Real Estate Investment Fund

If you want to invest in real estate without the complexities associated with directly purchasing property, a real estate investment trust could be a great option. Investing is simple and does not necessarily require a lot of money. Some investment platforms allow investments as low as $100.

Unlike traditional real estate investments that are flipped and resold, REITs have properties in their portfolios that generate income. They include retail spaces, medical facilities, residential properties, and commercial properties such as office buildings.

You can purchase REIT shares through a broker or directly from the REIT company. REITs pay their shareholders dividends, which are taxed as regular income however, gains are taxed as capital gains.

Mutual Funds And Etfs

Both mutual funds and ETFs are baskets of securities. They are diversified portfolios that you invest in with other investors. Mutual funds are slightly less liquid than ETFs only because you can only sell them after the market closes, but ETFs you can trade during open market hours.

Related Article | The 5 Best Finance Apps for Immigrants

Before You Receive Your Lump Sum

Depending on how much money you are due to receive, and assuming you have a little time before you receive your cash or check, you should begin looking for a place to hold your money. It’s important not to rush the decision. Research savings vehicles or security types carefully to invest your cash.

You may have more than one use for your cash windfall. For example, you may want to pay off debt with a portion, give some away, use some for a well-deserved vacation and use the remainder to invest for retirement. Any amount you do not use within a few weeks’ time can begin earning interest.

Don’t Miss: Purchase Investment Property With No Money Down

Demonetisation Will Help You Put Your Money For Better Use

With an estimated Rs 6 lakh crore deposited in bank accounts in the past two weeks, the saving bank accounts of Indians are bulging with cash.Given the restrictions on withdrawals, a large chunk of this money is going to stay put in the bank accounts for the next few months.Though interest on savings bank accounts is tax-free up to Rs 10,000 per year, it’s not a good idea to keep Rs 2.5 lakh idling in your bank account.Here are a few ways it can earn better returns without compromising liquidity or incurring high risks.

Liquidity: Same or next dayExpected returns: 7 per cent to 8 per centTaxability: Gains taxed at normal rates up to three years. After three years, tax is 20 per cent with indexation benefit. If you are a mutual fund investor and have fulfilled the KYC requirements, you can invest in liquid mutual funds. These are ultra-safe schemes that can deliver up to 7-8 per cent returns in a year.The big benefit is that unlike fixed deposits, the income from mutual funds is treated as capital gains and taxed at a lower rate if the investment is held for at least three years.They are also more flexible.You can withdraw small amounts whenever required or invest more when you have surplus cash.Most mutual fund houses offer online investment fa cilities and the entire process does not take more than 30-40 minutes.

What Real Estate Options Are Good To Invest $100k

Real estate flipping, which involves purchasing, renovating, and later selling a property for profit, is one common real estate investment option.

Real estate investors can also rent out the property to generate monthly income while the property’s value appreciates.

However, purchasing real estate requires a large amount of cash.

Another option is to invest in a real estate investment trust , which invests in income-producing real estate and requires less capital.

Read Also: What Is Liability Driven Investment

What Not To Do With Your Down Payment Savings

Because of the risk that comes with putting your money in the market, do not invest that cash you are stockpiling to buy a home in four years or less, suggests Douglas Boneparth, a New York City-based CFP, president of Bone Fide Wealth and co-author of The Millennial Money Fix.

“If you have a little more time on your side or are OK with losing some money, you could consider a very low-risk investment portfolio, but there’s no guarantee,” Boneparth adds.

The stock market offers the potential for much higher returns than the interest you’d earn in a savings account. The average stock market return has historically hovered around 10% per year, while annual percentage yields on high-yield savings accounts in the recent past reach just over 2% at best.

But Williams points to the last few years as an example of how volatile investing can be: The sharp decline in the S& P 500 back in February and March 2020 at the onset of the pandemic was unprecedented and a decline we hadn’t experienced since the stock market crash of 1929 during the Great Depression. Trading platform Robinhood points out that it took just 22 trading days for the S& P 500 to drop 30% .

How To Pick Cash Equivalent Accounts

Cash equivalents may be the slow-and-steady part of your portfolio compared with the growth potential of stocks and the higher income yield of bonds but they still deserve care and attention.

Picking the right cash equivalent accounts can make the difference between whether this part of your portfolio makes or costs you money. It can also determine whether your money is fully available to you when you need it.

Here are some types of cash equivalent accounts that are readily available at most banks:

Heres what to know about each of these issues

Recommended Reading: What Is Investment Risk Management

What Is A Liquid Investment

A liquid investment is an investment that you can easily convert to cash without experiencing a significant impact. Low impact means that it wont take much time or energy to convert your assets to cash.

Liquid assets or investments are generally safer ways to invest your money so you can still access them quickly. That makes them a good option for your emergency fund or short-term savings account.

For example, if youre planning to buy a house soon, you need a way to save up for a downpayment without taking on too much risk. You dont want to lose money on your investment, and you want to be able to access your savings as soon as you find the perfect house.

But there is a downside to some liquid investments: they typically yield lower returns. Cash, for example, is highly liquid. But saving only cash will never net the kind of return you could gain from investing in the stock market.

Are Fixed Indexed Annuities A Good Investment

They can be trickier than choosing savings accounts and money market accounts because:

Yield comparisons are difficult. Fixed indexed annuities offer a specified rate of interest plus some percentage of participation in the stock markets appreciation.

They arent purely fixed income or equity instruments. Comparing different yields is complicated because equity participation may differ and is of variable value.

Commissions can be high. Make sure you fully understand the commission structure and how it will affect your net return.

Past returns are not representative.

Dont focus on the returns these instruments have provided in the past, because most of those returns were earned in a much higher interest rate environment. What matters is the yield being offered going forward.

Liquidity is limited.

Annuities typically lock you in for a period of time, with penalties for early withdrawals. There may be a limited annual amount you can withdraw, but make sure this is sufficient to meet your needs.

Also Check: How To Start Investing In Real Estate With Little Money

Is Investing In Stocks Worth It

One thing to keep in mind about investing in the market is that it involves a certain degree of risk. Some investments may be riskier than others. Stocks, for example, typically entail more risk to investors than bonds.

So, is investing in stocks worth the risk?

It can be if growing a diversified portfolio is the goal. Investing in stocks can yield benefits in the form of consistent income from dividends or price appreciation.

If youre able to buy low and sell high, investing in stocks could prove profitable and be instrumental to building wealth.

Features Of Liquid Mutual Fund

Here are some features of liquid funds:

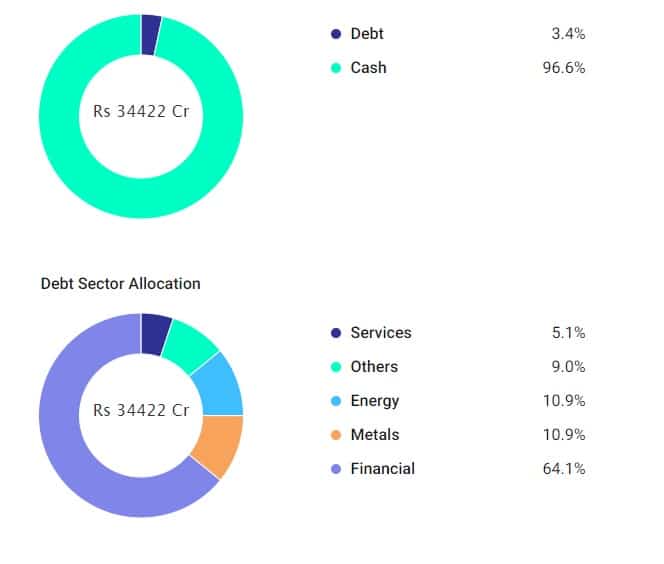

Asset allocation: As per the Securities and Exchange Board of India rules, liquid mutual funds must invest in debt and money market instruments with a maximum maturity period of 91 days.

Risk-reward ratio: The returns generated bytop liquid mutual fundsdepend on the market price of the underlying debt and money market instruments. Nevertheless, since the prices of these short-term securities do not change as much as that of mid-term and long-term bonds, these funds are much more stable than other debt fund schemes.

Don’t Miss: Best Place To Invest 50000 Dollars

Factors To Consider When Investing In Liquid Funds

If you are considering investing in liquid funds, you should keep the factors below in mind:

- Estimated returns While a bank savings account gives you relatively low-interest returns, these returns are guaranteed. A liquid investment does not have guaranteed returns. You are taking a risk. Usually, the risk pays off, with positive dividend returns and up to 9% returns on investment.

- Financial goals Depending on what your financial goals are, liquid investments might be appropriate. If you are trying to establish an emergency fund, liquid investments are great. The funds generate returns, and you can easily pull out your invested cash when there is an emergency.

- Investment term Liquid funds are best suited for short-term financial goals. For long-term investments, including your retirement fund, consider other funds to invest in.

- Amount of risk Among all available debt funds, liquid mutual funds have the least amount of risk. However, the fund can experience a sudden drop in value if the underlying securities decline. Even though liquid funds are not entirely immune from declines, they are the safest.

- Cost You will be charged a fee for liquid funds. This often takes the form of a fund managers fee. The expense ratio for liquid funds is usually lower than traditional investments due to the fund managers investment strategy to hold till maturity. This low expense ratio helps to provide favorable higher returns in a short time.

Can Investing Make You Rich

Investing can help you to build wealth if youre using the right strategy.

For example, buy and hold investing involves buying investments and holding onto them long term. The goal is to sell those investments later after theyve increased in value.

Remember that the longer you stay invested, the more opportunity you have to benefit from compounding interest.

So in terms of getting rich from investments, time can be your most powerful tool.

You May Like: Peer To Peer Investment Platforms

Bank Fixed Deposits And Other Deposits

If you want slightly higher returns of 200-250 basis points, then you can opt for bank FDs . A typical bank FD with a 1 year maturity will be available at an interest rate of around 6.5-7%, although the rates are continuously falling. Bank FDs will have a lock in of around 1 year but you can always fall upon the FD in times of liquidity needs. You can easily take a loan against your FD up to 75% of the FD value and your banker will arrange the same.

An attractive way to make money for short-term returns is to invest in a recurring deposit with any bank. You can earn returns of 6% – 7%, and with this, your investment multiplies faster. Thus, you may get higher returns than with a regular bank FD, or a savings bank account. An RD grows your money by earning interest over the interest accumulated in your account. The applicable interest rate is fixed when you start the deposit, and as long as you dont make premature withdrawals, you earn interest in high amounts. If you are thinking about where to invest money for the short term, this could be an avenue to seriously consider. A plus of this kind of deposit, is that you can choose terms as short as a month and extending to more.

What Is A Liquid Investment 8 Best Liquid Investments

Disclaimer: This post may contain affiliate links. Please read our disclosure for more information.

Having some of your money saved in a liquid investment can be a safer alternative than having all of your cash tied up in the stock market or real estate.

Liquid investments are a safer way to save for emergencies. Theyre also a great option if you have a short-term savings goal like saving up to buy a new car or for a downpayment on a house.

Still, there are several different kinds of liquid investments, so lets explore what they are and how they work.

Read Also: Investing In Nasdaq Vs S& p 500

The 8 Best Types Of Liquid Investments

Liquid investing offers the opportunity to build your wealth while keeping your funds easily accessible. With the help of liquid investments, you can steadily grow your net worth without tying up all of your funds in an inaccessible investment opportunity.

Lets explore what liquid investments are and why it is important to maintain these types of assets as a part of your financial strategy.

How To Invest In The Best Liquid Funds

An investor can make a liquid fund investment directly using the online platform provided by the fund house or broker or an intermediary platform like Glide Invest. You can either choose a regular direct investment plan. A direct investment plan allows you to save commission expenses and thus reduce the expense ratio.

To invest in best in the best liquid fund, you need to

- Complete your e-KYC formalities.

- Create an account by registering either on the AMC website directly or on an intermediary channel like Glide Invest

- Now, select your preferred liquid fund scheme for investment, the amount, etc. Investors can choose a lump-sum investment or start a systematic investment plan . For a SIP, you need to select the installment amount, investment date , the tenure of the SIP, & more

Hope you got an idea of how to invest in the liquid funds. Before you invest, make sure you compare and assess the available funds so that you invest in the best liquid fund, which offers you the lowest risk and return at your end.

Read Also:

Also Check: How Do I Invest In A Specific Company

How Much Money You Should Save To Buy A House

Before we dive in, you should first calculate how much cash you’ll even need to save up to buy your home. Conventional loans typically requires a down payment of 5% to 20% of the home’s value. On top of that, you need to factor in closing costs and other fees, which can be another 2 to 5% of your home’s purchase price, according to the real estate site Zillow. Then, experts recommend setting aside cash reserves to cover at least three months of living expenses, to play it safe this is also known as an emergency fund. And all of that is before factoring in home furnishings and other move-in costs.

Why Is Investing Better Than Saving

Depositing money into a savings account can allow you to earn interest while keeping your funds relatively safe. Investing can be better than saving, however, for building wealth long term.

When you invest money in the market, you have an opportunity to earn higher returns compared to what you may realize with a savings account.

For example, you may be able to earn an average annual return of 6% to 7% by investing in stocks while a high yield savings account may return closer to 1%.

Also Check: Selling Investment Property At A Loss

Where Should You Hold Your Cash

With interest rates and inflation rising in tandem, you might be wondering how to get the most out of the cash you hold. Rising interest rates have started to offer better yields on the cash you can invest, even as inflation erodes your long-term purchasing power. So, where’s the smart place to keep your cash? It depends on how you plan to use it.

How To Invest In Best Liquid Funds In 5 Simple Steps

- How To Invest In Best Liquid F …

While investment is the current rage, most investors do not have a high-risk appetite for the same. Besides, not all of them can be comfortable staying invested for the long term.

So what is the best way to work the investment out? Its through Liquid funds.

If you are an investor who wants to go for short-term investment and generate higher returns or has just received windfall gains or a large sum of money at hand but is unsure about where to invest, liquid funds might be just the right option for you.

Contents

You May Like: Can I Invest In Sequoia Capital

Should You Get Professional Help

Thanks to modern technology, its relatively easy to invest on your own or with the assistance of robo-advisors. You can get started even if you dont have a lot of experience or money.

If youre still unsure about how to start investing, it might make sense to get professional investment advice. A good investment advisor or certified financial planner can help you pinpoint your goals and create an investment strategy. Some financial advisors charge a fee to help you create a plan and offer recommendations to help you make the most of your money.

Additionally, some robo-advisors will help you build a portfolio but also provide add-on services that allow you to talk to a human financial advisor for a fee. No matter your needs, its possible to find someone to help you navigate all your investment decisions.