Can I Get An Sba Loan For Rental Property

The SBA 504 loan is the best choice for buying commercial property. Money can be used to buy a building, finance ground-up construction, or rehab an existing building. With the SBA 504 loan, you are likely to have the lowest interest rates and a 25-year repayment term.

Borrowing limits are normally $2 million for commercial property. Key requirements of this loan include the owner must occupy 51% of an existing building or 60% of a new construction building.

What Is A Mortgage

A mortgage is a loan that you can use for the purchase of a home. Mortgages are secured by the house youre borrowing money to buy, so the house serves as collateral. If you dont pay your mortgage, the lender can foreclose and take your home. Most mortgages are paid off over a long period of time, with borrowers generally choosing either a 15-year or a 30-year repayment term.

There are different kinds of mortgages, including conventional loans, which are not insured by any government agency, and loans that are guaranteed by one of several agencies including the Federal Housing Administration , the Veterans Administration , or the U.S. Department of Agriculture . Both government-guaranteed loans and conventional loans are made by private lenders, including banks, online lenders, and credit unions.

There are also conforming loans and non-conforming loans. Conforming loans fall below financing limits set by the Federal Housing Finance Agency and non-conforming loans known as jumbo loans are for higher amounts. Fannie Mae and Freddie Mac, two government-sponsored entities, buy conforming loans on the secondary mortgage market so lenders can package and sell them.

If you are new to the world of mortgages, check out our beginners guide to home loans.

How Do I Compare Investment And Rental Property Mortgage Rates

The only way to find the lender with the most competitive investment or rental property mortgage rate is to compare multiple lenders, and then compare their rates and fees. Within days of being preapproved, youll receive a Loan Estimate from each lender. These let you compare every aspect of the loan side by side, so you can see the total cost including the investment property mortgage rate, origination fee, closing costs and more.

Also Check: Average Commission For Investment Advisor

Recommended Reading: Top Annuities To Invest In

How Do I Get Down Payment Assistance

Once you find a down payment assistance program that you most likely qualify for, you’ll have to gather supporting documentation and fill out an application. Sometimes, you’ll have to sit through an interview or participate in homebuyer education classes, as well.Every organization offering down payment assistance has its own procedures, but generally, they’ll need to see:

- W2s from the past few years to verify your employment and income history

- Bank statements

Where Do Down Payment Assistance Programs Come From

State and local housing finance agencies administer many down payment assistance programs. The grants for them often come from the U.S. Department of Housing and Urban Development, or HUD, as well as employers, community organizations, and state and local governments.If the federal, state or local government runs the program, it usually comes from tax dollars set aside to help buyers. However, because many buyers don’t think they’re eligible, the money often goes unused. Other programs, such as those run by lenders, are loans that rely on the bank’s capital still, others get money through donations to nonprofit organizations. Depending on the program, buyers can often get between a few thousand and several thousand dollars in help.

Read Also: Best Way To Set Up A Real Estate Investment Company

What To Consider Before Buying An Investment Property

Theres one rule above all to consider when youre looking to take on an investment property: Make sure that you can afford the property youre trying to purchase. In the real estate industry, many buyers use whats called the 1% rule to determine how much youll have to charge in monthly rent to make an income. The 1% rule requires basic math: Multiply the total purchase price by 1% to find the monthly rent youll need to charge. For example, if the purchase price is $200,000, youll have to charge $2,000 per month in rent. The rent amount will need to be close to the median rent cost in your area or you may not be able to find high quality tenants.

All loan offers are not created equal, so be sure to shop around since you might find a better rate and terms elsewhere. Your required down payment can also vary quite a bit from lender to lender. Also, be aware of all fees that go into your investment property loan, as you may have origination and/or administrative fees. In addition, consider costs of managing the property for things like standard and unexpected maintenance, insurance, and property taxes.

Find Funding Fast

Negotiate The Down Payment

Along with everything else in a real estate contract, the amount of the down payment and who pays it is almost always negotiable. A buyer may elect that the seller pay the down payment, or give credit at closing for the buyer’s down payment. A buyer could also request to pay the down payment in installments, whether in monthly installments or as a balloon payment at the end of the year.

Recommended Reading: Apps To Invest In Stock Market

Best For Rehab Loans: Lendingone

LendingOne

-

$175 charge for each draw

-

Only available for one- to four-unit properties, no commercial

In 2014, Bill Green and Matthew Neisser founded LendingOne in response to their frustrations felt toward the difficult lending environment from rigid bank criteria and the easier, though more expensive, hard money alternatives.

As a direct private real estate lender, LendingOne has become the best rehab lender in the industry because they help investors get what had been missing in the market, such as pre-approval letters and proof of funds, higher leverage, and lower rates and fees.

LendingOne offers fix-and-flip and rehab-to-rent loan products. Down payments range from 10% to 20%. For rehab to rent, they have a 30-year fixed-rate loan as well as 5/1 and 7/1 ARM loans. Their fix-and-flip loans can finance up to 90% of your repair costs. Two years of interest only payments are an option on the fix-and-flip loans too. LendingOne loans on two- to four-unit properties only, including condos and townhouses.

