What Is A Self Directed Ira

In a normal IRA, investors can hold stocks, bonds, certificates of deposit, mutual funds, and exchange-traded funds. However, these retirement accounts do not allow investing in alternative asset classes like partnerships, precious metals, and real estate. With a self directed IRA, or SDIRA, account holders can invest in these asset classes. This serves as the primary difference between a standard IRA and an SDIRA.

As the name suggests, an SDIRA account holder directs the investment decisions in the account. However, the IRS still requires that a separate custodian or trustee administer these accounts. And, whereas most banks offer normal IRAs, only specialized firms provide these SDIRA administration services. Many of these firms also specialize in a particular asset class. For instance, some self directed IRA custodians may only allow investments in precious metals, while others may focus solely on real estate.

Furthermore, SDIRA custodians cannot provide investment or other financial advice to the account holders. As a result, SDIRAs place the research, due diligence, and research burdens on the account holder. These additional burdens mean that SDIRAs are typically only used by savvy investors, people who already have in-depth understanding of the alternative asset class in which theyd like to invest and would like to do so in a tax-advantaged account.

The Pros Of Buying Property With A 401k

The primary benefit of buying investment property via a 401k is that youre able to do so by taking a loan that is both tax-free and penalty-free.

There are other tax benefits worth consideration. For instance, when purchasing a property with a 401k, any income generated from that property will not be taxed. Instead, the income is put directly into the 401k plan. This means that the owner never actually receives the income, but theyll have this income available in their 401k upon retirement.

However, there is one important exception to this rule: loans against a 401k need not be the only investment in a rental property. Lets say you take out the maximum loan amount and then use the proceeds to invest in a property that requires a $200,000 down payment. The property then generates $2,000 per month in rental income. The 401k would be entitled to $500 of that income each month. The remaining funds would be dispersed to other investors accordingly, even if the person investing is the only investor in the deal. In the latter case, the remaining 75% of rental income each month would flow back to him for use as he pleases.

Real Estate Investing Within A Self

Real estate is a popular retirement investment among self-directed IRA investors. Some of the benefits include: owning a tangible asset that can produce a steady income, potential for the investment to appreciate in value, and providing another option for building a balanced and diversified portfolio. Another reason for the rising popularity of real estate investments is its a time-tested hedge against inflation.

Earnings and appreciation from real estate property are tax-deferred if held in a traditional IRA and have the potential to be tax-free if held in a Roth IRA.

Real estate investing also offers multiple investment strategies, including buy-and-hold or flip-and-sell. In addition, there are multiple options for funding your real estate investment. This includes direct purchases, partnering with other investors, and leveraging with a non-recourse loan.

Before investing, it is also important to know the risks and potential pitfalls of owning real estate within an IRA. Speak with an attorney, tax accountant, or investment professional before investing. Review the guidelines and prohibited transaction information available in our real estate guide and Internal Revenue Code 4975.

