Developing Your Investment Strategy

Before investing, take some time to think about what you want your share investments to achieve for you and how it fits in with your whole investment portfolio, not just shares. Also consider the circumstances in which you might need to change your strategy or sell your shares.

Questions to ask before investing

Growth or income

- Why are you investing?

- Do you want a return in the form of income or capital growth, or a combination of both?

- Are you prepared to risk some of your capital for the opportunity to make higher returns?

- How will this investment fit in with your broader investment portfolio and your investment goals and strategy?

Investment strategies commonly focus on growth, income or a combination of the two.

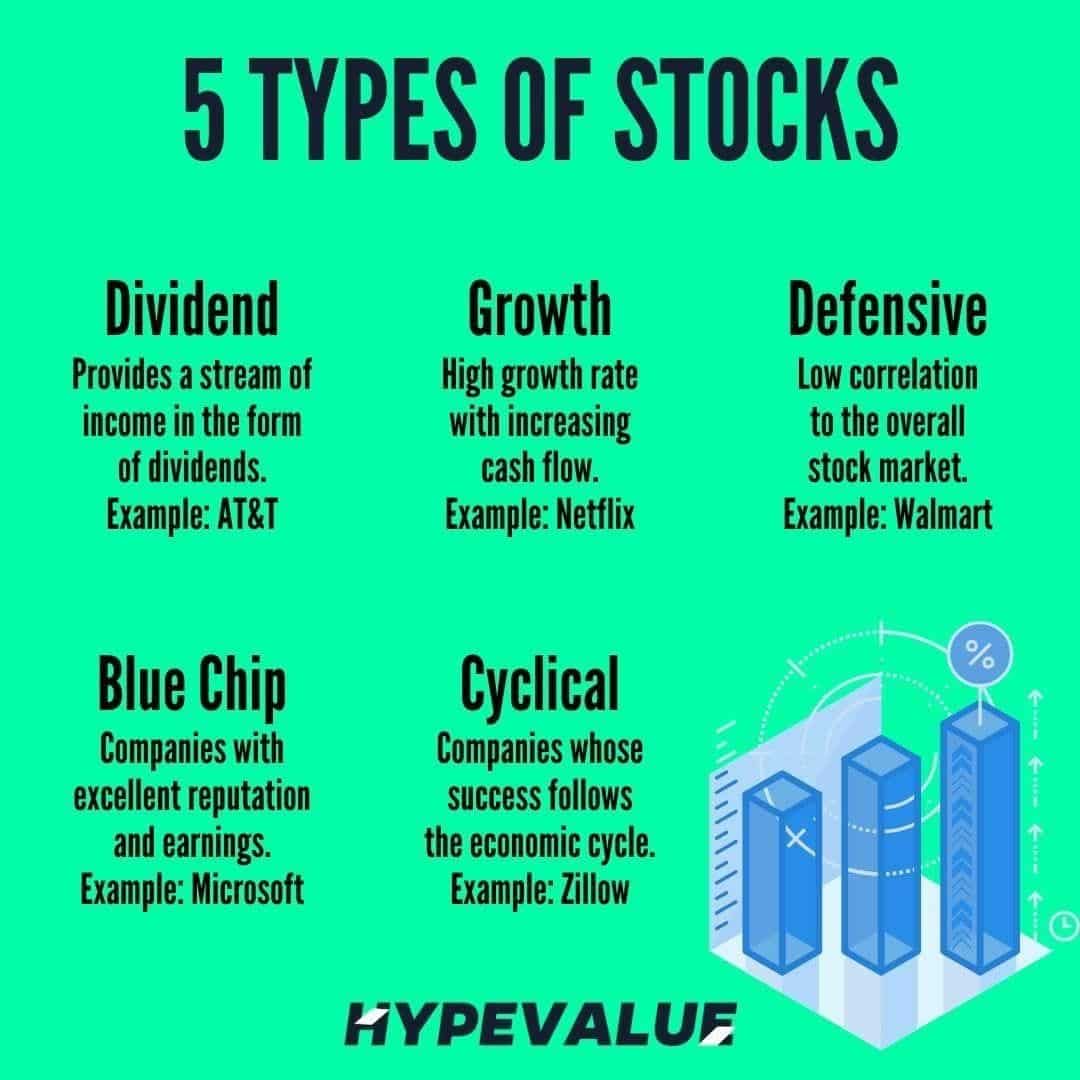

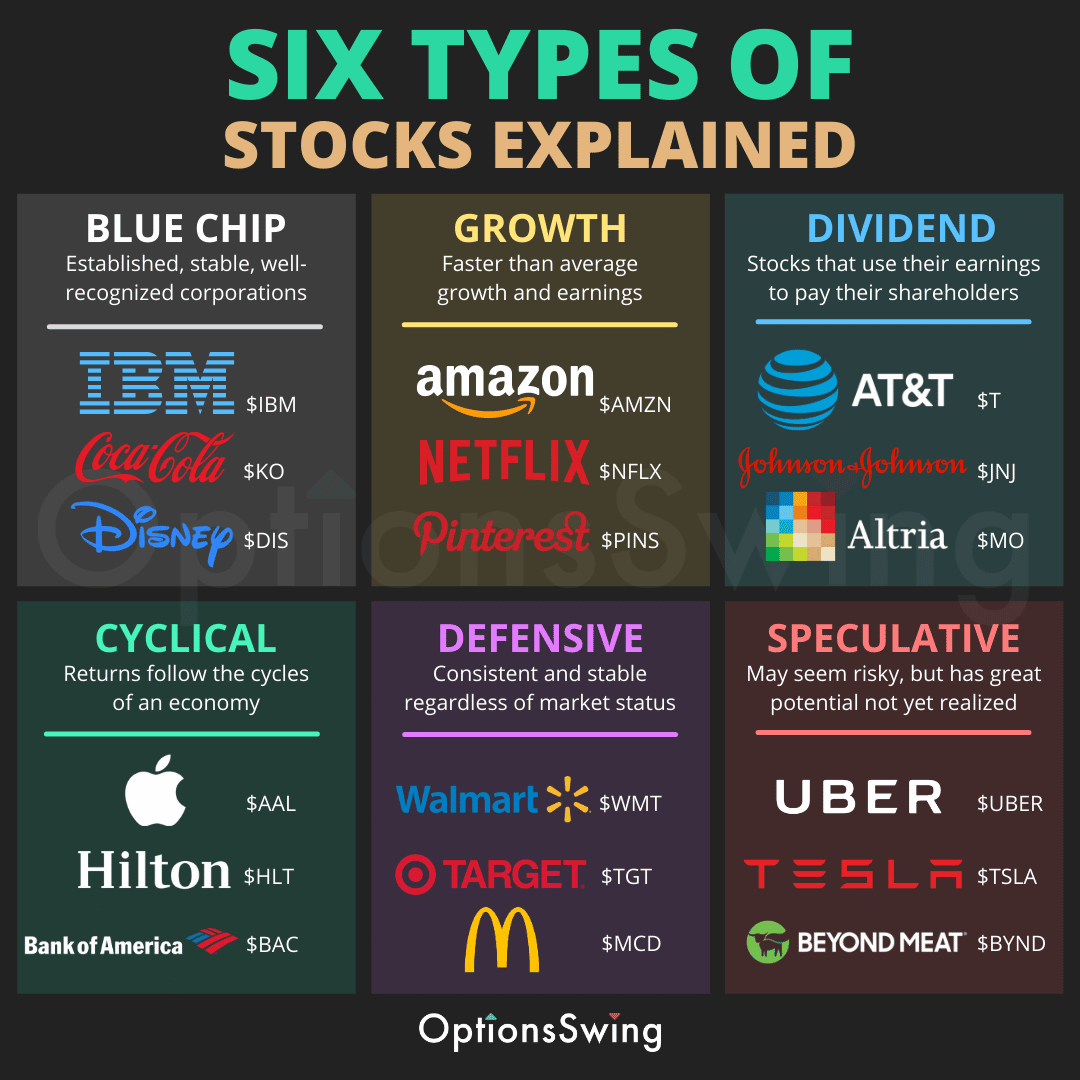

- Growth: A growth strategy aims to achieve share price growth at a rate higher than inflation. It favours shares that are likely to see strong capital growth rather than paying dividends. A growth strategy might suit you if you have a long term investment horizon and are looking to build up a substantial asset base. Shares with higher growth potential are also likely to have a greater risk profile.

