. The exact amount of profit depends on the difference between the stock price and the option strike price at expiration or when the option position is closed.

A call option writer stands to make a profit if the underlying stock stays below the strike price. After writing a put option, the trader profits if the price stays above the strike price. An option writer’s profitability is limited to the premium they receive for writing the option . Option writers are also called option sellers.

Keep Some Of Your Portfolio Defensive

The best sports teams excel at both offense and defense. Your portfolio is no different. If you want to be successful, you need to be able to find winners, but also protect yourself from huge losses. The key is to add some defensive shares that are comparatively immune to recessions and economic slowdowns. Look for a company which fulfills basic needs, such as food and health. The consumer demand for their products or services is likely to remain intact even during difficult economic times. Investment in defensive stocks is considered relatively secure, less volatile and gives steady returns over long run. Plus, many pay dividends!

Read Also: American Funds Investment Company Of America R6

What You Get For Your Money

Our Investing Daily review looks at the bang for your buck. At its heart, Investing Dailys Personal Finance is an options trading advisory service. But you get a whole bunch more than just this monthly advice.

This is what you get with a subscription:

- The Investing Daily Personal Finance Elite Advisory. This is the heart of the product. Its where Fink tells you exactly what trades to make. Whats more, all the research has been done for you. All you need do is follow the simple instructions to place the trade

- The Options Strategy Manual. This is the system and strategies used by Jim Fink.

- Your First Easy Start Options Trade. Once you sign up to Investing Dailys Personal Finance you get instant access to a super trade recommendation you can use straight away. Additionally, youll get explicit instructions thatll walk you through exactly what you need to do. Think of it as Options Trading For Dummies.

- The Quick Start Online Video Program. This course covers the information you need to successfully trade options think strategies.

- The Report How To Buy Stocks At A Discount. This is a companion to the video training series.

- The Report The Biggest Legal Loophole In The IRS Tax Code. Want tips on how to grow your personal account and not have to pay a dime in tax? Well, youll find it here.

Read Peter Lynchs Book One Up On Wall Street

The book One Up On Wall Street ranks as one of the best investment primers ever for small investors. Peter Lynch guides you on developing strategies in buying, selling and holding equities with a preference for value investing in companies that have sound fundamentals. His investing philosophy generally resembles the value investing and is largely consistent with Graham & Buffetts, but he also had successful investing in Small Cap and Growth stocks.

Read Also: What Do Investment Companies Do

Understand The Basics Of Securities Regulations

Various Acts have been enacted by the Governments for regulating the stock markets. Regulatory Authorities such as the Securities and Exchange Commission have been established for regulating markets and protecting the interests of investors and others. Read and understand the main provisions. Although a regulatory agency seeks to regulate the activities of the securities markets, this does not guarantee a safe investment. You should always be careful while investing.

Keep A Small Amount Of Money In Your Savings Account

A savings account adds liquidity to your portfolio. You can withdraw the money anytime. But savings accounts offer only 2-3% interest, which is very small. Therefore, keep only a small amount of money in a savings account that meets your small and immediate needs. Park your money elsewhere to earn more.

Check out our list of the best high yield savings accounts.

Recommended Reading: Real Estate Investment Firms San Diego

Understand Safe Debt Investments

Investments in Treasuries are safe and free from default. Deposits with banks are also good for safety. The next option is a debt fund, but its not always safe. There are wide variations in the performance of debt funds. There is also the possibility of losing part of your principle.

Make sure you also understand the difference between a bond fund and individual bonds.

Both Bear And Bull Markets Are Temporary

Historically, markets move to the extremes. But these movements have always been temporary. Both phases provide you opportunities to gain. Bear markets provide the opportunity for buying good companies at a discount. Buy in a bear market and sell in a bull market. This requires courage to venture, while keeping emotions under control.

You May Like: Fisher Investments Wealth Builder Program

Max Out Your Retirement Accounts

You can invest in index funds and mutual funds in your retirement accounts and shoot for maxing out these accounts.

