Open An Investing Account

If youve decided to go it alone, youll need to open a brokerage account first, which is where you can buy and sell investments. Some brokerages have stronger socially responsible investing offerings than others. For example, Merrill Edge and Fidelity have screener tools to help you find the right funds for your portfolio.

» Ready to build an SRI portfolio? Learn more about how to open a brokerage account

The Next Decade Of Esg

If the last decade saw ESG become mainstream, the next ten years will likely bring a new wave of shareholder-driven accountability from the world’s largest companies.

As issues like climate change and global poverty become more immediate, and as megatrends are set to take shape, people will increasingly call on the most powerful players to take action. Corporations will have to step up, and ESG metrics will need to crystallize.

“The largest investors in the world, which control how stocks are ultimately valued, care about this. Endowments and foundations are totally focused on ESG considerations pension funds care about it, labour unions care about the safety of their employees the biggest asset managers in the world have now awoken and said ‘ESG matters to me,’ and therefore it’s going to matter to companies,” Robbins said.

– CNBC’s Michael Bloom contributed to this report.

Risks Of Esg Investing

Lack of universal ESG standards.

There are no agreed-upon standards for evaluating ESG performance. That creates inconsistencies in ESG portfolios and funds. You may be surprised to find some ESG funds hold tobacco stocks, for example.

No long-term data on the financial performance of ESG companies.

Longer-term data could show that ESG companies arent as resilient as once thought. If that happened, investors who are wholly focused on financial returns would likely shift away from the ESG sector.

Companies could stop reporting on ESG issues.

Companies could stop voluntarily reporting sustainability data. Any broad deprioritization of ESG attributes would reduce the supply of high-quality, investable ESG companies.

Also Check: How To Start An Investment Management Firm

What Is Socially Responsible Investing

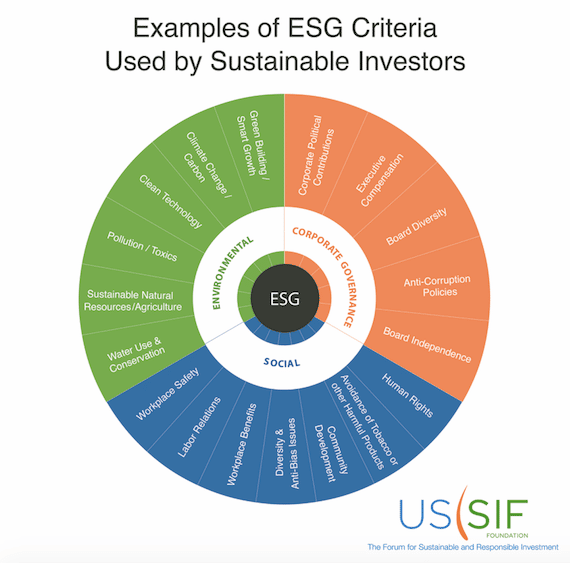

Socially responsible investing is an investment strategy that chooses securities to invest in based on how socially responsible its business practices are. The goal of SRI is to create positive social and environmental change while still generating financial returns.

SRI investments can range from green bonds to solar energy to fair trade companies. Sometimes SRI is often referred to as “green investing” or “sustainable investing.” SRI investing can take into account things like environmental, social, and corporate governance, which is often referred to as ESG investing factors. Ultimately, a true SRI investment choice is just one that aligns with the values of the investor.

Choose The Right Ethical Standards

Before choosing investments itâs important to have the right ethical standards and rules that the portfolio is going to base investment choices on. The right standards could greatly vary by the individual investor so no two SRI investment strategies are going to align and look exactly the same. Writing out these rules makes it easy to evaluate any potential investment choices.

Read Also: How To Open An Investment Account

Understanding Socially Responsible Investment

Socially responsible investments include eschewing investments in companies that produce or sell addictive substances or activities in favor of seeking out companies that are engaged in social justice, environmental sustainability, and alternative energy/clean technology efforts.

