Increased Accountability For Regional Centers And Migration Agents

EB-5 regional centers are granted authority by USCIS to manage funds from multiple investors across various EB 5 investment projects. Under the Act, USCIS will now oversee regional centers activities more carefully. Greater oversight will make fraud, fund mismanagement, and non-compliance even more unlikely.

These reforms will discourage each EB 5 regional center from taking liberties with its affiliation and loan agreements. The Act will also keep EB-5 industry participants accountable by placing substantial penalties on non-compliance, such as providing inaccurate information. These measures will help protect all regional center investors from losing their investment funds or becoming disqualified for investment Green Cards.

Trust Independent Due Diligence

There are lots of great regional centers out there. But understand what they give investors is marketing its designed to showcase an EB-5 project’s best features. And its not meant to highlight risks or negative elements. Unless youre both an EB-5 immigration expert and a financial analyst, you should rely on independent due diligence that examines the strengths and risks of all your investment options and gives you an unbiased and completely transparent analysis.

Too many EB-5 projects have failed due to poor execution or even willfully criminal acts. And too much depends on the outcome a Green Card and at least $900,000 to take chances. Get a third party with experience reviewing EB-5 investments.

I Haven’t Paid Taxes Individual Or Business Because My Country Of Residence Doesn’t Require It Or It Isn’t Customary Is This A Problem

Catharine: We normally tell clients if they can provide income tax returns, its great to do so. If they can’t, it’s not going to make or break their petition.

We let them know that if USCIS sends a request for evidence for copies of their income tax returns, they will need to either produce them or get a letter from an attorney in their country of residence stating the legal reason behind why they can’t provide those tax returns.

I always request tax returns but Ill still file a petition if I don’t have them.

Read Also: How To Invest Money In Real Estate Business

An Extended Window For Job Creation

EB-5 investors who file Form I-829, the final application used to obtain an EB-5 investment Green Card, are no longer required to have created all 10 required jobs at the time of filing. Instead, they can be actively in the process of creating the jobs. In such cases, foreign investors are allowed one additional year to show that the jobs were created. Before the end of the additional year, these investors must submit another petition showing that the jobs were created and that the project resulted in economic development. This increased flexibility strengthens EB-5 investors chances of obtaining permanent residency even if job creation is delayed.

How Does An Eb

An enterprise creates a job by hiring a full-time qualified employee for a job that that did not previously exist. Replacing an existing employee does not count as creating a job. For purposes of the EB-5 Immigrant Investor Program,employment is defined as follows.

EB-5 Employment Criteria:

- A qualified employee is one who can legally work in the United States, including US Green Card holders. However, the EB-5 Visa holder from Canada and his or her family members cannot be counted among the ten new employees.

- A full-time employee is one who works at least 35 hours per week

An EB-5 investor preserves a job by keeping someone employed in a troubled business. To qualify as a troubled business, the US business must satisfythe following requirements.

EB-5 Troubled Business Conditions:

- Enterprise must have existed for at least two years

- Enterprise must have operated at a loss during the period beginning 24 months before, and ending 12 months before, the date on which the USCIS accepted the filing of the candidate’s EB-5 I-526 petition

- The business loss must reduce the companies net worth by at least 20%

Don’t Miss: What To Invest In Roth Ira Fidelity

What Roi Can I Expect From My Eb

Rupy: The eb5Marketplace investment platform has recently offered ROI of 0.25% – 8% per annum.

EB-5 investments dont offer the same ROI as general investments because there is added cost to projects to structure an EB-5 investment, and there is less certainty of when the capital will be able to be used by the project. Therefore, to make EB-5 money more appealing to a project, it will have to offer lower than traditional ROI to investors.

Did You Know That Like Any Other Business Eb

Most people are aware of the EB-5 Immigrant Investor Program. Its a somewhat complicated programme that offers U.S. permanent residency and a path toward citizenship for foreign nationals who invest a certain amount of capital in the country and create at least ten full-time jobs in the same area where they made this investment. Interestingly, if you were to think about risks regarding this programme, failing EB-5 projects is probably not on the list.

