Difficulties Of Raising Capital

Lending may be more challenging if the property is holding real estate in an LLC. As a result, investors must go elsewhere for funding because many traditional bankers will not lend on or mortgage a property owned by an LLC. In addition, most short-term financing options charge higher interest rates.

Create Your Articles Of Organization

The articles of organizationsometimes called the certificate of formationoutline the finer details of your LLC. It includes things like your name, purpose and how you plan on managing your real estate business.

Fill out this state-specific form, have all the business owners sign it and file it with your state. In some states, such as New York and Nebraska, youll need to publish an ad in the local newspaper to let people know about your new LLC before you submit your paperwork.

Keep Business And Personal Lives Separate

Many LLC owners may like the idea that buying property with an LLC allows them to separate their property ownership from their personal lives. However, owners who use the LLC for personal expenses make it easier to pierce the corporate veil and disregard the corporation or LLC’s separate existence should the LLC face a lawsuit. Piercing the corporate veil can become an issue for LLCs of all sizes.

Don’t Miss: Real Estate Investing In Southern California

Clearer Finances For Each Property

After you create your real estate LLC, make sure you open up a business bank account for that property. Any funds you use to perform repairs and maintenance, store tenant deposits, etc., should be transmitted through that account.

Having separate finances and bank accounts for each property can help you understand what money is coming into and going out of each LLC . You’ll be able to quickly see how much you’ve spent on each property and you can even keep your annual LLC fees organized by property. This prevents you from having to spend the time later trying to figure out what properties are profitable and what properties may have caused losses.

The Main Benefit: Protection Of Personal Assets

An LLC is often set up to offer asset and liability protection. In the event of a lawsuit resulting from damages in or on a property, the property owner is likely going to be named in the suit. If the property is owned by an LLC, the LLC is the entity that’s most likely to be named in the lawsuit.

In the event of a suit brought against the property owner, the plaintiff won’t typically have direct access to sue the individual investor. He or she would have to sue the LLC, thus any assets within the LLC would be at risk but, this limits the liability of the individual owner and protect non-LLC owned assets from an award to the plaintiff in the event that the lawsuit is decided in their favor.

This means that your personal retirement accounts, primary residence, and other investments owned outside of the LLC are generally protected. This can be an important way of ensuring that you, your family, and your long-term financial health are protected in the event of legal action against one of your properties.

You May Like: 10 Down Payment Investment Property

How To Create A Real Estate Llc

Forming a real estate LLC is not difficult, but it is location specific. Starting a new company of any kind is heavily dependent on the local laws of every state. Each jurisdiction has its own process. While the broad strokes are usually the same, the specific rules in each location are different. If you want to start an LLC, take the following steps.

Most importantly, just like when you make any legal decision, look up the rules in your individual state. We cannot guide you on exactly what steps to take in every state and territory, so make sure you check your rights and responsibilities for yourself. Given the scale and consequence of real estate investments, ideally consult an attorney.

If you have multiple members of your LLC, draft a written operating agreement between parties. Among other things this should specify each members role in the organization, its leadership structure, how the LLC will divide its net income and how it will divide any financial obligations.

Also with your states relevant agency, look up available company names. Select a name for your company based on whats available. Once you have a name for you LLC, go to the IRS and file for an Employer Identification Number . Your LLC will use this EIN to pay its taxes. Fill out the paperwork necessary for your states articles of incorporation. File it with the relevant agency. Pay any filing fees associated with these forms. This is typically several hundred dollars.

Verify That The Name You Want To Use For Your Llc Is Not Already Taken

Having the right company name is more important than most people think. The companys name must be unique. Prepare a list of possible options before checking for their availability online. Remember, your l.l.c.s name is what will represent you in the public, so pick a name with promise. Problems with business names are the most typical reason LLC applications are rejected.

Don’t Miss: The Calvert Principles For Responsible Investment

Do You Have To Live In The Same State As Your Llc

Real estate companies are pretty much free to set up an LLC in any state they choose, with a few exceptions. It is common for business owners to file in the state they currently work in to avoid confusing tax requirements, but sometimes it may be worth it to file in a different state. Take the states tax laws into consideration when deciding for yourself.

Should You Put Your Real Estate Investments In An Llc

With the residential market continuing its surge, a number of people are turning to real estate as a way to diversify their investment portfolio. We are seeing more and more clients with a variety of legal issues related to the acquisition and development of rental properties.

One of the main questions that we hear is whether there is an overall benefit to using a limited liability company to hold an investment property. While LLCs can be a great way to limit any personal liability, it is important to consider a few different issues before taking that step.

Many real estate investors are drawn to using LLCs because they are easy to use, and they limit the exposure of any personal assets from claims related to the property. Unlike corporations, limited liability companies are fairly straightforward in their structure and allow for maximum flexibility for business and tax planning purposes. However, similar to corporations, LLCs provide their owners with a great deal of protection from various claims arising for the development and leasing of the property. As a result, holding this high-risk asset in a separate LLC can be ideal for individuals who want the benefit of simplicity while still providing that added layer of protection.

In any event, it is important to consult with an attorney to ensure that the proper steps are taken that will minimize your costs while securing the protection that you need to maximize the return on your investment.

Don’t Miss: How To Invest In Healthcare

Youll Give Up Preferential Capital Gains Treatment

You pay capital gains tax when you sell your house for more money than you paid for it. Normally, you would receive special treatment on capital gains tax when you buy a primary residence. You pay no capital gains tax on the first $250,000 of profit if as a single individual. Married couples enjoy a $500,000 exemption. However, you forfeit this treatment when you own property for investment purposes.

In order to qualify for the capital gains tax exemption, you have to own the home for at least 2 years out of the 5 years preceding the sale. You also have to have lived in the home as your primary residence for at least 2 years of the previous 5 years. They dont need to be the same 2-year period.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

What Are The Disadvantages Of Buying A House With An Llc

You should also remember that there are significant disadvantages to buying a property through an LLC before you take this route. Consider the initial and ongoing costs, difficulty getting a mortgage, lack of preferential capital gains treatment and a few other disadvantages, which we’ll go over in detail.

Recommended Reading: How To Invest In Cryptocurrency Mutual Funds

How To Set Up A Real Estate Llc In 6 Steps

Starting a real estate investment LLC has risen in popularity in the past decade, namely due to the unique benefits that cannot be ignored. Forming a real estate LLC is not difficult rather, it is a matter of doing your research and getting organized. The following is a brief overview of the required steps, which can vary by state.

Research your states regulations on forming a LLC.

Pick out a business name and run a search to make sure it doesnt already exist.

File an Articles of Organization document that can be found on your Secretary of State homepage.

Create an Operating Agreement for your LLC, which outlines how your entity will be organized and run.

Find out whether your state requires you to publish an intent to file through your local newspaper.

Obtain any necessary business licenses and permits, as well as apply for a tax identification number through the IRS.

Limits Your Personal Liability

The main reason to open a real estate LLC is to reduce your personal liability. For example, imagine if someone got injured on your property and wanted to sue you for damages. Since your LLC owns the property, they would have to sue the LLC, meaning that your personal assets wouldnt necessarily be on the line. Any damages you may have to pay out can come from your business instead.

Another example might be if you fail to make payments on a loan for the property. If the debt is in your LLCs name, you wont have to wipe out your personal assets to satisfy the remaining loan amount.

Also Check: Non Profit Real Estate Investment

Verify Whether Your State Mandates A Public Notice Be Made Of Your Intent To File A Petition

Only Arizona, Nebraska, and New York require that the LLC the applicant made public his or her intent to do so. To form an LLC in one of these three states, your intention must be published in the local newspaper. Generally, investors will run three to six-week newspaper ads. The newspaper will subsequently transmit an Affidavit of Publication to the Secretary of State.

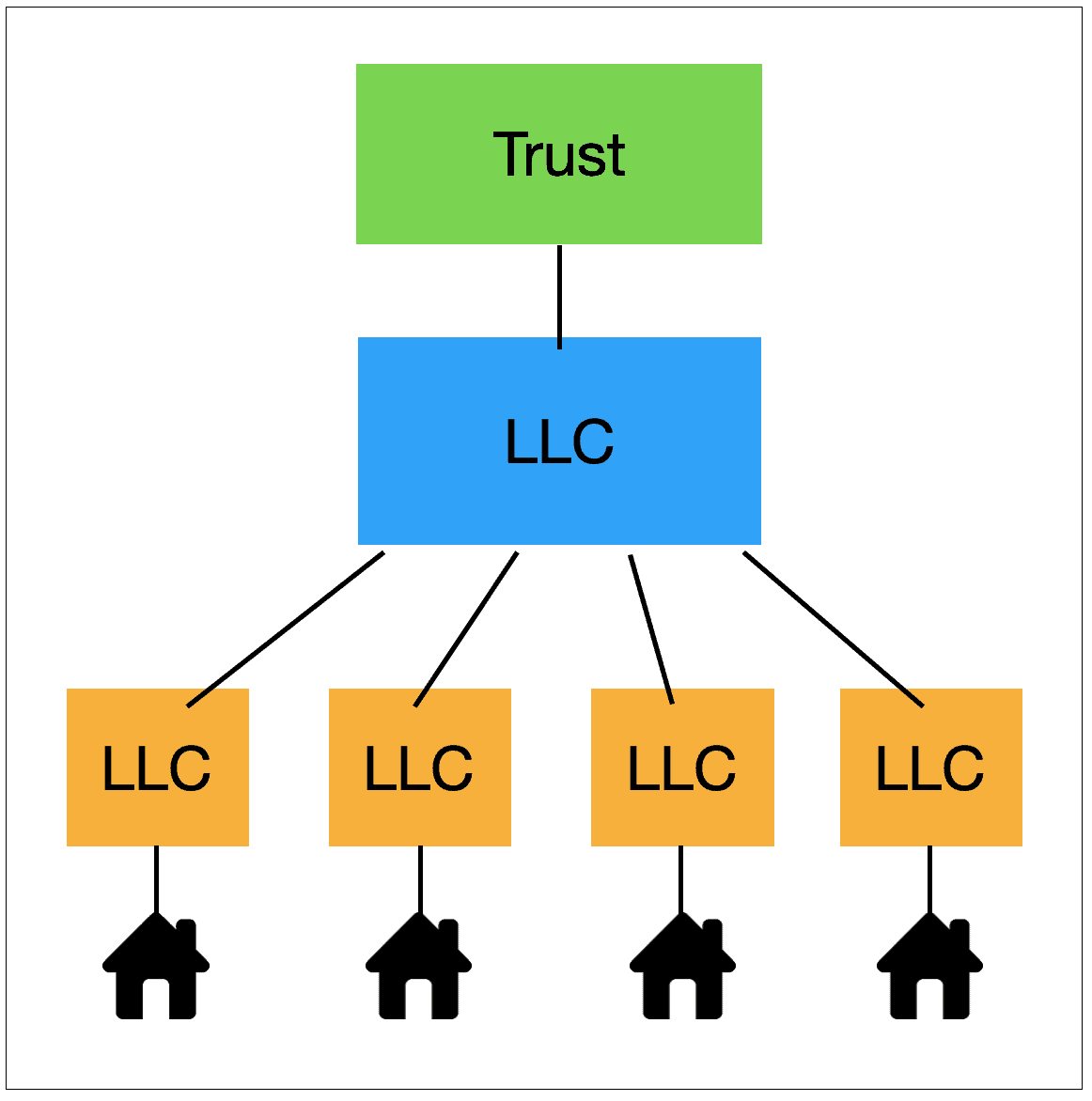

Llcs: Best Biz Structure To House Multiple Properties

A common question real estate investors have regarding their companys business structure is: Should I create a separate Limited Liability Company for each investment property I own, or can one LLC can cover all properties? Well, theres no one right answer because the best business structure for multiple properties can depend on a variety of factors. Generally, though, forming an LLC for each property proves advantageous for several reasons.

Read Also: Term Sheet For Venture Capital Investment

Choose A Business Name

The right business name is more fundamental than you might think. Not only does it need to attract potential clients, but it must also be unique to register as an LLC. Write out a few potential options before going online to check their availability. One of the best tips to follow as you name your business is to avoid pigeonholing yourself. Starting an LLC is only the beginning of your real estate business, so choose a business name with potential. Once you have some candidates in mind, make sure they are not already taken. The most common reason LLC applications are rejected is because of problems with business names.

What You Need To Know Before Creating An Llc For Your Rental Property

As you establish yourself as a real estate investor, youll start to delve into some of the ins and outs of protecting yourself from liability and maximizing the value of your investment.

One of the tools you may consider is the formation of a Limited Liability Company or LLC. There are a variety of different types of LLCs, and each have their pros and cons, tax implications, and other specific considerations.

Please Note: The information contained within this article is not designed to offer legal or tax advice. It is to be used for informational purposes only. Professional legal advice should be obtained prior to forming or holding a legal entity.

