Want A Lower Rate On Your Investment Loan

Obviously you want to minimize your investment loans interest rate as much as possible. To help move the needle, consider putting down a hefty down payment and have at least a years worth of estimated mortgage payments in the bank before applying. Improving your credit score can also help your case in the rate department.

Tips For Managing Your Investment

Find out about government help, managing, leasing and marketing your property in a tough rental market.

8am-8pm, 7 days a week , except public holidays.

Find a lender

Things you should know

Conditions, credit criteria, fees and charges apply. Terms and conditions available on request. Based on Westpac’s credit criteria, residential lending is not available for Non-Australian Resident borrowers. This information has been prepared without taking your objectives, needs and overall financial situation into account. For this reason, you should consider the appropriateness of the information and, if necessary, seek appropriate professional advice. This includes any tax consequences arising from any promotions for investors and customers should seek independent advice on any taxation matters.

*Comparison rate: The comparison rate is based on a loan of $150,000 over the term of 25 years. WARNING: This comparison rate is true only for the examples given and may not include all fees and charges. Different terms, fees or other loan amounts might result in a different comparison rate.

*** Interest Only in Advance: Subject to Bank’s approval and normal lending criteria apply. Interest Only in Advance interest rates and discounts apply to new Fixed Rate Investment Property Loans and loans which have been switched into Interest Only in Advance products. Existing fixed loans are not eligible unless the loan is re-fixed. Discounts are subject to change.

Are You Ready To Be An Investor

Property investment can be both risky and rewarding. Rental income and capital gains are never guaranteed. Before taking the plunge, here are some of the potential risks and benefits you should think about.

Benefits

- Rental income. You may earn a rental income that puts cash in your pocket right away some investors may enjoy returns of $50, $100 or more every week, over and above the costs of owning the property. You can invest this money into the mortgage to pay the loan off sooner, or use these funds to supplement your own income.

- Capital gain. Many investors buy property with an eye on the long-term gains, so they’re aiming for future price appreciation. When it comes time to sell your property, you may benefit from making a capital gain if the value of your property has risen. You could potentially grow wealth far more effectively with property than through savings alone.

- Tax and depreciation benefits. You can deduct investment loan interest charges and other investment costs from your income tax each month, making the cost of owning a property far more affordable.

- The potential to add value. Unlike shares or other investments, you may be able to manufacture equity or price appreciation in your property asset by adding value through renovations.

Risks

Also Check: Financial Advisor To Investment Banker

Investment Strategies And Tips

While investing is always a risk, Australian property investors have some big advantages. For one thing, your investment expenses are tax deductible. Negative gearing means you can cut your tax bill if the investment loses you money in the short term.

But a bit of expert knowledge can help you make better investment decisions.

The biggest mistakes property investors make when it comes to financing their purchase

Michael Yardney is the founder and CEO of Metropole Property Strategists and a veteran property investor.

Property investment is a game of finance with some houses thrown in the middle

“Beginning investors think they can just go to any bank, get the lowest loan rate and they will be set. On the other hand, strategic investors don’t use finance to buy properties, they set up their finance to buy the time to ride the ups and downs of the property cycle so their investment properties can increase in value and give them the equity and cash flow to buy further properties.

“They do this by setting up cash flow buffers in facilities such as offset accounts so that they have the ability to pay for unexpected expenses or manage cash flow shortages.”

Focus on the long term

“This year the performance of our share market and the property markets, as well as the numerous pessimistic property predictions by the so called ‘experts’, reminded us that we should not make 30-year investment decisions based on the last 30 minutes of news.

What Affects My Investment Property Interest Rate

Fannie Mae and Freddie Mac guidelines arent the only things that affect your investment property mortgage rate. All the personal factors that determine mortgage rates are in play, too.

That includes:

- Your cash reserves

- Loan-to-value ratio on the investment property

In fact, your personal finances including your credit report and possibly your tax returns will be put under even stricter scrutiny when you buy an investment or rental property than when you buy a home to live in.

It will take a more robust financial profile to qualify for your investment mortgage and to score a competitive rate on top of that.

