When Can I Withdraw From My 401 Plan

You can start to withdraw your savings penalty-free when you reach age 59 ½. Taking out your savings before that time could cost you an extra 10% on top of what youd normally pay in state and federal taxes.

When its time to start using your savings, be sure to consider the tax implications. In addition, once you turn 72, you typically have to withdraw a minimum amount annually to comply with distribution requirements

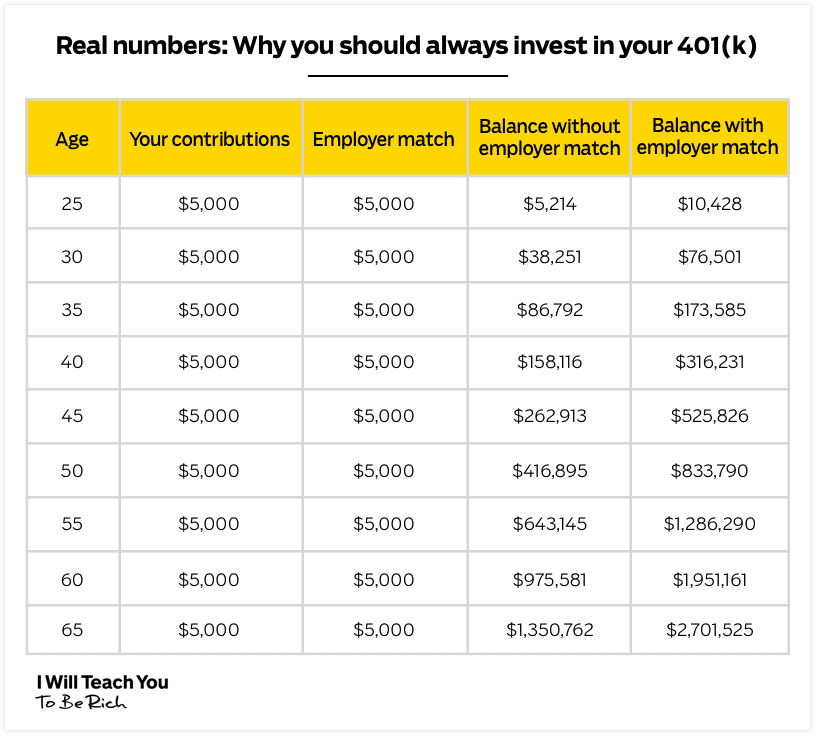

401 plans can be very useful tools in saving for retirement, particularly if you take advantage of features that your plan may offer to help maximize your savings. And the sooner you start saving in your 401 plan, the longer any investment earnings have to produce earnings of their own.

How Nua Stock Is Generally Taxed

| Cost basis | Immediately taxable as ordinary income when NUA distribution takes place after qualifying event |

| NUA gain | Taxable as long-term capital gains when company stock shares are sold |

| Post-distribution gain | Taxed at short- or longer-term capital gains rates based on the holding period from the distribution date |

How To Protect Your 401 And Ira From Losing Money In A Stock Market Crash

Shawn Plummer

CEO, The Annuity Expert

Is the market about to crash? This guide teaches how to prepare, protect, and grow a 401k, IRA, retirement savings, and investments before, during, and after a stock market crash and recession. In addition, the guide will go over the difference between a bear market and a bull market, a brief stock market crash history of the New York Stock Exchange, and a solution to combat the losses to retirement plans and avoid long recovery times.

Americans like to talk about whether the stock market is rising, the market is falling, or how much money their 401k has earned or lost. However, the recovery time between a crash and the amount of time before the market fully recovers to its previous high point is not a part of the conversation.

The recovery time is critical because this is the time before investors break even on their retirement plans . Unfortunately, not all Americans have the time to wait to break even, specifically someone planning to retire soon.

So lets dive in and figure out how to grow your retirement savings even in tough economic times. So dont wait read on to learn more!

Recommended Reading: How To Easily Invest In Stocks

Pros And Cons Of 401 Brokerage Options

Expanded investment choices make this self-directed approach a double-edged sword for 401 investors.

| For more news you can use to help guide your financial life, visit our Insights page. |

Important legal information about the e-mail you will be sending.

Content for this page, unless otherwise indicated with a Fidelity pyramid logo, is selected and published by Fidelity Interactive Content Services LLC , a Fidelity company. All Web pages published by FICS will contain this legend.Fidelity Brokerage Services LLC Before investing, consider the funds investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

What To Consider Before Investing

You dont have to pick just one fund. Instead, you could spread your money over several funds. How you divvy up your moneyor your asset allocationis your decision. However, there are some things you should consider before you invest:

- Your risk tolerance

- How much you need

The first consideration is highly personal, your so-called risk tolerance. Only you are qualified to say whether you love the idea of taking a flier or whether you prefer to play it safe.

Don’t Miss: Best Retirement Investments For Retirees

‘s Best Mutual Funds In 401 Retirement Plans

A key to smart retirement saving: spreading your portfolio across a few of the best mutual funds in your 401 plan. Here are the 29 top options available.

Checking your 401 balance when the market gets choppy, as it has in recent months, can feel a lot like watching a scary movie: You’re afraid to look, but you want to know what’s happening. And in that context, we decided now was a good time to check in again with the country’s most popular 401 mutual funds.

Every year, with the help of financial data firm BrightScope , a financial data firm that rates workplace retirement savings plans, we analyze the 100 mutual funds with the most assets in 401 and other defined contribution plans, then rate them Buy, Hold or Sell. Our goal: To guide you toward the best mutual funds likely to be available in your plan.

In the end, only a cool 29 funds, which we’ll describe in detail below, won our “Buy” seal of approval. But you’ll want to pay attention to the fine print. Some funds are appropriate for aggressive investors others are geared for moderate savers.

We’ll also point out that we didn’t weigh in on index funds. That’s because choosing a good index fund always rests on three simple questions: 1.) Which index do you want to emulate? 2.) How well has the fund done in matching that index? 3.) How much does the fund charge? Generally speaking, however, we have no issues with any of the index funds listed in the top 100.

Dont Panic When Your 401 Loses Value

Itâs natural to freak out when your 401 loses value. Checking your 401 balance and seeing youâve lost hundreds or thousands of dollars in a few months is never fun.

However, what you donât want to do is panic and make any changes in the moment.

It may seem counterintuitive, but during a stock market crash, the last thing you want to do is take money out of your 401. The reason is that you paid a price for the stocks, mutual funds, and index funds youâre invested in. If they lose value and you sell, you sold your investments for a loss. In fact, the best strategy is to invest even more money into the funds youâre invested in because youâll be paying a discount for the same funds because theyâre lower in value. And because time is on your side, the funds will recover long before youâll need to start taking distributions during retirement.

Also Check: Websites To Invest In Stocks

Using A 401 Vs Stock Picking

Contributing to a 401 retirement account and investing in individual stocks outside a retirement account represent two drastically different approaches. A 401 account is part of many employer-sponsored retirement plans. They offer immediate tax savings and, sometimes, employer matching of contributions. They also have notable restrictions. Investing in individual stocks offers no comparable tax benefits or employer matches. However, the benefits of greater liquidity and choice mean stock picking has a place in many investment portfolio strategies.

You have a myriad of choices for investing. Consider working with a financial advisor as you seek to match those choices with your goals and risk profile.

Before we dive into 401 plans vs. stock picking, remember that while both can be important parts of planning for retirement, other income sources can be equally or even more important. Social Security benefits, corporate pensions, family homes and inheritances, for instance, should be factored into retirement planning as well.

A Few Words About Mutual Funds Or Pooled Investment Options

We all hear about people making it big on individual stocks. But its also easy to lose money on any single investment. It may be intimidating to think about researching and picking stocks or investments with the pressure of potentially losing money.

Mutual funds and other commingled investments include a variety of investment types. That helps reduce risk.

Investment professionals with special training and tools manage mutual funds. That means you dont have to worry about the everyday decisions involved in picking individual investments within a mutual fund. And in some types of funds, the managers even adjust the mix of investments over time to help you stay on track to reach your goals.

In general, its good to have less risk as you get closer to your end goal, whether thats retirement or another date.

Thats because if the market drops, you have less time to recover from losses. Giving up some potential for growth might be worth it in exchange for lower risk.

Its also a good idea to rebalance your portfolio at least annually. Over time, some investments may grow more than others. After a while, your mix of investments isnt the same as when you started. That could mean youre taking on more risk than you originally intended.

Rebalancing takes everything back to your original mix, but if the change is more in-line with where you want to be, thats OK, too. Most financial institutions can help you with rebalancing. Some do it automatically for you.

Recommended Reading: How To Get A Loan To Buy Investment Property

Determine How Much You Can Contribute

Workers under 50 can contribute up to $19,500 to a 401 in 2020, but how much you actually earmark for the account depends on your income, debt level and other financial goals. Still, financial experts advise contributing as much as you are able to, ideally between 10% to 15% of your income, especially when you are young: The sooner you start investing, the less youll have to save each month to reach your goals, thanks to compound interest.

Thats your company literally saying: Hey, heres some free money, do you want to take it? financial expert Ramit Sethi told CNBC Make It. If you dont take that, youre making a huge mistake.

Mistake #: Failing To Take Full Advantage Of Retirement Saving Plans

If your companys 401 or other qualified employer sponsored retirement plan , including 403 and governmental 457, offers a company match , you have an extra incentive. If you neglect to invest enough to receive the full company match, youre leaving money on the table. If you get a raise, consider increasing your QRP contribution.

Also Check: Enterprise Trust And Investment Company

The 411 On 401 Upsides

Retirement plans are a great way for employers to attract and retain top talent. Employers should also consider the tax benefits of offering a 401 plan, particularly the advantages of matching employee contributions. To ensure compliance, businesses must evaluate the hours of full- and part-time employees when determining who is eligible for company-sponsored retirement plans. But by following the tips above, youll reap the rewards of offering this valuable retirement benefit to your employees.

Kimberlee Leonard contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

You May Like: Is There A Fee To Rollover 401k To Ira

How To Protect Your 401 From A Stock Market Crash

Stock market crashes are impossible to predict. However, you can protect your 401 from losing money if the market does crash.

Making sure you have enough money for retirement is the primary goal of contributing to a 401. Your 401 will inevitably go through a series of ebbs and flows throughout your working years. Some years youâll see tremendous growth, others you may even lose money. However, as you near retirement, youâll want to protect your 401 from down years, even a stock market crash.

To protect your 401 from stock market crash, invest more in bond, which has a lower rate of return but also much lower risk. To gain as much value as you can, investments heavier in stocks give you the best chance of multiplying your money. However, with stocks comes increased risk. Shifting the percentage of your investments to a more bond-heavy allocation can help shield you if the stock market crashes as you get closer to retirement.

Capturing as much of the good times as possible while avoiding significant losses isnât an exact science there are strategies to help shift the odds in your favor. Letâs take a look at the basics of investing your 401, so you can protect your retirement nest egg.

Also Check: Why Move 401k To Ira

Recommended Reading: When To Refinance Investment Property

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

Should I Stop Contributing To My 401

Research has shown that consistent investing pays off over time. For instance, Charles Schwab looked at five different investing styles, ranging from trying to time the market to keeping everything in cash. The best performing strategy was the investor who managed to perfectly time the market an impossibility for most investors, as noted above.

After that, the most effective strategy was one where an investor socked away money at the start of the year, followed by an approach called “dollar-cost averaging,” or investing a set amount of money on a regular basis, such as monthly or with each paycheck. In other words, how most people invest in their 401s.

The worst performer? The investor who stuck with cash, Schwab found.

“I am a big believer in the adage that time in the market is more important than timing the market, and that means that any time you can set aside money to invest is a good time,” Richardson noted. “If you have the ability to put more toward your 401 or other retirement accounts, this is as good a time as any.”

Read Also: How Do You Open An Investment Account

Understanding Your Investment Choices

Even if youve got a traditional 401k, you have more control over your investments than you might think. Some of the options at your disposal include:

- Making ETF selections where possible

- Figuring out your risk tolerance level

- Taking out a self-directed 401k

- Opening a separate investment account

If you pursue the latter two approaches, you have the final say over your investments. You can purchase ten company stocks or one. And as you figure out your post-retirement steps, you can visit a 401k retirement blog, collect retirement brochures, or speak to a financial professional.

The final choice is yours.

What Is The Difference Between A Traditional And Roth 401 Plan

There are two common kinds of 401 plans: traditional and Roth. These plans have some similarities: They are subject to the same annual contribution limit and may offer the same investment options. However, traditional and Roth 401 plans differ in terms of the tax benefits they offer.

|

Traditional |

|

|

Subject to income tax |

Tax-free after age 59 ½* |

*Only if the distribution satisfies certain conditions, for example that it has been at least five years since the first Roth contribution, or that the participant is disabled.

IRS.gov. Data as of Dec. 2020.

A traditional 401 plan is sometimes referred to as a pre-tax 401 plan. You contribute to the plan with before-tax dollars. Because you dont pay taxes on the money you put into the plan, you must pay taxes when you withdraw it. This structure could be an advantage if youre in a high tax bracket today but expect to be in a lower one when retired.

With a Roth 401 plan, the opposite is true. You save after-tax dollars in the account. Because youve already paid taxes on what youre saving, your withdrawals are considered qualified distributions and wont be taxed as long as you meet both of the following criteria:

- Youve had the account for at least five years.

- You begin to make withdrawals either after youve turned 59½ or due to disability.

Read Also: Invest In Penny Stocks Online

Other Unique Features Of Brokerage Accounts

Invest for non-retirement goals. With a 401, IRA, or Roth IRA, there are limits as to when you can use the fundsand for what purposewithout incurring a penalty. With a brokerage account, there are no such restrictions . Any money you need access to in the short-term should be kept in a high-yield savings account, but for goals with an intermediate or long-term time frame a brokerage account can be a great solution.

Avoid required minimum distributions. Just as there are no rules on how early you can access the funds, there are also no regulations on when you must begin tapping the account, as with Traditional IRAs, 401s, pension plans, and so forth. This is important as retirees who dont need the income can avoid unnecessary tax consequences, fees, and the disruption to their portfolio by staying invested.

Tax-efficient way to leave a legacy. The tax rules change when a beneficiary inherits a taxable brokerage account. If the original account owner sells a position during their life, the difference between their cost basis in the investment and the sale price will determine the gain thats subject to capital gains taxes . When an investor has highly appreciated securities in a taxable account, there may be a significant tax liability if the position is sold. However, if your spouse or heirs inherit a taxable brokerage account, the assets can pass on a stepped-up cost basis, which steps-up their inherited cost basis in the asset to the value on the date of your death.

Understanding Reverse Ira Rollovers

Rolling the assets in an IRA account over into a 401 is sometimes referred to as a reverse rollover. Thats because its far more common, at least nowadays, to move assets in the opposite directionfrom a 401 to an IRA. This often happens when an employee leaves a job or decides they would like more investment options than a strict corporate 401 offers.

Its certainly possible to move assets between other types of retirement accounts, though. However, its important to check if your employers 401 accepts this kind of incoming transfer. Some plans do, but others do not. The IRS also provides guides as to what kinds of transfers are allowed and how to report them.

As this guidance states, you are only allowed one rollover in any 12-month period, and you must report any transaction when you submit your annual tax return for both direct and indirect rollovers. If you move assets out of your IRA to put them in your 401 or use them for another purpose, your IRA brokerage will send you a Form 1099-R that will show how much money you took out. On your 1040 tax return, report the amount on the line labeled IRA Distributions. The taxable Amount you record should be $0. Select rollover.

Though this maneuver is unusual, it can have advantages in some circumstances.

Dont Miss: How To Rollover 401k To Ira Fidelity

Don’t Miss: Max Cash Out On Investment Property