Max Life Guaranteed Income Plan

Max Life Guaranteed Income Plan is another money-back plan that allows the insured to receive guaranteed income for over 10 years. If the insured passes away during the term of the policy, the nominee of the insured receives a lump sum death benefit.

Some features include:

- Can change the mode of benefit earned after the plan matures.

- Allow transfer of income as a lump sum amount rather than receiving as monthly pay.

- Minimum sum assured is 1 lakh rupees.

- Minimum policy age is 25 years for entry.

- No loan facility available with this plan.

- Surrender benefit is available.

Is 10% A Realistic Investment Return Rate

A couple of weeks ago, I did a presentation at EY, a company I used to work for in New York and which provides advisory, assurance, tax, and transaction services around the world.

As I finished talking, several women came to me with more specific questions about investing.

One of them, Marie, did not have a question. Instead, she came to me saying:

You showcase examples that use an investment return rate of 8% to 10%. My boyfriend works in finance, and he told me that this was totally unrealistic.

I responded that I chose these rates based on historical returns of the S& P 500.

Still, Marie was not convinced: Is it realistic to expect that going forward?

I knew that the historical performance of the S& P 500, which represents the 500 largest listed companies in the US, has had a consistent average annual return of 9-10% for the last 100 years.

But is it realistic to use it to project the performance of our investment portfolio?

I decided to dive in and figure it out.

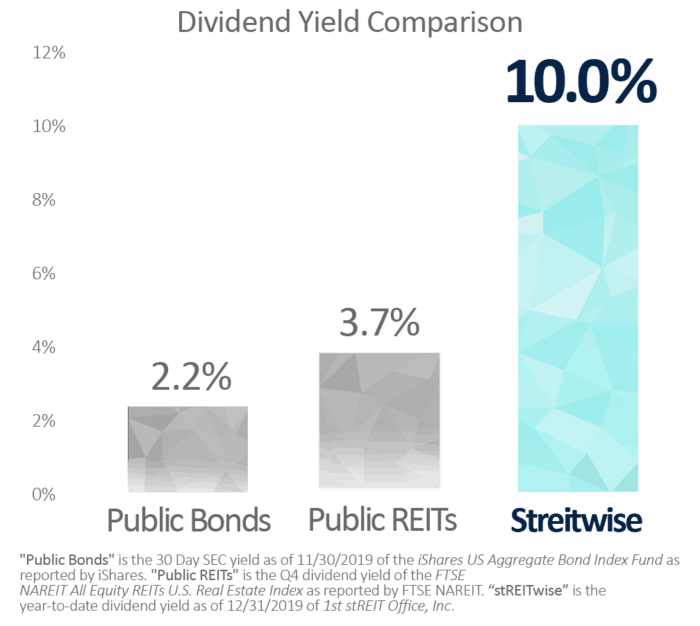

Investment #1: Real Estate Investment Trusts

Key Takeaways: REITs are companies that own and manage real estate.

Best For: Investors who want to own real estate but without the hassle of managing the property investors looking for passive income or cash flow retirees.

The REIT market is made up of a number of sub sectors that investors can choose from. Popular sectors include housing REITs, commercial REITs, retail REITs, hotel REITs, etc.

Investing in an REIT that is publicly traded on major exchanges instead of a private fund is the safer investment option. Look for REITs with a long history of a continually rising dividend as opposed to funds with the best current returns.

Cash from REITs can be taken out any time the stock market is open.

Recommended Reading: Annual Qualified Default Investment Alternative

What Is A One

A one-time investment plan is a type of investment where a lump sum amount is invested in one go in a particular scheme for a specific duration. As an investor, if one has a substantial amount of money with higher risk tolerance, they can invest in a one-time investment plan.

COMP/DOC/Jun/2021/256/6112

Checklist For Investing 10000

Also Check: Best Investment Strategy For Grandchildren

Icici Pru Guaranteed Wealth Protector Another Lucrative One

ICICI Pru Guaranteed Wealth Protector ensures you enjoy potentially better returns while keeping your invested money safe. Following are the key benefits of this plan –

- Minimum Life Cover equal to 105% of the total premiums received up to the date of death

- Protect your savings from market downturns through an Assured Benefit**

- Pay premium just once for a limited period of 5 or 7 years

- Get rewarded with Loyalty Additions## and Wealth Boosters##

Thus, if you wish to grow your wealth, go for a one-time investment plan.

| 2.50% of Single Premium | 2.75% of Single Premium |

For the 10-year policy term,the wealth booster will be 2.75% of a single premium including top-up premiums less partial withdrawals if any.

** The Assured Benefit amount shown assumes all due premiums as per the premium payment term shown above are paid. On maturity, you will receive a higher of Assured Benefit or fund value. Assured Benefit will be 101% of total premium paid which is applicable only on maturity of the policy and does not apply on death or surrender. You can utilise this benefit amount only as per the available options. Alternatively, you can choose to postpone your vesting date.

~ Past performance is not indicative of future performance.

ICICI Pru Guaranteed Wealth Protector UIN 105L143V02

ICICI Pru1 Wealth UIN 105L175V03

W/II/2378/2020-21

How & Where To Invest Money To Get Good Returns In 2022

There are many investments where you can get good returns, including dividend-paying stocks, real estate and businesses. While these investments can produce high returns, some are much safer than others.

These individual factors should make it easier to determine where to safely invest your money while still earning returns that will help you reach your financial goals and build lasting wealth.

Recommended Reading: Buying Gold Bullion As An Investment

Safe Investments With The Highest Returns

A high return is what every investor is after, but its not the only factor that matters. When reviewing investments, professionals look not only at absolute return potential but also something called risk-adjusted return. The bottom line is that not all returns are created equal, and smart investors look to invest where theyre getting the best value for the risk that they are taking on even if that means accepting lower returns.

Through that lens, you might prefer an investment that pays just 2% a year over one thats returning 20%. Why? Because if that 2% return is guaranteed, such as via a U.S. Treasury, but the path to the 20% return involves the risk of losing 40%, that steady 2% could be a better value over time, based on its low risks especially for a risk-averse investor.

For the individual investor, this balance is all the more important. If you understand how comparing investments requires looking at both returns and the risk with equal weight, you can understand how even a tiny return can be a great deal if the investment is really risk-free.

Invest In Stocks For The Long

Long-term investments tend to carry less volatility than short-term ones.

Even stocks that may have volatile movements on a daily basis can produce stable returns in the long run.

Additionally, you earn a tax advantage for holding stocks for at least one full year.

Currently, you pay no taxes on long-term capital gains if your income falls below $41,675 as a single tax payer.

If you earn more than that, but less than $459,750, you pay 15% of your gains. If you earn a higher income, those gains get taxed at 20%.

Meanwhile, short-term capital gains count as ordinary income, which takes a much larger cut of your profits.

Long-term investing can sometimes also save people money from transaction costs.

Another advantage comes when you purchase stocks that pay a dividend. In this scenario, you have the option to reinvest your earnings.

This acts as an excellent way to compound your profits over time.

Finding growth stocks that outperform the market year after year can lead to outsized gains over the long-term.

By adding a small part of your portfolio to quality growth stocks, you can additional returns that compound more over time.

With enough additional return held over many years, you can add a significant amount of value to your net worth.

You have plenty of investing apps like Robinhood, Webull, M1 Finance and others to buy these stocks.

This stock picking service and investment newsletter has elevated my overall portfolio return.

You May Like: Investment Property Mortgage Rates 30 Year Fixed

Flipping Products For Profit

Most rich people understand that working a day job does not make you rich. Selling products and investing well can make you rich. Luckily, you dont even have to go far to find products you can sell.

Yep, you dont even have to make a product. You just need to find the right product to put in the right marketplace.

Imagine going to your favorite stores and raiding the clearance rack. You can sometimes find amazing deals 40, 50, and even 90% off!

You can then sell these items on Amazon, eBay, Mercari, Poshmark, and many more sites! Thousands of people are doing this every day. The process is called Retail Arbitrage.

But does Retail Arbitrage work?

Absolutely! However, you will need to work to find items, list them, and ship them out promptly.

For example, I once found dog treats selling at Grocery Outlet for $1.99 per pack. I then sold these treats on Amazon for around $3. Amazon took their cut, which put my overall cost close to $2.50.

I would earn around $0.50 or 25% return on investment for every pack sold. I know what youre thinking who cares about 50 cents?

I did! There was no way I could keep the Amazon store stocked with these treats. It didnt matter that the profit margin was only $0.50 when the product flew off the shelves.

How Much Do Day Traders Make Per Year

The Bureau of Labor Statistics categorizes all traders under the umbrella term of “securities, commodity contracts, and financial investment sales agents.” The average salary for this category was just under $90,000 in 2020. However, many people who try day trading lose money and never become profitable.

Also Check: Different Coins To Invest In

The More Capital The Harder It Is To Maintain High

Making 10% to 20% is quite possible with a decent win rate, a favorable reward-to-risk ratio, two to four trades each day, and risking 1% of account capital on each trade. The more capital you have, though, the harder it becomes to maintain those returns.

If you are trying to day trade millions of dollars, it is much harder to make 10% a month than it is for someone trading a $75,000 account. There is only so much buying and selling volume at any given moment the more capital you have, the less likely it is that you will be able to utilize it all when you want to. This is typically why only individuals or very small hedge funds can generate huge yearly returns, yet these returns are unheard of when discussing traders or hedge funds with very large accounts.

Follow Me As I Invest My Own 50000

Hopefully you should now be confident about starting investing. You now know the sort of assets you should invest in and how to buy funds with which to do that. However, if you are deciding to run your own investments you are still left with a couple of dilemmas. How do you know which funds are best for growth? How do you know when to change your investments to ensure you make the best return on £100,000. The table below shows how my own investment of £50,000, which I run live for 80-20 Investor members, has outperformed the market, and most passive strategies and professionally managed funds. I would invest £100,000 in exactly the same way. In fact I would run £1million in exactly the same way. I would just invest more in each of the 10 funds that I hold.

Despite being a widely quoted investment expert in the national press I became disillusioned at how no other commentators or IFAs ran an open portfolio to show how good they are at investing. It is for this reason that I began investing £50,000 of my own money live for 80-20 Investor members. 80-20 Investor is my DIY investing service which teaches people how to run their own money and make sure they are in the best performing funds using a unique algorithm. I continually update subscribers with the funds I buy and why.

| Name | |

| Passive Vanguard benchmark | 29.69% |

To put the above return into context, if I had invested £100,000 back in March 2015 it would now be worth £148,050.

You May Like: Best Way To Get Income From Investments

Expectations For Return From The Stock Market

Most investors would view an average annual rate of return of 10% or more as a good ROI for long-term investments in the stock market. However, keep in mind that this is an average. Some years will deliver lower returns — perhaps even negative returns. Other years will generate significantly higher returns.

For example, the following chart shows the S& P 500 index returns for 2010-2020. This chart illustrates the kind of year-to-year volatility investors can experience with the stock market.

In two of the past 11 years, the S& P 500 had a negative return. In 2011, the index delivered a 0% return. In 2016, the S& P generated a positive return of 9.5%, but that was below the “good” ROI of 10% that investors prefer. Even with these subpar years, though, the S& P 500 delivered a CAGR of 11.4% during the entire period — a very good ROI.

This combination of year-to-year volatility and long-term attractive gains underscores why a buy-and-hold strategy offers investors a better chance of achieving a good ROI.

You might lose money in any given year investing in stocks. Selling during those times, though, prevents you from benefiting from big gains later on. If you buy and hold stocks over the long term, your prospects for generating attractive returns will greatly improve.

Edelweiss Tokio Life G Cap Plan

The Edelweiss Tokio Life G CAP Plan supports the insured in gaining wealth to allow them to reach their life goals. The plan comes with guaranteed benefit on maturity along with death benefit. It also offers an assured accrual. This is a non-linked plan that is available with death and maturity profit.

Some features include:

- Allow the insured to choose the policy period and terms of premium pay.

- Minimum entry age is 91 days, while 55 years is the maximum age of entry.

- The policy can be bought for different durations of 10 years, 15 years, 20 years , 25 years and 30-year as per requirement.

Recommended Reading: Mutual Funds That Invest In Startups

Is 10000 A Good Investment Amount

Yes, £10,000 is a good amount to invest. As we mentioned above, the longer you can leave your money invested, the better.

This will give it enough chance to grow and ride out any fluctuations in the stock market.

If you want to find out more about the basic principles of investing then we have produced a free online investing for beginners course. Check out module onehere.

Buy Assets When Theyre On Sale

As an investor, you should always seek quality assets for as cheap as possible.

Most people want to jump into cryptocurrency or whatever the media and their friends are talking about. They might see Bitcoin going to the moon, but the best time to buy Bitcoin was before liftoff occurred.

Most individual investors buy at the top because thats when people talk about it.

Instead, look for the assets nobody is talking about. Good companies will typically rebound.

As previously mentioned, I own some of the following:

- VTI: Vanguard Total Stock Market Index Fund ETF

- VNQ: Vanguard Real Estate Index Fund ETF

- VYM: Vanguard High Dividend Yield ETF

- VOT: Vanguard Mid-Cap Growth Index Fund ETF

- VBK: Vanguard Small-Cap Growth Index Fund ETF

- QYLG: Global X Nasdaq 100 Covered Call & Growth ETF

- JEPI: JPMorgan Equity Premium Income ETF

Growth ETFs include VTI, VBK, and VOT. If growth stocks are down, Im probably buying one of these three ETFs.

Alternatively, Im probably buying VNQ, VYM, QYLG, or JEPI as my favorite dividend ETFs if dividends are down.

You May Like: How To Invest In Gold And Silver Stocks

How To Get A 10% Monthly Return Day Trading

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

Raphye Alexius / Getty Images

For most people who start day trading, the ultimate goal is to quit their job and be able to make a living off of the markets. There are two ways to make a living from day trading:

Below is a blueprint for ramping up your returns to 10% or more per month. That way, even if you’re starting with $10,000, you’ll be making at least $1,000 per month, and that income will grow as your capital and/or returns grow.

Whether you day trade stocks, forex, or futures, align your trading process around the tactics discussed below. With hard work and practice, over the course of six months to a year, you just may be able to become one of the few traders who make a living from day trading.