How Does The Coffee Market Work

Like all markets, the price of coffee is directly related to its supply and demand. There are lots of different factors that affect its supply and demand, and in the bullet points below, weve explained a few of the main ones.

- Weather. Extreme heat or rain plays a significant role in coffee bean crops and can directly impact its price. Coffee bean farms can produce lower crop yields if weather conditions are not in keeping with whats required. If farmers cannot produce enough coffee, then supply would be limited, and its price would likely increase.

- Political instability. Most of the worlds coffee is grown in regions where governments are often unstable. For example, a lot of coffee plantations exist in South America or Africa. Both areas are well known for experiencing political issues at times, and an unstable government can affect coffee exports, thus impacting its price.

- Exchange rates. The British Pound and U.S. Dollar both play an essential role in the price of coffee. It is traded on the New York and London stock exchanges. Buyers of coffee using another currency need to closely monitor exchange rates as falls in either would impact its price.

- Environment. Farmers are always on the lookout for the best places to grow their crops and whats around them can impact their yields. Chemical usage can greatly disrupt coffee bean growth, as can disease. In 2009, South American farmers saw crop yields drop by 40% when fungus started to grow on coffee leaves.

Price Spikes Are Often Short

Over time prices of commodities will tend to move toward an equilibrium price that matches demand and supply. But in the short term, commodity prices are volatile and they will tend to overshoot this equilibrium price on both the upside and downside. So, markets often overcorrect as producers rush in to correct a lack of supply. But then they might stick around to recoup their investment and end up staying too long pushing the commodity price below a sustainable level.

So price spikes and even massive declines are often short-lived. The spikes bring marginal suppliers online, while later declines shake out the marginal suppliers.

What Coffee Stocks To Buy Today

So what are the best coffee stocks to buy or add to your watch list right now? Among the best are Restaurant Brands International Inc. , Starbucks Corporation , and Dutch Bros Inc. .

Restaurant Brands International Inc.

The Georgia-based food and beverage group owns many food chains such as Burger King and Popeye’s. Restaurant Brands International also acquired the Canadian coffee shop Tim Hortons in 2014. In early 2021, Tim Hortons invested more than $63 million to boost its products and offer more items on its menu. As a result, restaurant Brand’s International stocks soared 18% that same year.

The company has a stock price of $30.92 billion and offers a dividend yield of 3.17%. The company reported second-quarter adjusted EPS of $0.77, beating the consensus EPS of $0.61. Restaurant Brands International’s revenue was $1.44 billion, above consensus expectations of $1.15 billion.

As Keurig Dr Pepper Inc, Starbucks Corporation, Nestle S.A., McDonald’s Corporation, Monster Beverage Corporation, and Yum China Holdings, Inc, Restaurant Brands International is among the best coffee stocks to buy today.

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Starbucks Corporation

Today, Starbucks holds more than 34,000 places worldwide. Although Starbucks has long seemed ubiquitous, the coffeehouse chain continues to grow.

Dutch Bros Inc.

Read Also: How To Invest In Google Stocks

Growth In The World Of Coffee Consumption

The worldwide coffee consumption has risen from 146.98 million 60 kilogram bags in 2012/13 to around 165.35 million 60 kilogram bags of coffee in 2018/19. The United States is the largest consumer of coffee in the world, with nearly 500 million cups a day. The US consumed a total of 27,430,000 60kg bags in 2019/20. However, if you look at the average per capita consumption of coffee, the Netherlands tops the chart with 8.3 kg per capita, whereas in the US it is 3.5 per capita.

However, there are countries where coffee consumption is not prominent. China, the most populated country in the world has one of the lowest coffee consumption rates with an average of just one cup a year. However, the coffee consumption rates are growing at 30% per year, compared to the international rates of 2%.

Stock Of Commodities Producers

If you dont want to own physical commodities , you can opt for producers of commodities and still be in a position to win when commodities prices rise.

Stockholders can benefit in two ways with producers. First, if the price of the commodity rises, the underlying company usually sees its profit rise. Second, the company can increase production over time to increase profit. So you have two ways to make commodities work for you.

Risks: Commodity producers are often risky investments. Commodities industries are subject to boom and bust cycles, and companies require a lot of capital. Buying individual stocks requires a lot of work and analysis, and investing in a few stocks is riskier than buying a diversified group of stocks. So if you go this route, youll want to carefully understand the company and industry.

