Use Conservative Estimates For Expenses

Heres the most common rookie mistake and real estate investing risk: underestimating expenses.

New investors get starry-eyed when first evaluating rental properties, and they fail to adequately forecast costs like:

- Accounting, bookkeeping, travel, and other miscellaneous expenses

A propertys cash flow is not rent minus the mortgage payment. Its rent minus all the expenses above, and then minus the mortgage payment.

Just because vacancies and major repairs dont happen every month doesnt mean you can ignore them. Theyre irregular but extremely expensive, so you have to take the long-term average cost to account for it in your monthly cash flow. For example, if the property turns over once a year, and sits vacant for one month while you repaint and advertise it for rent, thats a roughly 8% vacancy rate.

Read up on how to accurately forecast rental property returns, and get a sense for how real estate cash flow looks visually. Then, for each prospective rental investment, run the numbers through our free rental cash flow calculator.

As a general rule, non-mortgage expenses come to around 50% of the rent. This rule is creatively known as the 50% Rule. And creatively named or not, it holds true remarkably often.

Best Low Risk Real Estate Investments

When investors think real estate, low-risk is not always the first thing that comes to mind. However, there are several real estate strategies that are thought to be lower risk when compared to other investment types. These investments can be a great way to increase your reward, while still shouldering a minimal amount of risk. Here are the best low risk real estate investment types:

Long-Term Rental Properties

Multi-Family Homes

Real Estate Investment Trusts

Real estate investment trusts, more commonly known as REITs, are something like mutual funds that hold real estate. They mostly concentrate on the large properties, including office buildings, shopping centers, large apartment complexes, industrial facilities, warehouse space, and other property types.

They give small investors an opportunity to invest money in large commercial real estate projects, once reserved only for the wealthy and for institutional investors.

Overall, the long-term performance of REITs has been equal to or even slightly better than the performance on the S& P 500 index.

Theyre becoming increasingly popular among investors and even robo-advisors, not only because of high yields, but also because they add an alternative investment component to a portfolio.

Real estate is, after all, a hard asset. It even has the potential to perform well when the financial markets are wobbling. REITs are legally required to return at least 90% of their net income to their shareholders as distributions.

Whats more, since real estate involves depreciation, some of the income received may be tax-free. And in addition to the income from dividend distributions, there can be capital appreciation from the sale of the underlying properties.

According to the FTSE Nareit All REITs Index, the current yield on REITs is 3.97%. And that doesnt include the capital appreciation the funds offer.

Real Estate Winners

Also Check: Esg Vs Socially Responsible Investing

Tip #: Dont Put All Your Eggs In One Basket

Before the pandemic it was typical to see high-net-worth investors, acting independently, purchase their own properties. Post-pandemic, many investors have decided that the health crisis and economic headwinds are just too great for them to justify putting all their eggs in one basket that is, a property or properties that they own solely.

Its a timeless defensive strategy to diversify real estate investment capital into multiple properties in multiple geographic locations in multiple asset classes and with multiple tenants. This can be accomplished easily through a range of DST, tenant-in-common or limited liability corporation investments, though the tax treatment of these structures is different.

Although diversification does not guarantee profits or protection against losses, many investors are realizing that its just as prudent to diversify their real estate portfolios as it is to diversify their stock portfolios. For example, instead of purchasing one 100-unit property in Nashville, an investor can diversify his or her capital across 5,000 multifamily units in 15 different multifamily communities in nine different states, using DSTs. Or instead of purchasing one net lease pharmacy building for $5 million, an investor can diversify his or her capital across 12 different single-tenant net lease properties consisting of pharmacies, e-commerce industrial distribution facilities, discount stores, dialysis clinics, auto parts stores and more.

Real Estate Etfs And Mutual Funds

Investing in funds is an indirect way to invest in real estate. You actually own shares of the ETF or mutual fund, but you do not have direct ownership of the real estate itself. The funds invest in the shares of companies that are in the real estate business.

