Sofi Invest Review: What Is Sofi

SoFi was founded by Stanford business school students in 2011. The company is still based in the area, calling San Francisco its home.

In 2012, it introduced student loan refinancing. Since that was initially the only service the company offered, people equated that with its business. But it offers much more than that. SoFi provides a variety of financial products and wants to help its customers reach financial independence.

It expanded its product line in the ensuing years, added several new services:

- In 2014, it added mortgages.

- In 2015, it started offering personal loans.

- In 2019, it launched SoFi Money and SoFi Invest.

As you can see, SoFi Invest is one of its newer products, so it doesnt have a long track record. Dont worrywere going to cover all the details in this review. For now, it suffices to say its Automated Investing has no management fees and its Active Investing has commission-free trading.

Note that all SoFi Invest customers have access to SoFi Money, a high-interest savings account that pays you a regular APY.

SoFi says its core values define the company. They include everything from putting members interests first to embracing diversity. Basically, they want to do everything they can to keep their customers happy.

How To Invest With Sofi

This article may contain affiliate links, meaning we may receive a commission if you decide to purchase through the link, at no extra cost to you. Please read full disclosure here for more info.

Are you looking for ways to start investing your hard-earned money? Its always a good idea to prepare for the future, and your finances should be on top of your list of priorities. The phrase making money in your sleep comes to mind. If this rings a bell, sounds off an alarm, or interests you then read on. This post aims to help you get started. Here, we talk about how to invest with SoFi.

Investing For Beginners: Considerations And Ways To Get Started

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey. Read more We develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right. Read less

Investing can be a great way to secure your financial future, but it can also be an intimidating minefield for the uninitiated. Fortunately, modern technology has made it easier to start an investment portfolio. You could get started today if you have an internet connection and a bank account.

Its worth understanding what youre doing before you put your money into the nebulous financial markets. Youll want to know the basics of investing, from the different types of investments to the various strategies you can make money from them. With this knowledge, you should have a good idea of what sorts of investments are right for you and how to get started.

Don’t Miss: Socially And Environmentally Responsible Investing

Goal Planning Features Are A Major Plus

SoFi Automated Investing is reaping seriously high marks for goal planning.

With an ultra-low barrier to entry and an encouraging assortment of zero-fee investment options, SoFis robo advisor hits the bulls-eye when appealing to younger capital-poor investors.

This is a major win, especially when you factor in the rapid digital on-boarding process you can have your account set up and activated in a few clicks and voila! You are an investor! This limits new-investor anxiety and back-tracking. Before you know it, the algorithm will go to work to set up your portfolio and allocate your assets. Overall, this is a good thing.

However, because of the self-directed nature of the platform, it will be up to you to reach out to the human advisors who are there to serve you and answer your questions.

Rather than sitting back and scratching your forehead while wondering why is that asset in my portfolio? you will need to remind yourself to take action if you want to see changes in your portfolio allocations.

Interested in learning more about SoFi? See our SoFi Lending review.

No Socially Responsible Investing Option

SoFi does not offer a socially responsible investing option as one of its portfolios used in the automated platform, which is a hole in SoFis offering. This has become a common feature for many robo-advisors as younger investors express more of an interest in how their money is invested and the impact it has. Investors interested in taking this approach might consider robo-advisor options from E-Trade or Morgan Stanley Access Investing, each of which offers socially-responsible funds.

Also Check: Should I Invest Hsa Money

Sofi Automated Investing Review Wrap Up

The SoFi robo-advisor could be a good choice for new and small investors. You can open up an account with as little as $1. The $0 account management fees are also beneficial for all investorsmall or large alike.

SoFi also offers social events in large communities. Especially enticing for younger investors is the opportunity to chat with career counselors. Ellevest is the only other robo-advisor with this benefit.

Larger more seasoned investors may want to look elsewhere. While free account management is certainly appealing, the platform currently does not offer tax-loss harvesting. This might be a disadvantage for investors with large positions in taxable investments.

As mentioned in this review, SoFi is also a P2P lending powerhouse. Since student loan refinances are SoFis specialty, this could be a good robo-advisor for recent college graduates with student loans to refinance and those who are looking to begin investing. Additionally, existing SoFi clients seeking a robo advisor might take a look.

We recommend SoFi Invest, but with a bit of caution as it is one of the newer robo-advisors. Additionally, the SEC sanctions, accusing the firm of breaching its fiduciary responsibilities gives us cause for concern. As with any investment decisions, its important to examine your own circumstances, weigh the pros and cons, and make a reasoned decision.

Is Carbon Credit Investing Right For You

Investing in carbon credits can be a profitable way to get involved in a growing market and support the transition to a low-carbon global economy. Since their launch, carbon credit ETFs have increased in value. However, they do come with risks, and past performance is not a predictor of future performance.

If an investor is looking to diversify their portfolio, allocating a small amount to carbon credit ETFs may be one good option.

