Roth Ira Taxes Vs Traditional Ira Taxes

With a Roth IRA, you pay taxes on your contributions upfront so you don’t have to pay them later when you withdraw money from your retirement fund .

This is the biggest difference from a traditional IRA, which lets you delay paying taxes until you withdraw funds later down the road. With traditional IRAs, your contributions are also tax-deductible, up to certain limits, so your contribution reduces the amount you owe in taxes each year.

A good rule of thumb when choosing between the two types of IRA accounts is to consider your tax bracket:

- Choose a Roth IRA if you expect that you’ll be making more money in your later years and thus in a higher tax bracket. It makes more sense to pay taxes today to take advantage of your current low tax rate before it goes up. Plus, since your withdrawals from Roth IRAs don’t count as income and aren’t taxed after 59 and a half, you can count on every dollar in your account when making withdrawals.

- Choose a traditional IRA if you expect that you’ll be making less money in your later years and thus in a lower tax bracket. In this case, it makes more sense to reduce your taxable income in the present, so in theory you’ll pay less in taxes both now and in the future when your tax rate is lower.

Use an online calculator like this one from Charles Schwab to help you decide between a Roth IRA or a traditional IRA.

Whats The Difference Between A Roth Ira And A Traditional Ira

A Roth IRA is very similar to a traditional IRA: You can make consistent contributions to your Roth, which will be invested in the market allowing the money to grow over time so you have a healthy savings when you reach retirement age.

But Roth IRAs have a few components that make them stand out from your traditional IRA. Heres what makes them unique:

- When you withdraw your contributions from a Roth IRA in retirement, those withdrawals are generally tax free and they dont count as income. Withdrawals in retirement from a traditional IRA and 401 will be taxed as income.

- Contributions into a Roth IRA use after-tax dollars, unlike contributions to a traditional IRA or 401, which are not taxed. This may be a bigger hit to your finances in the short term, but your money will grow tax free.

- If you withdraw earnings youve made on investments in a Roth IRA before age 59 and a half, youll incur a 10% early withdrawal penalty and may be subject to income tax.

- There are exceptions to the early withdrawal penalty on Roth IRAs, including taking out funds for first-time home purchases, college expenses and birth or adoption expenses.

- Your tax filing status and income level determine whether or not you can contribute to a Roth IRA: if married filing jointly, the annual income threshold is below $208,000 if single, the income threshold is below $140,000 if married filing separately and you lived with your spouse, the income threshold is below $10,000.

Top Reasons To Consider A Fidelity Ira

There are several benefits to opening your rollover IRA at Fidelity.

Fidelity investments offer some of the widest range of investment options in its commission-free lineup. Any US stock and ETF can be bought or sold for no transaction fee, and index funds have no internal expenses.

Having plenty of investment options is incredibly valuable. Weve had several clients come to us with heavily concentrated positions of their own company stock in a 401. Weve been able to help them diversify and protect their savings by rolling it into an IRA at Fidelity. One client, in particular, stood to lose nearly half of their savings in a concentrated company stock position!

With over $10 trillion in assets, Fidelity brokerage services LLC has enough depth and stability for you to be comfortable that your money is secure.

Fidelitys interface is incredibly user-friendly too. When you log in, you can easily view your Fidelity account balances and positions, or place trades to rebalance your portfolio. Head on over to fidelity.com to see for yourself. Its straightforward to integrate your Rollover IRA at Fidelity into the rest of your financial plan to maintain the consistency you need to meet your goals.

We can help you as well.

Contact us for a free consultation.

Disclosures:

Recommended Reading: Best Hard Assets To Invest In

Recommended Reading: Barclays Investment Bank New York Ny

Fidelity Go: Is It Trustworthy

Fidelity Investments currently has an A+ rating with the Better Business Bureau. The BBB’s ratings range from A+ to F, so this is the highest score a company can receive.

Other factors that the BBB takes into consideration include type of business, time in business, licensing and government issues, and advertising issues. But the bureau also says its ratings don’t ensure a company will be reliable or perform well. This is why it’s crucial to do your own due diligence in addition to its findings before committing to an investment app.

Fidelity Investments has closed more than 330 complaints in the last 12 months, according to the BBB. Its profile also shows that it has one unresolved complaint.