Also Check: Best Bank Of America Hsa Investment Options

Options For Investing In Real Estate With Your Self

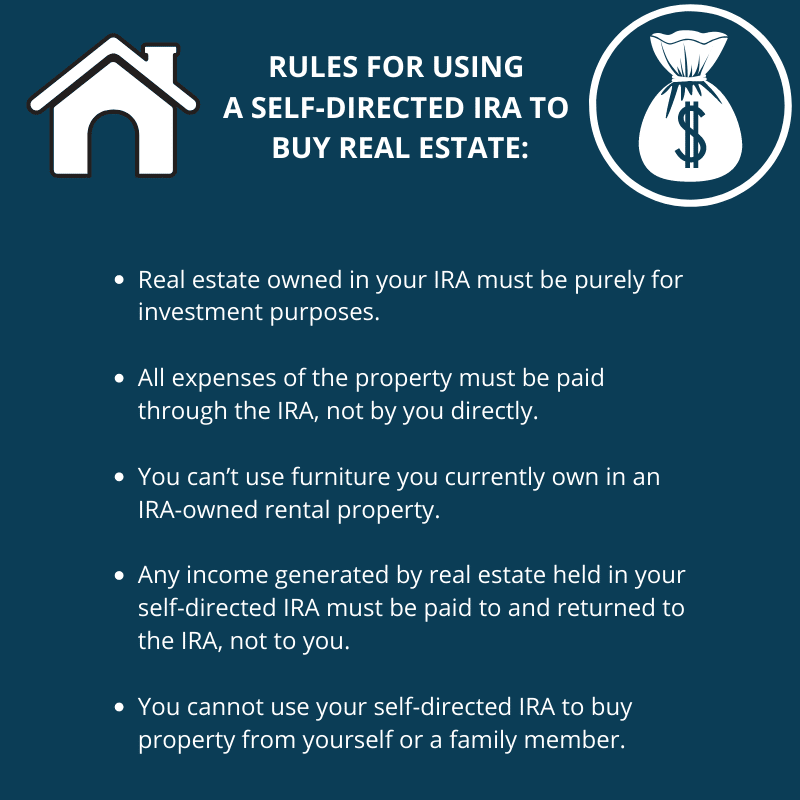

Once youve started your self-directed IRA, the next step is to figure out what kind of real estate investment you want to make. Before you decide to buy an investment property, you must consider a few things. First, you will have to buy the property flat out. You cannot get a mortgage on a property bought by an IRA. You will have to purchase whatever piece of real estate you want in full without financing.

Why? Its because of IRA rules that prevent self-dealing. Remember, IRAs are designed to help you stash your income on a pretax basis until retirement. Accordingly, they have prohibitions on what is known as self-dealing, which is using IRA funds for any immediate tangible benefit. Using your post-tax income to make mortgage payments on a property in your self-directed IRA counts as self-dealing under IRA rules.

Once the property is in your self-directed IRA, you can do one of the following three things:

- You can hold the property until it appreciates and sell it.

- You can upgrade a distressed or outdated property you bought for a low price and then resell it a practice known as flipping.

- You can rent the property on a short- or long-term basis.

Bear in mind that regardless of how you choose to make money with your self-directed IRA real estate, you are prohibited from using anything but the funds in your IRA to make any needed improvements, repairs or pay other property-related expenses.

Ubti And Ubit Exemptions

Typically, IRA investments get penalized if they make investments that use debt . Theyre allowed to make those investments, but some of the income is considered taxable, which defeats the purpose of using the special tax-advantaged real estate accounts in general.

This is called Unrelated Business Taxable Income , and then investors have to pay Unrelated Business Income Tax .

The GREAT news for IRA investors is that Arrived investments are exempt from UBIT. Each Arrived property is taxed as a Real Estate Investment Trust , and as such they are excluded from any UBTI/UBIT scenarios, even though each property utilizes a non-recourse loan.

This is fantastic news for IRA investors! Youre able to invest into individual rental homes- that are each leveraged with 60-70% debt, and there are STILL no tax considerations!

You May Like: What Is The Best Way To Invest In Precious Metals

What Are The Tax Consequences Of An Sdira

If you want to make money, dont be scared to pay taxes. How do you mitigate the risk of getting taxed too high? You either pay when you put the money in or when you take it out. If you buy a house under an SDIRA, you can buy or sell the house without tax.

But heres an example: UVFI / UVIT. UVIT allows you to buy a $200K property you buy with your IRA. If you pay cash, you own it free and clear, and you dont have to worry about UVIT. If you sell the property at $400K, you just made $200K profit tax-free.

On the other hand, if you take a loan with a non-recourse IRA, you have to make a mortgage payment, and youre breaking even. At the end of 2 years, you sell it for $400K. You get $200K of profit, but of that $200K, 50% of the profit goes back to the IRA tax-free, but the other piece that you borrowed money on, youll pay $37K in taxes. The total proceeds going back to your IRA is $163K after tax.

Is that tax scary? Well, you made over 100% profit on whats being taxed, and thats still okay.

Roth Ira Income Limits

You can contribute to a Roth IRA no matter how young or old you are, provided you have earned income. The most you can contribute to a Roth IRA for each of the 2021 and 2022 tax years is:

- $6,000, if you’re under age 50

- $7,000, if you’re age 50 or older

However, there is one income-related reason you might not be able to contribute to a Roth IRA: You make too much money. Your ability to contribute to a Roth IRA is based on your modified adjusted gross income and filing status.

If your MAGI is in the Roth IRA phase-out range, you can contribute a reduced amountbut you can’t contribute anything at all if your MAGI exceeds the upper limit for your filing status. Here’s a rundown for the 2021 and 2022 tax years:

| Filing Status |

|---|

-

Unqualified withdrawals may trigger taxes and penalties

-

Limited investment choices

-

No ability to leverage funds

Read Also: Real Wealth Show Real Estate Investing Podcast

Invest In Real Estate With Retirement Funds

Most retirement funds are invested in accounts through a brokerage firm or bank, which offers limited investment choices. Many people have been conditioned to think that only securitized investments like stocks, bonds, and mutual funds are the only options for investing their retirement dollars. Thats because most IRA administrators only offer products which they sellwhich typically include stocks, bonds and mutual funds. Individuals who are unsatisfied with the returns these accounts earn often look for alternative investments, leading them to discover the self-directed IRA.

