Consequences To Refinancing To Buy A Rental Property

There are some negatives when using a cash-out refinance to buy an investment property.

- Shifting IndebtednessDebt is debt. Going into debt on your primary residence to buy an investment property for a bit of cash flow may not be the best idea. Make sure your priorities are in balance.

- Missing Out on Tax Advantages I am no tax expert, but a cash-out refinance on your primary residence will keep you from getting to claim the repayment of the mortgage on your taxes. On the other hand, if the loan was on investment property you may be able to off-set profits with the mortgage repayments. Talk with a tax professional to find out which is the best option for you.

- Cash Exhaustion Cash out refinances are a great way to pay off high interest debt, pay for college tuition for a child, or to improve your primary residence. Once you have used a cash-out refinance to buy an investment property you cant necessarily do it again without re-shuffling a lot of things around.

To Fund A Property Purchase Should I Get A Lump Sum Home Equity Loan Heloc Or A Cash

As opposed to the one-time, lump sum payment received through a home equity loan, HELOCs, or home equity lines of credit, function similarly to a credit card, as they allow you to access and utilize the equity as you choose up to a certain limit and within a certain time frame. Although HELOCs can offer more flexibility than home equity loans, they also come with higher closing costs and variable interest rates, which may mean paying more over time. Rocket Mortgage does not offer HELOCs.

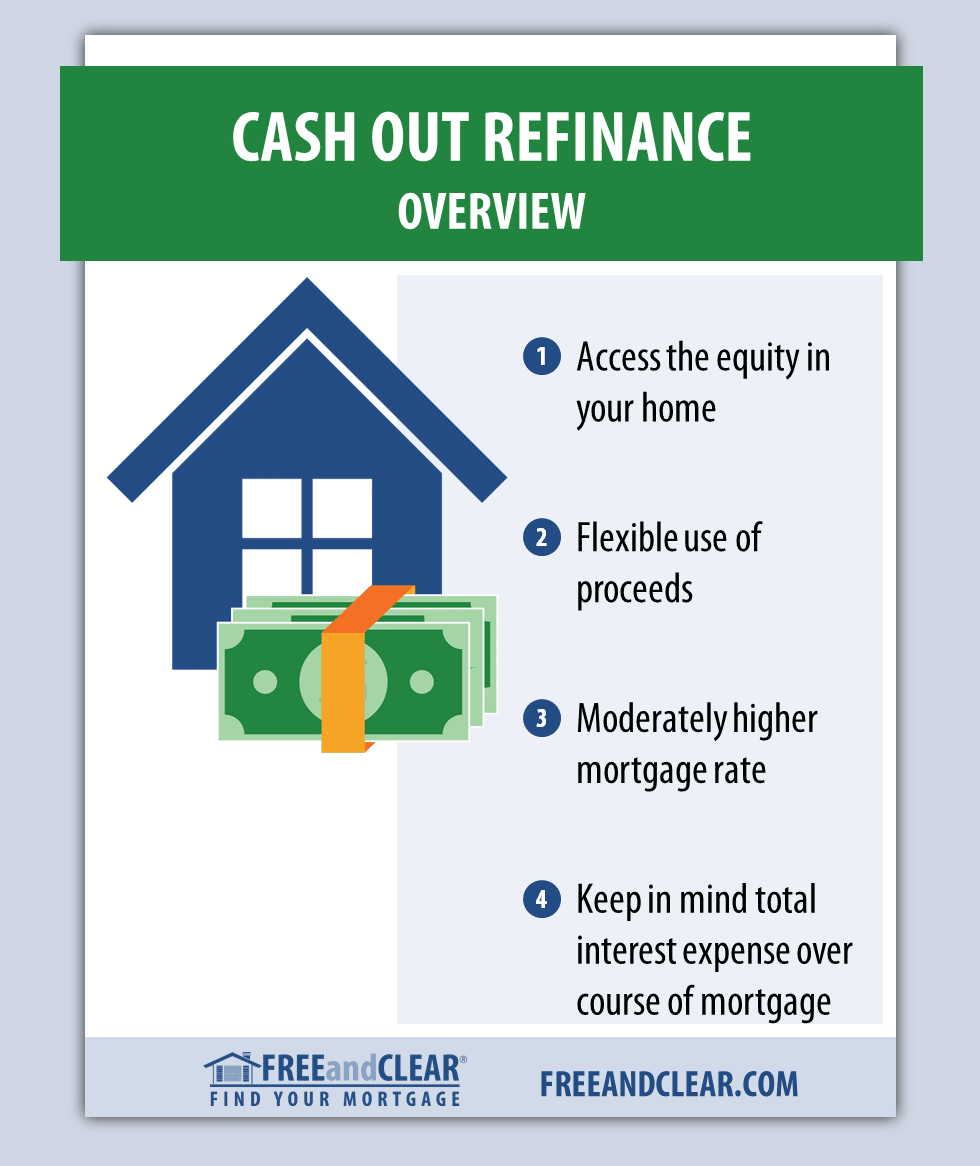

Another option to consider is a cash-out refinance, which allows you to take on a larger mortgage in exchange for accessing equity in your home. Because its a form of refinancing and not a second mortgage, a cash-out refinance doesnt add to your monthly payment and instead extends the length of the original loan.

Theres a lot to consider when choosing between a HELOC and a cash-out refinance, but if youre planning to use your money as a lump sum as you would with a down payment, a cash-out refinance or home equity loan will probably make more sense.

How Much Can I Earn From A Rental Property

The profit you can make from monthly rent payments depends on the area youre in, how good of a deal you get on the home, and how you manage your expenses month-to-month.

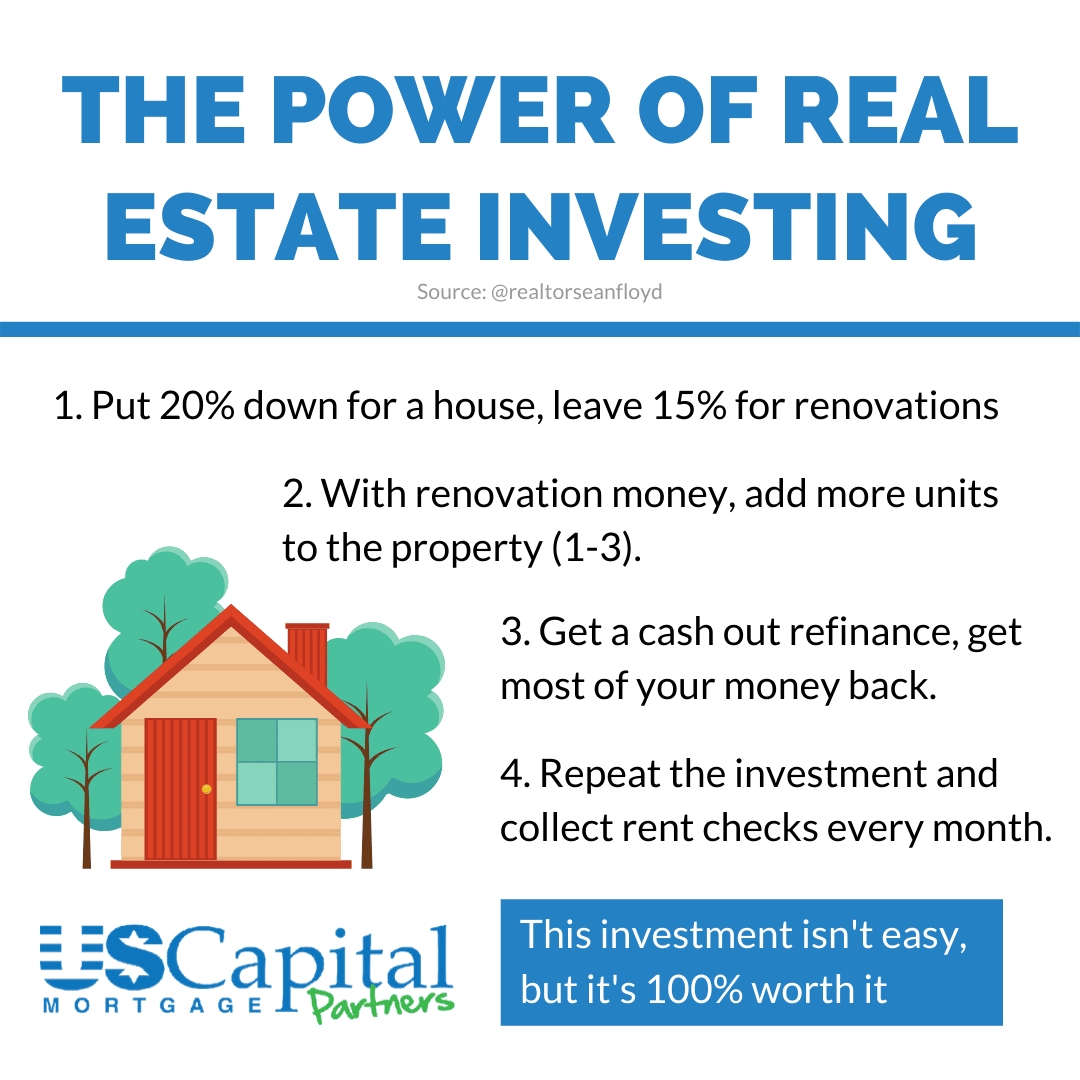

That being said, maintaining rental properties are great investments because they can often become passive income when everything lines up perfectlyan up-and-coming neighborhood can command higher rent each year, and if the home doesnt need a ton of maintenance, you might not have to do much work at all throughout the year. Simply sit back, collect the rent checks, and enjoy your new source of income!

Also Check: Best Way To Invest Money In Mutual Funds

What Is The Maximum Cash

When you apply for cash-out refinancing, lenders will look at the loan-to-value ratio. LTV is a measurement that compares your mortgage to the appraised value of your property. For investment properties, lenders may require an LTV of no more than say 70% to 80%, depending on the lender and property specifics.

You can calculate your LTV by dividing the loan balance by your propertys appraised value. In the example of a $250,000 home with $100,000 remaining on your mortgage, your current LTV is 40% well within the LTV threshold that lenders will likely require.

Where To Apply For A Rental Property Cash

Once you factor all of the above into your decision, you may find that a cash-out refinance on your investment property can help you buy more rental homes or make improvements on existing properties.

The key with this option as with any refinancing is the new mortgage should either lower your monthly payments right away or put more cash flow into your pocket over time. If a non-owner-occupied cash-out refinance has one of those outcomes, then you should speak with a lender who specializes in these loans.

Most of todays lenders offer cash-out refinances on rental properties at similar terms. You can get started on your application now. A loan officer can pre-qualify you and give you a rate and payment quote, which is the first step to making sure this type of mortgage refinance is the right move.

Tim Lucas

Editor

You May Like: Best Investment Plan For Kids

Real Estate Is Unique

With gold or jewelry, the owners can get cash but they will likely have to leave the asset with the lender as collateral. They cannot use it or keep it with them.

Owners of stocks and bonds can borrow money as well. But that money cannot leave the brokerage that holds those assets for them. They have to invest the cash in other assets at the same place. In other words, invest in stocks, bonds and other exchange-traded assets only.

When it comes to real estate though, they can not only keep the asset with them but they can also continue to use it like they normally do. And yet, they can borrow cash that can be used for any purpose. The best of all worlds as one would say.

And thats not all. The interest rates at which they can borrow money are very reasonable too. The transaction through which they can do so is what is called as a cash-out refinance.

You May Like: How To Invest In Multifamily Real Estate

Lower The Refinance Rates For Your Investment Property

You might be surprised by the difference between an investment property and a primary propertys interest rate. Typically, the interest rate for an investment property runs at least 0.5% 0.75% higher than what the same borrower might pay for a mortgage on their primary residence.

Investment properties represent a larger risk for lenders. Banks and online lenders know that if you run into financial hardship and can only afford a single mortgage payment, youll always choose your personal home.

To account for this risk, lenders charge more in interest on investment properties. Two mortgage payments can be unsustainable, so you might want to search for a lower rate by refinancing.

Refinancing can give you access to lower rates if you can show that you are successfully managing your rental property. Compare your current interest rate with offers from lenders before you refinance.

Read Also: How Much Money To Invest In Cryptocurrency

How To Do Cash Out Refinance To Purchase Investment Property

The following are the basic steps to take when refinancing a rental property to take out a loan:

Collect the Papers That the Lender Requires

- If youre self-employed, youll need proof of income, such as pay stubs or bank records.

- Bring copies of W-2, 1099 forms, or the latest tax returns to prove income and job history.

- Proof of homeowners insurance and coverage for rental properties.

- Copy of the most current title insurance policy you got when you bought the house.

- Extra asset and debt data, including personal and commercial banking and savings accounts, pension and brokerage accounts, as well as existing debt and monthly bills.

Register for a Cash-Out Refinance of Your Rental Property

Although lenders can establish their own regulations for refinancing rental properties, most stick to Fannie Mae and Freddie Macs guidelines.

Based on your banking institution and the present success of your rental property, some lenders may be prepared to work with you on the interests rate and loan fees.

Lock Down the Interest Rate

When your cash-out refinance request for your rental property is accepted, the lender will usually offer a choice of locking in your interest rate.

Interest rate locks can last anywhere from 15 to 60 days, depending on the property and loan kind. Locking the interest rate gives you time to analyze the cash-out refinancing arrangements without worrying about changing interest rates.

Continue With Underwriting

Settle On the Refinance Loan

Cash Out Refinance Steps

These are the exact steps that you can follow:

While every lender is different, the loan process is usually the same.

Before finalizing the loan, ensure you are getting the cash back you need and are comfortable with the new loan terms.

When you first apply for the loan, you provide the lender with basic paperwork.

This usually includes:

- Paystubs for the last 30 days

- W-2s from the last two years

- Tax returns from the last two years

- Two months of bank statements

Recommended Reading: Investing In A Brokerage Account

Get A Second Mortgage

Assuming you could still get a 75% LTV overall on the property, that is $93,750. If the first loan still had a balance of $75,000 .

The 2nd mortgage would be $18,750 for a second mortgage.

Lets do some quick numbers.

Lets say you have a $75,000 mortgage with 30-year term at 5% interest.

Total principal and interest = $403

The second mortgage of $18,750 is shorter and at a slightly higher interest rate, lets say 20 years and 6.5%

Total principal and interest = $140

Total = $543

S To Guide You When You Refinance Your Rental Property Mortgage

Home \ Blog \ Posts \ Steps To Guide You When You Refinance Your Rental Property Mortgage

Join millions of Canadians who have already trusted Loans Canada

Investing in rental properties is a popular strategy to earn passive income. However, as a rental property owner, you have to account for property tax, landlord insurance, repairs, property management, and a number of other expenses. In order to maximize your rental property income, you need to minimize these associated costs. Additionally, some rental property owners reduce costs by refinancing their rental property mortgage. In fact, refinancing can not only help reduce expenses, it can also help rental property owners gain access to additional funds.

You May Like: Private Equity Investments For Small Investors

Cash Out Refinance Rules

While each refinancing transaction is unique, here are the general cash out refinance rules of thumb for investment properties:

- Seasoning: You must own the property for at least twelve month, unless you qualify for a delayed financing exception.

- Property Status: The property must not be listed for sale.

- Debt-to-Income Ratio: From 36% to 45%.

- Equity: At least 30% in the current property.

- Cash Reserves: At least one-half year.

- Debt Service Coverage Ratio : At least 1.20.

- Owners Credit Score: 640 minimum.

- Owners Tax Returns Required: Two years .

Naturally, you will need a higher DSCR and greater cash reserves if you have a lower credit score.

Risk Factors And Their Measurement

The major risk factors are:

1. The borrowers credit score is below some critical level, usually 740-760.

2. The property will be rented rather than occupied by the borrower.

3. If a refinance, the borrower is withdrawing cash.

4. The ratio of loan amount to property value is greater than 75-80%.

5. The property is other than a single-family home.

6. The borrower wants to avoid the escrow requirement.

The effect of these risk factors is measured by comparing interest rates with and without the factor on transactions that are otherwise identical. The rates cited below cover conforming loans that are eligible for purchase by Fannie Mae and Freddie Mac, and have been adjusted to include all loan fees. They were obtained by shopping for a 30-year fixed-rate mortgage, the most widely used of the various mortgage types, at the 6 lenders who price mortgages on this site. In every case, the rates shown are the lowest of those posted by the 6 lenders. Readers can do the same at .

Recommended Reading: Are Nnn Properties Good Investments

Getting Closer To Passive Income Goals

If youre like Adam, and you only own four properties and need to make $6000 per month on passive income to retire, you still have a ways to go before you can hit that passive income goal. But if you do the cash-out refinancing on those four properties and get eight properties, you get closer to that $6000 per month goal. Plus, as property values continue to rise, so do rents rise.

Youre still positively cash flowing, even on the previous asset. Right now, because rents are up and interest rates are low, the chances are very high youll preserve your positive cash flow. Its a win-win situation for your retirement plan, so we encourage you to speak with your JWB portfolio manager to see if the cash-out refinance is a wise move for your situation.

The debt paydown, the tax benefits, and holding onto properties through a full market cycle are all ways to leverage your JWB assets. Usually, youll see a 20% return on investment. But even if you give up some cash flow and still get a 10% ROI, youre still in a good position for growing your revenue.

How To Apply For A Cash

To start the refinancing process, you can often fill out an application online, or you can visit a bank in person.

To refinance your investment property, youll usually need the following documents:

- Proof of income, such as copies of your W-2 or 1099 forms

- Recent personal and business tax returns

- Proof of homeowner insurance

- Copy of your title insurance

Also Check: How To Create A Real Estate Investment Trust

Still Not Sure If A Cash

The objective of this article was to share everything one should know before deciding on a cash-out refinance. Things such as why one should consider this option, when it would be a good idea, how much cash can one borrow, along with a lot of other information.

Its quite possible that even with all the information we provided above, you are still not sure about your decision and/or are not sure if a cash-out refinance is good for your situation.

If thats the case, please feel free to reach out to us. At Stem Lending, our job is to guide you and help you make the most informed decision. If you are already sure about it though, you can start right away at: stemlending.com/apply

Tapping Home Equity To Fund Investments May Deliver Returns But Definitely Comes With Significant Risks

You can withdraw equity from your home for virtually any purpose, including to invest. But is it a good idea to risk your home for investments?

If youve been in your house for a while, you likely have built up some equity the difference between what you still owe on your current mortgage and your homes value. You can use equity for practically anything, including funding stock purchases or other investments.

When the stock market is doing well and mortgage interest rates are low, you may wonder if refinancing and pulling the equity out of your home to invest in stocks is a wise choice. Investing can pay off, but its also inherently risky.

So, when is a cash-out refinance to fund your investments a good strategy, and when is it a mistake? Lets look at things to consider.

Don’t Miss: Is Interest Rate Higher For Investment Property

Home Equity Line Of Credit

A HELOC lets you access the equity in your home through a revolving line of credit, which is secured with your home as collateral. Its a popular option because you dont have to go through a refinance, but interest rates can be higher and theyre usually variable. Since you only pay interest on the portion of the credit line you actually use, it can make a great emergency fund. Connect with a lender to learn more about HELOCs.

Are You Eligible

A cash-out refinance typically has higher qualification requirements when compared to a conventional mortgage. The following eligibility requirements should be expected:

-

Many lenders will require a minimum credit score between 650 and 700, though it will vary depending on the loan.

-

Cash Reserves: Lenders will want to verify how much money you can access outside of the refinance loan, called your cash reserves. When approving a cash-out refinance for an investment property, lenders may want to see anywhere from two and six percent of the loan amount in a separate asset account.

-

Waiting Period: Anyone wishing to utilize a cash-out refinance will typically need to wait at least six months after buying the property.

-

Equity: Before you can tap into the equity in a property, you must build it up to a certain percentage. Lenders will typically require over 25 percent equity, but the exact requirement will vary.

If you are considering a cash-out refinance for an investment property, the best thing to do is research different lenders. This will give you a better idea of whether or not you are eligible and it will help you identify the best loan terms. Most lenders will want to know the same information about your financial profile, but some may be more willing to work with you regardless.

Recommended Reading: How To Invest In Private Companies Pre Ipo