Romero Mentorings Analyst Prep Program

The Analyst Prep Program teaches the technical and practical skills that investment banks, hedge funds, and private equity & consulting firms look for in a candidate. Students begin with little to no technical skills and develop into fully prepared professionals who can perform as first-year analysts from day one through the programs training and internship.

Iii Other Substantial Scale Investment Banks With A Presence In The Us

It posted revenues of $85.06 billion in 2019, and it has a industry share of 2.1% in the investment banking industry. As of November 2021, it has a industry capitalization of $88.64 billion. The enormous sale of bonds to finance WWI brought scores of new players into the securities markets. Banks have been anticipated to assist the war work by lending investors the funds to obtain war bonds on favorable terms they did so in large numbers by expanding their bond departments or forming new securities affiliates. By 1922, 62 industrial banks had been straight engaged in investment banking, and an additional 10 had launched securities affiliates.

How Can Small Banks Compete

Chime Co-founders Chris Britt and Ryan King

Neobanks secured a record $2.5 billion globally. Chime, a San Francisco-based neobank, took about four years to reach one million users in 2018. It has since acquired over 4 million usersquadrupling its user base in just one year. The competition put forward by digital-only banks will eventually force traditional banking leaders to revamp their banking practices and offerings due to the increasing digital demands of consumers.

Recommended Reading: Free Stocks To Invest In

Goldman Sachs Group Inc

The Goldman Sachs Group, Inc., currently headquartered in New York City, is a multinational investment bank and financial services company. The services they offer in investment banking include advisory for mergers and acquisitions and restructuring, securities underwriting, asset management, investment management, and prime brokerage. They make markets and broker credit products, mortgage-backed securities, insurance-linked securities, securities, currencies, commodities, equities, equity derivatives, structured products, options, and futures contracts. The current market cap is at $136.28 billion and current assets are at $1,443 billion.

You can learn more at Goldman Sachs.

How Are The Top Investment Banks Different

Size is the most obvious difference, but thats not the best way to think about these categories: Many tiny firms end up working on mega-deals these days.

Instead, you can use these four criteria:

- Deal Size: Does the bank work on deals worth less than $100 million USD? Or mostly deals below or above $1 billion?

- Geography: Do they have a presence only in one city or region? Are they global? Are they strong in Europe but not North America or Asia?

- Services Provided: Do they only advise on M& A deals, or do they also work on debt and equity deals? Do they also do Restructuring? Or does the bank focus on private placements?

- Exit Opportunities: Where do bankers at this firm move to afterward? Are mega-fund PE exits common, or are middle-market funds, other banks, or normal companies more common?

There are some other differences as well for example, you often earn more at elite boutiques than at bulge bracket banks. But its easiest to start with the four criteria above.

Also Check: Piggyback Loan For Investment Property

The 8 Best Investment Banks

When you think of a bank, you may think of a place that takes deposits, maintains checking and savings accounts, and more. Thats true, but theres another type of bank focused on stocks, bonds, and investment products. These financial firms may be a part of larger firms that also offer commercial banking services, but they occupy an important place in the financial system, which impacts the entire economy.

The best investment banks are large financial institutions that play an important role in facilitating money moving around the economy. Initial public offerings , for instance, are an opportunity for investors to help a company raise money. At the same time, they can also get a stake in the business.

Full-service investment banks offer a wide range of business and investment services. Many of them also own or affiliate with a consumer bank. Most regular consumers wont need investment banking services, but for growing businesses and high-net-worth individuals, this type of bank may offer unique financial products and services to meet their needs. Need some advice when it comes to finding one to use? Take a look at our picks below for the best investment banks.

Capital One Financial Corporation

Capital One boasts nearly $400 billion in assets with around 300 branches domestically. With a strong focus on credit cards, Capital One is consistently one of the largest card issuers by purchase volume. However, Capital One also offers financial services, including consumer and investment banking.

Read Also: How To Invest In Pharmaceutical Stocks

Pnc Financial Services Group Inc $55190 Billion

PNC Financial Services Group, Inc. is a bank holding company and financial services corporation operating in the United States of America. Its headquarters is based in Pittsburgh, Pennsylvania.

It was originally founded on April 10, 1855, in Pittsburgh as the Pittsburgh Trust and Savings Company.

The name PNC originates from the initials of the banks two parent companies, which merged in 1983: Pittsburgh National Corporation and Provident National Corporation.

PNC Bank, which is a subsidiary of the company, conducts business in all 27 states and the District of Columbia with a total of 2,629 branches and 9,523 automated teller machines. The PNC Financial Services Group has a total asset amounting to $551.90 Billion, and it is widely regarded as one of the largest banks in the U.S.

Furthermore, the company offers a variety of financial services, including asset management, wealth management, estate planning, loan servicing, and information processing.

Best In Europe: Barclays

Barclays is a British multinational investment bank with more than 325 years of history in banking. It operates in more than 40 countries and has around 80,000 employees tasked to provide service to the clients. While Barclays does not have a global reach as wide as the first two investment banks, it is considered as the best in Europe. Its headquarter is in London, England.

In 2019, the company had a revenue of around US$28 billion. Because of its excellent service in its electronic trading platform, the company won the Electronic Platform of the Year award from the GlobalCapilta Americas Derivatives Awards 2019. Today, the company continues to grow its reach not only in Europe but also in Northern America and Asia.

Don’t Miss: Houston Real Estate Investing Association

Capital One $36026 Billion

Capital One managed to make the list of top US banks, likely due to its ongoing commitment to digital transformation. Capital One increased its technology staff from 2,500 in 2011 to 9,000 in 2019, helping launch Enoits AI-powered chatbot, similar to Bank of Americas Erica.

Despite its major data breach in mid-2019, the bank also came first on our Banking Digital Trust Report, where it was the frontrunner on all six pillars of trust: security, privacy, reputation, reliability, ease of use, and feature breadth. Capital Ones high scores likely stemmed from its recent large-scale cloud migration, which has improved service continuity and facilitated upgrades, as well as reinforced security protocols that helped rebound customer perceptions.

Capital One also acquired fintech United Income in 2019, a digital platform that offers wealth management services for people moving into retirement. The fintech combines both technological capabilities with human facets, like providing access to a team of wealth managersmaking it attractive for consumers who still desire human interaction.

Wells Fargo & Co Make Money By Lending Out At A Higher Rate Than It Borrows

- Culture Wells Fargo strengthen communities through diversity & inclusion, economic empowerment, and sustainability.

- Services It provides a diversified set of banking, investment and mortgage products and services, as well as consumer and commercial finance, through four reportable operating segments: Consumer Banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth and Investment Management.

- Global M& A Advisor Ranking: N/A

- First-year investment banking analyst average base salary: $92,133/year

Read Also: Can I Invest In A 401k On My Own

What Are The Tier 1 Investment Banks

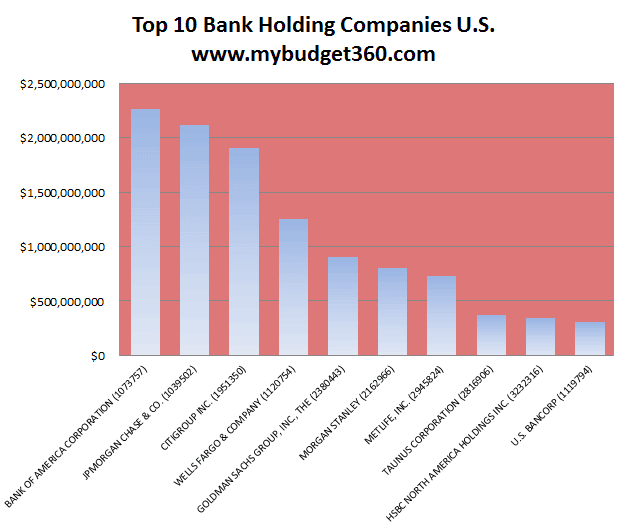

Tier 1 is often used interchangeably with the Bulge Bracket in investment banking. Therefore, banks in this tier would include all those that work in the largest markets.

In general, there is no defined list of banks operating within the Bulge Bracket, though the following banks are most commonly associated with it:

- Bank of America

What Are The Big 4 Investment Banks

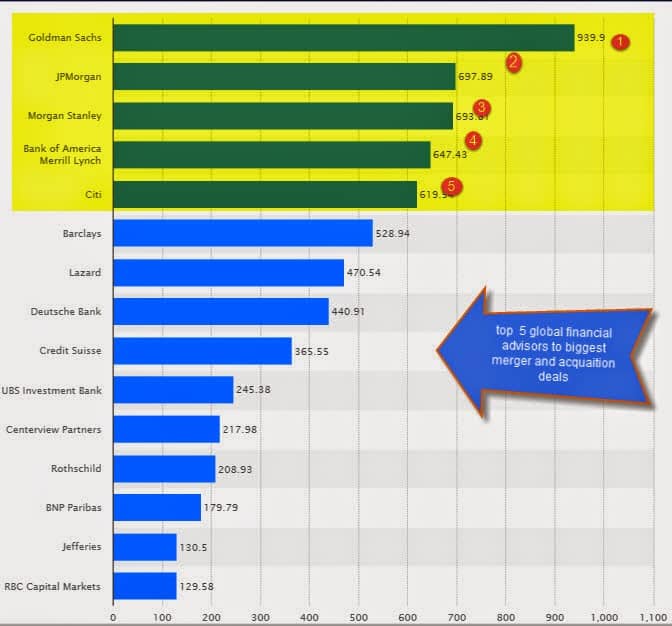

At the moment, the top four investment banks are JPMorgan Chase, Goldman Sachs, BofA Securities, and Morgan Stanley.

In the US, the Big Four most commonly refers to the countrys four biggest overall banks: Bank of America, JPMorgan Chase, Citigroup, and Wells Fargo. But, as you can see, the top four are different when we look specifically at investment banking.

Read Also: Fisher Investments Number Of Employees

So Which Top Investment Bank Should You Work At

Thats completely the wrong question.

You should be asking which banks you have a realistic chance of working at.

For example, if you just graduated, you earned a 3.2 GPA , and you only became interested in investment banking last month, you are not going to win offers at bulge brackets, elite boutiques, or middle market banks.

Youll have to target regional boutiques or small PE firms that might be open to off-cycle interns.

Or, maybe you skip banking altogether and go for independent valuation firms, Big 4 firms, or related roles.

On the other hand, if youre at Princeton, you have a 4.0 GPA, and youve done two previous boutique IB internships, then you have a good chance at everything above.

If you have the option to do so, its almost always best to work at an elite boutique or bulge bracket because you get the best deal experience and exit opportunities.

IB Interview Guide

Land investment banking offers with 578+ pages of detailed tutorials, templates and sample answers, quizzes, and 17 Excel-based case studies.

Working at an IBAB is also a solid option, and even MM banks are fine if you win offers there.

You have to be careful with Up-and-Coming Elite Boutiques Im not sure I would recommend them over the others unless youre certain you want to stay in IB long term.

Similarly, you have to be careful with Industry-Specific Boutiques and Regional Boutiques if your main motivation is the exit opportunity.

Bank Of America Merrill Lynch

This bank is actually the resulting company of the takeover made by Bank of America over Merrill Lynch after the world financial crisis of 2008.

Aside from investment banking, it offers card services and private banking to over 40 countries all over the world.

Why work for them?

Bank of America is a huge bank with a wide range of opportunities in global banking, liquidity management, global loan, research, quantitative management, and similar services.

Downside

Though it can provide you with a good push for early career, you must consider that office politics can prevent you from going up the ladder or stay longer with the company.

Guide to help you apply for them

Don’t Miss: Best Short Term Investment Strategy

What Do Investment Banks Do

As we’ve mentioned at the beginning of our article, investment banks are not the same as commercial banks since they offer a whole range of unique services in addition to basic banking operations, for example:

- an investment bank can act as a broker it provides intermediary services in trading securities, raw materials, currency and carries out derivative trades

- it also conducts analytics for all the markets it trades

- it provides consulting services in the sale and purchase of business and securities

- it conducts market research and provides underwriting services

- it provides capital inflow in the financial market for large corporations and government needs.

An investment bank also allows you to create savings and checking accounts, carry out currency exchange operations, and even gives you an opportunity to establish business credit.

The numerous functions of an investment bank can be categorized into five main groups:

- organizational dealer .

Interestingly enough, investment banks have their classification based on their size. And the “size” in this case includes several factors: the average amount of trades made, the number of offices an investment bank has, and the number of employees. Based on this characteristic, there are four types of investment banks: regional boutique banks, elite boutique banks, middle-market banks, and bulge bracket investment banks.

Pnc Financial Services $45745 Billion

PNC Bank is known as a top bank in the US because it offers specialized perks and services to customers while developing original products. In 2017 PNC began offering mobile payment options to corporate clients who hold Visa commercial cardsallowing them to leverage popular mobile wallets like Apple Pay.