Recommended Reading: Best Investment Firms In The Us

How To Start A Real Estate Holding Company In 6 Steps

Aloun Khountham is a contributor to Fit Small Business. Her real estate experience stems from over five years as a New York City real estate operations executive focused on implementing processes, procedures, and new technology solutions designed to help agents succeed.

A real estate holding company is a legal entity that helps minimize risk to protect an asset and shield property owner information. It can hold a singular asset or act as a parent company to many properties, also known as subsidiaries. To start a real estate holding company, choose a name for it, hire an attorney, obtain permits, and open business banking accounts. Many holding companies are created as limited liability corporations , which are easier to create and manage while providing better tax benefits than a corporation.

Follow the six steps below to learn how to start a real estate holding company:

Pros And Cons Of Creating An Llc For Your Rental Property

For many real estate investors, forming an LLC for rental property offers the best of all worlds when it comes to protections, tax treatment, and raising investment capital. However, using an LLC for rental property may not be the right choice for every investor.

In this article, well take a quick look at how an LLC works and discuss the pros and cons of forming an LLC for rental property.

Key takeaways

- An LLC for rental property can be a single-member LLC or have multiple members.

- Three advantages to using an LLC for rental property are pass-through of income and losses, protecting personal assets, and creating a flexible ownership structure.

- Drawbacks to using an LLC include possible self-employment tax, difficulty of financing, and annual fees.

Read Also: Annual Qualified Default Investment Alternative

Fundamental Mistakes To Avoid When Starting An Llc For Real Estate

While forming a real estate LLC is immensely important for protection, the beginning stages of setting it up can also be massively intimidating for beginners. Also, there are several common mistakes that investors make along the way. To better assist in understanding the complexity of a real estate LLC, the following outlines the biggest mistakes people need to avoid when forming an LLC:

Not starting the process of forming your LLC before pursuing new deals.

Selecting the wrong LLC structure for your business.

Commingling personal and business funds, or engaging in unethical practices.

Not consulting a professional on the best corporate and tax structures for your business.

Omitting the proper steps and due diligence recommended when forming an LLC.

Underestimating ongoing costs and maintenance to keep the LLC up and running.

Filing And Management Fees

Costs associated with the setup of an LLC can include legal fees and initial filing fees. Some states require that you pay an annual fee of hundreds of dollars just for the existence of an LLC. For this reason, it is important to ensure that you plan to use your LLC before setting it up.

You should have separate and well-defined bookkeeping processes for each LLC. This may require additional expenses for bookkeeping and accounting services.

In addition, each LLC requires its own separate tax return, so there are additional accounting costs associated with the financial management and tax filing for each entity. Because each LLC requires its own separate bank account, you may also have bank fees associated with each LLC.

Holding properties under an LLC can also affect your ability to borrow from a bank. Many banks require a personal guarantee and will not lend to an LLC. Check with your financial advisor to better understand strategies for financing properties owned by an LLC.

Don’t Miss: Best Franklin Mutual Fund To Invest

Ability To Establish And Grow Your Business Credit

Creating multiple LLCs and establishing credit as a business owner will keep your personal finances protected. You can look at business credit in the same manner as you do personal credit. When you need money and ask for a loan, many banks will decline your loan application because you don’t have any credit. Your ability to get the funding necessary to purchase properties, make renovations and pay for expenses all falls on whether or not you have the credit banks are looking for.

The better your business credit is, the easier the process goes and the greater your chances are of getting approved for the amount you’re asking for. Any credit inquiries and loans taken out under your LLC will not affect your personal credit history, keeping your personal and business finances separate.

SBA.gov mentions that if you want to build your business credit, there are five things you need to focus on and complete.

File Your Llc’s Certificate Of Formation

To register your Texas LLC, you’ll need to file Form 205 – Certificate of Formation with the Texas Secretary of State. This can be done online, by mail, or in person.

Consider an S Corp tax status for your real estate LLC. As an IRS tax classification, an S corp can provide your real estate business with certain tax benefits. You can find out more if an S corporation is right for you with our LLC vs S Corp guide.

Now is a good time to decide whether your LLC will be member-managed vs. manager-managed.

Recommended: For help with completing the form, visit our Texas Certificate of Formation guide.

OPTION 1: File Online With Texas SOSDirect

Austin, TX 78701

Don’t Miss: Can I Invest In Venture Capital