In recent history, socially conscious investing has been growing into a widely-followed practice, as there are dozens of new funds and pooled investment vehicles available for retail investors. Mutual funds and ETFs provide an added advantage in that investors can gain exposure to multiple companies across many sectors with a single investment. However, investors should read carefully through fund prospectuses to determine the exact philosophies being employed by fund managers, along with the potential profitability of these investments.

There are two inherent goals of socially responsible investing: social impact and financial gain. The two do not necessarily have to go hand in hand just because an investment touts itself as socially responsible doesn’t mean that it will provide investors with a good return and the promise of a good return is far from an assurance that the nature of the company involved is socially conscious. An investor must still assess the financial outlook of the investment while trying to gauge its social value.

Investing Better Means Paying A Little Bit Of Attention

Theres an old maxim in investing attributed to Andrew Carnegie and Mark Twain that says you should put all your eggs in one basket, and then watch the basket. If you want to invest ethically, you have to watch the basket or leave it with someone who will.

Minow, from ValueEdge Advisors, said that the easiest way to try to move your money toward doing good is to take a look at your 401. If theres an index fund with an ESG component in there and the potential social benefits outweigh the potential costs, consider choosing it. A next step, if youre up for it, is to look at how funds vote their proxies, meaning ballots shareholders get to vote annually on various corporate issues.

In the case of many funds, the firms behind them vote on behalf of their individual investors, and because they have so many shares, they have quite a bit of sway. Are they voting for or against outrageous CEO pay packages? Climate proposals? Diversity requirements? Big investment managers like BlackRock say theyre paying attention, but are they?

Either they put their money where their mouth is or they dont, Minow said. If a company says were making a commitment to be carbon-neutral by 2050 but they dont make that part of the CEOs pay plan, dont listen to them, because theyre not serious about it.

Related

The sad, predictable limits of Americas economic recovery

Recommended Reading: How To Invest On Cryptocurrency

Example Of Socially Responsible Investing

One example of socially responsible investing is community investing, which goes directly toward organizations that both have a track record of social responsibility through helping the community, and have been unable to garner funds from other sources such as banks and financial institutions. The funds allow these organizations to provide services to their communities, such as affordable housing and loans. The goal is to improve the quality of the community by reducing its dependency on government assistance such as welfare, which in turn has a positive impact on the community’s economy.

Sustainable Investing With Fidelity

Where appropriate and aligned with a funds investment objectives, we apply an ESG perspective directly to the products we offer our clients. Fidelity sustainable funds prioritize one or more of these ESG factors in their fundamental research and investment disciplines*:

- Environmental themes, such as investing in companies that are responding to consumer demand for sustainable practices

- Social themes, such as investing in companies committed to a diverse and inclusive workplace

- Governance themes, such as investing in companies committed to diverse board composition, strong oversight, and shareholder friendly policies

Two-thirds of retail customers say social impact is key to their investing decisions1, according to Fidelity research.

181 CEOs from some of Americas largest companies have committed to lead their companies for the benefit of ALL stakeholders customers, employees, suppliers, communities and shareholders.2

Read Also: How Do I Invest In 5g Technology

The Pros Of Socially Responsible Investing

When you see someone taking the SRI strategy, it tends to be all-or-nothing. What I mean is, you either fill your portfolio entirely with socially responsible stocks and funds, or you dont put a targeted focus on them at all. Here are some of the benefits of employing a socially responsible investment strategy:

Understanding Socially Responsible Investing

Investors interested in SRI dont just select investments by the typical metrics performance, expenses and the like but also by whether a companys revenue sources and business practices align with their values. And since everyone has different values, how investors define SRI will vary from person to person.

If youre passionate about the environment, your portfolio will likely have investments in green energy sources such as wind and solar companies. If you care about supporting the advancement of women, people of color and other marginalized groups, you may have some mutual funds that invest in women-run companies or hold stock in Black-owned businesses. And since socially responsible investing is as much about the investments you dont choose as the ones you do, you may choose to divest from a company if you learn that it mistreats LGBTQ employees.

