Average Commercial Real Estate Loan Rates For Investment Properties

Interest rates on investment property loans can be as low as 3.77%. An investment property loan would allow you to purchase a property to renovate and resell for a profit. However, the LTV ratios on these loans will be lower than owner-occupied commercial real estate loans, meaning that youll be required to put more money down. On average, the LTV ratio for these types of loans is between 66% and 73%. So, if you purchase a $1 million building, the lender may only give you a loan for $730K, meaning that youll have to put $270K down.

| Building Type | |

|---|---|

| 7.85 years | 23 years |

Regional banks, credit unions, and commercial mortgage companies are the best options for obtaining an investment property loan. A FICO Score of at least 620 would increase your chances of being approved. To qualify, youll also need a proven track record of managing investment properties, a strong investment pitch and sufficient cash for a down payment. A substantial down payment could help you get the most favorable rates and terms. Be prepared to shop around to get the best deal and to negotiate the terms of the loan contract. We recommend borrowers consider local banks and mortgage lenders over national ones, as these institutions have a greater interest in investing in local communities.

Investment Property Mortgage Rates And Closing Costs

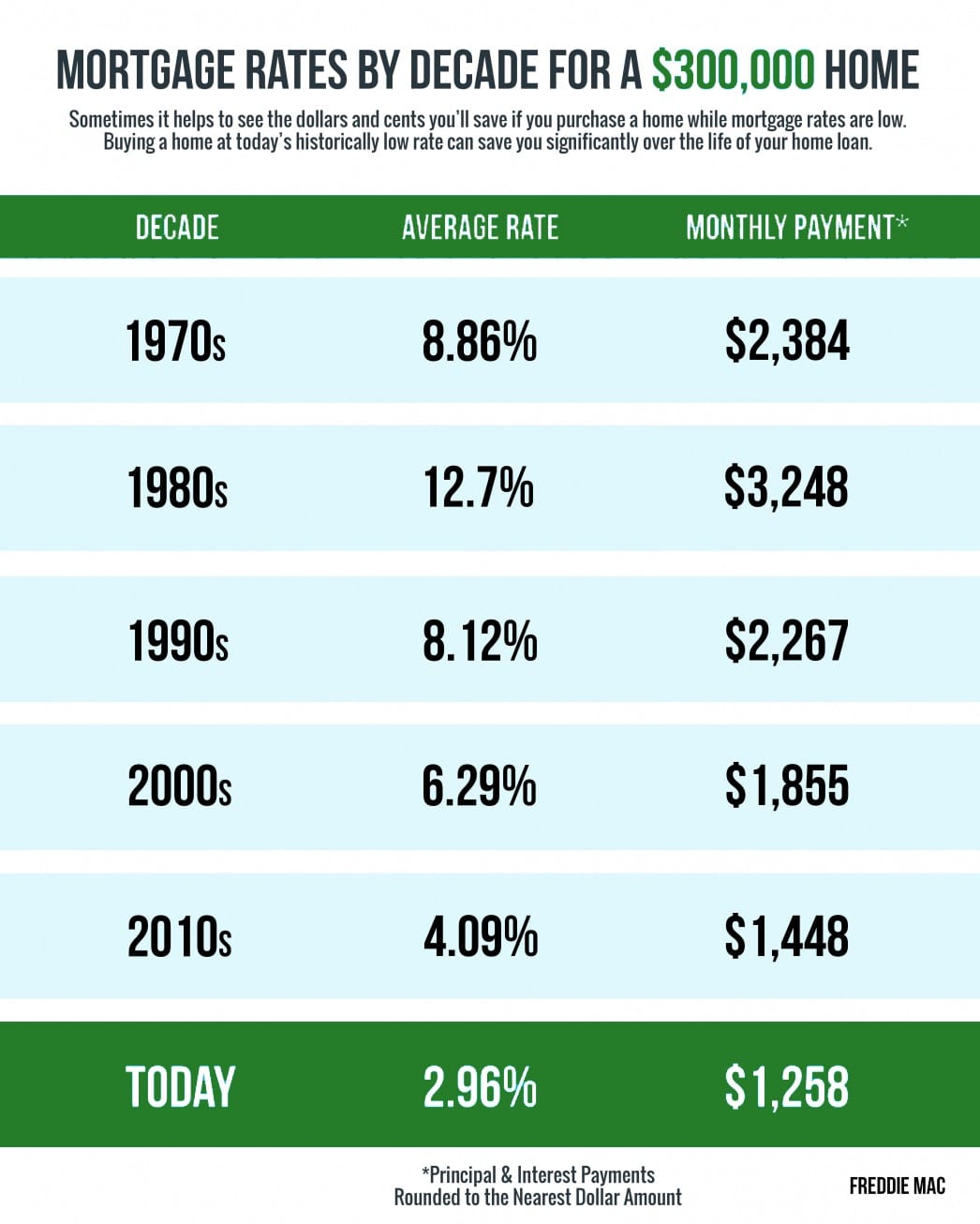

Lenders must mark up investment property mortgage rates to cover the extra risk that the loans might default. In general, rates for an investment property will be 0.5 to 0.875 percentage points higher than for a primary residence.