If your employer offers a 401 that matches employee contributions, and you arent currently contributing enough to earn that match, let your extra 10k free up some space in your budget so you can do so.

The other option is to contribute to a Roth IRA or traditional IRA. These retirement accounts do have annual contribution limits $6,000 in 2021 . You can pad these retirement accounts in order to help prepare yourself for retirement down the road. Your retirement accounts commonly invest in index funds and ETFs, mutual funds, and are low-risk investments because your investments are diversified.

Invest In Government Bonds

Bond yields and its market price move in opposite directions. High inflation and a high interest rate pushes bond yields up and brings down the bond price in the market. Investments in Government Bonds are free from default and provide reasonable returns, especially if invested when Bond Yields are high.

Also Check: Apps For Investing In Cryptocurrency

Know Your Risk Tolerance

Always remember investments in securities are subject to market risks. You may even lose your capital. The level of risk investors can take varies from investor to investor which mainly depends on the individuals risk tolerance. Ascertain your loss bearing capacity and limit your investments accordingly. Understanding your risk tolerance will help you come up with a suitable investment strategy.

How Much Money Can You Make Investing In Stocks

Some of the richest people in the world have made tremendous amounts of money by investing in the stock market. Your earnings potential is inherently unlimited, making it a no brainer for those looking to grow their money. Warren Buffet, George Soros, and Carl Icahn have all made millions investing in stocks.

Lets take a look at how much money you can make if you invest your money in stocks. Lets start by investing $10,000 into the market and never investing another penny. Well assume a market average of 7% annual return rate. After 30 years, your initial $10,000 investment will be worth $76,122.55. Thats a $66,000+ profit without working a minute! This makes it one of my best ways to invest your money.

Making a lot of money in the stock market is all about long term returns and limiting expenses. If you choose to hire a financial advisor, this can cost you a few percentage points, eating into your gains which can cost thousands of dollars annually. Thats why I prefer a simpler investment like index funds.

Related: How to Make Money on Autopilot

Read Also: Harsch Investment Properties Las Vegas

Understand The Global Markets Before You Invest

When you can earn a good return in the US stock exchange, why invest in foreign stocks?

You can understand US companies better. You will need extra time to understand foreign markets. Your investment abroad will be subject to political and economic uncertainties especially due to changes in government policies. New investors shouldnt invest in the global market.

Look Beyond Last Quarters Results

The market reacts instantaneously on good results or any exciting news about a company. It factors this and the stock price increases. When this happens, you will be paying a higher price which may not be sustained. Graham does not recommend buying companies which have just reported, or are likely to report, superior results.

You May Like: Top 10 Investment Banks In Usa

If The Market Is Likely To Move Wide In Either Direction Buy A Put And A Call Option

Outcome of a forthcoming event, such as a presidential election or the FEDs announcement, affects the market. But you are not sure in which direction it will move. You simultaneously purchase both a call and a put option with the same underlying asset, strike price and expiration date. You will make a profit depending on the quantum of the price movement. But if there is no or negligible price movement, your loss will be limited to the premium paid.

Invest In Crowdfunded Real Estate To Grow Your Money

While it might surprise you, real estate investing apps are another excellent way to start investing and make money daily and fast.

Historically, real estate investing was for the wealthy who could afford to acquire land. But these days, you can invest in this asset class with only $10.

Real estate crowdfunding companies basically pool money together from numerous investors and buy real estate. Usually, properties are multi-family homes or commercial real estate that generate rental income for shareholders. Investors can also benefit from property appreciation.

One leading company in this space is Fundrise, which lets you start investing with $10.

Fundrise invests in a variety of real estate projects. You pay 1% annually in management fees, and historically, Fundrise has returned around 8% per year.

Fundrise has multiple tiers of plans depending on how much you invest, but $10 is enough to benefit from owning real estate.

The main risk of Fundrise is that its fairly illiquid, so its not always easy to sell your shares instantly if you want to exit. However, if youre investing for the long-term, real estate can definitely be a worthwhile small investing idea.

Also Check: How To Calculate Equity Investment