The loan minimum is $75,000. Interest rates and loan terms are underwritten based on your experience, income, credit, and LTV. Their fees are transparent, too. Fees and closing costs apply, but are not on the loan product page. They generally require a credit score of 680, but there may be some variation depending on product and situation.

LendingOne can fund rehab loans in as little as 10 days, and you can apply online or over the phone.

Should You Hire A Property Management Company

You need to decide whether you want to handle property repairs, tenant management and maintenance yourself or if youll hire a property management company to manage the daily maintenance on your behalf.

Property management companies take both scheduled and emergency repair calls and check up on your property with both drive-bys and scheduled visits to make sure that tenants respect your space. They can also collect rent on your behalf. Some property management companies also offer tenant placement services and eviction processing for an additional fee. In exchange, the property management company takes a percentage of your monthly rent. If you live far away from your property or you dont have the home repair skills to fix your own property, hiring a property management company may be a great choice.

Don’t Miss: How To Invest In Kuwaiti Dinar

Va Loans: 0% Down Payment

VA loans are like FHA loans in that theyre government-backed, and you must intend on living in one of the four units. Also, this loan is only available to veterans or active service members. However, if you qualify for one of these loans, this is an outstanding investment property loan because you dont have a down payment, and interest rates tend to be some of the best.

Freddie Macs Home Possible Loan Program: 3% To 5% Down Payment

Freddie Macs Home Possible Loan Program can help moderate- to low-income borrowers buy a property with a 3% down payment 5% may be required if the borrower has a low credit score.

Under this program, you can use it to purchase a single-family or multi-family property, providing you plan on living in one of the units. That said, if you plan on using the property as an investment property, the lender could use the rental income when calculating the debt-to-income ratio.

Unfortunately, to satisfy Freddie Macs guidelines, youll need to show proof of having a tenant who has lived with you for at least a year and will move into the new property with you.

To learn more about this program, check out the eligibility requirements and the Frequently Asked Questions.

Read Also: Best Green Funds To Invest In

Bank Vs Mortgage Broker

Similar to when you took out the mortgage on your principal residence, you can choose to have either a bank2 or a mortgage broker help you get pre-approved and then approved for investment property financing. With investment property mortgages, it could be even more important to consider working with a mortgage broker because of their experience with other investors and familiarity with the special financing conditions required by individual lenders.

The other benefits of working with a mortgage broker are obvious: they only need to pull your credit report once, they shop around for you and they look for a product and rate that will match your financial situation. The best part is that you don’t have to pay them for their services – instead, the lender you end up getting financing from pays the mortgage broker a fee.

Investment Property Loans And Primary Residence Loans: How Are They Different

Conventional lenders will usually consider investment property loans to be riskier than loans for a primary residence. This is because rental income is usually needed to pay the mortgage since the homeowner wont be residing in it. Conventional lenders will often require borrowers to secure higher down payments and maintain higher credit scores in order to qualify for rental property loans.

You May Like: How Soon Can You Refinance An Investment Property

Ask For Owner Financing

In the days when almost anyone could qualify for a bank loan, a request for owner financing used to make sellers suspicious of potential buyers. But now its more acceptable because credit has tightened and standards for borrowers have increased.

However, you should have a game plan if you decide to go this route.

You have to say, I would like to do owner financing with this amount of money and these terms, Huettner says. You have to sell the seller on owner financing, and on you.

This game plan shows the seller that youre serious about the transaction and that youre ready to make a real deal based on the practical assumptions that youve presented.

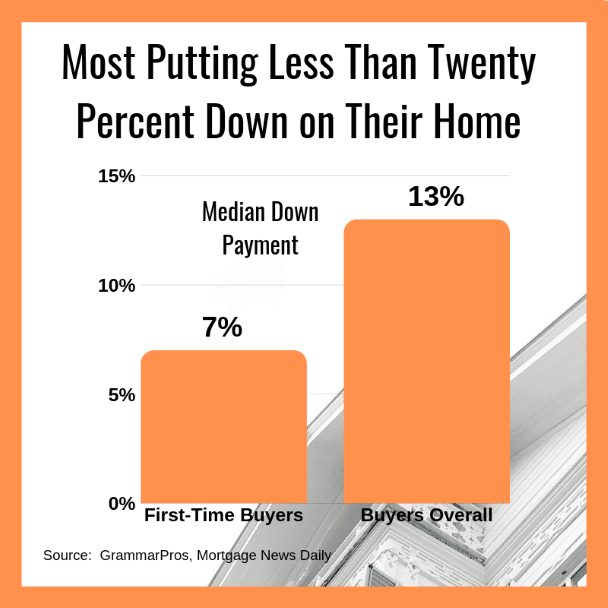

Cost Of A Lower Down Payment

Low or no down payment programs have two primary costs:

- Higher interest rates

- Higher mortgage insurance premiums.

The downside of a small down payment, whether you are using a conforming loan or a non-conforming program, is that you will need to pay higher interest rates and mortgage insurance.