Also Check: How To Invest In Adidas

Our Top Crypto Play Isnt A Token

Weve found one company thats positioned itself perfectly as a long-term picks-and-shovels solution for the broader crypto market Bitcoin, Dogecoin, and all the others. In fact, you’ve probably used this company’s technology in the past few days, even if you’ve never had an account or even heard of the company before. That’s how prevalent it’s become.

Sign up today for Stock Advisor and get access to our exclusive report where you can get the full scoop on this company and its upside as a long-term investment. Learn more and get started today with a special new member discount.

Guaranteed Interest Rates And Insurance

Because investing in CDs is less liquid than a savings account, the interest rate tends to be higher. CD rates are quoted as an annual percentage yield . The APY is how much the account will earn in one year, including compound interest.

When the period is up, also known as the CD maturity date, the CD holder can receive the original investment, plus any interest earned.

As of December 2021, the average rate for a 1-year CD was about 0.51% the average rate for a 5-year CD was 0.86%. But the interest rate can vary considerably, depending on the institution.

The money in a CD is protected by the same federal insurance that covers all deposit products, whether at a bank, credit union, or other institution.

Recommended Reading: Best Places To Invest In Real Estate In Ny

Mutual Funds And Etfs

A mutual fund is an investment managed by a professional. Funds typically focus on an asset class, industry, or region, and investors pay fees to the fund manager to choose investments and buy and sell them at favorable prices.

Exchange-traded funds are similar to mutual funds, but the main difference is that ETFs are traded on a stock exchange, giving investors the flexibility to buy and sell throughout the day.

Mutual funds and ETFs allow investors to diversify their holdings in one investment vehicle.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Buying Investment Property In Another State

Sofi Invest Review 202: How It Compares Plus Expert Opinion

Home » Product Reviews » SoFi Invest Review 2022

Disclosure: This page may contain affiliate links. This means we earn a small commission if you purchase a product through our links.

4.7/5

In a nutshell: SoFi Automated Investing provides a simple, incredibly low-cost investing platform perfect for beginners and cost-conscious investors. Plus, its $5 minimum makes it easy for anyone to get started.

SoFis Active Investing also has commission-free stock and ETF trading, though it does lack some advanced trading features. Overall, SoFi Invest is a solid investment and trading platform.

| Fees |

|---|

SoFi Invest offers no-fee investing and portfolio management, plus free access to financial advisors. For fee-conscious investors, SoFi Invest is tough to match.

Pros & Cons

- No management fees for Automated Investing

- Free access to financial advisors

- Commission-free trading for Active Investing

- Invest for free

- Only available in the US

Where Active Investing Falls Short

Although Active Invest allows you to do quite a bit without paying a single fee, that doesnt mean it includes everything. There are several types of assets you cant trade on the platform, including index funds and mutual funds. Plus, you cant trade certain niche assets, like futures and forex.

Active Investing also lacks certain advanced features, such as stop-loss orders. Given that this is a commonly-used feature, some active traders may find the platform a bit lacking for their overall needs.

Recommended Reading: Is Fundrise A Good Way To Invest

Sofi Invest Review Summary

SoFi, short for “Social Finance”, is a US-based fintech startup founded in 2011. It first specialized in student loan refinancing, but has expanded into the broker space since 2018. SoFi is regulated by the US Securities and Exchange Commission and FINRA. SoFi Invest is SoFi’s brand for zero-fee or discount brokerage services.

SoFi Invest offers active and automated investing services. The former means a self-directed account where you can trade stocks, ETFs, and cryptocurrencies on your own. By contrast, SoFi Invest automated investing is a robo-advisory service where SoFi Invest handles your investments. In this review, we tested SoFi Invest active investing. Click here for the SoFi robo-advisory review.

SoFi Invest is considered safe because it is regulated by top-tier financial authorities and provides up to $500,000 investor protection as part of the SIPC protection scheme.

Recommended for

Access To Human Advisors

One of the main selling points of SoFi Automated Investing is that you get access to SoFi Advisors who can help answer your questions and plan your financial goals.

Advisors, who are Certified Financial Planners, are paid a salary, not a commission. So you wont run into issues with conflicts of interest or crazy fees. In fact, SoFi offers this advisory service at no additional cost. If you want a robo-advisor with human support, SoFi Automated Investing is one of your best options.

Plus, you also get access to other SoFi products and discounts. For example, members can get discounts on SoFi personal loans, use SoFi Money to earn interest on your cash, and open a rewards credit card.

Competing products from Betterment and Personal Capitaloffer similar access to a human advisor, but this is not the standard in low-cost, automated investing.

You May Like: What Is The Best Ira To Invest In

Why Is Investing Important

Investing is important because it helps you build wealth. Investing is simply the process of putting your money into assets that have the potential to grow in value over time. Doing this may increase your wealth and achieve financial goals, like saving for retirement.

You may wonder why youd want to risk putting your hard-earned money in the financial markets, where it has the chance to decline, rather than simply stashing it in a savings account or even under your mattress. Its because inflation can eat away at your moneys purchasing power if you dont invest.

Your money sitting in a savings account earning little interest will eventually decrease in value because of inflation. The money you put into the market may be at risk, but it also has the potential to grow. By investing, you can ensure your money keeps up with inflation or even outpaces it. And historically, the market tends to increase, even accounting for significant stock market crashes like the Great Depression and the 2008 crisis.