Why invest in real estate using ETFs and Mutual Funds?

The funds invest in the stock of builders and developers, building material suppliers, or even in REITs. They have the advantage of the highly liquid and are perfect for investment portfolios of all types, including retirement plans.

The downside of real estate ETFs and mutual funds which is true of nearly all real estate related investments is that they run with real estate cycles. When the real estate market is doing very well, they can be incredibly profitable. But when real estate is in one of its bust cycles, they can be one of the worst investments possible.

Also Check: Interest Rates Mortgage Investment Property

How To Get Started With Roofstock

Getting started with Roofstock is rather straightforward. Signing up is free you only need an email address and phone number.

After signing up, you can browse rental properties or list your own. Roofstock can also be a broker or agency.

Roofstock also provides property management services. The site connects you to property managers. This is part of the platforms mission to make property management easier for real estate investors you dont have to be a hands-on landlord.

Buying A Vacation Home Or A Second Home

Similar to the previous strategy, if you want to become a real estate investor nearly risk-free, you could consider the option of buying a vacation home or a second home and renting it out for the period when you dont reside in it. If you have already been thinking about buying a vacation home in one of the top tourist destinations in order to enjoy a homey experience during your annual vacation, why not rent this second home out for the rest of the year? Again, this rental strategy is one of the low risk investments in the real estate business because you are buying a property anyway. Its not like you have to get yourself into an additional mortgage with payments you might not be able to make. Actually, renting out your second home will only make paying the mortgage for it easier than otherwise.

Related: The 7 Best Places to Buy a Vacation Home in Florida

Read Also: How To Create A Real Estate Investment Trust

Is Real Estate A Good Place To Invest

Does investing in real estate make sense for you? Youll need to ask yourself what kind of investor youre willing to be. You can make a lot of money in each kind of real estate investment, so its more a question of your financial position and your willingness to do whats necessary. The type of investment should match your temperament and skills, if at all possible.

In particular, potential investors should ask themselves questions across three broad areas:

- Financial resources: Do you have the resources to invest in a given real estate investment? There are opportunities at every investment level. Do you have the resources to pay a mortgage if a tenant cant? How much do you depend on your day job to keep the investment going?

- Willingness: Do you have the desire to act as a landlord? Are you willing to work with tenants and understand the rental laws in your area? Or would you prefer to analyze deals or investments such as REITs or those on an online platform? Do you want to meet the demands of running a house-flipping business?

- Knowledge and skills: While many investors can learn on the job, do you have special skills that make you better-suited to one type of investment than another? Can you analyze stocks and construct an attractive portfolio? Can you repair your rental property or fix a flipper and save a bundle on paying professionals?

Ways To Lower Your Real Estate Investing Risks As A Landlord

by G. Brian Davis | Last updated Jul 2, 2020 | Advertising & Tenant Screening, General Property Management, Leasing Issues, Real Estate Investing, Spark Blog |

One of the great advantages to real estate versus stocks is the predictability of real estate investing returns.

When you buy a rental property, you can accurately predict your average annual yield and cash flow. And while I love stocks too, theyre as volatile as a bipolar teenager with raging hormones.

Still, the risks of real estate investing are real enough in their own right. From bad tenants to bad cash flow to bad contractors, anyone looking to buy rentals needs to plan for and mitigate common real estate investing risks.

Here are eleven ways to mitigate the risks of real estate investing, to always come out ahead when buying rental properties.

Read Also: Macy’s Inc 401k Retirement Investment Plan

Purchase Money Mortgage/seller Financing

The first proven way to invest in real estate with no money is through seller financing. When buyers are unable to secure a loan from financial institutions, they may opt to seek real estate financing from the sellers. With conventional real estate transactions, the buyers will provide the sellers with the cash, to gain ownership of the property. However, with a purchase money mortgage, the seller extends finances to the buyer. The buyers will then repay the sellers, for the agreed terms.

