Next Steps To Consider

In general, the bond market is volatile, and fixed income securities carry interest rate risk. . Fixed income securities also carry inflation risk, liquidity risk, call risk and credit and default risks for both issuers and counterparties. Lower-quality fixed income securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer. Foreign investments involve greater risks than U.S. investments, and can decline significantly in response to adverse issuer, political, regulatory, market, and economic risks. Any fixed-income security sold or redeemed prior to maturity may be subject to loss.

Investment Grade Bond Rating Not Permanent

A point to note is that the investment-grade rating that a bond gets is not permanent. This rating may change, which means the bond may get a better investment grade rating or lose its investment-grade rating. While determining the rating for an instrument, the agencies consider many external and internal factors that have a bearing on the final rating for a bond. These factors are economic growth, global economic scenario, regulatory changes, industry-specific issues, financial and liquidity strength of the issuers, the operating and future business growth of the issuer, extent of loans and their payment liabilities, and more.

For instance, if an economy is facing a downturn, it could get hard for companies to meet their financial obligations. This will obviously weaken the strength of the company and thus, in turn, lead to a drop in the rating of its bonds. A point to note is that companies with low ratings are more susceptible to changes in the economic environment. Also, if a company takes on more debt, the rating agencies may slash their rating.

In contrast, when an economy is doing well, there are better chances of a company meeting its financial obligations timely. And, in turn, get a better rating for their bonds.

Default And Credit Risk

If you have ever loaned money to someone, chances are you gave some thought to the likelihood of being repaid. Some loans are riskier than others. The same is true when you invest in bonds. You are taking a risk that the issuer’s promise to repay principal and pay interest on the agreed upon dates and terms will be upheld.

While U.S. Treasury securities are generally deemed to be free of default risk, most bonds face a possibility of default. This means that the bond obligor will either be late paying creditors , pay a negotiated reduced amount or, in worst-case scenarios, be unable to pay at all.

