Reits: An Attractive Investment Vehicle

- Abstract- Real estate investment trusts are becoming an appealing instrument for investors. Despite being introduced way back in the early 1960s, the REITs have not been a commonly favored instrument due to the instability of interest rates and unsound investments made by some trusts. However, solid capital systems, more desirable management, and enhanced locational variety being offered by new REITs are minimizing risks involved and, thus, making them a better investment choice for investors. Both the Tax Reform Act of 1986 and the Technical and Miscellaneous Revenue Act of 1988 have greatly contributed to the removal of most of the limiting requirements for qualifying and sustaining REIT status. Characteristics and taxation of REITs are discussed.

Changes in the tax law have made REITs more appealing for investorsinterested in real estate. Here’s how REITs are taxed and what to lookfor when investing in REITs.

REITs have been around since the early 1960s, but volatile interestrates and risky investments by some of the trusts kept the focus of mostinvestors on limited partnerships. Several newer REITs offer solidcapital structures, better management, and greater geographic diversity,lowering their risk and making them more appealing toinvestors.

Characteristics of a REIT

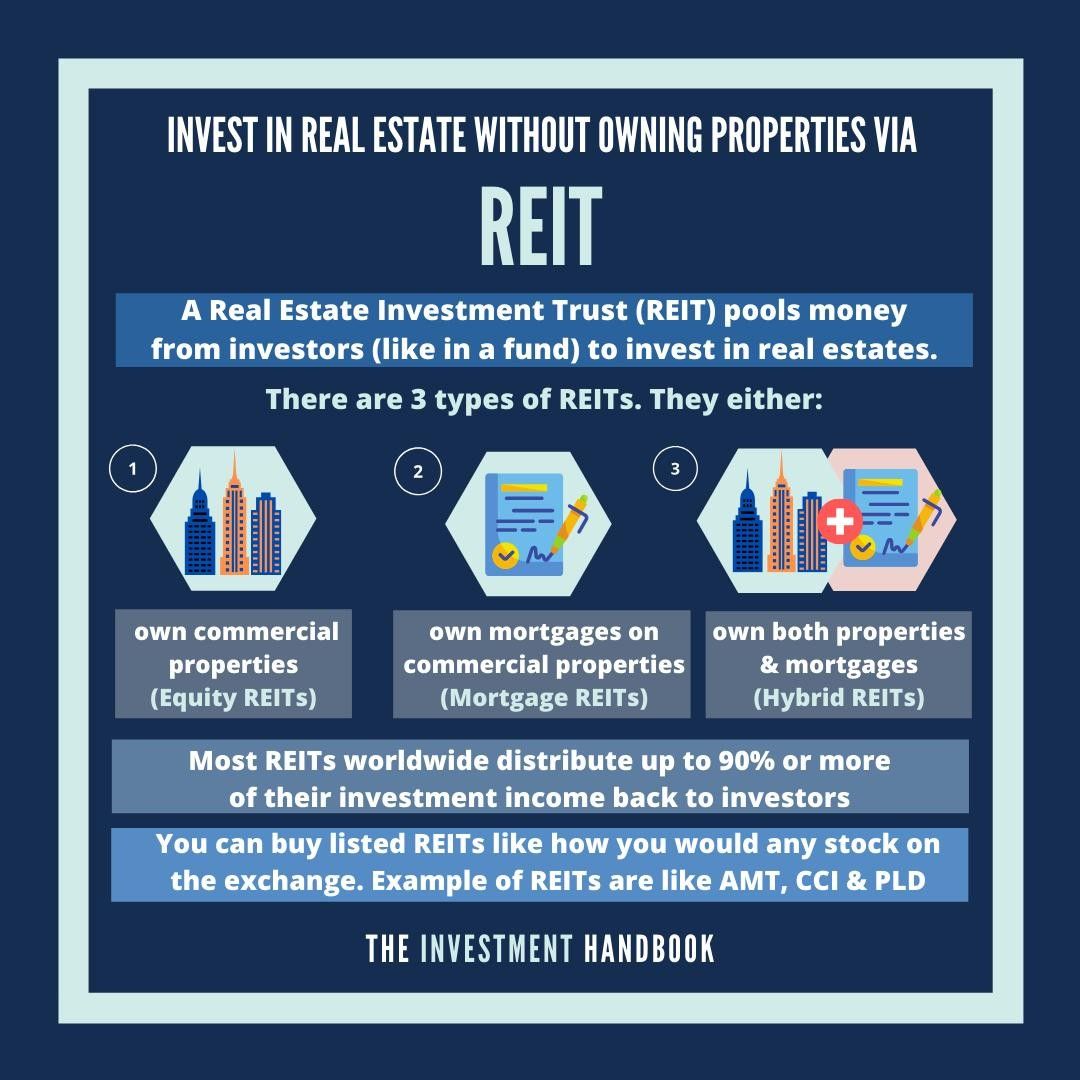

Types of REITs

Taxation of REITs

Qualifying To Be A REIT

The Three-fold Income Test. Seventy-five percent of the REIT’s grossincome must comefrom the following sources:

* Rents from real property

You Can Benefit From Consistent Dividend Payments

In addition to making it possible to invest in many types of real estate at once, REITs allow you to enjoy the rewards of steady dividend income. Most REITs distribute dividends quarterly, but some pay much more frequently, including monthly.

