Renovation Contract Must Include

- Itemize the specific work that the contractor agrees to perform for the borrower.

- State the agreed-upon cost of the renovation.

- Identify all subcontractors and suppliers.

- Include an itemized description that establishes the schedule for completing each stage of the work and the corresponding payments to be made to the contractor.

Homestyle Mortgage Slashes Investment Real Estate Down Payments

When buying investment real estate properties leverage is key. The more cash you use the lower your leverage and experience a lower return on investment. Fannie Mae has introduced the HomeStyle Mortgage to help you with that. With the HomeStyle Investor loan, you can buy properties with less cash out of pocket and at lower prices.One of the greatest challenges of investing in real estate is leveraging your cash and being able to buy more properties creating even higher leverage and greater returns. Most investment real estate loans for individual single family properties require between 20 percent and 210 percent down.

In this market, you may have been outbid for prime properties because of other investors overbid for them. There is an answer: Bid on properties that need some work that the other investors or homeowners dont want to bid on and banks or sellers want to dump without making the needed repairs to garner a prime price.

What Is A Homestyle Renovation Loan

Fallen in love with a fixer-upper?

You can take out a renovation loan also called a rehab loan to turn a dump into your dream home. While you have a few options for renovation loans, HomeStyle loans rank among the best.

But rehabbing an old home adds another set of wrinkles to the homebuying or refinancing process, and maybe to your forehead too. Make sure you know exactly what youre getting yourself into before making an offer.

Read Also: How Do I Invest In Cryptocurrency

Find A Qualified Fannie Mae Homestyle Lender

As mentioned, not all lenders or mortgage brokers are qualified or set up to provide the HomeStyle mortgage. It takes quite a bit more staff and processes for the lender to be able to provide these. Make sure it is a lender that you feel comfortable working with. This is a process you need to be comfortable with your lending partner.

I strongly urge you to use a mortgage broker or lender that is in the area of the property. This process involves a few extra people. Having a direct relationship with someone who wants to keep you happy for referral business and repeat business is important. Celebrating with a blender of margaritas when your house is done is even better. Once you have your lender selected, you will need a pre-approval letter to present with offers.

Congrats Your House Is Renovated And Ready To Move Into Sell Or Rent

Im sure that there are investors who use these loans to flip with, but most investors are using them to keep the property as a rental.

If you are building a portfolio of rental properties, this can be a great way to impact your cash on cash returns, minimize the number of loans taken out on the property, and maximize your buying power.

Recommended Reading: Bitcoin Funds To Invest In

How A Homestyle Renovation Loan Works

The basic process for getting a HomeStyle loan is the same as getting any other type of loan. Youll need to apply for a home loan and meet basic income, credit and qualifying guidelines . Extra steps you need to take to be approved for a HomeStyle loan include:

Get A Contractor And An Inspection

Most contracts permit a 10-day inspection period or other amount of time that is negotiated to have a professional inspection. This can be money well spent to make sure that you have located all or most of the necessary renovation items that you will need to take care of during the process. A qualified inspector can make reasonable suggestions on what and how to repair certain items.

But the important part of this process is to have a renovation contractor develop a Scope Of Work with you. The contractor will also need to complete a contractor profile. These are required parts of the loan paperwork. The lender needs a SOW, also called the Scope Of Repairs , to know what you plan to do to the house and that those items will actually bring it to a livable condition. Here are some items that you will be required to provide to your lender:

- Scope of Work with itemized repair budget

- The cost of the renovation cannot exceed 50% of the purchase price of the property

