Advantages Of Alternative Investments

- Low correlation. One of the greatest advantages that alternative investments offer is low correlation with traditional asset classes. When the stock market is under pressure, commodities, for example, could very well be performing well.

- Diversification. Thanks to low correlation to stock or bond markets, including alternatives in a portfolio can improve diversification.

- Lower volatility. Since alternative investments are less exposed to broad market, the impact of can be lower.

- Inflation hedges. Some types of alternatives, such as gold, oil or real estate, can be effective in hedging inflation risk. Commodity futures and options can also be used to hedge against rising or falling prices.

- Potentially higher returns. Since alternative investments entail a higher level of risk, they also offer the potential for higher returns.

To Diversify Your Portfolio

In the investment world, to diversify means to invest in different kinds of assets.

The basic idea of diversification is that a portfolio that includes several different types of assets wonât totally bottom out even if one of those assets drops in value â because, at the same time, chances are another asset in the same portfolio is growing in value.

An investment portfolio that contains a mix of assets generally experiences higher returns and lower losses than any one single asset within that portfolio.

This is what makes portfolio diversification a strategy for serious investors who realize that investing over the long-term is ultimately more effective than any âget rich quickâ scheme.

Diversification Of A Financial Portfolio

No matter which investment professional or financial advisor is asked, they are all agreeing on one thing: the importance of portfolio diversification. As the value of securities are influenced by many external factors, like popularity, consumer trends and forecasts, its impossible to predict their future value. Just like spreading out ones stock portfolio through an index, experts recommend spreading even further to other asset classes like real estate, commodities, and alternative investments.

Beyond investing through traditional methods, alternative assets become attractive because many hold low or no correlation to the stock market. This means that if the stock market goes down, prices of these assets are not affected, helping to generate more stable returns over time.

Read Also: Ways To Invest Besides Stocks

How Much Should You Invest In Alternative Investments

The amount you should consider funneling into alternative investments will vary. There isnt a one-size-fits-all number to target.

However, most experts agree to keep it fairly low. Some financial advisors recommend that alternative investments make up 7% to 12% of your total portfolio. Others may suggest a range of 10% to 30%.

Due to the added level of risk and lack of liquidity, alternative assets shouldnt be your primary source of investment income. But, you should also make sure your entire nest egg isnt wrapped up in an employer-sponsored plan.

Ultimately, the amount you invest in an alternative investment should depend on your risk tolerance and retirement timeline.

How To Buy A Money Market Fund

With the advancement of technology, purchasing a money market fund is readily available for retail investors.

You can get it from your advisers or you can buy them from many online platforms.

For example, if you look at the Money market fund in the Moomoo platform, Fullerton SGD Cash Fund has a 3.4263% based on a 7-day annualized yield and CSOP USD Money Market Fund has a 3.22% based on the last 7-day annualized yield.

If you do not have a moomoo account, you can . You will get Free Stocks and Cash Back* as the sign-up bonus.

Also Check: Can You Use A Va Loan To Buy Investment Property

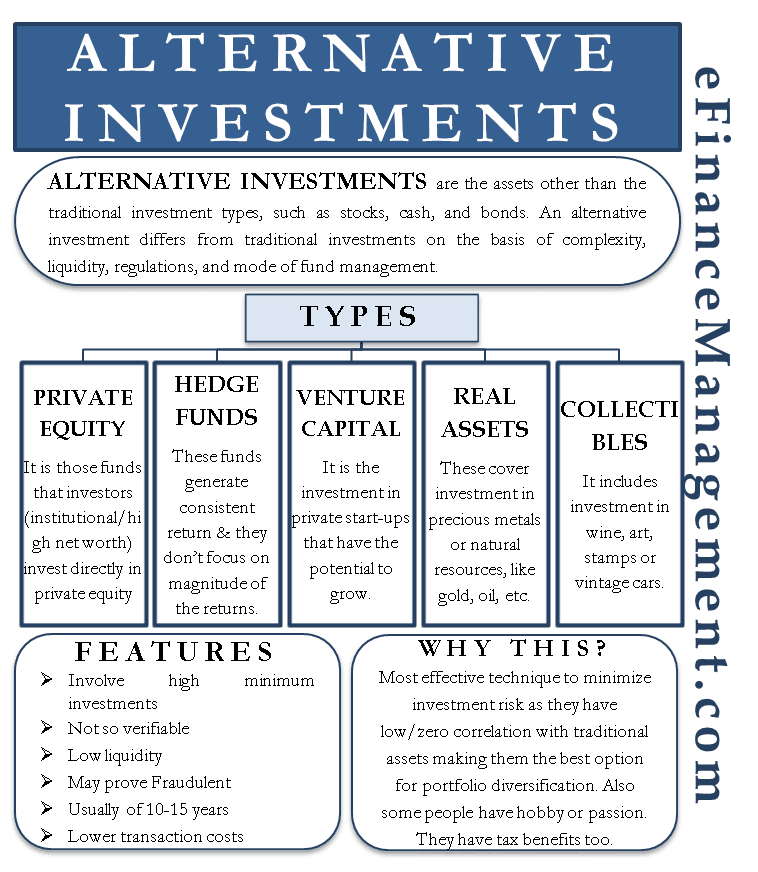

What Is An Alternative Investment

Alternative investments include anything that isnt stocks, bonds, or cash. The most common form of alternative investment is real estate however the real estate market is relatively correlated with traditional financial markets, making it not really the best alternative investment. Its a good start though, and adds good portfolio diversification however traditional real estate in our opinion shouldnt be considered an alternative investment.

Alternative investments generally have low-liquidity and are harder to buy/sell, and are often expensive or harder to purchase compared to traditional investments like stocks, bonds, and traditional real estate investments. Alternative Investments often have inverse correlations to traditional investments like stocks, or have completely independent pricing meaning they do not necessarily go up when stocks go up, and they do not necessarily perform negatively during a recession.

It should be noted that some alternative investments require you to become an accredited investor. Well specify if a specific investment mentioned below requires you to be an accredited investor or not however pretty much all the ones we cover below are available to everyone. We know most people arent accredited, so we arent going to waste your time mentioning tons of investments most of you cannot access.

Column: Alternative Investments Are Showing Dispersion In A Challenging Environment

2022 has so far shown the value of adding alternatives to a portfolio and debunked the myth that rising rates per se are negative for all types of investments, writes Christoph Junge, head of alternatives at Velliv in this column.

The third quarter of 2022 started very differently to how it ended.

The first half was characterized by falling interest rates and rising equities, which gave some much needed relief after a very bad second quarter for most investors.

Unfortunately, the happy days didnt last, and the downtrend in equities and bonds resumed by mid-August.

A 60/40 portfolio, a widely used benchmark for a balanced portfolio consisting of 60% equities and 40% bonds, lost another 6%. during the third quarter, bringing the total losses to 22.8% in the first nine months of 2022.

According to Bank of America, this is the worst year for a balanced portfolio in 100 years! Adding some alternative investments has helped so far this year, with commodities, real assets and some types of hedge funds acting as diversifiers.

But can alternative investments really defy gravity any longer or will they eventually drop together with bonds and equities? As so often in financial markets, the answer is: It depends.

In this column we will make a deep dive into some of the interesting parts of the alternative investment universe and shed some light on the recent developments.

But before we dig into the numbers, I want to remind you of a few technical facts of importance.

Read Also: How To Invest In Currency Exchange

Traditional Stock Market Investing

If you want to invest in the ultimate income producing asset, traditional stocks should be part of your portfolio. Im talking about regular stocks that dont necessarily pay dividends, or even mutual funds, index funds, or ETFs.

Investing in the stock market can help you gain a steady income that you can use to fund your lifestyle or even retire. Plus, the returns are superior to other investment vehicles over the long term.

For example, the S& P 500 offered an average return of 8.91% during the 20 years leading up to the beginning of 2022. If you look at returns over 30 years instead, the average increases to 9.89%.

While you can select your own individual stocks, investing in index funds is one of the easiest ways to get started. Index funds allow you properly diversify your portfolio by investing in all of the major companies that fall within an index across various industry sectors.

Examples of popular index funds include the Vanguard Total Stock Market Index Fund Admiral Shares , Vanguard 500 Index Fund Admiral Shares , Schwab S& P 500 Index Fund , and Fidelity U.S. Sustainability Index Fund .

While you can invest in individual stocks, mutual funds, or index funds by opening an account with the best online brokerage firms, you can also lean on a robo-advisor for help.

For example, a robo-advisor like Betterment can help you craft a portfolio of stocks that can help you reach your goals. Heck, they will even help you define your goals.

Cash Alternative #: Singapore Government Treasury Bills

Singapore is one of the few countries that still has a AAA credit rating. So there are always demands whenever the Singapore government issues bonds.

The Singapore government issues short-term bonds called T-bills with both 6-month and 1-year durations. These are the shortest-tenured Singapore Government Securities available.

T-bills have garnered huge interest recently because the yield has raised rapidly. If you look at the Treasury Bill statistics, the rate jumped from 1.69% in May to 4.19% in October. It means the rates raised nearly 2.5 times in less than half a year.

If were to chart these data, you can see that the T-Bill yield only comes down a bit in Nov 10 auction due to high demand.

But I want to caution you that T-bill is auction-based. With more and more people aware of this instrument, the current level of yield may not sustain. The latest 6-month Treasury bill auction on November 10 drew a record 92,000 bids totalling S$14.2b. That is likely the reason why the yield is lower than the previous auction.

Read Also: Using Investments To Pay Off Debt

Are Alternative Investments Right For You

Many types of alternative investments are only accessible to investors with a high income or high net worth. Regulatory requirements may require you to be an accredited investor, meaning that either your net worth — excluding your home — is greater than $1 million or your earned income exceeds $200,000 per year.

Investing in alternative assets often requires a lot of capital, and the investments can be illiquid, so theyâre not easily bought or sold. Many online marketplaces for alternative investments have multi-year minimum holding requirements for the alternative assets.

Owning alternative assets is best suited for investors whose portfolios are already diversified. If you are happy with your allocations to traditional securities such as stocks, bonds, and exchange-traded funds , then allocating money to alternative assets may be a good fit.

As for which alternative investment types to choose, you can consider your appetite for risk, your investing time horizon, and how much time you have to devote to investing. Once you’ve considered these elements, you can identify the specific alternative investments that most appeal to you.

Are Alternative Investments Now

Alternative investments have been around for decades, but until recently were limited mostly to wealthy investors and institutional investors like pension funds and endowments. But as the financial world has evolved, alternative investment strategies have become increasingly popular with average investors looking for higher returns.

Alternative investments are high-risk, high-return investments that include hedge funds, private equity, real estate, and commodities. Theyre not for everyone especially if you dont know much about them but they can be an excellent addition to your portfolio if you want to take advantage of the potential rewards without taking on too much risk yourself.

Don’t Miss: Can Non Accredited Investors Invest In Startups

To Insulate Your Portfolio From Market Volatility And Grow Returns

Along with diversification, enhancing your return is one of the key reasons to invest in alternative assets according to Michael Harris, financial advisor and partner at Verdence Capital Advisors.

How can alternative assets help you get an outsized return on your investment? By disconnecting the value of your portfolio from fluctuations in the traditional asset market.

While itâs been shown that investing in alternative assets is a great way to keep your portfolio steady even when the rest of the world is suffering from major stock market fluctuations, Harris says itâs important to remember that itâs never guaranteed that your alternative assets wonât sometimes move with the market â or even go down when the rest of market is trending upward.

“Lowly correlated means, on the spectrum of a plus one to a negative one correlation, those funds are trying to get as close to zero as possible,â Harris said. âIt means that sometimes they’re going to move with traditional assets. And sometimes they will move in the opposite direction. It’s not a promise that those alternative investments will always perform well when markets go down.”

Connect And View All Your Accounts And Alternative Assets Using Kuberas Dashboard

What sets Kubera apart from other portfolio trackers is clear immediately: We custom-built our infrastructure to integrate with multiple financial aggregators. Between these and our easy-to-use, spreadsheet-like dashboard youâll be able to connect almost any type of financial account in no time.

If youâre interested in individual stocks or cryptocurrencies, add Kuberaâs tickers to your dashboard to make educated purchasing or selling decisions when they matter most.

In addition, our flexible fields empower you to add the details for almost any kind of asset â domains, rare artwork, vehicles, businesses, and more.

For homes, vehicles, or web domains specifically, Kubera integrates with leading asset experts to feed your dashboard with real-time market data. That means you can always track the value of some of your most valuable assets.

All you have to do is plug in your accounts and assets to get a single view of your financial situation and overall net worth.

Don’t Miss: How To Invest In Oil Futures Options

Art Wine And Other Collectibles

Fine Art

Investing in art has been an opportunity restricted to ultra-high-net-worth individuals who like to hold about 6% of their investments in fine art. The value of art in private hands is estimated at $1.7 trillion, of which $67.4 billion changes ownership every year. Masterworks is a startup that wants to democratize the art market by offering shares in blue-chip art along with some mid-late career artists like Banksy. The startup uses a proprietary pricing database to find artists gaining momentum and offers investments in a number of their works.

Top artists have outperformed the S& P 500 over the past 18 years and come with the added benefit of close to zero correlation with other alternative and traditional investments. While art investments are not very liquid, Masterworks is setting up a secondary market where investors can trade their shares to help increase liquidity. A competing startup called Maecenas only targets accredited investors and uses blockchain tokens to keep track of ownership transactions.

Fine Wine

Fine wine is similar to art in that it both outperformed the S& P 500 by +1,000% over the past 20 years, and that its uncorrelated to traditional asset classes. A startup called Vinovest lets anyone invest in the asset class from $1,000 upwards. The company employs three of the worlds 280 Master Sommeliers as consultants, and combines their insights with proprietary machine learning algorithms to find the next cult wine to invest in.

Risks Of Alternative Investments

- Lack of regulation. Not all alternative assets are registered with the SEC, and therefore are not regulated. However, they do fall under the purview of the Dodd-Frank Act and therefore their practices may be reviewed by the SEC.

- Lack of transparency. Since most alternatives are not regulated by the SEC, there are few to no public regulatory filings. This results in a dearth of information for investors.

- Low liquidity. Because many alternatives are not publicly traded, it may be difficult to buy or sell these investments. Many hedge funds and private equity funds may have lockups that commit investors to a defined period of investment during which redemptions are not possible.

- Difficult to value. In the absence of a market price, it may be challenging to determine the value of alternative investments. Valuations may vary widely depending upon the appraiser and are more vulnerable to subjectivity.

- High minimum investments. Alternatives are not structured with the average investor in mind, so minimum investment requirements can be prohibitively high.

- Greater risks. With the potential for high returns comes higher risk. Many alternative investments may involve risky strategies like short selling or trading complex derivatives.

Don’t Miss: Alternative Investments To Stocks And Bonds

What Are The Profit Margins

This is certainly not for everyone. It definitely requires that you get off your rusty dusty, participate and earn your success. It doesnt take a lot of money, but it might take a while to learn.

Its not calling a broker and ordering 100 shares, and its not watching your bank account purchasing power erode with inflation.

Dont fool yourself and think youre going to be rich with an IPO and easily become a millionaire with your stock options. Most of those fail.

This investment is a nitty-gritty business. However, when its done correctly, the margins for profit are huge.

Conventional investments usually employ multiple investment advisors, financial planners, brokers, attorneys, and lots of registered reps that all get a piece of the profit.

If this is interesting to you, I have a free mini course, a free gift from me to you that will teach you the secrets of tax lien certificates and how to profit in tax deeds, which I consider to be among the best of the best alternative investments.

After taking this course, I believe youll see it that way too. Take advantage of it today!

Pros And Cons Of Alternative Investments

Alternative Investments can be very beneficial to include in your portfolio or they can be disastrous if implemented wrongly or without understanding the benefits and risks they entail. Alternative investments generally should be seen as long-term investments and hedges that help protect your networth and portfolio no matter market-conditions, however depending on your goals you may prefer certain types more than others.

Generally wed say its safe and reasonable to have around 30% to 40% of ones portfolio in alternative investments , however its important to not to rush into alternative investments, especially many types, too soon in your investing journey. Wed say picking a few to start and then slowly expanding the ones youre investing in as your networth grows.

Also Check: Interest Only Loans For Investment Properties

Downsides Of Alternative Investments

Of course, there are always risks involved with investing in alternative investments being aware of them will help you avoid making critical mistakes that could put your portfolio at risk.

Low-Liquidity

While Alternative Investments often have higher returns one of the prices that comes with is lower-liquidity and higher slippage when buying/selling the investment.

For example if you startups or private companies youll likely be locked into owning the company until its next funding round, or until it goes public, unless you use an online marketplace that allows you to trade it to other investors or find a 3rd-party investor on your own to buy it off you. Regardless when doing so, selling it early, itll often take many days to weeks to get the sale finalized.

In comparison with stocks and publicly traded companies you can sell near-instantly most days of the week and get the cash either immediately or within a few days if you are withdrawing it off the stock-brokerage platform.

Basically with alternative investments you will get your money back to you, but itll take time. The investment isnt highly liquid and you wont be able to rely on having access to the funds in the case of an emergency. This is one of the reasons why its generally best to hold alternative investments for the long-term .

Lack of Regulation