Mortgage insurance is calculated against the loan amount, so you get hit with a double-whammy. Lower down payment means a higher loan amount and a higher mortgage insurance rate.

Mortgage insurance can be removed once sufficient equity is produced. So if the property shows at least 20% equity in a few years, the mortgage insurance can be refinanced away.A related burden of lower down payments is obviously higher loan amounts, which translates into higher monthly payments.

Consider, for example, the purchase of a $100,000 condominium with market interest rates of 6.500%.

- With a 5% down payment, the loan of $95,000 would have monthly payments of $600.46.

- However, a 10% down payment would decrease the loan amount to $90,000 and the payment to only $568.86 per month.

During the first few years of the mortgage loan, the bulk of your monthly payments are for interestwhich is normally tax-deductible. So you actually get a bit of your monthly payments back at the end of the year in the form of tax deductions.

Also Check: How To Set Up A Real Estate Investment Fund

How To Invest In Real Estate With No Money Down

When you have to put 20% cash down on an investment property, theres a lot less of your cash available to you for when you need it. When you get a call from your tenant about a furnace emergency, having this money is a game changer. But its important to note that in most cases a lender wont just give you money with no money down, nor will a seller will agree to forgo this extra cash either. The truth is, the money has to come from somewhere. In order to make a no money down option possible, there are a couple of ways to do it:

Buying Rental Property With No Money Down Loan Options

No lender will lend you money with no money down, and no seller will carry a note without you putting some money down even if its a promise to do money in the future. There is no such thing as no money down in any type of real estate investment because the money is going to come from somewhere. Investors borrowing money for rental property investment can choose from this list of loans.

Recommended Reading: App That Lets You Invest In Real Estate

Investment Property Loans In The Carolinas

Are you itching to quit your day job and make passive rental income instead? Or maybe you want to flex your creative muscles by flipping a fixer-upper? If this sounds like you, an investment property loan could be a viable financing option.

Simply put, this lending option³ helps borrowers buy an income-generating property. The property could be a downtown duplex destined for renters or a vacation rental. No matter your vision, Dash Home Loans will work with you to secure an investment property loan in North Carolina or South Carolina.

- Single-family homes

- Duplexes and quadplexes

Unfortunately, investment property loans command a higher interest rate. Why? Because when the economy nosedives, borrowers are more likely to default on their rental unit or fixer-upper than their primary residence. To compensate for that risk, lenders jack up the interest rates.

Investment Property Loans: Private Investors & Low Credit Scores

You may be doing research now to save yourself some time and not deal with a ton of mortgage brokers and sales people. We get that. And its smart. You dont want to explain your unique lending scenario to every lender under the sun, have them pull your credit, run the numbers, shop it out to more lenders under the sun and all the while the clock is ticking and your business venture isnt moving forward. However, we work with so many private investors and national loan companies that we couldnt possibly provide a real-time, comprehensive list of all our investment property loan information on our site, and we do encourage you to call our loan advocates in order to give us your unique situation that we can quickly make a yes or no determination on without a full application and credit report.

Well simply check your investment property loan type, your cash-out or purchase needs and all the other unique variables that make your loan special against the underwriting guidelines were working with now and tell you if it makes sense to proceed to the loan application process. Once we do, at Active Business Loans we provide you with 24 48 hour initial approvals, so you can rest assured knowing your next business venture is on its way!

Read Also: Fidelity Investments Money Market Government Portfolio Institutional Class

Who Is Eligible For An Investment Property Loan

Are you ready for an investment property? While conventional loans are structured to make the loan experience simple for the borrower, investment loans require strong financial standing and healthy cash reserves. If you meet the qualifications below, thereâs a good chance that purchasing an investment property is the right choice for you and your family.

For an investment loan, a down payment is a must. For a single-family home, though it can be as little as a 15% down payment is required, but on a 2 – 4 unit property, it is as low as 25% down. If youâre already in the property management game, you know that rental income can help you qualify, based upon the current rental market value.

Qualifying for an investment loan generally requires:

Real Estate Investing & Taxes

With multiple streams of income and properties, your taxes can become much more complicated. Here are some of the tax implications you can expect when pursuing real estate investing.

Note: Capital Gains Tax and Short Term Capital Gains Tax are applicable when rental properties are sold. Borrowers should always refer to a financial advisor or accountant for tax advice.

Capital Gains Tax: Youll be forced to pay capital gains on your investment property if youve owned it for at least one year. You can deduct the money paid in real estate commission fees, but the income you gain from selling your property is still taxed depending on the tax bracket you are in for the rest of your income

Short-Term Capital Gains Tax: If you havent owned your property for at least a year, you will still be assessed short-term capital gains taxes. These taxes are at least easier to computeyour profits from your investment property are simply considered part of your yearly income.

Taxes on Rental Property Income: Income made from a rental property need to be disclosed in your tax return. At the same time, you can deduct certain expenses such as repairs and maintenance when you own the property.

Its still a great time to get into the real estate investing realm. The returns can be significant and the experience, rewarding.

Read Also: How To Open An Investment Account