A Doorway To Investing

History has shown that the stock market typically outperforms fixed-income assets and interest-bearing savings accounts by a wide margin. If equities continue to provide returns comparable to the long-term average of 7%, even a small investment can outperform money market savings accounts, which typically yield 1-2%.

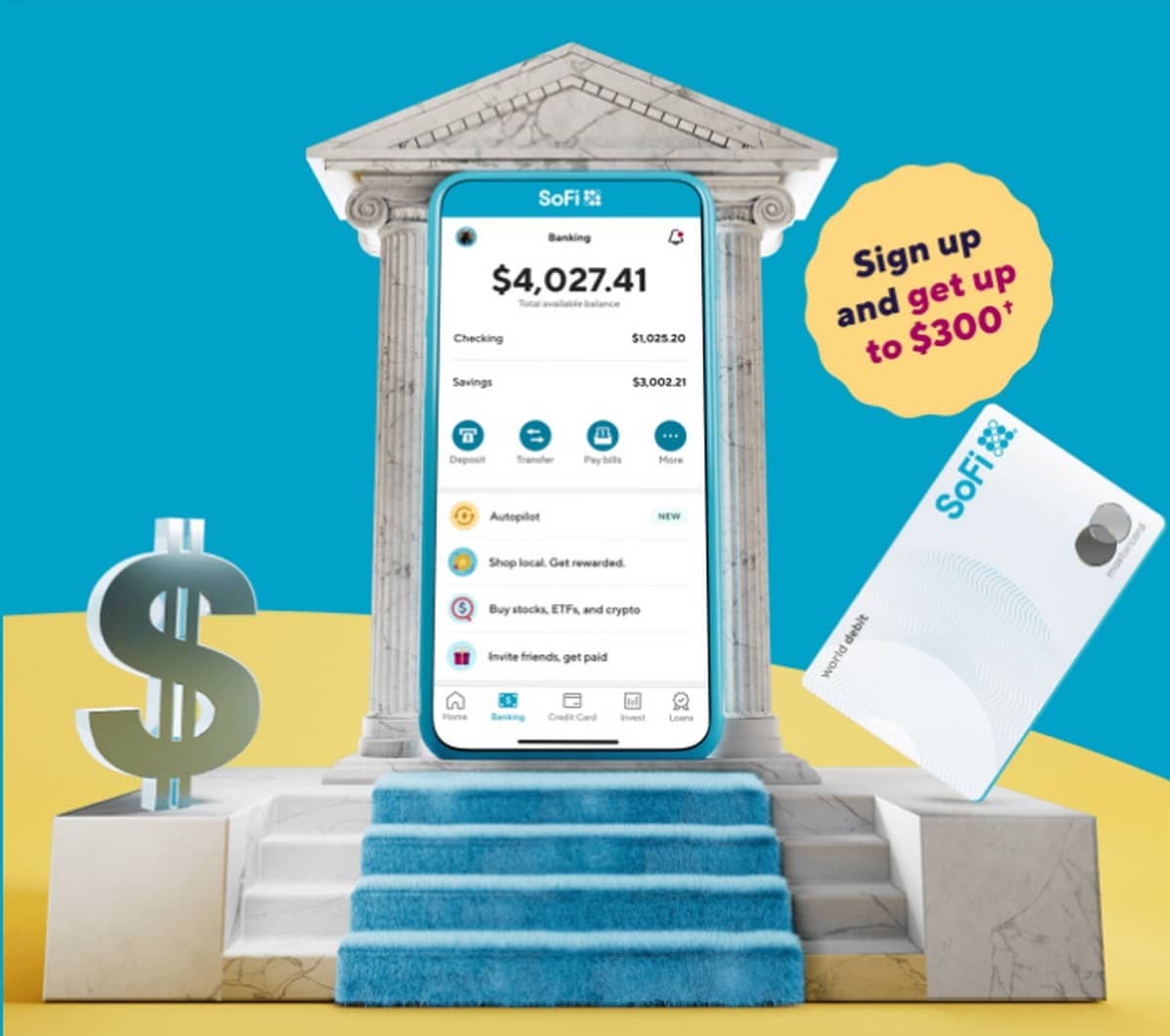

Sofi Checking And Savings

Interest Earnings

SoFi Checking and Savings customers can earn up to 1.25% APY on all balances in the separate checking and savings accounts included in this package.

To earn 1.25% APY, you need to set up monthly direct deposits of any amount. Customers who donât make direct deposits earn 0.70% APY on account balances.

Access to Your Money

Account holders get a debit card thatâs tied to the checking account. You can access your money at more than 55,000 fee-free Allpoint ATMs worldwide. Paper checks are available at no cost.

Features

SoFi Checking and Savings offers the ability to access your direct deposit paycheck up to two days before the scheduled deposit date. How early you get access to your paycheck depends on when SoFi receives payment notification from your employerâs payroll service. Your entire direct deposit amount will be available as soon as itâs posted to your account. There is no penalty for early access to your paycheck.

You wonât find many bank fees with SoFi. Thereâs no minimum balance requirement and or monthly maintenance fee. There are also no fees on overdrafts, and members with $1,000 or more in monthly direct deposits get no-fee overdraft protection.

Another perk, tied to SoFiâs debit card, is that you can potentially earn up to 15% cash back at select local retailers. How much cash back you can earn depends on your spending habits and location.

Which Trading Platform Is Better: Robinhood Or Sofi Invest

To compare the trading platforms of Robinhood and Sofi Invest, we tested each brokers trading tools, research capabilities, and mobile apps. For trading tools, E*TRADE offers a better experience. With research, E*TRADE offers superior market research. Finally, we found E*TRADE to provide better mobile trading apps.

Recommended Reading: Where To Start Investing In Real Estate

Read Also: How To Find Good Investment Opportunities

Is Sofi Covered By Fdic

SoFi Checking and Savings isn’t a bank account it’s a brokerage account. But your deposited funds are FDIC insured once it reaches SoFi’s program bank. The financial tech company also offers a number of other financial products, including investment accounts, student loans, personal loans and mortgages.

Sofi Active Investing Is Right For You If:

- You’re a beginning investor: SoFi is geared toward beginning investors. It isn’t intended to be the best place for experienced investors who are analyzing stocks.

- You want to keep all of your finances in one place: SoFi is well known for its loan products, especially personal loans. It also offers the SoFi Money account, which combines the best features of checking and savings accounts. And SoFi has one of our top-rated robo-advisors, SoFi Automated Investing. With an all-in-one app and a wide range of financial products, SoFi can be a great choice for people who want to keep their investments in the same place as their other financial accounts.

- You don’t care about options or mutual funds: SoFi Active Investing is a great place to buy and sell stocks or cryptocurrencies. That’s all. If you want to invest in options, mutual funds, or pretty much anything else, you’ll have to do it elsewhere.

- You want low frills, but also want to invest for retirement: This is a big differentiator. Most other low-frills platforms don’t offer IRAs. Robinhood and Cash App don’t. SoFi gives investors an easy-to-use way to invest for retirement.

Read Also: Why Are Bonds Considered Fixed Income Investments

How Do I Open An Account

Creating a SoFi Invest account is easy and should only take a few minutes. To begin, visit the SoFi Invest page and click the big “Invest Now” button at the top right-hand corner.

After providing your basic personal information, you’ll answer a few identity verification questions as well as questions about your risk tolerance and investing experience. Your answers will help SoFi to choose the right automated portfolio for your goals and needs.

Lastly, you’ll connect your bank so that you can transfer over the funds that will be invested into your custom portfolio. You can make a one-time transfer or set up a recurring schedule.

Is Sofi Legit Using Sofi To Invest

Disclaimer

We only endorse products that we truly believe in. Some of the links below may earn us some extra guac at no additional cost to you. Please pass the chips & thank you for feeding our habit.

Ready to start investing? While youre free to DIY an investment portfolio with a broker of your choosing, online investment apps like Social Finance make it a breeze to start investing, too.

Its no wonder why 79% of Minority Mindset readers use 1-3 apps for investing!

But investing can feel risky, and its nerve-wracking to trust your money with a new fintech startup like SoFi.

So, is SoFi legit, or is it a scam masquerading as a fintech company? Lets look at how SoFi Invest works, and whether its a legitimate way to grow your money.

| Platform |

|---|

You May Like: Invest In Something That Pays You

How To Recover Your Money If A Bank Fails

When a bank fails, the FDIC has two jobs: First, it pays depositors up to their insurance limit.

Second, as the receiver of the failed bank, it collects and sells the assets of that institution and settles its debts, including claims for deposits in excess of the insured limit.

Because of the FDIC safety net, you wont likely see fearful customers lining up to get their money the way they did before deposit insurance was established.

Still, when a bank closes, it affects depositors, creditors, and borrowersand naturally there are questions about automatic deposits and payments, earned interest, outstanding checks, and more.

The FDIC states that it will post information as promptly as possible, or you can contact the agency at 877-ASK-FDIC.

Is Sofi Bank The Same As Bancorp Bank

Yes, SoFi Bank is a real bank. In January 2022, SoFi was conditionally approved by federal regulators to become a national bank, pending its purchase of Golden Pacific Bancorp, Inc. After the acquisition, Golden Pacific Bank was renamed SoFi Bank, National Association , and is now SoFi’s banking subsidiary.

Read Also: Cash Out Refinance To Invest

How To Open An Account With Sofi

SoFi Money has a simple sign-up process that takes 5 to 10 minutes to complete . Make sure all of the relevant

Step 2.

Depending on whether you want to go it alone, or sign up with your business partner, you can choose between the individual and joint account.

Step 3.

Next, provide your physical address, city and, state. This is the address where SoFi Money will send your debit card.

Step 4.

SoFi will require you to provide your phone number for verification. The app will send you a code, which you must enter to proceed with the application. This number will also be used for two-factor authentication.

Step 5.

You will be required to confirm your Social Security and date of birth. SoFi uses this information to check your credit score. This is a soft pull, and it wont affect your credit score.

Step 6.

SoFi will require you to confirm your citizenship. Confirm whether you are a permanent US citizen, a non-permanent resident alien, or a green card holder.

Step 7.

The final step is to answer certain questions . These questions relate to your role in a brokerage firm or security exchange, your directorship or role in a publicly-traded company, or if you need to add a trusted person to help you manage the account.

Once youve answered these questions and accepted the agreement, your account is ready, and you can link up your bank account to add funds to your SoFi Money account.

Is SoFi Money FDIC Insured?

Bottom Line

Is CIT Bank better than SoFi Money?

Sofi Invest Review : How It Compares Plus Expert Opinion

Home » Product Reviews » SoFi Invest Review 2022

Disclosure: This page may contain affiliate links. This means we earn a small commission if you purchase a product through our links.

4.7/5

In a nutshell: SoFi Automated Investing provides a simple, incredibly low-cost investing platform perfect for beginners and cost-conscious investors. Plus, its $5 minimum makes it easy for anyone to get started.

SoFis Active Investing also has commission-free stock and ETF trading, though it does lack some advanced trading features. Overall, SoFi Invest is a solid investment and trading platform.

| Fees |

|---|

SoFi Invest offers no-fee investing and portfolio management, plus free access to financial advisors. For fee-conscious investors, SoFi Invest is tough to match.

Pros & Cons

Also Check: No Closing Cost Refinance Investment Property

Recommended Reading: Selling Investment Property Capital Gains

Not Every Financial Institution Is Covered By The Fdic

The FDIC insures deposits in most banks and savings associations, but not all of them. Every FDIC-insured depository institution must display an official sign at each teller window or teller station, so thats an easy way to check.

Or you can find out if your deposits are insured by using the FDIC BankFind tool.

If youre using an online bank or a mobile-first financial product, the companys website should contain information about its coverage.

The National Credit Union Administration , created by Congress in 1970, covers federally insured credit unions in much the same way as the FDIC, including deposits up to $250,000.

Who Sofi Is Best For

If you havent started investing yet, and are looking for a simple way to get started with a company you might already have a relationship with, SoFi is a great choice.

They support all of the securities that a beginner investor needs to be successful.

Not to mention, SoFi also allows users to make recurring investments in specific securities.

This is great for those looking for a truly hands-off approach to investing.

Read Also: Where To Invest If You Have 100k

Sofi Vs Acorns: Which Is Better

SoFi and Acorns are robo-advisors, meaning they digitally manage your investments or offer online advising. The two services target digitally native investors and cater to hands-off traders who prefer a passive investment strategy. Both offer investors the opportunity to start building their investment knowledge and allow them to start with little money. Picking the trading platform that best suits your goals, timeline and level of engagement can take time. If youre looking for professional help with your investments, consider speaking with a financial advisor.

You May Like: What Is A Personal Investment Plan

How Sofi Automated Investing Works

In addition to standard brokerage accounts, SoFi Automated Investing offers IRAs , SEP-IRAs, and lets members roll over existing retirement funds into a SoFi account. Members can access accounts through SoFis online portal or through its user-friendly mobile app.

SoFi Automated Investing customers can choose from several investment portfolios offering a variety of risk levels and investment goals. If you arent sure which one to choose, dont worry you can answer questions about your financial goals, current assets, and income, and SoFi will do the rest.

As with most robo-advisors, the portfolios are composed of exchange-traded funds that put your money into a mix of stocks, bonds, and other asset classes. Unlike many competitors, SoFi uses some proprietary ETFs in its Automated Investing portfolios, another way it keeps expenses low.

| 0% |

Recommended Reading: How To Invest In Multifamily Real Estate

Don’t Miss: Can I Invest In Stocks Without A Broker

Sofi Invest Vs Wealthfront

| Learn more |

SoFi and Wealthfront mainly differ when it comes to account types and investment types. While SoFi offers both self-directed and automated accounts, Wealthfront best suits those solely in search of automated portfolio management.

In addition, SoFi is the better option for stock investing. With Wealthfront, you can only invest in ETFs, index funds, and crypto trusts.

Sofi Money Review: 2022 Review

Writer, Contributor

Experience

Review & Fact Check: Baruch Mann

Baruch Mann

Financial Expert, The Smart Investor CEO

Experience

Writer, Contributor

Experience

Review & Fact Check: Baruch Mann

Baruch Mann

Financial Expert, The Smart Investor CEO

Experience

We earn a commission from our partner links on this page. It doesn’t affect the integrity of our unbiased, independent editorial staff. Transparency is a core value for us, read our advertiser disclosure and how we make money.

SoFi Bank

APY Savings

Founded in 2011, SoFi is a San Francisco-based non-bank financial service provider popular for student loan refinances. In 2019, SoFi introduced SoFi Money, an online cash management service offering a hybrid checking and savings account with no monthly or overdraft fees. In 2022, SoFi has officially become a bank.

You can earn a 2.50% APY on your account balance for recurring deposits of at least $500 or more into your SoFi account. When you sign up for SoFi Money, you also get a Visa debit card that you can use at any Allpoint Network ATM for free.

The ATM transaction fees incurred are reimbursed to your account. The debit card gives you instant access to your funds instead of transferring your funds from the online account to a standard account and waiting for the funds to clear.

SoFi can be a perfect fit if:

- No reimbursement of third-party ATM fees

- Withdrawal Limits

- No multiple accounts

What is required to open a SoFi account?

SoFi Money Review

Don’t Miss: Chief Investment Officer Job Description Family Office

Other Features You Should Know

SoFi offers goal planning to help you save for retirement, a down payment on a home, college or something else. The robo also offers bonuses to all members and there is no monthly minimum to be a member. Members can receive complimentary career coaching as well as members-only events such as dinners and talks. Theyre also eligible for reduced interest rates on SoFi loans. If you already have your student loans or a mortgage with SoFi, or are planning on taking out a loan, extending your relationship with the company could be worth something extra to you.

Who Is Sofi Active Investing For

If youre brand new to investing and want to keep things simple, SoFi Active Investing could be for you. This is even more true if youre currently using other SoFi products, like its high-yield checking and savings account or multiple loan offerings.

This isnt the right broker for experienced traders who want more tools and research. But if you want an all-in-one financial app thats geared for young investors, SoFi is worth considering.

Read Also: List Of Pension Funds That Invest In Real Estate

Sofi Automated Investing Review: Is It Worth It

Perhaps best known as a competitive student loan refinancing company that uses non-traditional approval criteria, SoFi has now entered the robo-advisor space with its automated investing platform. With few barriers to entry in terms of account minimums and fees, this newcomer deserves a closer look, particularly if you want a hands-off investment approach with plenty of built-in perks and support.

Heres everything you need to know about SoFi Automated Investing so you can find out if its really worth the hype.

Our Top Crypto Play Isnt A Token

Weve found one company thats positioned itself perfectly as a long-term picks-and-shovels solution for the broader crypto market Bitcoin, Dogecoin, and all the others. In fact, you’ve probably used this company’s technology in the past few days, even if you’ve never had an account or even heard of the company before. That’s how prevalent it’s become.

Sign up today for Stock Advisor and get access to our exclusive report where you can get the full scoop on this company and its upside as a long-term investment. Learn more and get started today with a special new member discount.

Read Also: Commercial Investment Property Loan Calculator

How To Take The Next Steps With Sofi Checking And Savings

If youre interested in opening a SoFi Checking and Savings account, reading SoFi reviews is a good place to start. By now, you should understand what SoFi Checking and Savings is, how it works, and what benefits it offers. Armed with this knowledge, you can decide whether its the right type of account for your needs.

Sofi Automated Investing Review 202: Pros Cons And How It Compares

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Don’t Miss: Short Term Mutual Fund Investment

How Does Sofi Automated Investing Compare

Although SoFi has some distinctive benefits, but it might not be the best option for everyone. If you want access to tax-loss harvesting, 529 plans, or socially responsible portfolios, you’ll need to look elsewhere. Here’s a quick look at how SoFi Automated Investing compares:

| Header |

|---|

| READ THE REVIEW |

Getting Traction And Keeping It

Adding all these new features and divisions is challenging. Youre ramping up staff, onboarding them and integrating all these new features into your constantly transitioning organization.

Im sure there were long discussions on whether SoFi should have stuck to its niche, courted a buyout from a deep-pocketed company that want exposure to the student loan sector and walk away with billions.

But its a moot point now. SoFi is deep into creating a challenger bank.

You May Like: How To Invest In Realty