Recommended: How to Protect Your Money From Inflation

Of course, that doesnt mean theres no place for a healthy savings account, especially for money that you need in the short term.

Many people hold off putting money into the financial markets because they believe common investment myths, like that you have to be an expert or that you need to devote a lot of time to your finances. But even novices can set aside a little time and money to start investing.

Where Sofi Automated Investing Falls Short

No tax-loss harvesting: SoFi does not offer tax-loss harvesting, a service offered by many of its competitors that can reduce taxes owed on investment gains.

Limited track record: SoFi started up its robo-advisor platform in 2017, so its among the newer kids on the block. That may give some investors pause, especially when larger players, such as Wealthfront and Betterment, have established track records.

Also Check: Best App For Investing In Penny Stocks

Sofi Invest Vs Vanguard

Vanguard remains something of a benchmark for all types of investors. In many ways, brokerages have used Vanguard as a baseline for their services. And, in many ways, Vanguard is still excellent. So, how does it compare to SoFi?

Vanguard allows you to purchase a wide variety of investments with no fees. Online trades are free, including equities, options, and ETFs. Trades placed over the phone will incur a fee up to $25 .

Although Vanguard remains an excellent broker, there are some things it lacks. While its still great for passive investors who just want to buy index funds, it does lack fractional shares.

SoFi Invest, on the other hand, does allow you to purchase fractional shares. Plus, it has no fees for trading or for its robo-advisor, Auto Invest. And you have access to CFPs for no fee.

The closest equivalent Vanguard has to SoFis Auto Invest is Vanguard Digital Advisor, but it comes with a 0.10% management fee. If you want access to financial advisors through Vanguard, youll have to sign up for Vanguard Personal Advisor Services, which comes with a 0.30% fee.

Sofi Invest Fees And Costs

SoFi Invest widely touts its lack of any annual management fee. On its face, this certainly compares very favorably to its competitors. Vanguard Digital Advisor, a completely automated robo, charges around 0.15% of assets under management while the cheapest tier on Ellevest is $12 a year. Plus those competitors either donât offer access to financial advisors or charge extra for that service.

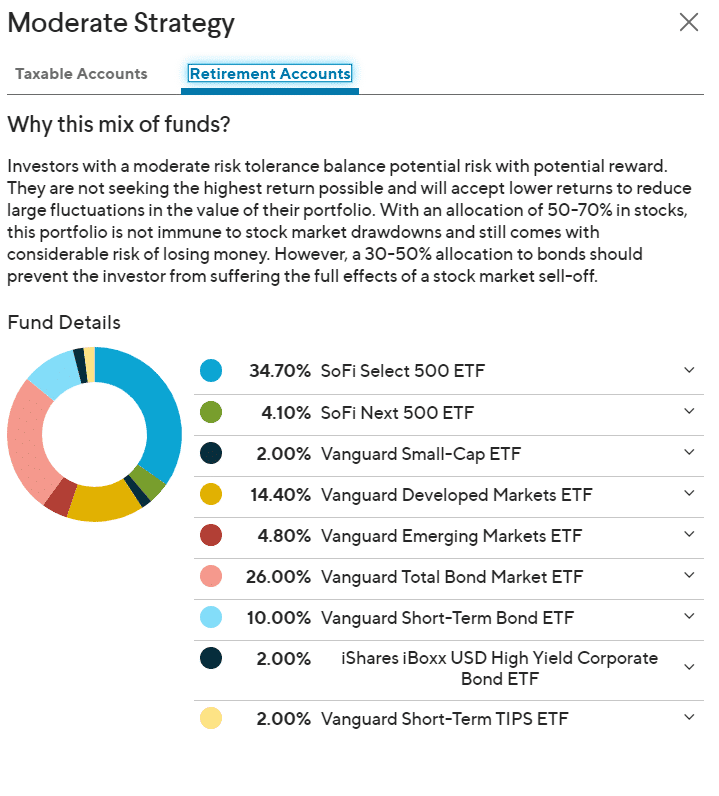

But as weâve noted above, thereâs really no such thing as a free robo-advisor. While SoFi Invest charges zero annual management fees, it also may include some of its own proprietary ETFs in your automatically managed portfolio. The two that were included in Forbes Advisorâs sample portfoliosâSoFi Select 500 and SoFi Next 500âcontained waivers that nixed the expense ratio through June 2022. If the expense ratio stays the same after the waivers expire, then youâll be stuck in ETFs that charge much higher costs than many other comparable funds.

SoFi has other ETFs as well that werenât included in any automated portfolio that we observed but are available to purchase through its active trading platform. These specialized ETFs charge much higher fees than your standard passively traded ETFs that follow a broad-based index and therefore probably donât deserve a place in your buy-and-hold portfolio. All four are relatively new and have so far attracted relatively few assets. Hereâs a full list of SoFiâs proprietary ETFs and their expense ratios:

Recommended Reading: How To Start An Investment Advisory Firm