Trxt Charges 045% More Than Schz

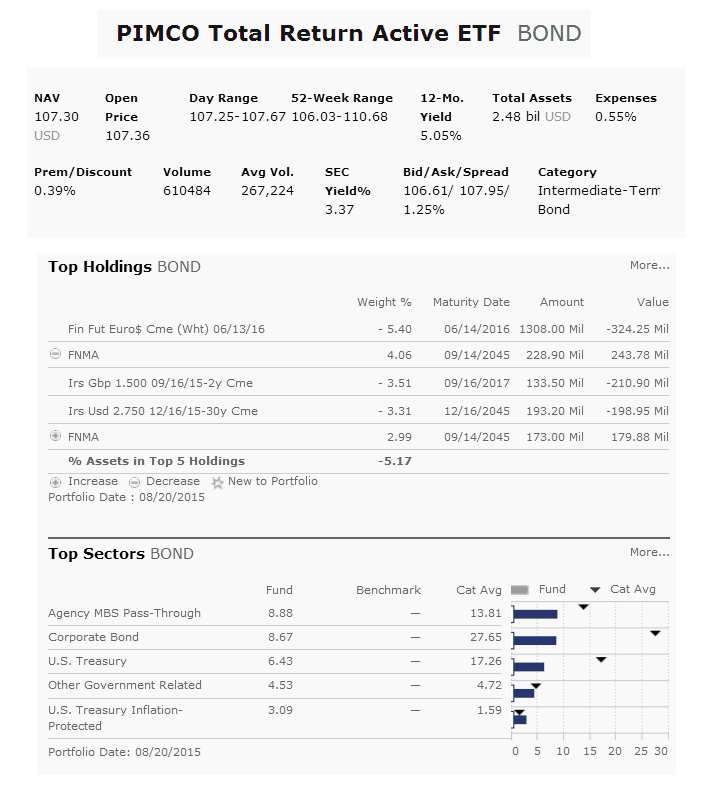

PIMCOs TRXT will be benchmarked against the Barclays Capital U.S. Aggregate Bond Index, a benchmark that measures the performance of the investment grade bond market in the U.S. Currently, there are four different ETFs that seek to replicate that exact same index, including funds from Vanguard , iShares , State Street , and Charles Schwab . Of those, SCHZ is the cheapest option available with an expense ratio of just 0.10%. By comparison, TRXT will charge 0.55%.

In other words, TRXT needs to beat its benchmark by about 55 basis points every year just to match the returns that SCHZ can be expected to deliver. Thats a potentially tall alpha hurdle to clear, especially in a low interest rate environment where returns to investment grade fixed income securities are relatively low.

The 7 Best Pimco Funds

Bond-management powerhouse Pimco has more than Bill Gross to crow about. We profile its seven best mutual funds.

With $2 trillion under management and new money pouring into Pimcos funds, you might worry that the company is bound to stumble. But there are reasons to believe Pimco can maintain its terrific record. Chris Sawyer, an analyst for Litman Gregory, which publishes the No-Load Fund Analyst newsletter, says that Gross and the Pimco team seem to be aware of the pitfalls of resting on their past successes. He demands excellence of his colleagues and expects his colleagues to demand that of him, Sawyer says. And although Pimco has tended to excel in part by making superb calls on the big economic picture, its funds dont bet the farm on any one particular economic prediction. Theyll hold a range of bets at any given moment making big flameouts unlikely.

Pimco Funds Like The Total Return Fund Have Been A Way For People To Invest In Bonds For Decades Is A Pimco Fund Right For You

Pacific Investment Management Company, better known as PIMCO, is one of the largest investment management firms in the world, with more than $1.2 trillion in assets under management. Since its founding in 1971, PIMCO funds have been largely based on fixed-income investments in bonds.

For many years, the PIMCO Total Return Fund was far and away the largest bond fund in the world, though it was recently passed by a Vanguard index-based bond fund when PIMCO co-founder and longtime fund manager Bill Gross left in late 2014.

Besides the Total Return Fund — which you can learn more about here — PIMCO manages a number of fixed-income and equity mutual funds, ETFs, and closed-end funds. Is one of them right for you? Let’s take a closer look.

Is a bond fund the right fit for your needs? Considering that bonds are the company’s bread and butter, let’s focus here. Interest rates have begun creeping up, but still remain well below historical averages, putting a damper on bond yields. However, it’s important to remember that fixed-income investments are intended to offer more than just income, but also more stable capital value:

Dividends for stocks and interest payments for bonds provide significant sources of return:

PTTRX Total Return Price data by YCharts.

As you can see, interest and dividend payments significantly boost the returns for both bonds and stocks.

Read Also: How To Invest In Fixed Income Bonds

Pimco’s Total Return Fund

The company’s Total Return Fund seeks to maximize capital while preserving capital. The fund, established in 1987, emphasizes higher-quality, intermediate-term bonds and is more globally diversified, therefore aiming to reduce concentration risk. The fund also has flexibility that helps respond to changing economic conditions.

The fund pays a monthly dividend and covers the U.S. investment-grade, fixed-rate bond market with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Who Is The Manager Of Pimco Total Return Fund

The fund, which is managed by Pacific Investment Management Company LLC , a member of the Allianz Group and one of the top 10 asset managers in the world with about $1.6 trillion in assets under management, seeks to achieve a maximum total return, consistent with the preservation of capital and prudent investment management.

You May Like: What Is The Interest Rate On Investment Property Loans

Read Also: Setting Up An Llc For Personal Investments

The Pimco Total Return Fund Remains One Of The Largest Mutual Funds And A Big Way To Invest In Bonds Does It Make Sense For You That Depends

For years, the PIMCO Total Return Fund, which describes itself as “a true core bond holding,” was the largest mutual fund in the U.S., peaking with almost $300 billion in net assets in 2013. It remains one of the largest mutual funds, with more than $110 billion in assets, but it has fallen from grace over the past few years, as interest rates are at historical lows and longtime fund-manager Bill Gross is no longer at the firm.

However, investing in bonds is about much more than capturing the interest payment. Not holding bonds could leave you exposed to a lot more risk than you realize. With that in mind, let’s take a closer look at the PIMCO Total Return Fund and see why an investor would want to hold bonds in their portfolio — even in today’s low-yield environment.

Dismissing bonds out of hand today could lead to a hard lesson down the road about the importance of fixed-income assets in your mix.

Image source: Getty Images.

Why hold bonds? Investing in bonds is about risk mitigation as much as anything else. Using the Total Return Fund as a stand-in for bonds in general, here’s a look at how bonds have performed versus the S& P 500 over the past 34 years:

But that’s only part of the story, because the chart above doesn’t show the value paid to you in interest, measured as dividends when you invest in a bond fund:

That’s where bonds pay off: capital preservation.

Furthermore, it depends on which kinds of shares you can buy:

Why Pimco High Income Sounds Attractive

The fund objective is set out clearly on PIMCOâs website: it âseeks high current income, with capital appreciation as a secondary objective.â That sounds attractive.

However, it does raise some questions, which, in the case of PIMCO High Income Fund, I think, are particularly pertinent. First, how sustainable is it to seek high current income? Secondly, if capital appreciation is not achieved, what does that mean in practice?

Recommended Reading: How To Invest In A Roth Ira Account

Also Check: How Do You Invest In Ripple

Pimco Investment Grade Corporate Bond

That process has resulted in some remarkably good forecasts, including Kiesels call of the top of the U.S. housing market in 2006, within one month of the overall peak for home prices . Over the past year, Kiesel has turned bullish on real estaterelated sectors, buying up the bonds of Weyerhaeuser, a real estate investment trust that builds homes and owns timberland Masco Corp., which makes building supplies, such as windows and doors and drywall-maker USG Corp.

Those picks have served shareholders handsomely. The fund recently yielded 2.7%, and its 10.5% annualized returns over the past five years place it in the top 1% of all taxable intermediate-bond funds. It even beat Pimco Total Return by 2.2 percentage points per year on average. Watch out, Bill.

Also Check: Average Commission For Investment Advisor

Bill Gross Turns 68 In April

Bill Gross is not only the manager of the Total Return Fund, but also a co-founder of PIMCO back in the 1970s. In other words, hes no spring chicken the bond fund giant will turn 68 in a couple months, so its logical for investors to question how much longer hell be around calling the shots. Gross has said that he has no plans to retire in the near term, so that should give investors some peace of mind. But its worth keeping an eye on in the coming years, as talks for a succession plan come into focus and talk of life after a Gross retirement becomes more meaningful.

So it turns out Warren Buffett might not be the only legendary investor whose succession plans are a topic of discussion in coming years investors will no doubt be keeping a close eye on Gross and any intentions to step aside in the future .

Disclosure: No positions at time of writing.

Don’t Miss: Merrill Edge Guided Investing Fees

Should You Dump Pimco Total Return

Bill Gross is arguably the best bond-fund manager on the planet. But his fund is much too big, and you can find a lot of better alternatives.

Bill Gross’ Pimco Total Return regularly outperforms its peers, but if you still hold it, you might want to sell.

Consider this: From the fund’s inception in mid 1987 through May 23, it has returned an annualized 8.4%. That’s an average of 1.1 percentage points per year better than its benchmark, Barclays Capital U.S. Aggregate Bond index.

Recent performance is even more remarkable. Over the past five years, Total Return ) returned an annualized 8.8%, beating the Barclays index by an average of 2.3 points per year and outperforming 97% of its peers . In the bond world, where performance is measured in basis points , this kind of outperformance is stunning.