- Income: An income strategy aims to achieve high dividend payments. Using franking credits can also increase the value of dividends. An income strategy might suit you if you are looking to supplement or replace an income for example, if you are in retirement.

Many investors combine elements of both analysis techniques to make their buy and sell decisions.

Dividend Investing Strategy #: Balanced Growth And Dividend Income

Our last dividend investing strategy seeks to find the sweet spot. Doing so by finding the perfect balance between dividend growth vs dividend income.

Here, dividend investors search out dividend yields between 3% and 5%. Looking for such companies that also increase their dividend rates per share by 4% to 7% annually.

Thus, providing a nice balance of earning dividend income today. With the potential for solid dividend growth in the future.

Portfolio Strategies #5 Diversification As A Strategy

Adding a wide range of securities to your portfolio is termed diversification. In an attempt to limit exposure to the fluctuations in any single asset, it is advised to have a mix of distinct investment vehicles that can help achieve higher returns with lower risk.

Diversification is a key component of the Modern Portfolio Theory . As per the theory coined by Harry Markowitz, investors could achieve their best results by choosing an optimal mix of high risk and high return or low risk and low return asset classes.

According to the experts, over-diversification is when you have over 20 stocks in the portfolio. On the other hand, under-diversification is when the mix has less than 3 stocks. The ideal mix should be 8-20 stocks.

You May Like: How To Invest Online For Beginners

How Do Beginners Invest In Stocks

Beginners can get started with stocks by depositing funds in a low-fee or no-fee brokerage firm. These brokerage companies will not charge when the investor deposits, trades, or withdraws funds. In addition to getting started with a brokerage firm, you can leverage information on the broker’s website to begin researching which asset classes and securities you’re interested in.

Types Of Trading Strategies For The Stock Market

As a day trader, you buy and sell stocks to take advantage of price changes. These trades often occur throughout the day. Sometimes, you have days where you make multiple trades in a period of a few hours. Regardless of how many times you trade per day, it would be best to have a strategy. Here are several trading strategies for the stock market that you can use as a new trader.

Read Also: Invest In Something That Pays You

What Is The Best Investment Strategy

The best investment strategy is the one that helps you achieve your financial goals. For every investor, the best strategy will be different. For example, if you’re looking for the quickest profit with the highest risk, momentum trading is for you. Alternatively, if you’re planning for the long-term, value stocks are probably better.

Creating A Swing Trading Strategy

Another option you have while buying and selling stocks is to use a swing trading strategy. Swing traders hold stock shares over more extended periods than day traders to win short- and medium-term price movements. While day traders look at fundamentals while selecting stocks to trade, swing traders focus on picking breakout stocks that will shift in price within the next days or weeks.

There are a few reasons why you may prefer swing trading over day trading. If you choose to hold positions for longer than one day or you dont want to watch charts all day, then youll enjoy swing trading. However, swing traders often select volatile stocks to trade, meaning you must avoid emotional decisions over your holding period. The overall goal is to maximize profits by buying into long positions and selling out of short ones.

Recommended Reading: Russell Jeffrey Providence Investment Management

Best Source Of Stock Picks For The Last 5 Years

We have been tracking ALL of the Motley Fool stock picks since January 2016. That’s over 5 years and 120 stock picks. Take a look at their stock picks’ performance for the last 5 years:

- Average return of their 120 picks from 2016 to 2020 is 233%

- That beats the SP500’s 88%

- 84% of their picks are up

- 57 of those 120 stocks have doubled

Now, no one can guarantee that their next picks will be as strong, but our 5 years of experience has been super profitable as you can see. They do pick some losers, but the key for investors is to invest equal dollar amounts in all of their picks. So if you have $1,000 to invest in the market each month, buy $500 of each of their 2 monthly stock picks.

Normally the Motley Fool service is $199 per year but they are currently offering it at their lowest price ever: Just $79 for 12 months..

What Is Asset Allocation

When investing you should always spread your investment across a range of different assets and asset classes, rather than putting all your eggs in one basket. Not only does this reduce the overall risk, but it also enables you to balance out different investments so that when one type is falling, another may be rising.

This spreading of investments called asset allocation. It should be carefully designed and managed, based on your goals, risk tolerance and length of investment. You can do this yourself, but more often a portfolio/wealth manager will do it for you. Here’s how to find a good wealth manager to help you grow your investments.

