Benefits To You And Your Clients

Reduced business risk

- SEI has investment discretion on most equity trading

- Guided open architecture with customization

- Lower investment minimum than investing directly with the manager

- Designed for tax-efficient transition of securities

SEI as investment manager to the firm

- Asset managers hired by SEI as sub-advisor

- Your firm is the advisor to the client

Consistent investment process across all investment vehicles

- Asset-allocation-driven

Enhanced tax management in the overlay manager option

- Coordination of buys and sells

- Integrated loss harvesting

An active, rules-based approach to factor investing with the flexibility to adjust portfolio allocations as the market environment evolves.

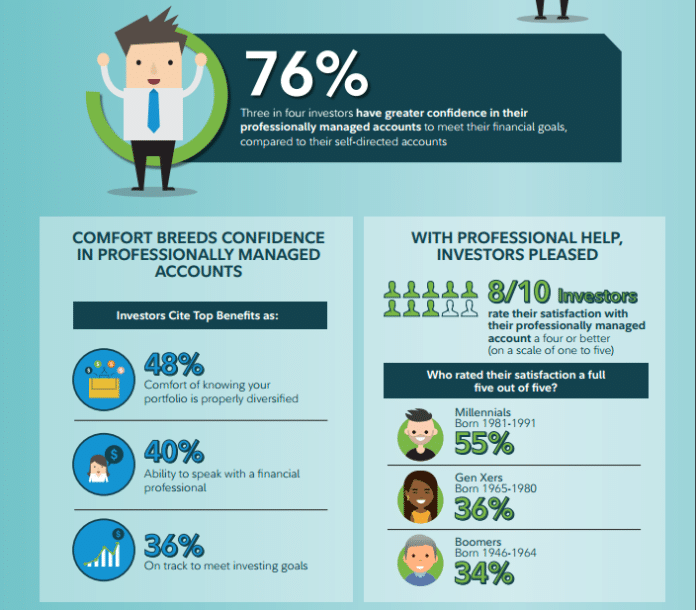

The Pros Of Managed Investing

Choosing to have your account professionally managed, either in person or via an online financial advisory firm, comes with many benefits. The most significant advantage of managed accounts is the alleviation of stress. Lets talk about managed accounts when it comes to either a 401 or IRA.

Most people are incredibly excited to land a good job which offers a 401, but then are left to figure out the word of financial investments by themselves. Questions such as What should I invest in? and How much money should I invest in each fund? can cause major headaches. Continuously managing your 401 by yourself can quickly become overwhelming, causing people not to bother with the task. At that point, portfolios can fall off track and lead to a loss in investment. A professionally managed account will be monitored and rebalanced on your behalf so you wont need to worry.

Most people with IRAs are looking for something to invest in, either to augment their existing investments or to grow their capacity for savings. The tricky part, however, is actually choosing which funds to invest in, determining how much money to allocate, and making meaning out of the rise and fall of numbers through continuous management. Employing professional account management makes this process much easier your advisor or online financial advisory firm can help you make the right decisions and assist you in reaching your investment goals without spending more money than necessary.

What Is A Unified Managed Account

A unified managed account is a professionally managed private investment account that can include multiple types of investments all in a single account. Investments may include mutual funds, stocks, bonds, and exchange-traded funds. Unified managed accounts are often rebalanced on a specified schedule.

Also Check: How To Invest In Canada

Are Managed Accounts Worth It

Managed portfolios are worth itâfor certain types of investors.

A managed account might be right for you if:

You want to save time: With a managed account, the investment advisor does all the heavy lifting for you from researching investments, following markets and any day-to-day decision making.

You want a professional at the wheel: You donât need to be an investing expert. Instead, you can use an individual or service and feel comfortable that your portfolio is in experienced hands that can navigate the market as situations change.

You prefer a more disciplined investment approach: An investment advisor helps you to avoid the emotions associated with buying and selling on your own, thereby alleviating stress. You can avoid panic when markets fall, and know that an individual is managing your money on your behalf.

Alternatively, managed accounts may not be right for you if:

You want total control: Your managed account advisor will be making the decisions on which assets to buy and sell. You will not be able to direct individual purchases without communicating with your advisor. So if you like to have control over the investments you hold in your portfolio or the precise timing of your trades, a managed account may not be the best option for you.

Investing Through A Unified Managed Account

The same banks and brokerage firms typically offer unified managed accounts as separately managed accounts. Their offering has also broadened to include registered investment advisors and private wealth managers. Technology has been a driving factor supporting their expansion. A unified managed account provider has a much greater overall fiduciary responsibility since they serve as the overseer for a multitude of investments, which can include stock positions, employee stock option plans, third party separate account management, and more.

UMA providers work with high net worth investors to integrate all of a clients assets. Once the assets have been aggregated, a UMA provider will work with the client in a number of ways. The UMA provider can examine the total portfolio for a comprehensive plan. UMA account planning can include an overlay strategy that seeks to manage the portfolio from a targeted asset allocation diversification approach. UMA providers also offer investors new options with affiliated companies and products that an investor may want to invest in over time. Often a UMA provider will analyze the portfolio to conform with modern portfolio theory given the comprehensive, efficient frontier for which the combined assets create. A UMA provider’s alternative options may help a client to align their total portfolio for risk-return optimization better.

Don’t Miss: Epic Real Estate Investing Podcast

A Word About Your Risk Profile

As a rule of thumb, the greater the potential for returns, the greater the level or risk. Therefore its important with any investment that youre comfortable with the level of risk involved.

The degree of risk youre willing to accept will depend on a number of factors but at the most basic level ask yourself – how would you feel if you lost a significant portion of money youve invested?

Managed investments will have different risk levels so its important to select a fund that suits your individual risk profile.

Managed Accounts Vs Mutual Funds

Managed accounts and mutual funds both represent actively managed portfolios or pools of money that invest over a variety of assetsor asset classes.

Technically, a mutual fund is a type of managed account. The fund company will hire a money manager to look after investments in the fund’s portfolio. This manager may alter the fund’s holdings per the fund’s objectives.

When mutual funds began to be , they were touted as a way for the “little guy”that is, small retail investorsto experience and benefit from professional money management. Previously, this was a service available only to high-net-worth individuals.

-

Customized managed accounts address the account holder’s needs mutual funds invest according to the fund’s objectives.

-

Managed account trades can be timed to minimize tax liability mutual fund investors have no control when a fund realizes taxable capital gains.

-

Managed account-holders have maximum transparency and control over assets mutual fund-holders don’t own the fund’s assets, only a share of the fund’s asset value.

-

Some managed accounts require six-figure minimum in funds mutual funds demand much lower initial investment amounts.

-

It may take days to invest, or de-vest managed account assets mutual fund shares are more liquid and can be bought or sold daily.

-

Managed account managers tend to charge high annual fees that impact overall returns mutual funds’ expense ratio fees tend to be lower.

Don’t Miss: Can F1 Students Invest In Cryptocurrency

Be Smart About Managed Broker Accounts

Once you realize what’s involved in getting an account that’s managed by your broker, you might decide that it’s worth the savings to handle things on your own. It doesn’t necessarily take a huge amount of effort to invest successfully, and avoiding unnecessary fees means keeping more of your hard-earned money in your own pocket.

However, if you need the benefits of a managed account, there are brokers that can do a good job. If you make sure that they meet the criteria above, then brokers offering managed accounts can take a big burden off your shoulders and help you reach all of your long-term financial goals.

What To Look For In A Managed Broker Account

by Dan Caplinger |Updated Aug. 30, 2021 – First published on Feb. 5, 2019

Getting professional advice to help you invest your portfolio can be smart for some investors. Follow these steps to get the best managed broker account for you.

Image source: Getty Images.

Brokerage accounts have given investors the power to control their own financial fate. Smart investment decisions can lead to riches, but making mistakes can be extremely costly. Some people are so intimidated by the potential to suffer catastrophic losses that they never even try to find a brokerage company at all, leaving their money in low-return investments like bank accounts or CDs that won’t provide the growth necessary to help you achieve your biggest financial goals.

Just because you don’t want to go it alone with your investments doesn’t mean that you can’t invest at all. Many brokerage companies offer what’s known as a managed broker account in order to give hands-off investors the peace of mind that their money will get the attention it deserves. There are some potential dangers involved with managed broker accounts, though, so it’s important to seek out favorable characteristics and avoid potential pitfalls when you’re evaluating brokers.

You May Like: Lila Preston Generation Investment Management

How To Find The Best Managed Accounts

A managed accountsometimes called a “wrap account”is a type of investment management service that packages together a group of investments for you. Some managed accounts offer good services for the price, while others have high fees and tax inefficiencies. The challenge is in figuring out which are which.

Guidedchoice Advice And Management

Over the last 20 years, GuidedChoice has helped over 1.5 million people invest in their future. Our proprietary and rigorous methodology that we employ across all of our services was developed by Nobel Laureate Dr. Harry Markowitz. Our methodology was designed with investors in mind we know that many investors favor balancing avoiding risk while seeking reward, and our methodology is designed to deliver just that.

Professional 401 Management

GuidedChoice professional 401 management will allocate the investments in your account to help you reach your goals. We will also advise you on what you need to save to achieve those goals, and can assist you in setting them if youre unsure where to start. Fill out your employer information to check if they offer GuidedChoice services. If so, simply sign in and receive your personalized investment strategy. You can easily implement our investment strategy tailored to your goals with just a click of a button at a very low cost.

If your employer hasnt yet partnered with GuidedChoice, we can still help you set a confident path to your retirement goals.

Use our professional 401 advice to learn:

- How to make better decisions to reach for financial goals

- How much you will need to save inside and outside your 401 account to be prepared for retirement

- How to allocate your various investments to help you reach your goals

- How to tell when its time to rebalance your account and instructions on how to do it

Professional IRA Management

Read Also: Can I Take A Heloc On An Investment Property

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Types Of Managed Accounts

The terms and services offered under different types differ according to firms. We have provided a basic understanding of the types, with the major ones listed below.

You are free to use this image on your website, templates, etc., Please provide us with an attributi linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Managed Account

#1 Individually Managed Accounts

- IMAs are customized share portfolios built and managed by a money manager on behalf of an investor.

- An investor can include or exclude certain shares according to his preferences and needs from the managers model portfolio.

- IMA is mostly suitable for those with $500,000 or more. IMAs cater to the personalized goals of an investor.

#2 Separately Managed Accounts

#3 Managed Discretionary Accounts

- MDAs are discretionary investment accounts that permit a money manager to trade investments without the investors approval for each transaction.

- The investor must sign a discretionary agreement with the manager setting limits regarding trading in the account the manager must adhere to.

- Money managers charge higher fees for MDAs as they have to handle every transaction and decisions, unlike non-discretionary accounts.

#4 Unified Managed Accounts

Don’t Miss: Best Place To Invest Money For 6 Months

Investment Styles And Managers

Choose from a diverse set of style-specific equity managers such as Large Cap, Small Cap, Midcap, International and Managed Volatility. Both programs can also be supplemented with our ETF strategies and select fixed-income managers

You may also complement our solution with your own selection of managers, mutual funds or ETFs to fully execute your best thinking for your client.

What Is A Self

This type of account puts you in charge of managing your investments and is designed for those with a high degree of comfort with the market. You decide what assets â be it stocks, bonds, options etc. â to buy and sell, and when. You request the tradesâall the brokerage does is execute them.

Typically, you donât get access to an investment advisor with a self-directed brokerage account, which means youâre responsible for monitoring and managing your investments on your own.

Self-directed brokerage account features

Consider some of the benefits of a self-directed brokerage account:

Youâre the decision-maker: You call the shots. That means your portfolio is entirely in your hands, which could be a good thing if youâre an active investor or trader who likes to be involved in the day-to-day management of your investments.

Your costs may be lower: With a self-directed brokerage account, youâre generally charged per transaction. In other words, the only time you pay a fee is when you buy or sell. Unlike a managed account, there is no advisor fee, so a self-directed brokerage account may be a less expensive option if you donât trade very often.

You may have more options: Self-directed brokerage accounts often offer more flexibility than managed accounts when it comes to available investment options.

Possible drawbacks:

Domain Moneyâs offerings

Also Check: Invest In Ripple Company Stock

What Types Of Investments Will A Managed Broker Account Hold

Various brokerage companies offer different types of managed broker accounts. With some, your broker will select a group of individual stocks, dividing your investment capital across them in order to build a diversified portfolio. Most brokers will have an internal team of professional portfolio managers whose job it is to evaluate many different stocks and pick the ones that the team believes have the best prospects for success.

However, other managed broker accounts specialize in investing solely in mutual funds or exchange-traded funds. Here, the use of funds automatically makes the portfolio well-diversified, and the nature of the management services provided centers on the decisions of how much money to allocate to each fund rather than picking specific winning stocks.

Both approaches have their pros and cons, but as you’ll see below, it’s important to ask the right questions to make sure that you’re not getting taken advantage of by a prospective brokerage company.

Our Solution To Tax Drag

Many investors dont realize how consequential taxes can be to their long term goals.

Important Information

Information provided by SEI Investments Management Corporation , a wholly owned subsidiary of SEI Investments Company

Investing involves risk, including possible loss of principal. Diversification may not protect against market risk. For those portfolios of individually managed securities, SEI makes recommendations as to which manager will manage each asset class. SEI may recommend the termination or replacement of a money manager and the investor has the option to move the account assets to another custodian or to change the manager as recommended. SEI is a wholly owned subsidiary of SEIC.

The programs socially responsible investing Guidelines may cause the manager to make or avoid certain investment decisions when it may be disadvantageous to do so. This means that accounts held in the program may underperform other similar investments that do not consider the SRI Guidelines when making investment decisions.

What we do

Read Also: B Of A Investment Banking

The Case For Professional Portfolio Management

John Canally, a CFA charterholder and a TIAA chief portfolio strategist, believes that a well-thought-out long-term strategy is essential to helping investors stay the course through the market’s ups and downs.

“The reality is most of us are not emotionally equipped to make the tough calls during times of significant volatility,” he said. “That’s where an objective process utilizing teams trained to do the right thing under difficult circumstances can really make a difference. For example, when the markets were down 34% in March, portfolio managers were buying equities for those accounts that needed to be repositioned to align with the client’s stated risk tolerance. It’s very hard to do that with your own money. It’s also difficult to sell positions that are down significantly, even though that may be the right thing to do for tax purposes.”

Rising Demand For Bfsi Education And Public Sector Retail And Manufacturing Healthcare Other Will Drive The Managed Siem Services Segment Growth Over The Next Five Years Global Market Analysis For Managed Siem Services Market Including Sales Volume Price Revenue And Market Size By Regions And Top Key Players : Trustwave Controlscan 1440 Security Armorpoint Bluevoyant Bulletproof Clearnetwork Compucom Systems Content Security Corporate Technologies Corserva Sumo Logic Paladion At& t Cybersecurity Redscan Pratum And Many More

The MarketWatch News Department was not involved in the creation of this content.

Jan 18, 2023 —Final Report will add the analysis of the impact of Russia-Ukraine War and COVID-19 on this industry.

“Managed SIEM Services Market” Research Report explains how the market growth has been unfolding over the recent past and what would be the future market projections during the anticipated period from 2023 to 2029. The research divides the global Managed SIEM Services market into different segments of the global market based on types, application, key players, and leading regions.

Managed SIEM Services Market Size is projected to Reach Multimillion USD by 2029, In comparison to 2021, at unexpected CAGR during the forecast Period 2022-2029.

Browse Detailed TOC, Tables and Figures with Charts which is spread across Many Pages that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

Managed SIEM Services Market – Segmentation Analysis:

Which segment is expected to lead the global Managed SIEM Services market during the forecast period?

Based on Type, the market can be classified intoMonitoring, Reporting

What are the key driving factors for the growth of the Managed SIEM Services Market?

Use of BFSI, Education and Public Sector, Retail and Manufacturing, Healthcare, Other and in multiple sectors has led to significant growth in demand for Managed SIEM Services in the market

Customization of the Report

About Us:

Also Check: How To Start An Investment Club With Friends