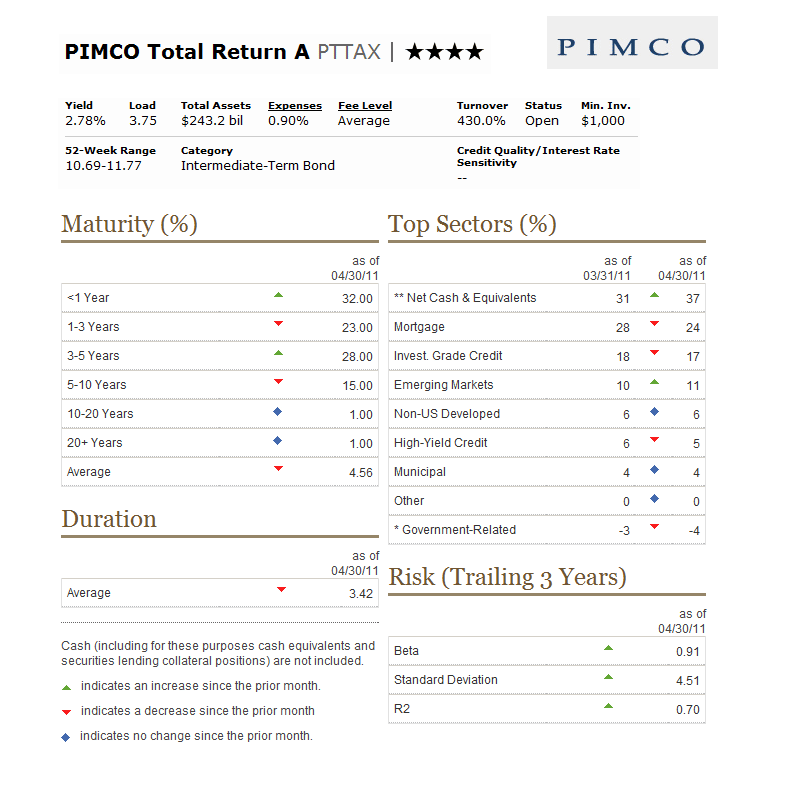

Fees And Expenses At Pimco Total Return

PIMCO Total Return’s annual expenses depend on which share class you own. The institutional class, which is open to 401 plans and other institutional investors, has annual operating expenses of 0.46% and doesn’t charge a sales load. By contrast, the Class A shares available to individual investors include a 0.85% charge for annual expenses. Those who invest less than $100,000 will pay a 3.75% load, with smaller sales charges applying up to the $1 million mark, at which point the load disappears.

Recommended Reading: Guide To Investing In Gold And Silver

Pimco Global Bond Unhedged

The whole world is up for grabs for Scott Mather, manager of Pimco Global Bond Unhedged. Although Mather invests the majority of the funds assets in the developed world, he can also take positions in the debt of emerging-market governments and corporations. And he expects emerging markets to only keep growing in importance for his fund. A lot of the lines that created distinctions between emerging markets and the developed world have blurred, Mather says. Indeed, he says that in many instances emerging countries are now financially healthier than some developed nations.

At the same time, Mathers fund is measured against an index with heavy allocations to developed-market government debt, including European government debt. Although the European Union may be cracking up and many of its members are struggling, Mather says hes finding attractively priced bonds and sectors in Europe. For example, he says, his positions in European covered bonds, which are similar to some types of U.S. mortgage-backed securities, have performed well in recent years. And he has found attractive value in the bonds issued by certain German government agencies, such as the KfW state-sponsored development bank.

You May Like: Bank Of America Chief Investment Officer

Pimco Head Of Total Return And Esg Funds Scott Mather Takes Leave Of Absence

Pacific Investment Management Co. is bolstering the teams that run the Total Return Fund and several other funds as Scott Mather, one of the firm’s longest-tenured executives, takes a personal leave of absence.

Dan Ivascyn, the head of the flagship PIMCO Income Fund, will join the management team for the Total Return Fund, as will Qi Wang, according to a regulatory filing. Other top executives, such as Mike Cudzil, Jerome Schneider, Daniel Hyman and Marc Seidner, will join the management teams of additional vehicles that Mr. Mather helped run, including the Low Duration and Moderate Duration funds and several related ESG funds.

Mr. Mather, 53, joined PIMCO in 1998. He was previously head of global portfolio management and currently serves as chief investment officer of U.S. core strategies. His responsibilities include helping to manage some 27 funds, portfolios and trusts with assets totaling almost $98 billion, according to the most recent data compiled by Bloomberg.

Mr. Mather and Mark Kiesel took over Total Return in September 2014 after PIMCO co-founder and CIO Bill Gross shocked Wall Street by leaving the firm. At the time, Total Return, which Mr. Gross had managed since inception, ranked as the world’s largest bond fund with more than $220 billion of assets. Mohit Mittal later joined the fund’s management team.

PIMCO Income, which had $119.5 billion of assets at the end of August, declined 7.35% after fees in the first eight months.

Related Articles

Don’t Miss: Is Gold A Good Thing To Invest In

Are Pimco Funds A Good Investment

No matter what you are investing in, there will always be some risk involved, even if the rewards can be high. The trick to gaining more money rather than losing it is to invest in the right things at the right time.

One of the more well-known investments currently are those created by Pimco, an investment firm in the USA. But what exactly is Pimco? And how can they make you a profit?

Here we will explain everything you need to know about Pimco, from their founding and history to the strategies they use when investing your money. Read on to find out if this is the right investment opportunity for you.

How We Make Money

We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters.