REITs are reliable sources of dividend income because federal law actually requires them to pay out at least 90% of their taxable earnings to shareholders as dividends.

Next

Should I Invest In A Real Estate Investment Trust

As with all other types of investing, it might be best if a real estate investment trust makes up part of a diversified portfolio, as a way of protecting you from financial shock and unexpected disruptions to the market.

If youd prefer to put your money somewhere safe where it can both earn interest and benefit from FSCS protection, you might want to consider a competitive rate savings account, such as fixed rate bonds. Alternatively, another option considered as a safer way to invest is investing in bonds.

Don’t Miss: Real Estate Investing With Little To No Money

When To Invest In Reits

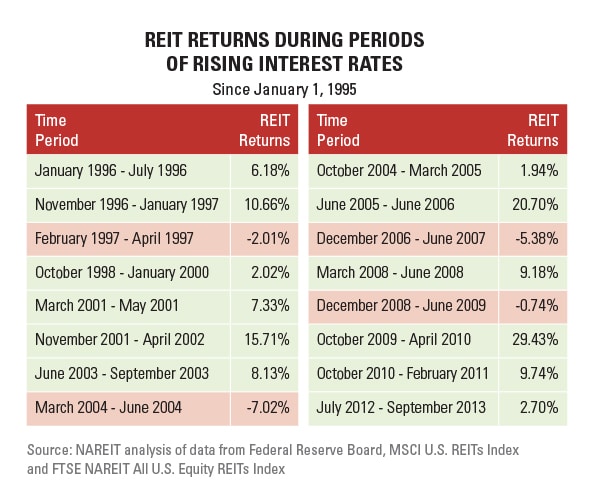

REITs have a reputation for weathering inflation well, but not doing so well during high interest rates. With interest rates rising and inflation the highest it has been for 40 years, is now the right time to get into REITs?

Investing in REITs During Inflation

REIT trade body NAREIT reports that, ‘in 2021, with inflation running well above recent trends, REITs outperformed the S& P 500 by 12.6 percentage points.’

Investing in REITs During High Interest Rates

Theoretically, the REIT business model makes them vulnerable to high interest rates. This is because REITs borrow money to invest in property. However, as of August 2022, data from the Nareit Total REIT Industry Tracker Series Report reveals that REITs posted ‘record-high funds from operations as they navigate ongoing interest rate increases and high inflation.’

How To Invest In Public Non

Buying shares of unlisted public REITs is more challenging. Because they arenât traded on an exchange, it may be more difficult to find public non-traded REITs on your online brokerageâs trading platform. Instead, you may need to purchase them directly from the REIT company itself or a third-party broker-dealer firm. Although anyone may invest, public non-traded REITs typically have a minimum investment requirement of $1,000 to $2,500.

Crowdfunding real estate investing platforms like the DiversyFund, Fundrise and Realty Mogul offer another way to invest in public unlisted REITs. These platforms generally require investors to commit to real estate investments for longer periods of time, however. This can be up to five years or more in many cases.

Also Check: Can F1 Students Invest In Cryptocurrency

How To Invest In Real Estate Investment Trusts

Like popular public stock, investors may decide to buy shares in a particular REIT that is enlisted on the major stock exchanges. They may do so in the following three ways.

- Exchange-traded funds: With this particular investment option, investors would avail indirect ownership of properties, and would further benefit from its diversification.

Notably, REIT as an investment option tends to resemble mutual funds, the only difference being that REIT holds properties instead of bonds or stock options. Additionally, REIT investors are entitled to avail the assistance of financial advisors to make more informed decisions in terms of investing in an appropriate REIT option.

Which Sources Of Reit Income Are Counted Towards The 75%

REITs must distribute at least 90% of their Net Investment Income to be “regulated” under Subchapter M and thus qualify for conduit tax treatment. In addition, 75% of the REIT’s assets must be invested in real estate related activities and 75% of its income must come from real estate related activities.

Don’t Miss: Online Investing And Trading Companies

Real Estate Select Sector Spdr Etf

An influential REIT ETF, this tracks the Real Estate Select Sector Index. XLRE includes some companies which are not REITs, and excludes mortgage REITs.

As a tracker index fund, it is not surprising to discover that this ETF has an Expense Ratio of just 0.10%. Founded in 2015, XLRE trades on the New York ARCA exchange. It has a market capitalization of $52bn and 31 assets under management totaling $5bn+.