Your credit score and down payment also substantially impact the rate youre offered. In fact, lower credit score borrowers may end up paying mortgage points to obtain an investment property loan.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

You May Like: How To Invest In Share Market Online

A Note About Investment Property Mortgage Rates

Lenders consider rental properties to be a riskier investment than primary residences, and for good reason: If things go south and theyre unable to make payments, a borrower is more likely to default on a loan for an investment property than on their primary residence. As a result, investment property mortgage rates are generally higher than those for residential mortgages. That said, by working with a mortgage broker versus, say, a bank you can ensure that you get the lowest rate possible on your rental property loan.

Why Are Interest Rates Higher On Investment Properties

Mortgage rates are higher for investment properties because of the increased risk on the lender’s behalf. Borrowers are more viable to default on a property other than their main dwelling, so lenders are more stringent. More often than not, riskier investments result in loftier interest rates and harsher loan terms.

Not only are there increased interest rates, but lenders also ask for more substantial down payments. For a one-unit property, a conventional mortgage requires at least 15% down, and a two- to four-unit property requires a minimum of 25% down. Loan terms are also often shorter than the standard 30-year residential mortgage.

Rather than a real estate purchase, this process is likened to a business transaction.

Recommended Reading: Investing At All Time Highs

How To Shop For Investment And Rental Property Mortgage Rates

The best way to find affordable mortgages is to compare the rates and fees of several lenders. Borrowers will receive a loan estimate they get pre-approved with. Such estimations enable comparisons between every aspect, allowing you to see the total cost, including the closing costs, origination fees, interest rates, and more.

Creative Lending For Investment Property Needs

Finance experts vouch for real estate investing as lucrative, explaining why there is a growing interest in it. Based on a , 15.9% of all U.S. properties are owned by investors, which is a sharp increase from Q1 2021 figures.

Despite the increasing number of people who would like to get their foot in the door, the loan approval process of banks and other traditional lending institutions has not slackened to accommodate more people to invest in real estate.

Self-employed individuals, foreign nationals, and even wage earners who may have the means to invest but fall short of bank requirements are discouraged from investing in real estate. What to do? Seek out progressive lenders who are bold enough to offer creative financial solutions to investors.

If you are not sure how to go about it, contact us today to discuss your options.

Send Us A Message

DAK Mortgage is a licensed mortgage broker that can navigate you through the process of finding the right loan for your needs.

Read Also: Environmental Social And Governance Investing

Know Your Options Here Are 7 Types Of Loans For Investment Properties

Investing in property is an outstanding way to build a strong, profit-making portfolio. While there can be higher levels of risk and a lot more work involved, investment properties can bring a steady income, often outpacing traditional investments like stocks and mutual fund accounts.

But far more people own typical investment accounts than commercial and residential property.

Why is that?

Probably the biggest reasons is that investment property is expensive. Even moderately-priced investment properties cost around $100,000, and commercial or rental properties can cost go into the multimillions. For this reason, some people overlook investment properties, but there is a solution: loans for investment properties.

If you are seeking an investment-property loan, you might think your choices are limited. But in truth there are many options.

Finding the right financing for your needs is important, so lets learn about the top loans for investment properties

Dscr Loans For Foreign Nationals

DSCR mortgages are available to foreign nationals who want to purchase property in the United States. There are a few things that make these loans different from regular investment property loans.

First, the maximum loan-to-value ratio is usually 80%. This means that youll need a down payment of at least 20% if you want to finance a property with a DSCR mortgage.

Second, these loans often have higher interest rates and fees than regular investment property loans.

Finally, youll need to provide proof of income from your rental property in order to qualify for a DSCR loan.

However, buying a US property can be tricky for foreign nationals, and the loan process is also complicated. HomeAbroad connects you with a CIPS real estate agent and appropriate lender to provide the proper guidance and ease your property buying and mortgage process.

Also Check: Mit Commercial Real Estate Analysis And Investment Certificate

Top 7 Investment Property Loan Options

Real estate can be one of the most lucrative investments if you know how to play your cards right.

Several athletes, actors, models, and other celebrities grew their wealth through real estate. But you might argue that these people are in top-paying professions and could very well afford to invest in real estate.

Investing in real estate indeed requires hefty capital. However, whether you are a self-employed individual, an executive, or working in a nine-to-five job, real estate investing is possible for everyone and can be both rewarding and challenging.

There are plenty of creative investment property loan solutions to help you start or expand your real estate investments.