A typical portfolio might contain a proportion of high-growth, high-risk assets such as equities , balanced with medium-risk fixed-income bonds and some low-risk, low-growth cash. The equities and bonds segments might be further divided into lower and higher risk types.

Read Also: Bob Diamond Real Estate Investing

When Addressing Volatility Your Choices Matter

Weve always believed that diversification is the best defense against market adversity. By diversifying, you spread your money across many kinds of investments to manage volatility. When one type of investment goes up, another may go down, helping provide stability in your portfolio.

If you are already diversified, the best option may be to hang tight and avoid sudden decisions.

If youre not, however, you may want to talk to an expert. Investment Consultants can help you determine your best course of action depending on your current situation.

How To Choose Your Personal Investment Strategy

There are several things to consider when choosing the best investment strategy for you. For a start, the approach should interest you. You will be more likely to learn and do the required research if you find an approach interesting.

Secondly, your own skills and experience can give you a head start in some areas. For example, value investors need to understand financial statements. If you have knowledge of certain industries, this can also be an advantage. If you can write code, you may gravitate toward momentum investing and develop your own algorithm.

Another important factor to consider is the time you have to devote to investing. Value, growth, and small cap investing requires a lot of time to do the necessary research. On the other hand, momentum and passive investing require very little time. Finally, your risk tolerance needs to be considered. This concerns both your financial situation and your temperament. If a volatile investment is going to keep you awake at night, passive investing or a portfolio with broad asset allocation will be more appropriate.

You May Like: Best Stock Brokers To Invest With

Mutual Funds And Etfs

Both mutual funds and exchange-traded funds allow you to buy small shares of different securities, like a collection of various stocks or a mix of stocks and bonds. They’re investment vehicles that provide built-in diversification. Mutual funds are actively managed by a fund manager and typically have higher fees, while ETFs are usually passively managed and trade like stocks. Mutual funds and ETFs share some similarities but also have key differences.

Trying A Scalping Strategy

So far, you understand several strategies for locating stocks that you would like to purchase. However, none of these strategies explain when you should sell your stocks. A scalping strategy makes it easy to determine when to accept profits. Scalp traders sell immediately after a trade is profitable and make several trades in succession to meet their income goals. To use a scalping strategy, youll consider how much income you want to earn from each trade and sell your shares the second your deal meets your profitability goals.

Recommended Reading: How To Become A Registered Investment Advisor In California

Who Should Use Value Investing

Value investing is best for investors looking to hold their securities long-term. If you’re investing in value companies, it may take years for their businesses to scale. Value investing focuses on the big picture and often attempts to approach investing with a gradual growth mindset.

People often cite legendary investor Warren Buffett as the epitome of a value investor. Consider Buffetts words when he made a substantial investment in the airline industry. He explained that airlines “had a bad first century.” Then he said, “And they got that century out of the way, I hope.” This thinking exemplifies much of the value investing approach: choices are based on decades of trends and with decades of future performance in mind.

Over the long-run, value investing has produced superior returns. However, value investing has seen prolonged periods where it has underperformed growth investing. One study from Dodge & Cox determined that value strategies have lagged behind growth strategies for a 10-year period during three periods over the last 90 years. Those periods were the Great Depression , the Technology Stock Bubble , and the period 2004-2014/15. Indeed, value investing, has consistently underperformed growth investing since 2007, producing a drawdown of more than 50% through 2020. It remains to be seen whether value stocks will regain their luster in the near future.

Keep Your Portfolio Diversified

Let’s say there is a slumpis there a remedy to help your portfolio get back on its feet?

Being well diversified can help cushion against losses. In every bear market there are likely certain segments of the markets that get hit much harder than others. It’s extremely difficult to forecast these ahead of time, so a preventive measure you can take now is to diversify within the equity market as well as across asset classes. Consider the assets you’ve set aside for medium-term needs or goals. Being diversified means you have a wide variety of investment-grade bondscorporate, municipals, Treasuries, and possibly foreign issues. And they should have varying maturity dates, from short-term to mid-term, so you always have some bonds maturing and providing you with either income or money to reinvest.

Your long-term assets should be divvied up among a wide array of domestic stocksbig and small, fast-growing and dividend-payingas well as international stocks, real estate investment trusts and commodities, says Mark. That mix gives you exposure to asset classes that tend to move at different times and speeds, he says.