Should you be concerned with what happens if an EB-5 investment fails? The answer is yes. But why should an EB-5 investment failure be such a big deal?

Also Check: Century 21 Homes And Investments

How Do I Choose An Eb

Some USCIS EB-5 Regional Centers are riskier than others. Risk depends in part on the strength of the local economy, the skill with which the investment is managed, and the success of the individual projects in which investments or loans are made.

Taking a greater risk might give an EB-5 participant a higher return on investment , but it may also cause him or her to lose all their investment or a portion thereof. A less risky investment might provide a minimal return on investment but may give the EB-5 investor a better opportunity to withdraw their investment in full after two years when they have satisfied all the conditional US Investor Visa requirements.

When evaluating which are the best EB-5 Regional Centers in the United States, there area variety of factors to consider. How long has the EB-5 Regional Center been operating? What is its historical performance? How experienced is the Regional Center’s leadership team? What is the nature of the EB-5 projects it will be investing in? Do the proposed numbers look realistic? Has the Regional Center invested in similar projects before? Is the project located in a Targeted Employment Area ? What is theeconomic outlook for the region? How do the EB-5 Regional Center’s fees and expenses compare to those of other EB-5 Centers?As of October 2021, the official USCIS EB-5 Regional Center list contained 632 approved Regional Centers, although many of these are not currently open for new investment from Canadians.

Thoroughly Review The History Of The Financial Institutions And The Project Developer That Will Handle Your Investment

Once the potential immigrant has turned over his or her investment, it is fully managed by the project developer for the enterprise that the investment has been placed in. In order to protect the investment and ensure that it is used in compliance with program regulations, it is important to evaluate the history of the project developer as well as any others involved in handling the investment. Evaluation can include looking at the number of projects the developer has successfully completed, the developers total development experience, any prior loan defaults, current involvement in litigation, experience the developer has with the financial institution involved in the project, and the amount of equity capital that the developer has at risk.

Recommended Reading: Should I Sell My House And Invest The Money

Protections Against Terminated Or Debarred Eb

Even if a foreign national carefully evaluates an EB-5 project before investing, there is still no guarantee of future success. Fraud, mismanagement, or non-compliance on the part of an EB-5 project or regional center may result in the termination or debarment of the project or regional center. Prior to the Act, USCIS was almost certain to deny the EB-5 visa petitions of investors whose regional centers or EB-5 projects were terminated or debarred. To address this risk, the Act includes provisions to protect innocent investors against events that are outside of their control. Investors whose regional centers or EB-5 projects are terminated or debarred are now given 180 days to invest in other EB-5 projects or to have their project affiliate with a different regional center. Innocent investors who take advantage of this provision will not lose their USCIS processing priority dates or the child status of dependent family members.

Investment Visa Usa History

Congress created the EB-5 Immigrant Investor Program in 1990 in order to help stimulate the US economy. The program was intended to promote the creation of jobs by attracting new business investment from abroad. To serve that end, the program encouraged immigration by foreign investors who were willing and able to start new businesses that created jobs for Americans.

In 1992, Congress added a pilot program that gave EB-5 applicants the option of investing in a designated Regional Center rather than making a direct investment in a business. Ten years later, Congress removed the word “pilot” from the program, demonstrating its ongoing commitment to the EB-5 Regional Center investment option.Congress has also been extremely committed to the Green Card by investment program itself having consistently reauthorized the EB-5 Program for more than 20 years.