You May Like: How To Invest In The Stock Market As A Teenager

Investment Grade Bond: The Basics

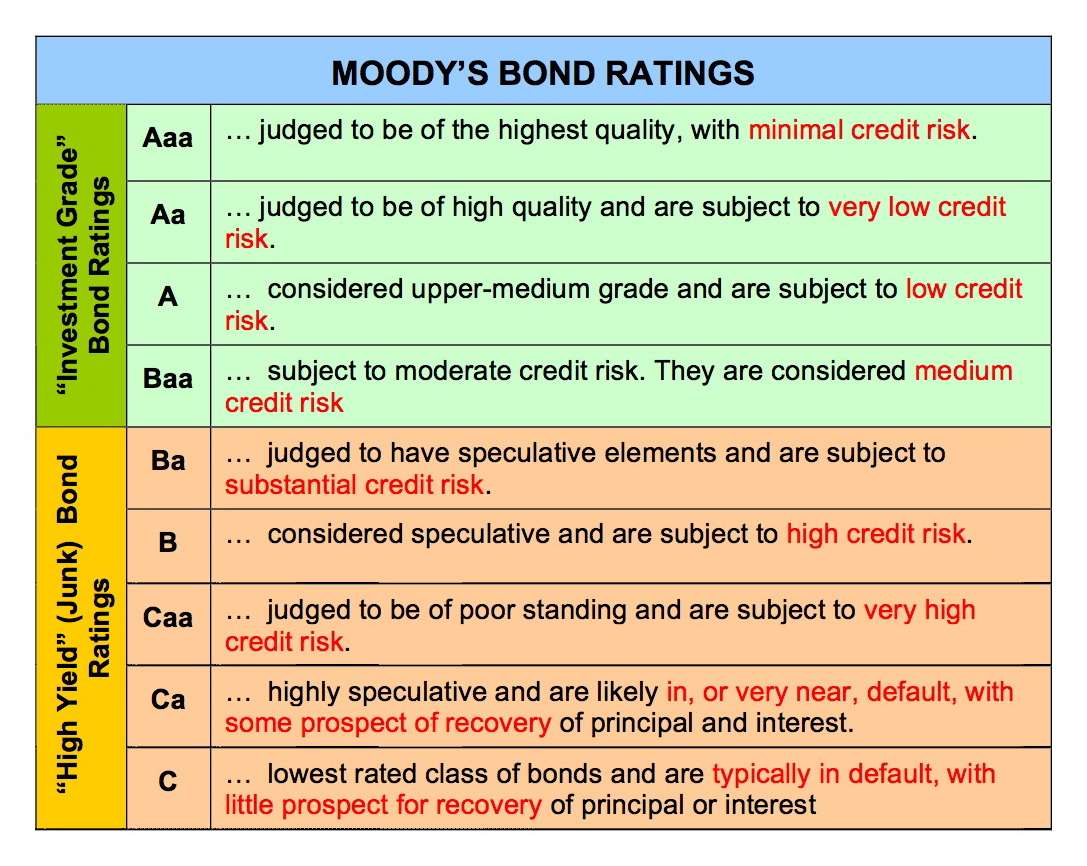

Investment grade bonds are bonds whose creditworthiness earns them high ratings by the investment ratings agencies, the two primary agencies being Standard & Poors and Moodys. To be investment grade, a bond must be rated of BBB- or higher by Standard & Poors or Baa3 or higher by Moodys. The highest ratings for investment grade bonds are AAA by Standard & Poors and Aaa by Moodys.

Just What Is a Bond?

In simple terms, a bond is a promise by a bond issuer to repay the amount of money for which the bond is sold. The proceeds of a bond sale are treated as debt by the issuer. You can contrast this with stocks, which are considered equity. Companies, institutions or governments use bonds as a form of debt when they have borrowing needs of longer than a year.

The Importance of Investment Grade

Investment grade bonds are considered reliably certain to be repaid. Financial institutions and parties holding fiduciary responsibilities can legally invest in bonds only if they are investment grade. Because corporations use bonds as one method of raising funds, bond issuers will strive for the highest ratings they can get. And, clearly, for a similar reason, the objectivity and trustworthiness of the ratings agencies is paramount.

Investment Grade versus Government Bonds

Investment Grade versus High-Yield or Junk Bonds

Understanding the Risks

Implications Of Credit Rating On Bond Yields

The higher rated the bond, the lower the bond yield. Bond yield refers to the return realized on a bond. As such, investment-grade bonds will always provide a lower yield than non-investment grade bonds. It is due to investors demanding a higher yield to compensate for the higher credit risk in holding non-investment-grade bonds.

For example, an investor may demand a yield of 3% for a 10-year bond rated AAA due to the extremely low credit risk but demand a yield of 7% for a 10-year bond rated B due to the higher implied credit risk associated with the bond.

Don’t Miss: Short Term Investment Mutual Fund

High Yield Bond Issuance

High-yield bond issuance usually entails three steps:

Often, the process is often more fluid and less exact than with other fixed-income securities because the issuer has a story to tell to market the deal, because issuers and underwriters are subject to more questions, given the higher risks, and because deal structure can be reworked numerous times.

What Does Investment Grade Mean

A Tea Reader: Living Life One Cup at a Time

provide a useful measure for comparing fixed-income securities, such as bonds, bills, and notes. Most companies receive ratings according to their financial strengths, prospects, and past history. Companies that have manageable levels of debt, good earnings potential, and good debt-paying records will have good credit ratings.

Investment grade refers to the quality of a company’s credit. To be considered an investment grade issue, the company must be rated at ‘BBB’ or higher by Standard and Poor’s or Moody’s. Anything below this ‘BBB’ rating is considered non-investment grade. If the company or bond is rated ‘BB’ or lower it is known as junk grade, in which case the probability that the company will repay its issued debt is deemed to be speculative.

Read Also: What Is Cash To Invest On Stash

Why Trade Shares With Fxcm

- $0.00 Commission*

- Mini Shares – Fractional Share Trading with minimum trade sizes of 1/10 of a share.

- Low Margin Requirements

According to S& P Global’s 2018 Annual Global Corporate Default and Rating Transition Study, which tracked corporate bond performance over a period of more than 30 years, the highest one-year default rates for bonds rated AAA, AA, A, and BBB were 0%, 0.38%, 0.39%, and 1.02%, respectively. By contrast, the highest one-year default rate for bonds rated BB, B, and CCC/C were 4.22%, 13.84%, and 49.28%.

Because of the high risk of loss that investing in below investment-grade bonds entails, many institutional investors, such as bank trust departments, insurance companies and pension funds, are required to only invest in investment-grade bonds. However, many investors are willing to accept the risk of default for higher yields. Many mutual funds and exchange-traded funds invest in lower rated bonds, which spreads the risk among a large portfolio.

