How To Get A Fair Vc Term Sheet

Although a VC term sheet is non-binding in many respects, it may be filled with unfamiliar terms that require definition because this plan will serve as a guide for your investor agreements going forward. Therefore, you need to protect your interests and the interests of your business. Although it is imperative to have legal representation, you also need a working knowledge of terms to ensure you can negotiate effectively.

Work with your partners and advisors to identify the most important terms to you and your team and focus on those. Not only are you negotiating for favorable terms, but you are also building credibility with the VC. If you take the term sheet as is or inversely argue every point without strong rationales, youre creating a negative image for yourself and your team going forward.

Identify terms that are most important to you and your team and focus on those.

Be willing to stand up for the important issues and show that you know what the most critical issues are. Then, the VC will understand what is important to you and will respect you for trying to strike a good and fair deal.

If you are uncertain about which terms to prioritize, work with a trusted advisor or an experienced startup lawyer to identify those that will help you the most. Typically, however, the most salient points are:

Negotiating With Angel Investors

When dealing with angel investors, it is typical for the company to produce the initial draft of the term sheet. There are variations by region and it is not uncommon to see an angel investor or angel group prepare the initial draft of the term sheet, especially if the company has not already prepared one. If an angel investor or angel group has taken on the role of lead investor, it is common to see the term sheet negotiated. In such cases when a term sheet has been negotiated, it is important that the company communicate that fact with subsequent prospective investors to avoid further negotiations and different terms.

A Standard And Clean Series A Term Sheet

While working with companies in YCs Series A program, weve noticed a common problem: founders dont know what goodlooks like in a term sheet. This makes sense, because it is often, literally, the first time in their careers thattheyve seen one. This puts founders at a significant disadvantage because VCs see term sheets all the time and knowwhat to expect. Because weve invested in so many founders over the years and have seen hundreds of Series A termsheets, we know what good looks like. We work with our founders to understand where terms diverge from good, whatthey can do about that divergence, and when and how it makes sense to negotiate.

Below is what a Series A term sheet looks like with standard and clean terms from a good Silicon Valley VC. Bracketeditems are always or frequently negotiated. Items not in bracketsare sometimes negotiated, but this has more to do with the idiosyncratic features of the company or the situation, andgenerally arent terms that parties intend to heavily bargain over during the negotiation.

Note: this term sheet doesnt belong to any particular VC — we drafted it — but it does substantively reflect what wesee most often. Founders with a lot of negotiating leverage can sometimes do better, and the converse is true too.

Notes

This is not legal advice.

Thanks to Carolynn Levy, Jon Levy, and Nicole Cadman for their comments on this.

You May Like: Best Dividend Stocks For Long Term Investing

Own The Process Internally

See yourself as the middleman. Youâre not only the founder whoâs eager to develop and sell a great new product that will change the world. Youâre also the go-to person for your investors. As such, you are the host of your financing party. Make sure that everyone knows the program, has a drink in their hand, and is entertained.

I have seen founders delaying signing multiple times or calling investors to stay up late just to sign a shareholder resolution. Donât be that person. Instead, run a smooth process. Make sure everything is aligned and the investors have a positive experience dealing with you. Some things to consider:

PROCESS

Corporate approvals: As a founder, it is your responsibility to manage existing shareholders and investors. You can outsource most of this work stream to your lawyer. Your new investor expects this to be lined up well in advance before you get close to signing.

Keep everyone in the loop: This encompasses two things. First, be proactive with updates. Second, make sure that relevant parties talk to each other. You do not need to send daily updates on progress, but make sure to chime in with the major parties involved at least twice per week .

Lock in economics: Lock in the economic dynamics of the round as early as possible. If the cap table is still moving close before signing, consider a second closing so that you are able to close the investors that are already on board.

NEGOTIATION

SIGNING / CLOSING

Execution versionsâ

Signatures

Venture Capital Heads Of Terms

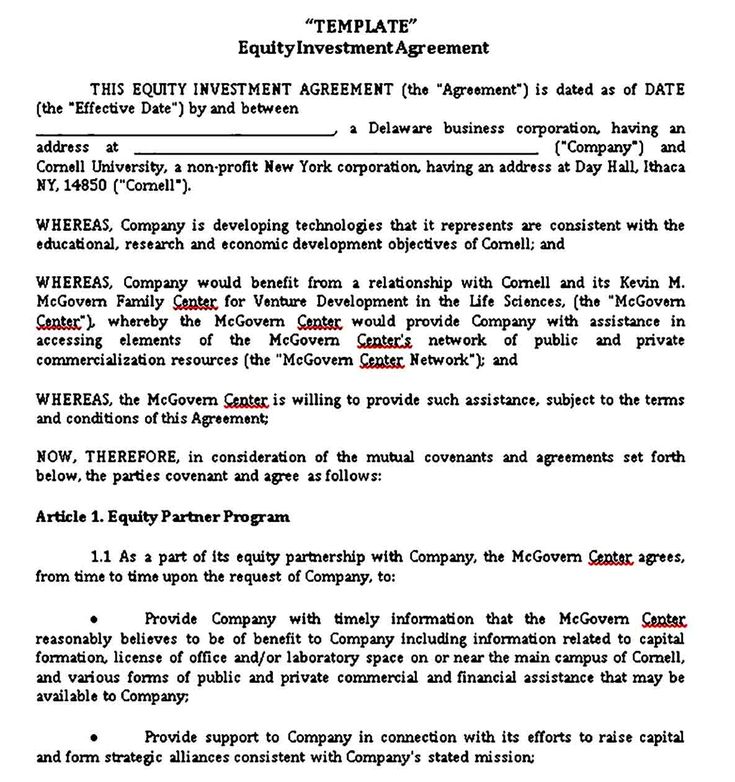

A Term Sheet is a document which outlines the key financial and other terms of a proposed investment . Investors use a Term Sheet as a basis for drafting the investment documents. With the exception of certain clauses commonly those dealing with confidentiality, exclusivity and sometimes costs provisions of a Term Sheet are not usually intended to be legally binding. In addition to being subject to negotiation of the legal documentation, a Term Sheet will usually contain certain conditions which need to be met before the investment is completed and these are known as conditions precedent.

If a company seeks to raise venture capital in the UK the principal documents needed for an investment round are generally a Subscription Agreement, a Shareholders’ or Investors’ Rights Agreement . The provisions of a Term Sheet will be included in these documents.

The Subscription Agreement will usually contain details of the investment round, including number and class of shares subscribed for, payment terms and representations and warranties about the condition of the company. These representations and warranties will be qualified by a disclosure letter and supporting documents that specifically set out any issues that the founders believe the investors should know prior to the completion of the investment.

Also Check: Cash Out Refinance Investment Property Ltv

Gives You The Opportunity To Negotiate

The term sheet is the first step to negotiating the final investment, and the lawyers will use the term sheet to build final docs. Make sure you understand the term sheet well and know which terms you are fine with and which are nonnegotiable. Use your leverage to make the investment as friendly to you and your business as possible.

Vc Term Sheet Definition

The VC term sheet is a non-binding legal document that forms the basis of more enduring and legally binding documents, such as the Stock Purchase Agreement and Voting Agreement.

Although short-lived, the VC term sheets main purpose is to lay out the initial specifics of a VC investment such as the valuation, dollar amount raised, class of shares, investor rights and investor protection clauses.

The VC term sheet will then flow into the VC capitalization table, which is essentially a numerical representation of the preferred investor ownership specified in the term sheet.

Don’t Miss: How To Find Business Investment Opportunities

How To Fill Out Term Sheet For Venture Capital Investment

Use US Legal Forms to obtain a printable Term Sheet for Venture Capital Investment. Our court-admissible forms are drafted and regularly updated by skilled lawyers. Ours is the most complete Forms catalogue on the internet and offers reasonably priced and accurate samples for consumers and attorneys, and SMBs. The documents are grouped into state-based categories and some of them might be previewed before being downloaded.

To download templates, users must have a subscription and to log in to their account. Hit Download next to any form you need and find it in My Forms.

For individuals who do not have a subscription, follow the tips below to quickly find and download Term Sheet for Venture Capital Investment:

US Legal Forms provides a large number of legal and tax templates and packages for business and personal needs, including Term Sheet for Venture Capital Investment. More than three million users already have utilized our service successfully. Select your subscription plan and get high-quality documents within a few clicks.

What Is A Term Sheet

A term sheet is a nonbinding agreement that shows the basic terms and conditions of an investment. The term sheet serves as a template and basis for more detailed, legally binding documents. Once the parties involved reach an agreement on the details laid out in the term sheet, a binding agreement or contract that conforms to the term sheet details is drawn up.

You May Like: How To Invest In Hyundai

Pros / Cons Of Fundraising

From the perspective of an entrepreneur and existing investors, there are several advantages and disadvantages of raising outside capital.

We have listed some of the most important considerations in the table below.

|

Pros |

Cons |

|

|

Entrepreneur |

Increased valuation if the company performs well, more capital to implement new expansion plans, access to experienced value-add partners |

Time-consuming process to raise funds |

|

Existing Investors |

Control mechanisms with options to double down or hedge risk, validation of the firms investment thesis |

Potential for ownership dilution, less voting power |

VC Capital Raising Timeline

While time to investment can vary from a few weeks to a few years, the venture capital timeline for an early-stage company has six discrete steps:

- 1) Start-up Formation: formulation of the idea, core team hiring, intellectual property filings, MVP

- 2) Investor Pitch: roadshow marketing of start-up, feedback on the idea, the start of diligence

- 3) Investor Decision: the continuation of due-diligence, final investor pitch, venture partner decision

- 4) Term Sheet Negotiation: deal terms, valuation, cap table modeling

- 5) Documentation: complete due-diligence, legal documentation, government filings

- 6) Sign, Close and Fund: fund, budget and build

Record & Manage Your Venture Capital Term Sheet In Eqvista

Venture Capital is the lifeline for every successful startup business. How a startup works with VCs and develops a healthy relationship will determine their professional reputation in the industry. One of the most important aspects of this is documentation. It is in the best interest of startups to ensure all formative documents are in place, especially the ones regarding equity management. Eqvista is a pioneer in this sector. Starting with company incorporation and leading on to company valuation, issuing shares, and cap table management, the expert team at Eqvista are adept at all these activities. For further information, reach us today.

Also Check: Best Franklin Mutual Fund To Invest

Type Of Security And Liquidation Preference

Most VC investments are purchases of convertible preferred shares. Preferred stock is stock that has a liquidity preference over common stock, but can be converted to common stock to participate in the upside.

Write down the conversion price — this is the price at which the preferred shares will be converted to common shares — and you will need to know it if there is an anti-dilution provision.

While preferred stock has a liquidity preference over common stock, VCs may also add a liquidation preference dictating that they must be paid a certain multiple of their original investment before other equity investors are paid.

Also be on the lookout for participation. It isnt as popular as it once was but it can dilute founder shares. Participation allows investors to earn their liquidation preference and participate in the remaining pool of profits if a sale happens.

Example Of Venture Capital

Once a startup crosses the angel funding stage, the journey becomes explosive as well as arduous at the same time. The right frequency of fund inflow becomes a crucial part of this phase. Thus venture capital as a whole is being an umbrella term is further categorized into three types based on the stage of business they are supporting:

- Early-stage VC funds This further covers three areas: seed money, funds to develop new products or services, and funds for startups ready to enter the market with an MVP

- Expansion stage VC funds This is otherwise also known as mezzanine financing. These funds are a brief injection for expanding startups heading towards an IPO.

- Acquisition or buy-out stage VC funds These funds are the largest and help businesses to acquire new companies or business units. Another scenario supported by this category of VC funding round is a leveraged buyout.

Read Also: I Want To Invest In Mutual Funds

What To Include On A Term Sheet

You will likely face many term sheets from venture capitalists as a startup. A term sheet is a document that outlines the key terms and conditions of a proposed investment.

While every VC has their own preferences, there are some key elements that should be included on every term sheet. Here are a few of the most important things to remember when negotiating your next term sheet:

Be Realistic About The Timeline

Tinkering with the details of the actual agreements requires not only your lawyerâs attention, but yours as well. The same is true for your VC. Itâs good to drive the process , but do not overstep it.

Here are some guidelines to follow based on the 300-plus deals our team has done in the last two years:

Also Check: Investments With High Compound Interest

Fantasynet Venture Capital Term Sheet Negotiation Financial Analysis

The third step of solving the FantasyNet Venture Capital Term Sheet Negotiation Case Study is FantasyNet Venture Capital Term Sheet Negotiation Financial Analysis. You can go about it in a similar way as is done for a finance and accounting case study. For solving any FantasyNet Venture Capital Term Sheet Negotiation case, Financial Analysis is of extreme importance. You should place extra focus on conducting FantasyNet Venture Capital Term Sheet Negotiation financial analysis as it is an integral part of the FantasyNet Venture Capital Term Sheet Negotiation Case Study Solution. It will help you evaluate the position of FantasyNet Venture Capital Term Sheet Negotiation regarding stability, profitability and liquidity accurately. On the basis of this, you will be able to recommend an appropriate plan of action. To conduct a FantasyNet Venture Capital Term Sheet Negotiation financial analysis in excel,

- Past year financial statements need to be extracted.

- Liquidity and profitability ratios to be calculated from the current financial statements.

- Ratios are compared with the past year FantasyNet Venture Capital Term Sheet Negotiation calculations

- Companys financial position is evaluated.

Another way how you can do the FantasyNet Venture Capital Term Sheet Negotiation financial analysis is through financial modelling. Financial Analysis through financial modelling is done by:

Financial Analysis is critical in many aspects:

Key Elements Of A Vc Term Sheet

A venture capital term sheet is essentially the same from one VC firm to another. So, it may be surprising to see that often the terms can fit on a single page, making the document relatively user friendly, though the terms can be confusing.

Before you sign a term sheet, however, you need to do due diligence. Although it is exciting to have someone interested in your company, you should confirm that your potential investor is trustworthy. You should also try to limit the number of conditions outlined in the term sheet and define terms as precisely as possible to avoid misunderstandings and confusion.

Certain terminology in a term sheet is common. Here are ten terms youll likely encounter and should be familiar with.

1. Money raised2. Pre-money valuation3. Non-participating liquidation preference4. 1:1 conversion to common5. Anti-dilution provisions6. The pay-to-play provision7. Boardroom makeup 8. Dividends9. Voting rights10.Drag along

Also Check: How To Invest In Sip Online

Be Mindful Honest And A Little Paranoid

Most term sheets issued by VCs are non-binding and make the investment subject to due diligence or even certain milestones. However, for most serious VCs, the following holds true: If a term sheet is issued, it is quite likely that the VC wants to follow-through with the investmentââunless a last-minute red flag pops up that cannot be solved in an economically justifiable way.

This is because a VC usually has to go through several steps internally, including getting partners and investment committees on board, before a term sheet is even issued. Of course, in the current volatile market environment, thereâs no fool-proof method to avoid losing a term sheet. Disappearing term sheets unfortunately seem to be the new normal. But you can at least avoid losing a term sheet because of mistakes youâve made.

Pro tip: There is no need to âoptimizeâ your product, figures or budgets. A VC knows that all commercial assumptions will likely change over time.

VC is a people business. They do not invest in annual statements or products. They invest in founders. For this to hold up, a VC needs to trust the founders. If you are dishonest, then youâre opening the door to some serious consequences, including losing term sheets. It is as simple as that.