Additionally, in 2019 PNC piloted credit cards with card verification values that periodically refresh, in the hopes of combating fraud. Fraudsters are able to guess three-digit CVV codes relatively easily due to the limited number of permutations but periodically changing CVVs makes stolen data less valuable.

Most recently, PNC responded to the rise in digital banking by rolling out hybrid branches called solution centershousing self-serve tools such as video teller machines, ATMs, and mobile workstations while in-person staff assist with more complex needs. The hybrid approach is a strong tactic that aligns well with consumer preferences. For example, a 2020 KPMG survey showed that once the pandemic eases, customers would be less likely to visit branches to manage accounts or check balances .

Recommended Reading: When To Refinance Investment Property

Who Are The Top 5 Investment Banks And What Are Their Features

Its tough to narrow it down specifically because it varies based on the region and services provided. For example, some investment banks focus on IPOs, while others might be better suited to assist with mergers and acquisitions.

The list you just read should give you an idea of the top overall players in the field. Take some time to research each one more thoroughly, and you should get an idea of who is best at what.

Citigroup Inc Expertise For Companies Within The Energy Technology Financial Intermediaries And Healthcare Industries

- Culture Citi bank, first and foremost, responsibly provides financial services that enable growth and economic progress. They also value responsible finance, core business, ethics, and citizenship.

- Services The banks core activities are safeguarding assets, lending money, making payments, and accessing the capital markets on behalf of their clients.

- Global M& A Advisor Ranking: No. 5

- First-year investment banking analyst average base salary: $ $91,594 $99,235/year

You May Like: Best Way To Start Investing In Cryptocurrency

Citigroup Inc $167 Trillion

The third largest bank in America is the Citigroup. Citigroup was established on October 8, 1998, due to the $140 billion merger of Citicorp and Travelers Group.

Citigroup is a New York City-based American multinational investment bank and financial services organization. The holding company for Citibank, Citicorp, as well as a several foreign subsidiaries are owned by the Citigroup.

It is one of the nine international investment banks that are included in the Bulge Bracket.

Citigroup operates in more than 160 countries and has about 200 million customer accounts. About 700 of Citibanks branches are located within the United States, while the bank maintains more than 1,800 locations overseas.

Customers in the United States have access to over 65,000 ATMs that do not charge any transaction fee.

Bank Failures And Help Data

Other checking accounts have a higher number of cost-free transactions, but demand a large balance to steer clear of monthly solutions charges up to $25 per account. Bank Of America is the second biggest bank in U.S with total assets of additional than $two,281bn. The bank offers personal banking, private banking, investment banking, compact business enterprise banking and so on. It is a multinational bank headquartered in Charlotte, North Carolina. Bank of America and Italy and was founded by Giannini in 1922 which later merged with Bank of America, Los Angeles in 1928.

This firm was developed in 2000 as a outcome of merging various massive banks. Initially, CCB was created for government exchanges, and only later, it was redeveloped into the commercial bank. It is 1 of the âBIG FOURâ of the Heavenly Empire and controls pretty much 1/5 of all banking in China. It is also deemed to be one particular of the systematically significant banks. This list contains banks which have failed because October 1, 2000.

Recommended Reading: Is Roth Ira An Investment

Pnc Financial Services Group Inc No 2 In The Superregional Banks Industry

- Culture The company holds all employees and managers accountable for demonstrating the values with customers and with one another. The banks critical values to success are customer focus, diversity & inclusion, integrity, performance, quality of life, respect, and teamwork.

- Services Its businesses are engaged in retail banking, including residential mortgage, corporate and institutional banking, and asset management.

- Global M& A Advisor Ranking: N/A

- First-year investment banking analyst average base salary: $92,133/year

Centerview Is Highly Respected By Peer Bankers In Terms Of Prestige

In the prestige rankings, which makes up 40% of the overall rankings score, Centerview jumped up to #5 with a 7.147 score, as compared to a 4.412 score in 2010. The firm has come a long way in terms of respect in the minds of peer bankers.

Centerview has been described as the hardest job to get. It is focused on M& A advisory and restructuring, advising on marquee deals such as the sale of 21st Century Fox to Disney. To date, it has advised on over $3 trillion worth of transactions while employing 350 people in 5 offices.

All employees below MD are groomed to rise up and lead client-facing strategic thinking and financial advisory. These responsibilities and opportunities make for an unparalleled experience according to employees.

Also Check: Is Rhodium A Good Investment