Our Top Mortgage Lenders

Do Second Mortgages Have Fixed Rates Or Adjustable Rates

The typical gold standard for primary mortgages is a 30-year fixed-rate loan. This means that the interest rate is fixed for the entire 30-year term. Whatever type of primary mortgage there is, the terms, including the interest rate, for the second mortgage may be different than the primary mortgage. If there is an adjustable-rate second mortgage, which is somewhat more common, the interest rate will increase or decrease throughout the term of the loan. ARMs have clearly-defined terms that shows:

- how long the initial fixed rate lasts

- the frequency your rate can change after that first term

- how much the rate may change

- how the periodic rate changes are calculated

A second mortgage is considered a loan independent of the primary mortgage, so borrowers should be careful to understand the distinctions between the two.

Va Interest Rate Reduction Refinance Loan

If you have an existing VA loan and you want to lower your interest rate or move from an adjustable interest rate to a fixed rate, then a VA IRRRL may be the right option for you.

You may be eligible for an IRRRL if you:

- Already have a VA loan and

- Are using the IRRRL to refinance your existing VA loan and

- Meet the VAsand your lenderscredit and income requirements and

- Currently live in or used to live in the home covered by the loan.

You May Like: How To Invest In Stocks Outside Of Us

Introduction To Va Refinance

VA loans are provided by private lenders to service members, veterans, and surviving spouses who meet Department of Veterans Affairs qualifying requirements. The VA guarantees a portion of these loans, enabling lenders to offer favorable terms to borrowers. VA loan benefits include competitive interest rates, a streamlined application process, and not having to pay expensive monthly mortgage insurance.

VA refinance loans take place under the auspices of the VA loan program. These are broken down into two different products: VA interest rate reduction refinance loans and VA-backed cash-out refinance loans.

Investment Property And Second Home Mortgage Rates Faq

What is a second home?

A second home is a property you dont live in full-time but use part-time or visit as a vacation home. Homeowners must live in their second homes for at least a portion of the calendar year. Although each mortgage lender will have its own eligibility requirements, the IRS says a second home is a residence that you visit for at least 14 days each year or 10 percent of the total days that you rent it out.

What is an investment property?

An investment property is typically a rental property or a home purchased to renovate and flip for a profit. They differ from second homes in that the buyer does not usually reside in an investment property. Additionally, they can also be larger than one-unit properties.

Are second home mortgage rates always higher?

While its impossible to answer this question without knowing the rate on your existing mortgage loan, second home mortgages and investment properties typically have higher interest rates. The rate you qualify for will vary depending on your income, credit score, location, and more.

What are alternative ways to finance a second home?What are the risks of a second home mortgage?

Also Check: Can I Buy An Investment Property With A Va Loan

Heloc For Investment Or Rental Properties

- Access up to $400K in your homes equity

- 100% online application

- Check your rate without impacting your credit

If youre considering a HELOC, Figure is one option to look at. The online lender offers a HELOC product, as well as other mortgages including crypto loans.

Heres a look at Figures HELOC requirements and specs:

| Figure HELOC |

Interest Rates: Standard Market Rates

Because residential financing involves little risk, mortgage rates are low relative to vacation homes and investment properties. The market rates you see advertised by banks and lenders apply to primary residences. Of course, your own rate depends on factors like your credit score and down payment and may be higher or lower than what you see advertised.

Also Check: How To Invest With Leverage

Alternatives For Using Your Equity To Buy Another Home

As with any loan, home equity loans come with benefits and drawbacks that might affect your financial situation. However, numerous financial instruments can help you leverage your equity for a home purchase. So, its a good idea to assess the following alternatives when deciding how to use your equity:

How To Apply For A Mortgage

These days, you can complete almost the whole mortgage process online. After you’ve checked your credit score, figured out how much house you can afford and researched the best mortgage lenders, it’s time for some paperwork.

Keep in mind that the mortgage lender makes a hard inquiry on your credit when you apply. Hard inquiries cause your credit score to take a small dip, so only try to get preapproved when you’re serious about putting in an offer on a home.

- *APR shown is provided by a partner of ConsumerAffairs. The APR of 4.901% is available for a 15yr Fixed Rate loan in the amount of $124,454.00 with 80% LTV paying discount points up to 2%. The APR of 5.312% is available for a 30yr Fixed Rate loan in the amount of $123,062.00 with 80% LTV paying discount points up to 2%. Rates are effective 11/30/2022 and are subject to change without notice.

- *ConsumerAffairs is not a licensed mortgage broker in this state. Any information regarding mortgage terms in this state is being presented as a courtesy to the consumer. Contact a licensed mortgage lender to learn more about specific rates or terms in this state.

- â Bankrate NMLS #1427381 . Bankrate NMLS #1743443 .

