Why Teenagers Should Also Consider Having A High

While savings accounts arent as exciting as other types of investments, there are advantages to opening one.

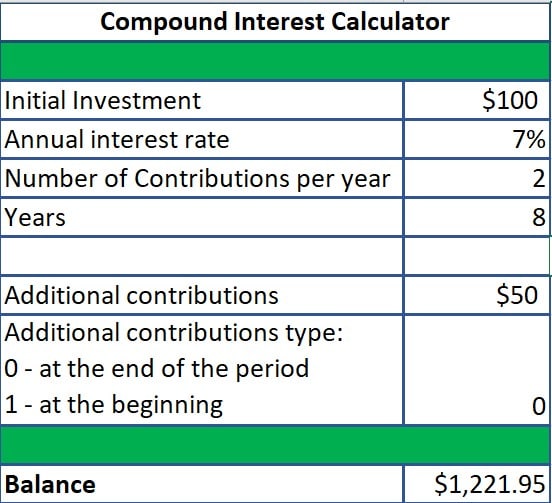

If youre new to managing money, savings accounts are a useful way to start experiencing the benefits of compound interest and practicing restraint from spending money.

Plus, once you open a high-yield savings account, all you have to do to start making profits is leave the money alone. No picking the right stock or fund necessary!

With a high-yield savings account, you can have joint ownership as a teenager, as opposed to a custodial account where you cant access funds until you reach the age of majority.

A high-yield savings account will, as the name suggests, earn you more money than a standard savings account. The average interest rate for savings accounts hovers around 0.09% APY. However, some high-yield savings accounts can more than double that rate. And they can generate even more income over time when benchmark interest rates start heading higher, as they began to in 2022.

When choosing a high-yield savings account, in addition to the interest rate, take into consideration any required fees and the minimum balance amount.

A product acting as a high-yield savings account you might consider with attractive interest rates comes from Greenlight Max.

Brokers That Accept Non Us Residents And Non Us Citizens

Finding a broker that accepts non US resident and non US citizen is the most difficult part for foreigners to invest in the US market. Many people might even think it is not possible to invest in US markets as some of the most popular brokers do not allow non residents to invest.

The good news is, that many brokers allow you to open an account, even if you are not a resident. To name a few you have Interactive Brokers, tastyworks,TD Ameritrade, and Tradestation.

What Is Custodial Account

Thisaccount allows adults, relatives and parents to open investing account for theindividuals under 18. These are great because users can set it up easily, theyoffer scalability to invest in different ways while letting you utilize thecash how you see fit. It is beneficial for children. These teens are in controlof the account until they reach to the age of 21 or 18 as per the laws of thestate. When they approach it, they can request it. These users are able to makewithdrawals at any time so long as it is utilized for the benefit of children.

Recommended Reading: Wells Fargo Real Estate Investment Banking

Recommended Reading: Phoenix Real Estate Investment Group

Account Type #: Custodial Account

A custodial account is a type of financial account that an adult maintains for another person, usually a child. Many parents open a custodial brokerage account to invest for their teens.

Importantly, custodial accounts can hold a variety of assetsstocks and bonds, sure, but also CDs, insurance contracts, even antiques and collectibles.

The money in these accounts is controlled by a custodian, typically a parent. The teen or child doesnt have access to the funds until he or she reaches that states age of majority. Depending on the state, that age might be 18, 21 or even 25.

Custodial accounts allow custodians to control assets for the benefit of the minor without the need for setting up a special trust fund, which has its own advantages but is a far more complicated process.

Whereas assets in a joint brokerage account are co-owned by the child and the custodian, assets in custodial accounts irrevocably belong to the minor.

However, the listed custodian can complete transactions on the minors behalf until they are of legal age to take over the account and its investments as a young adult.

You can use money from the account for any purpose that benefits the child.

Start With Index Funds in an Acorns Early Account

- Price: $5/month for Acorns Family

If youre beginning your investing journey and wish to start by following a buy-and-hold strategy, consider investing in index funds.

You can diversify across several types of assets to help smooth out your returns over time.

Tell Your Teenagers To Try Out Index Funds

Most teens love instant gratification. And learning how to invest isnt always appeasing. So to ensure they remain engaged, allow them to have more control over their investments. While tech stocks are fascinating for many teens, index funds offer a few other benefits.

Investing in a single company causes you to feel every high and low the company experiences. So instead, encourage your teen to invest in index funds.

Theyll still get exposure to their favorite companies. They just wont be tied to one single investment, as the experts at U.S. News discuss.

This is important. And it can make a huge difference, not only in your teens success but also in their attitude towards investing.

If youre not savvy about how to diversify your stocks, that could also be an issue. Can you offer your teen advice to prevent them from dealing with significant stock problems in the future? If not, definitely consider talking to them about index funds.

I recommend putting at least half of your invested dollars in index funds. This way, your teen can feel what its like to invest, without all the risk.