Since everyone has different values, how investors define SRI will vary from person to person.

You may find that some SRI funds match your values while others do not and you may be surprised at what companies end up in an SRI fund. For example, Vanguards VFTSX fund is screened for certain ESG criteria and excludes stocks of certain companies in industries such as fossil fuels and nuclear power. But the funds holdings include Amazon and Facebook two companies some SRI investors have opted not to support.

Don’t Miss: Best Place To Start Investing For Beginners

Outline Whats Important To You

It may be helpful to specifically write down what youre looking for in an SRI or ESG investment. Are gun manufacturers a deal-breaker? Would you be comfortable owning stock in a company that scores lower in the environmental category if it had a majority-female board of directors? Knowing what industries you are and arent OK with supporting will make it easier to include or exclude certain investments.

Types Of Socially Responsible Investments

Taking the different investing methods into account, there are different types of socially responsible investments. They include:

1. Mutual Funds and Exchange-Traded Funds

Several mutual funds and ETFs adhere to the ESG criteria. If an investor is looking to invest in either of the two funds, visit the SIF website, which outlines over 100 socially responsible mutual funds. Also, they can also look at different socially responsible ETFs here.

2. Community Investments

An investor can also put their money directly into projects that benefit communities. An easy way to make such an investment is to contribute to community development financial institutions .

3. Microfinance

Another way individuals can make socially-sound investments is by offering microloans or small loans to startups. They can look for businesses in developing countries that offer financial assistance.

You May Like: What Is Long Term Stock Investment

Socially And Environmentally Responsible Investing Is Possible

CLARK FINANCIAL ADVISORY GROUP – Providing financial direction and wealth management throughout the decades

Increasingly investors are interested in making sure their money is invested in socially and environmentally responsible ways. It turns out there are a growing list of good options for investors to consider. These are known as Responsible Investing funds

Loosely speaking, RI funds incorporate environmental, social and governance factors into investment decisions. Governance might include things like the companys impact on climate change, human rights or other factors. You may even have heard of some of these investments. They are sometimes known as ethical investing, socially responsible investing, green investing, impact investing or mission-based investing.

As of 2014, US portfolios that focus on RI totaled US$6.6 trillion. Much of that money is being invested by University endowments and Foundations. Although $6.6 trillion is a lot of loot, it represents less than one percent of the money invested in Canadian and US domiciled mutual funds and exchange traded funds. While its clear from a recent Ipsos Reid poll that 50% of Canadians believe its important to consider RI funds, the amount invested remains small.

Why so little or retail investors money is invested in RI mandates is due to several factors but a significant one is that many advisors are not up to speed on what is available and how it compares with other more commonly used investment funds.

What Role Does The Pri Play

The PRI is a global organisation that encourages and supports the uptake of responsible investment practices in the investment industry.

Interest in responsible investment has risen rapidly since the PRIs launch in 2006, with total PRI signatories now exceeding 3,500, and reaching all around the world.

PRI signatories commit to implement the six Principles for Responsible Investment across their organisation. The PRI helps investors to do this via:

Don’t Miss: How To Invest In A Etf

Socially Responsible Investing: Marketing Tool Or Solution To Esg Problems

Socially responsible investing refers to an investment strategy aimed at both creating social change and generating financial returns for an investor. Investment funds with an ESG label have skyrocketed in recent years, and, according to a 2021 survey, 82% of professional investors worldwide plan to increase their allocations to socially responsible investments over the next year.

As the number of assets in sustainable investment funds have soared, so too have concerns over greenwashing, inadequate regulations, and a lack of transparency when it comes to metrics.

In this months MIT Sloan Management Review Strategy Forum, we asked our panel of strategy experts from across the globe to respond to the following statement: Socially responsible mutual funds are more of a marketing tool than a solution to environmental and social problems.