Read Also: How Do You Make Money Investing In Cryptocurrency

Why Second Home Mortgage Rates Are Higher

The home you live in is considered your primary residence, and its seen as the least risky form of real estate. Its likely to be the one bill homeowners will pay, even if times get tough. A vacation home or investment property, on the other hand, is riskier. Borrowers are a lot more likely to forego those mortgage payments when money is short.

Because of the higher risk second homes pose, they come with stricter rules about financing. As shown above, those rules include above-market interest rates, bigger down payments, higher credit scores, and more.

Of course, borrowers will find different lending standards for different types of property, depending on the lender and the mortgage program.

For example, even when financing a second home with a conventional loan, youll pay mortgage insurance premiums if you bring less than a 20% down payment. Additionally, FHA and VA loans do not allow for the purchase of rental properties at all. So its important to compare loan options before financing a second home.

Second Mortgage On Rental Property: Pros & Cons

Taking out a second mortgage on investment property assets has served investors as a great alternative source of financing. If, for nothing else, the more ways an investor knows how to secure funding, the more likely they are to secure an impending deal. However, it should be noted that a second mortgage on rental property assets isnt without a few significant caveats. Like nearly every strategy used in the real estate investing landscape, one must weigh the pros and cons of second mortgages. Only once an investor is certain the positives outweigh the negatives should they consider using a second mortgage on investment property assets. Here are some of the most common pros and cons of taking out second mortgages on rental properties to help you form your own opinion.

Read Also: Types Of Fixed Income Investments

Find A Local Real Estate Agent

Your real estate agent is the most important person in this second home process. Theyll work to find you the perfect home, negotiate on your behalf and be there to guide you through the rest of the buying journey.

Be sure to look for an agent local to the area where youll be purchasing. Theyll know the intricacies of the real estate market better than a regional agent, which means they can offer advice on finances and neighborhoods to explore.

When you search for a REALTOR®, be sure to look for a buyers agent only. Working with a dual agent, or an agent who represents both you and the seller, can cause conflicts of interest.

Also Check: Top Investment Management Firms In Boston

The Costs Of Home Equity Loans

One of the drawbacks of home equity loans is that you have to put your house up as collateral and that does bear some risk. In addition, a number of lenders charge a flat origination fee which can be anywhere around $50 or into the hundreds of dollars or more. More significantly, many lenders charge a closing fee as part of the loan which can be as much as 2%-5% of the loan value.

Recommended Reading: Best Dividend Stocks For Long Term Investing

Using Your Existing Homes Equity

If you have built sufficient equity in your existing home, you have the option of using it to purchase a new home. What you have to bear in mind, though, is that the existing home then acts as security toward the new home.

Since loans for second homes and investment properties come with different approval requirements,it is best that you equip yourself with all the required information in advance.

Ways To Come Up With A Down Payment For An Investment Property

Not scared away yet? Good, because despite the high cash requirements for buying investment properties, you have plenty of options to come up with the cash for a down payment on a rental property. You may even be able to buy your next rental property with no money down!

Before we dive in, its worth pausing to note that the best source of funds for a down payment was, is, and always will be cash from your savings. When you borrow a down payment from someone else, you leave yourself vulnerable to overleverage, to narrow cash flow margins or even negative returns, and to possible rate hikes or called loans.

This is why were so big on boosting your savings rate and cutting your spending, and even going so far as living on half your income. The more of your own savings and cash you can invest with, the better position youre in to earn high returns from your rental properties.

All right, enough proselytizing, lets dive into some alternative ideas for coming up with the down payment for an investment property!

Also Check: How To Invest In Aramco Stock

Second Home Mortgages In North Carolina: What You Need To Know

Not only is North Carolina one of the most beautiful places to visit, but it is also one of the most affordable places to have a second home. From the growing industrial hubs in the city of Charlotte to the peaceful shorelines on the coast of Beaufort, the Tar Heel State is a popular place for tourists to visit and vacationers to dwell.

If youve ever visited North Carolina, you may be thinking that it could be the perfect place for your home away from home or perhaps you see a booming real estate opportunity for an investment property. No matter your unique intentions, theres no time like the present to pursue your homebuying dream.

Were covering everything you need to know about qualifying for a second home mortgage in North Carolina. But first, lets talk about some of the benefits of buying a second home.

What Are The Risks Of Using A Home Equity Loan To Buy Another House

The major risk of a home equity loan, as with a regular mortgage, is that it is secured by your home. This means that if you are unable to keep up with the payments, your lender could seize the home, sell it, and evict you. Instead of a home equity loan, you also may be eligible for an unsecured personal loan, which wont put your house at risk but will typically have a higher interest rate.