How To Find Low Risk Investments When Buying Rental Property

What is the best option for your cash investment?Low risk investmentsthat provide a high return on investment, of course! Thats why so many successful investors turn to real estate investing in rental properties.

But what about all of the horror stories youve heard about real estate investors losing tons of money from rental properties? Theyre probably rushing into your mind as you hear Buying rental property is one of the best options for low risk investments.

The reason these stories exist? Every decision a real estate investor makes when buying rental property affects whether it will be a low risk cash investment or not. So, if a real estate investor does not learn exactly how to find low risk investments when buying rental property, his/her real estate investment can fail.

Still, rental properties can be the best low risk investments.

Don’t Miss: Real Estate Investment Houston Texas

Learn Real Estate Investing For Beginners

If youre ready to start investing in real estate, the next step is to make a plan, figure out your financing, and find the perfect property. Learn how to do these things here: How to Get Into Real Estate.

With rumors of a recession on the horizon, some would-be real estate investors worry about whether now is the right time. To learn if you should get started right away or wait until later, read, Is Real Estate a Good Investment in 2022?

How Can I Lower Risk Overall

Do the Math

First and foremost, the best way to lower risk is to find the right property before investing. There are a plethora of tools available to you which can allow you to run the right real estate analytics and properly study up on your investmentâs potential. Overall, your aim is to find low risk high yield investments. You can use tools like Mashvisorâs Property Finder, coupled with our rental property analysis calculator. This will give you very clear numbers on your expected return on investment, thereby giving you a fuller image before investing. The higher your anticipated return on investment, the lower your overall risk.

Related: What Is a Good Return on Investment for Real Estate?

Find Good Tenants â and Lock Them In

One of the best ways to guarantee consistent cash flow is to lock in good tenants with a long-term lease. If avoiding risk is your primary concern, you can consider negotiating favorable terms with your tenants. This can lead to a situation wherein they are satisfied with their benefits, and youâre offered security for years to come. A mutually beneficial lease can provide you with years of consistent rental income and lower your risk overall.

Have a Backup Plan

Diversify Your Assets

Real estate market trends are ever-changing, and some slumps are to be anticipated every now and then. By having a diversified portfolio of assets, you can ensure that your other assets can lift you through a slump in any of the others.

Don’t Miss: Investment Property Loans No Money Down

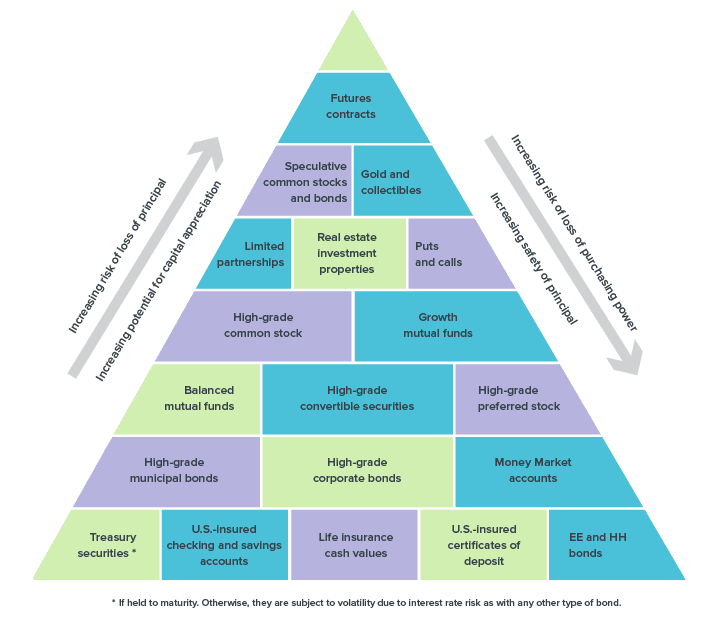

What Are The Safest Investments

The safest investments are those that provide a guaranteed value, or something close to it, with a steady income. Unfortunately, since there is little or no risk of loss of principal, these types of investments also tend to provide the lowest yields.

The safest investments include high-yield savings accounts, money market accounts, certificates of deposit, and short-term US Treasury securities. The principal value of the investment is guaranteed by the bank, the US government, or by FDIC insurance.

Because of the high degree of safety, returns on the safest investments are typically no more than 2% per year.

What Type Of Real Estate Is Not An Investment

This investment list covers most forms of real estate investing but the one that didnt make the list? Your primary residence.

Homeownership can help boost your net worth, and there are multiple strategies to use your house as a way to help earn you income. But by itself, homeownership isnt an asset.

Owning a home is expensiveyou pay for repairs, taxes, insurance, and monthly mortgage. Most people dont live in one house long enough to pay off their mortgage, so the cost is comparable to or more than renting.

Of course, you can get lucky. You may make a tidy profit when you sell your house . But honestly, you might be surprised that your house profit isn’t much better than if you simply rented. See this buy vs. rent a house comparison.

Most people shouldnt count on their primary house as a cornerstone of their investment property. Dont fall into the trap of becoming house poor, or buying a house you really cant afford, by fooling yourself that its an investment that will always pay off in the future.

Recommended Reading: How To Invest Money In Gold

Cons Of Real Estate Companies Vs Regular Real Estate Investing

However, there are also a few disadvantages. These include:

- Slow returns: Property may be a solid way to make money, but it isnt the most rapid one. Often renovations must be done before the property itself sees a profit and in turn, you see one as well. If youre looking to realize a profit right away, consider an investment property thats already tenant-occupied or a REIT both will provide quick cash flow.

- Accessibility: While new investors can find a home with real estate companies, they wont be able to do so with all such companies. Many deals are inaccessible unless you have $1 million in assets or at least $200,000 in annual income and these can be the choice opportunities. This isnt a deal-breaker but something to know as you start out.

- Risky asset class: While risk is mitigated by the lower amount of investment here, the fact that real estate company deals are backed by just one asset does amp up the risk a bit. If rents plunge, for example, you will feel the sting.

- Lack of liquidity: If you need the money now, you cant simply sell a building. In fact, if youre investing through a real estate company, expect to commit to at least 3 years. That means you wont be accessing tons of cash any time soon.

Take Advantage Of Compounding Interest

Compounding interest is one of the most powerful concepts in finance, and its a great way to grow your wealth with minimal risk. When you earn interest on an investment, that interest can then be reinvested, so you earn even more interest! This process continues over time, creating whats known as compound returns.

The power of compounding really starts to kick in after several years of investing. After 10-15 years, youll likely see much higher returns than if you had just left your money alone without taking advantage of compounding. The longer you invest, the more significant the impact will be.

In addition, compounding can help you manage risk. Since your investment is growing over time, it has more potential to withstand market downturns and still turn a profit. This helps reduce the overall volatility of your portfolio, which can help keep you from selling when the markets are down and locking in losses.

You May Like: Best Type Of Loan For Investment Property

By Owning Shares Of Real Estate Investment Trusts

A REIT is a real estate investment trust. REITs have several advantages, the foremost being liquidity. If you own 20% of an apartment building, you cannot get your money out unless someone else buys your share or the property is sold. When you own shares in a real estate trust, it is generally as easily sold like shares of stock. You can buy targeted real estate investment trusts such as those in firms that build medical buildings, nursing homes, malls, and industrial parks. It is easier to diversify your holdings by owning a variety of REITs, and you never have to manage anything.

The modest downside is that they take a chunk of the profits in administrative overhead before distributing the remainder to shareholders. A related financial product is the real estate mutual fund. These mutual funds are more liquid than REIT shares. They are more diversified, too. They may invest in REITs, the publicly traded shares of homebuilders, and companies that sell building supplies. Real estate ETFs are simply ETFs that invest in the same sorts of businesses. A REIT ETF is an E TF that invests in REITs. You’ll have lower returns, but there is less risk than investing in a REIT. In every case, you don’t have to invest in real estate directly, much less manage it.

References