Esg For Public Markets

Environmental, Social and Governance

There are two kinds of socially responsible investing we employ at Balanced Rock. The first is Environmental, Social and Governance investing where we combine product or industry exclusions and behavioral data about public companies to customize client portfolios. With exclusions, we can divest from and avoid your choices from a long list of industries such as fossil fuels, defense & weapons or the prison industrial complex. The ESG data looks at how companies perform on nonfinancial behavioral metrics and how they compare to their peers in each industry. We consider metrics like carbon footprint, water stress, supply chain labor standards, corporate behavior, and stakeholder controversies. While we invest in some public companies that make a positive impact, for the most part, socially responsible investing in public markets means eliminating the worst actors and shifting client portfolios towards better actors.

Also Check: Real Estate Investment And Development Company

Investing In Capital Markets

Social investors use several strategies to maximize financial return and attempt to maximize social good. These strategies seek to create change by shifting the cost of capital down for sustainable firms and up for the non-sustainable ones. The proponents argue that access to capital is what drives the future direction of development. A growing number of rating agencies collects both raw data the ESG behaviour of firms as well as aggregates this data in indices. After several years of growth the rating agency industry has recently been subject to a consolidation phase that has reduced the number of genesis through mergers and acquisitions.

ESG integration

ESG integration is one of the most common responsible investment strategies and entails the incorporation of environmental, social and governance criteria into the fundamental analysis of equity investments. According to the non-profit Investor Responsibility Research Center institute , approaches to ESG integration vary greatly among asset managers depending on:

- Management: Who is responsible for ESG integration within the organization?

- Research: What ESG criteria and factors are being considered in the analysis?

- Application: How are the ESG criteria being applied in practice?

Negative screening

Negative screening excludes certain securities from investment consideration based on social or environmental criteria. For example, many socially responsible investors screen out tobacco company investments.

Divestment

How To Become A Socially Responsible Investor

If youre trying to be a socially responsible investor, you should be going out of your way to buy funds that meet that criteria.

The simplest way of doing that is with a robo advisor, which will manage and invest your money for you based upon your own individual risk tolerance. Some of my favorite robo advisors have socially responsible investing tracks, including Personal Capital, which focuses on ESG metrics, and Betterment, which also offers SRI alternatives for large cap U.S. stocks and emerging market stocks.

Ally Invest now has what they call Robo Portfolios–which is their version of a robo-advisor. They now feature a socially responsible portfolio option that, according to Ally Invest, is shaped by companies with ethical track records, and youll only invest in businesses that actively practice sustainability, energy efficiency or other environmentally-friendly initiatives.

Ally Invest has NO advisory fee, either, which makes it a huge bargain. You can open an account with as little as $100 and youll also get call, chat, or email support at no additional cost. Make sure you read our complete review on Ally Invest for more details on their Robo Portfolios.

Recommended Reading: Hire Someone To Invest For You

Can An Sri Strategy Be Profitable

The short answer is that yes, some SRI strategies have been proven to be profitable and render decent returns, but no investment is guaranteed to have a strong return. Additionally, choosing a full SRI-only investment strategy is likely to eliminate some potential big wins in your investment portfolio because part of the market is closed-off from being an option.

Many ETFs and mutual funds have prospered as full SRI-only investment funds, providing large returns over a long period of time. This is proof enough that this type of investment can be profitable as long as you apply not just the ethical standards that you have but also a strong investment selection strategy to make a portfolio profitable.

What Is A Socially Responsible Investment

Socially responsible investing , also known as social investment, is an investment that is considered socially responsible due to the nature of the business the company conducts. A common theme for socially responsible investments is socially conscious investing. Socially responsible investments can be made into individual companies with good social value, or through a socially conscious mutual fund or exchange-traded fund .

Don’t Miss: What Does Fixed Income Mean In Investing