Recommended Reading: How To Invest In Popeyes

What Is An Apr

When you get a mortgage, youll see two interestrates on a quote: an interest rate and an annual percentage rate . The APRand interest rate are not the same. The former expresses the interest rate withother loan costssuch as insurance, closing costs, and origination feesrolledinto it. For this reason, APRs are higher than interest rates on mortgagequotes.

Pro tip! When shopping around for quotes, pay moreattention to APRs than you would standard interest rates. APRs offer moreaccurate mortgage cost representations since they incorporate other loanexpenses.

Special Mortgage Rules For Investment Properties

One of the advantages of buying an investment property is that you can typically add your anticipated rental income to your existing income when you apply. That will help you prove you can comfortably afford your new mortgage payments.

However, dont assume your lender will count all that extra income, nor that it will take your word for how much it will be.

Lenders typically allow 75% of the future rental income to count toward your qualifying income. And they require either a current lease agreement or a rental schedule, which will use the appraisers view of your likely rental income based on local comparisons with similar rental properties.

Youll likely need that extra income to qualify. Because your lender will want to be sure you can afford payments on your existing mortgage as well as your new loan.

When youre budgeting, also keep in mind that investment properties typically offer much more generous tax breaks than owner-occupied ones. So speak to your professional tax adviser to discover what those might mean to you.

Recommended Reading: Can I Invest Under 18

Average Rates For Different Types Of Commercial Real Estate Loans

A wide variety of lenders provide business loans for commercial real estate financing. While SBA loans and bank loans are generally reserved for the most qualified borrowers, hard money loans and bridge loans are more widely available.

Hereâs a summary of commercial mortgage rates for some of the most common types of commercial real estate loans:

Is It Hard To Get A Loan For An Investment Property

Qualifying for an investment property loan is more challenging because lenders view investment properties as a greater risk. Lenders will want to make sure that you earn enough to afford monthly mortgage payments in the worst-case scenario, such as your tenant stops making their payments.

Compared to loans for your personal residence where you may qualify for a 0% or 3% down program, lenders want to see a larger down payment on investment properties, often between 20% to 35%.

To get the best rates and terms, youll want to get a traditional mortgage, which is why most of our winners here have come from that sector. However, you can max out at four conventional loans for investment properties. If you want to keep going, youll need to convert to private and hard money lenders

Read Also: How Can I Invest In Stocks With Little Money

Why Choose Us For Your Colorado Investment Loan Needs

Here are a few reasons to consider Front Range Mortgage as your property investment mortgage company:

We know the housing market in Colorado inside and out, both in the Front Range area and beyond. We can help you overcome barriers to financing so that you do not miss out on a valuable investment opportunity.

Closing fast is among our specialties. Well let you know upfront if we can process your investment loan within your required timeframe. Youll never be left guessing, and youll never lose an opportunity because of closing time.

We have helped real estate investors with a broad variety of financial situations and goals to fund their purchases throughout Colorado. There is no scenario we are not ready to handle. As dedicated and creative problem-solvers, we will work aggressively to help you achieve your goals.

We are Colorado Local, Colorado Only, Colorado Proud. Being a local company rather than a big bank, we are able to spend as much time with you as needed to match you with the investment loan which is best suited to your needs.

Intro To Investment Property Mortgages

When you buy an investment property, you need an investment property mortgage. The first thing to know is what other names these mortgages go by, so you know them when you hear them.

A lot of consumers and real estate agents will call this kind of loan a rental property mortgage.

Lenders, on the other hand, will call this a non-owner occupied mortgage.

The reason for this is that lenders categorize loans by the occupancy, and there are three kinds of home loans:

Don’t Miss: Fixed Rate Investment Property Loan

Rental Property Investor From Atlanta Ga

Likely a big bank that doesnt ever have someone available to talk to you and will say they can close you in 30 days but orders the appraisal late and misses deadlines resulting in a ton of headache and a later closing .

Everyone is about the same right now so go with someone that will pick up the phone when you call and keep things on track. Best to ask around in your market for referrals to who gets stuff done.

