Stock Funds: Best For Long

- Minimum Investment: ETFs, the cost of one share mutual funds, $1,000 and up

- Stability/Risk Level: Low to moderate stability / moderate to high risk

- Liquidity Level: High

- Where to Invest:M1 Finance, Betterment, Zacks Trade, E*TRADE, and TD Ameritrade

How to invest. You can purchase shares in stock funds through the best online stockbrokers, some of which are listed above. You can decide to invest in either mutual funds or ETFs. Mutual funds are usually actively managed portfolios that attempt to outperform the market . ETFs are more typically index funds. Rather than actively trading securities in the fund, they instead match the portfolio to an underlying index, like the S& P 500.

Benefits. As measured by the S& P 500 index, stocks have returned an average of 10% per year for the past 50 years. You can take advantage of that growth by investing in an ETF index fund tied to the S& P 500. ETFs also can be traded with no commissions, and for as little as the cost of one ETF share. And since they rarely trade stocks, the capital gains they generate will usually be long-term, giving you the benefit of lower long-term capital gains tax rates.

Drawbacks. The return of 10% is only an average, and not consistent from year to year. You may have certain years where you lose 20% or 30%. Its completely a long-term play. Also, be aware that mutual funds require a minimum investment of at least $1,000, and often have load fees of between 1% and 3%.

Is E*trade Right For You

E*TRADEs investing tools, educational resources, large selection of no-transaction-fee mutual funds and innovative trading technology will suit all types of investors. Active traders will love the $0 commissions, and beginners will easily get up to speed with the company’s deep educational resources.

For U.S. residents only.

Etrade Vs Interactive Brokers

ETrade and Interactive Brokers are reputable brokerages with a lot to offer. This review compares them on all fronts.

Tim Fries is the cofounder of The Tokenist. He has a B. Sc. in Mechanical Engineering from the University of Michigan, and an MBA from the University …

Meet Shane. Shane first starting working with The Tokenist in September of 2018 and has happily stuck around ever since. Originally from Maine, …

All reviews, research, news and assessments of any kind on The Tokenist are compiled using a strict editorial review process by our editorial team. Neither our writers nor our editors receive direct compensation of any kind to publish information on tokenist.com. Our company, Tokenist Media LLC, is community supported and may receive a small commission when you purchase products or services through links on our website. Click here for a full list of our partners and an in-depth explanation on how we get paid.

Having to choose between two of, arguably, the best brokers in the online brokerage industry isnt too bad of a complaint, right?

During such uncertain timesin the era of COVID-19, and political unrestfinding the most suitable broker will be vital in helping you get the most out of your money.

Interactive Brokers, on the other hand, is renowned for its low cost service, and robust trading platform. The firms recent addition to its Trader Workstation will also no doubt delight sustainable investors.

Sound good? Lets get started!

8.0

Recommended Reading: How Can I Start Investing In Stock Market

How Ibm’s Strategy Aligns With Its Businesses

IBM’s hybrid cloud approach is a perfect fit for its cadre of enterprise clients, such as Citi and Barclays. Big Blue’s customers are primarily in the financial services, government, and healthcare industries, all of which require the strict security controls delivered by private clouds while taking advantage of the IT cost savings offered by public clouds.

Similarly, IBM’s enterprise customers want the hand-holding offered by the company’s consulting division, which helps clients adopt and implement Big Blue’s tech solutions. This one-two punch has served IBM well, as evidenced in its financial performance.

The company’s hybrid cloud revenue was up 15% over the trailing 12 months. Meanwhile, its consulting division, which accounted for $14.3 billion of its $43.8 billion in revenue over the last three quarters, saw Q3 revenue rise 5% year over year.

The company’s infrastructure segment also adds to IBM’s hybrid strategy by selling servers for private cloud use. This division had an outstanding third quarter, with revenue up 15% year over year. It was down 2% in the first quarter but bounced back in the second quarter with the release of the IBM z16 mainframe server in April. The z16 includes an artificial intelligence chip.

AI is another growth area for Big Blue since it’s well-suited for IBM’s enterprise customers. These clients need the power of AI to streamline large operations and reduce costs.

Products And Markets Available

E*TRADE has a range of investments that will please both active traders and retirement investors. Their selection of choices includes futures and advanced options strategies, along with over 4,500 mutual funds with no transaction fees. This selection of mutual funds is rarely offered by competing brokers. Above this, mutual funds that arent featured on the no-transaction-fee list will cost $19.99 per transaction.

You can check out eToro for their 0% commission stocks trading.*

*Your capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.

All investment services offered including stocks, options, bonds, and financial-planning are done via ETRADE Capital Management. Banking services are provided through ETRADE Bank, and futures trading is offered through E*TRADE Futures LLC.

E*TRADEs platform features a mutual fund list that is regularly updated by analysts called the All-Star Funds Report. This contains the top funds and ETFs that are being offered.

The only notable feature that their platforms are lacking is international trading and forex trading. This is a surprising downside as this is rare among US-based brokerages.

Also Check: Can Indians Invest In Us Stock Market

But What About Volatility Decay

The daily resetting of leveraged ETFs means the fund only provides the return multiple relative to the underlying index on a daily basis, not necessarily over the long term. Because of this, volatility of the index can eat away at gains this is known as volatility decay or beta slippage.

Unfortunately, the financial blogosphere took the scary-sounding volatility decay and ran with it to erroneously conclude that holding a leveraged ETF for more than a day is a cardinal sin, ignoring the simple underlying math that actually helps on the way up. In short, volatility decay is not as big of a deal as its made out to be, and we would expect the enhanced returns to overcome any volatility drag and fees.

Real Estate Investment Trusts : Best For Diversifying Into Commercial Real Estate Investing

- Minimum Investment: The cost of one REIT share

- Stability/Risk Level: Low to moderate stability and risk

- Liquidity Level: High

- Where to Invest:Zacks Trade, E*TRADE, TD Ameritrade

How to invest. Many publicly traded REITs are listed on major stock exchanges. They can be purchased through investment brokerage firms, like those listed above. The minimum investment is the cost of one REIT share.

Benefits. REITs give you an opportunity to invest in real estate without taking direct ownership of property or managing it. It also gives you a chance to invest in commercial real estate, like office buildings, retail space, and large apartment complexes. The trust holds and manages the properties, giving you a diversified portfolio. And because REITs are required to pay out at least 90% of their income as dividends to their shareholders, REITs are an excellent source of regular income.

Drawbacks. A downturn in the economy could lead to a decline in commercial real estate rents and property values. That could result in reduced income and share value.

Recommended Reading: Morgan Stanley Los Angeles Investment Banking

Interactive Brokers And Cfds

Interactive Brokers offers low commissions starting at 0.05% on its share CFDs. Active traders can benefit from lower rates. The broker charges an overnight finance at +/-1.5%, and lower spreads are available for bigger balances. Heres a quick rundown:

| IBKR Index CFDs |

|---|

|

|

E*trade Trading Platforms And Tools

E*Trade offers two trading platforms: the brokerages website and Power E*Trade. There are also two mobile apps: The E*Trade Mobile app and the Power E*Trade app.

The standard web platform is for investors who are just starting out and new to investing basics but still want to manage their own portfolios. You can make trades, handle money transfers, check real-time quotes and commentary and get independent research from top news organizations.

The standard platform also gives you access to investment screeners, analyzers, portfolio backtesters and optimizers. If youre new to investing or just need a refresher, theres a library of articles and videos to help you educate yourself on the investing journey. Theres also access to market trends and active trader analysis.

If youre an advanced investor, Power E*Trade offers risk/reward analysis and technical pattern recognition, which help you explore possible scenarios before you press buy. A practice account option lets you trade stocks, options and other securities without risking real money.

Don’t Miss: Ways To Invest Money Long Term

What Does It Offer

E*TRADE might be best known for its pricing. But it’s also a bonafide full-service broker that offers a bevy of features and tools. Here’s a close look at what you get as an E*TRADE client.

As a result, E*TRADE was named a top online stock broker for 2022 based on our annual reader poll. Their low fees and no commissions, along with their suite of tools, make them a top choice. See the full list of best online stock brokers here.

How We Ranked Fees

We ranked E*TRADE’s fee levels as low, average or high based on how they compare to those of all reviewed brokers.

First, let’s go over some basic terms related to broker fees. What you need to keep an eye on are trading fees and non-trading fees.

- Trading fees occur when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading feesinclude charges not directly related to trading, like withdrawal fees or inactivity fees.

In the sections below, you will find the most relevant fees of E*TRADE for each asset class. For example, in the case of stock investing the most important fees are commissions.

We also compared E*TRADE’s fees with those of two similar brokers we selected, Charles Schwab and Fidelity. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of E*TRADE alternatives.

To have a clear overview of E*TRADE, let’s start with the trading fees.

Recommended Reading: What Is The Best Free Investment App

Eth Is Becoming Deflationary

ETH becoming deflationary means that the supply of ETH decreases over time. Many proponents claimed that ETH will turn into ultrasound money.

The upgrade called EIP-1559, which was part of the London hard fork . Ethereum Improvement Proposal -1559 refers to the reforms in Ethereums fee market mechanism implemented in July 2021.

Essentially, EIP-1559 eliminates the first-price auction model as the primary gas fee calculation. Gas fees are payments users make to compensate for the computing power needed to validate transactions on the blockchain. In the first-price auction model, users bid a specific amount to pay for their transaction to be processed, with the highest bidder winning.

With EIP-1559, theres a discrete base fee for transactions, which is included in the next block. If I want to prioritize my transaction, I can add a tip, referred to as a priority fee to pay for a faster transaction. This new model splits transaction fees into base fees and tips while burning used fees to curtail ETH inflation.

The burning of ETH, as a result of the EIP-1559 upgrade of July 2021, is what makes it potentially deflationary.

Roughly one year after the upgrade, 2 614 424 ETH has been burned. Thats not enough to make Ethereum deflationary, but the burning will accelerate with adoption, and the issuance of new coins will decrease with proof of stake. This sets Ethereum up to become deflationary.

Is Bitcoin A Good Long

Following on from the previous section, theres a school of thought that Bitcoin has evolved from being a long-term investment to a short-term investment. Although it might not be the next cryptocurrency to explode, BTC has still shown itself capable of outperforming equities on the smaller timeframes.

For this reason, many people opt to day trade Bitcoin, as its not uncommon for the coins value to rise by 5% in a matter of hours. The image below highlights this, yet this isn’t an isolated incident moves like this occur regularly.

At the same time, it’s important to remember that bearish moves are just as common. The crypto market is inherently volatile, so day trading BTC is best-suited to risk-seeking traders. However, those happy to trade both sides of the market may find an abundance of opportunities making it a viable alternative to the FX market.

But is Bitcoin a good investment over the long term? We struggle to believe that BTC has superior long-term value due to its reliance on high-energy mining processes and the lack of utility. As such, we believe BTC is best for short-term traders investors with a long-term investment horizon may find better opportunities elsewhere.

Recommended Reading: Best Custodial Investment Accounts For Minors

E*trade Vs Vanguard: Services And Features

Both E*TRADE and Vanguard are full-service brokerages. This means that almost all popular assets, technical indicators and trading data are available on both platforms.

Vanguard offers a wide range of investments, from mutual funds to stocks to CDs. However, its mutual fund offerings are massive and very inexpensive. The average Vanguard no-load mutual fund cost is 83% less than the industry average. Vanguards Total Stock Market Index Admiral Shares fund, for instance, has an expense ratio, also known as an operating expense ratio, of 0.04%, which means that an investment of $100,000 would only cost $40 a year.

E*TRADE offers users free screeners to find companies that fit a portfolio, real-time streaming market data, interactive charts and stock ticker pages. E*TRADE users also have access to OptionsHouse, a powerful platform for trading options and other securities. In addition to stocks, E*TRADE customers can also trade bonds and options. In addition, E*TRADE provides access to ETFs and mutual funds. While many of these funds charge fees to buy and sell, E*TRADE offers hundreds of commission-free funds.

Both E*TRADE and Vanguard have research reports to help investors make informed decisions. Vanguard provides research from Thomson Reuters, First Call and Standard & Poors E*TRADE provides research from S& P Capital IQ, Thomson Reuters and Morningstar.

E*trade Research And Education

E*TRADE is among the very best online brokers in our survey when it comes to research and education. The educational formats cater to every type of learner, including articles, videos, online courses and webinars. The organization of the research information is clear, intuitive and arranged by category.

Read Also: What Is A Broker Dealer Vs Investment Advisor

How Do Etfs Work

ETFs track a particular index and try to duplicate the performance of that index. Different ETFs invest in different asset categories such as stocks, commodities, bonds, etc. Since they replicate the performance of an index it tracks, it is called passively managed funds.

For example, Reliance ETF Nifty BeES is a stock ETF that invests in all the stocks included in the Nifty 50 Index, and it tries to copy the performance of the stocks on the Nifty 50 Index. There may be some differences in the returns provided by the index and the returns generated by the ETF, it is called tracking errors.

You should pick an ETF that has fewer tracking errors because it indicates that the ETF is efficiently replicating the performance of the benchmark index.

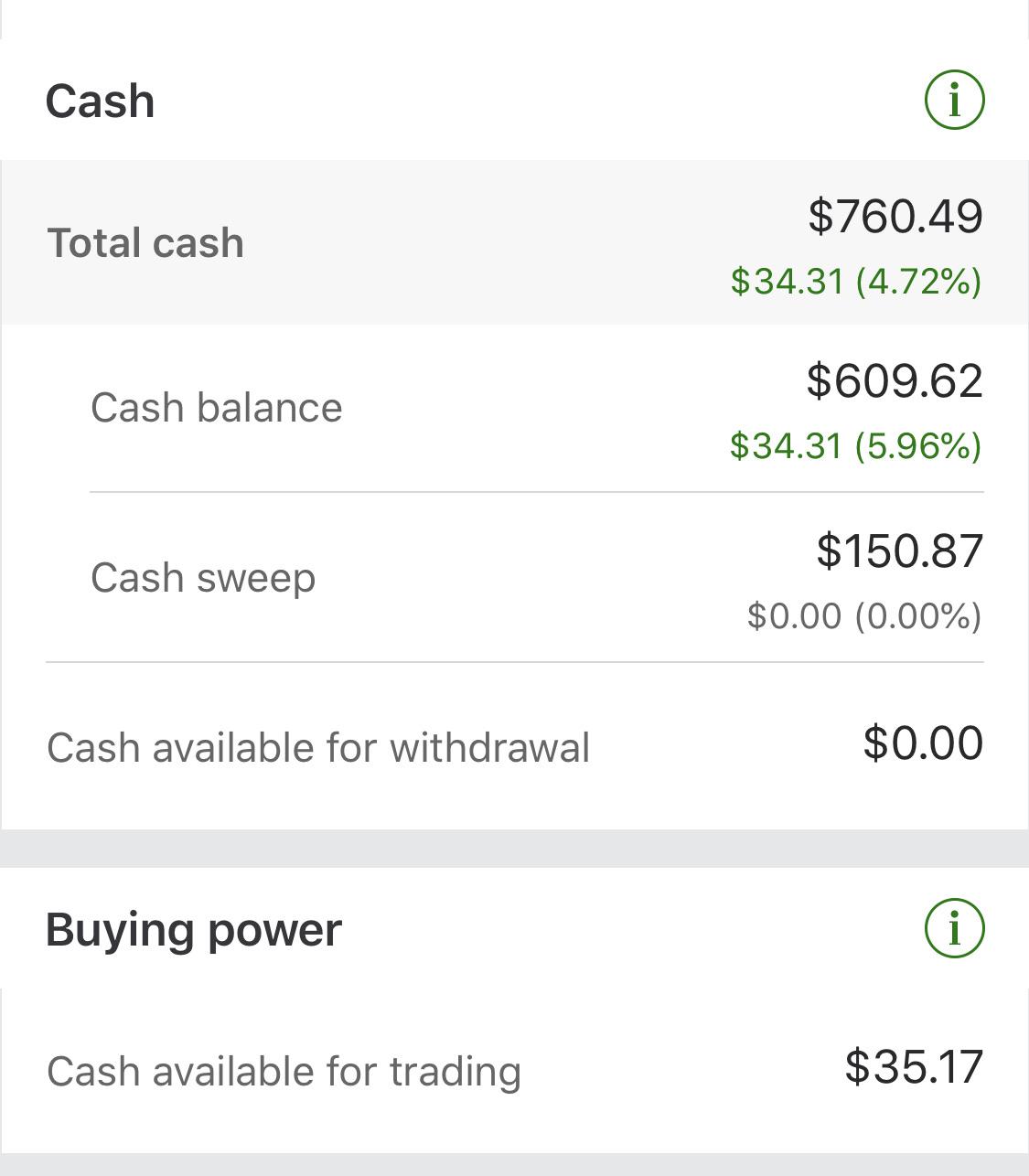

Deposit Fees And Options

E*TRADE charges no deposit fees. You can use checks, ACH and wire transfers to deposit funds.

Unfortunately,, similarly to E*TRADE’s closest competitors.

| $0 | $0 |

How long does it take to withdraw money from E*TRADE? We tested the ACH withdrawal and it took 2 business days.

You can only withdraw money to accounts that are in your name.

How do you withdraw money from E*TRADE?

- Log in to the account

- Go to ‘Accounts’

- Select the ‘Transfers’ menu, then click ‘Transfer money’

- Choose your E*TRADE account in the ‘Transfer from’ field and your previously linked external account in the ‘Transfer to’ field

- Add the amount you wish to withdraw and set the frequency and date of the withdrawal

- Preview and initiate the withdrawal

Don’t Miss: New Residential Investment Corp Mortgage

E*trade Review: Is It Still The Best In The Business In 2022

E*TRADE has developed a reputation for being one of the most innovative investment brokers in the industry. Now that its a part of Morgan Stanley, the company offers more than ever. It has low fees, a generous sign up bonus, the widest selection of investment options and retirement accounts, as well as banking services with checking and high interest savings.

If you like to trade mutual funds, youre an active options trader, or you have a large portfolio, theres even more to like about E*TRADE.

Commissions & Fees – 10

Accounts Available – 10

More Details About E*trade’s Ratings

Account minimum: 5 out of 5 stars

E*TRADE’s account minimum is $0. This is typical of brokers these days the vast majority of the brokers we review don’t require a minimum to open or maintain an account. Keep in mind that some investments, such as mutual funds, may require a minimum initial investment.

Stock trading costs: 5 out of 5 stars

In 2019, E*TRADE dropped its once-high $6.95 trade commission to $0 for online stock, options and ETF trades. Many other brokers did the same, and now free commissions are standard in the industry. You’ll still pay a fee to trade certain securities, including futures, as well as a per-contract fee for options trades .

Options trades: 4 out of 5 stars

Options trades are commission-free, but they still carry a contract charge, which is $0.65. E*TRADE offers a discounted fee of $0.50 for active traders .

Account fees: 4 out of 5 stars

E*TRADE charges no annual or inactivity fee. There is a $75 full transfer out fee it’s $25 for a partial transfer. Most brokers impose a fee to transfer securities out of your account that fee is often higher if you transfer out your full balance and close the account completely. E*TRADE waives the partial transfer fee if you have a remaining account balance of more than $5,000.

Number of no-transaction-fee mutual funds: 5 out of 5 stars

Tradable securities: 4 out of 5 stars

Crypto availability: 2 out of 5 stars

Trading platform: 5 out of 5 stars

Mobile app: 5 out of 5 stars

You May Like: How To Invest In Germany