Recommended Reading: Which App Is Best For Mutual Fund Investment

Black Rifle Coffee Company

Black Rifle, which went public through a SPAC merger in February 2022, puts a unique spin on a commodity product by branding for a specific customer subset — conservative Americans and veterans in particular. The company’s mission is “to serve premium coffee and content to active military, veterans, first responders, and those who love America.”

That distinct branding and its direct-to-consumer origins and marketing have helped the company quickly build brand awareness and sales. In 2020, revenue doubled to $164 million, seemingly helped by the stay-at-home nature of the pandemic and the company’s e-commerce positioning. Through the first three quarters of 2021, revenue rose 55%.

Unlike the typical coffee company, Black Rifle also defines itself as a media company, and it’s a lifestyle brand as much as a coffee brand. The company puts out a magazine and is active in political and cultural issues with its blog and on social media. With a brand that also functions as an identity, a key component of its strategy is selling branded merchandise like apparel and equipment that helps build awareness and gives its customers a way to signal their affinity for the brand. In 2020, merchandise sales made up 12% of revenue.

Black Rifle has begun opening its own stores, which it calls “outposts,” and had nine locations as of Sept. 30, 2021. In addition to e-commerce sales, it also sells ready-to-drink and bagged coffee through retailers such as 7-11, Publix, and Walmart .

Coffee Market Trading Hours

ICE sets out the following hours when trade in coffee is allowed for futures and options:

|

Coffee type location |

|

|

Robusta |

16:00 – 00:30 |

*Hours are set by ICE and may vary. Hours will shift between March and November as the UK and US change to and from daylight savings on different days, while Singapore remains on Singapore Standard Time all year round.

If you choose to trade contracts for difference , you can follow the prices of Robusta coffee futures and the Arabica spot coffee price live with our comprehensive charts. With Capital.com, you can trade CFDs in these coffee trading hours:

Arabica coffee: Monday to Friday, from 12.15 to 20.30

Robusta coffee: Monday to Friday, from 03:05 to 00:00

You May Like: How To Invest In Amazon Cryptocurrency

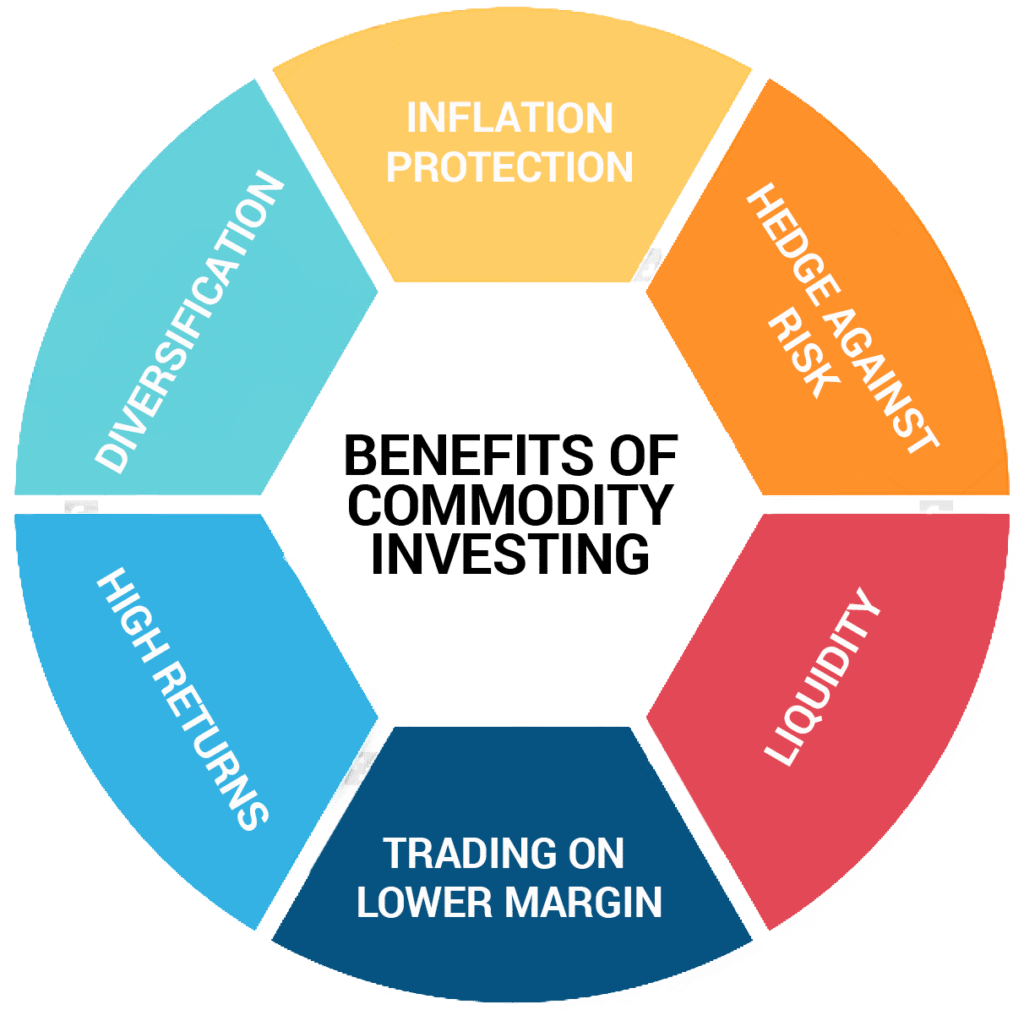

Should You Invest In Commodities

Investing in commodities may offer investors a potential hedge against inflation, together with a means of diversifying their portfolio across different assets. As with shares, commodity prices are volatile and should form part of a long-term investment strategy.

Depending on your preference and appetite for risk, you may choose to invest in commodity-based products such as ETFs, funds and shares. However, it is important that any investment in commodities forms part of a diversified portfolio.

Your investment can go down as well as up, and you may not get your money back. If you are unsure as to the best option for your individual circumstances, you should seek financial advice.

Featured Partner Offer

The Decline Of Coffee Beans Price

The price has been trading in a bearish pattern since November 2016, when the price reached a high of $1.80 per pound. In 2011, the commodity was trading at $3.0625 per pound. This trend is shown on the chart below.

There are several reasons for this decline.

First, the coffee market has been going through increased oversupply. The main producer of the crop are Brazil and Vietnam. As Economics 101 states, increased oversupply leads to lower prices.

This oversupply has happened as the number of acreage in Brazil continue to increase. Unlike the crude oil industry, this like OPEC to regulate prices.

As such, countries produce as much as they can.

Another reason why prices have declined is the Brazilian Real. The currency has been on a downward trend against the US dollar as shown on the chart below. A depreciating real is usually negative to the price of coffee beans.

Real-USD comparison

Read Also: How Can I Invest In Stocks With Little Money

How To Success With Coffee Investments

When purchasing coffee, it is critical to keep an eye on what is available. Coffee has a significant benefit in that many people are used to drinking it, and therefore demand will not decline much. As a result, the supply side will largely influence the eventual price of coffee. Furthermore, coffee is seen as a fundamental commodity eaten even during difficult economic times. This makes predicting the price of coffee simpler than predicting the price of a social media share.

If you want to succeed with coffee investments, you need to keep up with the news and see how the harvests are doing. Colombia produces a large amount of coffee, long been plagued by leaf rot.

Such an occurrence might significantly impact the coffee supply, causing the price of coffee to skyrocket. Meanwhile, they’ve succeeded in creating a rust-resistant shrub, which has remedied the issue.

Why You Should Own Coffee Stocks

Coffee is a high-margin business for the world’s top consumer products companies. It’s also a timeless product that’s likely to gain popularity as people in China and other countries move into the middle class and consumers seek alternatives to sugary beverages like sodas.

While coffee is a competitive industry, it offers opportunities in both consumer discretionary and consumer staples stocks. Different types of investors can find the right fit whether they’re seeking growth stocks or dividend stocks. There may not be a lot of pure-play opportunities in the sector, but investors looking to perk up their portfolio should consider the six stocks above.

Recommended Reading: Investment Loans For Rental Property

Best Coffee Commodity Stocks

Nestle S.A.

Nestle, headquartered in Switzerland, is one of the best companies to invest in coffee stocks. It is the world’s leading food company, a diverse business group with more than 2,000 brands in coffee, tea, bottled water, chocolates and chocolates, soups, dressings, and pet food. Although it is impossible to summarize such a diversified company in a single product, coffee is an essential component of its business. Brands such as Nescafé and Nespresso are famous worldwide.

Nestlé’s most relevant activity is powdered and liquid beverages, including Nescafé and Nespresso’s coffee brands. This sector contributed $25.9 billion of the $93.9 billion profit in 2021. In addition, soluble coffee and coffee products contributed $18.4 billion in sales as the company recovered from a decline caused by the pandemic the previous year.