How Age Affects How Much To Invest In Stocks

Why every year counts

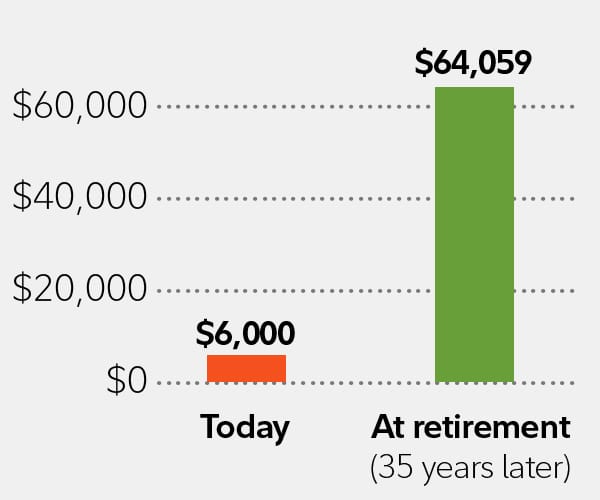

Age can also be used as an initial guideline when determining how much to invest in stocks when you’re investing for retirement. That’s because the longer the money will be invested, the more time there is to ride out any market ups and downs. That could help realize the potential for growth in your investments, which may be an important factor in saving enough for retirement. In general, the younger you are, the heavier your investment mix could tilt toward stockas much as you are comfortable with and fits with your time horizon, risk preferences, and financial circumstances. The chart shows how a $6,000 IRA investment could grow to $64,059 over 35 years.

All else equal, as you get closer to retirement, you may want to adjust your allocation. Being too aggressive could be risky as you have less time to recover from a market downturn. As a general rule, in the absence of changes to risk tolerance or financial situation, one’s asset mix should become progressively more conservative as the investment horizon shortens. However, investing too conservatively could limit the growth potential of your money. So, it may make sense to gradually reduce the percentage of stocks in your portfolio, while increasing investments in bonds and short-term investments.

To learn more about building an asset mix that fits you, read Viewpoints on Fidelity.com: How to start investing

Don’t Miss: What Is Long Term Stock Investment

Does A Fidelity Roth Ira Have Fees

There is no cost to opening a Fidelity Roth IRA and no annual fee. However, a $50 fee may apply to close out an account. The investments held in the account may be subject to other fees, such as management, low balance, and short-term trading fees. Also, online U.S. stock, ETF, and option trades are commission free.

How To Choose The Right Ira For You

Regardless of how you decide to divide your funds between a traditional IRA or Roth IRA, its important to compare options to diversify your investments with an approach calibrated to your risk tolerance and your retirement timeline.

If you want to be in full control over the investing decisions, look for firms that empower you with a full slate of educational offerings about the market and potential places to grow your money. If you would rather put your IRA on cruise control, a target-date retirement fund or robo-advisor that can deliver sophisticated, low-cost investing tailored to your needs will be a simple way to save.

| For more news you can use to help guide your financial life, visit our Insights page. |

Content for this page, unless otherwise indicated with a Fidelity pyramid logo, is selected and published by Fidelity Interactive Content Services LLC , a Fidelity company. All Web pages published by FICS will contain this legend.Fidelity Brokerage Services LLCBefore investing, consider the funds investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Don’t Miss: How To Invest In Index Funds For Beginners

What Could Be Improved

Tax strategies

Unlike some of its competitors, Fidelity doesnt offer tax-loss harvesting, a valuable strategy that can dramatically reduce investors capital gains. This is most significant for investors who have large account balances or are otherwise in high tax brackets, but if youre in one of those categories and plan to invest in a standard brokerage account, this is worth taking into consideration.

Human financial advisors

Most major brokerages with robo-advisor platforms dont offer access to human financial advisors, and Fidelity Go is no exception. There are some robo-advisors that do, however, so if getting financial advice beyond your automated investment portfolio is a priority, Fidelity Go might not be the best choice for you.

Few account types

Fidelity Go offers the standard account types that pretty much every robo-advisor has, including standard brokerage accounts , and individual retirement accounts, or IRAs. If you want to open a specialized account type, such as a UGMA/UTMA account or solo 401, you cant do it through Fidelity Go.

Is Fidelity A Good Roth Individual Retirement Account

Fidelity provides investors with a broad range of low-cost investment options to choose from for their Roth individual retirement account . Investors have the option to have their accounts managed by professionals at Fidelity or manage their own investments. Fidelity offers investors access to more than 10,000 mutual funds from the companys family of funds and other fund companies. The company also offers online trading of exchange-traded funds , U.S. stocks, and options with zero commission fees.

Don’t Miss: How Do I Invest Online

How To Invest Your Ira

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

One of the best things about an IRA compared with, say, a workplace retirement plan like a 401 is the much larger selection of investment options available within the account.

In most IRA accounts, you can pick individual stocks or choose from a long list of mutual funds. Or you can leave those decisions to an expert by choosing a low-cost robo-advisor a computer-powered investment manager to do the work for you.

That breadth of choice makes the IRA both Roth and traditional IRAs an attractive option for your retirement savings, especially once youve maxed out 401 matching dollars. But in some ways, choice also makes things more difficult for the investor.

Heres a step-by-step process for how to choose investments for your IRA.

How A Roth Ira Works

A Roth IRA requires you to contribute after-tax savings to the account, rather than pre-tax savings, as with a traditional IRA. Then it allows you to withdraw qualified earnings tax-free at retirement. So you pay taxes today in exchange for keeping your savings and earnings tax-free in the future. Thats one of many ways that a Roth IRA beats a traditional IRA.

Its best to think of a Roth IRA as a wrapper that can go around many types of accounts to protect them from the taxman. Many companies offer a Roth IRA, including banks, brokerages and robo-advisors, and each allows you to make various types of investments.

What you can earn in a Roth IRA all depends on what youre invested in. At a bank you can invest in CDs, which are safe and insured by the FDIC so that you wont lose principal .

At brokerages and robo-advisors, you can invest in assets such as stocks and bonds that can earn much more over time, but arent protected and can lose money. While a CD specifies what youll earn each year, these other investments can fluctuate, sometimes drastically.

Read Also: What To Invest In Roth Ira Fidelity

Can I Put 500000 In A Roth Ira

You can contribute up to $ 19,500 per year in 2021 and $ 20,500 in 2022 . Some employers even offer Roth version 401 with no income limit.

How much should I put in my Roth IRA to become a millionaire?

IRA Millionaire: A Detailed Analysis If you contribute to this years IRA to a maximum of $ 6,000 each year and earn 7% of your average annual return on investment , it would take just over 37½ years to increase your account to $ 1 million. But it is possible to arrive earlier.

What is the max amount of money you can put in a Roth IRA?

More in Retirement Plans For 2022, 2021, 2020 and 2019, the total contributions you make each year to all your traditional IRAs and Roth IRAs cannot exceed: $ 6,000 , or. If less, your taxable fee for the year.

What Is A Roth Ira

A Roth IRA is the Roth version of a traditional IRA. That is, it has similar parameters, but very different tax treatment.

Both plans have the same contribution limit as of 2021. You can contribute $6,000 per year, or $7,000 if you are 50 or older. Both plans allow for tax-deferred accumulation of investment income prior to retirement. And both are fully self-directed accounts, that allow you to choose the trustee that will hold the account, as well as the investments within it.

But its the tax treatment where the traditional and Roth IRAs go their separate ways.

For starters, contributions to traditional IRAs are typically tax-deductible when made. Roth IRA contributions, on the other hand, are never tax-deductible.

Second, distributions taken from a Roth IRA are tax-free, as long as you are at least 59 ½ years old, and have participated in the plan for at least five years. This is very different from traditional IRAs, in which any distributions taken from the plan are generally subject to ordinary income tax.

This means Roth IRAs can provide you with a tax-free income source in retirement, and thats why theyre so popular.

Read Also: Llc To Invest In Stocks

Fidelity Roth Ira Tutorial How I’m Getting A 51% Return On Investment

by Retirement Advisor | Jul 31, 2022 | 27 Comments

Invest in your Fidelity ROTH IRA Account with this same strategy that earns me 51% returns, and retire earlier than expected. This $100 Course Taught Me How to Earn Thousands of Dollars Online: How to Get Paid for Your Expert Knowledge: Get a FREE Robinhood Stock Valued Up to…

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on “Register Now” at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose “Contribution Amount“. If you are already logged in, click on the “Contributions” tab.

Step 2:There are three choices

- Contribution Amount – to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program – to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers – to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

Read Also: Prosper Peer To Peer Lending Investing

Transfer Money Into Your Roth Ira

Next, we need to transfer money into the Roth IRA. Money transferred will go into the Core Position, meaning itll just sit in your account as if its sitting in your checking account. Its not invested, yet, but you still need to take this step.

Select the Transfer tab.

In the From section, select Link a bank to a Fidelity account and follow the instructions to add your bank account.

Then, youll want to set From to be your bank account and To to be your Roth IRA.

You may have the option to select your contribution year as well. You can contribute to the previous year until April of the current year. Its always best to max out the previous year before getting started on this year so that you have more money to contribute in the future.

Select Continue.

Once you have confirmed the transfer, it will take approximately one business day until the transfer is complete. So, now you can take a break.

Where Fidelity Go Shines

Low cost: Fidelity Go charges no fees for accounts below $10,000, and a flat monthly fee of $3 for account balances between $10,000 and $49,999.

Fidelity integration: Customers who already have an IRA or taxable account with Fidelity can easily take advantage of the companys robo offering.

Human portfolio oversight: The day-to-day investment and trading decisions for portfolios are handled by a team of humans from Strategic Advisors, a registered investment advisor and Fidelity company.

Recommended Reading: Investment Strategies For Nonprofit Organizations

You May Like: Hedge Funds Investing In Residential Real Estate