Hope this helps a bit reach out anytime if you have other questions or just want to chat!

Other Guidelines For Rental And Investment Property Loans

When you apply to buy a rental property, underwriters will verify your ability as a potential landlord. If youve never owned a home or managed any property, youll have a tougher time.

Some lenders allow first-time real estate investors to get around this by hiring a property manager. There is nothing definitive about this in the official guidelines so check with your loan officer.

There are limits to the number of properties you can own with mortgages on them, if you go with conforming financing.

And youll be required to have reserves several months of mortgage payments in the bank to cover those months when your property is unoccupied.

You May Like: How To Invest In Healthcare

Can I Use The Equity In My Home To Buy An Investment Property

Yes. Provided you qualify, you could tap your equity through a cash-out refinance, home equity loan or home equity line of credit , and use those funds to cover the down payment on an investment property mortgage.

A cash-out refinance allows you to take out a new mortgage for more than your current loan and withdraw the difference in cash. A home equity loan is a lump-sum payment thats repaid in fixed monthly installments similar to a traditional mortgage while a HELOC is a revolving credit line that works much like a credit card. Your main home is used as collateral for all three of these options, and you could lose it to foreclosure if you fail to repay any of these loans.

Bank Commercial Real Estate Loan Rates

Interest Rates: Start at 3.75%

Bank loans are another option for business owners in need of affordable commercial real estate loan rates. SBA loans are great, but there are a lot of rules and regulations that banks have to follow before they can approve and fund this type of financing. Smaller community banks, in particular, may not be familiar with the process, but they may be willing to give you a traditional commercial real estate loan instead.

The rates on these traditional bank loans are similar to SBA loan rates, but there are a few differences. Itâs harder to get small loans from a bank because itâs not profitable for them to spend the time to process these loans. In addition, you might have to put up a slightly larger down payment for a traditional loan because the bank wonât have the assurance of the SBA guarantee. Finally, the repayment terms on bank loans are typically shorter than with SBA loans.

As with SBA loans, youll need good credit and strong business credentials to get approved. Large banks, like Wells Fargo and Bank of America, provide commercial real estate loans, as do smaller regional banks.

Don’t Miss: Heloc On Investment Property California

Investment Property Rates Vs Primary Residence Rates

There is a difference between primary residence mortgage rates and investment mortgage rates. Although you will find investment property interest rates to be higher, theyre not always significantly higher. Investment property loans typically carry an additional 0.5% to a 1% surcharge on the interest rates.

Investment Property Rates Are Above Standard Rates

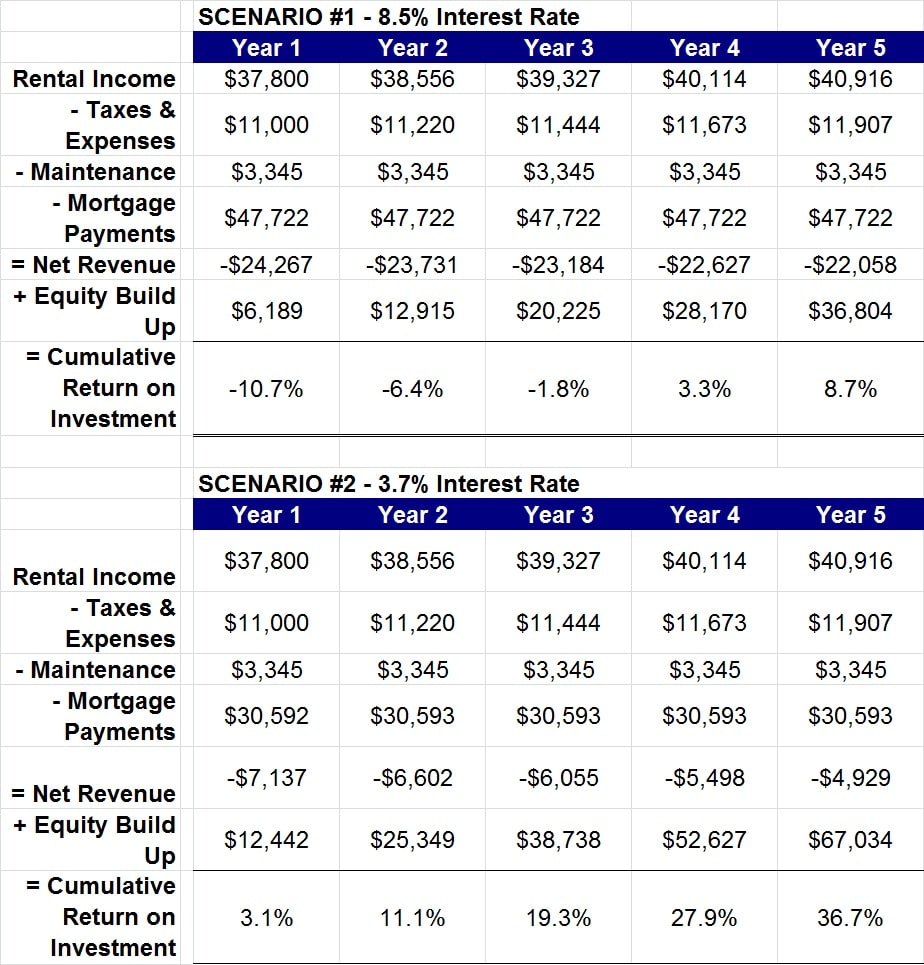

If you buy an investment property at the right price and finance it correctly, it can create cash flow for you almost immediately.

But getting an ultra-cheap mortgage rate on a rental or investment property is tougher than for a primary residence. Thats because lenders charge more for non-owner occupied transactions meaning a property you dont plan to live in.

Despite higher rates, investing in real estate is often a good idea long-term. Heres how much you can expect to pay now to finance that future cash flow.

In this article

You May Like: Best Way To Invest In Crypto

How Is Interest Calculated

Interest is calculated based on the unpaid daily balance of your loan. For example, if you had a loan balance of $150,000 and your interest rate was 6% p.a., your interest charge would be: $150,000 x 6% divided by 365 days = $24.66 for that day. For most ANZ Home Loans, interest is usually calculated daily and charged monthly. For details refer to the ANZ Consumer Lending Terms and Conditions and your letter of offer.

What’s The Difference Between Principal And Interest And Interest Only Loans

If you choose interest only, the minimum payment amount on your loan will be lower during the interest only period because you are not required to repay any of the loan principal. You will have to repay the principal down the track and so you may end up paying more over the life of your loan. There may be additional restrictions on the amount you can borrow or loan type you can select if you choose to pay interest only.

Choosing to repay principal and interest means that, with each repayment, you’re paying off interest charges as well as some of the loan principal.

Learn more about payment types.

Recommended Reading: How Can I Invest In Foreign Stocks

Residential Real Estate Investment Loans

Residential real estate investment loans are available for various property types including single family residences, condominiums, apartment buildings and other multifamily property . Loan to value ratios up to 70-75% are available for residential real estate investments loans with financing terms up to 3 years.

Current Average Investment Property Mortgage Rates

Investment property interest rates vary all the time. Its difficult to give a hard figure because not all lenders charge the same. Several factors influence how much a lender will charge, including income, debt, cash reserves, and credit score.

The majority of lenders typically increase standard property mortgage rates by 0.5% to 0.75% for investment properties.

For example, if you are taking out a primary mortgage, the average 30-year fixed interest rate may be 3.92%. The average 15-year fixed interest rate may be 2.97%.

So, what can you expect to pay based on current investment property mortgage rates?

The average interest rate for a 30-year fixed investment property mortgage may be 4.42% to 4.67%. For a 15-year fixed investment loan, you may expect to pay 3.47% to 3.72%. Again, this depends entirely on the lender in question, your current circumstances, and, especially, how much your down payment will be.

Its important to calculate your potential monthly repayments and your expected rental yield to determine whether youre likely to get approved for an investment loan.

Recommended Reading: Real Estate Investment Jobs Nyc