Types Of Joint Venture Agreements

There are different types of joint venture agreements which you can make. They would depend mainly on the purpose of the joint venture and the objectives it is meant to achieve. In any case, a joint venture would have to be agreed upon by two separate parties who want to achieve the same goal for their own benefit. Here are the different types of joint ventures:

State The Terms Of Your Partnership

Like every standard agreement, write down the terms of your partnership. Enumerating each ones roles in the partnership is the secret to a successful career in real estate. The functions should be both agreed upon by the two of you to make sure that you see eye to eye about the parts each one of you will play.

What Is A Joint Venture In Real Estate

A joint venture in real estate is when two or more investors combine their resources for a property development or investment. Despite working together, each party maintains their own unique business identity while working together on a deal. Therefore, even though a joint venture sounds like a partnership, its a little bit different.

To avoid any confusion, lets compare the two:

Who does what in a joint venture is decided on a project-by-project basis. Furthermore, the share of the profits is also agreed upon by the parties involved.

You May Like: Is Sofi A Good Investment

How A Joint Venture Agreement Works

However, what remains the same, regardless of industry, is that the key players in a joint venture must ensure their best interests are considered. Each member of a joint venture creates an agreement that is binding by law. They share an obligation to one another within the venture that is outlined in the agreement.

Who Are The Parties

The General Partner can either be a legal title or a description for a Manager who has many of the same rights and responsibilities. Essentially, a general partner is the organizer who is assembling the real estate investment and is responsible for the overall success of the project. Typical duties would include placing a property under contract, coordinating the debt, signing any personal guarantees if needed, obtaining bids for renovation or construction work, calculating equity returns and compiling investor equity to execute the plan.

The Limited Partner need not be a true LP in a Limited Partnership, but can be referred to as anyone who invests passive capital and limits their own responsibility for decision making. These investors can be individuals, LLCs, equity groups, pension funds, university endowments, etc. The key factor is an investor who has more capital than time or expertise. They trade some return for the ability to passively invest.

Typically, the general partner will arrange every aspect of the investment, from hiring inspectors, drafting legal documents, and setting the total project return and profit splits. While its important to trust the general partner, every participant has an obligation to carefully review and understand the binding legal reality.

You May Like: Apply For Investment Property Loan

Enter Agreements With Joint Ventures Wisely

Joint venture Agreements are great when you need cash now or can’t qualify for financing. They also enable you to work with someone who can bring something to the table you can’t. But in any case, always make sure you carefully consider everything before entering into one.As always, if you have any questions about this article please do not hesitate to ask. If you’re wondering whether a joint venture arrangement is right for you or have questions about setting up a venture-specific LLC, contact us today.

Simple Joint Venture Agreement

You may think of a simple joint venture agreement as the standard, most flexible type of JV contract. Parties could use this type of joint venture contract can meet the different needs of the underlying parties. Some popular uses of a simple joint venture agreement may include:

- producing a special event

- introducing a party to new markets

- collaborating with designers or manufacturers to produce a new product line

- licensing and contributing the limited use of intellectual property to a project

- reducing competition and price demands for starting a business project on your own

- achieving other business expansion goals

Simple Joint Venture Agreement Example

A company produces a popular widget. Theyve done some market research and believe their product would do well in a country where they dont currently have a principal place of business. The company is hesitant to immediately enter the new market because it would require extensive capital costs and compliance with regulatory demands. To reduce these costs, the company enters into a simple joint venture agreement with a domestic company to sell the product in the new market.

You May Like: Alternative Investments Instruments Performance Benchmarks And Strategies