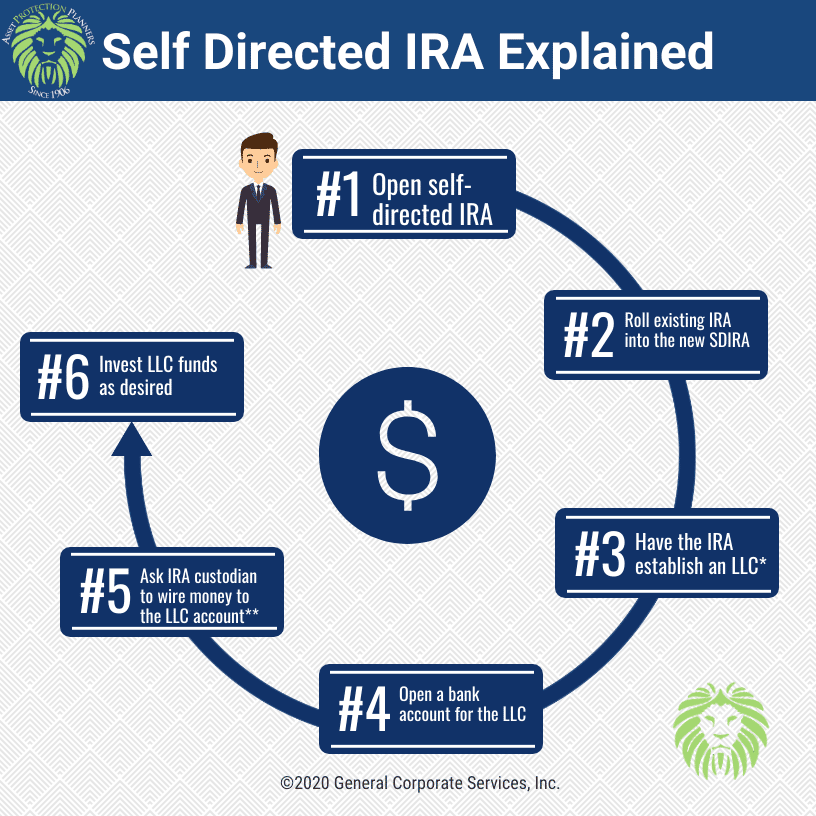

Additionally, individuals learn that by using self-directed IRAs, they can invest in other types of assets they possibly understand much better than those offered at more traditional institutions. Investing in what you know and understand can lead to higher returns within the retirement account. If your current IRA is not self-directed, you can roll over money from your current IRA into a self-directed IRA with no early withdrawal tax penalty. While major investment firms such as Vanguard and Fidelity Investments do not generally offer self-directed IRAs themselves, they will allow the transfer of your IRA funds to an established self-directed IRA custodian.

Learn These Key Real Estate Ira Rules

Investors from all across the country know the value of using an IRAit means tax benefits for the retirement savings they put away. But using an IRA can also mean more than that. With a Self-Directed IRA, a retirement investor can use these tax benefits on a wide variety of retirement assets. And one of the most popular assets for preparing for retirement is simple: real estate.

With real estate, investors can potentially stock away passive income for retirement, using the rent they charge within a real estate asset to generate income even after working. But what about using real estate within a retirement account? To do that, youll have to know some of the ground rules of using a Real Estate IRA the proper way.

What is a Real Estate IRA?

A Real Estate IRA is simply a nickname for a Self-Directed IRA in which the investor holds assets like real estate. For that reason, there is no specific type of IRA that is designed for real estate. You can hold real estate within a Roth IRA, for example, or within a Traditional IRA. The key is in using self-direction by working through a Self-Directed IRA custodian. This custodian can assist with the administration on the account and help execute the buy and sell orders that make it possible for you to hold real estate within the IRA.

Key Real Estate IRA Rules

Don’t Miss: What Is An Impact Investment Fund

Buying Real Estate With A Self

To buy real estate with a self-directed IRA, you first need to set up an account. Many companies allow you to set up an SD-IRA on your own, but these accounts can be complex. It is helpful to have a custodian who can provide guidance as you work your way through the IRS tax code.

Because real estate investments create more of a burden on the custodian, many do not offer real estate as an investment option for IRAs. However, the Internal Revenue Service does allow plans to offer real estate as an option for IRA investments.

Some IRA custodians have more involved fee structures than others. You’ll need to do your research and examine all of the fees and expenses that will impact the full return on your investment.

What Are The Benefits Of Owning Real Estate In An Ira

Using a self-directed IRA to buy real estate comes with the potential for tax benefits. As is the case with any holding in your IRA, the income that goes into your IRA is not taxed until you take withdrawals. If you have a Roth IRA, you pay tax on your income as usual. Then, your investment gains will grow tax-free and can be withdrawn tax-free, as well.

Also Check: Real Estate Investing In Southern California

Why Would Someone Go The Self

Ask yourself, Do I want my entire retirement future to be left in the hands of Wall Street and money managers? Or do I feel confident that I can direct some of my funds and actually know where my money is invested? Some investors believe that giving money managers or Wall Street complete control of their retirement is not the best path for them.

Any Chance We Can Have A Worksheet With The Non

Yes! On a future Thursday, Gregg can go through an example during the property of the Week show. But when meeting with our clients, JWB employs a planning component to view YOUR numbers and YOUR retirement account because no investor is the same. If you want to learn more about SDIRAs, ChatwithJWB.com is a great way to start the conversation.

Don’t Miss: Which Investment Company Has Lowest Fees

Two Ways To Buy A Home With A Self

Self-Directed IRA

A Self-Directed IRA offers an investor more investment options than a financial institution Self-Directed IRA. IRA Financial Trust, a regulated trust company, will serve as the custodian of the IRA. Unlike a typical financial institution, IRA Financial generates fees simply by opening and maintaining IRA accounts and does not offer any financial investment products or platforms. The IRA funds are held with IRA Financial Trust and, at the IRA holders direction, will invest the funds into alternative asset investments, such as real estate.

Self-Directed IRA LLC

The Self-Directed IRA LLC with checkbook control has quickly become the most popular vehicle for investors looking to make alternative assets investments, such as rental real estate, that require a high frequency of transactions. Under the Checkbook IRA format, a limited liability company is created which is funded and owned by the IRA and managed by the IRA holder. The checkbook control Self-Directed IRA allows one to eliminate certain costs and delays often associated with using a full -service IRA custodian. The Checkbook IRA LLC structure allows the investor to act quickly when the right investment opportunity presents itself cost effectively and without delay.

Real Estate Ira Investment Strategies

While you can purchase properties outright, you do not need to have the full purchase amount in your self-directed IRA to buy property. You can use your IRA to get a non-recourse loan to buy investment properties or bring in another IRA or individual to partner on the investment .

Another way to substantially save on fees is to open a self directed IRA LLC. Often called a Checkbook IRA , an IRA LLC is considered one asset with IRAR, meaning you’re charged for a single asset, regardless of how many assets are within the LLC itself. The LLC holds multiple investments, while IRAR holds your LLC as one IRA investment.

Strategies can also include analyzing the type of retirement plan that is best for you based on your retirement goals. Taking distributions from an investment property that was purchased with Roth IRA funds vs Traditional IRA funds has different tax consequences because of the different tax advantages of each account.

These strategies can be mixed and matched in different ways maximizing your investment potential. For example, you can invest through an IRA LLC while partnering with your brother’s self directed account.

When figuring out your strategy to build retirement wealth, it’s smart to seek investment advice from a qualified professional.

Don’t Miss: How To Invest In Cryptocurrency

Pros & Cons Of Using A Self

Now that you understand how to use your self-directed IRA for real estate, its time to decide whether or not its for you. In these next sections, well go over the advantages and disadvantages of this strategy.On one hand, the biggest advocates of self-directed IRA real estate say that they enjoy having more control over their retirement savings. On the other, some might caution that there are considerable restrictions. Keep reading to find out more.

Ner With Another Person To Fund The Purchase

If you dont have enough money in your SDIRA to purchase the property that you want, you can opt to partner with a non-disqualified family member, friend, or colleague. In this type of arrangement, your SDIRA will be purchasing an interest in the property.

For example, if the property in question is $100,000, your SDIRA might purchase a 50% interest for $50,000 and your partner would have the other 50% interest and supply the other $50,000 to make the purchase. All income and expenses will then be divided according to each partys percentage of ownership if your SDIRA has a 50% interest, you will earn 50% of income and pay 50% of the expenses out of your SDIRA.

You May Like: Where To Find Stocks To Invest In

The Most Overlooked Opportunityin Real Estate

Real estate is the most common asset for self-directed accounts. IRAs can own single family rentals, flips, LLC interests in partnerships owning real estate and private funds and offerings of real estate.

When your IRA or IRA/LLC owns real estate it receives the income and pays the expenses. And the income or gain from the sale goes back into the IRA with zero tax .

There are important management and operational rules new self-directed IRA owners must learn when managing their rental properties and other real estate owned by their IRA.

The quick start guide breaks down the options and the key considerations and rules to know when using an IRA or other self-directed retirement account to invest in real estate.