XLRE’s top holdings are:

XLRE’s dividend yield is 3.04%. This REIT ETF is available with eToro.

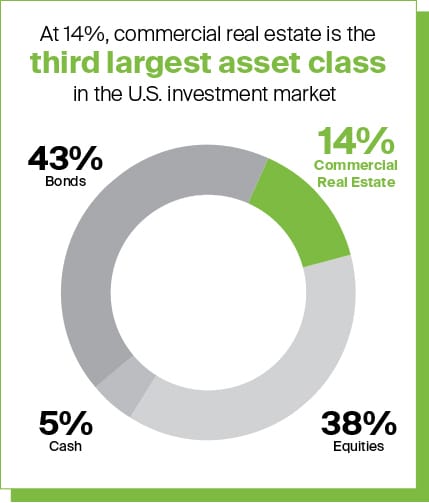

Are Reits A Good Investment

REITs are a good investment if you want exposure to real estate but don’t have the capital for direct investment. This is because it’s possible to invest in REITs with very small amounts of money, so it’s very beginner friendly. REITs are also a good investment if you want to diversify across property types and geographic locations. Plus, there are REITs that pay dividends, so they can be included in income portfolios.

The idea of REITs is that you have exposure to real estate without actually owning, directly, the property.

In contrast, REITs probably aren’t a good investment if you’re investing for the short-term since liquidity can be low. Additionally, since REITs must pay out at least 90% of income as dividends to shareholders, they don’t typically have as much growth potential as growth stocks. This is why general advice is to balance your portfolio between asset classes like real estate, stocks, and ETFs rather than going all-in on just REITs.

Read Also: Does Fisher Investments Sell Annuities

What Types Of Reits Are There

Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs. Others may be registered with the SEC but are not publicly traded. These are known as non- traded REITs . This is one of the most important distinctions among the various kinds of REITs. Before investing in a REIT, you should understand whether or not it is publicly traded, and how this could affect the benefits and risks to you.

What Does Reit Stand For

REIT stands for “Real Estate Investment Trust”. A REIT is organized as a partnership, corporation, trust, or association that invests directly in real estate through the purchase of properties or by buying up mortgages. REITs issue shares that trade stock exchange and are bought and sold like ordinary stocks. In order to be considered a REIT, the company must invest at least 75% of its assets in real estate and derive at least 75% of its revenues from real estate-related activities.

Also Check: Family Offices Investing In Life Sciences

Is Epd A Reit

So, let’s take a look at what REIT lovers need to know about midstream, including important differences and risks to consider, as well as why Enbridge , Enterprise Products Partners , and Magellan Midstream Partners are some of the best high-yield investments you can make, not just in this industry but …

Your Experience Level Doesn’t Matter

REITs can be wise and profitable additions to any investor’s portfolio. That is true whether you are a seasoned investor with significant capital to draw from or just starting your portfolio and have only a modest amount of cash.

REITs make real estate investing remarkably accessible to anyone, making them an incredibly popular vehicle for building wealth through real estate.

Previous

Next

Don’t Miss: Real Estate Investment Fund Deck

How Do I Invest In Reits

Your approach to investing in REITs depends on what type of investor you are. Some investors may want to invest in an exchange-traded fund or mutual fund that tracks a broad-based REIT index rather than investing in individual REITs. You can buy and sell REITs on your own with a Schwab One® brokerage account or call us at 877-566-0054 to talk to an experienced specialist about whether REITs are right for you.

How Are Reits Taxed

Broadly, both dividends and capital gains on REITs are subject to taxation.

But taxation of REITs is complicated, as:

- Both capital gains and dividends are involved.

- Taxation varies from country to country.

- Taxation regimes change.

Investors are urged to consult a tax professional before investing in REITs. In the meantime, investors can learn from REIT trade body Nareit about taxes and REIT investment.

Don’t Miss: How Do I Invest In Cryptocurrency

Lodging / Hotel / Resort Reits

Lodging REITs own hotels and other properties which are rented on a nightly basis. Because rents are always changing, Lodging REITs tend to have more variability in income. Their income is tied to the economic cycle and whether or not tourists and business people are traveling. This is a consumer-focused business which requires a high degree of skilled on-site management. It tends to be more of a hands-on business for the REIT operator and much less passive than some other sectors.

Examples: NYSE: HST, NYSE: APLE

Reits Are Not Without Risk: Factors Like Location And Lease Terms Can Influence The Risk Level Of A Particular Non

Much like with any type of investment, REITs carry some amount of risk. Publicly traded REITs, for example, can experience dips since their share price fluctuates with the stock market.