Also Check: Stocks To Invest In 2014

Buying A Second Home With A Homestyle Renovation Loan

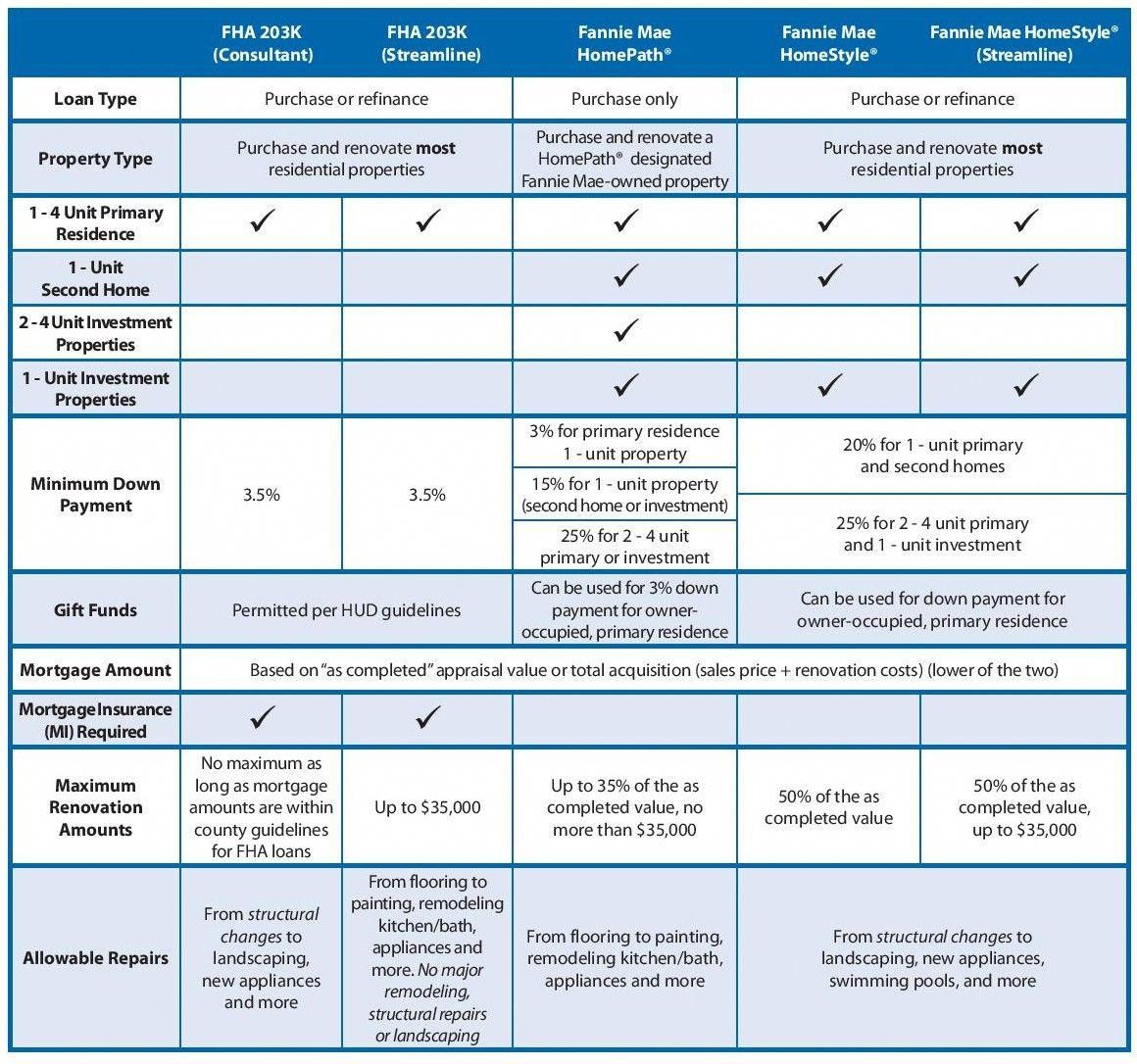

As you will see in other OVM articles, we offer several renovation loans. These include VA Renovation, FHA 203k Limited, FHA 203k Standard, and the FNMA HomeStyle Renovation we are discussing. One of the biggest ways Homestyle Reno stands out is that it allows for the purchase or refinance of a second home, where a buyer can create their own oasis for vacations. One of our more recent scenarios included a home buyer purchasing a property but wanted an inground pool. Follow the scenario below.

How Much Will You Need To Put Down

The down payment requirements for a HomeStyle loan depend on the type of residence youre repairing or remodeling. If its a single-unit home that youll live in , your down payment can be as low as 3 percent with a fixed-rate mortgage or 5 percent with an adjustable-rate mortgage.

- Manufactured home: 5 percent

- Two-unit principal residence: 15 percent

- Three- or four-unit principal residence: 25 percent

- One-unit second home: 10 percent

Recommended Reading: Companies Similar To Fisher Investments

Homestyle Loan Contractor Requirements

Understand that you arent the only one who has to meet Fannie Maes requirements. You also need to choose a licensed contractor to complete the bulk of the work.

You cant get an old, handy pal to do the rehab for you unless he or she meets Fannies standards.

According to Fannie Mae, your mortgage lender must determine that your contractor is:

- Qualified and experienced,

- Has all appropriate credentials required by the state,

- Is financially able to perform the duties necessary to complete the renovation work in a timely manner, and

- Agrees to indemnify the borrower for all property losses or damages caused by its employees or subcontractors

Those shouldnt be a problem for most reputable, licensed professionals. But it can help to choose one whos been through the HomeStyle process before.

It can be a big help to choose a contractor whos already familiar with the HomeStyle loan process.

Using a contractor whos already familiar with the HomeStlye process means theyll already know how to complete their plans, schedule, and cost estimate according to Fannies requirements. This can help the process go more smoothly and ensure that your renovations are completed without setbacks.

Allowable home improvements

Unlike some rehab loans, Fannie imposes few restrictions on how you can spend the renovation funds. However with the exception of kitchen appliances it does say that improvements should be permanently affixed to the real property.

What Are The Benefits

Loan amount based on as-completed value

The HomeStyle® Renovation Program offers borrowers financing based on the value of the property after the renovations have been made. This allows borrowers to qualify for a higher mortgage based on the property value after renovations.

Can help save loans that have repair contingencies

Home purchases that may have otherwise been thwarted by costly repair contingencies can be saved with the FNMA HomeStyle® Renovation loan. With this program, borrowers can finance the cost of the repairs into the loan amount and ensure they still get the home they want.

Not just for owner occupied

Unlike many renovation loan options, the FNMA HomeStyle® can be used for one unit second homes. This can create an excellent opportunity for building instant equity in a vacation home.

Luxury Improvements Allowed

Most renovation loan programs dont allow the financing of luxury items on the home improvements such as swimming pools, hot tubs, tennis courts, and outdoor kitchens. These projects are all eligible through HomeStyle®!

Who is eligible for a FNMA HomeStyle® Renovation Loan?

Eligibility will be determined by examining the borrowers income, assets, liabilities, and credit history and score, as well as the market value and condition of the property to be financed.

Also Check: Best Free Investment Research Sites

How Much Debt Can You Have

Your debt-to-income ratio plays a critical role in a lenders evaluation of your finances. Essentially, the lender needs to know that you can pay your other debts such as your car loan, student loans or credit cards and still pay back this new loan. For a HomeStyle loan, youll want a DTI ratio no higher than 45 percent but if its 36 percent or less, youre in much better shape.

Alternatives To A Homestyle Loan

As outlined above, you can always take out a second mortgage or HELOC to cover the renovation costs. With these options, you dont have to restart your entire mortgages amortization from scratch. In the case of HELOCs, you get a revolving line of credit you can tap into repeatedly. As a new homebuyer, either option gives you some breathing room before they tackle a renovation.

You could take out a cash-out refinance, which avoids the scrutiny and draw schedule, but it still involves shelling out for closing costs and restarting your mortgage from Square One.

Alternatively, you can draw on credit cards or take out a personal loan. You avoid closing costs, unlike HELOCs or second mortgages, but youll probably have higher interest rates. Consider these options if you can pay off the balances quickly, or if you want to DIY the work or use unlicensed workers instead of licensed contractors.

Nor is HomeStyle the only rehab mortgage in town. Freddie Mac offers a competing program called CHOICERenovation, and military veterans can take advantage of VA renovation loans. The latter is a benefit of military service, and usually beats out market-based alternatives like Fannie Mae and Freddie Mac loans.

The Federal Housing Administration has its own rehab mortgage program, called 203 loans. Like all FHA loans, theyre more lenient on credit scores, but they require you to pay the mortgage insurance premium for the entire life of the loan.

Read Also: Second Mortgage To Buy Investment Property

Costs You Can Finance

You cant get any cash back when you refinance a HomeStyle loan, but you can include closing costs, fees and prepaid items in your loan. Other things you can finance include labor, materials, architect fees, permits, licenses, contingency reserves, and up to six months worth of mortgage payments for any period when the home is uninhabitable.