You May Like: Socially Responsible Investing Robo Advisor

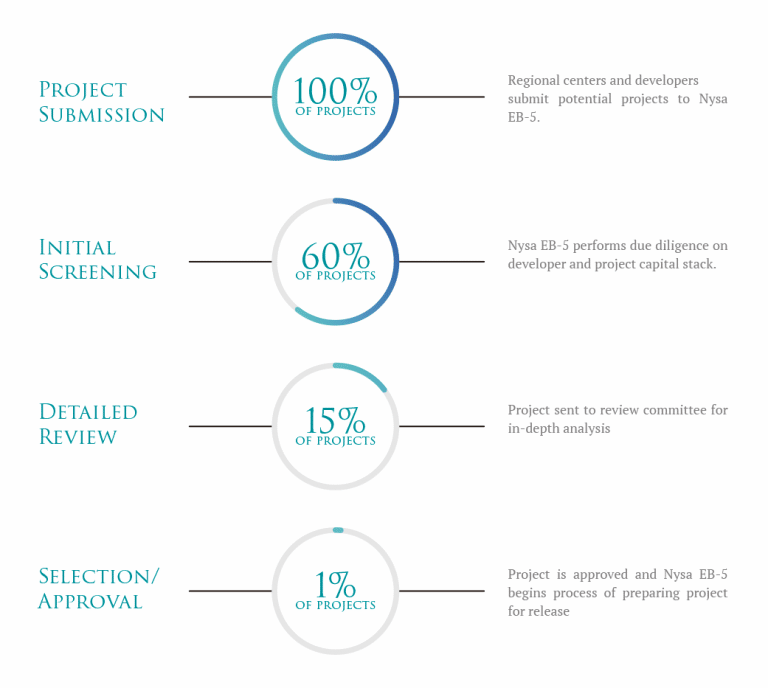

Project Evaluation & Due Diligence

Running a sensitivity analysis to determine project viability in both current and future market conditions

Ensuring a project includes adequate capital from developers and project sponsors to ensure securitization of EB-5 investor capital

Verifying that the project will create the jobs required as per USCIS regulations

Verifying that the funds be invested within the appropriate timeline to count towards the investors EB-5 filing

Running background checks on project principals to validate their credentials

Meeting and visiting project sites to check for progress of project construction

Confirming the position of investors in the projects capital stack

Completing a risk analysis on the return of investment

Increased Safety Implies More Expenses For Investors

Under the Act, the minimum investment cost of pursuing an EB-5 investment Green Card has increased. The Act raised the capital investment threshold for projects in a targeted employment area from $500,000 to $800,000. A targeted employment area is a rural or high unemployment location in need of economic development. Of the two classifications, high unemployment targeted employment areas have historically been more popular in the EB-5 program.

These minimum investment amounts apply to all visa applicants in the EB-5 Immigrant Investor Program, regardless of whether they make a direct investment in a commercial enterprise or invest through a regional center.

Additionally, since the new regional center program compliance requirements stemming from the Act will cause a significant increase in the cost to operate a regional center and correctly administer an EB-5 project, it is expected that EB-5 regional centers will raise their administration fees. EB 5 immigrant investor returns are expected to decrease correspondingly.

Read Also: How To Invest In Qualified Opportunity Fund

How Do I Know Whether An Eb

Rupy: A review of the PPM should disclose the relationship of the Regional Center and the Issuer . It should outline who the principals of the Regional Center are, who the principals of the NCE are and who the principals of the JCE are. And it is important to identify any conflicts of interest disclosures in the PPM.

Sometimes even though the parties are unrelated, there can still be conflicts of interest due to the way compensation is structured. There can also be conflicts regarding common ownership and conflicts regarding incentives given to certain parties. These are serious issues investors need to evaluate.

How Is The Return And Profits Of My Eb

I talked with an EB-5 regional center and they told me that if I invest now I will be able to get the return and profits of my investment in six years. I am wondering what the common mechanism of distributing the money would be? Monthly? Quarterly? Semi-annually or annually? Will I able to get the money back after six years even if my I-829 is still pending?

The funds usually are distributed at one time, as a lump-sum payment. If your I-829 is still pending, you cannot get the funds back. You will have to wait for I-829 approval.

The return and profit distribution arrangements vary, depending on what was discussed , negotiated and agreed upon at the time you invested in the project. It is critical that you fully understand and are comfortable with these elements, especially the exit strategy. Return of initial capital while the I-829 is pending may also be subject to the terms you agreed upon.

Each project has the right to do this any way they see fit and you agree. Most have some type of small annual dividend.

The return and profits distribution from your EB-5 investment should be spelled out in your contract with the regional center.

You May Like: Best Way To Invest Home Equity

Can I Receive A Loan From A Family Member Or Friend Not A Financial Institution

An EB-5 investor can obtain a loan, secured by their personal or real property, from a financial institution , friend or family member. Immigration attorney Edison Samways of the Alexandre Law Firm notes. It is important that the loan and terms of repayment are properly documented to facilitate the origin and tracing of investment funds. A number of law firms work with Chinese and Latin American EB-5 investors on different financing mechanisms. And are seeing more and more clients who are inquiring about different loan models.

If the investor owns a house, or other real property. And does not want the hassle of dealing with a bank, his friend or family member can agree to loan the funds needed for the EB-5 investment. Some of the documents that might be required include:

- An appraisal of the property securing the loan.

- Proof that you have clear title to this property.

- A signed and executed agreement mortgaging the property, evidence of the transfer of the loan proceeds to your account from the lenders account.

- Proof that the person loaning you the funds obtained the money lawfully.

This is a great way to simplify obtaining funds for an investment. And the tracing of the origin of those funds. Always remember, however, that the repayment of the loan cannot be secured by the assets of the EB-5 enterprise. It must be secured only by separate assets of the EB-5 investor.

What Is A Common Roi For An Eb

I am in the middle of my EB-5 due diligence and I noticed that the return of investment mentioned in the documents provided by a regional center is very low. Is this common for other regional centers/projects? What is the average ROI for an EB-5 investment?

- Answered onJanuary 13, 2020

There is no general standard ROI for EB-5 investments. However, the common percentage expressed most often is about 1.0% to 2.0%.

- Answered onDecember 18, 2019

For most EB-5 investments you should concentrate on capital preservation as the return on investment is usually low.

- Answered onDecember 16, 2019

It is common for EB-5 returns to be lower than the industry standard, but you have to keep in mind that U.S. lawful permanent residence is a significant benefit and should be considered also part of the ROI. There is no average ROI for an investment.

- Answered onDecember 16, 2019

They are often very low. Some are 1% or even lower. The “return” for most investors is their permanent residency, and the exit strategy or how to obtain repayment of the original investment becomes the primary concern.

Recommended Reading: Nyu International Hospitality Industry Investment Conference

Guaranteed Processing If The Regional Center Program Lapses

When the regional center component of the EB-5 program lapsed on June 30, 2021, USCIS stopped processing regional center applications. The only hope for EB-5 investors in regional center projects was that Congress would reauthorize the regional center program. The Act both reauthorized the regional center component of the EB-5 program and provided protections to investors in case of a future lapse: under the Act, all regional center investors who file I-526 petitions on or before September 30, 2026, are guaranteed to have their applications processed even if the EB-5 Regional Center Program lapses once more.

Can I Continue To Travel In And Out Of The Us While My I

Sam: Generally yes, although it depends on the type of visa the immigrant has. Typically if an investor has a B visa or if they come from a country where they’re able to use ESTA, there are no problems with traveling. Sometimes we get stories of clients who are stopped at the airport and questioned, but we haven’t encountered any major problems.

Traveling outside the US may become more difficult once a client’s I-526 petition gets approved, so it is important to explain to them what their visa allows for, what duel intent means and what to do if they are stopped at the border.

It can be difficult for a client to apply for a non-immigrant visa after their I-526 petition, because theyve already put on record that they had immigrant intent through the I-526, so establishing non-immigrant intent can be very tricky.

You May Like: What Is A Real Estate Syndicate Investment

If I Get Denied Is My Money Returned Right Away Or Is It Locked In The Investment

Rupy: Know that most investments have provisions to return the investor capital to an investor who is denied. However the terms and structure of those provisions vary by regional center investment. Some of those differences may include the conditions required to fully refund an investors money, if there is a separate fund for such an event, and what entity makes the repayment because of the fact that the investor capital will already be invested by the time of a petition denial.