Also Check: Using Home Equity To Invest In Stock Market

Pimco Total Return Instl Fund Market Info

Recommendations: Buy or sell Pimco Total Return Instl fund?Pimco Total Return Instl forecastsPimco Total Return Instl’sPimco Total Return Instlbearishnegative trendPimco Total Return Instlnot a good investmentnegativewe recommend looking for other projectsbear marketsPimco Total Return InstlNMFQS

What Funds Should I Invest In

With Pimco offering up several funds for potential investors to choose from, picking the right one is extremely important if you want to make a big return on your investment. Here are the best-performing funds currently.

Pimco Municipal Bond A

PMLAX strives to provide a high degree of tax-free income while preserving capital. The majority of PMLAXs assets are invested in debt securities that pay tax-free interest in the United States. About one-fifth of the funds assets could include money market instruments and US government securities.

This product has provided positive total returns for more than ten years. PMLAX has an annual expense ratio of 0.82 percent. The funds one-year and three-year returns are 4.5 percent and 5.4 percent, respectively.

Pimco Diversified Income Fund Class C

The goal of PDICX is to maximize total return on investment, which is similar to capital preservation. The funds assets are primarily invested in a variety of fixed-income instruments with varying maturities. It has the ability to invest in both high-yield and investment-grade securities.

This bonds product has a favorable total return track record of ten years. PDICX has an annual expense ratio of 1.94 percent. The fund has a one-year and three-year return of 4.9 percent and 4.6 percent, respectively.

Pimco Fixed Income SHares: Series M

Pimco RAE US Small Fund Class A

Read Also: Why Is Esg Investing Important

Insider Activity At Pimco California Municipal Income Fund Ii

In related news, insider Thibault Christian Stracke acquired 25,000 shares of the firms stock in a transaction that occurred on Wednesday, September 21st. The stock was bought at an average price of $6.75 per share, for a total transaction of $168,750.00. Following the acquisition, the insider now directly owns 25,000 shares of the companys stock, valued at approximately $168,750. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website.

Chasing Yield Here Can Risk Capital

Imagine that, as a yield hunter, you were offered a savings account with a variable interest rate. While you might end up getting suboptimal yield, you could reassure yourself with the knowledge that at least your capital was safe. Clearly, in a fund like PIMCO High Income, that is not the case.

Look at the chart. The current price of $5.50 is a drop of roughly two-thirds from the $16.39 the shares hit in June 2007. At that price, the shares yielded 8.9%. Today, they yield 10.6%. Itâs a high yield fund, so investors expect a high yield. As distributions are cut, the share price rebases to reflect that fact, and yield continues to look good. But the share price has broadly moved downhill for years, roughly in step with distribution cuts over the past five years.

There have been exceptions, notably around the financial crisis when there was speculation that the distribution would be cut but wasnât. It was during that time I got into the name, before later realising that I had made a mistake of judgment, since in the long-run, the distribution â which looks too good to be sustainable â was indeed too good to be sustainable.

The share price could recover in future. For example, if bond yields pick up, that could result in higher distributions and improved share price. Realistically, though, I do not assess that as probable.

You May Like: Best Cash Out Refinance For Investment Property

Sign Up For Kiplingers Free E

Profit and prosper with the best of Kiplingers expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of Kiplingers expert advice – straight to your e-mail.

What’s more, Gross has continued to put up great numbers even as Total Return’s assets have swelled to $241 billion, making it the world’s biggest mutual fund .Total Return is now bigger than some of the bond-market niches it invests in. Its size is almost triple the $85 billion the fund held in mid 2005 and nearly double the $132 billion it held at the start of 2009.

In addition, another $243 billion resides in more than 65 public and private Pimco-managed funds, including Harbor Bond ), a member of the Kiplinger 25, that are virtually identical to Total Return. So Pimco is managing nearly $500 billion with one strategy. And now the company is getting ready to launch an exchange-traded version of Total Return.

I don’t worry as much about asset bloat as some other fund analysts do. But enough is enough. If you hold Pimco Total Return, sell it. If you don’t, but you want to own a solid bond fund, look for something else.