“Covid happened and the market went down 30-40%,” Jhangiani said. “When the market goes down like this, the price of publicly traded REITs will go with it even though the value of the real estate in its portfolio isn’t lower. So if you’re forced to sell, then you’re forced to sell at the bottom.”

But with non-traded REITs, other factors like a tenant’s lease for their commercial property or even whether you’re investing in a finished property or one that’s still in development can influence risk.

“Generally, the shorter the lease term, the higher the risk because you don’t know how long it might take to find a new tenant once one lease is up,” Jhangiani said. “Another big thing that influences risk is if you’re betting on a property that’s still under construction. The risk on this is higher because you won’t have income coming in on that property for the first few years since it’s still under construction.”

Don’t Miss: Merrill Lynch Alternative Investments Llc

Securities And Exchange Commission

There are both public and private REITs available for investment. Well discuss the differences below, but for now, understand that publicly traded REIT or REIT fund shares are securities subject to regulation by the SEC. As such, publicly traded securities must comply with strict SEC rules aimed at fostering a competitive and fair marketplace.

Why Should I Invest In Reits

REITs are total return investments. They typically provide high dividends plus the potential for moderate, long-term capital appreciation. Long-term total returns of REIT stocks tend to be similar to those of value stocks and more than the returns of lower risk bonds.

Because of the strong dividend income REITs provide, they are an important investment both for retirement savers and for retirees who require a continuing income stream to meet their living expenses. REITs dividends are substantial because they are required to distribute at least 90 percent of their taxable income to their shareholders annually. Their dividends are fueled by the stable stream of contractual rents paid by the tenants of their properties. The relatively low correlation of listed REIT stock returns with the returns of other equities and fixed-income investments also makes REITs a good portfolio diversifier. REIT returns tend to zig when those of other investments zag, helping to reduce a portfolios overall volatility and improve its returns for a given level of risk.

REITs historically offer investors:

Also Check: What Is Long Term Stock Investment

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Single Family Residential Reits

Single Family Residential REITs were not a thing until the real estate bubble burst in 2006 and institutional money started buying large numbers of foreclosures. While still just a small fraction of the total single family housing market, these REITs own hundreds of thousands of homes concentrated in growing cities like Orlando, Phoenix, Dallas, Las Vegas, and Charlotte. They tend to buy homes in good school districts with home price and rent growth. One negative compared to other REIT types is that the real estate is spread out over thousands of different properties. Its not easy to manage and repair homes that are spread out all over huge metro areas.

Examples: NYSE: INVH, NYSE: AMH

Read Also: Can I Invest In Gold

You Should Do Some Digging On A Reit’s Performance To Figure Out Which Ones Are A Potentially Strong Investment

When picking a reliable REIT, you should look at the track record of the management team. This can provide clues about their past successes. It would also be wise to ask how the team is compensated. A team that earns performance-based compensation, for example, will of course put a lot of energy into making sure their investments are high-performing.

“Investors should consider the fees, strategy, the manager’s underwriting process, leverage on the properties, the dividend yield and all other risks related to that particular REIT,” Jhangiani said.

You can search online for these specifics on the REIT’s website or you can speak to a broker or financial advisor about gathering this information for you.

Why Invest In International Reits

There are many benefits to investing in REITs, both domestically and internationally. The Morningstar financial services firm found that ownership of REITs has increased investors’ total returns over time and lowered the overall risk in both equity and fixed income portfolios.

Foreign REITs offer even greater diversification for U.S. investors in many cases. The real estate isn’t tied to the U.S. market. Foreign REITs also have low correlation coefficients with their respective country’s domestic markets. These factors make them a nice option for diversification.

You May Like: How To Invest In A Company Before Ipo

You Don’t Need To Dedicate A Ton Of Time To Invest In Reits

Most investors don’t have hours every day to dedicate to their portfolios. Whatever your investing style, REITs can enable you to allocate money across different areas of real estate more quickly.

Even so, before adding any REIT to your portfolio, you should always take ample time to learn about its sector and underlying business or businesses to ensure they fit with your investment preferences and aptitude for risk.

Next

You Don’t Need Substantial Investing Capital To Get Started

Real estate investing is often viewed as a wealthy investor’s game. Nothing could be further from the truth. Most REITs are publicly traded on the stock market, meaning you can buy them through your brokerage account just as you do stocks.

Many brokerages will also allow you to purchase fractional shares of a REIT, enabling you to invest only the amount you’re comfortable with or can at any given point but still venture into the real estate investments you find most compelling.

Previous

Next

Don’t Miss: Gw& k Small Mid Cap Core Equity Collective Investment Fund

You Can Compound Your Wealth Over A Period Of Years

It is not uncommon for a REIT to implement mid-single to double-digit dividend increases every year. In fact, some of the best REITs have extensive track records of doing so.

Coupled with the ability to realize gains from share price appreciation over the years, this is another reason these types of investments are so compelling in various market environments.

Previous

Next