The HomeStyle renovation loan even lets you finance the cost of materials for do-it-yourself work on one-unit properties. Up to 10% of the post-renovation value can go toward DIY work, with the lenders advance approval. If you want to save money on labor by painting the homes interior yourself, for example, you can finance the cost of paint, drop cloths, brushes, rollers and painters tape.

You cant use the loan to pay yourself for your labor, though, and youll have to allocate part of your renovation budget to a contingency fund in case you end up needing to hire someone to finish your work.

If the renovations end up costing less than projected, the extra money can be applied toward your principal balance so you dont owe as much, or you can make additional improvements.

What Home Improvements Does A Homestyle Loan Cover

You can use a HomeStyle loan for virtually any home improvement project. But it does have to, you know, improve the value of the house, as confirmed by an appraiser.

Example renovations include home updates like new kitchens or bathrooms, new flooring, painting, new mechanical systems such as HVAC or electrical, and structural updates like a new roof or foundation repairs. You can use HomeStyle loans for home additions or to add an accessory dwelling unit for house hacking, such as a carriage house, garage apartment, or basement apartment.

You can even use HomeStyle loans for luxury additions such as a swimming pool or hot tub, but again, the appraiser has to sign off on it actually improving the property value. Pools often dont do that.

Recommended Reading: Getting A Second Mortgage For Investment Property

What Is The Lifecycle Of A Homestyle Renovation Loan

You Are Now Leaving The Cherry Creek Mortgage Website

Please be advised that you are leaving the Cherry Creek Mortgage, LLC NMLS #3001 website. This link is provided as a courtesy. Cherry Creek Mortgage, LLC NMLS #3001 does not manage or control the content of third party websites.

If you are planning to use a credit card to make your payment, please check with your credit card company to find out if any fees will apply to your transaction.

Don’t Miss: Socially And Environmentally Responsible Investing

Who Can Benefit From Using The Homestyle Renovation Loan

The HomeStyle Renovation Loan program can be used on 1-4 unit primary residences, 1 unit second homes, and even 1 unit investment properties. It will most benefit borrowers who cannot afford the cost of home renovations out of pocket, and sellers who want to sell their homes but cannot do so because of repair contingencies.

A single mortgage is typically more cost-effective, providing access to a lower interest rate and only one-time closing costs.

Buying A Rental Property With A Homestyle Renovation Loan

Investors have realized that buying a vacation rental or long term rental can be a huge step towards financial freedom. Although, with a limited housing supply and increased buyer competition, it is tougher to buy investment property. But, what if an investor has a purchase renovation loan available to buy a distressed or rundown property? This could create so many positive outcomes such as:

- Better tenant experience

- Longer term or repeat tenants

Maybe youre considering the world of investment properties. Imagine being able to make bids on distressed properties in as is condition. This could provide a huge advantage over a small pool of buyers. With rising home prices often exceeding the comfort level of first time home buyers, these prospective buyers are deciding to rent. Therefore, it creates a great situation for a landlord with renovated properties. Worried about qualifying for an investment property? In addition to the buyers income, we can add the new properties rent to help qualify. Basically, 75% of the propertys market rent as determined by the appraiser is added to the buyers income.

Some investors have a contractor on call for handyman jobs or they are savvy enough to do the work themselves. A key point to remember is that none of the renovation loans allow DIY projects. The work must be completed by a contractor.

You May Like: Changing Second Home To Investment Property

About These Listings And Why They’re Unique

This site provides you with the list of “big equity” properties that savvy investors DO NOT want you to know about. They don’t want the competition. It’s a list that will enable you to reap huge profits, just like they are, from today’s chaos.

This isn’t your typical list of over-shopped and over-priced MLS listings, foreclosures, HUD homes, and REO properties. At most, those types of properties are discounted by 10% to 15%. Realtors may call that a deal. We call that “trash.”

The properties on this site are under-shopped and, as a result, under-priced. They are “under the radar” so to speak. A majority of them are not listed anywhere else.

Most investors are unaware of this insider’s list. And for you, that’s a good thing. Less competition means bigger – often absurd – profits.

Most investors are unaware of this insider’s list. And for you, that’s a good thing. Less competition means bigger – often absurd – profits.

But most importantly, the properties on this site have big equity and bigger profit potential. Dozens of them are marked down by 30% to 40%. And dozens more have at least $20,000 in equity.

We provide you with two specialized types of properties: