How To Invest In The Nikkei 225

Institutional Investor NewsFamily Wealth Report

The Nikkei 225 Stock Average is Japans primary stock index and a barometer of the Japanese economy. It gauges the behavior of 225 large Japanese companies, covering a broad swath of industries. Broadly considered to be Japans equivalent to the Dow Jones Industrial Average, it includes the top 225 blue-chip companies listed on the Tokyo Stock Exchange.

Although you cannot invest directly in an index, you can gain exposure to the underlying stocks within the Nikkei 225 via an exchange traded fund .

Tse Market Restructuring And What It Means For Investors

The TSE is still considered quite complex, and offers few incentives for listed companies to look after shareholders or to grow business sustainably. As a result, the TSE has undergone a major restructuring. Its Japans largest overhaul of equity markets for over a decade.

It aims to raise the standards of listed Japanese companies alongside higher standards to be added to a particular market. Improvements will mean a clearer environmental, social and governance focus, including diversity within companies and better disclosure. This could mean companies are viewed more positively, fuelling potential interest from foreign investors.

On 4 April the current market divisions changed into three new market segments the Prime Market, Standard Market and Growth Market. Investors should be aware that the Tokyo Pro Market has not been included in the restructure and will remain untouched for the time being.

The Prime Market requires listed Japanese companies to have the highest levels of liquidity, corporate governance and commitment to sustainable growth. They also need to demonstrate constructive dialogue with investors.

The Standard and Growth Markets are also required to place an emphasis on liquidity, corporate governance and sustainable growth. But not to same extent of the Prime Market.

Current Outlook For Investing In Japan

“We believe the Hennessy Japan Fund is well-positioned as the portfolio is built around Japan’s manufacturing excellence.”

– MASA TAKEDA

The Japan Fund is invested in companies that demonstrate Japans manufacturing excellence and high-quality craftsmanship along with asset-light technology businesses. Read our Sector Highlight: Japan’s Most Durable Advantage

With many challenges facing global investors, we asked Masa Takeda, Portfolio Manager of the Hennessy Japan Fund to provide his insights. In our latest manager commentary,he shares his views on the Japanese market, how the Fund is positioned to take advantage of “growth in disguise” companies, and why investors may want to consider Japanese equities for the long term. Here are the key takeaways:

Read our latest portfolio manager commentary Investing in “Growth in Disguise” Japanese Companies

Don’t Miss: How To Invest In Dubai Real Estate

Direct Investment In Japanese Stocks

Investors who are looking to directly purchase Japanese stocks can do so by either opening a Japanese brokerage account or an international brokerage account. Some of the most popular Japanese stockbrokers include Rakuten Securities, GMO Click Securities, SBI Securities, and DMM.com Securities. However, these will require knowledge of the Japanese language.

One of the most popular online brokers that let you invest directly in Japan is Interactive Brokers. It lets you invest indirectly Japanese stock indexes, stocks listed on the Tokyo Stock Exchange , Osaka Exchange , JAPANNEXT, and CHI-X Japan . Although Interactive Brokers is popular amongst professional traders, it also recently launched IBKR Lite for casual investors.

Furthermore, benefits of Interactive Brokers include low commissions, better margin rates, the ability to buy fractional shares, and its trading platform. Requirements for opening an account are relatively simple, however they do vary depending on the country you are based in.

IF you want to look for specific brokers in your country who will let you invest in the Japanese stock market then you can just follow this list.

- Monex Securities

Three International Etf Securities For Japan Stock Market

It is possible to use exchange traded funds to access Japanese stocks. Investor located in the USA or Europe could use several different international exchange traded funds that are listed on US exchanges or European exchanges in London or Frankfurt.

These exchange traded funds track several different indexes of Japans stock market. The most typical example is EWJ the MSCI Japan Index Fund issued by Ishares and traded in the USA. This fund holds several major Japanese companies in its portfolio, like Toyota Motor, Mitsubishi Financial and Honda motor to name few of them.

Another opportunity is available by SCJ MSCI Japan Small Cap Index Fund. This index ETF targets small cap companies from the Japanese market.

I personally also have third Japanese ETF in my list of exchange traded funds. It is ITF S& P/TOPIX 150 Index Fund that tracks stocks listed in the Tokyo index TOPIX.

These international ETFs represent good ways to invest in the Japanese stock market for USD based investors. These funds are priced in USD so you dont need to make a currency hedge for international investing.

Don’t Miss: How To Invest Without A Financial Advisor

What Are The Benefits Of Buying Reits In Japan

REITs bring plenty of benefits to investors in developing and emerging markets alike.

While the benefit of investing in Singapore REITs is that you can own a small piece of a large-sized income-generating shopping mall, Vietnam REITs allow fractionalized ownership of commercial real estate.

The outspoken benefits of investing in Japanese REITs are listed below.

1. Market Access

Sitting on the other side of the globe put restrictions on foreigners who wish to invest in foreign markets. Not to mention the real estate types as commercial property is often beyond the reach of foreign buyers.

Even if the real estate market is open to foreign ownership in Japan, commercial properties are in the upper price segment.

You probably understand that buying office space or a shopping mall in Shibuya is a big no for individual investors with limited capital.

Yet, by investing in REITs, you have access to all kinds of properties, including warehouses, industrial real estate, hotels, and more.

Besides, the REIT is managed by experts with long experience in the market. If you make money, they do. The performance of the REIT is mutually important.

2. Liquidity

Investing in immovable properties can be a lengthy process and requires much documentation and payments of various taxes. The most infamous is the stamp duty which has reached double digits in Singapore and Hong Kong.

Saying that REITs are more liquid than buying and owning physical real estate is an understatement.

Nyse Tokyo Stock Exchange Collaborate To Support Cross

Intercontinental Exchange, Inc. Pranav Ghumatkar

- The NYSE, part of Intercontinental Exchange and Tokyo Stock Exchange has announced a new agreement to support cross-border investment between the U.S. and Japan by collaborating in areas including product development, marketing, and information sharing.

- âIn addition, as the public and private sectors in Japan are pushing forward with joint initiatives to realize a âNew Form of Capitalism,â we hope that this agreement will contribute by improving the investment environment, among other things,â said Hiromi Yamaji, President & CEO, TSE.

- The two exchanges have agreed to strengthen and further advance their relationship to promote and support the development of both exchangesâ businesses.

Recommended For You

You May Like: B Of A Investment Banking

How To Buy Japanese Stock

Want to claim 12 FREE stocks? Head over to Webull to get started.

Buying stocks has been a traditional investment option the world over, and Japanese stocks are no exception to this rule. For U.S. residents, some Japanese stocks are available for purchase via American Depository Receipts and exchange-traded funds at virtually any major stock broker since they are listed on U.S. exchanges.

Investors in Japan have to follow a different protocol before being able to trade and invest in the stock market. If you wish to trade or invest directly in Japanese stocks, then read on to find out the steps youll need to take to get started.

Looking Out For The Stakeholder

One of the big differences between the Japanese and American markets is that companies in the Asian nation are stakeholder-friendly, while U.S. businesses are shareholder-friendly.

U.S. companies pay dividends, engage in share buybacks and allocate capital effectively all things equity owners like. In Japan, companies are more focused on those that have a stake in the business, like employees, who are often given jobs for life. They also tend to hoard cash.

“Japan’s society is about benefiting everyone,” he said. “So companies manage their business to the good of society.”

Read MoreWhy investors think Japan has some pretty hot property

It’s a noble idea, but it doesn’t jive with what international investors tend to want from the companies they own: fast growth. However, the corporate culture is slowly changing.

Prime Minister Abe wants businesses to become more shareholder-friendly, in part by encouraging them to return money to shareholders through dividends and buybacks. While it’s been a slow process, it does seem to be working, as evidenced by rising returns on equity , said Gandhi. In December 2011 the average ROE in Japan was around 3 percent. It’s now at 8.8 percent. That’s still below the S& P 500’s 12.9 percent ROE, but it’s clear that improvements are being made.

Read Also: Is Buying Property In Dubai A Good Investment

Why Should I Invest In The Tokyo Stock Exchange

As the worlds third largest stock exchange, and Asias largest, the Tokyo Stock Exchange offers investors the ability to buy shares in some of the most important and successful companies in the world, such as Toyota and Sony. Many of these stocks are also available to buy via international brokers and digital trading platforms, which means theyre often just as easy to buy as British stocks.

Nikkei Compared To Topix

The other major index that tracks the Tokyo Stock Exchange is the Tokyo Stock Price Index, otherwise known as TOPIX. As mentioned previously, the Nikkei Index ranks stocks by price and tracks the top 225 companies listed on the Tokyo Stock Exchange.

In contrast, TOPIX ranks stocks by free-float adjusted market capitalization. TOPIX also tracks all domestic companies listed in the First Section of the Tokyo Stock Exchange. The First Section included 2032 companies as of October 2017.

As can be observed, there are major differences between the Nikkei Index and TOPIX. It is often argued that TOPIX is a better representation of Japans stock market. This is because of the weighting differences between the two indices and the larger number of companies included in TOPIX.

You May Like: Single Investment Property Line Of Credit

How To Invest In The Nikkei

The Nikkei index does not allow individual foreign investors to buy and manage stocks directly. However, investors can obtain exposure to the index by buying stocks through exchange-traded funds whose components correlate to the Index. Exchange-traded Funds comprise a selection of stocks or other securities. ETFs trade during the day and are prone to price fluctuations just like stocks.

Investors use ETFs for speculative trading strategies like trading on margin and short-selling. Investors can trade the entire market as though they are trading a single stock. In creating a diversified portfolio, ETFs allow investors to meet specific asset allocation needs such as an allocation of 80% and 20% for stocks and bonds, respectively. Tax-aware investors can also take advantage of ETFs to reduce tax implications. The unique structure of ETFs allows investors trading large volumes of ETFs to redeem them for shares of stocks that the ETF track.

MAXIS Nikkei 225 ETF

The only USD denominated ETF that tracks the Nikkei 225 is the MAXIS Nikkei 225 ETF. The ETF was introduced in 2011, and it is the least complicated and most direct way for individual investors to invest in the Nikkei Index. MAXIS Nikkei 225 lists more than $80 million of assets under management. The MAXIS ETF trades on ARCA, which is the New York Stock Exchanges electronic ETF trading platform. The MAXIS Nikkei 225s price was 17.91 as at close of March 11, 2017.

Yen Denominated ETFs

Derivative Indices and Products

Labor Reforms And Cultural Shifts Offset A Shrinking Workforce

To help offset the national labor shortage brought on by the decline in Japanese workers, a recent suite of labor reforms were enacted. A new visa system was introduced to bring in more foreign labor, underfunded pensions encouraged retirees to continue working, and Abenomics child care initiatives brought almost two million more Japanese women into the labor force since 2012.

Beyond government-mandated policies, corporate culture in Japan is also modernizing. The days of Japan, Incs rigid, closed corporate culture and lifetime employment are starting to fade as companies move toward a more merit-based system.

Don’t Miss: How To Invest In The Stock Market As A Teenager

Tokyo Stock Exchange Vs National Stock Exchange India

When it comes to stock exchanges, there are really only two that matter in Asia: the Tokyo Stock Exchange and the National Stock Exchange of India . Both are large, well-established exchanges with a long history of operation. But which one is better?

The TSE is the larger of the two exchanges, with over 3,500 listed companies and a market capitalization of over $6 trillion. It is also the oldest exchange, having been founded in 1878. The NSE, on the other hand, was founded in 1992 and has around 2,000 listed companies.

In terms of performance, the TSE has been the most successful exchange. It was the most active exchange in Asia in 2016, with a total trading value of $5 trillion. The NSE lagged behind with a trading value of $2.9 trillion.

One key difference between the two exchanges is that the TSE is a public company, while the NSE is a private company. This means that the TSE is more transparent and accountable to its shareholders. The NSE also has stricter listing requirements, which has helped it to attract some of the biggest companies in India.So, which exchange is better? It really depends on what you are looking for. If you want a large, well-established exchange with a long history of operation, then the TSE is the better choice. If you are looking for a more modern exchange with stricter listing requirements, then the NSE is the better choice.

Tse Hours Of Operation

The standard trading hours for most products listed on TSE are 09:00 to 11:00 and 12:30 to15:00. Product-specific trading hours include:

- Japanese Government Bonds 13:00 to13:30

- Foreign currency-denominated foreign bonds 13:30 to14:00

- Straight bonds 10:00 to11:00

- Equity derivatives 09:00 to11:00 and 12:30 to15:10

- JGB derivatives 09:00 to11:00, 12:30 to15:00, and 15:30 to18:00

Note: The trading hours mentioned above are stated in local time Tokyo, Japan. The standard time zone for Tokyo is UTC / GMT +9 hours.

About the Author – Tokyo Stock Exchange

Moneyzine Editor

Read Also: Pacific Investment Management Company Llc Pimco

Getting Into The Market

There are several ways for investors to get into this market, from buying ETFs and mutual funds to individual stocks on the Tokyo stock exchange or through ADRs on American exchanges.

For investors who want to make a bet on the entire market or certain parts of the Japanese market, an ETF, such as WisdomTree Japan Hedged SmallCap Equity Fund

There are only 11 America-based Japan-focused mutual funds, according to Lipper, but all have outperformed the index this year. The Nuveen Tradewinds Japan Fund tops the list with a 17.86 percent return.

Why buy a fund? One reason is for diversification, but the other, said Mayur Nallamala, senior portfolio manager and head of Asian equities for RBC Global Asset Management in Hong Kong, is that it’s an easier way to play the economy’s cyclical upswing than buying stocks.

However, there is plenty for stock pickers to choose from. Investors can buy companies through ADRs on American stock exchanges, or they can purchase equities directly from Japan’s exchange. There’s many more options going direct than in the ADR market, said Nallamala.

There are also currency issues to consider in the short term. You’ll be paying in U.S. dollars when buying an ADR, which could be good or bad, depending on where you think the yen is headed. The currency issues should balance itself out, though, over the long term, said Nallamala.

How To Invest In Japan

The Japanese economy is the third-largest in the world, trailing only the United States and China. A market that size is one that many investors, understandably, dont want to ignore. Heres an overview of the Japanese stock market, as well as its investments, risks and requirements. Consider working with a financial advisor as you explore ways to diversify by investing in non-U.S. economies such as Japans.

Japans Stock Market and the Nikkei

Japans major stock exchange merged with 10 other Japanese stock exchanges in 1943. After World War II, it reorganized and became the Tokyo Stock Exchange in May 1949. Its now the third-largest stock exchange in the world, with a market capitalization of $5.68 trillion as of the writing of this article. Some of the best-known companies in the world have their homes on the Tokyo Stock Exchange, like Toyota, Honda and Sony.

The Nikkei 225 stock index is the equivalent of the U.S. Dow Jones Industrial Average . It contains 225 large, blue-chip stocks, representing the Japanese stock market. The Nikkei is a price-weighted index just like the DJIA. Companies are ranked by stock price instead of market capitalization.

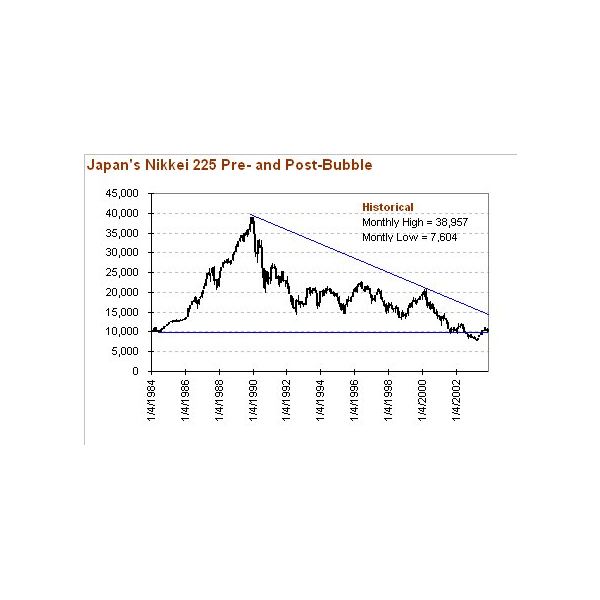

During Japans decade of high growth in the 1980s, the Nikkei reached a high of about 38,000. By 2009, due to Japans economic problems, it closed at a little over 7,000. Now, in 2021, it is trading around 30,400.

Investing in Japan Through ADRs and ETFs

Investing in Japanese Stock Markets

Bottom Line

Tips for Investing

Also Check: Piggyback Loan For Investment Property

Yen In The Early 1980s

During the first half of the 1980s, the yen failed to rise in value, though current account surpluses returned and grew quickly. From ¥221 per US$ in 1981, the average value of the yen actually dropped to ¥239 per US$ in 1985. The rise in the current account surplus generated stronger demand for yen in foreign-exchange markets, but this trade-related demand for yen was offset by other factors. A wide differential in interest rates, with United States interest rates much higher than those in Japan, and the continuing moves to the international flow of , led to a large net outflow of capital from Japan. This capital flow increased the supply of yen in foreign-exchange markets, as Japanese investors changed their yen for other currencies to invest overseas. This kept the yen weak relative to the dollar and fostered the rapid rise in the Japanese trade surplus that took place in the 1980s.