You May Like: How To Automatically Invest In Etf

Second Home Mortgage Requirements

Second-home loans regularly have a lower interest rate than investment-property loans and might include a Second Home Rider along with the mortgage. This rider usually states that:

- the borrower will occupy and only use the property as the borrower’s second home

- that the property will be kept available for the borrower’s exclusive use and enjoyment at all times

- the property can’t be subject to any timesharing arrangement or rental pool, and

- the property can’t be subject to any agreements that require the borrower to rent the property or give a management firm control over the occupancy and use of the property.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: Is Ivr A Good Investment

Interest Rates Will Likely Be Lower

Lenders spend less time originating home equity loans, which may save you money, as it typically means lower fees and closing costs. But perhaps the biggest advantage of this option is the potential to lower your interest rates.

Home equity loans offer lower interest rates because they are secured by collateral in the form of real estate. This means by utilizing a home equity loan, you can avoid the hefty interest rates you would encounter through other forms of financing, like hard money and personal loans.

Also Check: Companies Similar To Fisher Investments

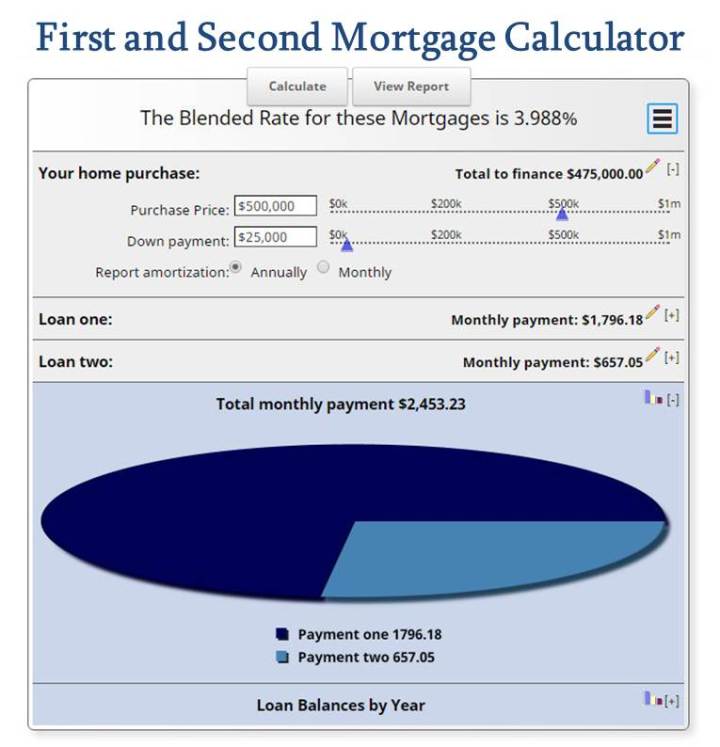

What Makes Up A Monthly Mortgage Payment

Once you’ve covered all the upfront costs of a home loan, your monthly mortgage payments include principal, interest, taxes and insurance . In some cases, other regular expenses include homeowners association or condo fees.

- Principal: The principal is the balance of the loan amount you borrowed. Each month, your mortgage payment reduces the principal.

- Interest: Interest is the amount you agree to pay your lender in exchange for a mortgage loan. Fixed interest rates stay the same throughout the term of the loan. Adjustable interest rates can vary over the life of the loan.

- Property taxes: Property taxes are often included in mortgage bills. Lenders keep your property tax payments in an escrow account until they’re due and then pay them on your behalf.

- Mortgage insurance: Mortgage insurance protects the lender if you stop making payments on your loan. The two types of mortgage insurance are private mortgage insurance and mortgage insurance premiums . For conventional mortgages, you can avoid the need to pay for PMI by making a down payment of 20% or more. For FHA and other government-backed loans, you can avoid MIP after 11 years by putting at least 10% down.

- Homeowners insurance: Homeowners insurance covers damage from fire, storms, theft and other perils. Most lenders require homeowners insurance and charge premiums on your mortgage bills.

Recommended Reading: How Much Of My Salary Should I Invest

Consider Different Investment Types

When you are looking for new investment opportunities, it’s time to consider your options. When you invest in properties, you can choose from residential homes and apartment complexes to retail spaces. You may even find a building you love that offers both commercial spaces for businesses and residential space. Talk to your real estate agent about your preferences. Whether you want to be the property owner of a large residential facility that has hundreds of units, or you are looking for a two-family home to increase your investment portfolio, the right property is out there for you.

Once you identify the type of property you want, locating the right property can take some time. During this time, you can make sure that your finances are in order. Keep in contact with your real estate agent so that you can look at a property quickly if one crops up. If the real estate market is tight, you will want to be able to make an offer fast. Good properties that are in the right location are going to be purchased quickly, and you want to be there if an opportunity comes up.

The type of real estate investment you make will depend on your overall budget, the number of units you want to own, and whether you prefer commercial, residential, or a combination of both types of properties. Your real estate agent will give you the support you need to find the perfect match for you when it comes to purchasing your next real estate investment.