Read Also: Pre Seed Vs Seed Investment

Read Also: How To Invest In Real Estate With Low Capital

Investing For Teens: What Makes Sense

If you are going to be part of the investment decision-making process for a brokerage account, I think it can be OK to bend the rules a bit. If you are building a stock portfolio, you probably want to have at least 20 stocks which would be 5% each of the account, for example. If you are investing $1,000, you may not be able to buy 20 stocks. Sure, you could buy a mutual fund or exchange traded fund for diversification, but that may not be as educational for a young saver.

Would it be a bad idea to put the whole account into one or a few stocks? Maybe not. Especially if the stocks are companies you can relate to and be interested in and learn from while investing, even if you end up under-diversified. That is a personal decision.

Can A Minor Invest In Stocks

The first doubt that every parent may have regarding stock investment for minors is whether their child is eligible for stock market investment. The answer is that there is no minimum age limit set by the Indian legal structure for stock market investment. The law focuses on certain terms and conditions to be followed while investing on behalf of minors.

If a minor is interested and willing to gain exposure to the stock market by himself/herself, they can do so legally. However, before starting off:

Also Check: Best Investment Plan For Nri In India 2020

Open A Custodial Account

In order to do this, you will need to enlist the help of your parents or legal guardian. There are two Acts that provide parents with the right to invest and save money in the name of their child. These are the Uniform Gift to Minors Act and the Uniform Transfer to Minors Act .

With the help of these Acts, you can open a custodial account with your parents as joint holders and begin buying and selling stocks just like you would in a standard brokerage account. Your parents can contribute to this account, and there are no restrictions on the contributions being made.

Once you have attained the legal age required by your state to begin investing on your own, the control of the custodial account and all of its assets will be transferred over to you, and you can then begin investing in it as a legal adult.

Investigate Each Stock Or Company You Consider

When buying stocks, you should investigate every company or stock in mind. You’ll have to look at a company’s metrics to determine whether its stocks are good purchases.

Valuation, for instance, is essential when picking stocks. The valuation includes company profitability, earnings growth prospects, the quality of company management, and many other factors. Furthermore, remember that stock price can differ from the asset’s intrinsic value.

Generally, a stock is a good purchase if:

- The company attached to it has had good growth over the last few quarters.

- Has good leadership.

- Has a good market position .

You May Like: App To Invest Small Amounts Of Money

Us Stock Market: Overview

According to Statista, as of 2020, US Stocks are 54% of the global stock market. That is just one the reason why many individual and corporate investors try to find ways to invest in the US stock markets. Invest in US stocks can be in fact, much easier than what you would think.

The US stock market actually goes way beyond US companies list. Apart from getting your shares of Apple, Microsoft or Amazon, you can actually have access to a huge array of options. Those include companies operating in many countries around the world, ETFs, REITs and more.

Getting access to the US market has gotten fairly simpler in recent years. Now, without a few exceptions, almost anyone, living in most of the countries can invest in US stocks.

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

When you buy shares of stock you’ll have to pay the broker a fee or commission. And because you’re probably investing a small amount of money, you’ll want to keep your commissions as low as possible.

That probably means going through a no-frills online broker. A good choice for a fledgling investor like yourself is , which has no minimum investment, no account minimum and no inactivity fee. It costs just $4 to buy a stock, and you can even buy fractional shares. So, for example, if your soda company costs $12 a share and you want to invest $100, you could buy 8 1/3 shares.

You May Like: Investing In The Stock Market Vs Real Estate

How Old Do You Have To Be To Invest In Stocks

Before you consider signing up for one of the best stock apps on the market and funding your account, youll need to ask yourself, How old do you have to be to invest in stocks?

Well, if you want to invest in the stock market , you have to be an adult, or at least 18 years old to buy stocks.

Minors cant invest in the market by themselves, teenagers under 18 included in that group.

Yes, apps like Robinhood and Webull look like they were practically designed for teenagers trying to invest by themselves, you still cant legally participate in the stock market on your own yet.

If you want to learn how to invest as a teenager or minor under the age of majority in your state, you should open a joint brokerage or custodial account through a number of the best investing apps for beginners.

How To Invest As A Teenager

Investing, essentially, is putting your money into something with the hope of a financial return, and its one of the best ways to build wealth and save for your biggest financial goals, from retirement to your dream home.

While most people start investing as adults, investing as a teen can give you a huge head start on saving for the future and learning vital money lessons.

Investing may sound complicated, but its easier than youd think to get started . In this article, parents and teens will learn the benefit of investing as a teenager, the best investments for this age group, and what accounts you can use to start investing.

Read Also: Invest In Ripple Company Stock

You May Like: How To Invest In Property Without Buying A House

Open These Three Accounts

Broadway recommends three account types for your child.

You dont have to do all three, Broadway advises. Pick one based on what works for you, your financial situation, and the goals you have for your family and your children.

Custodial savings account.

A custodial savings account is the easiest to set up and perfect for anyone whos not ready to start investing yet but wants to put aside money for their children, says Broadway. It can be opened at most banks or credit unions and will let you hold and manage money for your child until they reach the age of maturity.

Custodial investment account.

Another option is a custodial investment account, which is similar to a custodial savings account in that an adult manages the account on behalf of a minor. The only difference is that in this custodial investment account, you are able to actually start making investments for your child, says Broadway. And the barrier for entry is lower than what many people assume. Dont feel like you need a lot of money, she adds. You can literally start investing for $5.

529 college savings plan.

A major draw of a 529 plan is the tax benefits, which may include both federal and state tax write-offs and credits. Different states offer different 529 plans, so be sure to check the details of your states plans on the official College Savings Plans Network website. Some states 529 plans dont even require the owner or beneficiary to be a resident.

Opening And Funding An Account

The first step in buying stock is to open an account and put money in it. Many investment houses will let you open an account by filling in a form on their website. You can fund it by mailing in a check, dropping a check or other form of money off at their offices or by transferring money into the account electronically. If youre a minor, you will have to have your parents open a custodial account for you. This account is legally under your parents control, but the money in it is yours, and your parents cant take money out for their own purposes. Plus, when you reach the age of majority in your state, your parents get taken off of the account.

You May Like: Investment Apps For Non Us Citizens

You May Like: Types Of Investment Management Firms

Choose An Investment Platform

Now you need to choose the right investment platform. You can invest in stocks on the stock market using a variety of investment platforms from companies like Fidelity, Vanguard, and Charles Schwab.

The investment platform you choose allows you to pick stocks and purchase them through a broker. Stock brokers are market professionals who put in your orders to buy or sell stocks at your command without you having to be there in person.

What Age Can You Start Investing In A Tfsa

A minor cannot contribute to a tax-free savings account . Taxpayers do not start to accumulate room in a TFSA until the year they turn 18. That said, many Canadians, and that includes parents or grandparents, have the TFSA room, given the cumulative TFSA limit is up to $81,500 as of January 2022.

A parent or grandparent could contribute your savings to their own TFSA and have it notionally belong to you. They could consider opening a separate TFSA to distinguish the funds from their own or buying different investments within their primary TFSA. By opening a separate TFSA, they could even name a minor as the beneficiary in the event of their death.

Recommended Reading: Minimum Amount To Invest In Gold

Account Type #: Custodial Roth Ira

Have you worked a summer job? Done some babysitting? Tutored some classmates for pay? If so, youve got what the IRS considers earned income.

That means you can contribute the lesser of your earned income or $6,000 per year toward your retirement and invest in a tax-advantaged manner.

Of course, you probably dont have access to a workplace retirement account. That means you can really only contribute to an individual retirement account .

An IRA is a tax-advantaged retirement account that allows you to save money for retirement. You set up an IRA at a financial institution and make contributions that you can invest in a variety of investment choices.

There are two primary types of IRA:

- Traditional IRA: These retirement accounts allow you to contribute pre-tax dollars today. You only pay taxes on the money once you withdraw it, which you are allowed to do without penalty once you retire.

- Roth IRA: These work in the opposite manner. You can only contribute to a Roth IRA with earnings that you have already paid taxes on. However, once you contribute that money, thats itits tax-free while its in your account, nor do you pay taxes once you withdraw it.

Since youre young , you probably pay very little in taxes, or you might not pay taxes at all. As a result, youd want to lock in the low tax rates you pay now by making after-tax retirement account contributions to a Roth IRA.

Just have a look:

What Teens Will Learn About Investing

This article explains how to invest as a teenager by addressing the above mentioned obstacles.

Along the way, we discuss custodial accounts for minors and affordable investments, including stocks, exchange-traded funds , Roth Individual Retirement Accounts , United States Savings Bonds, and Certificates of Deposits . In addition, it briefly addresses the issue of teen investors and taxes a subject often ignored by minors investing in the stock market and other financial assets.

Remember, we are not financial advisors, so you should consult your parents or professional money advisors about investing in any assets. All investments involve a certain amount of risk that should not be ignored.

Before we get into investing under 18, you should consider registering for the TeenVestor Stock Certification Course.

As you are preparing to invest as a teenager, you should also check out our article on 7 Steps to Investing as a Teenager, which outlines the following steps in your journey to becoming a prudent investor:

Gain Basic Knowledge — go to sites that specialize in teaching teens about stocks basics

Stick to Your Interests at the Beginning — looking for companies that suit your interest will keep you engaged later, you can expand your investment universe.

Find out Exactly What Companies Do — you should know the business in which your company of interest is engaged.

Choose an Appropriate Online Broker — online brokers with no fees and no minimum are ideal.

Read Also: Pacific Investment Management Co Llc Newport Beach Ca 92660