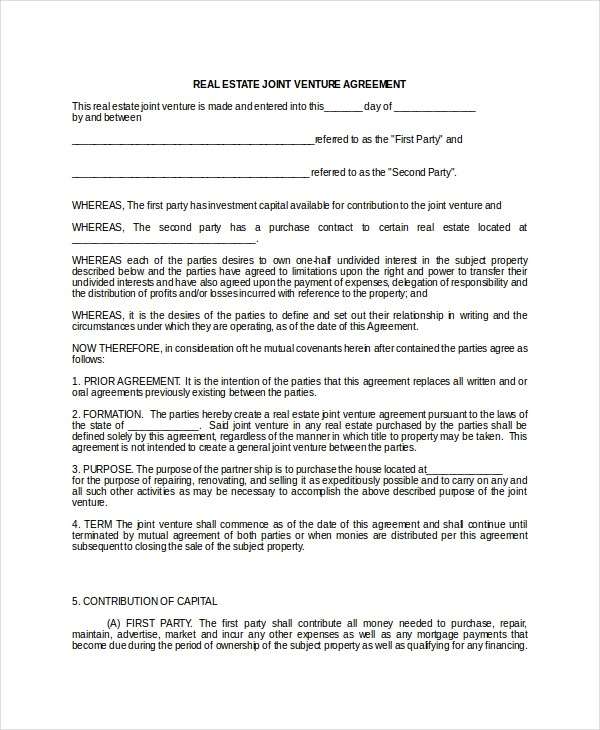

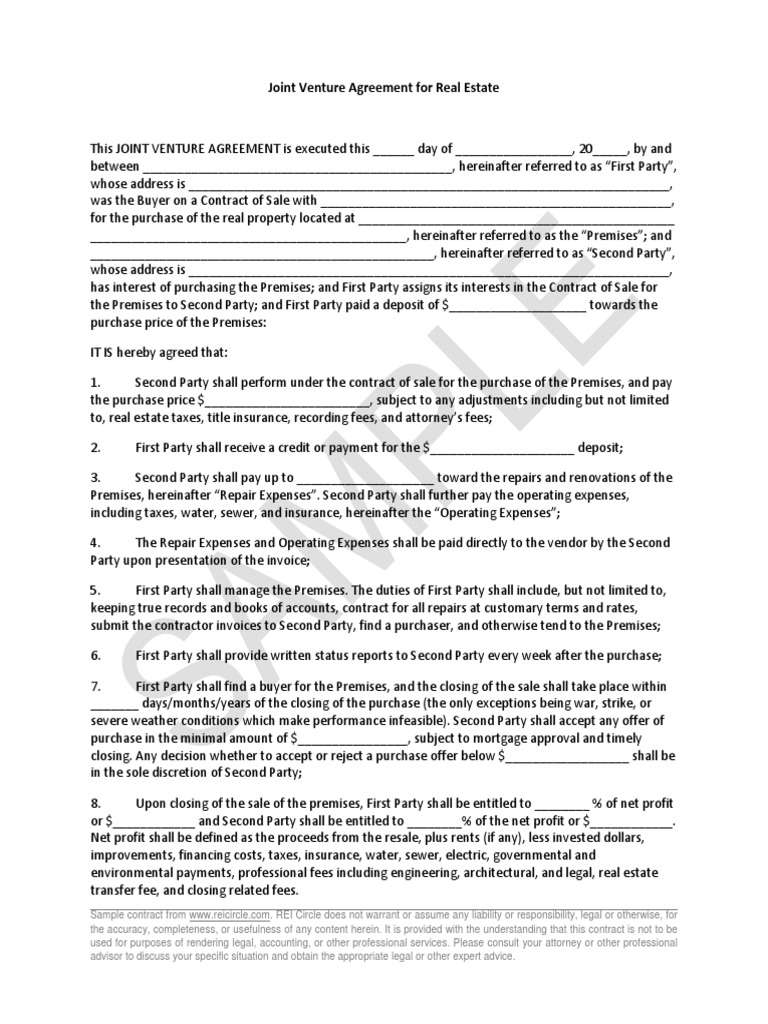

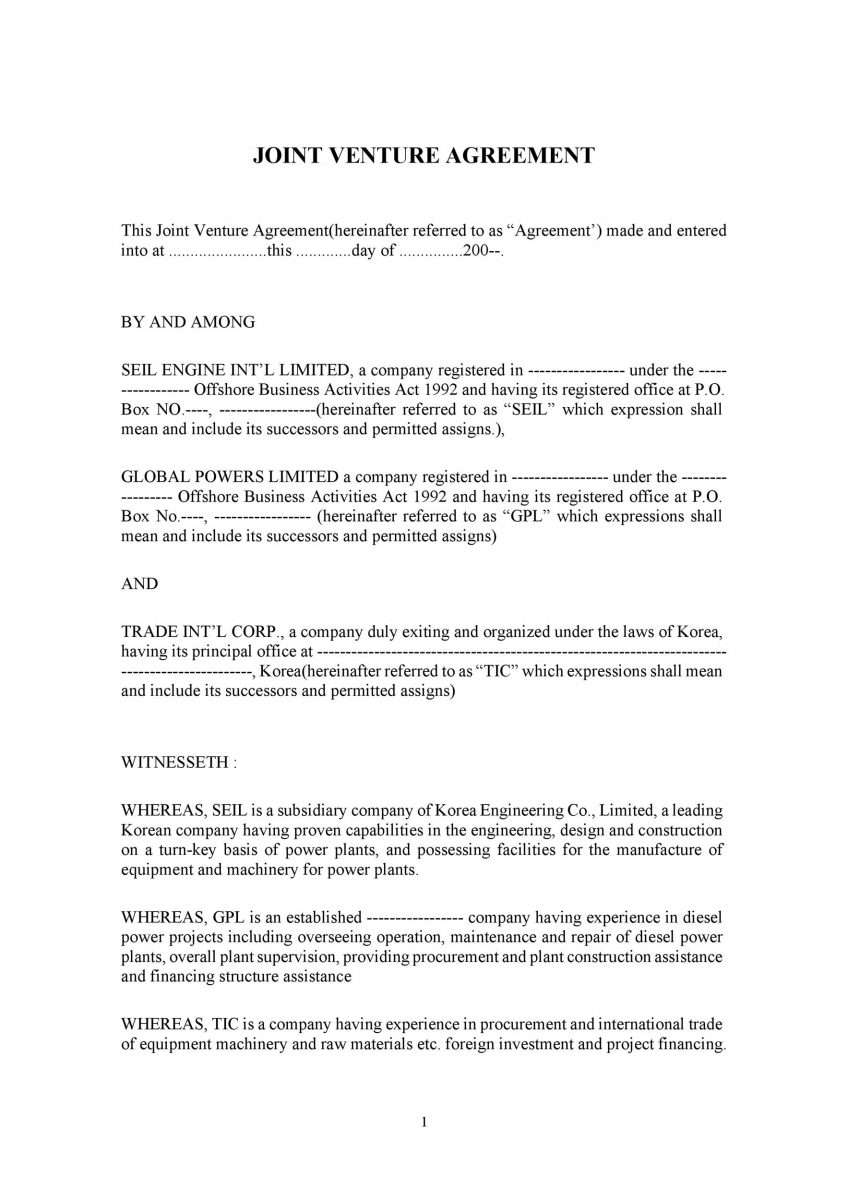

Sample Joint Venture Agreements

Below are our free joint venture agreement template samples, including a real estate joint venture agreement form. You can download them as a Word doc or PDF. As a disclaimer, these forms are examples meant for general education purposes and will require modifications to meet the necessary terms of your joint venture. If you have any questions about the forms or the joint venture agreements, please consider a consultation with one of our attorneys.

Our Key Takeaways On Jv Contract Agreements

JV contract agreements are a useful tool for entering into new or temporary business relationships that are mutually beneficial. However, these partnerships often require assistance from experienced attorneys and professionals to help protect the rights and interests of involved parties.

Creating an enforceable written agreement provides the necessary structure to the partnership and avoids confusion over key terms like capital contributions, profit sharing, dispute resolution, and other covenants.

Don’t Miss: Can I Invest In A Private Company

How To Evaluate A Real Estate Joint Venture

Commercial real estate can be an excellent diversifier to an existing investment portfolio. Investors with significant capital may consider investing in real estate through a joint venture.

Joint ventures are one of several methods of accessing private commercial real estate, and one way to access direct real estate without the need to establish a large team to manage the assets.

You can think of joint ventures as a miniature private fund. While funds would raise capital from many investors to invest in many different real estate deals, joint ventures consist of a minimum of two partners investing in a legal entity for the purposes of acquiring a single real estate asset.

Joint ventures serve multiple purposes, and the partners involved can split the responsibilities in various ways. For the purposes of this discussion, we will focus on joint ventures with only two members, the sponsor and investor member, investing in a single asset:

- The lead investor is the sponsor or general partner, responsible for the day-to-day activities of the joint venture and the operation of the real estate acquired by the partnership.