Don’t Miss: Investment Accounts You Can Withdraw From

How To Choose Your Investment Strategy

The first step to start investing is to take stock of your current financial health. Look at where you spend and save your money, how much income you generate, and any existing investments you may not realize you have. Often a great place to get started is by opening a retirement account through your employer, particularly if they have matching options. Consider what is already available to you and make sure you are using those opportunities to the fullest. Then, look for extra money in your budget to get started with an investment strategy.

What Is Dividend Investing

There are other methods also for long term investing like Dividend Investing, in which investors focus on higher dividend paying stocks by which they will get a good regular annual return. For which investors select stocks with higher dividend yield. But all those stocks which offer higher dividend yield may not have good fundamentals hence might not give good capital growth in future. Therefore we must focus on fundamentally good stocks with higher dividend yield if we want regular dividend income.

To know more about short term trading you can check our article different types of trading in stock market. And if you want to know how to select good stocks for investing then you can check this article.

Disclaimer Investing and trading in stock market is subject to market risk. We have to learn all the risk factors before making any investment decisions. This article is only for basic knowledge about stock market investing for educational purposes only and not any type of recommendation. In case you need any professional advice please consult your financial advisor. Thats all in this post, if you like our post please share with your friends and thanks for visiting our page. Wish you all happy investing.

Don’t Miss: Where Can I Invest In Etfs

Pros Of Combining Growth And Dividends

Combining growth and dividend stocks can be an overwhelmingly lucrative move. Not only do you benefit from the growth involved in picking stocks that are seeing compelling movement, you also ice your cake with the dividends paid through these investments. Some other perks to deploying this strategy include:

How To Find The Right Investing Strategy For You

There are more investment strategies than those mentioned in this article in fact, too many to list. Regardless of the investment strategy you adopt, it is important you have one.

Any of these strategies may generate a competitive return when you make an informed choice based on your financial position. They all also carry risks which should be considered carefully.

When developing your own investment strategy or making a major investment decision, you should always consult a licensed financial adviser or financial planner. They will work with you to develop a plan that suits your needs.

This article is issued by Trilogy Funds Management Limited ABN 59 080 383 679 AFSL 261425 and does not take into account your objectives, personal circumstances or needs, nor is it an offer of securities. Investments in Trilogy Funds products are only available through the relevant Product Disclosure Statement and by considering the Target Market Determination issued by Trilogy Funds and available at www.trilogyfunds.com.au. All investments, including those with Trilogy Funds, involve risk which can lead to loss of part or all of your capital or diminished returns. See PDS and TMD for details. Investments with Trilogy Funds are not bank deposits and are not government guaranteed. Past performance is not a reliable indicator of future performance.

You May Like: How To Invest In Mobile Apps

Know What You Can Control

When global events dominate headlines and fill up newsfeeds, investors often feel compelled to make emotional decisions.

As a result, the thrill of higher returns often drives investors to buy at the peaks, while panic amid declines causes them to sell low and lock in losses.

That’s the opposite of what a well-structured investment plan would have you do.

Best Investing Strategies: Growth Investing

Growth investing using fundamental analysis is one of the oldest and most basic styles. This is an active investing strategy. It involves analyzing financial statements and factors about the company behind the stock. The goal is to find a firm whose metrics show the potential to grow in the years ahead.

This style of investing looks to construct a portfolio of 10 or more individual stocks. If you’re a beginner, it can take a lot of time to do the research needed to make this strategy a success, but it is what many fund managers use to get returns.

Growth stocks often perform best in the mature stages of a market cycle. The strategy reflects what investors do in healthy economies . Tech companies are good examples here. They are often valued high but can grow beyond those valuations when the environment is right.

If you choose this strategy, you will analyze data from a business’s financial statements. In doing so, you may arrive at a valuation of their stock. That will help you figure out whether the stock would be a good purchase or not.

Don’t Miss: Can I Invest In Gold

The Dave Ramsey Portfolio

Talk show host and finance guru Dave Ramsey touts a four mutual fund strategy. Dave’s wisdom is in his simplicity. His methods are easy to grasp. However, the wisdom stops there. These four mutual fund types will often find fund overlap, meaning that there is little diversity. Further, lower-risk assets, such as bonds and cash, are absent from the portfolio.