High Yield Bond Issuers

Companies issuing high yield bonds usually are seeking money for growth , for working capital and for other cash-flow purposes, or to refinance existing loans, bonds, or other debt.

Companies with outstanding high-yield debt cover the spectrum of industry sectors and categories. There are industrial manufacturers, media firms, energy explorers, homebuilders and even finance companies, to name a few. The one thing in common indeed the only thing is a high debt load, relative to earnings and cash flow . Its how the issuers got there that breaks the high-yield universe into categories.

The most frequent types of issuers are detailed below. As well, other capital-intensive businesses, such as oil prospecting, find investors in the high-yield bond market, as do cyclical businesses, such as chemical producers.

Recommended Reading: Where Can I Get Investment Advice

How Is The Investment

Investing in a bond is nothing but lending money in lieu of interest. While lending money to someone, it is essential to have a detailed understanding of the creditworthiness of the borrower, in this case, the bond issuer. Therefore, an investment-grade rating helps you to gauge the creditworthiness of the bond issuer.

For instance, this is how Standard & Poor defines its different investment-grade ratings:

A rating of AAA indicates an extremely strong capacity to meet financial commitments. AA denotes a very strong capacity to meet financial commitments, while A indicates a strong capacity to meet financial commitments while also being susceptible to economic conditions. Lastly, BBB denotes an adequate capacity to meet financial commitments with subject to economic conditions.

A strong rating is generally considered an indication of the strong and stable financial condition of the bond issuer.

Investment Grade And High Yield Bonds

Investors typically group bond ratings into 2 major categories:

- Investment-grade refers to bonds rated Baa3/BBB- or better.

- High-yield pertains to bonds rated Ba1/BB+ and lower.

You need to have a high risk tolerance to invest in high-yield bonds. Because the financial health of an issuer can changeno matter if the issuer is a corporation or a municipalityratings agencies can downgrade or upgrade a company’s rating. It is important to monitor a bond’s rating regularly. If a bond is sold before it reaches maturity, any downgrades or upgrades in the bond’s rating can affect the price others are willing to pay for it.

You May Like: How Best To Invest In Cryptocurrency

Example Of Investment Grade

As per S& Ps investment-grade rating, the following are few rated bonds in the United States

- Kansas Dev Fin Auth

- Hopkins Pub Schs

- Willis North America Inc.

- Michaels Stores Inc.

As per S& Ps investment-grade rating, below are few rated bonds in the United Kingdom.

- Towd Point Mortgage Funding 2018 Auburn 12 PLC

- Lloyds Bank Corporate Markets PLC

- FCE Bank PLC

What Are Investment

An investment-grade bond is a bond classification used to denote bonds that carry a relatively low compared to other bonds. There are three major credit rating agencies that provide ratings on bond. Each credit rating agency sets a minimum bond rank to be classified as investment-grade:

- Standard & Poors denotes bonds rated BBB- or higher as investment grade.

- Moodys denotes bonds rated Baa3 or higher as investment grade.

- Fitch denotes bonds rated BBB- or higher as investment grade.

You May Like: Best Investment For 401k Plan

What Is A Bond

Typically, a loan agreement between the bond issuer and the investors, bonds are generally issued by corporate houses and state, local, central, or national government bodies. Commonly, referred to as fixed-income securities, bonds are debt instruments issued in the market to raise capital or funding.Unlike stockholders, bond investors dont have any ownership of the company. However, bondholders are entitled to an annual fixed income at a pre-decided rate and to get the principal back at the end of the maturity period.

Here are a few different types of bonds.

Corporate bonds: Bonds issued by public or private corporations.

Investment-grade bonds: Bonds that are being rated by credible rating agencies, generally issued by only private entities.

High-yield bonds: Generally issued by private entities looking to finance their merger or acquisition activities. These bonds are expected to provide a high yield but have a low credit rating and high credit risk.

Municipal bonds: Often referred to as Muni bonds, these bonds are issued by government entities belonging to either a state, city, municipality, country or by all of them. These bonds are generally issued to finance government projects,capital expenditures or special projects.

T-bonds: Treasury bonds or T-bonds, principally considered to be risk-free, are bonds issued by the U.S. Treasury Department on behalf of the federal government. T-bonds are generally not subject to credit quality ratings.

How Bond Ratings Work

Ratings agencies research the financial health of each bond issuer and assign ratings to the bonds being offered. Each agency has a similar hierarchy to help investors assess that bond’s credit quality compared to other bonds. Bonds with a rating of BBB- or Baa3 or better are considered “investment-grade.” Bonds with lower ratings are considered “speculative” and often referred to as “high-yield” or “junk” bonds.

| Investment grade |

| D |

Moody’s, Standard & Poor’s, and Fitch append their ratings with an indicator to show a bond’s ranking within a category. Moody’s uses a numerical indicator. For example, A1 is better than A2 . Standard & Poor’s and Fitch use a plus or minus indicator. For example, A+ is better than A, and A is better than A-.

Remember that ratings aren’t perfect and can’t tell you whether or not your investment will go up or down in value. Before using ratings as one factor in your investment selection process, learn about the methodologies and criteria each ratings agency employs. You might find some methods more useful than others.

Don’t Miss: How To Invest Without Being An Accredited Investor

Advantages Of Investment Grade

Disadvantages Of Investment Grade

Read Also: Best Investments For 40 Year Olds

What Is Investment Grade

An investment grade is a rating that signifies a municipal or corporate bond presents a relatively low risk of default. Bond rating firms like Standard & Poors and Moody’s use different designations, consisting of the upper- and lower-case letters “A” and “B,” to identify a bond’s credit quality rating.

“AAA” and “AA” and “A” and “BBB” are considered investment grade. for bonds below these designations are considered low credit quality, and are commonly referred to as “.”

Relation To Bond Ratings

While not perfect, bond ratings have been a good predictor of default. Historically, there is a strong correlation between high bond ratings and low defaults, and vice versa. Default rates among corporate bond issues differ markedly based on credit rating.

According to S& P Global’s 2018 Annual Global Corporate Default and Rating Transition Study, which tracked corporate bond performance over a period of more than 30 years, the highest one-year default rates for bonds rated AAA, AA, A, and BBB were 0%, 0.38%, 0.39%, and 1.02%, respectively. By contrast, the highest one-year default rate for bonds rated BB, B, and CCC/C were 4.22%, 13.84%, and 49.28%.

Because of the high risk of loss that investing in below investment-grade bonds entails, many institutional investors, such as bank trust departments, insurance companies and pension funds, are required to only invest in investment-grade bonds. However, many investors are willing to accept the risk of default for higher yields. Many mutual funds and exchange-traded funds invest in lower rated bonds, which spreads the risk among a large portfolio.

Don’t Miss: Investing Outside Of Retirement Accounts

Ridgewood Canadian Investment Grade Bond Fund Announces Estimated Distribution Rate For Third Quarter

TSX Symbol: RIB.UN

TORONTO, June 30, 2022 /CNW/ – Ridgewood Canadian Investment Grade Bond Fund is pleased to announce the estimated distributions of the Fund for the third quarter of 2022 as follows:

|

Estimated Payable Date |

Estimated Distribution Amount per Unit |

|

$0.0530 |

This distribution rate equates to an annualized distribution rate of 5.30% on an initial subscription price of $12.00 per unit. Details of each distribution, including the record and payment date, will be confirmed at the time of the declaration of the distribution.

About Ridgewood Canadian Investment Grade Bond Fund:

The Fund will seek to achieve the following investment objectives: to provide unitholders with monthly cash distributions targeted to be 5.3% per annum on the original issue price of $12.00 per unit and to maximize total returns for unitholders while preserving capital in the long term.

About Ridgewood Capital Asset Management Inc.:

Ridgewood is an independent investment manager that manages approximately $1.4 billion in assets for a diversified client base of high net worth individuals, foundations/endowments, First Nation mandates and institutional accounts, of which approximately $1.05 billion is invested in fixed income assets.

View original content:

Ishares Iboxx $ Investment Grade Corporate Bond Etf

You can trade this ETF now.

- NAV as of Dec 22, 2021$132.6952 WK: 128.46 – 137.89

- 1 Day NAV Change as of Dec 22, 20210.46

- NAV Total Return as of Dec 22, 2021YTD: -1.54%

- Fees as stated in the prospectus Expense Ratio: 0.14%

1. Exposure to a broad range of U.S. investment grade corporate bonds

2. Access to 1000+ high quality corporate bonds in a single fund

3. Use to seek stability and pursue income

Also Check: Invest In International Stock Market