Whether you plan to rent a property or fix and flip a property, capital will be a primary concern. Although banks offer various loan products that could help, the requirements are often too stringent. Not everyone has two years of tax returns, W2s, or pay stubs to prove their income and ability to repay the loan.

The challenge is to find creative loan solutions that would allow an investor whether first-time or seasoned to fulfill their investment goals. If you are one of those investors who would like an easier time to avail of investment loans, consult with experienced mortgage brokers to discover unconventional mortgage loans for all types of borrowers.

Option : Conventional Bank Loans

If you already own a home thatâs your primary residence, youâre probably familiar with conventional financing. A conventional mortgage conforms to guidelines set by Fannie Mae or Freddie Mac, and unlike a Federal Home Administration , U.S. Department of Veterans Affairs , or U.S. Department of Agriculture loan, itâs not backed by the federal government.

With conventional financing, the typical expectation for a down payment is 20% of the homeâs purchase price. With an investment property, however, the lender may require 30% of funds as a down payment.

With a conventional loan, your personal and determine both your ability to get approved and what kind of interest rate applies to the mortgage. Lenders also review borrowersâ income and assets. And obviously, borrowers must be able to show that they can afford their existing mortgage and the monthly loan payments on an investment property.

Future rental income isnât factored into the debt-to-income calculations, and most lenders expect borrowers to have at least six months of cash set aside to cover both mortgage obligations.

Recommended Reading: Austin Real Estate Investment Club

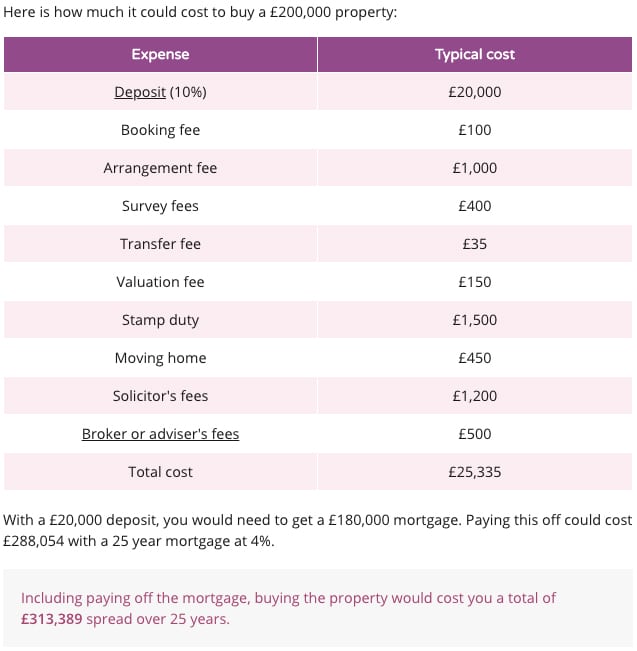

How To Get A Loan To Buy A House

When you apply for a home loan to purchase a house, you’ll need to provide information about the value of the asset, your income and liabilities such as existing debt. Lenders will evaluate these details and other considerations, including credit history, for the amount you intend to borrow and the type of loan you’re looking to obtain.Before settling on a particular type of loan, you should evaluate your options and compare rates with multiple lenders. Mortgage providers such as loans.com.au that operate entirely online can often offer better rates by cutting overhead expenses. Additionally, you should assess the financial impact of different interest rates, terms and payment plans using a loan calculator so you can choose the option that best suits your economic situation and goals. Speak with a trusted loan advisor if you need assistance evaluating your choices.After you submit your application for a mortgage, the lender will contact you to discuss your eligibility, options and any other information you need to provide. For instance, you may be required to submit financial statements from the last few years, pay slips, tax documents, proof of sale of your property and documentation for your current assets and liabilities.

Q7 How Can I Improve My Dscr

The easiest way to improve your DSCR is to invest more money, but you can also buy insurance, fight annual property taxes, and charge more rent. Allowing pets or including extra amenities like a washer and dryer are easy ways to increase your rent. Additionally, In order to improve your DSCR, you need to increase your net operating income or reduce your debt service payments.

You May Like: How To Invest In Palantir

Hard Money Loans For Investment Properties

You can obtain hard money loans from professional individuals or companies that lend money specifically for real estate investing purposes. The best thing about these types of loans for investment properties is that they are faster to secure than conventional mortgage loans. Moreover, hard money lenders donât look at the real estate investorâs credit score â instead, they evaluate the value of the income property youâre planning on buying to decide whether or not to grant you the loan.

Looking to buy an incomeproperty? Click here to analyze and find the best investment properties in your city and neighborhood of choice!

Although this is one of the common types of loans for investment properties in real estate, it does come with a list of formalities, documentation, and guarantees. Another thing to keep in mind before approaching hard money lenders is that these are short-term and they come with higher interest rates .

As a result, these loans for investment properties are not suitable for any type of income property. Hard money loans are a good financing option for property investors who aim to buy cheap investment properties, renovate them, and quickly sell them for a profit and pay off the loan in due time . On the other hand, you wont possibly be able to pay off a hard money loan on a long-term residential investment property in only 3 years.

Will Investment Property Interest Rates Drop In 2020

Average mortgage rates fluctuate daily and are influenced by economic trends including the inflation rate, the job market and the overall rate of economic growth. Unpredictable events, from natural disasters to election outcomes, can impact all of those factors. See NerdWallets mortgage interest rates forecast to get our current take.

Read Also: How To Invest In New Tech Companies

Compare Investment Property Mortgage Ratesforcreditin

Investment properties appeal to those who seek to build wealth by, perhaps, flipping fixer-uppers or buying rentals. Find and compare current investment property mortgage rates from lenders in your area.

Edit my search

About These Rates: The lenders whose rates appear on this table are NerdWallets advertising partners. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a lenders site. The terms advertised here are not offers and do not bind any lender. The rates shown here are retrieved via the Mortech rate engine and are subject to change. These rates do not include taxes, fees, and insurance. Your actual rate and loan terms will be determined by the partners assessment of your creditworthiness and other factors. Any potential savings figures are estimates based on the information provided by you and our advertising partners.

Investment Property Loan Faq

Do you need 20 percent down on an investment property loan?

That depends on your lenders rules and the type of mortgage you want. Often 15 percent down is enough for a conventional loan. And for multifamily dwellings where you occupy one unit, you could put down 3.5 percent , 3 percent , or even 0 percent , although these are not considered true investment properties.

Can you put 3 percent down on an investment property?

You cannot put 3 percent down on a true investment property. But, as discussed above, a mortgage from Fannie Mae or Freddie Mac has a minimum 3 percent down payment for a multifamily dwelling where you live in one unit. So you can buy with one of these loans and still generate rental income from the additional units in your home.

Can you get a 30-year loan on an investment property?

Absolutely! Most borrowers do.

What bank will loan me money for an investment property?

Many banks, mortgage lenders, and other lenders are happy to lend on investment properties as long as you meet lending criteria, which are stricter than for your main home. In addition, investment property loans are easier to find when the economys doing well. You might have a harder time finding investment property loans during economic downturns, like when the Covid pandemic was at its peak.

Can I use my 401 to buy an investment property?Can I live in an investment property? How much can I borrow for an investment property?

Also Check: Age For Investing In Stock

What Are The Most Common Investment Property Loans

Investors try to use a conventional mortgage to buy a property with one to four units if they can meet the banks criteria because this is where theyll find the lowest rates and fees.

To buy a home to renovate and resell or lease, investors often turn to private lenders that specialize in this process. Many banks either wont provide these loans or take too long to close for an investors preference, so private money lenders are successful here.

Private and hard money lenders are also helpful when investors want to buy commercial properties like apartment complexes, medical office buildings, or office towers for example. Their terms are more flexible than conventional mortgages and they will work with borrowers who have lower credit scores where banks and credit unions may not.

Make A Bigger Down Payment

The surest way to get a lower interest rate on your investment property is to make a bigger down payment. Much of the added cost goes away if you can put at least 20% down.

It might be worth borrowing against the equity in your current home to increase your rentals down payment. You can also buy a cheaper house, or find a foreclosure you can buy at below market value.

You could even consider if this is an exceptional investment borrowing against your 401.

Read Also: Kroger 401k Plan Investment Options

Conventional Rental Property Mortgages

Most new real estate investors think first of conventional mortgages, when brainstorming loans for investment properties. You probably worked with one when you bought your own home, so you instinctively call up the same mortgage lender.

But these lenders limit the number of mortgages allowed on your credit report. They typically stop lending to you once you have four mortgages reporting on your credit.

That makes conventional loans for investment properties a good fit for your first rental property or two, but not scalable after that.

Expect a down payment requirement in the 20-30% range for conventional loans for investment properties.

Todays Conventional Rental Property Mortgage Rates:

- 15-Year Fixed-Rate Loan: 4.25% 6.99%

- 30-Year Fixed-Rate Loan: 4.99% 7.99%

Check Mortgage Interest Rates At: Credible

Pros:

- Lower interest: often lower investment property mortgage rates than portfolio lenders

Cons:

- Not scalable: most lenders only allow four mortgage loans on your credit report

- Conventional real estate investor loans are reported to credit bureaus, and too many mortgages on your credit report will wreck your credit

- They usually dont allow mortgage loans to LLCs and other legal entities

- Minimum credit score: most types of loan require a score of at least 620, often 660 or higher

- Lenders verify your personal income tax returns and check your debt-to-income ratio

- Slow to settle: minimum 30 days, typically

- Lots of paperwork and headaches