Overall, the powdered and liquid beverage line is highly profitable, with an underlying operating return of 23.5%, placing it as the company’s second most profitable category. In addition, trading bagged coffee, and ready-to-drink beverages have been a key expansion source for Nestlé.

Keurig Dr Pepper Inc.

As a private company, investors may not own JAB stock. However, coffee investors should be sensitive to this company’s influence in the market, as it has acquired several coffee companies in recent years. It also led to the IPO of Krispy Kreme on July 1, 2021. In addition, at the end of 2020, JAB owned 33% of Keurig Dr Pepper.

Pros And Cons Of Trading Coffee Cfds

Commodities can be highly volatile, experiencing enormous price swings. Coffee prices can be especially volatile given the impact of sudden climate or geopolitical events on supply and demand. Trading CFDs for coffee is one way that traders can use to speculate on sharp price fluctuations.

CFDs give you the option to trade the coffee markets in both directions. Whether you have a positive or negative view of coffee prices, you can take a long or short position to try to profit from the price movement. Note that the assets price can go against your position, which could trigger losses.

Moreover, trading coffee through CFDs is often commission-free, with brokers making a small profit from the spread and traders trying to earn from the overall change in price.

Additionally, the 10% margin offered by Capital.com means you have to deposit only 10% of the value of the trade you want to open, and the rest is covered by your CFD provider. For example, if you wanted to place a trade for $1,000 worth of coffee CFDs with a 10% margin, you would need only $100 as initial capital to open the trade.

However, you should be aware that trading coffee CFDs carries risks, as they are leveraged products that amplify the size of the loss if prices move against your position, as well as maximising gains if the price moves in the same direction.

It is important to understand how leverage works and have a risk management plan in place before you start trading CFDs.

Don’t Miss: What Is The Best Investment Account

Are Commodities Volatile

Commodities volatility is generally reflective of the supply and demand. If there were loads of avocados grown just as everyone decided they didnt like guacamole anymore, then the price of your average avocado is likely to go down. If a worldwide virus leads to everyone panic buying toilet roll, youre likely to see the price rise.

Due to supply and demand, the volatility of commodities tends to be higher than for other types of investment, but this depends entirely on the commodity.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: Is It Better To Invest In Gold Or Diamonds

How To Begin Trading

Many of the trading sites online are a great way to start for knowledgeable investors. They also have information according to the market commodity. This is a great place to educate yourself if you are interested in trading futures. The market websites themselves are also an excellent way to gain knowledge about the industry.

If you are a beginner trader, it is a good idea to consult a professional. Going at a risky business alone, like futures and options, is probably not the best plan. Study the coffee market, the agricultural news and fill your cup with some time honored advice.

Etfs Of Commodities Producers

One way to gain diversified exposure to commodities producers is to buy an ETF that owns a portfolio of them. Youll gain the benefits of diversification and may be able to gain focused exposure to producers of a specific commodity. For example, you could buy a gold miner ETF, and enjoy the benefits of cash-flowing producers and bet on the rising price of gold, too.

Risks: If your ETF is focused on a specific commodity, such as oil producers, youre diversified, but narrowly. That is, youre not overexposed to any single company, but if the price of oil falls, this kind of diversification wont protect you as much as broad diversification would. But thats the flip side of trying to gain pure play exposure to producers of a specific commodity.

Don’t Miss: Best Place To Invest In Commercial Real Estate

Custom Blend: Coffee Stocks

Investors can gain exposure to coffee in the stock or futures markets. When it comes to stocks, think of businesses that are in the business of selling coffee.

Other more roundabout ways to invest in coffee involve firms where coffee makes up a fair share of business. Think of fast food companies that also sell coffee and grocery store brands.

Invest In Coffee Mutual Funds

Similar to ETFs, you can buy shares in a mutual fund. However, unlike ETFs, mutual funds are managed by a professional fund manager who controls what the fund buys and sells. There are currently no solely coffee-focused funds however, it is possible to invest in funds that hold some coffee companies. Using this method will allow you to gain exposure to a broader market.

Also Check: Sites To Invest In Cryptocurrency

Should I Invest In Coffee

Coffee prices can be very volatile, so investors should take that into account when deciding whether or not to invest.

Commodities provide traders with protection against inflation and a declining US dollar, as well as asset diversification.

There are three compelling long-term trends that could boost coffee prices specifically: