No Bad Choice Between Stocks And Real Estate In The Long Run

The choice between investing in real estate or stocks is like choosing between eating a chocolate cake or a hot fudge sundae. Both are good provided that you dont eat too much.

When you are younger, investing in stocks is easier since you have less money and are more mobile. If you have enough money to buy a rental property when you are younger, youll have more enthusiasm and energy to deal with the work required to own such an asset.

As you get older you probably want to set some roots. Therefore, owning at least your primary residence is beneficial. It feels great to settle down and enjoy an asset that will probably appreciate over time. An older you may also want to simplify life more due to lower energy and more family responsibilities.

With stocks, its terrific to see portfolios go up. The 100% passive nature of owning stocks and collecting dividends is much appreciated if youre extremely busy.

But after a while, it becomes less satisfying to see more money accumulate in your brokerage account. Money needs to be spent on something, otherwise, whats the point of saving and investing? The older and wealthier you get, the more youll find yourself asking this question.

Less Control Over Your Investments

The first significant risk is that you do not have complete control over where you are putting your money.

Apple could stop being innovative and become the next Blackberry. Congress could consider Facebook a monopoly and break it up. Elon might jump on SpaceX rocket imploding in flames, causing my Tesla stock to crash. Of course, diversification with an index fund approach will mitigate some of the risks, but company-specific factors are still outside my control.

With commercial real estate investing, investors know what they are investing in and where their money is going. However, with the stock market, the investor does not know what companies they are potentially handing their money over to or what those companies plan for that money.

Disadvantages Of Investing In Real Estate

Like all investments, real estate also has its drawbacks. Most importantly, the investment is illiquid. When you invest in a property, you usually cannot sell it right away. In many cases, you may have to hold the property for several years to realize its true profit potential. Also, the closing cost can add up to thousands of dollars, and include taxes, commissions, and fees.

Further, real estate prices tend to fluctuate. While long-term prices generally increase, there are times when prices could go down or stay flat. If you have borrowed too much against the property, you may have trouble making the payment with a property that is worth less money than the amount borrowed on it.

Finally, it’s often hard to get diversified if investing in real estate. However, diversification is possible in real estate, provided that you do not concentrate on the same community and have a variety of different types of property. That being said, there is an additional way that you can be able to diversify in real estate through real estate investment trusts , under which you can purchase a trust that is invested in a large portfolio of real estate and will offer you a dividend as a shareholder. However, in general, stocks offer more diversification because you can own many different industries and areas across the entire economy.

You May Like: Best Passive Real Estate Investments

Advantages Of Real Estate Over The Stock Market

Real estate has the advantage over stocks in that its value tends to fluctuate relatively little . In addition, rental income tends to be more independent of economic crises and the worlds economy than the broad stock market. As long as residential and commercial space and buildable areas are limited, landlords often do not have to fear falling rents, even in times of recessions.

Stocks Also Are Taxed Favorably Compared To Income

Long-term capital gains and dividend income are taxed at lower rates than the top four W2 income rates (32%, 35%, 37%. If you can build your financial nut large enough so that the majority of your income comes from dividends, you could lower your marginal tax rate by as much as 20%, depending on the current legislation.

To get to the 20% maximum marginal tax differential, you would need to replace your W2 income of between ~$200,001 $425,800 with dividend income or long-term capital gains.

Recommended Reading: How To Invest In Toilet Paper

Home Values Tend To Rise

Of course, real estate investing is not free of risk. Any type of investment comes with some level of risk, and due diligence is a large part of mitigating it. According to CNBC, U.S. home prices increased 48.55 percent over the last decade. Despite temporary ebbs and flows in the market, home values have risen over time.

Real Estate Or Stocks For Fire Invest In Both

Yes, in the sample numbers above, its far faster to reach FIRE with real estate than with stocks. But reaching FIRE isnt just about dollars and cents.

Financial independence and retiring early also rely on security and risk management. And you know by now, diversification is crucial for risk management.

I personally recommend investing in rental properties for income, and stocks for growth and diversity. Why choose only real estate or stocks? Invest in both, and get the best of both worlds.

If you encounter a true financial emergency, youll be able to liquidate stocks for immediate cash. If your stocks have a terrible year, you can lean more heavily on your rental properties, and not sell any stocks.

Less important than whether you invest in real estate vs. stocks is your savings rate. If you can live on half your income, or even less, you can reach financial independence quickly.

The trick to reaching FIRE is trimming your expenses, and pumping every penny you can into investments. Real estate investments, stock investments, private notes, bonds just start building an investment portfolio. Check out our free FIRE calculator to play around with different numbers.

Youll learn as you go, but theres no getting back lost time!

Whats your plan for reaching financial independence and early retirement?

Don’t Miss: Merrill Edge Automatic Investment Plan

Is Rental Property A Better Investment Than Stocks

This is a common question among would-be-investors who are trying to figure out where to place their savings. The answer depends on your wants and needs, your financial situation, and the amount of time you are willing to invest. While a rental property is often considered passive income, it requires a substantial amount of time and financial investment.

Successful property managers devote a considerable chunk of time to managing their real estate, staying up-to-date with the recent real estate trends, and following the real estate market.

Investing in the stock market, on the other hand, demands a lot less work than real estate. But dont assume that you can simply buy a bunch of stocks and forget about them while your investments continue to grow passively.

The stock market is seen as riskier, as it can turn volatile in a matter of hours because of military conflict in another country or a tricky political situation that could undermine the worlds economy. Even speculation, which triggered the Great Depression in the U.S., can stir up panic and bring the market to its knees. Indeed, smart stock investors know when to invest and when to cash in their shares before the market turns for the worse.

Here are a few insights that will help you figure out the right form of investment for you.

Real Estate: The Choice For Greater Stability

Real estate prices experience bubbles, too. They are just not usually as explosive as stock market bubbles, the difference being the liquidity challenge present in real estate dispositions. An exception is the Millennium Boom, which was due mostly to Wall Street infiltrating the real estate business by becoming its near-exclusive mortgage lender.

Compared to stock investors, who may lose a fortune in a single day, real estate income property investors have a much longer time period for reacting to changes in property sales volume and pricing to and minimizing their losses through liquidation. Further, while enduring a real estate bubble is financially problematic for short-term investors speculators bubbles have much less influence on long-term investors of real estate. Their losses are primarily limited to tolerable reductions in rental income when not excessively leveraged.

Historically, income property prices are drawn toward the mean price trendline, a reflection of the gradual upward movement of consumer inflation and wages over the years. Unlike stocks, real estate is fundamentally tied to the cost of labor, materials and ground. That said, cyclical real estate prices change in tandem with movement in personal income and population trends local demographics.

Recommended Reading: How Can I Get Free Bitcoins Without Investment

Why Is Real Estate Better

Real estate is considered a safer bet by many, because of its perceived stability and low risk. While many stocks could yield better results in the short term, real estate could bring a significant return on investment over time.

Investing in real estate can diversify your portfolio, if you already have stocks. In addition to generating monthly income from your rentals, you could also benefit from long-term appreciation and take advantage of the number of benefits such as tax write-offs and various deductions.

Choosing Real Estate Over Investing In Stocks

When done the right way, real estate investing can provide great returns through rental income, tax advantages and the capital appreciation gained from buying below the market value.

However, investing in real estate is not for everyone. It takes time to learn to competently and confidently invest. It takes perseverance and effort to find awesome deals. And it takes financial discipline to save up enough money to get started. Lets face it: Investing in the stock market is much easier!

Still, I have found that real estate is a much better way to invest my money than the stock market. I am making a much higher return on my real estate holdings than on my traditional stock portfolio. And real estate offers some unique qualities that make it attractive.

Here are key reasons real estate investing beats the stock market:

Recommended Reading: Apps For Investing In Cryptocurrency

Were Heading Into A Much Different World Investors In Stocks Bonds And Real Estate Arent Going To Like It

In my opinion, financial markets are too optimistic about inflation and interest rates in the long run and the effect they will have on economic growth. And yet pundits believe the world has not changed and we can reach conclusions about the future based on historical relationships drawn from the past 30 years.

I beg to differ. I believe we are in or heading into a world that is different from what we have experienced in the past.

Inflation and interest rates can come down significantly in the short term, especially if central banks force a deep recession in world economies. But this will be a business cycle effect. Business cycle effects, by definition, are short term in nature.

What I worry about is the long run. There are secular adverse changes in globalization, as well as in inflation and real interest rates that do not augur well for the stock, bond and real estate markets.

First, the secular trend toward globalization has ended. Following the pandemic disruptions companies now place higher importance on having goods for manufacturing and distribution close by. The invasion of Ukraine by Russia will accelerate the process of deglobalization.

The markets have yet to discount a 70s-like era of stagflation low growth and high inflation. Older investors have seen that movie before and it doesnt end well.

Real Estate Vs Stocks: Which Is The Better Investment

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

To grow your wealth, which is the better strategy: Investing in real estate or building a portfolio of stocks?

Many Americans do a bit of both: 65% of U.S. households are owner-occupied, according to the U.S. Census Bureau, and the Bureau of Labor Statistics says 55% of American workers participate in an employer retirement plan. If youre among them, you likely have some exposure to the stock market.

But if youre looking to double-down on either type of investment or youre new to investing and trying to pick between the two its wise to know the advantages and disadvantages of each strategy.

Its also important to know that you dont have to choose. You can purchase shares in real estate investments without the headaches of actually buying, managing and selling properties.

You May Like: Mutual Fund Investing In Startups

Additional Factors To Consider

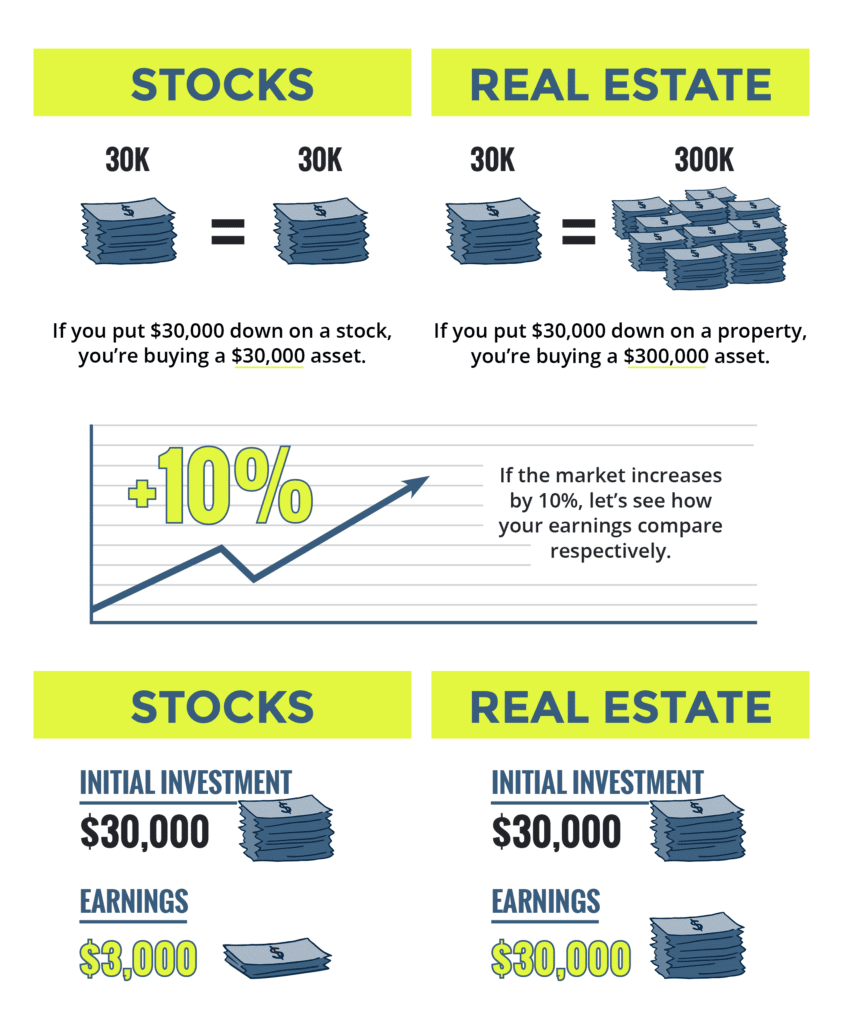

Buying a property requires more initial capital than investing in stocks, mutual funds, or even REITs. However, when purchasing property, investors have more leverage over their money, enabling them to buy a more valuable investment vehicle.

Putting $25,000 into securities buys $25,000 in valueassuming you’re not using . Conversely, the same investment in real estate could buy $125,000 or so in property with a mortgage and tax-deductible interest.

Cash garnered from rent is expected to cover the mortgage, insurance, property taxes, and repairs. But a well-managed property also generates income for the owners. Additional real estate investment benefits include depreciation and other tax write-offs.

Mortgage lending discrimination is illegal. If you think you’ve been discriminated against based on race, religion, sex, marital status, use of public assistance, national origin, disability, or age, there are steps you can take. One such step is to file a report to the Consumer Financial Protection Bureau or with the U.S. Department of Housing and Urban Development .

Real estate that generates monthly rental income can increase with inflation even in a rent-controlled area, which offers an additional advantage. Another consideration is taxes after selling the investment. Selling stocks typically results in capital gains taxes. Real estate capital gains can be deferred if another property is purchased after the sale, called a 1031 exchange in the tax code.

What Makes It A Good Investment Choice

Stocks have always been a great investment vehicle which is why countless investors continue to buy and trade stocks for wealth accumulation. These are just some of the reasons why stocks make for a good investment choice:

It allows investors to stay ahead of inflation.

It is historically proven that stock investments have generated very generous annual returns. For instance, as January 2022 ended, the S& P 500s 10-year annualized return was 15.43% which is a lot higher than the annualized inflation rate. This works especially well for long-term investors as they can buy and hold even if the value goes down.

Stocks are easy to buy and quite affordable.

Buying company shares is quite easy in the stock market. All you need is a broker or a financial planner to help you set up an account. Plus, its a lot cheaper compared to other investment vehicles which makes it easy for first-time investors to jump in.

It can generate returns from price appreciation and dividends.

Investors in stocks can earn money in two ways. First, they can invest in companies that have great appreciation value as it works for them in both the short and long term. Second, investors have the choice to invest in companies that pay dividends regularly.

Recommended Reading: Should You Invest In Crypto

Stocks Offer More Variety

Unless you are super rich, you cant own properties in Honolulu, San Francisco, Rio, Amsterdam and all the other great cities of the world at the same time. The best you can do is invest in diversified real estate funds and REITs, in which case, youre investing like a stock investor.

With stocks, you can invest in different companies, sectors, and countries with ease. Your stock investment options are so much more vast. It can be overwhelming.

The Pros Of Traditional Real Estate Investing

Passive Income

Some real estate investments, such as rental properties and retail investment groups, can provide returns in the form of both the increased property value, as well as passive income. Passive income allows investors to generate additional stable cash flow. For those looking to achieve financial independence, passive income is essential.

Hedge against Inflation

Another benefit of real estate investments is that they act as a hedge against inflation. Property values and the cost of rent generally rise with inflation, which helps to protect investors and offset some of the negative impacts of inflation on other investments in your portfolio.

Safer to Invest with Debt

Traditional mortgages or bank loans allow investors to use debt to purchase more costly real estate investments. This is much less risky than investing in stock with debt .

Read Also: How To Invest In Stocks Without Fees

Passive Investing Means Following Someone Elses Plan

When you invest in the stock market via a fund, this is considered passive investing. You do not have a say in the management of the fund. Although many fund managers are very good at what they do, you are at their mercy. At times, there will be no warning when your invested capital loses value dramatically. This is somewhat the same with investing in a multifamily property syndication, though you are privy to the business plan and there is less volatility. Because of this, there are fewer surprises. No quick fluctuations in value.