- The remaining investors, typically referred to as investor members or limited partners, usually have limited day-to-day responsibilities but often retain certain major decision-making rights.

Are you evaluating a prospective real estate joint venture? Heres what you need to know.

Examples Of A Joint Venture Agreement In Commercial Real Estate

In terms of commercial real estate, most joint ventures follow the same formula. A developer or a commercial real estate company is looking to move on from managing small projects and wants to graduate to properties worth hundreds of millions of dollars. Typically, joint ventures are formed for properties starting at around $5M and go up from there.

Since they have a good track record, they seek out a JV partner to dramatically increase their equity. JV agreements are seen in association with single-family housing developments, office buildings, and large-scale retail or event spaces. However, these are only a few examples and can exist in virtually any commercial real estate scenario.

Read Also: Fidelity Investments Socially Responsible Funds

Real Estate Joint Ventures: Marriage Of Equity And Expertise

Real estate joint ventures enable capital providers to have greater control over strategic decisions as to how the property is managed, while asset managers can look to gain a share of the JV proceedsin addition to their fees. Victoria Landsbert, Peita Menon and James Pullen of global law firm White & Case explain the key steps to success

Joint Venture Restructuring And Investments

The lawyers of Goldfarb & Fleece LLP help clients pursue real estate investments through joint ventures, limited partnerships, tenants-in-common agreements, and other entities and investment structures that increase resources and foster business growth.

Our law firm supports clients engaged in such opportunities by forming partnership or joint venture entities, drafting and structuring investment and acquisition agreements, and handling all details of the purchase of operating assets and investment property.

Our attorneys are experienced in reviewing and negotiating joint venture agreements to protect the interests of our clients, who include real estate developers, entrepreneurs and investors. We ensure that the goals of the joint venture are clearly stated, the roles of the participants are appropriately outlined, the management of the venture is adequately described, and the distribution of profit and loss is properly allocated.

When handling a joint venture matter for a client, our firm ensures that the terms of the agreement match the clients goals and level of comfort with risk. We have handled joint venture sale and acquisition transactions involving some of New York Citys highest-valued properties, as well as real estate throughout the United States.

Don’t Miss: How To Invest In Kuwaiti Dinar

Options For Structuring Joint Venture Real Estate Deals

There isnt one right way to structure a JV. Over time youll discover the way that is the most fair for you and your partners given what each party is bringing to the table .

We look to our partners to put in 100% of the initial investment capital in exchange for 50% ownership in the property. When we sell the property, their initial investment is repaid first, then any capital we have invested, and then we split the proceeds 50% / 50% as per the ownership.

As long as we can reasonably suggest our partner is going to get 10-15% per year return on their capital and they dont have to put in any effort, we believe its a fair exchange for them and for us. Those are our measurements, by the way, they dont have to be yours.

Its about the return and the limited amount of involvement they have in the deal not the share of the deal they own. These folks are busy usually successful businesses or careers, families and hobbies they want to focus on. They want to be in real estate but they dont have the time or inclination to become experts. Thats where we come in. Weve spent thousands and thousands of hours becoming experts. While we may only put 40 hours into getting a deal done for our partner, that doesnt account for the $100,000 in education and 10,000+ hours weve put into learning what to do to minimize risks and maximize returns.

Reasons To Form Joint Ventures

Real estate development partners enter into joint ventures for the following reasons:

1. Complements

Managing partners bring industry expertise and put time and effort to manage the project, while limited partners provide the capital required to fund the project.

2. Incentives

Managing partners are often provided with disproportionate returns to keep them motivated to work hard.

3. Structures

Investors possess limited liability and liquidation preference in the case that the assets of the partnership are liquidated.

Don’t Miss: Pros And Cons Of Investing In Silver

Understanding Partnership Contributions In A Real Estate Joint Venture

As an investor member, you want the sponsor to have meaningful skin in the game. To accomplish this, you will usually want the sponsor to contribute at least 5% to 10% of the total investment equity.

Any more than 10%, and the sponsor may require more control than the investor member would want. Any less than 5%, and the investment may not be meaningful enough for the sponsor to provide the appropriate level of time and attention to the deal or it may create a misaligned incentive whereby the sponsor is incentivized to take undue risk due to their potential upside with disregard for their invested equity .

For example, if an investment is $30 million and $20 million will be financed, the investment will require $10 million of equity. Of that $10 million, the sponsor should contribute between $500,000 and $1 million the investor member would contribute the rest.

However, this is only a rule of thumb. Depending on the deal size, those proportions might change. The purpose is for the sponsor to be appropriately aligned with the success of the investor member.

Identify The Project And Type

For specific closed end funds, the property should be identified with enough particularity that the seller knows which piece of land or which properties will be under contract. The alternative is a more open ended fund which will not identify with any particularity the types and assets to be invested in.

In the first scenario, calculating returns and drafting legal documents will be focused on the particular asset and project . Therefore, the waterfall distributions should be easier to understand for the investment.

However, for open-ended funds, the investment may be governed by broader rules and allow for more flexibility for the general partner. The GP will have discretion to disburse without specific legal obligations written for a particular project.

Don’t Miss: Best Place To Buy Gold For Investment

Use Of Debt In A Joint Venture Real Estate Agreement

The use of leverage in real estate acquisitions provides many benefits. Chief among them is the ability to magnify returns. Conversely, debt can also magnify losses. For this reason, it is important to understand how the joint venture will utilize leverage in the acquisition of real estate. The amount and type of debt used will vary depending on the property type and strategy . In short, the type of debt used should align with the business plan.

Since the sponsor is responsible for the day-to-day execution of the business plan, the sponsor will typically drive decisions on the use of debt financing, subject to any approval rights the investor member may have retained. Certain loans, such as a construction loan, may require a guaranty. Typically, the sponsor should have the balance sheet and willingness to provide any guarantees a lender might seek.

There are a limited number of circumstances where an investor member would provide a guarantee in place of a sponsor for a loan to the joint venture. In those cases, careful consideration should be given to evaluate whether you are being adequately compensated for the additional risk associated with providing a debt guarantee. This may come in the form of a direct payment for the guarantee, participating in the carried interest, or reduced fees.

What Is A Joint Venture Agreement

A JV Agreement is a contract between two or more parties. It outlines who is providing what. . It also outlines what the parties responsibility and authority are, how decisions will be made, how profits/losses are to be shared, and other venture-specific terms.A joint venture agreement is typically used by companies or individuals who are entering into a onetime project, investment, or business opportunity.Usually the two parties will form a new company such as an LLC to conduct operations or to own the investment. This is usually the recommended path if the parties intend to cooperate over the long term.However, if the opportunity between the parties is a one-time venture where the parties intend to cease working together once the agreement or deal is completed, a joint venture agreement may be an excellent option.

You May Like: Investment Company Of America Class A

What Should Be Included In A Joint Venture Agreement

What is included in a Joint Venture Agreement?Business location.The type of joint venture.Venture details, such as its name, address, purpose, etc.Start and end date of the joint venture.Venture members and their capital contributions.Member duties and obligations.Meeting and voting details.More items…

Other Uses Of Jv Agreements

A joint venture agreement also enables businesses to take part in investment projects that they normally would not be able to join. Primarily, it allows a company to invest in projects in other countries by entering into a joint venture with a local partner. In this case, the home company may either be the operating partner or the capital partner.

Many countries impose restrictions on foreigners entering the domestic real estate market. In such cases, setting up a joint venture agreement with a domestic company is often the only avenue into the country.

Don’t Miss: Best Investment Platform For Small Investors

Why Do Firms Enter Into Joint Ventures

There are many reasons to join forces with another company on a temporary basis, including for purposes of expansion, development of new products, or entering new markets . JVs are a common method to combine the business prowess, industry expertise, and personnel of two otherwise unrelated companies. This type of partnership allows each participating company an opportunity to scale its resources to complete a specific project or goal while reducing total cost and spreading out the risk and liabilities inherent to the task.

Need Help With A Joint Venture Agreement In Florida

The business attorneys at Cueto Law Group offer their skills and experience to clients on all matters related to joint venture Florida law. This includes the negotiation and drafting of deal points along with representation in the event of a dispute or other civil action.

Contact us today to schedule a consultation about your Florida joint venture agreement.

Recommended Reading: What Do Investment Companies Do